Drink LMNT: Difference between revisions

No edit summary |

No edit summary |

||

| Line 1: | Line 1: | ||

'''On a salty rebellion to restore health through hydration''' | |||

== Highlights == | == Highlights == | ||

| Line 54: | Line 56: | ||

=== With everything you need and nothing you don't... yes, that means lots of salt and zero sugar. === | === With everything you need and nothing you don't... yes, that means lots of salt and zero sugar. === | ||

[[File:C825b31657acba61a724fe4912198cbc3bc89c2f.png|thumb|300x300px]] | |||

LMNT delivers a truly meaningful dose of electrolytes without the sugar or other dodgy ingredients. It's formulated to help anyone with their electrolyte needs and is perfectly suited to folks following '''low-carb''', '''active''', or '''fasting''' lifestyles. | LMNT delivers a truly meaningful dose of electrolytes without the sugar or other dodgy ingredients. It's formulated to help anyone with their electrolyte needs and is perfectly suited to folks following '''low-carb''', '''active''', or '''fasting''' lifestyles. | ||

=== One core formulation, across multiple flavor occasions === | === One core formulation, across multiple flavor occasions === | ||

[[File:66121-1653604801-020e0f4e1da8b0bcebef8083759d05672c66d6c3.png | [[File:66121-1653604801-020e0f4e1da8b0bcebef8083759d05672c66d6c3.png]] | ||

== Traction == | == Traction == | ||

| Line 66: | Line 71: | ||

=== In three years LMNT has become one of the fastest-growing beverage brands. === | === In three years LMNT has become one of the fastest-growing beverage brands. === | ||

[[File:64131-1651083388-4b3e9f6e593b49afa08a002b085fe4abd261f9d0.jpg|thumb|473x473px]] | |||

* Loved by avid tribes of health seekers. | * Loved by avid tribes of health seekers. | ||

