A novel approach focusing on income and ESG

SummaryEdit

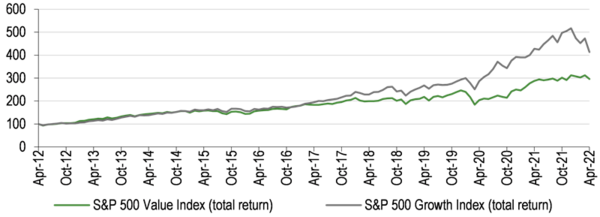

BlackRock Sustainable American Income Trust (BRSA) changed its investment strategy at the end of July 2021 to integrate explicit ESG objectives. It has three managers: Tony DeSpirito, David Zhao and Lisa Yang, who form part of BlackRock’s US income & value investment team. They aim to deliver an attractive level of income and long-term capital appreciation from a portfolio of dividend-paying companies that are trading at attractive valuations and are deemed to be ESG leaders, improvers or ‘sustainability enablers’. The managers explain that growth companies tend to be highly rated on ESG metrics, but BRSA offers a value fund with superior ESG traits, which sets it apart from the competition. Growth stocks have led the US market over the last decade; however, data from BlackRock show that value stocks should perform relatively better in the current environment of rising interest rates.

Significant outperformance of growth versus value stocks in last five years[1]

The analyst’s view

BRSA’s portfolio with its quality, income, value and sustainability attributes has the potential to perform relatively well given the current uncertain macroeconomic background, which is characterised by rising inflation and interest rates and the war in Ukraine. Data from BlackRock show that since the early 1920s, value stocks have outperformed growth names during periods of rising inflation.

The trust’s managers are finding interesting opportunities across a range of sectors; these may include companies with attractive growth and income profiles that have what the managers perceive to be short-term operational issues. They stress that they do not buy stocks just because they are trading on low valuations or have a high dividend yield. The managers believe that BRSA’s dual focus on income and ESG is a unique proposition for investors seeking US equity exposure.

Scope for a narrower discount

BRSA’s current 4.3% discount to cum-income NAV compares with the 3.1% to 4.8% range of average discounts over the last one, three and five years. There is the potential for a narrower discount once investors gain a greater understanding about the trust’s unique proposition of an attractive dividend yield from a reasonably priced portfolio of quality companies with above-market ESG credentials.

Change of name and investment strategyEdit

Following shareholder approval at a general meeting held on 29 July 2021, BRSA’s investment mandate was changed to incorporate explicit ESG objectives, as the board is mindful of the increased demand for investment products that place a sustainable investment philosophy at their core – a trend that has accelerated in recent years. The changes are intended to enhance the experience of existing shareholders and to increase the trust’s appeal to new investors. In Exhibit 1, Edison Investment Research highlights the consistencies and changes in BRSA’s strategy.

| No change | Changes |

|---|---|

| Partnering with the same BlackRock investment team – US income & value. | Evolved to have specific performance and sustainability objectives. |

| Maintaining the trust's primary exposure to US equities. | Transitioned to a multi-cap portfolio with meaningful exposure to mid-cap stocks. |

| Preserving the portfolio's value investment style and focus on dividend-paying stocks. | Narrowed the range of portfolio holdings from 80–120 to 30–60 stocks. |

| Continuing to target an attractive level of income with long-term capital appreciation. | Committed to the structural use of gearing (range of 0–10% with a neutral level of 5%). |

| Ceased the systemic use of an active options overlay strategy, which was used to enhance the level of income. | |

| Lowered the trust's management fee by 5bp per annum. |

The trust’s name was changed from BlackRock North American Income Trust (ticker: BRNA) to BlackRock Sustainable American Income Trust (ticker: BRSA).

Market outlook: Macro uncertainties warrant selectivityEdit

Exhibit 2a shows the performance of US and UK shares over the last decade. The broad US market, as shown by the S&P 500 Index, has performed significantly better than both US value and UK shares. It is unsurprising that within the US, investors have favoured growth over value names given the ultra-low level of interest rates. However, the macroeconomic backdrop is changing; inflationary pressures are building, fuelled by higher commodity and wage costs, and the US Federal Reserve has started to tighten monetary policy. Risks of an economic slowdown or a recession are rising, especially if the central bank is behind the curve and has to accelerate the pace of interest rate increases to try and combat higher inflation. The geopolitical environment is also challenging due to the war in Ukraine and ongoing tensions between the US and China.

