A specialized microbrewery and event space in Lane County, Oregon

SummaryEdit

- Production site, Eugene Oregon

- A much-needed, open-to-all craft brewpub in Lowell, Oregon

- Veteran- and woman-owned and operated

- Small batch, hand crafted beers

- Estimated profits within first six months: $66k

- Expecting to produce and sell approximately 174 barrels in 2022

OpportunityEdit

Lowell, Oregon

A historic town poised for expansionEdit

Located in beautiful Lane County, Lowell is a historic and family-oriented town that was established in the 1800's. The town sits on the north shore of the Dexter Reservoir and the Middle Fork of the Willamette River, and is a popular recreation area for people from nearby Eugene and Springfield.

Until now, there's been no craft brewery-tasting room in the area. Locals have to travel over 20 miles outside their town for a craft brewery experience; the community does not have a place where they can gather together. With only two other restaurants serving the area, the town needs a place where people can meet for great beer and food.

ConceptEdit

A microbrewery with a unique indoor/outdoor environment and food from rotating local food trucksEdit

Arable is committed to always being fully transparent in our business practices. During the site-planning phase in Lowell, we discovered that the infrastructure available for lease cannot support the daily functions of a production brewery. We have identified a site in Eugene that is move-in ready and can sustain a production brewery. We plan to have our brewery/production site in Eugene, along with a temporary tasting room.

Once the infrastructure is available for us in Lowell, we plan to open our tasting room in downtown Lowell.

The tasting room in Lowell will be the cornerstone of what will soon become many other retail businesses with the same goal: to breathe new life into the town. The city administrators also have plans to add residential real estate, markets, restaurants, and retail locations.

Arable will fulfill a need in Lowell for an open-to-all craft brewpub. Local residents will come to enjoy their hometown ales just as their town is starting to grow. Just as importantly, the tasting room will give the town a place to call its own.

DetailsEdit

A year-round drink, food, and event spaceEdit

The beerEdit

Founding Brewmaster Chris Archer will manage the brewing process. Chris plans to brew a variety of beers, including IPAs, stouts, pale ales, porters, lagers, Belgians, and sours.

The spaceEdit

We will be able to bring the community together in the family friendly environment that we will create in both our temporary tasting room in Eugene and our future tasting room out in Lowell. The 25–30 seat front of the house (with additional standing room) will be complemented by additional outdoor seating, which will be covered and heated for year-round use.

Our concept is clean and simple, with a lived-in natural feel that elevates the beer, fosters community, and nurtures a connection. We will establish Arable’s tasting room in Lowell as a destination spot for locals and tourists alike to visit. We also plan to work with the food truck community to set up rotating trucks to provide food at the tap room.

On-site eventsEdit

Additionally, events are essential in promoting economic activity and building off new or continuing initiatives—they bring the community together, and also encourage people to spend money locally. Events show outsiders that the community is alive; things are happening and people care. We plan to have events, events, events!

- Trivia nights—These are very popular and have shown an average sales increase of 20%

- Movie nights

- Meet the brewer/tasting

- Brew with the brewer

- Live music

- Brewery tours

- Beer release night

- Pint card—similar to a coffee punch card

- Mug club

- Dollars off—to go growlers

- Local events in the Lowell area

Off-site eventsEdit

Arable plans on building a mobile tap unit. Once we have opened the tasting room out in Lowell, we plan to stage the tap unit at the lake during special boating events and local events in town to serve our beers. We will also be able to set the tap unit up at other festivals around Oregon. This will help expand Arable's visibility to a wider market base.

We have hosted numerous "pop-up" sample tasting events that were very successful. We have a growing fan base that are always excited to try what we come up with next; our last event drew approximately 100 guests.

Business modelEdit

A community-focused business modelEdit

The vision of Arable is centered around the community of the tasting room and on-premise sales. This will allow the business to have an immediate and direct connection with its patrons. The company will derive sales from the sale of beer, wine, food, and merchandise.

Beer:Edit

The company will sell high-gravity and low-gravity beers. High-gravity beers include IPAs and stouts and will be sold for between $6 and $7. The average cost of goods sold percentage for high-gravity beer is roughly 12%. Low-gravity beers include pilsners and lagers, and the company will sell them for between $4 and $5 per pint. The average cost of goods sold percentage for low-gravity beer is roughly 8%.

Wine:Edit

Arable will sell wines from local Oregon wineries, with a rotating selection of 3 or 4 varieties. It will sell the wine by the glass with an average price of $8 per glass. The estimated cost of goods sold percentage for this revenue segment is estimated to be 37.5%

Food and non-alcoholic beverages:Edit

The company will not have a full kitchen in the tasting room, but it will offer a variety of cold foods, bags of chips, and soups and chilis. Once we have opened the tasting room out to Lowell, Arable Brewing will also work with the Dexter Lake Club’s Rattlesnake BBQ restaurant to provide several of their pre-made sandwiches. The average cost of goods sold is expected to be 80%.

Merchandise:Edit

Arable will sell branded merchandise that includes t-shirts, sweatshirts, hats, and stickers. The average price of merchandise will be $30.

Operations planEdit

Locations & FacilitiesEdit

The company will lease one space in Eugene that will house both its brewhouse and the tasting room. This unique model will give patrons the ability to be “in the brewery” while drinking the beer that was brewed there. Once the infrastructure is available for us in Lowell, we plan to open a tasting room in downtown Lowell, creating a destination spot for locals and tourists alike to visit.

The Eugene site is virtually move-in ready. Arable will need to make a few leasehold improvements to the space totaling $21,500. The company has submitted an LOI to the property landlord, and will have an executed lease for the property before the closing and disbursement of the start-up financing.

StaffingEdit

The founders of Arable will solely handle the operations of the business in the first year of operation, with the exception of part-time seasonal tasting room staff. In his position at the Eugene brewery, Ninkasi, Chris operates a brewhouse and cellar of the same size on his own. He also manages the beer from conception to packaging. With this knowledge, Arable feels confident Cam and Chris can manage every aspect of making beer from start to finish while ensuring the highest quality.

The company will hire the following additional staff:

- In year one, Arable will hire two part-time seasonal tasting room staff members between June and September. Tasting room staff members will serve beer, handle cellar operations, clean up, work at events, and provide general labor.

- In year two, the company will hire a part-time cellarman, who will handle fermentation, cleaning the tanks, transferring beer, and racking beer. It will also hire two part-time seasonal tasting room staff members between June and September.

- In year three, Arable will hire one full-time and two part-time tasting room staff members. It will also hire a full-time cellarman.

Equipment & toolsEdit

Arable Brewing will purchase the furniture, fixtures, and equipment that it will need for its operation. The total cost of these items is expected to be $142,550 and includes everything needed for both the brewhouse and the tasting room. The furniture, fixtures, and equipment that will be purchased includes:

| 5 barrel brew system | 5 fermentation vessels | Steam boiler |

| Glycol chilling system | Cold storage unit/under-counter refrigerator for tap room | Draft system for pouring beers to customers |

| Keg Washer | Process hoses | Glass cleaner for tap room |

The above are examples of the high-level capital purchases that we will need to make in year 1.

DistributionEdit

Arable will not be partnering with any third party distributors. We will only self-distribute draft beers to selective establishments and collaborative partners. Third-party distribution is expensive, and they do not have the brewery's best interests in mind.

Financial planEdit

Key assumptionsEdit

The assumptions used in the creation of the financial forecast are based on the extensive firsthand experience of the founders. Two of the founders have 16 years of experience working in craft breweries, with both having worked at the largest brewery in the region. The owners have used this experience to develop the realistic revenue, expense, and profit projections found in the forecast.

It was assumed that the financing would be received and assets would be purchased before month one of the projection period. The financing, asset purchases, and working capital can be seen as beginning balances on the balance sheet.

