Summary[1]

The small satellite market has grown steadily over the past decade, it continues to follow an upward trajectory and is projected to represent much of future launch demand.

Existing launch providers however struggle to manufacture and launch vehicles frequently enough and the price to fly on such services remains a significant barrier for small companies seeking to leverage space access.

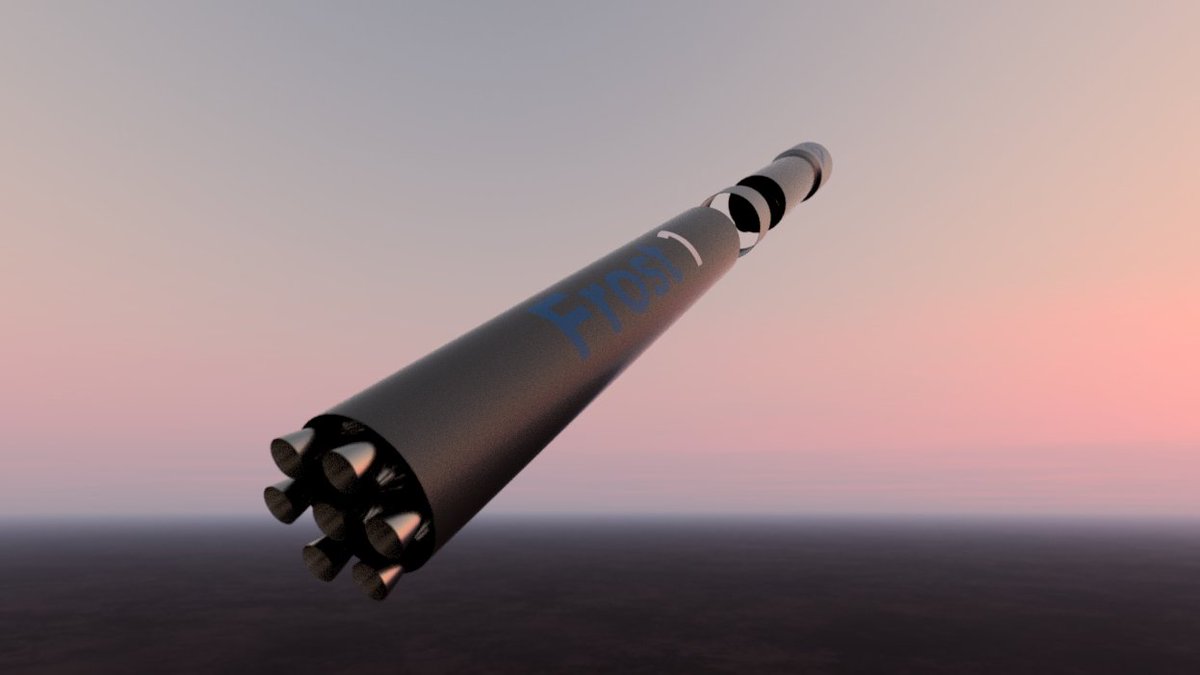

Astron Systems is using the physics of smaller scale launch vehicles to develop a fully-reusable launch vehicle, and the required technologies, to deliver much lower cost and much higher frequency launch capability to the small satellite market.

Our mission is to drive down the cost of access to space to enable transformative downstream technologies which improve life on Earth.

Seeking to raise £250k for development of a prototype reusable rocket motor over 9-12 months, of which a £5k research grant is committed.

Investment Interview[1]

Explain what your venture does.

We are using the advantages inherent of smaller scale launch vehicles, along with largely understood technologies, to develop a fully-reusable launch vehicle to provide much lower cost and much higher frequency launch capability to the growing small satellite market. In the near term, this involves creating a prototype reusable rocket motor ideally suited for this scale vehicle. This rocket motor technology, once proven, may additionally be sold to other interested parties to help fund development of the full vehicle.

What stage is your business?

We are at a pre-seed stage and are currently looking to raise funding to create a prototype reusable rocket motor, this is being done through a combination of research grants and private equity.

Describe your advisers.

We receive advice from the Westcott Business Incubation Centre. We have also received advice from Seraphim Capital and the Satellite Applications Catapult.

Give an overview of your startup's financing history.

To date, we have secured a £5k grant from the Westcott Business Incubation Centre to aid with the design of the rocket motor’s turbopump. We have no other previous funding.

Explain the ownership structure of your company.

