The Idea

Rio Tinto is the second-largest metals and mining company in the world. It is an Anglo-Australian conglomerate founded in 1873 when the company purchased the rights to mine at the Rio Tinto mines in southern Spain. These first mines were also the namesake of the company and were a rich source of copper, silver, and other metals.

The company is dual-listed in the UK and Australia and has significant mining/refining operations across several countries. With the increasing need for metals and environmental movements, Rio Tinto is currently researching better methods of metal extraction, recycling, and decarbonising the mining process.

Mission Statement

Rio Tinto being a large publicly traded mining company has a mission statement balancing shareholder duties with commitment to sustainable mining operations.

The aim of Rio Tinto is given as “Our ambition is to deliver superior returns for our shareholders by becoming a leader in the global energy transition and finding better ways to provide the materials the world needs.[1].

The statement demonstrates Rio Tinto’s commitment to providing materials in an environmentally conscious manner whilst balancing its fiduciary duty to shareholders.

Segments

Rio Tinto splits its business to focus on specific metals so each unit of the business can implement the best strategy for that product area. Below is a brief description of each business unit,

Iron Ore

As one of the leading producers of iron ore, this division is one of the integral parts of Rio Tinto. The division is responsible for 17 mines, 4 port terminals, and a rail network of over 2,000 km. The division employs 15,000 people and brought in a revenue of $30.9 billion.

Aluminium

As one of the most recyclable metals, Rio Tinto aims to boost the production of low-carbon aluminium. It is a key material in products ranging from beverages to electric vehicles. The division also employs 15,000 people with a revenue of $14.1 billion.

Copper

One of the most crucial elements in the fight against climate change. Copper is critical for the rapid electrification that governments across the world are currently investing in. The group is currently focussing on expanding copper mines in existing mining areas and mining copper underground. Copper employs 8,000 people and brought in a revenue of $6.7 billion.

Minerals

This division involves a mix of ceramics and mineral compounds such as titanium dioxide, diamond, and borates. These materials are typically used for electronics and is a growing market. The division is pioneering ways to extract commodities from detritus such as extracting scandium oxide from titanium dioxide production. The group also aims to diversify its portfolio of commodities by acquiring new mines for the mining of other minerals such as lithium oxide. The division employs 8,000 people.

Commercial

The commercial group is responsible for the global sales, marketing, and logistics that mining entails. They liaise with markets, customers, and suppliers across the world to deliver metals/minerals. The group has built a network of 20,000 suppliers and over 2,000 customers. They work closely with this network to generate new insights and opportunities.

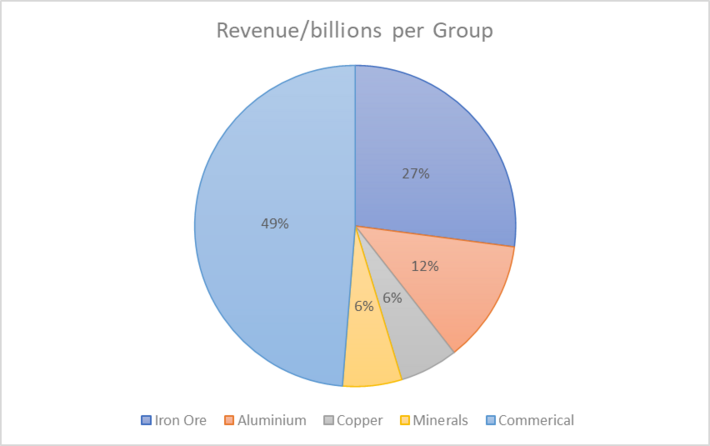

| Group | Revenue/billions $ | Percentage |

| Iron Ore | 30.9 | 27.08% |

| Aluminium | 14.1 | 12.36% |

| Copper | 6.7 | 5.87% |

| Minerals | 6.8 | 5.96% |

| Commerical | 55.6 | 48.73% |

Projects

Recently the mining landscape is rapidly evolving reflecting the rapidly changing consumer market, government investments, and company priorities. Given the need for greener technologies and electric generation has resulted in a higher demand for rare earth metals meaning that Rio Tinto has had to change its projects and strategies.

Some current projects are briefly described below.

Kennecott Underground Project, Utah, US

Over 100 million dollars is being invested into underground mining projects. The technology will enable safer, less toxic mining operations in Kennecott of various rare earth compounds. The mine would allow for potential mining expansion in developed countries allowing mining in less geopolitically sensitive areas.

