Formula One Group: Difference between revisions

No edit summary |

No edit summary |

||

| (4 intermediate revisions by 2 users not shown) | |||

| Line 25: | Line 25: | ||

|'''Website''' | |'''Website''' | ||

|[https://www.formula1.com/ formula1.com] | |[https://www.formula1.com/ formula1.com] | ||

|'''Pitch''' | |||

|<Youtube>TJlrvm1xFuw</Youtube> | |||

|} | |} | ||

]] | ]] | ||

| Line 44: | Line 46: | ||

* '''Stefano Domenicali:''' Currently the CEO of the Formula One Group, took over from Chase Carey. He previously served as the CEO of Italian sports car manufacturer Lamborghini from 2016 to 2020. Additionally, he held the role of team principal for the Scuderia Ferrari Formula One team. It was during his leadership that Ferrari secured their most recent Formula One World Championship victory<ref>https://en.wikipedia.org/wiki/Stefano_Domenicali</ref>. | * '''Stefano Domenicali:''' Currently the CEO of the Formula One Group, took over from Chase Carey. He previously served as the CEO of Italian sports car manufacturer Lamborghini from 2016 to 2020. Additionally, he held the role of team principal for the Scuderia Ferrari Formula One team. It was during his leadership that Ferrari secured their most recent Formula One World Championship victory<ref>https://en.wikipedia.org/wiki/Stefano_Domenicali</ref>. | ||

* '''Chase Carey:''' The former chief executive officer and executive chairman of the Formula One Group. | * '''Chase Carey:''' The former chief executive officer and executive chairman of the Formula One Group. His previous roles also include working with News Corp, DIRECTV, 21st Century Fox, and Sky plc<ref>https://en.wikipedia.org/wiki/Chase_Carey</ref>. | ||

=== Revenues === | === Revenues === | ||

{| class="wikitable sortable" | {| class="wikitable sortable" | ||

|+ | |+<ref>https://companiesmarketcap.com/formula-one-group/revenue/</ref> | ||

|'''Year''' | |'''Year''' | ||

|'''Revenue''' | |'''Revenue''' | ||

| Line 81: | Line 83: | ||

| | | | ||

|} | |} | ||

Using 2022 as an example, the primary revenue of F1 was divided among race promotion fees (28.6%), media rights (36.4%), and sponsorship (16.9%)<ref>https://www.autoracing1.com/pl/391479/f1-series-revenue-grows-by-20-to-2-5b-for-2022/</ref>. | |||

=== | === Competitors === | ||

* | * '''IndyCar:''' An American-based organization that oversees Indy car racing and various other types of open-wheel car racing. The organization is responsible for managing two racing series: the top-tier IndyCar Series, centered around the iconic Indianapolis 500 race, and the developmental series Indy NXT.<ref>https://en.wikipedia.org/wiki/IndyCar</ref>. | ||

* '''NASCAR:''' This is an American company that regulates and manages auto racing, primarily recognized for its involvement in stock car racing. It's regarded as one of the leading motorsports organizations globally and stands as one of the most significant spectator sports in the United States.<ref>https://en.wikipedia.org/wiki/NASCAR</ref>. | |||

* | |||

=== | === Stocks === | ||

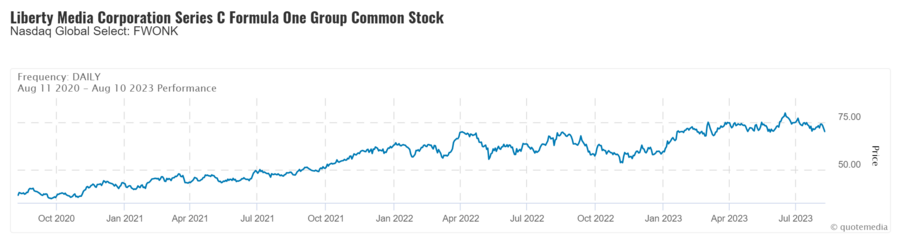

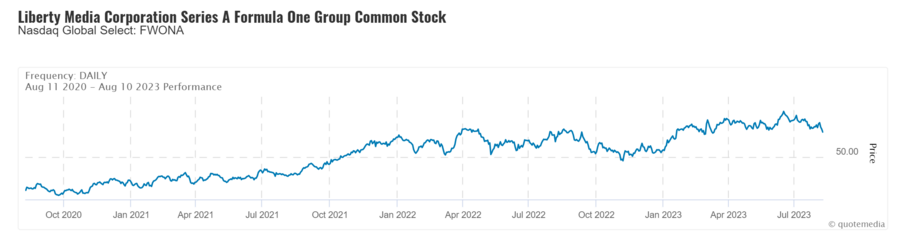

[[File:Fwonk.PNG|center|thumb|900x900px|<ref>https://www.libertymedia.com/investors/stock-data/quote/fwonk#symbol_fwonk</ref>[[File:Fwona.PNG|center|thumb|900x900px|<ref>https://www.libertymedia.com/investors/stock-data/quote/fwona#symbol_fwona</ref>]]]] | |||

