Ascension is an early-stage VC built by exited entrepreneurs to back the next generation of tech and impact founders.

SummaryEdit

- A fund dedicated to seed stage investing, with an established ‘go to’ brand for founders looking for early stage UK capital.

- Recently crowned the ‘most active’ investor in the UK in the last decade (Beauhurst), having invested in 150+ businesses including Wagestream, Credit Kudos, Lick and Vidsy.

- A fund with a deep UK network that assesses over 3,000 opportunities each year across a wide variety of sectors and business models.

About AscensionEdit

Ascension is an early-stage venture capital firm built by exited operators and entrepreneurs to back the next generation of tech and impact founders. Since 2015, Ascension has invested in over 150 start-ups across several venture capital funds, in the process becoming one of the most active early stage investors in the UK.

The fund is run by Jean de Fougerolles, Ascension’s founder, alongside partners Remy Minute and Emma Steele. Together, the partners have a mix of media and finance experience which is reflected in Ascension’s diverse seven-sector investment approach. Alongside this approach, the fund has a particular focus on backing promising impact businesses that are “using technology to solve some of the world’s biggest problems”.

Investment strategyEdit

Ascension is an early stage venture capital fund that focuses on investing in seed stage technology companies. They typically invest in a company’s first institutional funding round, at what Ascension terms the ‘Seed+’ investment stage (which is after initial pre-seed funding but before a startup’s series A round).

The fund has a multi-sector approach, investing in both B2B and consumer businesses. In assessing opportunities, the team focuses on three key elements of early stage business: the quality of the team, the robustness of the technology versus the competition, and the market size/potential of the product.

At the stage where the fund invests, Ascension recognises that a startup’s founding team is of key importance. Given this, Ascension emphasises that it looks for teams that have “a mastery of the problem they are trying to solve with a keen eye on commercial opportunities.” A typical team will also have complementary skill sets - for example two founders may be a CEO and CTO.

Ascension investee companies will typically be generating early revenue of around £30k per month when they receive investment. Ascension views this revenue level as evidence of early product/market fit. In addition to revenue, given many early stage startups overestimate future revenues and underestimate costs, Ascension typically requires investee companies to have a minimum of 12-18 months cash runway at the point of fundraising, assuming no revenue growth. Ascension believes this gives companies time to achieve key performance indicators (typically revenue or customer growth) before they complete a future, larger capital raise at a higher company valuation.

Through this strategy, Ascension was an early backer of Albert, the fintech acquired by Santander, ZigZag, the ecommerce software business acquired by Global Blue and Chilli Connect, the live game management platform acquired by Unity. In 2021, Ascension’s 2017 EIS fund was ranked the number one EIS fund for calendar year performance by Tax Efficient Review, an EIS review company.

Ascension’s team consists of 14 core members alongside 14 venture partners, who together manage and advise the Ascension portfolio. Ascension’s average ticket size is around £300,000 and they routinely co-invest alongside other funds and notable angel investors that are active at the seed stage.

Ascension’s main sources of deal flow are its existing portfolio company founders (through referral) and fund co-investors, through which it sees over 3,000 investment opportunities a year. The fund embraces a co-investment approach, where it seeks to invest in companies alongside other funds, and believes this philosophy “not only increases deal-flow opportunities but also the likelihood that portfolio companies are well capitalised and supported on their journey from Seed+ to Series A and beyond”.

Past investmentsEdit

ChilliConnect (exited)Edit

ChilliConnect is a live game management service for building and managing connected games. Their platform offers cloud-based services aimed at allowing developers to run online games at scale, without an in-house server infrastructure. ChilliConnect was acquired by Unity Technologies in 2019.

WagestreamEdit

Wagestream is a financial wellbeing tool for corporate employees. The business works with employers to enable salary advances for their workforces, without the need for costly interest to be charged. Wagestream recently raised $175m in the form of $60m in equity led by Smash Ventures and $115m in debt from Silicon Valley Bank.

WeGiftEdit

WeGift is a global online gift card purchase and management platform offering corporate customers a powerful set of API and eCommerce solutions that make buying and selling online gift cards simple, for example when used as part of a corporate reward scheme. WeGift raised £8.7m in March 2021, led by CommerzVentures and with existing investors AlbionVC, Stride and Unilever Ventures participating in the round.

As this Fund is an EIS fund, upon investing you will gain access to new investments made by the fund manager on your behalf. Please note that the companies set out above are past investments by the fund manager and are presented for indicative purposes only.

Lick HomeEdit

Lick is a home decorating platform for the Iinstagram generation. Ascension first invested in the D2C paint, wallpaper and tools company in 2019 (during its pre-seed funding round), and the company has recently raised a £15m Series A led by OMERS Ventures with participation from Felix Capital and several prominent angel investors including Alex Chesterman (Zoopla, Cazoo, LoveFilm).

zeroheightEdit

zeroheight is a design documentation platform that enables users to easily create and codify style guides and common design elements for easy and fast re-use. The platform integrates with UX tools and allows design teams to share work and save time through customisable design documentation. Zeroheight raised a $10m round in August 2021 led by Tribe Capital with participation from Adobe, Y Combinator, FundersClub and Expa as well as several well-known angel investors.