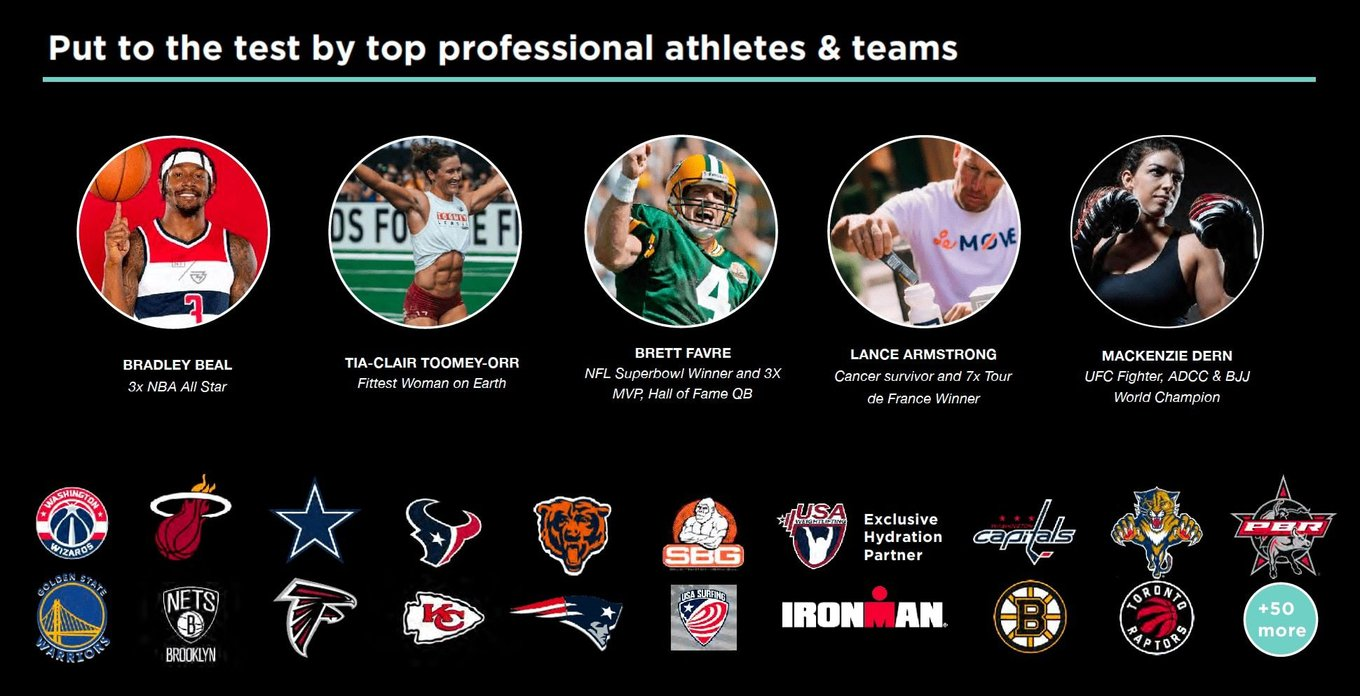

* Put to the test by dozens of professional athletes and sports teams. | * Put to the test by dozens of professional athletes and sports teams. | ||

* Recommended by leading health influencers | * Recommended by leading health influencers | ||

| Line 78: | Line 84: | ||

[[File:07512-0d187d8f9fc166a5cea5ce1bc189cbf1e022517f.png|1360x1360px]] | [[File:07512-0d187d8f9fc166a5cea5ce1bc189cbf1e022517f.png|1360x1360px]] | ||

=== And we’re just getting started... === | === And we’re just getting started... === | ||