* FWONA represents the Series A shares, which come with voting rights, whereas the FWONK shares belong to Series C and lack voting rights. FWONK shares are traded at a significantly higher volume compared to FWONA shares<ref>https://tickeron.com/compare/FWONA-vs-FWONK/</ref>. | |||

* As of August 2023 the Formula One Group has a market cap of $16.33 B. This makes Formula One Group the world's 1061th most valuable company by market cap<ref>https://companiesmarketcap.com/formula-one-group/marketcap/</ref>. | |||

* FWONK has become profitable over the past 5 years, growing earnings by 23.4% per year<ref>https://simplywall.st/stocks/us/media/nasdaq-fwon.k/formula-one-group/past</ref>. | |||

* Formula One Group is forecasted to grow earnings and revenue by 3.1% and 11% per annum respectively. EPS is expected to grow by 5.5%. Return on equity is forecast to be 6.3% in 3 years<ref name=":0">https://simplywall.st/stocks/us/media/nasdaq-fwon.k/formula-one-group/future</ref>. | |||

* Earnings vs Market: FWONK's earnings (3.1% per year) are forecast to grow slower than the US market (15.7% per year)<ref name=":0" />. | |||

* Revenue vs Market: FWONK's revenue (11% per year) is forecast to grow faster than the US market (7.7% per year)<ref name=":0" />. | |||

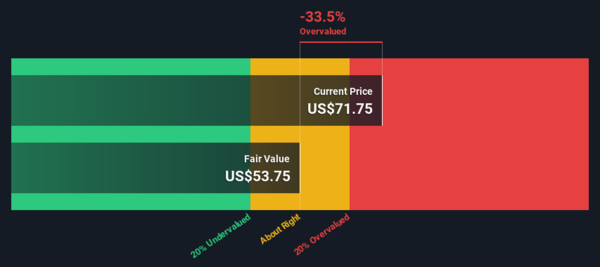

=== DCF<ref>https://simplywall.st/stocks/us/media/nasdaq-fwon.k/formula-one-group/news/formula-one-groups-nasdaqfwonk-intrinsic-value-is-potentiall</ref> === | |||

[[File:DCFF1.png|center|thumb|600x600px]] | |||

The | * Formula One Group's estimated fair value is $53.75 based on two-stage FCFF. | ||

* The current share price of the Formula One Group at $71.75 suggests a potential overvaluation of around 33%. | |||

* The analyst's price target for FWONK is set at $81.00, indicating a notable 51% increase compared to the fair value estimate. | |||

=== Growth of F1<ref>https://frontofficesports.com/newsletter/the-unstoppable-rise-of-formula-1/</ref> === | |||

F1's recently renewed three-year agreement with ESPN is reportedly valued between $75 to $90 million annually, showcasing a notable increase from the current deal's $5 million per year. While this amount might seem modest when compared to the NBA's massive $2.6 billion yearly contract with Turner and ESPN, the F1 deal represents a significant step forward from its previous value. Both Amazon and Comcast also submitted bids, with rumors suggesting that Amazon's bid hovered around $100 million annually. | |||

Starting in 2018, Formula One has witnessed a consistent rise in the average viewership per race in the United States, escalating from around half a million viewers in 2018 to nearly 1.5 million during the 2022 circuit. | |||

{| class="wikitable" | |||

|+ | |||

|'''Year''' | |||

|'''Number of viewers per race''' | |||

|- | |||

|2018 | |||

|547,722 | |||

|- | |||

|2019 | |||

|672,000 | |||

|- | |||

|2020 | |||

|608,000 | |||

|- | |||

|2021 | |||

|934,000 | |||

|- | |||

|2022 | |||

Formula | |1,400,000 | ||

|} | |||

The significant 47% increase just in 2021 alone has played a crucial role in boosting Formula One's financial achievements. As indicated by the latest filings, the Formula One Group managed to generate $360 million in revenue during the first quarter of 2022, marking a remarkable 100% surge compared to the corresponding period in 2021. This growth in audiences also attratcs sponsor such as SalesForce, DHL, Rolex, amaco, AWS, MSC Cruises, Qatar Airways, Liqui Moly, and Heineken. | |||