The company is owned equally by the founding members, all founders are also directors on the company board. Eddie is the CEO and chairman of the board, Kieran is the COO and CFO, Filippos is the CSO, Rafal is the CTO and Alvaro is the CCO.

How many employees do you have?

We have 6 founders:

- Eddie: CEO and engineer

- Kieran: COO, CFO and engineer

- Rafal: CTO and engineer

- Filippos: CSO and engineer

- Alvaro: CCO and engineer

- Lewis: Engineer

We are also considering recruiting an additional person with specialized knowledge in high power electronics.

Please provide the name of a lawyer, who will represent you for the upcoming investment round.

Either SeedLegals or Taylor Vinters (TBC)

How much money are you seeking to raise in the current round?

£250,000.

Do you have any existing commitments to the current round?

We have been accepted for a £5,000 Westcott BIC research grant. We are applying for an innovate UK smart grant which can fund up to 70% of the total round. We are also looking to likely apply for the ESA BIC scheme in Autumn which could further fund up to £43,000.

Explain why you are raising finance.

The initial funding will be used for development of a reusable rocket motor prototype. The funding will be expected to last for between 9 and 12 months. The successful creation of the prototype rocket motor will be the milestone used for securing seed funding. 45% of the funds will be spent on salaries for the 6 founders. We will also spend money on software, facilities, hardware, and fabrication of parts. We will outsource the production of parts in the pre-seed phase to cut back on initial costs.

Please explain the history of your venture.

Within the Imperial Aeronautics course, a third-year group design project was carried out regarding the creation of a launch vehicle. Key members of Astron Systems worked on this launch vehicle’s propulsion system, as well as the controls, systems and aerothermodynamics, Eddie was the overall project co- ordinator. From the knowledge and experience gained in this project, and additional experience with fluid systems and rocket propulsion within ICL Rocketry, the proposed launch vehicle concept and rocket motor concept suggested by Astron Systems were developed. This proposed vehicle is a fully reusable physics- informed design targeting the small satellite and nanosatellite constellation markets. Due to its reusability and low-cost design, the proposed vehicle will be capable of launching for a much lower cost than current market options and, critically, at a much higher launch frequency.

Please explain the longer term, future vision for the Company

After successful creation of the initial rocket motor prototype, we will aim to raise a further £2,000,000 from seed and angel investors. This will allow for rocket components to be designed and prototypes fabricated, in particular the design of the recovery system. Further optimisation of the rocket engine will also be carried out at this stage. Our long-term goal is to raise a further £122.8 million through additional funding rounds to complete the development of our vehicle. Our funding milestones are linked to key technology demonstrations.

Explain the core technologies and/or service propositions of your venture.

The key proposition put forward by Astron Systems is a fully reusable launch vehicle capable of delivering low cost and high frequency space access to the rapidly growing small satellite market. There are two key technologies in the vehicle which make this possible - The small methane and liquid oxygen rocket motor optimised for reusability and the reusable re-entry and recovery system. The recovery system takes advantage of the smaller scale nature of the launch vehicle and recovers the vehicle using parafoils to slow down each stage and a helicopter to retrieve.

Does your commercial strategy rely on intellectual property assets?

Our commercial strategy involves Astron Systems technology being owned by the company and kept as trade secrets. Astron Systems owns relevant IP produced to date and has confidentiality agreed by the founding team. Future exploration of the potential benefits of patenting technology is planned.

What commercial progress have you made?

To date we have a concept design for the reusable launch vehicle and rocket motor, we have incorporated the company and set up a website and emails to aid with business communication and have planned the development required for the creation of our rocket motor and vehicle. Our immediate plan is to raise our required capital, and work full time from August on the detailed design of the rocket motor and fabricating a prototype.

Risks

As with any investment, investing in Astron Systems carries a level of risk. Overall, based on the key risks highlighted below, the degree of risk associated with an investment in Astron Systems is higher than in a company that's trading on a public market.

Early-stage investment

Astron Systems is at one of the earliest stages of the business lifecycle, and the failure rate of companies at that stage is usually much higher than those at a later stage.

Illiquid investment

The number of transactions in shares of private companies is usually significantly lower than in public companies, typically resulting in it taking longer to sell shares in private companies at a price that is at least equal to the price that the shares were bought at. Accordingly, the Astron Systems investment opportunity is considered to be higher risk than more liquid companies.

Actions

To invest in Astron Systems, click here.

To contact Astron Systems, click here.

References and notes