In order for Arable to be successful, we must be able to produce top-quality beers of all styles. An essential part of being able to make that happen is a quality brewing system. This will allow our team to have better temperature control and yield better volumes. This will require capital to purchase the necessary equipment. This is a list of top-level equipment essential to our success. This equipment pricing was an average of prices from the brewery supply website probrewer.com.

- 5 bbl Brew System = $65,000.00

- Equipment shipping costs= $5,000

- Keg shells= $3,500

- Keg washer= $4,000

- Mill = $500.00

- TC Clamps = $1,000.00

- TC Gaskets = $300.00

- Hoses = $600.00

- Process Pumps = $1,000.00

- Air Compressor = $1,000.00

- Glycol System = $9,000.00

- Wort Chiller = $1,000.00

- CO2 Valves = $450.00

- Carbonation Stones = $300.00

- O2 valves = $100.00

- Boiler = $10,000.00

- Scale = $200.00

- Fermentation vessels 5bbl = $12,500.00

- Water hoses = $300.00

- Buckets = $50.00

- Mash paddle = $100.00

- Rubbermaid trash cans = $250.00

- Big buckets = $100.00

- Ladders = $300.00

- Equipment cost total estimate=$116,550

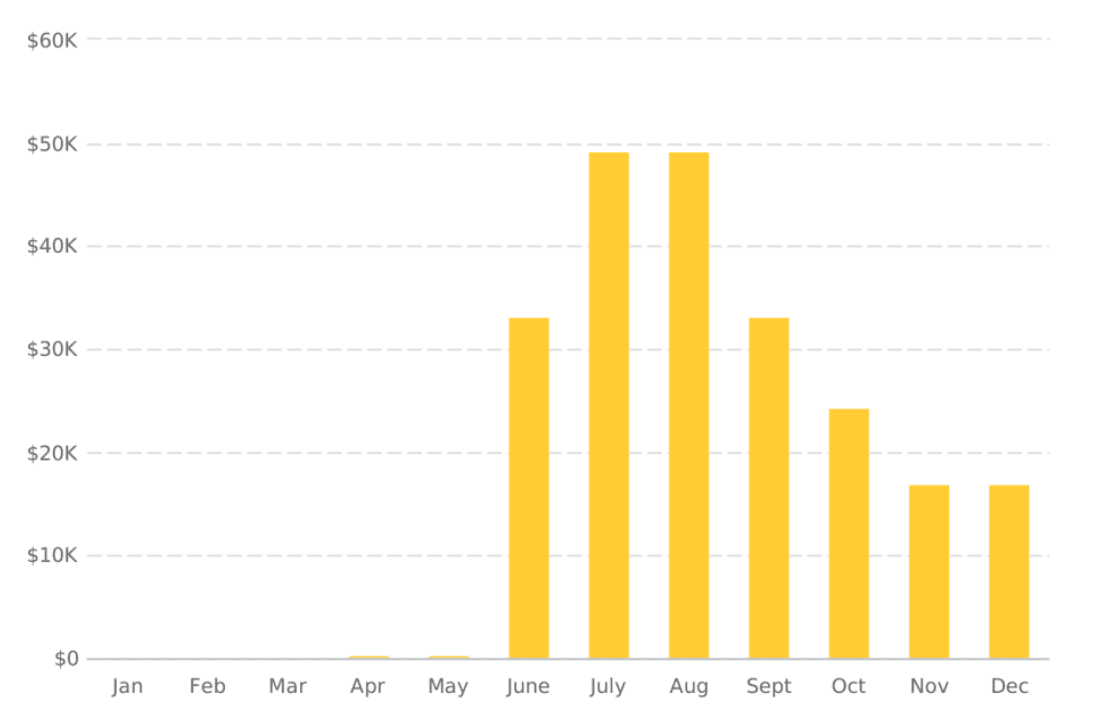

Revenue by Month

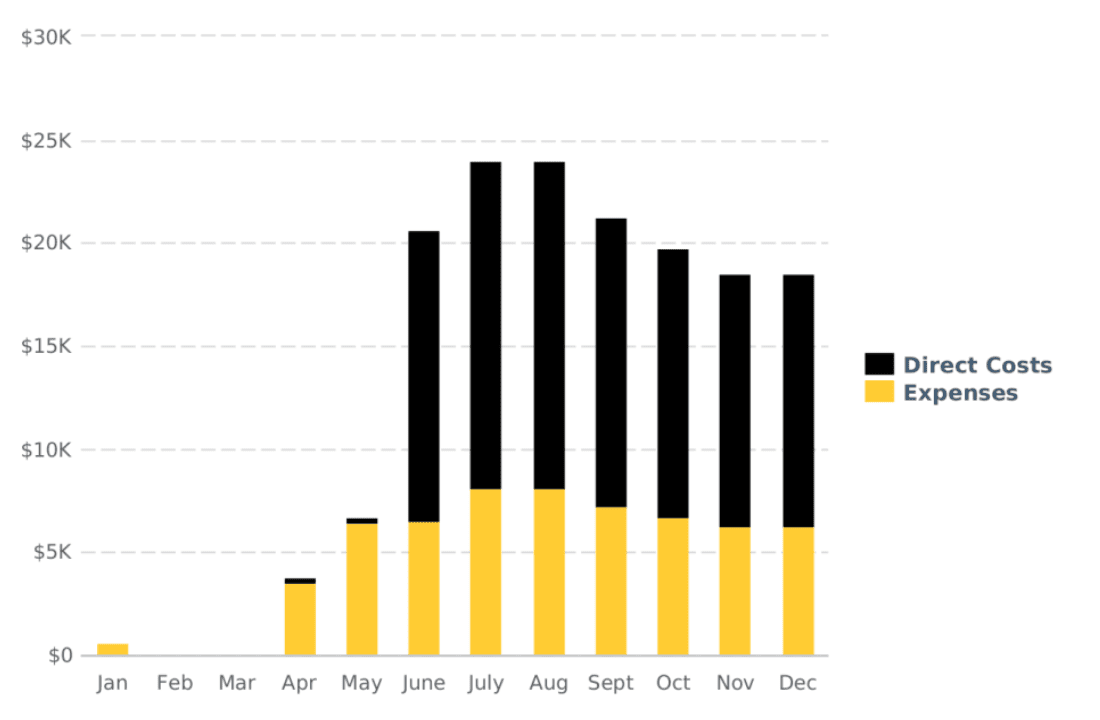

Expenses by Month

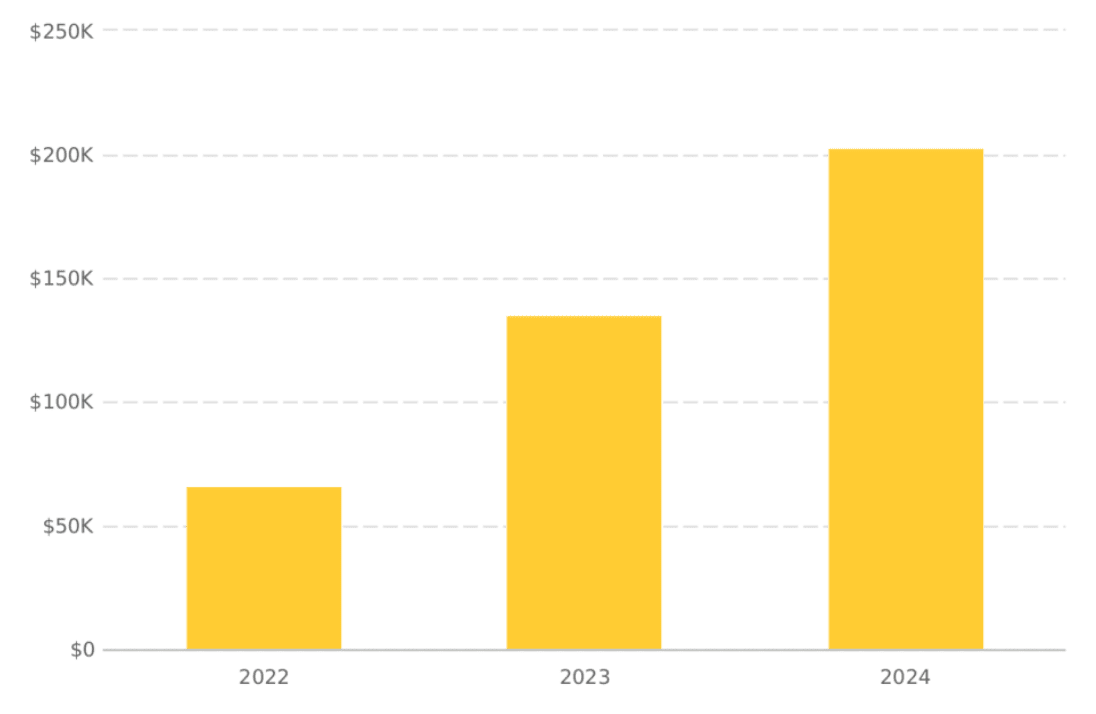

Net Profit (or Loss) by Year

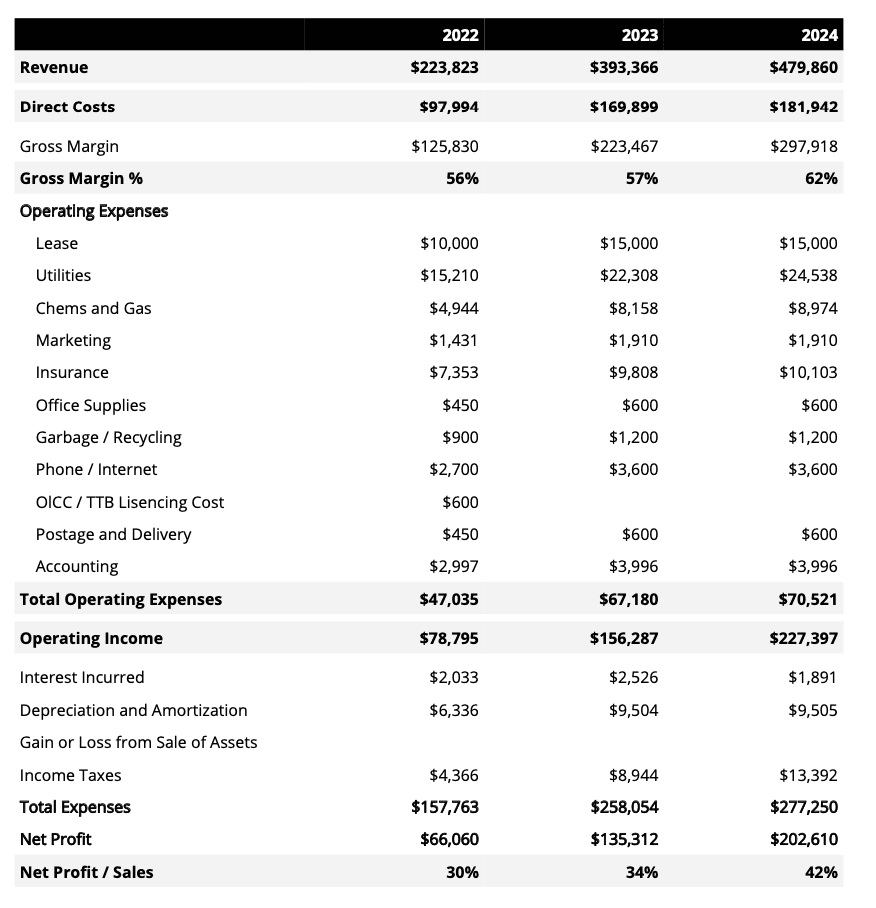

Projected Profit and Loss

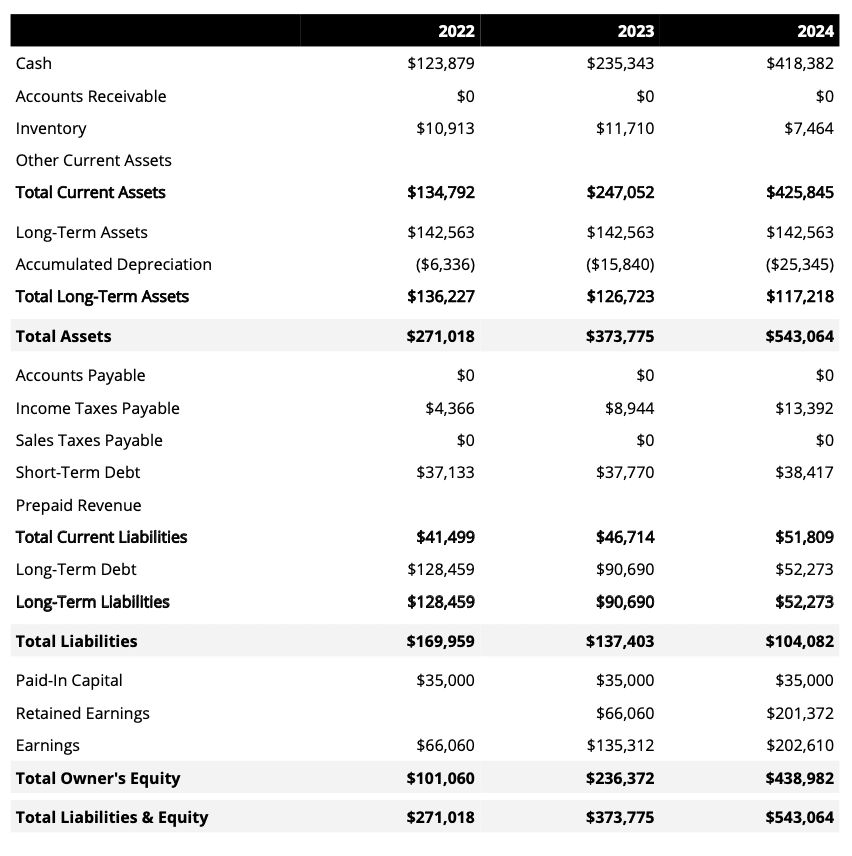

Projected Balance Sheet

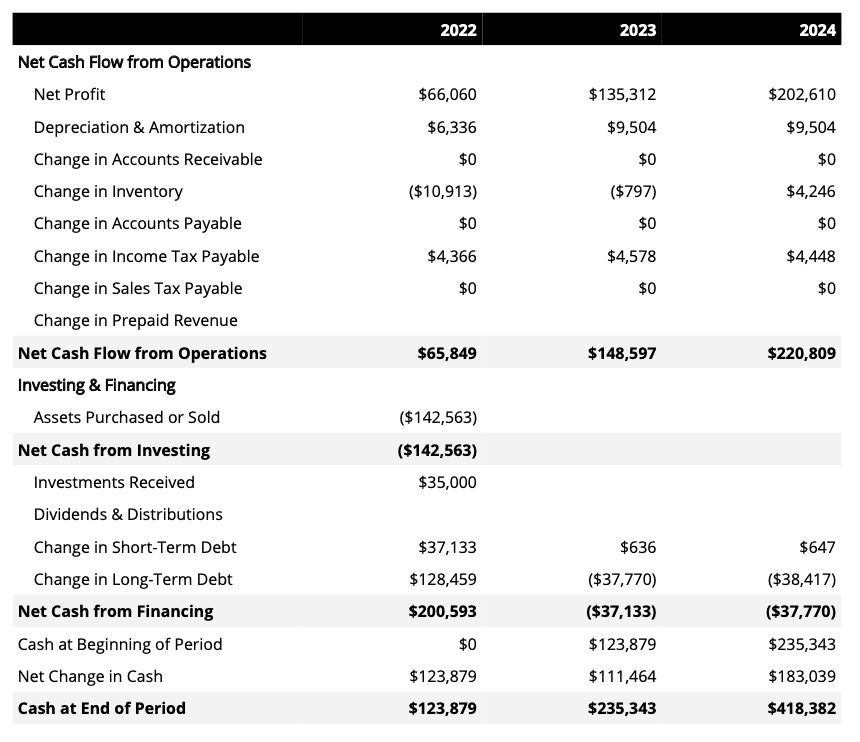

Projected Cash Flow Statement

TractionEdit

Building the Arable Brewing brandEdit

We have hosted numerous "pop-up" sample tasting events that were very successful. We have a growing fan base that is always excited to try what we come up with next.

