Recharging the human battery with the power of red light therapy

Summary

- $1.3B+ light therapy market, w/ red light therapy showing most growth

- Red & NIR light = countless research-backed health & anti-aging benefits

- Leading-edge, patent-pending red light therapy devices & education

- $1M+ revenue in 2021, $445K+ thru April ’22

- 100% organic marketing — ZERO paid ads

- 105K+ social media followers, 39K+ podcast downloads in its first year

Problem

80% of all modern diseases are tied to dysfunctional mitochondria

Modern life consists of people spending most of their waking hours indoors & surrounded by non-native, fake light (ie, fluorescent lights & blue-lit technology), which means our cells, specifically our mitochondria, are being perpetually deprived of nutrients normally derived from full-spectrum sunlight.

- Proper light exposure = robust, healthy mitochondria

- Inadequate light exposure = dysfunctional mitochondria

The world's leading mitochondrial researcher, Dr. Doug Wallace, has spent four decades researching mitochondria & proclaims that 80% of all modern diseases can be tied to mitochondrial dysfunction. Dr. Wallace also asserts that aging itself is due to mitochondrial dysfunction.

Solution

Mitochondrial health can be optimized w/ red light therapy

Red light therapy is an innovative technique that utilizes specific red and near-infrared (NIR) wavelengths from the light spectrum to promote health, wellness & longevity. These amazing benefits are achieved through modulation of inflammation in your body, improving circulation and boosting energy levels as a result of enhancing the functioning of your mitochondria.

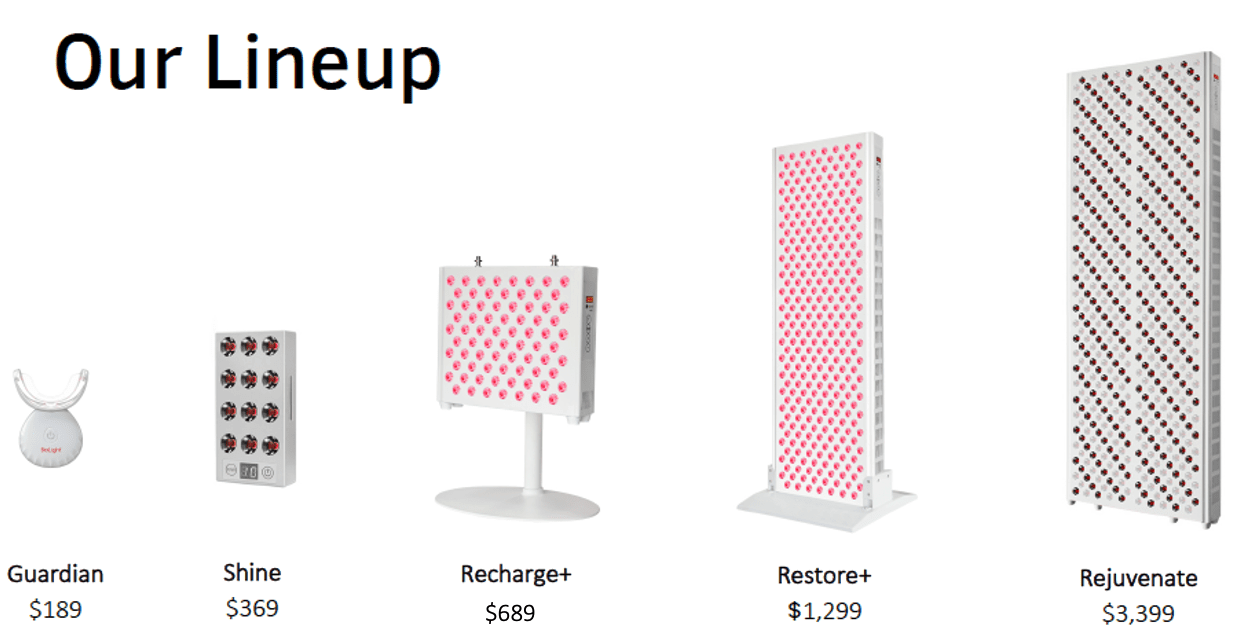

Product

Innovative, patent-pending red light therapy technology

In July '21, we released a ground-breaking RLT product to the market: the Guardian. The Guardian is the first red light therapy device of its kind, with patent-pending technology that implements dual LEDs, both red & near-infrared, in your mouth. Red light therapy can help you maintain optimal oral hygiene by modulating inflammation, improving circulation, and boosting the health and function of the mitochondria.