Exhibit 2a: Total return performance of US and UK equities over 10 years (£)[3]

| Last | High | Low | 10-year

average |

Last as % of

average | |

|---|---|---|---|---|---|

| US | |||||

| P/E 12 months forward (x) | 16.9 | 23.6 | 11.9 | 17.5 | 97 |

| Price to book (x) | 3.8 | 4.7 | 1.9 | 3.0 | 126 |

| Dividend yield (%) | 1.6 | 2.7 | 1.2 | 2.0 | 81 |

| Return on equity (%) | 18.1 | 18.5 | 9.8 | 13.6 | 133 |

| World | |||||

| P/E 12 months forward (x) | 14.3 | 20.0 | 10.6 | 15.3 | 94 |

| Price to book (x) | 2.3 | 2.6 | 1.4 | 1.9 | 116 |

| Dividend yield (%) | 2.3 | 3.4 | 1.8 | 2.4 | 96 |

| Return on equity (%) | 13.7 | 14.0 | 7.2 | 10.8 | 126 |

US stocks have rallied strongly following the coronavirus-led market sell-off in Q120, helped by corporate earnings, which have exceeded depressed consensus expectations. As shown in Exhibit 2 (right-hand side), the Datastream US Index is trading on a 16.9x forward P/E multiple, which is a 3% discount to its 10-year average. It is also trading at an 18.6% premium to the Datastream World Index; this is considerably higher than the 14.3% premium over the last decade. With an uncertain macroeconomic backdrop and valuations that look somewhat unappealing, investors seeking exposure to the US stock market may well benefit from seeking reasonably priced, high-quality businesses that can pass on rising input costs.

Investment process: ESG is an integral elementEdit

There are three main elements to BRSA’s investment process:

Idea generation – the managers aim to identify the best ESG and alpha opportunities from an investment universe primarily made up of North American large- and medium-cap equities, although up to 25% of the portfolio can be invested in liquid non-North American companies. ESG exclusion screens are used to narrow the investment universe. The managers are able to leverage the best fundamental and thematic ideas from BlackRock’s US income & value platform to generate a pipeline and prioritise the research agenda.

Fundamental research – this involves assessing the materiality of a firm’s ESG and sustainability factors and evaluating its important earnings drivers, along with engaging with company managements on business and ESG issues. A research document is prepared to illustrate the investment thesis and is discussed within the investment team. The managers evaluate how and over what time frame they expect their research insights to be reflected in a company’s share price.

Portfolio construction – the fund typically has 30–60 high-conviction positions. Gearing of up to 20% of net asset value (NAV) is permitted, but is likely to be in a 0–10% range, with 5% seen as a neutral level. There are clear buy and sell disciplines for both fundamental and ESG considerations. Portfolio risks and exposures are carefully monitored, with an emphasis on stock-specific risk. The fund is diversified by sector, industry and style factors.

The fund managers: Tony DeSpirito, David Zhao and Lisa YangEdit

The managers’ view: Well positioned for current environment

DeSpirito, Zhao and Yang explain that the current very uncertain investment backdrop has no historical precedent; we are emerging from the COVID-19 pandemic, there is a war in Ukraine, inflation is rising and there is a normalisation of Federal Reserve monetary policy. Inflation is running hotter than anticipated and the managers expect it to remain sticky. The consensus view is that the US central bank is starting to realise it is behind the curve, as evidenced by the accelerated pace of interest rate hikes. DeSpirito, Zhao and Yang suggest that important issues to consider are how high inflation will reach and what the risks of a Federal Reserve misstep are: either raising interest rates too much, which would likely choke off economic growth, or too little, so inflation will remain rampant. With this uncertain backdrop, the managers have built as much resilience into BRSA’s portfolio as possible by focusing on companies with robust balance sheets, healthy free cash flow and strong management teams. The managers believe that this quality approach is the best way to deal with an elevated level of stock market volatility and have been adding to some of the trust’s holdings that they believe have been overly punished. BRSA offers a value strategy with above-reference index ESG metrics; data from BlackRock show that over the long term, value stocks have outperformed growth names and the wider US market, particularly in an environment of rising inflation and interest rates.

If the Federal Reserve is behind the curve, the managers suggest that it has a narrow window in which to manoeuvre. The US labour market is very tight, with unemployment at 3.6% and wage growth running at an annualised rate of c 6%. In April 2022, the annualised US Consumer Price Index was +8.3%, with the core inflation rate at +6.2%, which is higher than after the 2007–09 global financial crisis and before the recent pandemic. In addition, valuations are not inexpensive; the S&P 500 Index is trading on a c 17.5x forward P/E multiple, which is modestly above its 25-year average, although in aggregate equity valuations remain attractive compared with those of fixed income and growth assets. Growth stocks have had a decade-long tailwind of low interest rates and low inflation; however, higher interest rates are not helpful for the performance of these names as they reduce the present value of their long-term cash flows. US 10-year government bonds are currently yielding 2.8%, and the managers suggest that once they reach 3.4–3.5%, the equity risk premium becomes less attractive and there could be asset allocation shifts from equities to government bonds.