We have hosted numerous "pop-up" sample tasting events that were very successful. We have a growing fan base that is always excited to try what we come up with next.

Our last event drew approximately 100 guests.

MarketEdit

Targeting Eugene and surrounding areas in Lane CountyEdit

According to the United States Census Bureau, Lane County is home to 373,340 residents with a median annual household income of $52,426 and a mean annual household income of $70,956.

Arable Brewing will target the city of Eugene along with rural areas outside of Eugene. This target area includes the communities of Eugene, Oakridge, Lowell, Dexter, Pleasant Hill, Creswell, Fall Creek, and Winberry. According to census data, these communities have a combined total population of 190,453 residents.

The largest age segment of the target area and the county overall is the 65 and older segment. The second-largest segment is made up of residents aged 55 through 64. Concerning the market segments for the bar industry, 26% of the population in the target area falls into the highest consuming age categories for the industry.

Once the infrastructure is available for Arable, we plan to lease retail space in Lowell. Lowell is a historic and family-oriented town. Established in the 1800s, and incorporated in 1954, the town sits on the north shore of the Dexter Reservoir and the Middle Fork of the Willamette River. The most used route to Lowell is along Lowell Bridge, a covered bridge that crosses the reservoir from Oregon Route 58. Lowell is surrounded by three reservoirs, respectively Dexter, Lookout Point, and Fall Creek. This makes the town a popular recreation area for people from Eugene and Springfield. From 2000 – 2010 the population grew by 188 people, with the median age being 39 years.

Once Arable is able to open their tasting room in Lowell, we are certain the tasting room will be the cornerstone of what will soon become many other retail businesses with the same goal: to breathe new life into the town. The city administrators have plans to add residential real estate, markets, restaurants, and retail locations. Administrators also have plans to improve sidewalks and streets, enforce codes and determine the most efficient ways to attract other businesses in the area.

New housing subdivisions have also been approved in recent months, continuing Lowell’s population growth efforts and indicative of the region’s increasing popularity.

Because the city of Lowell is currently working on their Urban Development plan to revitalize downtown Lowell, we see a great opportunity here.

There are 10,000 vehicles that travel HWY 58 on average daily (Oregon Flow Map 2019), 1,200 vehicles that travel East Main in Lowell on average daily, and 100-150 vehicles that travel on N. Moss and N. Shore on average hourly, Arable has a great opportunity to bridge the gap for those wishing to enjoy world-class beers of all styles.

Alcohol industry analysisEdit

According to the research firm IBISWorld, the bar industry is on track to generate revenue of $25.1 billion in 2021. The industry is expected to grow at a compounded annual growth rate of 1.1% through 2026. Demand for the industry’s services is affected by the overall level of disposable income in the country, per capita expenditures on alcohol, and the overall health consciousness of consumers. Growing incomes and a robust economy both drive revenues for the industry.

Breweries are expected to have sales of $30.3 billion in 2021, with craft beer accounting for 16.6% of the industry’s revenue. The Brewers Association defines craft beer as beer produced by breweries that generate fewer than 6 million barrels annually and are at least 75% independently owned. IBISWorld reports that craft beer sales have grown exponentially in recent years, and growth is expected to continue.

According to the research firm Nielsen, craft beer drinkers tend to be males between the ages of 21 and 44 who earn between $75,000 and $99,000 annually. Women are also consuming craft beer, though, with 79% of women surveyed reporting that they enjoy a craft beer every month.

Oregon is home to 312 craft breweries that produce 859,780 barrels of beer annually.

CustomersEdit

Arable will be well-situated to serve these core groupsEdit

- Local workforce

- Weekend local community out for an evening of entertainment

- Tourists visiting Lane County and the Willamette Valley

- All those visiting Dexter, Lookout Point, and Fall Creek

- Travelers on HWY 58. A highly traveled route to Oregon camping, snow sport areas and central Oregon which is considered the outdoor activity mecca of Oregon

Unique opportunities that occur weekly, monthly, and annuallyEdit

- Dexter Reservoir is a very popular destination for boaters, swimmers, hikers and nature walks.

- Lowell state recreation site

- Dexter lake farmer's market

- Blackberry Jam Festival - a time for music, food and fun. We are excited to be able to be a part of this annual event. This event has an annual average attendance of 1500 people.

- Columbia Drag Boat Association and Arizona Drag Boat Association annual boat races. Drag Boat Racing

- Oregon association of rowers

- HWY 58 is a highly used route year around. Travelers heading to the Cascade mountain ranges looking to camp, mountain bike, ski and snowboard. HWY 58 connects the valley with eastern Oregon; we will be the only craft brewery in route between Dexter/Lowell and LaPine.

- There are 7 campgrounds in nearby Fall Creek Recreation area.

Based on these opportunities, the above examples together represent a pool of more than 50–60 potential customers per weekday.

With that figure doubling upwards of 100–150 potential customers per weekend days. Due to the expanded population accessing the nearby campgrounds and utilizing the lake, we feel our peak season will be the summer months. Although the winter months are generally slower for volume sales industry wide, Arable will have the advantage of benefiting from travelers that are heading to nearby winter sports. We will also be pursuing any opportunity to involve ourselves in the thriving outdoor community.

- Willamette Pass skiing and Snowboarding events

- Disc golf events

- Mountain biking events

- Columbia and Arizona drag boat racing events

- Whitewater rafting and kayaking events

Marketing & salesEdit

Marketing will be grassroots based, rather than more expensive mass marketing. Arable currently has a strong social media presence, both on its Facebook and Instagram pages.

- Arable Brewing Co/Facebook (508 likes)

- Arable Brewing Co/Instagram (377 followers)

Arable has also developed a dedicated website. The website provides information about the brewery and will be updated to include the location and hours of the facility. The website will also be search engine optimized to drive organic traffic to the site. The website development has been completed by a friend of the company’s founders. The company will continue to strengthen its presence online over the next three years.

Arable Brewing plans to reach out to the local e-newspaper in the Lowell area, the HWY 58 Herald. It will also advertise in the Eugene Weekly that is distributed to over 856 locations in the Willamette Valley area.

After Arable has expanded and opened a tasting room in Lowell, we plan to broaden our visibility by sponsoring one of the local disk golf teams, sponsor a drag boat during the races and even sponsor a rowing team.

Arable will also collaborate with other breweries in the state to expand our draft reach and our brand recognition. This will allow Arable to be served in many already established breweries like Coldfire Brewing in Eugene and Reach Break Brewing in Astoria. We have also agreed to collaborate with Boneyard Brewing in Bend.

