Malibu Boats, Inc.: Difference between revisions

No edit summary |

No edit summary |

||

| Line 23: | Line 23: | ||

== '''Upcoming catalysts''' == | == '''Upcoming catalysts''' == | ||

The firm is expected to release its earnings on the 29<sup>th</sup> of August. For their last quarter, Malibu Boats (MBUU) reported earnings of $2.59 per share, beating the street consensus estimate of $2.34 per share. This reflected a positive earnings surprise of 10.68%. For the upcoming quarter, we expect reported earnings of $2.4 per share, while the street consensus estimate sits around $2.32 per share. | The firm is expected to release its earnings on the 29<sup>th</sup> of August. For their last quarter, Malibu Boats (MBUU) reported earnings of $2.59 per share, beating the street consensus estimate of $2.34 per share. This reflected a positive earnings surprise of 10.68%. For the upcoming quarter, we expect reported earnings of $2.4 per share, while the street consensus estimate sits around $2.32 per share. | ||

== '''Financials''' == | |||

'''Historic and projected financial statements''' | |||

{| class="wikitable" | |||

|+ | |||

!Income Statement | |||

!2021A | |||

!2022A | |||

!2023P | |||

!2024P | |||

!2025P | |||

|- | |||

|'''Revenue''' | |||

|'''926,515''' | |||

|'''1,214,877''' | |||

|'''1,392,319''' | |||

|'''1,363,667''' | |||

|'''1,569,560''' | |||

|- | |||

|Expenses | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|'''Cost of Sales''' | |||

|'''(690,030)''' | |||

|'''(904,826)''' | |||

|'''(1,049,421)''' | |||

|'''(1,019,151)''' | |||

|'''(1,161,298)''' | |||

|- | |||

|Gross Profit/loss | |||

|236,485 | |||

|310,051 | |||

|342,897 | |||

|344,517 | |||

|408,262 | |||

|- | |||

|Selling and Marketing | |||

|(17,540) | |||

|(22,900) | |||

|(25,659) | |||

|(25,729) | |||

|(29,613) | |||

|- | |||

|General and Administrative | |||

|(61,915) | |||

|(66,371) | |||

|(76,545) | |||

|(68,183) | |||

|(78,478) | |||

|- | |||

|Amortization | |||

|(7,255) | |||

|(6,957) | |||

|(6,808) | |||

|(6,808) | |||

|(6,804) | |||

|- | |||

|'''EBIT''' | |||

|'''149,775''' | |||

|'''213,823''' | |||

|'''233,885''' | |||

|'''243,797''' | |||

|'''293,366''' | |||

|- | |||

|Interest Income/expense | |||

|(2,529) | |||

|(2,875) | |||

|(2,996) | |||

|(4,253) | |||

|(4,861) | |||

|- | |||

|Other Income/expense-net | |||

|1,015 | |||

|(983) | |||

|(263) | |||

|0 | |||

|0 | |||

|- | |||

|Non-operating Income/expense | |||

|0 | |||

|0 | |||

|220 | |||

|440 | |||

|440 | |||

|- | |||

|Earnings before Taxes | |||

|148,261 | |||

|209,965 | |||

|230,847 | |||

|239,984 | |||

|288,946 | |||

|- | |||

|Provision for Income Tax | |||

|(33,979) | |||

|(46,535) | |||

|(53,755) | |||

|(55,196) | |||

|(66,458) | |||

|- | |||

|Net Income | |||

|114,282 | |||

|163,430 | |||

|177,092 | |||

|184,787 | |||

|222,488 | |||

|- | |||

|Minority Interest (After Tax) | |||

|(4,441) | |||

|(5,798) | |||

|(5,554) | |||

|(5,544) | |||

|(6,675) | |||

|- | |||

|'''Net Income attributable to Malibu Boats''' | |||

|'''109,841''' | |||

|'''157,632''' | |||

|'''171,537''' | |||

|'''179,244''' | |||

|'''215,814''' | |||

|} | |||

{| class="wikitable" | |||

|+ | |||

!Balance Sheet | |||

!2021A | |||

!2022A | |||

!2023P | |||

!2024P | |||

!2025P | |||

|- | |||

|Current Assets | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Cash | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Trade Receivables | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Inventories (Net) | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Prepaid Expenses and Other Current Assets | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Total Current Assets | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Noncurrent Assets | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Property and Equipment, net | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Deferred Tax Assets | |||