== Customers == | == Customers == | ||

Revision as of 13:15, 10 July 2022

On a salty rebellion to restore health through hydration

Highlights

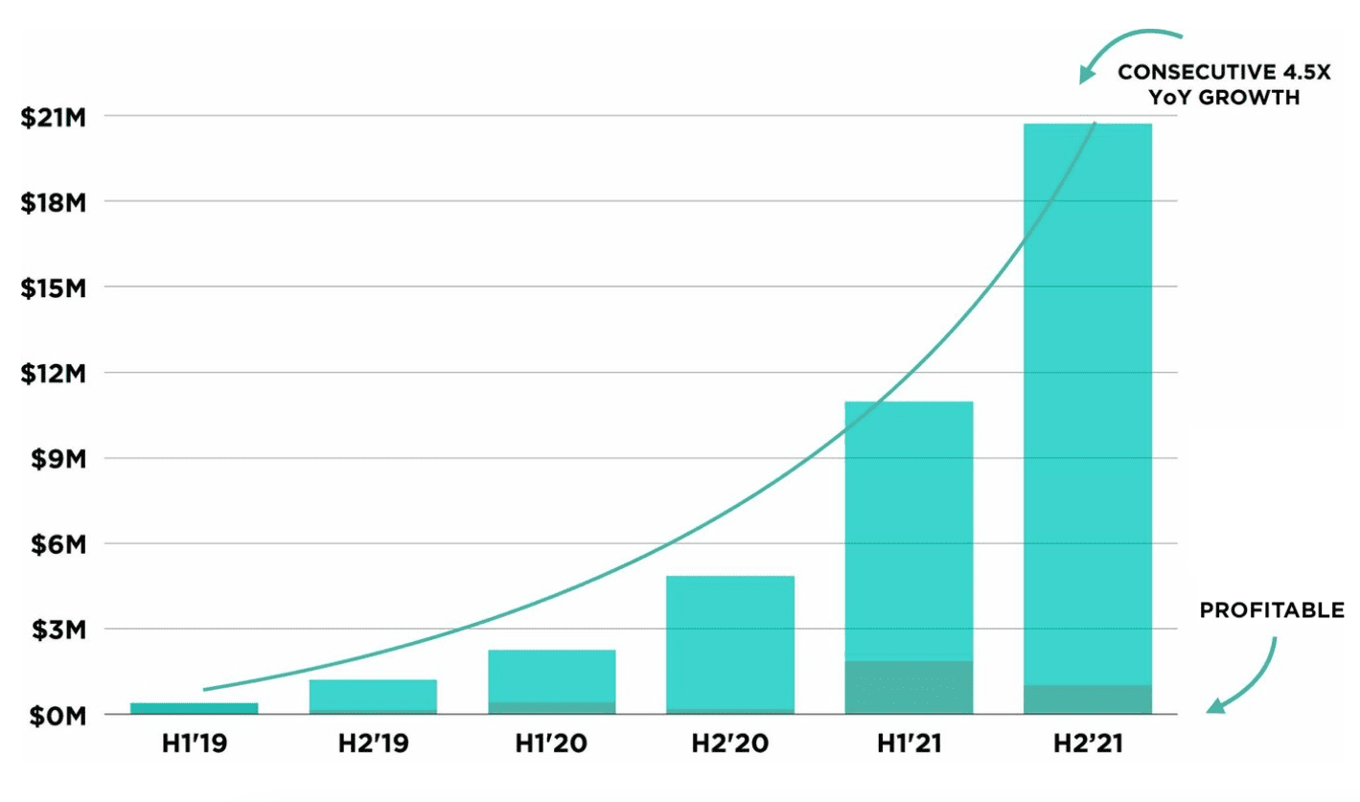

- One of the fastest growing beverage brands in the market (4.5x YoY)