CompetitionEdit

Filling a need in the Lowell communityEdit

Currently, locals have to drive 20–30 minutes for a craft brewery experience similar to what we will be providing:

- Family friendly

- Pet friendly

- Partnerships with local vendors to provide fresh, local ingredients for our recipes

- Great beers served on-site

- Fun, unique tasting room vibe

- Unique outside seating

Current alternativesEdit

Currently there are no other breweries, brewpubs, tasting rooms in Lowell. Arable will be the first small-batch, microbrewery to have a tasting room in Lowell. Lowell is located 21.6 miles away from Eugene.

While the tasting room is located in Eugene, our competition will be several local breweries; Ninkasi, Claim 52, Hop Valley, just to name a few which are currently operating under a very different business model and vision. Most, if not all of the breweries located in Eugene and surrounding areas are fighting for shelf space. Because Arable's business model does not include distribution, we will not be in that same fight. However, in the future, we will look into self-distributing draft and packaged beer to local and craft-focused bottle shops and markets.

Once the tasting room has opened in Lowell, our competition will consist of other local establishments that sell beer for immediate on-premises consumption. These include:

Dexter Lake ClubEdit

This bar offers beer and cocktails and an outdoor patio in Dexter, 2.7 miles outside of Lowell. It also has an affiliated barbecue restaurant attached. The restaurant serves barbecue chicken, pork, brisket platers, and sandwiches. Food prices range from $8 to $32.

Buckhorn TavernEdit

This establishment is located 3.3 miles from Lowell and offers domestic, import and craft beer, cocktails, and food. It is open for lunch and dinner and features video lottery machines and pool tables. The tavern services a variety of food, including appetizers, seafood, burgers, and sandwiches. Food prices range from $4 to $12.75.

Hilltop Bar & GrillEdit

This establishment is located 10 miles from Lowell in Pleasant Hill. It offers a variety of beers, including craft IPAs, pilsners, and stouts. It sells growlers and twistee cans so customers can take beer to go. Beer prices range from $5 to $12. Its food menu is extensive and includes small plates, sandwiches, soups, salads, and entrees. Food prices range from $7 to $26.

Round Up SaloonEdit

This establishment is located in Creswell, roughly 18 miles from Lowell. It offers a few craft options, Mirror Pond, Hefewizen, in addition to several domestic beers; Budweiser, Bud Light, Coors, Coors Light, PBR and Busch Light. It has a small food menu consisting of pizza, burgers, and appetizers. It also offers nightly dinner specials. Its food prices range from $7 to $9.50.

3 Legged Crane Pub & BrewhouseEdit

This establishment is located roughly 24 miles from Lowell. 3 Legged Pub brews onsite, strictly Casked Condition Ales. They serve lunch and dinner items that include soups, salads and burgers. Food items range in price from $4 to $15.

The CornerEdit

This is a local bar and grill located in Oakridge. The establishment is roughly 24 miles from the proposed location of Arable Brewing. It serves lunch and dinner items that include burgers, burritos, and sandwiches. Food items range in price from $6.95 to $9.95.

Our advantagesEdit

- Quality Process and Ingredients: Our beers will be of the highest quality and include only the finest natural ingredients. We will be creating a large variety of classic and innovative beers that will appeal to a wide range of palates. We will use fine North American two row barley malt in addition to imported German and Belgian specialty malts, generally regarded as among the finest malts in the world. We will use hops from the Pacific Northwest as well as hops from all over the world to create many different styles.

- Handcrafted: Our beers are stored in small 5 barrel batches (155 U.S. Gallons) under the close personal attention of our brewers.

- Location: Being located close to Dexter reservoir and in close proximity to local farms; we will be able to embrace agriculture, wine, and the recreational amenities around the reservoir. Partnering with local farms, we will be using only the freshest quality ingredients.

- Working with the local farms to host beer and food pairings. Such as the Arable Drink and Food Festival.

- Because of our smaller volume expectations and the fact we will not distribute or ship any of our beers across state lines, we will not be held to the same strict government expectations. We will not have to get the label art or beer names approved by the TTB (Alcohol and Tobacco and Trade Bureau).

- We will be able to respond to customer favorites as well as introducing new and innovative styles. Due to our smaller size, we will be able to have more control and flexibility in the beers we produce. Bigger breweries do not have this ability due to distribution contracts and batch sizes.

- We don't want or need to be the biggest brewery. Beer nerds love the unique idea of a small brewery using guerilla marketing and word of mouth advertising. Exclusiveness is an effective marketing strategy.

- There are so many breweries opening up every day across the country. As of 2020, there are 8,764 craft breweries in the U.S. In order to separate ourselves from the rest of them, we need a "niche". Our "niche" is small batch, on-premise craft beer.

Vision and strategyEdit

Producing and selling 5,394 gallons of beer in 2022Edit

With a planned opening in Fall 2022, Arable expects to produce and sell approximately 174 barrels (5,394 gallons) of beer in 2022. We expect to scale to approximately 261 barrels in 2023, and 320 barrels in 2024. We will achieve this growth through on-premise sales of draft and specialty bottled and can beers. In years 2 and 3, we will look into self-distributing draft and packaged beer to local and craft-focused bottle shops and markets.

FoundersEdit

Cam Wells

Co-Founder & CEO

Cam Wells will manage all aspects of the facilities' daily operations. Cam has extensive experience in brewing, process engineering and facilities management. He has been employed as the Plant Electrician at Eugene's largest craft brewery almost 6 years. After serving in the U.S. Navy for four years as a flight control and landing gear mechanic, Cam went to work at a heavy equipment manufacturer in Eugene, Oregon. During his 17 years employed there, he obtained skills in many different trades.

- Assembly

- Fitting and fabrication

- Certified welder

- Building Construction

- Machine tool operations

- Facilities and maintenance management

- Oregon Plant Journeyman electrical license

After leaving that employment, to help take care of his father-in-law, he was offered a job at one of the nations top 50 craft breweries located in Eugene Oregon. During his time at the brewery, he has obtained a solid skill set in the following:

- Stainless steel sanitary welding processes

- Production process engineering

- All aspects of the brewing processes from recipe development to cellar operations to serving pints in the tasting room

It has always been Cam's dream to work for himself and utilize the skills he has obtained over the years. It was when he started working at the brewery that he found his calling to help start and run his own brewery. With the combined skills of his partners and himself, Cam feels that given a realistic opportunity Arable can be very successful.

Chris Archer

Co-Founder & Founding Brewmaster

Founding Brewmaster Chris Archer will manage the brewing process. Chris is the lead brewer at Eugene's largest craft brewery. For over 10 years, he has excelled in all aspects of the brewing process from cellar operations to recipe development, tracking and optimization.

After serving in the Navy for 8 years, he got out and decided to take a job at a Eugene brewery working in the cellar department. It was there that he learned all about the heart of a functioning brewery. Chris has been able to learn many skills and he continues to master them.

- Transferring Beer

- Yeast Management

- Filtering and Centrifuging Beer

- Filling Packaged Beer from Tanks

- CIP of fermentation tanks, bright tanks, and brew systems (Cleaning and sanitation processes)

After working hard for 4 years in the cellar Chris worked his way up and was promoted to Brewer 1. In this new position he learned all about the brewing process. Over the last few years Chris has operated a 50 bbl brew house as well as a 90 bbl fully automated brew house. He has been in charge of the following tasks.

- Producing wort for fermentation

- CIP Brew house vessels

- Recipe Development

- Brewing to cellar hand off

After 4 years as a Brewer 1 Chris was promoted to Lead Brewer at the brewery. During this time, he also completed his Associates Degree in Business Management, with a focus in small business and entrepreneurship. In his role as lead brewer, Chris has taken on many new roles.

- Lead Recipe Developer

- Brew house Efficiency Tracker

- Proleit Program Developer

- Brew house Subject Matter Expert

- Hop Selection Team

- Malt Quality Team

- Brew house Supply Ordering

- World class sensory knowledge

After 10 years in the industry, involved in every aspect of production, Chris is excited to share his love and passion for beer with the world. Along with his stellar team, Chris looks forward to bringing Arable Brewing to life.