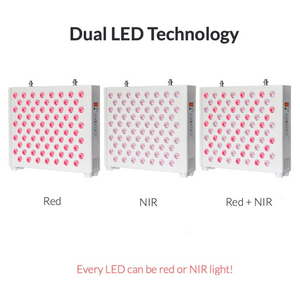

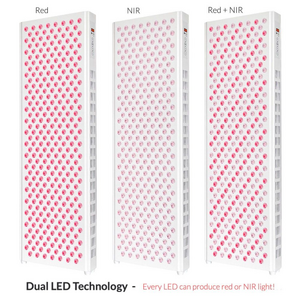

In August '21, we released our newest models of panels, which integrate patent-pending Dual LED technology. With dual LEDs, that means every single LED can be both red or NIR light. In comparison, all other panels on the market utilize LEDs that can produce red or NIR light — not both.

With dual LEDs, you can be certain to have maximal coverage of the area you are treating versus sporadic light exposure from the various light patterns other panels have. Also, now that you have twice as many LEDs producing light (for all red or all NIR light settings), treatment sessions will be more efficient because your body will be absorbing more light energy at a given time.

Traction

Organic growth has led to $445K+ in 2022

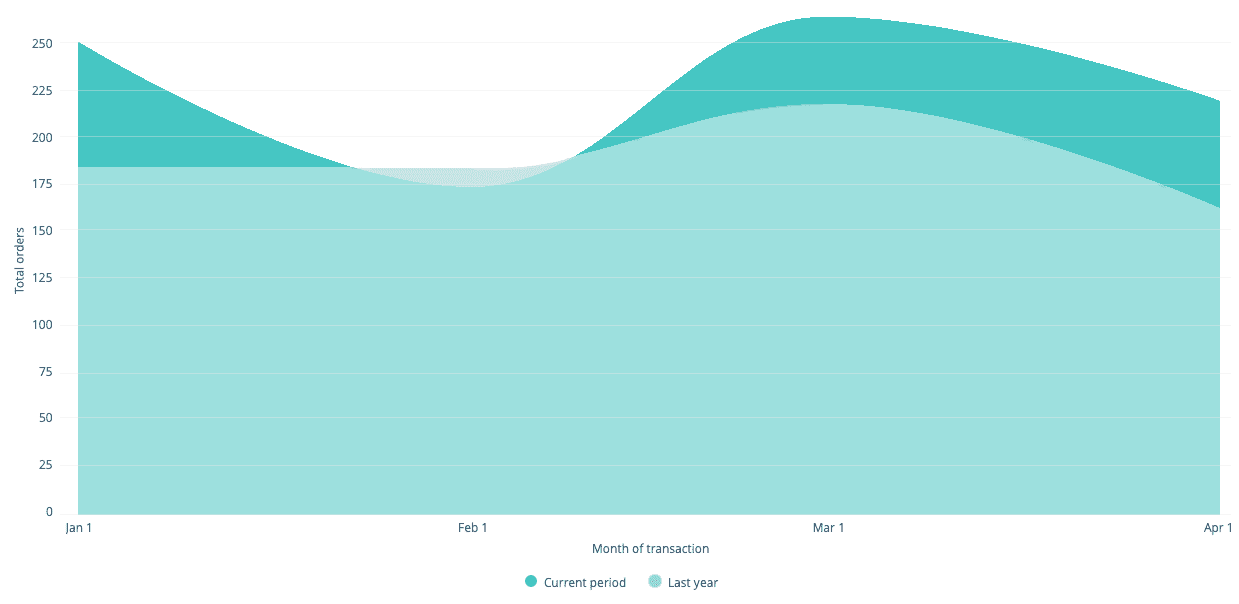

The metrics shown here have been achieved with 100% organic marketing. We've been able to achieve our quick results via: word-of-mouth, superior internal marketing skills, a strong affiliate system, and being a clear leader in a rapidly-growing space.