=== Risks<ref>https://www.kunalsf1blog.com/liberty-media-risk-factors-f1-business/</ref> === | === Risks<ref>https://www.kunalsf1blog.com/liberty-media-risk-factors-f1-business/</ref> === | ||

* | * A potential decrease in Formula 1's popularity could negatively impact its capacity to effectively utilize its commercial rights to the World Championship, potentially leading to significant adverse consequences. | ||

* | * If the 100-Year Agreements are terminated, Formula 1 could face the possibility of ceasing its operations. | ||

* | * Under specific circumstances, teams have the option to terminate their current commitment to participate in the World Championship up to and including 2025, or they might breach their obligations and withdraw. | ||

* | * F1 faces the risk of experiencing credit-related losses if the counterparties to its essential commercial contracts fail to fulfill their obligations. | ||

* | * F1 could encounter challenges when trying to expand into new markets, which might include difficulties in attracting race promoters for new events. | ||

* | * Incidents during events could lead to losses that insurance doesn't cover, potentially disrupting the event and causing reputational h__INDEX__arm to F1. | ||

Latest revision as of 13:06, 11 August 2023

| Industry | Motorsport | ||

| Founder | Bernie Ecclestone | ||

| Headquarter | 2 St. James's Market, London, U.K. | ||

| Area served | Globally | ||

| Brands | Formula 1 Paddock Club | ||

| Key people | Stefano Domenicali (CEO & President) Chase Carey (Non-executive Chairman) | ||

| Traded as | FWONA FWONK | ||

| Website | formula1.com | Pitch |

SummaryEdit

- The Formula One Group is a company that manages the commercial aspects of the Formula One World Championship, which is a premier international motorsport competition featuring single-seater racing cars.

- The group is responsible for organizing and promoting the races, negotiating broadcasting rights, managing sponsorships, and overseeing various business aspects of the sport.

Mission & vision[1]Edit

- Enhancing the fan experience: The F1 Group aimed to enhance the sport's appeal to fans by improving its digital and social media presence. They wanted to offer more behind-the-scenes content and provide better access to race data and insights, making the sport more accessible and engaging for everyone.

- Global expansion: The F1 Group had a goal of increasing the sport's popularity in different parts of the world, including new markets. They worked on this by considering new races and expanding the reach of the sport to new areas.

- Technical innovation: F1 has a history of being a platform for technical innovation in motorsport. The vision included promoting advancements in areas such as safety, sustainability, and hybrid technology.

- Sustainability: The F1 Group focus on making F1 more environmentally responsible. This involved working to decrease the sport's carbon footprint, incorporating more sustainable materials, and advocating for efficient energy usage.

- Entertainment: The F1 Group aimed to enhance the entertainment value of the sport, making it not only about racing but also about creating a captivating spectacle for fans.

TeamEdit

- Stefano Domenicali: Currently the CEO of the Formula One Group, took over from Chase Carey. He previously served as the CEO of Italian sports car manufacturer Lamborghini from 2016 to 2020. Additionally, he held the role of team principal for the Scuderia Ferrari Formula One team. It was during his leadership that Ferrari secured their most recent Formula One World Championship victory[2].

- Chase Carey: The former chief executive officer and executive chairman of the Formula One Group. His previous roles also include working with News Corp, DIRECTV, 21st Century Fox, and Sky plc[3].

RevenuesEdit

| Year | Revenue | Change |

| 2023 | $2.59 B | 0.82% |

| 2022 | $2.57 B | 20.46% |

| 2021 | $2.13 B | 86.55% |

| 2020 | $1.14 B | -43.37% |

| 2019 | $2.02 B | 10.67% |

| 2018 | $1.82 B | 2.47% |

| 2017 | $1.78 B |

Using 2022 as an example, the primary revenue of F1 was divided among race promotion fees (28.6%), media rights (36.4%), and sponsorship (16.9%)[5].

CompetitorsEdit

- IndyCar: An American-based organization that oversees Indy car racing and various other types of open-wheel car racing. The organization is responsible for managing two racing series: the top-tier IndyCar Series, centered around the iconic Indianapolis 500 race, and the developmental series Indy NXT.[6].

- NASCAR: This is an American company that regulates and manages auto racing, primarily recognized for its involvement in stock car racing. It's regarded as one of the leading motorsports organizations globally and stands as one of the most significant spectator sports in the United States.[7].

StocksEdit

- FWONA represents the Series A shares, which come with voting rights, whereas the FWONK shares belong to Series C and lack voting rights. FWONK shares are traded at a significantly higher volume compared to FWONA shares[10].