Amy Wells

Co-Founder & CFO

Amy Wells will manage marketing, sales and bookkeeping.

In the early 1990s Amy left her job at a Eugene area bank and went to work for her family's small food cart, Tres Hermanas. During those early years, they were the only food cart in Eugene. Tres gained a huge fan base and the family decided it was time to open a full service restaurant. They chose a location in downtown Eugene area and their fan base followed them indoors. For almost 10 years they enjoyed serving the local community their fresh and delicious food.

While working for the family business, Amy was responsible for the following tasks.

- Menu development

- Front house management

- Bookkeeping

- All aspects of daily operation of running a restaurant

For the past 20 years, since the close of the family restaurant Amy has been working at a nonprofit organization in Eugene, as the Grants Administrative Associate. While in this role, Amy has learned and perfected a large range of professional skills that she will bring to the team.

- File management/record keeping

- Interpersonal skills

- Teamwork

- Accounts Payable

- Customer relations

- Microsoft Office

- Outlook

- Event planning

- Budget management

- Excel/Data entry

Amy has dreamed of owning and operating her own business ever since her family's business closed. With the combination of their team, the skills, and the passion to succeed, Arable's success is inevitable.

Company historyEdit

Cam, Chris and Amy's dream of starting a brewery together was born about 6 years ago. We bought a 1 barrel "nano" brewing system to develop recipes and of course, enjoy the delicious beers we would be making. From Cam and Amy's garage, we have produced over 100 different beer recipes over the last 6 years.

In October, 2019, we applied for a rural area's "fermentation development incentive program". We were awarded the incentives through grants funded by the "urban development program" for this area. We had begun the process of improvements on the building we would occupy. We were given the green light for a SBA guaranteed loan from a local financial investment bank. The ball was rolling...

Then COVID-19 hit. We almost immediately felt the affects of the pandemic. The financial investment bank pulled the green light. Who could blame them? Why would they feel comfortable investing in a "hospitality" start up when the hospitality industry had basically been shut down?

As a team, Arable decided to pause on planning in hopes the pandemic would ease. During this time, we continued to brew beers on the "nano" system and even hosted a couple of very successful sample tasting "pop-ups".

During this time, we were contacted by Jerry Valencia, owner of Bridgeway Contracting.

He shared with us his plans to develop retail space in the downtown Lowell area. We had a meeting where he shared his vision and plans for urban development in the Dexter/Lowell area. We were impressed with Jerry's vision to further develop Lowell. After hearing his plans we realized it all aligned with what Arable was hoping to create.

There has already been extensive work on the infrastructure of Lowell. For example:

- Improved water and sewer system

- Improved K-12 school infrastructure

- Multiple housing developments are currently being built

Arable's tasting room will be occupying the first retail space that is expected to be completed in the Spring of 2022.

The enthusiasm and excitement we have received from the local government and residents is a perfect indication that Arable's model is a good fit for the community. We look forward to being the cornerstone of the area's urban growth process.

Arable Brewing Company TeamEdit

Amy Wells

Co-founder & CFO

Cameron Wells

Co-founder & CEO

Chris Archer

Co-founder & Founding Brewmaster

RisksEdit

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

Investors will not have voting rights.

Investors will not have the right to vote upon matters of the Company. Thus, Investors will never be able to vote upon any matters of the Company to affect its management or policies.

The Company’s success depends on the experience and skill of the board of directors, its executive officers and key employees.

We are dependent on our board of directors, executive officers and key employees. These persons may not devote their full time and attention to the matters of the Company. The loss of our board of directors, executive officers and key employees could harm the Company’s business, financial condition, cash flow and results of operations.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early stage companies. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

With shelter-in-place orders and non-essential business closings potentially happening throughout 2020, 2021, 2022 and into the future due to COVID-19, the Company’s revenue has been adversely affected.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an Investor to lose all or a portion of their investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. Our business currently does not generate any sales and future sources of revenue may not be sufficient to meet our future capital requirements. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

We source certain materials from a number of third-party suppliers and, in some cases, single-source suppliers.

Although we believe that alternative suppliers are available, the loss of any of our material suppliers could adversely affect our results of operations and financial condition. Our inability to preserve the current economics of these agreements could expose us to significant cost increases in future years.

We rely on other companies to provide components and services for our products.

We depend on suppliers and contractors to meet our contractual obligations to our customers and conduct our operations. Our ability to meet our obligations to our customers may be adversely affected if suppliers or contractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our products may be adversely impacted if companies to whom we delegate manufacture of major components or subsystems for our products, or from whom we acquire such items, do not provide components which meet required specifications and perform to our and our customers’ expectations. Our suppliers may be unable to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two contractors or suppliers for a particular component. Our products may utilize custom components available from only one source. Continued availability of those components at acceptable prices, or at all, may be affected for any number of reasons, including if those suppliers decide to concentrate on the production of common components instead of components customized to meet our requirements. The supply of components for a new or existing product could be delayed or constrained, or a key manufacturing vendor could delay shipments of completed products to us adversely affecting our business and results of operations.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company relies on certain intellectual property rights to operate its business. The Company’s intellectual property rights may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights. As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non- competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets, and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We continue to face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, and retail financing, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations and we expect these costs to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

Litigation relating to alcohol abuse or the misuse of alcohol could adversely affect our business.

There has been increased public attention directed at the beverage alcohol industry, which we believe is due to concern over problems related to alcohol abuse, including drinking and driving, underage drinking and health consequences from the misuse of alcohol. Several beverage alcohol producers have been sued regarding alleged advertising practices relating to underage consumers. Adverse developments in these or similar lawsuits or a significant decline in the social acceptability of beverage alcohol products that could result from such lawsuits could materially adversely affect our business.

Adverse public opinion about alcohol could reduce demand for our products

Anti-alcohol groups have, in the past, advocated successfully for more stringent labeling requirements, higher taxes and other regulations designed to discourage alcohol consumption. In addition, recent developments in the industry may compel us to identify the source and location of our distillate products and notify the consumer of whether the product was distilled by us. More restrictive regulations, negative publicity regarding alcohol consumption and/or changes in consumer perceptions of the relative healthfulness or safety of beverage alcohol could decrease sales and consumption of alcohol and thus the demand for our products. This could, in turn, significantly decrease both our revenues and our revenue growth, causing a decline in our results of operations.

Potential decline in the consumption of our products; dependence on sales of our beer.

Our business depends upon consumers’ consumption of our beer brand. Accordingly, a decline in the growth rate, amount or profitability of our sales of our beer could adversely affect our business. Further, consumer preferences and tastes may shift due to, among other reasons, changing taste preferences, demographics or perceived value. Consequently, any material shift in consumer preferences and taste in our major markets away from our brand, and our beer in particular, from the categories in which it competes could have a negative impact on our business, liquidity, financial condition and/or results of operations. Consumer preferences may shift due to a variety of factors, including changes in demographic or social trends, public health policies, and changes in leisure, dining and beverage consumption patterns. A limited or general decline in consumption in one or more of our product categories could occur in the future due to a variety of factors, including: • a general decline in economic or geopolitical conditions; • concern about the health consequences of consuming beverage alcohol products and about drinking and driving; • a general decline in the consumption of beverage alcohol products in on-premise establishments, such as may result from stricter laws relating to driving while under the influence of alcohol; • the increased activity of anti-alcohol groups; • increased federal, state, provincial excise or other taxes on beverage alcohol products and possible • restrictions on beverage alcohol advertising and marketing; • increased regulation placing restrictions on the purchase or consumption of beverage alcohol products or increasing prices due to the imposition of duties or excise tax or changes to international trade agreements or tariffs; • inflation; and • wars, pandemics, weather and natural or man-made disasters.