BRSA’s managers employ a barbell approach, with a mix of stocks that they expect to outperform if interest rates rise too far and the economy weakens, along with a range of more cyclical businesses that should benefit from the reopening of global economies; they are essentially hedging the portfolio against the risk of higher inflation.

Current portfolio positioningEdit

At end-April 2022, BRSA’s top 10 holdings made up 29.7% of the portfolio, which was a lower concentration compared with 31.5% six months earlier; six positions were common to both periods. Around 17% is held in non-North American listed companies.

| Company | Country | Sector | Portfolio weight % | |

|---|---|---|---|---|

| 30 April 2022 | 31 October 2021* | |||

| AstraZeneca | UK | Healthcare | 3.8 | 3.5 |

| Sanofi | France | Healthcare | 3.3 | N/A |

| Cisco Systems | US | Information technology | 3.2 | 4.0 |

| Verizon Communications | US | Communication services | 3.2 | N/A |

| Anthem | US | Healthcare | 2.9 | N/A |

| Sempra Energy | US | Utilities | 2.9 | N/A |

| Cognizant Technology Solutions | US | Information technology | 2.6 | 3.2 |

| Comerica | US | Financials | 2.6 | 3.4 |

| Komatsu | Japan | Industrials | 2.6 | 3.0 |

| Wells Fargo | US | Financials | 2.6 | 3.3 |

| Top 10 (% of portfolio) | 29.7 | 31.5 | ||

As shown in Exhibit 4, over the six months to end-April 2022, the largest changes in BRSA’s geographic exposure were a 2.1pp higher UK weighting and a 1.8pp lower weighting to Norway.

| Portfolio end-April 2022 | Portfolio end-October 2021 | Change (pp) | |

|---|---|---|---|

| US | 80.4 | 79.5 | 0.9 |

| UK | 5.6 | 3.5 | 2.1 |

| Japan | 4.6 | 4.8 | (0.2) |

| France | 3.3 | 3.3 | (0.0) |

| Canada | 2.2 | 2.7 | (0.5) |

| Australia | 2.0 | 1.3 | 0.7 |

| Switzerland | 1.5 | 1.9 | (0.4) |

| Denmark | 0.5 | 1.2 | (0.7) |

| Norway | 0.0 | 1.8 | (1.8) |

| 100.0 | 100.0 |

Looking at BRSA’s sector exposure in Exhibit 5, over the six months to end-April 2022, there were higher weightings in materials (+3.0pp) and energy (+2.3pp), and lower weightings in financials (-5.2pp) and consumer discretionary (-1.8pp). Compared with the reference index, the largest overweight exposures were information technology (+7.4pp) and materials (+4.1pp), while the largest underweights were industrials (-8.3pp), real estate (-4.2pp) and consumer staples (-3.0pp).

| Portfolio end- April 2022 | Portfolio end- October 2021 | Change (pp) | Index weight | Active weight vs index (pp) | Trust weight/ index weight (x) | |