- On a $50MM revenue run-rate as of Q1 2022 and profitable since year 1

- Meeting a true health need with real innovation in the electrolyte category

- Led by an experienced team with exits in the natural product space

- Backed by dozens of professional athletes, teams, and health influencers

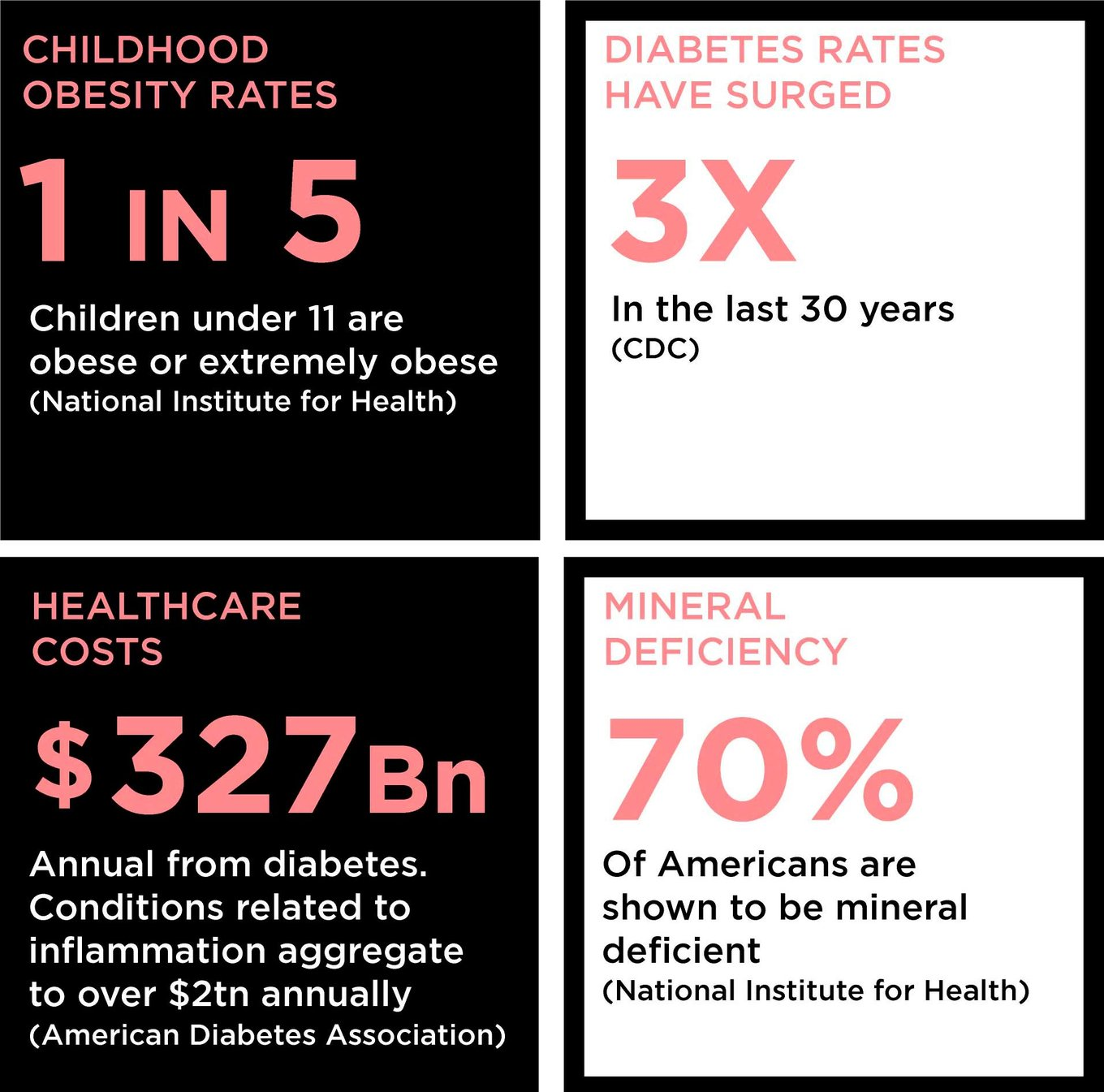

Problem

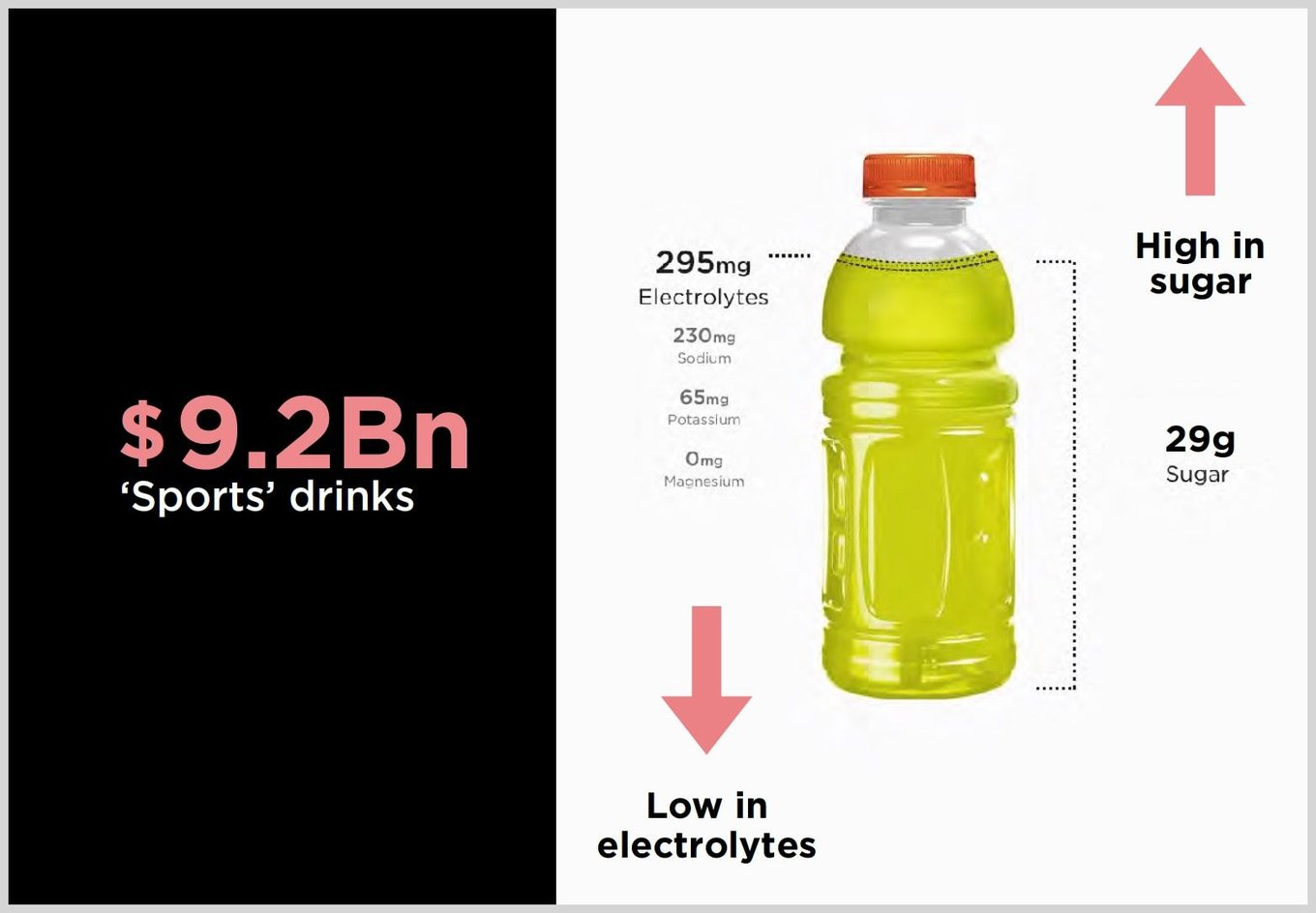

The 'hydration' market is giant and still full of garbage

Many drinks in the hydration category are loaded with sugar and desperately low in a key functional ingredient: SALT.

High sugar intake and misinformation around sodium has contributed to some of our most challenging health issues.

The body needs adequate electrolytes to refuel and be properly energized—not more sugar.

- Whole food diets are lacking in sufficient mineral electrolytes.