We may encounter difficulties in maintaining relationships with suppliers, distributors and customers.

Our business success is, dependent, in part, on our ability to maintain, grow, and we cannot guarantee any current relationships with our suppliers, distributors, partners, customers, or any other entity or individual selling our products on a consumer-facing platform. We define "platform" as any physical or digital intermediary through which our products are sold, including, but not limited to, retail and marketplace websites and physical retail stores. We cannot predict the financial health of our customers or other platforms through which our products are sold, and, consequently, the maintenance of our current and/or future relationships cannot be guaranteed. The loss of one or more a customer accounts could significantly negatively impact our business.

We rely on third-party suppliers to provide basic ingredients for our products.

We depend on these suppliers, distributors and subcontractors to meet our contractual obligations to our customers and conduct our operations. Our ability to meet our obligations to our customers may be adversely affected if suppliers or subcontractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our products may be adversely impacted if companies to whom we delegate production of our products, or from whom we acquire such items, do not provide ingredients or packaging components which meet required specifications and perform to our and our customers’ expectations. Our suppliers may be less likely than us to be able to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two subcontractors or suppliers for a particular raw material, component, basic ingredient subsystem.

Investors will not become equity holders of the Company.

Investors will not have an ownership claim to the Company or to any of its assets. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available.

The Company is vulnerable to fluctuations in the price and supply of ingredients, packaging materials, and freight.

The Company purchases large quantities of raw materials, including ingredients used in our products. Costs of ingredients and packaging, are volatile and can fluctuate due to conditions that are difficult to predict, including global competition for resources, weather conditions, natural or man-made disasters, consumer demand, and changes in governmental trade and agricultural programs. Additionally, the prices of packaging materials and freight are subject to fluctuations in price. The sales prices to the Companies' customers are a delivered price. Therefore, changes in the Company's input costs could impact their gross margins. Their ability to pass along higher costs through price increases to their customers is dependent upon competitive conditions and pricing methodologies employed in the various markets in which the Company competes. To the extent competitors do not also increase their prices, customers and consumers may choose to purchase competing products or may shift purchases to lower-priced private label or other value offerings which may adversely affect the Company's results of operations. The Company buys from a variety of producers and manufacturers, and alternate sources of supply are generally available. However, the supply and price are subject to market conditions and are influenced by other factors beyond the Company's control. The Company does not have long-term contracts with many of their suppliers, and, as a result, they could increase prices or fail to deliver. The occurrence of any of the foregoing could increase their costs and disrupt their operation.

Competition

We are in a highly competitive industry and our sales could be negatively affected by numerous factors including: ● our inability to maintain or increase prices; ● new entrants in our market or categories; ● the decision of wholesalers, retailers or consumers to purchase competitors’ products instead of ours; or ● a general decline in beverage alcohol consumption due to consumer dietary preference changes or consumers substituting or similar products in lieu of beverage alcohol. Sales could also be affected by pricing, purchasing, financing, operational, advertising or promotional decisions made by wholesalers, state and other local agencies, and retailers which could affect their supply of, or consumer demand for, our products. We could also experience higher than expected selling, general and administrative expenses if we find it necessary to increase the number of our personnel or our advertising or marketing expenditures to maintain our competitive position or for other reasons. We cannot guarantee that we will be able to increase our prices to pass along to our customers any increased costs we incur.

We face competition from other companies that produce alcoholic beverage products, and other alternative products with similar benefits, make-up, and general likeness as our products.

Competition in our industry, specifically, the production, sale, marketing, and distribution of beverage products is vigorous, with a large number of businesses engaged in this industry. Many of our competitors have established reputations for successfully developing and marketing their products, including their own versions of alcoholic beverages that incorporate the same or similar ingredients as our products, including other alternative ingredients that are widely recognized as providing similar benefits to our ingredients. In addition, many of our competitors have greater financial, managerial and technical resources than we do. If we are not successful in competing in these markets, we may not be able to attain our business objectives.

Consolidation in the beer industry may impact our market share.

Where we operate, we compete with Anheuser-Busch InBev S.A./N.V. (“ABI”) and its subsidiaries, the largest beer company in the world. ABI has expanded globally in recent years, through a series of mergers and acquisitions, and today has more than 500 brands and operations in 50 countries. The foregoing consolidation in the market, as well as any further consolidation of our competitors, may increase their pricing and/or investment competitiveness, which could negatively affect our market share, and accordingly, our results.

The craft beer business is seasonal in nature, and we are likely to experience fluctuations in operating results.

Sales of craft beer products are somewhat seasonal. Our sales volume may also be affected by weather conditions and selling days within a particular period. Therefore, the results for any given quarter will likely not be indicative of the results that may be achieved for the full fiscal year. If an adverse event such as an economic downturn or poor weather conditions should occur during the second and third quarters, the adverse impact to our revenues would likely be greater as a result of the seasonality of our business.

We may not be able to satisfy our product supply requirements for our beer in the event of a significant disruption, partial destruction or total destruction of our breweries.

A significant disruption at our breweries, even on a short-term basis, could impair our ability to produce and ship products to market on a timely basis. Alternative facilities with sufficient capacity or capabilities may not readily be available, may cost substantially more or may take a significant time to start production, any of which could have a material adverse effect on our business, liquidity, financial condition and/or results of operations.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

Our inability to successfully manage the price gap between our private-label products and those of our branded competitors may adversely affect our results of operation.

Competitors’ branded products could have an advantage over our private label products primarily due to advertising and name recognition. When branded competitors focus on price and promotion, the environment for private label products becomes more challenging because the price gaps between private label and branded products can become less meaningful. At the retail level, private label products sell at a discount to those of branded competitors. If branded competitors continue to reduce the price of their products, the price of branded products offered to consumers may approximate or be lower than the prices of our private label products. Further, promotional activities by branded competitors such as temporary price rollbacks, buy-one-get-one-free offerings and coupons have the effect of price decreases. Price decreases taken by competitors could result in a decline in the Company’s sales volumes.

We may be unable to anticipate changes in consumer preferences and trends, which could result in decreased demand for our products.

Our success depends in part on our ability to anticipate the tastes and eating habits of consumers and to offer products that appeal to their preferences. Consumer preferences change from time to time and can be affected by a number of different and unexpected trends. Our failure to anticipate, identify or react quickly to these changes and trends, and to introduce new and improved products on a timely basis, could result in reduced demand for our products, which would in turn cause our revenues and profitability to suffer. Similarly, demand for our products could be affected by consumer concerns regarding the health effects of nutrients or ingredients such as trans fats, sugar, processed wheat or other product attributes.

We are affected by extensive laws, governmental regulations, administrative determinations, court decisions and similar constraints both domestically and abroad and our failure to comply with these laws, regulations and constraints could lead to the imposition of significant penalties or claims, which could harm our financial condition and operating results.

