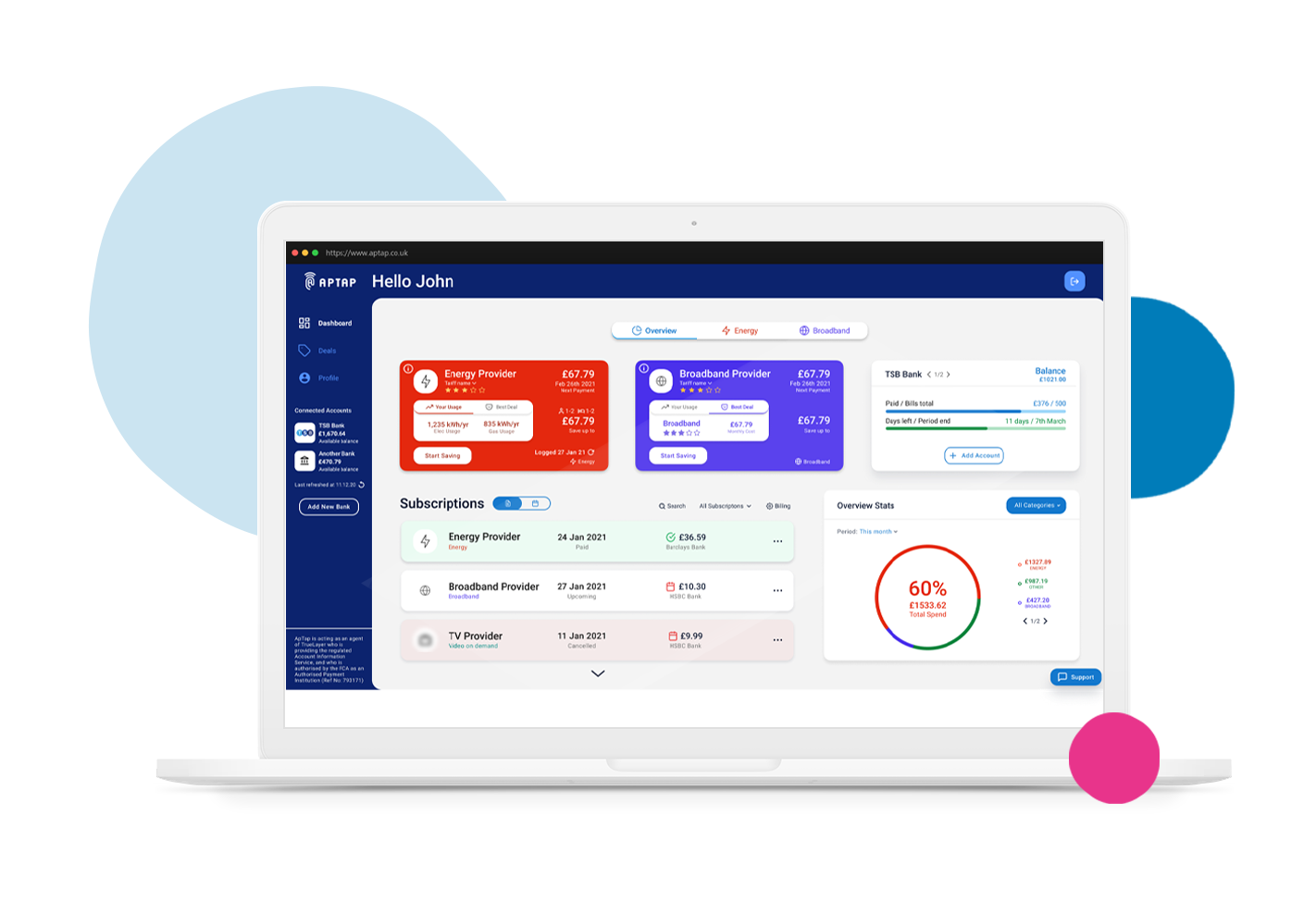

Comparing and switching your bills and subscriptions with just a tap

Summary[1]

- We building a simple platform that empowers users to instantly compare, switch and signup to services in a matter of seconds, not hours.

- Our simple set of APIs can easily be plugged into any bank, FinTech, platform or application as a white-label product.

- We already have 50 Energy and Broadband providers with 90% industry coverage with commission ranging from £20-100 per switch.

- We signed 3-year contract with TSB Bank and launched with 5,000,000 customers in April.

Build the World's Subscription Marketplace.

Seeking to raise of £1M (for 12.5% of ApTap (pre-money)) for the next 12 months.

| Website | https://www.aptap.co.uk/ |

| Contact | Nadal Sarkytbayev (Co Founder and CEO) nadal.s@aptap.co.uk |

| Company number | 11171584 |

| Date of incorporation | 26/01/2018 |

| Data Room | https://docsend.com/view/bm3xx7fzm74cwvjv |

| Your connection to the Imperial community | MSc Theoretical Physics 2016 |

| Describe all of your startup's connections to the Imperial community | All three co-founders are science graduates (Physics, Biology and Engineering) from Imperial College London. We were part of E Lab for two years, participated in VCC and received a lot of support from the mentors and coaches. Here are the links to Imperial publications: https://www.imperial.ac.uk/alumni/alumni stories/aptap/ https://www.imperialenterpriselab.com/casestudies/aptap/ |

| Which industry sector(s) best describe your startup? | FinTech, Platform, SaaS, AI/ML, Banking, APIs |

Investment Interview[1]

Explain what your venture does.