- Leading an active lifestyle (read: sweating) requires electrolytes for energy production.

- Numerous diseases and stressors demand specific electrolyte attention.

The science is clear, you need more salt. Period.

Public perception is catching up,

and new knowledge around functional

ingredients creates new winners:

Solution

LMNT

We’re owning SALT as a revolution

in hydration and functional beverages.

We know our salt

Our products are science-backed; and we publish in-depth content on electrolytes informed by the latest scientific literature. LMNT also consults with professional sports teams, elite military units, and numerous healthcare practitioners in support of nutritional interventions for optimal health.

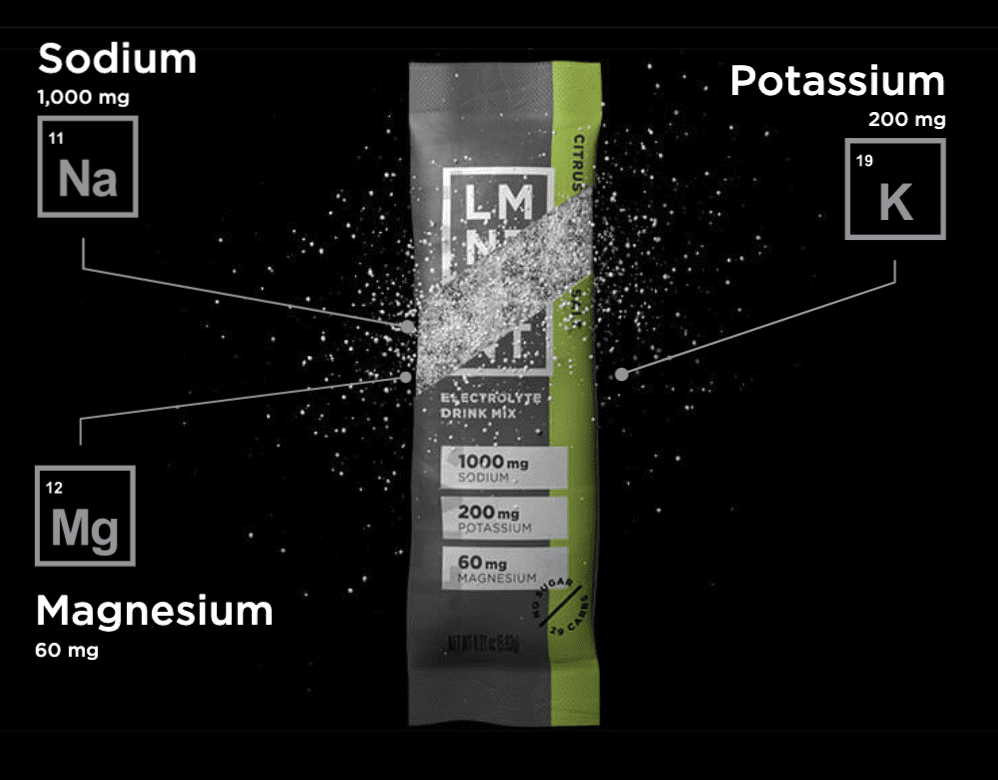

Product

A tasty electrolyte drink mix

With everything you need and nothing you don't... yes, that means lots of salt and zero sugar.