|---|---|---|---|---|---|---|

| Financials | 20.2 | 25.4 | (5.2) | 19.3 | 0.9 | 1.0 |

| Healthcare | 19.4 | 18.5 | 0.9 | 17.5 | 1.9 | 1.1 |

| Information technology | 14.9 | 14.9 | (0.0) | 7.5 | 7.4 | 2.0 |

| Consumer discretionary | 9.6 | 11.3 | (1.8) | 9.1 | 0.5 | 1.1 |

| Energy | 7.6 | 5.3 | 2.3 | 7.5 | 0.1 | 1.0 |

| Materials | 6.9 | 3.9 | 3.0 | 2.8 | 4.1 | 2.4 |

| Communication services | 6.2 | 5.7 | 0.5 | 4.6 | 1.6 | 1.3 |

| Consumer staples | 5.1 | 3.9 | 1.2 | 8.1 | (3.0) | 0.6 |

| Utilities | 5.1 | 5.2 | (0.1) | 6.0 | (0.9) | 0.8 |

| Industrials | 4.3 | 4.9 | (0.6) | 12.6 | (8.3) | 0.3 |

| Real estate | 0.9 | 0.9 | (0.0) | 5.1 | (4.2) | 0.2 |

| 100.0 | 100.0 | 100.0 |

Focusing on some of the individual sectors, financials is the largest exposure within BRSA’s portfolio with an overweight position versus the reference index. Holdings include American International Group (AIG, a multinational insurer), Comerica (a regional bank) and Wells Fargo (diversified financial services). US banks have strong balance sheets, and their earnings should be enhanced in a rising interest rate environment. BRSA’s largest overweight exposure is information technology, where an increasing number of companies are what the managers refer to as ‘industrial tech’; firms that are competitively insulated from disruptors and well-positioned to take advantage of long-term secular tailwinds. These businesses are generating strong earnings growth and free cash flow, leading to an increased number of technology companies paying growing dividends to shareholders, unlike during the dot-com era where growth was often prioritised over shareholder returns. BRSA’s technology positions include top 10 holdings Cisco Systems (networking equipment) and Cognizant Technology Solutions (IT services and consulting). Healthcare is another overweight sector and is benefiting from demographic tailwinds as older populations spend more on healthcare than younger ones. BRSA’s long-term and largest holding, AstraZeneca, has one of the pharma industry’s strongest pipelines and is focused on oncology. The company’s research and development spending exceeds that of its competitors, providing opportunities for cost reductions. In January 2022, there was a switch within the medtech industry; the holding in Zimmer Biomet (orthopaedic products) was sold as elective surgeries have been negatively affected by COVID-19 pressures on hospitals. The proceeds were reinvested into Dentsply Sirona, which is the global leader in the provision of dentistry equipment and is enjoying accelerating volumes.

BRSA’s largest underweight exposure is to the industrials sector due to unattractive valuations and better opportunities being available elsewhere. Within the construction equipment industry, Japanese firm Komatsu is preferred to US-based Caterpillar based on growth and valuation metrics. Komatsu has a new management team and has had fewer supply issues than Caterpillar as Japanese production is more insular and is therefore not as reliant on global supply chains. The trust also has an underweight allocation to the real estate sector, where the managers are finding few companies with both attractive valuations and strong or improving fundamentals. Retail real estate investment trusts (REITs) are challenged due to the growth in e-commerce and its negative impact on traditional bricks-and-mortar retailers, while data centre and logistics REITs have strong fundamentals, but unattractive valuations. The consumer staples sector has traditionally been a destination for equity income investors; however, BRSA has an underweight exposure as many of these companies have long-term fundamental issues of slowing growth or secular decline; reasons for this include changing consumer preferences, greater end-market competition from local brands and disruption from the growing adoption of online shopping.

Performance: Outperformance since strategy changeEdit

| 12 months ending | Share price

(%) |

NAV

(%) |

US 1000 value

(%) |

S&P 500

(%) |

CBOE UK All Cos (%) |

|---|---|---|---|---|---|

| 30/04/18 | 1.4 | 3.1 | 1.0 | 6.4 | 8.1 |

| 30/04/19 | 23.0 | 11.9 | 15.2 | 19.9 | 2.5 |

| 30/04/20 | (7.3) | (5.4) | (8.0) | 4.2 | (17.2) |

| 30/04/21 | 29.4 | 29.5 | 32.9 | 33.0 | 25.3 |

| 30/04/22 | 10.5 | 12.6 | 11.7 | 10.5 | 9.1 |

In FY21 (ending 31 October 2021) BRSA’s NAV and share price total returns of 36.0% and 42.4% were ahead of the reference index’s 35.6% total return. The largest positive contributor to the trust’s relative performance was stock selection and asset allocation within the financials sector, notably overweight exposures to banks and insurance companies. Negative relative contributors to BRSA’s performance included the real estate sector, both in terms of positioning (as the fund was underweight versus the reference index) and from stock selection within REITs. While writing covered call options enhanced the trust’s income in FY21, it capped the fund’s participation in a rising US stock market. The use of an options overlay was discontinued following the change in strategy in late July 2021.

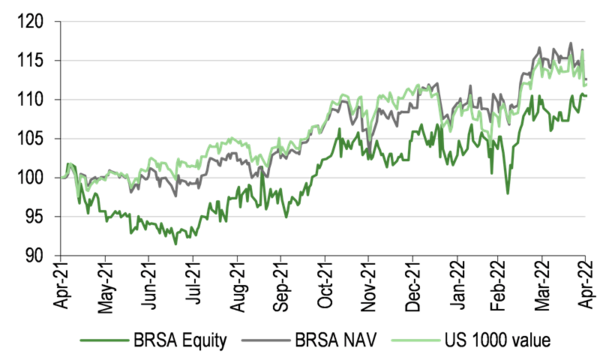

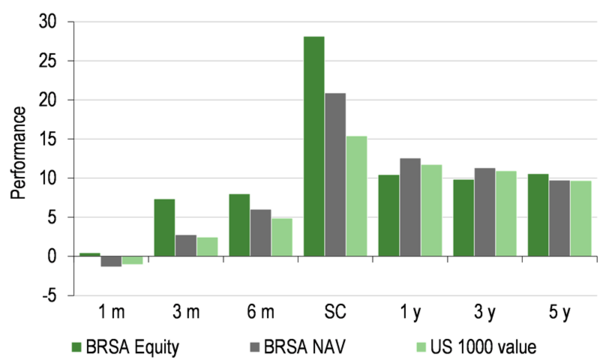

Exhibit 7a: Price, NAV and reference index total return performance, one-year rebased[8]