VidsyEdit

Vidsy is an online marketplace platform connecting creative video makers with major household brands to produce modern video content. Vidsy’s platform enables brands to create, test and optimise branded video content through its community of next generation digital creators, predominantly aged 18-26 years old. Vidsy recently raised £12m led by Access Entertainment alongside Delin Ventures and GMG Ventures.

BeemEdit

Beem is an augmented reality platform that enables musicians, performers and influencers to livestream themselves and have followers view broadcasts wherever they are. Beem also works with corporates on major online content, recently collaborating with ASOS on an augmented reality catwalk production. Beem recently raised $4m from 5 Lion, Grouport Ventures, Inertia Ventures, Lior Messika and other strategic angels.

ThursdayEdit

Thursday's mission is to make Thursday the most exciting day to be single. Their dating app comes alive for only 24 hours a week, enabling single users to keep their swiping, matching and dating to a single day - and to make dating fun and spontaneous again. Thursday raised $3.5m in June 2021 from Best Nights VC, Connect Ventures and early backers of CityMapper and TypeForm, alongside angels including Tom Blomfield (Monzo, GoCardless).

Track recordEdit

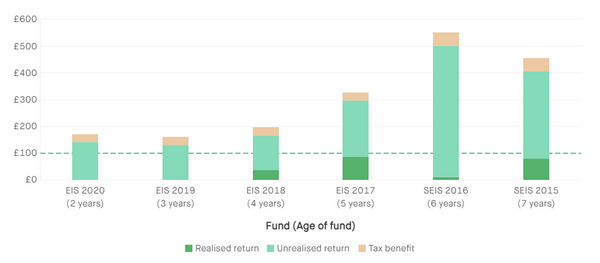

The below chart shows the fund's historic performance, represented as if you had invested £100 in the relevant year. For example, the 'EIS 2017' bar relates to what a £100 investment made in 2017 is worth today. As venture capital investments take time to mature, older investments typically have better performance than more recent investments, providing there is good fund performance.

Investments reported below that were made before 2017 relate to Ascension's SEIS fund, a fund that Ascension runs with the same team as its EIS fund.

Current value of Ascension’s previous funds[1]

Fund feesEdit

OverviewEdit

Expected annualised fee: 2.2%

This is the expected total fee of the fund, averaged across a 5 year hold period. This figure is an estimate only and below we set out the actual fees payable. Please note this figure does not include performance fees (as they are not guaranteed to be payable).

BreakdownEdit

Initial fee: 5%

This fee is a one-off fee that is deducted upon investment into Ascension. It is not charged on an ongoing or annual basis.

Annual management charge: 1.2%

This fee is the fund’s annual management charge, payable each year to the fund manager for making and managing investments. After the 5th year, no annual management charge is payable.

Exit transaction fee: 0.25%

Before any investment proceeds are returned to an investor, for each investment made in the fund this transaction fee is charged. This fee covers custodian and administration costs.

Performance fee (on total return between 1.3-2.3x): 20%

Ascension takes a performance fee of 20% on any capital returned in excess of 1.3x your invested capital. This means if you invested £100 and the fund returns £200, Ascension will take a £14 performance fee, making your net return £186. Ascension’s performance fee is subject to you first having received back 1.1x your invested capital before any fee is payable.

Performance fee (on total return over 2.3x): 30%

Ascension takes a performance fee of 30% on any capital returned in excess of 2.3x your invested capital. This means if you invested £100 and the fund returns £300, Ascension will take a £41 performance fee (£20 from £130-230 and £21 from £230-300), making your net return £259. Ascension’s performance fee is subject to you first having received back 1.1x your invested capital before any fee is payable.

The Expected Annualised Fee set out above is intended as a fee estimate only. Further receives an initial commission (2.5%) and a trail commission (0.0%) on funds processed for the fund manager. Commission is paid by the fund manager, so there is no additional charge to you. The fund manager charges fees of up to 5% at investment to investee companies.

Expert viewEdit

The view is provided by Tax Efficient Review.

When TER first reviewed the Ascension EIS in 2020 they were a relatively new EIS fund, having only launched in 2017, but they had achieved two exits and one partial exit in that time and they were showing early promise.

So in the time that has elapsed since this first review, how have things moved on? The positives to note are they have added some additional exits to those achieved back in 2020. There has been ZigZag (6x return on cost), Percent (4x) and Bizzon (1.6x) and early investors in the 2017 tranche have had their initial investment back, which is encouraging. The Ascension EIS also offers a fairly rapid deployment time frame of full deployment within 12 months of investing across typically 8-10 companies, and the performance fee has a decent hurdle on it at 130p returned to investors on 100p invested.

When we look at their track record, as mentioned the early investors should be rightly pleased with the returns they have seen. The 2018 cohort was significantly larger and has recently seen successful exits from three further companies since the previous review. Achieving successful/ profitable exits and returning cash to investors is the Holy Grail of the EIS industry and credit should be given to Ascension for achieving what they have in a relatively short time scale.

ReferencesEdit

- ↑ Based on having invested £100 in each fund set out below.