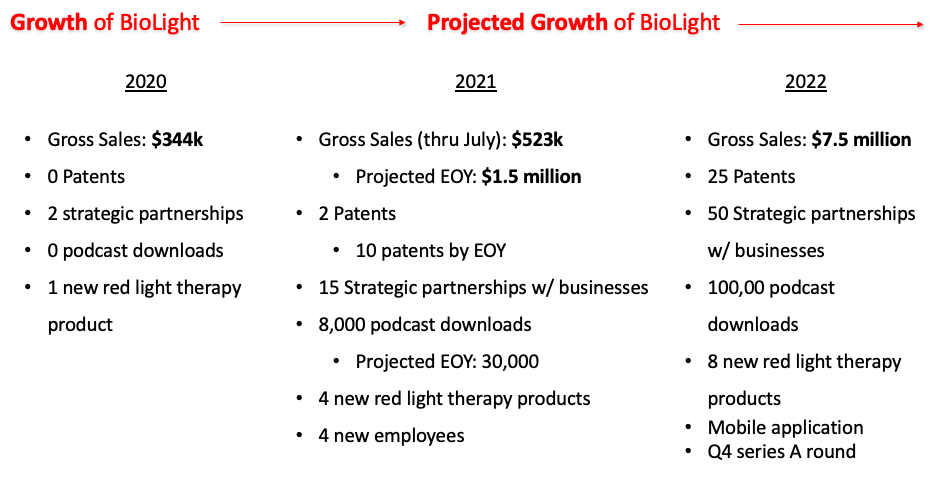

In 2020, our revenue was $344K+. We scaled that to $1M+ in 2021 and $445K+ through April 2022.