! | |||

! | |||

! | |||

! | |||

! | |||

|- | |||

|Goodwill | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Other Intangible Assets | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Other Assets | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Total Assets | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Current Liabilities | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Accounts Payable | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Accrued Expenses | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Current Maturities of Long-term Debt | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Income Taxes and Tax Distribution Payables | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Payable Pursuant to Tax Receivable Agreement, Current Portion | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Total Current Liabilities | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Noncurrent Liabilities | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Long-term Debt | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Deferred Tax Liabilities | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Other Long-term Liabilities | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Payable Pursuant to Tax Receivable Agreement | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Shareholders' Equity | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Common Stock - Par Value | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Additional Paid in Capital | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Accumulated Earnings (Deficit) | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Accumulated Other Comprehensive Loss | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Non-controlling interest | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Total Shareholders Equity | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Total Liabilities & Shareholders Equity | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|} | |||

== '''DCF Valuation''' == | == '''DCF Valuation''' == | ||

Revision as of 17:13, 24 August 2023

Investment Thesis

Our investment thesis is long on the stock given its significant Return on Invested Capital (ROIC), technology leadership, and increasing expansion in the international markets. We expect upside on several aspects of the business as well as financials which are currently underappreciated by the investor community. The company is reinvesting capital into its business at a very high rate as seen by its latest capital expenditures and accumulated retained earnings. This could help expand its strategic acquisition strategy as well as product offering. Our price target, under the base case, is $60.26 with more potential upside given by the comparable company analysis which showed that the company is undervalued by investors relative to its peers. Key assumptions used in formulating the price target were:

- Decreasing revenue growth rates for 2024 mainly due to the credit tightening I am currently noticing in the US economy. The company operated in a highly cyclical sector which makes its financial results correlated with the general economic consensus.

- Increasing revenue growth rates for the entirety of 2025 due to the economic rebound the economists are expecting.

- An expected gross profit margin of 25% for 2024 because of higher material and labor costs which are going to be offset by higher price per unit.

- An expected gross profit margin of 27% for Q2 and Q3 of 2025 (tied to the economic consensus) since those are the quarters that bring on the most profit for the company. The seasonality factor is highly evident in its annual quarterly financial statements.

- General and administrative expenses as well as sales and marketing expenses are forecasted to be around their historical levels of 5%, and 2% respectively.

- Tax rate and minority interest are also expected to remain at their historical levels of 23% and 3% respectively.

Risks to thesis and price target

Industry risks

- Economic conditions could cause greater than expected contraction in the recreational boat industry during 2024 given the cyclicality of the sector. Federal Reserve further tightening the economy by continuing to raise interest rates through 2023 and start of 2024 could lead to lower demand as consumers could face unemployment and higher costs of borrowing. As a result, they would have less disposable income to spend on discretionary items, such as recreational boats.

- Another key risk is the potential inflationary pressures that could affect the industry's gross profit margins. The rising costs of essential materials, such as hydrocarbon feedstocks, copper, aluminum, and stainless steel, could squeeze the profitability of manufacturers. Additionally, persistent inflation might lead to increased labor costs, further impacting the company's bottom line.

- Seasonality plays a crucial role in the profitability of the company. Historically, quarters 2, 3 are the most profitable for the firm. As such, bad weather conditions during these quarters would lead to lower consumer demand and inevitably to lower sales.

Company specific risks

- Malibu Boats has historically invested in new products and acquisitions. Success on these investments is not clear from the beginning and could lead to higher-than-expected expenses moving forward.

- The firm has entered into a Tax Receivable Agreement with its pre-IPO owners. There is an obligation to pay 85% of the tax benefits. This is an unpredictable expense as changes in tax legislation could potentially lead to higher or lower expenses. In any case, these payments can be substantial and may significantly impact the company's cash flow and liquidity.

Upcoming catalysts

The firm is expected to release its earnings on the 29th of August. For their last quarter, Malibu Boats (MBUU) reported earnings of $2.59 per share, beating the street consensus estimate of $2.34 per share. This reflected a positive earnings surprise of 10.68%. For the upcoming quarter, we expect reported earnings of $2.4 per share, while the street consensus estimate sits around $2.32 per share.