Exhibit 7b: Price, NAV and reference index total return performance (%)[8]

| One month | Three months | Six months | SC | One year | Three years | Five years | |

|---|---|---|---|---|---|---|---|

| Price relative to US 1000 value index | 1.5 | 4.8 | 3.0 | 7.2 | (1.1) | (3.0) | 4.0 |

| NAV relative to US 1000 value index | (0.3) | 0.3 | 1.1 | 3.1 | 0.8 | 1.0 | 0.1 |

| Price relative to S&P 500 Index | 5.0 | 9.4 | 9.5 | 12.1 | 0.0 | (13.5) | (15.4) |

| NAV relative to S&P 500 Index | 3.0 | 4.7 | 7.5 | 7.9 | 1.9 | (9.9) | (18.6) |

| Price relative to CBOE UK All Cos | 0.3 | 5.8 | 4.1 | 10.2 | 1.2 | 17.0 | 31.8 |

| NAV relative to CBOE UK All Cos | (1.5) | 1.3 | 2.2 | 6.0 | 3.2 | 21.8 | 26.9 |

BRSA’s relative performance is shown in Exhibit 8. The most relevant column is SC, which is since the trust’s change in strategy at the end of July 2021. BRSA has outpaced the performance of the reference index in both NAV and share price terms since then. Sectors that have contributed positively to this outperformance include communication services, financials and technology. The consumer staples sector has detracted from BRSA’s relative performance both in terms of an underweight exposure versus the reference index and from stock selection. Another thing to note is how well the trust has performed versus the broad UK market over almost all of the periods shown. BRSA has lagged the performance of the bellwether US S&P 500 Index over the last three and five years. This is unsurprising given that until the recent rotation towards value/cyclical stocks, investors have generally favoured growth stocks, as evidenced by the multi-year outperformance of the technology sector to the end of 2021.

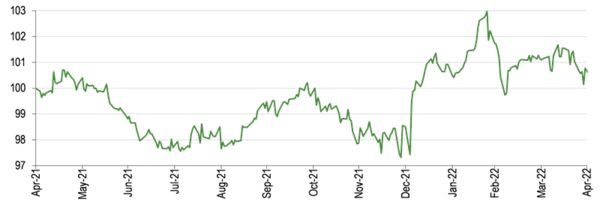

Exhibit 9: NAV performance versus reference index over one year[10]

Peer group comparisonEdit

BRSA is a member of the AIC North America sector, which is an eclectic mix of seven funds. The trust’s distinguishing features are a relatively concentrated portfolio offering an attractive level of income and capital appreciation potential, premium ESG scores and lower carbon emissions. Both the Canadian funds, Canadian General Investments and Middlefield Canadian Income, have an allocation to US equities. More than 25% of Baillie Gifford’s portfolio is held in unlisted companies and JPMorgan American is a hybrid fund made up of two portfolios run by separate managers, one investing in growth stocks and one in value names. Pershing Square Holdings has a very concentrated portfolio, typically holding only eight to 12 positions. BRSA’s closest peer is abrdn’s North American Income Trust, whose portfolio is broadly split 90:10 between US and Canadian equities.

BRSA’s NAV total return is above average over the last 12 months, ranking second out of seven, and is below average over three and five years, ranking sixth out of seven over the last three years and fifth out of six over the last five years. BRSA has the second narrowest discount in the sector and an ongoing charge that is modestly above average, ranking fourth. It currently has a below-average level of gearing and the highest dividend yield, which is 1.8pp above the mean.

| % unless stated | Market cap £m | NAV TR

1 year |

NAV TR

3 year |

NAV TR

5 year |

NAV TR

10 year |

Discount

(cum-fair) |

Ongoing charge | Perf.

fee |

Net

gearing |

Dividend

yield |

|---|---|---|---|---|---|---|---|---|---|---|

| BlackRock Sustainable American Income | 160.9 | 11.4 | 37.2 | 57.0 | (3.6) | 1.1 | No | 103 | 4.0 | |

| Baillie Gifford US Growth | 445.5 | (33.6) | 49.2 | (18.5) | 0.7 | No | 106 | 0.0 | ||

| Canadian General Investments | 463.5 | 0.5 | 57.4 | 98.9 | 206.7 | (26.7) | 1.4 | No | 114 | 1.3 |

| JPMorgan American | 1,320.0 | 7.6 | 56.5 | 91.8 | 351.4 | (2.9) | 0.4 | No | 107 | 1.0 |