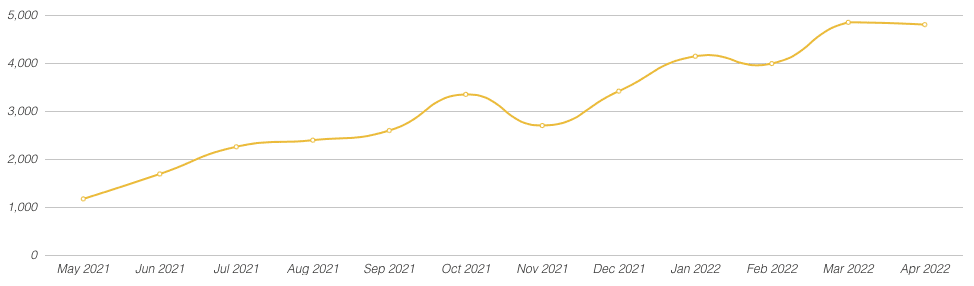

YOY Gross Sales Growth, 2021 vs. 2022

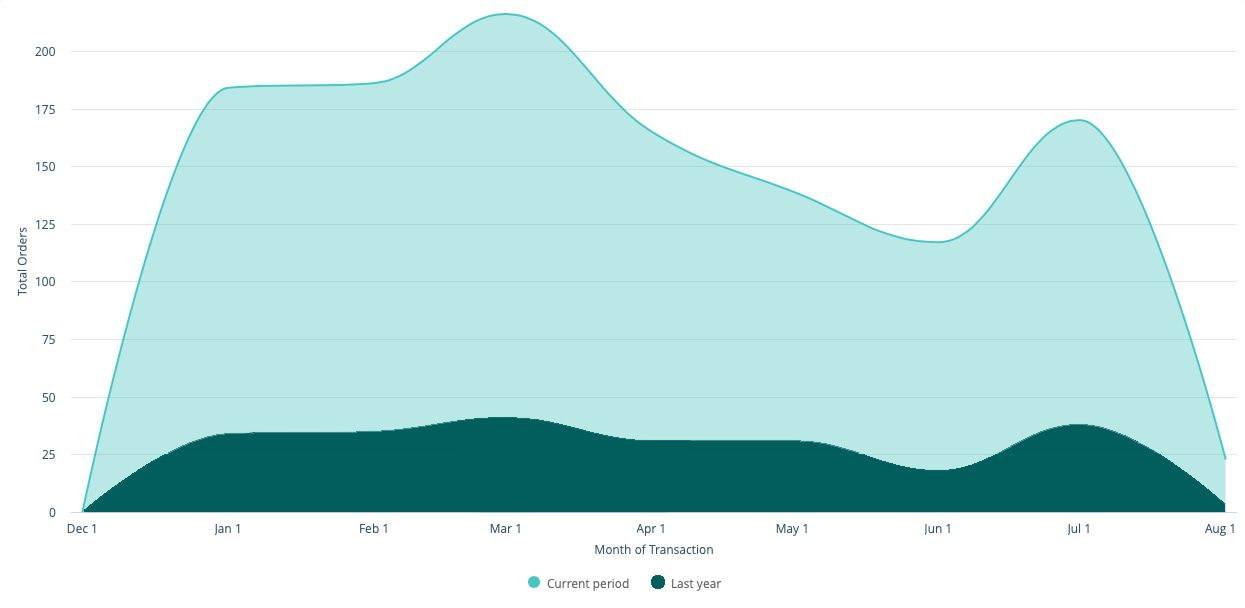

YOY Total Orders Growth, 2020 vs. 2021

We have the #1 red light therapy podcast in the world, The Red Light Report, which has already cumulated 37K+ downloads since its inception only 1 year ago in March 2021. There has been zero marketing of this podcast; again, all organic growth. This is yet another metric that demonstrates significant increasing interest and demand for red light therapy.

Downloads of Podcast By Month:

Customers

Clients include Sandra Kaufmann, Tim Shea, Camille Hyde and Lauren Davis

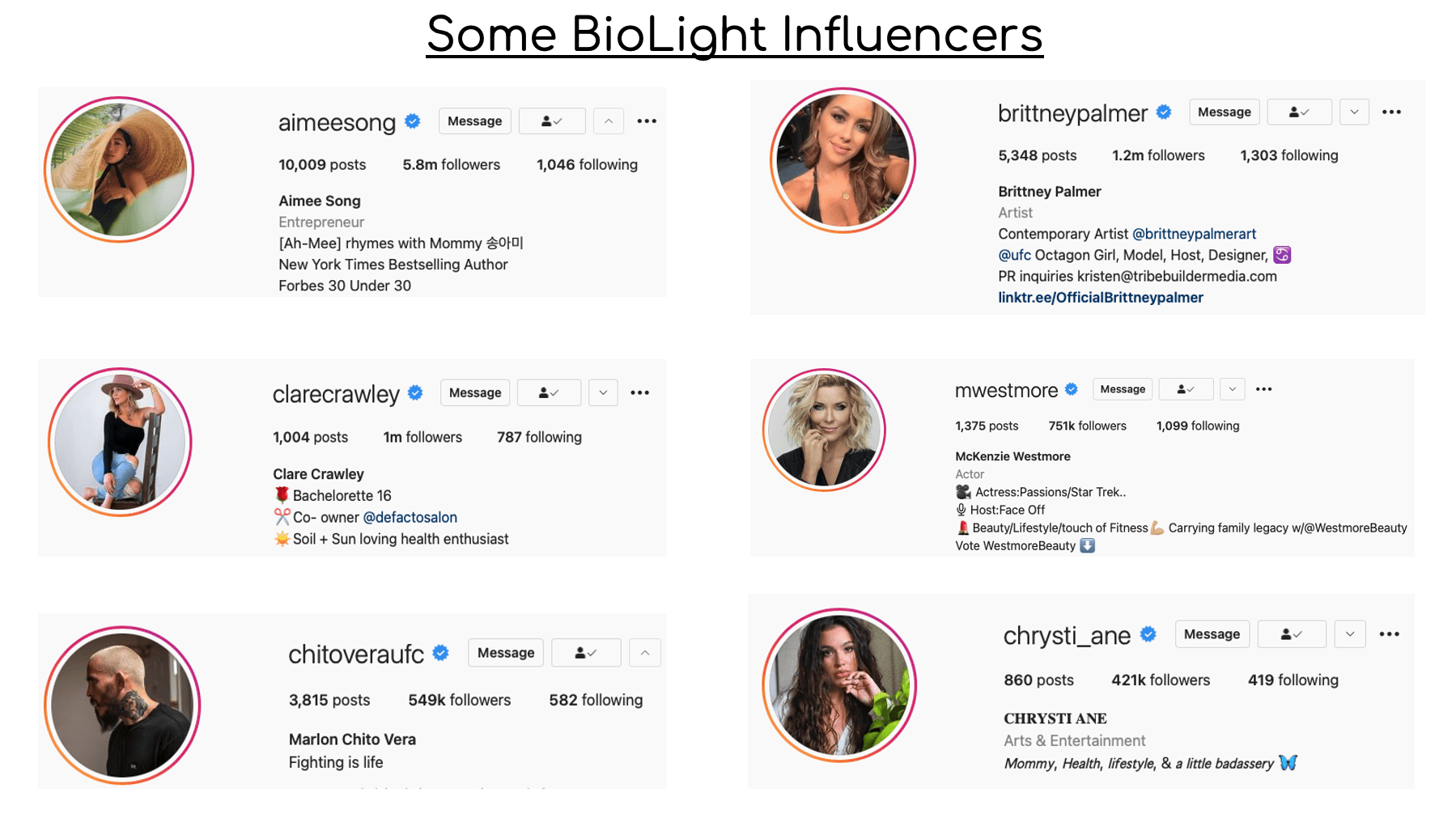

Red light therapy is an amazing health & wellness tool for humans across the life spectrum – especially for children dealing with endless immune issues and inflammatory conditions. Red light therapy can help mitigate and improve those conditions. We’ve established strong brand partnerships with notable influencers and are building a strong social media presence with users of our products.