Financials

Historic and projected financial statements

| Income Statement | 2021A | 2022A | 2023P | 2024P | 2025P |

|---|---|---|---|---|---|

| Revenue | 926,515 | 1,214,877 | 1,392,319 | 1,363,667 | 1,569,560 |

| Expenses | |||||

| Cost of Sales | (690,030) | (904,826) | (1,049,421) | (1,019,151) | (1,161,298) |

| Gross Profit/loss | 236,485 | 310,051 | 342,897 | 344,517 | 408,262 |

| Selling and Marketing | (17,540) | (22,900) | (25,659) | (25,729) | (29,613) |

| General and Administrative | (61,915) | (66,371) | (76,545) | (68,183) | (78,478) |

| Amortization | (7,255) | (6,957) | (6,808) | (6,808) | (6,804) |

| EBIT | 149,775 | 213,823 | 233,885 | 243,797 | 293,366 |

| Interest Income/expense | (2,529) | (2,875) | (2,996) | (4,253) | (4,861) |

| Other Income/expense-net | 1,015 | (983) | (263) | 0 | 0 |

| Non-operating Income/expense | 0 | 0 | 220 | 440 | 440 |

| Earnings before Taxes | 148,261 | 209,965 | 230,847 | 239,984 | 288,946 |

| Provision for Income Tax | (33,979) | (46,535) | (53,755) | (55,196) | (66,458) |

| Net Income | 114,282 | 163,430 | 177,092 | 184,787 | 222,488 |

| Minority Interest (After Tax) | (4,441) | (5,798) | (5,554) | (5,544) | (6,675) |

| Net Income attributable to Malibu Boats | 109,841 | 157,632 | 171,537 | 179,244 | 215,814 |

| Balance Sheet | 2021A | 2022A | 2023P | 2024P | 2025P |

|---|---|---|---|---|---|

| Current Assets | |||||

| Cash | |||||

| Trade Receivables | |||||

| Inventories (Net) | |||||

| Prepaid Expenses and Other Current Assets | |||||

| Total Current Assets | |||||

| Noncurrent Assets | |||||

| Property and Equipment, net | |||||

| Deferred Tax Assets | |||||

| Goodwill | |||||

| Other Intangible Assets | |||||

| Other Assets | |||||

| Total Assets | |||||

| Current Liabilities | |||||

| Accounts Payable | |||||

| Accrued Expenses | |||||

| Current Maturities of Long-term Debt | |||||

| Income Taxes and Tax Distribution Payables | |||||

| Payable Pursuant to Tax Receivable Agreement, Current Portion | |||||

| Total Current Liabilities | |||||

| Noncurrent Liabilities | |||||

| Long-term Debt | |||||

| Deferred Tax Liabilities | |||||

| Other Long-term Liabilities | |||||

| Payable Pursuant to Tax Receivable Agreement | |||||

| Shareholders' Equity | |||||

| Common Stock - Par Value | |||||

| Additional Paid in Capital | |||||

| Accumulated Earnings (Deficit) | |||||

| Accumulated Other Comprehensive Loss | |||||

| Non-controlling interest | |||||

| Total Shareholders Equity | |||||

| Total Liabilities & Shareholders Equity |

DCF Valuation

Our $60.26 price target represents our DCF valuation on Malibu Boats over the next 2 years. A discount rate of 9.76% (2.36% quarterly) and an exit multiple of 12.17x EV/EBITDA were used. Key assumptions used in formulating the three different cases can be seen below:

| Bull case | Base case | Bear case | |

| Rationale | On the 10th of August, the awaited CPI report is unveiled, bringing a pleasant surprise with better-than-expected news. The economic outlook takes a positive turn as it is revealed that the recession has been avoided. This encouraging development prompts a much-needed shift in the Federal Reserve's strategy, leading them to pivot towards rate cuts by the end of 2023. | The Federal Reserve is poised to implement either one or two additional rate hikes, while plans for interest rate reductions are anticipated by mid-2024. This prospect leaves investors in a state of uncertainty. | The US economy enters a recession, leading to a significant decline in consumer demand for leisure items. As a result, the revenues of Malibu Boats plummet, and investors' sentiment worsens. |