LMNT delivers a truly meaningful dose of electrolytes without the sugar or other dodgy ingredients. It's formulated to help anyone with their electrolyte needs and is perfectly suited to folks following low-carb, active, or fasting lifestyles.

One core formulation, across multiple flavor occasions

Traction

Surpassing a $50M run-rate, growing 4.5x YoY

In three years LMNT has become one of the fastest-growing beverage brands.

- Loved by avid tribes of health seekers.

- Put to the test by dozens of professional athletes and sports teams.

- Recommended by leading health influencers

We're honored to collaborate with some of the very best in their respective fields.

And we’re just getting started...

Customers

Over 25K+ reviews

and a 4.5+ rating

LMNT has generated over 25K+ reviews with key customer metrics showing avid loyalty. Now with over 250k customers, we impact a vast spectrum of demographics and health circumstances.

Our launch focused on low-carb tribes because diabetes and obesity are two of our most significant health challenges.

Managing electrolytes is an absolutely critical part of successful dietary interventions.

Business model

Direct-to-consumer focus, with plenty of runway left

Our core (and only) product is our drink mix stick packs sold online directly to consumers.

Strong margins, retention, and profitability have allowed us to scale as a highly capital-efficient business.

- In addition to hundreds of health and wellness influencers who support the brand, our customer base is one of our strongest drivers of growth through referrals.

- We launched our Wholesale Partnership Program on the back of efforts to support gym owners during COVID.

Traditional retail remains untapped

- FocusedWe’re currently focused on taking advantage of our direct-to-consumer opportunity.

- Unsolicited InterestFrom buyers at big box, specialty, and natural grocer retailers.