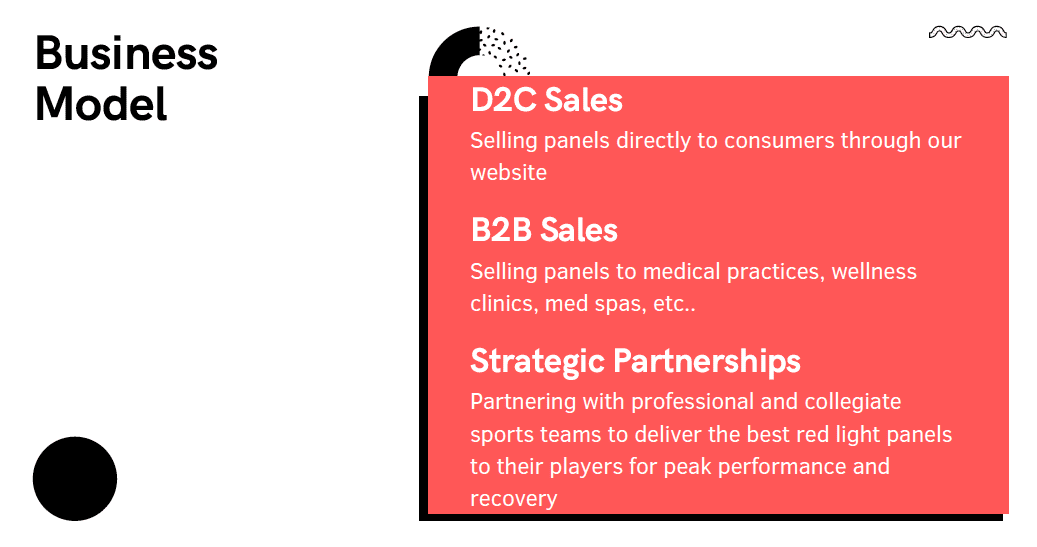

Business model

Moving into B2B and organization sales

BioLight currently accumulates revenue through 100% direct sales of red light therapy devices via D2C. Moving forward, we will make tactical, pragmatic efforts into B2B (medical spas, wellness clinics, sports performance) & organization sales (corporate, professional sports teams, etc.).

We have intentionally not engaged in any B2B sales or major partnerships due to the fact that we are fighting to keep up with our current demand. Increased funding will allow us to have a significant inventory, allowing us to pursue these new revenue generators.

Our products range in price from $189 to $3.4K+.

Market

Alternative health & self-care

People are becoming more cognizant of the limitations of allopathic medicine (prescription meds and invasive surgeries) and are instead seeking out more effective, holistic alternatives. The light therapy market size was recently valued at $1B+ in 2020 and is expected to grow at a CAGR of 5.1% until 2027.

Due to providing cutting-edge technology and establishing itself as a definitive leader in the red light therapy space, BioLight, along with founder + CEO Dr. Mike Belkowski, have been featured in countless press articles and podcast interviews.