| Target price | $65.79 | $60.26 | $55.21 |

Company description

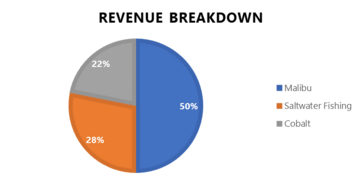

Malibu Boats designs, engineers, manufactures, markets, and sells a range of recreational boats. It operates through three business segments: Malibu, Saltwater Fishing, and Cobalt. The Malibu segment is responsible for the manufacturing, distribution, marketing, and sale of Malibu and Axis sports boat brands. The Saltwater Fishing segment is responsible for the manufacturing, distribution, marketing, and sale of Pursuit, Maverick, Cobia, Pathfinder and Hewes brands. Finally, Cobalt segment is responsible for the manufacturing, distribution, marketing, and sale of the Cobalt brand. The revenue contribution of each segment can be seen in the following diagram:

Industry dynamics

Total Addressable Market

The total addressable market for Malibu Boats is defined as the global consumer discretionary market. Unlike consumer staples companies, consumer discretionary businesses offer products or services that are considered nonessential or optional. These businesses cater to consumers’ desires rather than their basic needs.

Serviceable Available Market

The serviceable available market for Malibu Boats is defined as the global recreational boating industry. According to market research reports[1], the recreational boating industry’s value is around $18.9 billion. It is expected to reach $25.9 billion by 2027, growing at constant annual growth rate of 6.5%. The main reason behind this is the growth in the watersports and tourism industries. Moreover, more than 100 million Americans choose boating or fishing to devote their leisure time and outdoor recreation activities account for 2.1% of US GDP. Given the above statistics, it is expected that the company could increase its market share both in the US and internationally by utilizing its competitive advantage which is its large network of dealers globally (over 400 dealers).

Competition

The firm’s main competitors include both established companies such as Brunswick Corporation, Polaris Inc., as well as mid-market companies, such as MasterCraft Boat Holdings and Marine Products Corporation, that are looking for ways to innovate and gain market share. Malibu Boats competes directly with Marine Products in the fiberglass outdoor boat market while it competes with MasterCraft in the wake/ski boat market and the saltwater fishing boat market. Brunswick and Polaris have dedicated boat segments that manufacture and distribute a wide variety of brands.

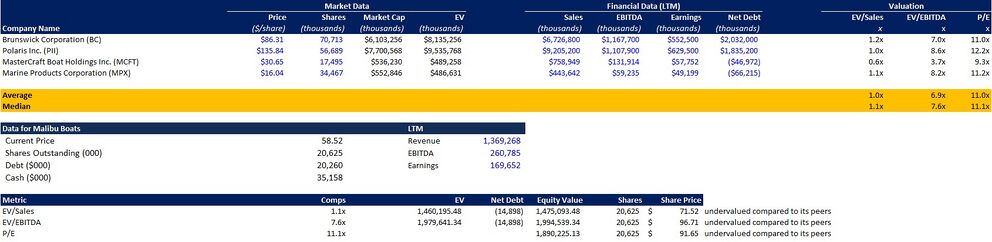

Despite the company’s high return on invested capital (ROIC) compared to its peers, it is evident that the investors have significantly undervalued the company. Its P/E ratio is lower than that of its peers. By conducting comparable company analysis, it is noticeable that investors have significantly underappreciated the company’s prospects. In the context of the comparable company analysis, three different ratios were used: EV/Sales, EV/EBITDA and P/E. Firstly, sales of 2022 were multiplied by the median EV/Sales ratio of the firm’s competitors. The implied enterprise value was $1,460 million. Next, net debt was subtracted, and we arrived at a $1,475 million market capitalization. This figure divided by shares outstanding resulted in a fair value of $71.52, which shows that the company is undervalued by 18% relative to its peers. A similar process was followed using EV/EBITDA and P/E and we arrived at a fair value of $96.71 and $91.65, respectively. These results may mean that investors may not be fully recognizing the company’s earnings potential or growth prospects relative to its peers, leading to a lower current valuation.

[1] https://finance.yahoo.com/news/recreational-boat-market-worth-25-080000401.html