| Middlefield Canadian Income | 137.9 | 25.7 | 51.9 | 66.9 | 152.2 | (13.5) | 1.2 | No | 120 | 3.9 |

| North American Income Trust | 416.5 | 10.5 | 22.2 | 47.4 | 210.5 | (8.1) | 0.9 | No | 103 | 3.5 |

| Pershing Square Holdings | 4,800.6 | 5.7 | 92.6 | 163.1 | (33.8) | 1.6 | Yes | 104 | 1.6 | |

| Simple average (7 funds) | 1,106.4 | 4.0 | 52.4 | 87.5 | 230.2 | (15.3) | 1.0 | 108 | 2.2 | |

| BRSA rank in peer group | 6 | 2 | 6 | 5 | 2 | 4 | 7 | 1 |

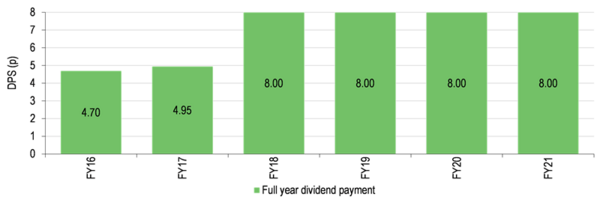

Dividends: Partly funded from distributable reservesEdit

In FY21, BRSA’s revenue earnings were 4.06p per share, which was a 38.9% decline compared with 6.65p per share in FY20. However, this needs to be put into context, as historically around 2.00p per share of the trust’s income was generated from writing options, which ceased with the change in strategy at the end of July 2021. Four quarterly interim dividends of 2.00p per share were paid in FY21. At the end of FY21 the trust had a c £0.5m revenue reserve and a further c £117.5m in other distributable reserves. Following shareholder approval at the 22 March 2022 AGM, BRSA’s c £44.9m share premium account was cancelled and converted into an additional distributable reserve. The trust’s total c £162.9m distributable reserves are equivalent to around 25x the last annual dividend payment. Based on its current share price, BRSA offers a 4.0% dividend yield.

Exhibit 11: Dividend history since FY16[12]

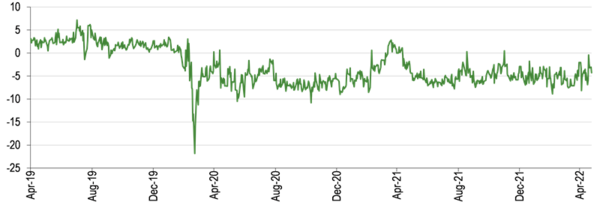

Valuation: Broadly trading around a 5% discountEdit

BRSA is currently trading at a 4.3% discount to cum-income NAV, which compares to a range of a 1.3% premium to an 8.9% discount over the last 12 months. It is wider than the average discounts of 4.8%, 3.1% and 3.2% over the last one, three and five years respectively. There is scope for a higher valuation if investors gain a greater understanding about the trust’s change in strategy with ESG considerations at the heart of the investment process.

Exhibit 12: Share price discount to NAV (including income) over three years (%)[13]

Renewed annually, BRSA has the authority to repurchase up to 14.99% and allot up to 10% of its share capital. In November 2020, 190k shares were repurchased at an average 6.8% discount, costing c £0.3m, while in April 2021, 445k shares were reissued from treasury at an average 1.7% premium to NAV for a gross consideration of c £0.9m. No further shares have been repurchased or reissued since then.

Fund profile: Focus on income and ESGEdit

BRSA was launched on 24 October 2012 and is listed on the Premium Segment of the London Stock Exchange. It is managed by three of BlackRock’s US income & value investment team: Tony DeSpirito (CIO, US fundamental equities), David Zhao (co-director of research) and Lisa Yang (consumer discretionary/staples specialist). There are more than 30 people in the US income & value team, which has c $68bn of assets under management. BRSA’s managers primarily invest in a diversified portfolio of North American equities, focusing on large- and mid-cap companies that pay and grow their dividends. To mitigate risk, at the time of investment, a maximum 10% of gross assets may be invested in a single investment, a maximum 25% in non-North American companies, and a maximum 35% in any one sector. The managers also take firms’ ESG characteristics into account seeking to deliver a superior ESG outcome compared with the reference index in terms of a better ESG score and a lower carbon emissions intensity score. Foreign currency is not hedged as a matter of course, but the managers may employ specific currency hedging.

How ESG is integrated into the investment processEdit

DeSpirito, Zhao and Yang seek to build a high-conviction portfolio of attractively priced, high-quality dividend-paying companies that are classified as either:

- ESG leaders: best-in-class companies that effectively manage environmental, social and governance factors to benefit all stakeholders. An example is Cisco Systems, which scores highly on a range of metrics including clean technology, human capital development, carbon emissions and water usage.