We integrate open banking and data from your service providers in a simple APIs plug-in that makes it easy for banks to offer bill management tools to their customers. We Empower users to instantly cancel, switch or sign up to services within the banking app. Our long term vision is to build World’s Subscription Marketplace.

What stage is your business?

We did a 6-month pilot with TSB last summer and we just signed an official partnership with them for 3- years and have access to 5,000,000 customers.

Describe your advisers.

Rachel Gentry (Open Banking) - Specialist in risk management, cyber security and GDPR. She’s currently DPO at ApTap. James Dickerson (Motive Partners) – Client Executive experienced in corporate strategy, enterprise sales, fundraising and Open Banking. Ajay Arora (Google) - Expert in enterprise sales, venture capital and team building. Neil Peck (Westbury) - Senior coverage banker with over 20 years business development, sales, fundraising and marketing.

Give an overview of your startup's financing history.

We raised two rounds of funding total of £700k. We raised an angel round of £200k in August 2019. Following that, we raised a pre-Seed round of £0.5M (£500k) at £3M Vlatuion (post-money) led by Twinkl Hive in November 2020. Majority of our money spent on salaries, developers and SaaS/APIs. We are currently applying for Innovate UK Smart Grant (£500k).

Explain the ownership structure of your company.

Three co-founders own the majority of the business, and we have four angels, syndicate and Twinkl Hive, who invested into ApTap. For full details, please the cap table in the data room.

How many employees do you have?

11 full-time employees and adding head of sales in May (total 12)

Please provide the name of a lawyer, who will represent you for the upcoming investment round.

Lewis Silkin or CMS

How much money are you seeking to raise in the current round?

£1-2M

Do you have any existing commitments to the current round?

Our lead investors from the previous round (Twinkl Hive) is looking to make a follow on investment. We are currently applying for Innovate UK Smart Grant (£500k). (no special requirement)

Explain why you are raising finance.

We just closed a big partnership deal with TSB Bank for 3 years and have access to 5,000,000 customers. In the next 12 month, we are planning to: Generate £250,000 in annual revenue and drive more switching across three industry verticals by the end of 2022 Switch 100,000 customers to new energy, broadband and mobile phone deals. Sign 2-3 years contracts with Tier-1 bank, challenger bank and FinTech to have access to 10,000,000+ customers. Direct partnership with BIG 6 energy providers, top 5 broadband and mobile phone providers. Market coverage of 90+% across 4 industries (energy, broadband, mobile phones and insurance). Comparison and switching APIs across 4 industries (energy, broadband, mobile phones and insurance). Deal recommendation system based on AI/ML. iOS and Android SDKs for full integration with clients Full details of the spending and revenue are available in the financial projection document available in the data room.

Please explain the history of your venture.

As mentioned above all three co-founders are science graduates (Physics, Biology and Engineering) from Imperial College London. Two of the co-founders (Nadal Sarkytbayev and Isa Ibrahim) received the Graduate Entrepreneur Visa for 2 years to start ApTap. In the beginning, the idea was simple - we wanted to build an app to help people reduce their carbon footprint emission and be more environmentally friendly. There are 4 simple ways of doing that: 1) Swap meat for a plant- based diet 2) Choose to travel by bicycle, PT or electric cars 3) Buy eco-friendly goods 4) Switch a Renewable Energy Providers Although changing your habits can be difficult, switching your energy provider to a green supplier is the simplest way of doing good environment. Therefore we decided to solve that problem with ApTap. We were part of E-Lab for two years, participated in VCC and received a lot of support from the mentors and coaches.

Please explain the longer term, future vision for the Company

Our Vision Build the World's Subscription Marketplace. We want to develop the most extensive set of APIs for comparing and switching any service providers with a 1-tap of a button.

Explain the core technologies and/or service propositions of your venture.

Once the user connects bank account through Open Banking, our algorithm (Python) analyses the transactions and automatically detect bills and subscriptions on the user's behalf. We use AI and ML model to train the algorithm to increase the accuracy of algorithm. We build APIs for comparison and switching across multiple industries (energy, broadband, phones, etc.). We use cloud infrastructure (e.g. AWS) and microservices applications. We have a D2C web app https://www.aptap.co.uk/signup-page, and we offer our APIs as a white-label service. We are currently developing a deal recommendation system based on AI/ML and building iOS and Android SDKs for full integration with clients.

Does your commercial strategy rely on intellectual property assets?

We don't need IP/patent in order to commercially operate with clients. The APIs and algorithm that we are building is our Intellectual Property.

What commercial progress have you made?

We did a 6-month pilot with TSB last summer (2020), they paid £50k and we agreed 50/50 revenue split. We have over 50 brands of energy and broadband providers onboard with 90% market coverage of the service providers. We generate £20-100 affiliate commission per deal switch. We signed a 3-years contract with TSB Bank in April 2021 and have access to 5,000,000 customers. We are onboarding 3 more clients this year.

Risks

As with any investment, investing in ApTap carries a level of risk. Overall, based on the key risks highlighted below, the degree of risk associated with an investment in ApTap is higher than in a company that's trading on a public market.

Early-stage investment

ApTap is at one of the earliest stages of the business lifecycle, and the failure rate of companies at that stage is usually much higher than those at a later stage.

Illiquid investment

The number of transactions in shares of private companies is usually significantly lower than in public companies, typically resulting in it taking longer to sell shares in private companies at a price that is at least equal to the price that the shares were bought at. Accordingly, the ApTap investment opportunity is considered to be higher risk than more liquid companies.

References and notes