Market

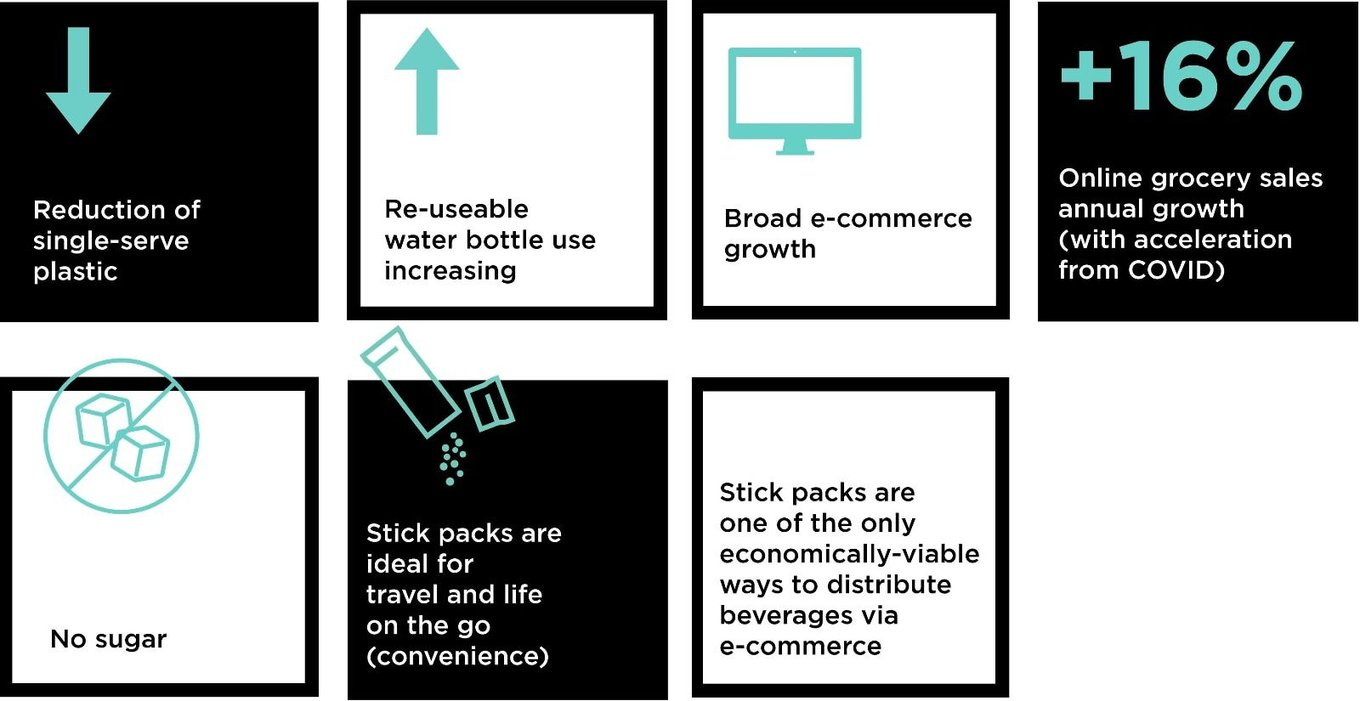

The 'hydration' market alone is a $9.2B+ opportunity

LMNT’s growth is further supported

by durable market trends.

Competition

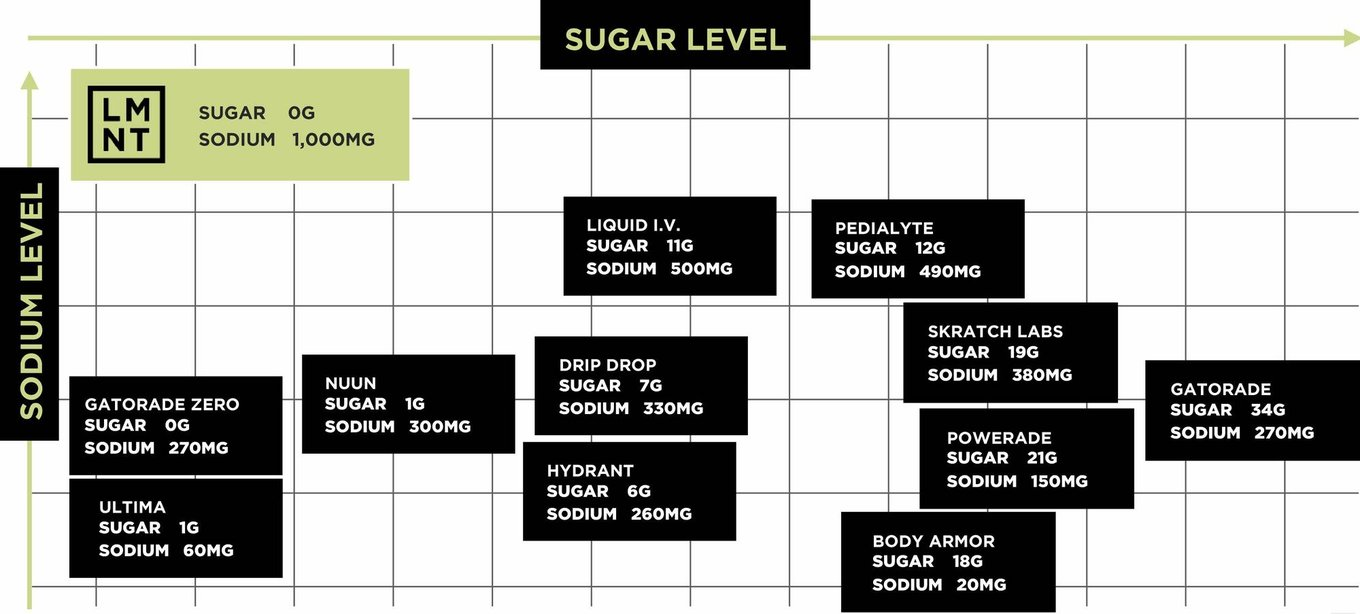

We're salt- and science-backed, not sugar-loaded

In a crowded space, we have a differentiated formula and flavor profile: salty, not sugary. Each packet of LMNT contains 1 gram of salt and absolutely no sugar, providing a unique and bold product to the market.

It's both what's inside...

...and what isn't...