In the U.S. market, the formulation, manufacturing, packaging, labeling, distribution, sale and storage of our products are affected by extensive laws, governmental regulations, administrative determinations, court decisions and similar constraints. Such laws, regulations and other constraints may exist at the federal, state or local levels in the United States. We are subject to regulation by one or more federal agencies including the U.S. Food and Drug Administration (FDA), the U.S. Federal Trade Commission, the U.S. Department of Agriculture (USDA), and state and local authorities. In addition, the adoption of new regulations or changes in the interpretations of existing regulations may result in significant compliance costs or discontinuation of product sales and may negatively impact the marketing of our products, resulting in significant loss of sales revenues. Our failure to comply with these current and new regulations could lead to the imposition of significant penalties or claims, limit the production or marketing of any non-compliant products or advertising and could negatively impact our business. The conduct of our businesses, including the production, storage, distribution, sale, display, advertising, marketing, labeling, transportation and use of our products, as well as our health and safety practices, are subject to various laws and regulations administered by federal, state and local governmental agencies in the United States. Many of these laws and regulations may have differing or conflicting legal standards across the various markets where our products are made, manufactured, distributed or sold. These laws and regulations and interpretations thereof may change, sometimes dramatically, as a result of a variety of factors, including, but not limited to, political, economic or social events. Such changes may include changes in: food and drug laws; laws related to product labeling, advertising and marketing practices; laws regarding the import or export of our products or ingredients used in our products; laws and programs aimed at reducing, restricting or eliminating ingredients or substances in, or attributes of, our products; laws and programs aimed at discouraging the consumption or altering the package or portion size of our products; increased regulatory scrutiny of, and increased litigation involving product claims and concerns regarding the effects on health of ingredients or substances in our products; state consumer protection laws; taxation requirements, including the imposition or proposed imposition of new or increased taxes or other limitations on the sale of our products; employment laws; privacy laws; laws regulating the price we may charge for our products. New laws, regulations or governmental policy and their related interpretations, or changes in any of the foregoing, including taxes or other limitations on the sale of our products, ingredients or substances contained in our products or commodities used in the production of our products, may alter the environment in which we do business and, therefore, may increase our costs or liabilities or reduce demand for our products, which could adversely affect our business, financial condition or results of operations. Governmental entities or agencies in jurisdictions where our products are made, manufactured, distributed or sold may also impose new labeling, product or production requirements, or other restrictions. If one jurisdiction imposes or proposes to impose new requirements or restrictions, other jurisdictions may follow and the requirements or restrictions, or proposed requirements or restrictions, may result in adverse publicity (whether or not valid). For example, if one jurisdiction imposes a specific labeling requirement or requires a specific warning on any product that contains certain ingredients or substances, other jurisdictions may react and impose restrictions on products containing the same ingredients or substances, which may result in adverse publicity or increased concerns about the health implications of consumption of such ingredients or substances in our products (whether or not valid). If consumer concerns, whether or not valid, about the health implications of consumption of ingredients or substances present in our products increase as a result of these studies, new scientific evidence, new labeling, product or production requirements or other restrictions, or for any other reason, including adverse publicity as a result of any of the foregoing, or if we are required to add warning labels to any of our products or place warnings in locations where our products are sold, demand for our products could decline, or we could be subject to lawsuits or new regulations that could affect sales of our products, any of which could adversely affect our business, financial condition or results of operations. In addition, regulatory authorities under whose laws we operate may have enforcement powers that can subject us to actions such as product recall, seizure of products or other sanctions, which could have an adverse effect on our sales or damage our reputation. Suppliers, producers, distributors or other third parties with whom we do business could take actions, intentional or not, that violate these policies and procedures or applicable laws or regulations. Violations of these laws or regulations could subject us to criminal or civil enforcement actions, including fines, penalties, disgorgement of profits or activity restrictions, any of which could adversely affect our business, financial condition or results of operations.

Federal, state and local beer, liquor and food service regulations may have a significant adverse impact on our operations.

We are required to operate in compliance with federal laws and regulations relating to alcoholic beverages administered by the Bureau of Alcohol, Tobacco, Firearms and Explosives of the U.S. Department of Justice, as well as the laws and licensing requirements for alcoholic beverages of states and municipalities where our operations will be located. Failure to comply with federal, state or local regulations could cause any licenses we obtain to be revoked and force us to cease the sale of goods at certain locations. Any difficulties, delays or failures in obtaining such licenses, permits or approvals could delay or prevent the opening of any operations in a particular area or increase the costs associated therewith. In addition, in certain states, the number of liquor licenses available is limited, and licenses are traded on the open market. We expect beer sales to comprise a significant portion of our revenues. If we are unable to obtain any required licenses, revenues and results of operations could be adversely affected. We may apply for liquor licenses with the advice of outside legal and licensing consultants. Because of the many and various state and federal licensing and permitting requirements, there is a significant risk that one or more regulatory agencies could determine that we have not satisfied the requirements for any necessary license.

The distribution and sale of beer has historically been subject to a continuously changing tax regime.

Historically, there has been significant variation in the taxation of beer sales. As recently as December 2017, the “Tax Cuts and Jobs Act” was passed by Congress which provided, among other things, a temporary reduction in federal excise taxes on beer. Further, individual states also impose excise taxes on alcoholic beverages in varying amounts. In the future, the excise tax rate could be increased by either the federal or state governments. Future increases in excise taxes on alcoholic beverages could have a material adverse effect on our business and financial condition.

As a food production company, all of the Company's products must be compliant with regulations by the Food and Drug Administration (FDA).

Certain products are or may become subject to FDA rules and regulations, including those regarding product manufacturing, food safety, required testing, and appropriate labeling of the products. It is possible that regulations by the FDA and its interpretation thereof may change over time. As such, there is a risk that the Company's products could become non-compliant with the FDA’s regulations and any such non-compliance could harm the business.

Substantial disruption to production at our manufacturing and distribution facilities could occur.

Substantial disruption to production at our manufacturing and distribution facilities could occur.

Reliance on major retailers and government agencies.

Local market structures and distribution channels vary worldwide. Within our primary market, we expect to offer a range of beer categories. In the U.S., we may sell our products to retail outlets and directly to government agencies, and we may explore entering into exclusive arrangements that generate a large portion of sales. Any retailers of our products may offer products which compete directly with our products for retail shelf space, promotional support and consumer purchases, and retailers may give higher priority to products of our competitors. The replacement or poor performance of our major retailers or government agencies could result in temporary or longer-term sales disruptions or could have a material adverse effect on our business, liquidity, financial condition and/or results of operations.

Manufacturing or design defects, unanticipated use of our products, or inadequate disclosure of risks relating to the use of the products can lead to injury or other adverse events.

These events could lead to recalls or safety alerts relating to our products (either voluntary or required by governmental authorities) and could result, in certain cases, in the removal of a product from the market. Any recall could result in significant costs as well as negative publicity that could reduce demand for our products. Personal injuries relating to the use of our products can also result in product liability claims being brought against us. In some circumstances, such adverse events could also cause delays in new product approvals. Similarly, negligence in performing our services can lead to injury or other adverse events.

Product safety and quality concerns, including concerns related to perceived quality of ingredients, could negatively affect the Company’s business.

The Company’s success depends in large part on its ability to maintain consumer confidence in the safety and quality of all its products. The Company has rigorous product safety and quality standards. However, if products taken to market are or become contaminated or adulterated, the Company may be required to conduct costly product recalls and may become subject to product liability claims and negative publicity, which would cause its business to suffer. In addition, regulatory actions, activities by nongovernmental organizations and public debate and concerns about perceived negative safety and quality consequences of certain materials in our products may erode consumers’ confidence in the safety and quality issues, whether or not justified, and could result in additional governmental regulations concerning the marketing and labeling of the Company’s products, negative publicity, or actual or threatened legal actions, all of which could damage the reputation of the Company’s products and may reduce demand for the Company’s products.

Future product recalls or safety concerns could adversely impact our results of operations.

We may be required to recall certain of our products should they be mislabeled, contaminated, spoiled, tampered with or damaged. We also may become involved in lawsuits and legal proceedings if it is alleged that the consumption or use of any of our products causes injury, illness or death. A product recall or an adverse result in any such litigation could have an adverse effect on our business, depending on the costs of the recall, the destruction of product inventory, competitive reaction and consumer attitudes. Even if a product liability or consumer fraud claim is unsuccessful or without merit, the negative publicity surrounding such assertions regarding our products could adversely affect our reputation and brand image. We also could be adversely affected if consumers in our principal markets lose confidence in the safety and quality of our products.

Contamination and degradation of product quality from diseases, pests and weather conditions