- ESG improvers: companies showing demonstratable progress on their ESG journey, where active engagement may lead to improving ESG practices and more sustainable outcomes. AIG is working to fix issues that have dogged the company such as poor management and an anaemic property and casualty (P&C) insurance business. The company had elevated catastrophe losses, but has acquired Validus Re, which has a skilled underwriting team, so its P&C operations should improve. Overall, AIG’s costs are coming down and margins are improving.

- Sustainability enablers: firms advancing the transition to sustainable solutions, such as companies contributing to greater energy efficiency and a lower carbon footprint. SS&C Technologies Holdings provides sustainable solutions; it is a US multinational financial technology company selling software and software-as-a-service (SaaS) to the financial services industry. It has grown via a series of acquisitions, and there are more opportunities available. The firm has more than 90% recurring revenues.

As part of the BlackRock US income & value investment team’s ESG engagement programme, Wells Fargo was identified as needing to prioritise customer remediation and improve its risk controls; its customers are now getting full protection. The company needed to do a better job in terms of human capital development, and there has subsequently been an improvement in this area. There has been a change in leadership at Wells Fargo and a series of external hires, while a higher level of risk controls have been implemented. Over time, BRSA’s managers believe that the company’s ESG score will continue to improve.

Outright exclusions from the fund include businesses manufacturing controversial weapons or civilian firearms, fossil fuel miners (thermal coal and tar sands) and tobacco companies. BRSA’s resulting portfolio has a premium ESG score and lower carbon emissions intensity than the reference index, as measured by a leading external ratings agency (MSCI).

| Portfolio | Reference index | Difference (%) | |

|---|---|---|---|

| Number of holdings | 56 | 853 | (93.4) |

| Gross dividend yield (%) | 1.8 | 1.8 | 0.0 |

| Return on equity (%) | 11.0 | 12.1 | (1.1) |

| Forward EPS growth (%) | 18.4 | 25.4 | (7.0) |

| Forward P/E multiple (x) | 14.1 | 16.6 | (15.1) |

| Non-US exposure (%) | 18.3 | 0.3 | 18.0 |

| MSCI ESG score (adjusted) | 6.59 | 5.76 | 14.4 |

| MSCI environmental score | 6.80 | 6.62 | 2.7 |

| MSCI social score | 4.83 | 4.69 | 3.0 |

| MSCI governance score | 5.13 | 4.96 | 3.4 |

| Carbon emissions intensity (total capital)* | 58.6 | 110.3 | (46.9) |

As detailed in Exhibit 13, at 31 December 2021, compared with the reference index, BRSA’s portfolio had the same dividend yield, a modestly lower return on equity, a lower forward earnings growth and unsurprisingly a much lower forward P/E multiple. The portfolio had higher ESG scores in all three of the subsectors – environmental, social and governance – while its carbon emissions intensity is considerably lower than that of the reference index.

GearingEdit

Gearing of up to 20% of NAV is permitted but is typically in a range of 0–10%, with 5% deemed a neutral level. At end-April 2022, BRSA had net gearing of 2.7%.

Fees and chargesEdit

BlackRock Investment Management (UK) is paid an annual management fee of 0.70% of BRSA’s NAV (0.75% before 30 July 2021). This is allocated 75% to the capital account and 25% to the revenue account. In FY21, the trust’s ongoing charges were 1.06%, which was in line with FY20.

Capital structureEdit

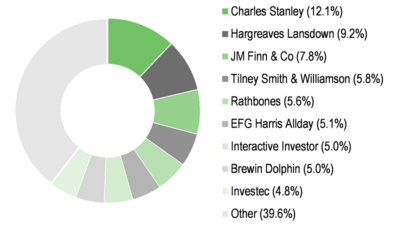

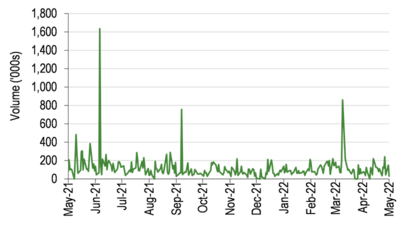

BRSA is a conventional investment trust with one class of share. There are 80.2m ordinary shares in issue. At end-FY21, 96.4% of the trust’s shares were held by banks or nominees (including retail investor platforms), which was a modest decrease compared with 98.1% at end FY20. BRSA’s average daily trading volume over the last 12 months was c 120k shares.