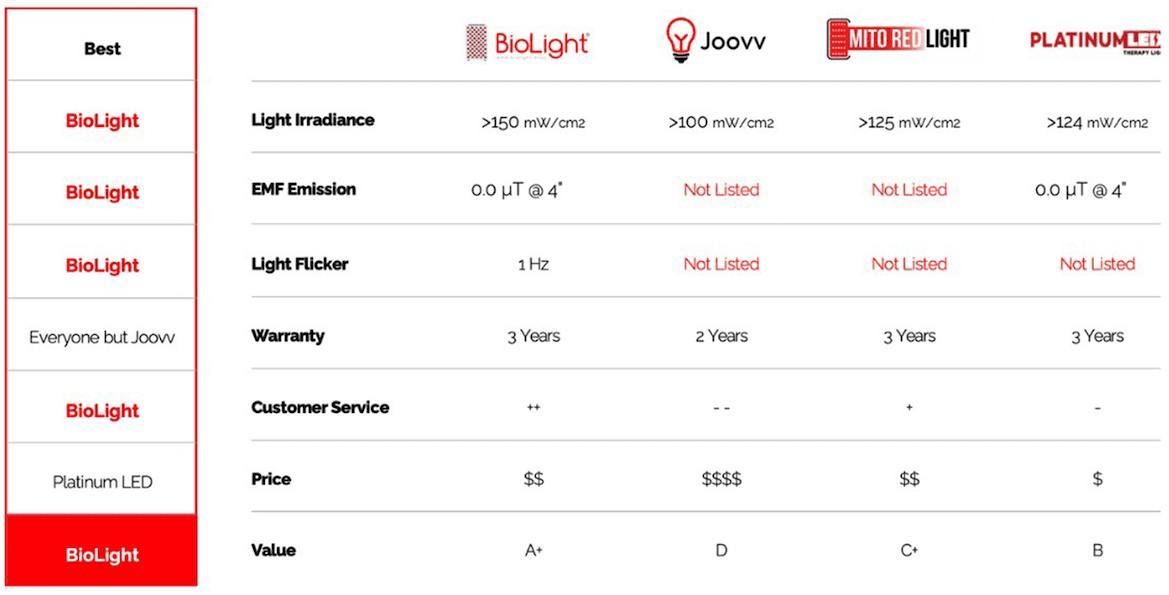

Competition

Best value on the market

BioLight devices are engineered with the most efficacious spectra of red & NIR light (based on the highest-quality scientific research), possess higher light power compared to the rest of the market for superior light penetration depth, and have the lowest EMF emissions & light-flicker on the market for unparalleled safety. We currently have our competition beat in these sectors and we plan to continue adding to this list as more research emerges that justifies the superiority of our lights.

*lowest EMF based on available emission data from other company websites

Vision and strategy

Becoming the go-to for red light products

At BioLight, we believe everyone deserves the right to a life of optimal health, free of mitochondrial dysfunction. We envision a world where anyone can access the red & near-infrared light that their mitochondria are craving. We plan to accomplish this by boosting consumer awareness about their potential malillumination, scaling our production to meet current demand, and introducing new red light products onto the market.