- As of August 2023 the Formula One Group has a market cap of $16.33 B. This makes Formula One Group the world's 1061th most valuable company by market cap[11].

- FWONK has become profitable over the past 5 years, growing earnings by 23.4% per year[12].

- Formula One Group is forecasted to grow earnings and revenue by 3.1% and 11% per annum respectively. EPS is expected to grow by 5.5%. Return on equity is forecast to be 6.3% in 3 years[13].

- Earnings vs Market: FWONK's earnings (3.1% per year) are forecast to grow slower than the US market (15.7% per year)[13].

- Revenue vs Market: FWONK's revenue (11% per year) is forecast to grow faster than the US market (7.7% per year)[13].

DCF[14]Edit

- Formula One Group's estimated fair value is $53.75 based on two-stage FCFF.

- The current share price of the Formula One Group at $71.75 suggests a potential overvaluation of around 33%.

- The analyst's price target for FWONK is set at $81.00, indicating a notable 51% increase compared to the fair value estimate.

Growth of F1[15]Edit

F1's recently renewed three-year agreement with ESPN is reportedly valued between $75 to $90 million annually, showcasing a notable increase from the current deal's $5 million per year. While this amount might seem modest when compared to the NBA's massive $2.6 billion yearly contract with Turner and ESPN, the F1 deal represents a significant step forward from its previous value. Both Amazon and Comcast also submitted bids, with rumors suggesting that Amazon's bid hovered around $100 million annually.

Starting in 2018, Formula One has witnessed a consistent rise in the average viewership per race in the United States, escalating from around half a million viewers in 2018 to nearly 1.5 million during the 2022 circuit.

| Year | Number of viewers per race |

| 2018 | 547,722 |

| 2019 | 672,000 |

| 2020 | 608,000 |

| 2021 | 934,000 |

| 2022 | 1,400,000 |

The significant 47% increase just in 2021 alone has played a crucial role in boosting Formula One's financial achievements. As indicated by the latest filings, the Formula One Group managed to generate $360 million in revenue during the first quarter of 2022, marking a remarkable 100% surge compared to the corresponding period in 2021. This growth in audiences also attratcs sponsor such as SalesForce, DHL, Rolex, amaco, AWS, MSC Cruises, Qatar Airways, Liqui Moly, and Heineken.

Risks[16]Edit

- A potential decrease in Formula 1's popularity could negatively impact its capacity to effectively utilize its commercial rights to the World Championship, potentially leading to significant adverse consequences.

- If the 100-Year Agreements are terminated, Formula 1 could face the possibility of ceasing its operations.

- Under specific circumstances, teams have the option to terminate their current commitment to participate in the World Championship up to and including 2025, or they might breach their obligations and withdraw.

- F1 faces the risk of experiencing credit-related losses if the counterparties to its essential commercial contracts fail to fulfill their obligations.

- F1 could encounter challenges when trying to expand into new markets, which might include difficulties in attracting race promoters for new events.

- Incidents during events could lead to losses that insurance doesn't cover, potentially disrupting the event and causing reputational harm to F1.

- ↑ https://dcf.fm/blogs/blog/fwona-mission-vision

- ↑ https://en.wikipedia.org/wiki/Stefano_Domenicali

- ↑ https://en.wikipedia.org/wiki/Chase_Carey

- ↑ https://companiesmarketcap.com/formula-one-group/revenue/

- ↑ https://www.autoracing1.com/pl/391479/f1-series-revenue-grows-by-20-to-2-5b-for-2022/

- ↑ https://en.wikipedia.org/wiki/IndyCar

- ↑ https://en.wikipedia.org/wiki/NASCAR

- ↑ https://www.libertymedia.com/investors/stock-data/quote/fwonk#symbol_fwonk

- ↑ https://www.libertymedia.com/investors/stock-data/quote/fwona#symbol_fwona

- ↑ https://tickeron.com/compare/FWONA-vs-FWONK/

- ↑ https://companiesmarketcap.com/formula-one-group/marketcap/

- ↑ https://simplywall.st/stocks/us/media/nasdaq-fwon.k/formula-one-group/past

- ↑ 13.0 13.1 13.2 https://simplywall.st/stocks/us/media/nasdaq-fwon.k/formula-one-group/future

- ↑ https://simplywall.st/stocks/us/media/nasdaq-fwon.k/formula-one-group/news/formula-one-groups-nasdaqfwonk-intrinsic-value-is-potentiall

- ↑ https://frontofficesports.com/newsletter/the-unstoppable-rise-of-formula-1/

- ↑ https://www.kunalsf1blog.com/liberty-media-risk-factors-f1-business/