Exhibit 14: Major shareholders[15]

Exhibit 15: Average daily volume[16]

The boardEdit

| Board member | Date of appointment | Remuneration in FY21 | Shareholdings at end-FY21 |

|---|---|---|---|

| Simon Miller (chairman) | 7 September 2012 | £42,000 | 38,094 |

| Christopher Casey | 7 September 2012 | £35,000 | 19,047 |

| Andrew Irvine* | 7 September 2012 | £29,000 | 38,094 |

| Melanie Roberts | 1 October 2019 | £29,000 | 0 |

| Alice Ryder | 12 June 2013 | £29,000 | 9,047 |

| David Barron | 22 March 2022 | £0 | 0 |

Simon Miller is chairman of Hampden & Co, a non-executive director of The Bankers Investment Trust and a senior independent director of STV Group. He was previously chairman of Brewin Dolphin Holdings, JPMorgan Global Convertibles Income Fund, Artemis Alpha Trust, JPMorgan Elect and Amati VCT.

Christopher Casey was previously a partner of KPMG and its predecessor firms, having joined Peat Marwick & Mitchell in 1977. He is chairman of The European Smaller Companies Trust and a director of CQS Natural Resources Growth and Income, Mobius Investment Trust and Life Settlement Assets.

Andrew Irvine is a past chairman of Jones Lang LaSalle Scotland and has over 35 years’ experience in the field of property development and investment. He is chairman of Fidelity Special Values and was previously chairman of Montanaro European Smaller Companies. Irvine is a past chairman of Celtic Rugby and the British and Irish Lions, and a past president of the Scottish Rugby Union.

Melanie Roberts has responsibility for sustainability, working alongside the rest of the board and the investment manager. She has 26 years of investment experience and is a partner at Sarasin & Partners, having joined the firm in 2011, where she is primarily responsible for the management of charity and pension fund portfolios. Prior to joining Sarasin & Partners, Roberts spent 16 years at Newton Investment Management as a fund manager of charity, private client and pension fund portfolios.

Alice Ryder is a partner at Stanhope Capital and has more than 37 years’ investment experience, including 15 years as an investment consultant in the charity sector and as a fund manager from 1985 to 2002. She is responsible for advising substantial charity and not-for-profit clients at Stanhope Consulting, a division of Stanhope Capital. Ryder is also a director of JPMorgan UK Smaller Companies Investment Trust.

On 22 March 2022, the board announced the appointment of David Barron as a non-executive director, with immediate effect. He has 25 years’ investment management experience and until November 2019 was CEO of Miton Group, having spent six years with the firm. Prior to this, Barron was head of investment trusts at JP Morgan Asset Management for more than 10 years, having joined Robert Fleming in 1995. He is currently chairman of Dunedin Income Growth Investment Trust, a non-executive director of Fidelity Japan Trust and a non-executive director of Premier Miton Group. Barron is also a lay member of the Council of Lancaster University. He is a member of the Institute of Chartered Accountants of Scotland having qualified with Thomson McLintock (now KPMG). Like his fellow directors, Barron is a member of BRSA’s audit and management engagement and nomination committees.

ActionsEdit

To invest in BlackRock Sustainable American Income, click here.

To contact BlackRock Sustainable American Income, click here.

NotesEdit

- ↑ Source: Morningstar, Edison Investment Research.

- ↑ Source: BRSA, Edison Investment Research.

- ↑ 3.0 3.1 Source: Refinitiv, Edison Investment Research.

- ↑ Source: BRSA, Edison Investment Research. Note: *N/A where not in end-October 2021 top 10.

- ↑ Source: BRSA, Edison Investment Research. Note: Rebased for net current assets/liabilities.

- ↑ Source: BRSA, Edison Investment Research. Note: Rebased for net current assets/liabilities.

- ↑ Source: Refinitiv. Note: All % on a total return basis in pounds sterling.

- ↑ 8.0 8.1 Source: Refinitiv, Edison Investment Research. Note: Three- and five-year performance figures annualised. SC = since change in strategy on 30 July 2021.

- ↑ Source: Refinitiv, Edison Investment Research. Note: Data to end-April 2022. Geometric calculation.

- ↑ Source: Refinitiv, Edison Investment Research. Note: Change in strategy at end-July 2021.

- ↑ Source: Morningstar, Edison Investment Research. Note: *Performance as at 23 May 2022 based on ex-par NAV. TR = total return. Net gearing is total assets less cash and equivalents as a percentage of net assets.

- ↑ Source: Bloomberg, Edison Investment Research.

- ↑ Source: Bloomberg, Edison Investment Research.

- ↑ Source: BRSA, Edison Investment Research. Note: *Metric tons/$m total capital.

- ↑ Source: Bloomberg, as at 30 April 2022.

- ↑ Source: Refinitiv. Note: 12 months to 24 May 2022.

- ↑ Source: BRSA. Note: *Retired at 22 March 2022 AGM.