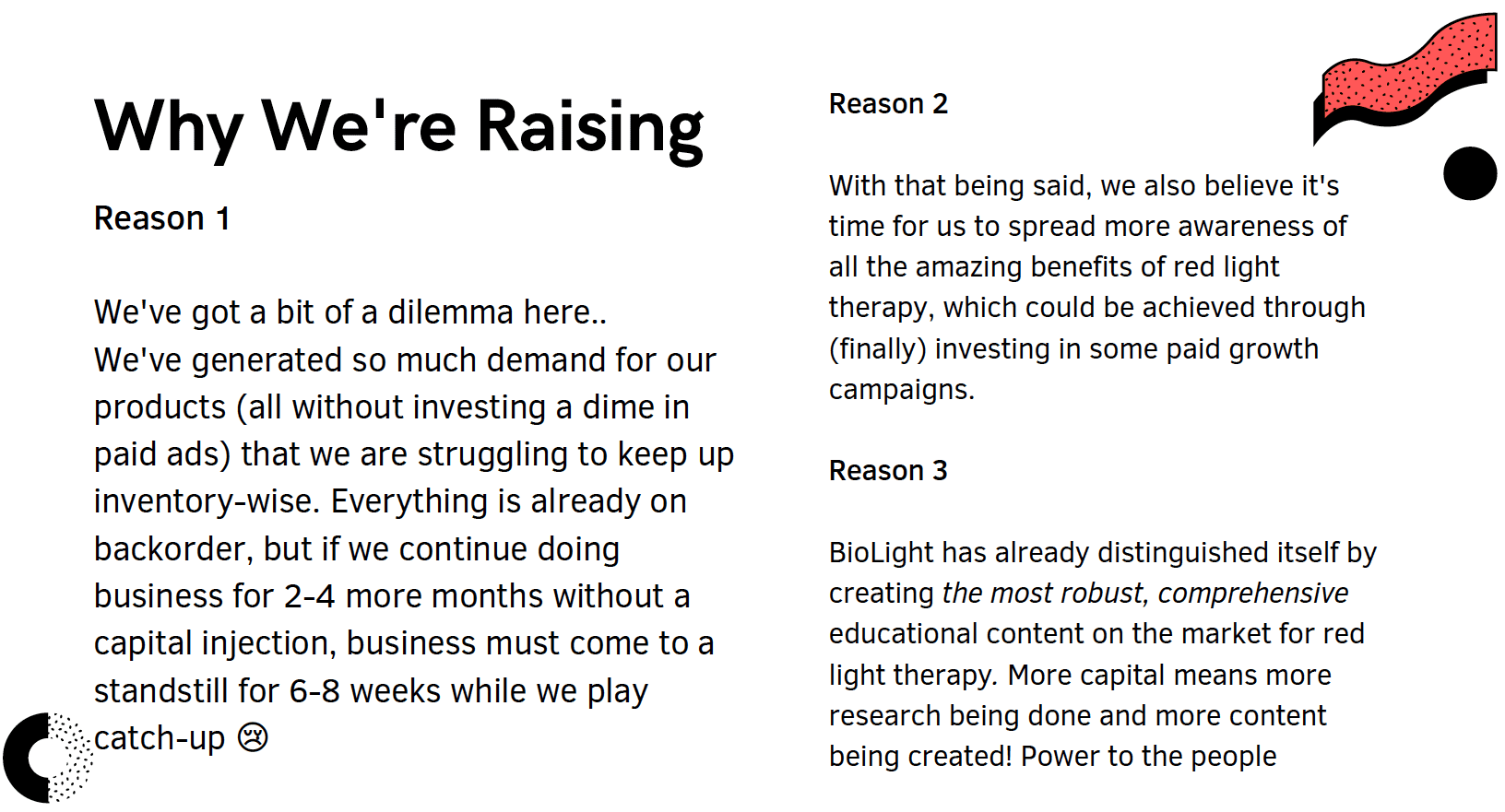

Funding

Raising funds to support customer demand

BioLight has been bootstrapped prior to this round of funding. We are raising $1M to support meeting consumer demand, invest in marketing campaigns, and continue researching the effectiveness of red light therapy for a number of critical medical conditions.

Founders

Dr. Michael Belkowski, Founder & CEO

Dr. Mike Belkowski graduated from the University of Montana’s Doctorate of Physical Therapy program in 2016. Months later, he started his own private outpatient practice, which is thriving today because of his holistic approach to physical therapy by integrating unique treatments, such as dry needling, cupping, blood flow restricting training, hyperbaric oxygen therapy and, of course, red light therapy. Impassioned to provide his patients with the most effective and efficacious treatments, Dr. Belkowski is bringing that same dedication and enthusiasm to the red light therapy industry by providing high-quality, safe devices. Equally important, his main mission is to educate the masses on the countless wellness benefits of red light therapy and how anyone can properly utilize this healing technology to achieve effective, real results.

BioLight Team

Dr. Mike Belkowski

Founder & CEO

Nate Peterman

CMO

Daniel Kiani

Head of Growth

Shawn Wells

Product Developer & Advisor

David Horinek

Product Developer

Dinesh Melwani

Strategy & Mentor

Ankit Aggarwal

Strategy & Mentor

Risks

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

Global crises, such as COVID-19, can have a significant effect on our business operations and revenue projections.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

We may face potential difficulties in obtaining capital.

We may implement new lines of business or offer new products and services within existing lines of business.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

We rely on other companies to provide components and services for our products.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company’s success depends on the experience and skill of its executive officers and key employees.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

In order for the Company to compete and grow, it must attract, recruit, retain and develop the necessary personnel who have the needed experience.

We need to rapidly and successfully develop and introduce new products in a competitive, demanding and rapidly changing environment.

The development and commercialization of our products is highly competitive.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

We face various risks as an e-commerce retailer.

Industry consolidation may result in increased competition, which could result in a loss of customers or a reduction in revenue.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

We have not prepared any audited financial statements.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

Changes in federal, state or local laws and government regulation could adversely impact our business.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company could potentially be found to have not complied with securities law in connection with this Offering related to "Testing the Waters".

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

The Company has the right to extend the Offering Deadline.

The Company may also end the Offering early.

The Company has the right to conduct multiple closings during the Offering.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

There is no present market for the Securities and we have arbitrarily set the price.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities.

Investors will not be entitled to any inspection or information rights other than those required by law.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

There is no guarantee of a return on an Investor’s investment.