Oyo Tolgoi Underground, Khanbogd, Mongolia

The Oyu Tolgoi copper mine is an open pit mine and underground mining project. Rio Tinto is using block-caving mining techniques to extract the ore and transport it to the surface.

The mine is expected to operate in the first quartile of copper cash cost curve which is where the mine generates more than operating costs.

This mine is expected to be the fourth largest copper mine in the world with over 500 kilotonnes of copper per year being produced between 2028 to 2036. It is one of the most safe and water efficient operations and represents the largest foreign investment in Mongolia.

Simandou, Nzerekore, Guniea

Siandou is home to the richest and largest iron ore deposits. This new mine would assist with diversifying the critical portfolio of iron ore products and provide much-needed resilience to the supply chain of iron ore.

Leadership

Chair – Dominic Barton

As a chairperson, Dominic Barton is responsible for presiding over board meeting and ensures that the board is functioning effectively,

Dominic has spent over 30 years at McKinsey & Co, and has also held many public sector leadership positions such as Canada’s ambassador to china.

His public sector experience along with business competencies has assisted Rio Tinto to navigate complex geopolitical landscapes.[2]

Chief Executive – Jakob Stausholm

Day-to-day management of the business is primarily handled by the executive committee and CEO.

Jakob joined Rio Tinto in September 2018 as CFO. He has had over 20 years of experience in senior finance roles at Maersk Group and Royal Dutch Shell. His expertise in logistics and the oil industry has assisted him with Rio Tinto and he is working to improve operational performance to progress value- accretive growth while delivering returns for the shareholders.[3]

CFO - Peter Cunningham

Peter was appointed CFO in June 2021 and has 20 years of experience working in Rio Tinto. He has held various senior leadership roles such as Group Controller, Head of Investor Relations, and Head of Energy and Climate Strategy which is a testament to his stakeholder management abilities.

Peter is currently working on the decarbonisation of Rio Tinto assets by prudential investments in commodities essential for energy transition whilst delivering attractive returns to shareholders.

Ownership Structure

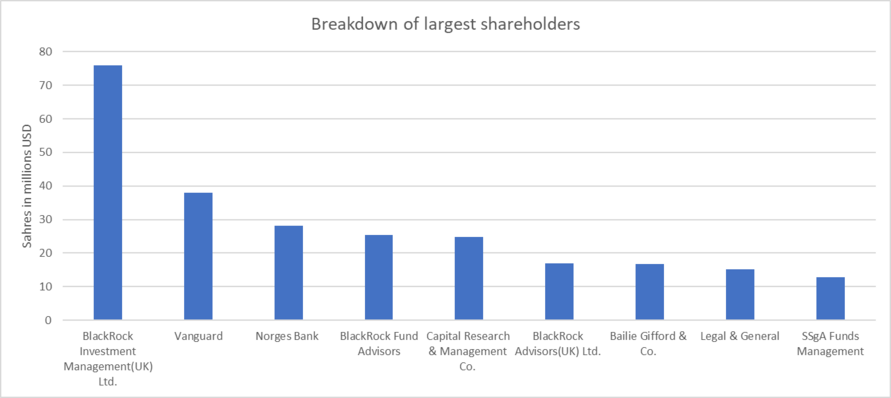

As Rio Tinto is a dual-listed company, the owners of both Rio Tinto plc and Rio Tinto Limited are mentioned below as they are managed together. The top 10 shareholders are listed below. Approximately 21.54% of Rio Tinto shares are held by the top 10 institutional shareholders.

| Shareholder | Shares in millions |

| BlackRock Investment Management(UK) Ltd. | 76.02 |

| Vanguard | 37.92 |

| Norges Bank | 28.11 |

| BlackRock Fund Advisors | 25.38 |

| Capital Research & Management Co. | 24.85 |

| BlackRock Advisors(UK) Ltd. | 16.9 |

| Bailie Gifford & Co. | 16.73 |

| Legal & General | 15.21 |

| SSgA Funds Management | 12.7 |

References

[1] https://www.riotinto.com/about#:~:text=Our%20ambition%20is%20to%20deliver,the%20materials%20the%20world%20needs.

[2] https://www.riotinto.com/en/about/board-of-directors/dominic-barton

[3] https://www.riotinto.com/en/about/executive-committee/jakob-stausholm

[4] https://www.riotinto.com/en/about/executive-committee/peter-cunningham

[5] https://www.researchandmarkets.com/reports/5781216/mining-global-market-report