Vision and strategy

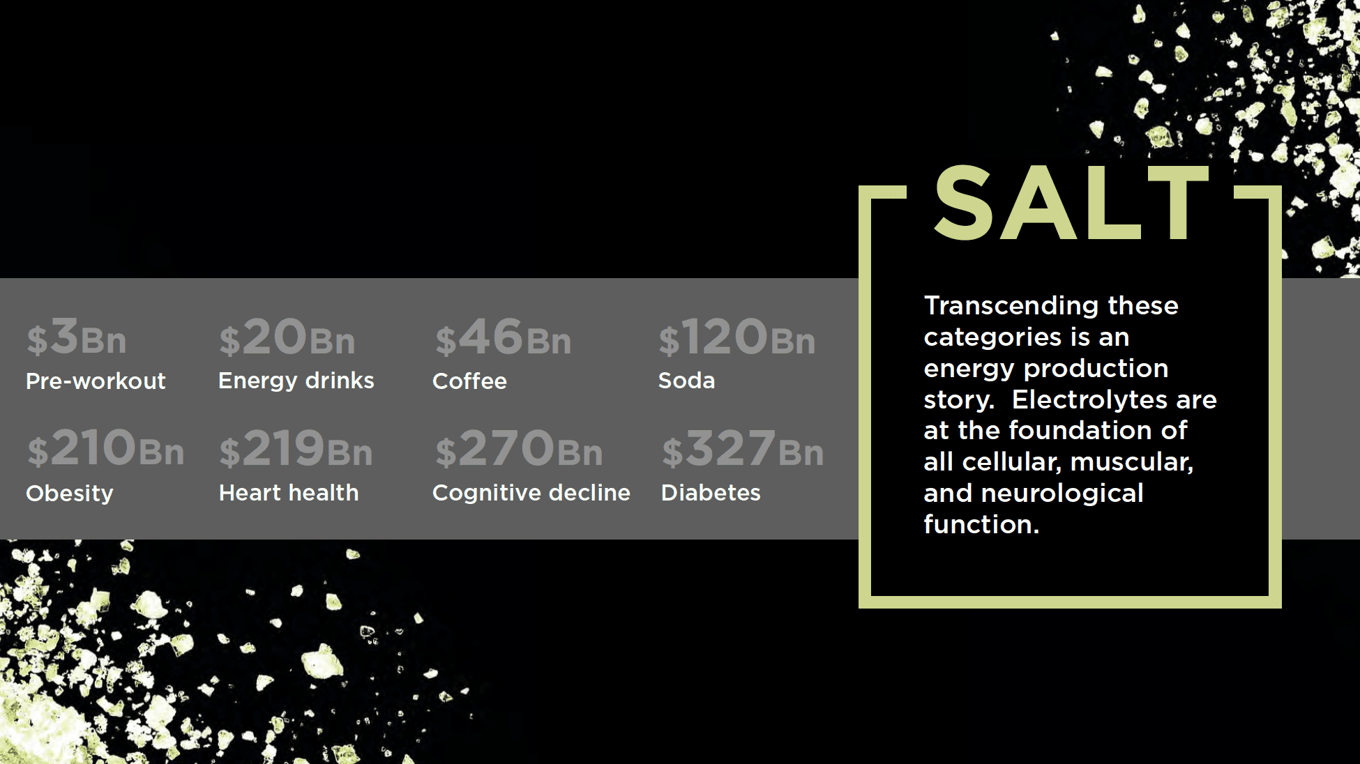

Our mission: To restore health through hydration

Our fundraise is focused on bringing in additional investor-allies to make an even bigger splash. We're honored to have you consider joining us for the journey.

While LMNT will initially targets the $9.2B hydration segment, transcending this category is an energy production story. Electrolytes are at the foundation of all cellular, muscular, and neurological functions.

As you reflect on your potential investment, consider that we are a company committed to health. At times what this means is that we might make decisions to support the health of our customers or community over what might be a profit-driven consideration. Some also call this a risk—we see it as the right thing to do, and will continue to be guided by this. We've also found it's good business.

Funding

Committed investors

With under $5M raised to date, our funding has focused on bringing on impactful investor-allies to support the business. We have over 700 investors from hall of fame professional athletes, top-tier founders, health leaders and industry leading investors such as ALIVE Ventures, Thrive Market Ventures, Wild Ventures, SHL Capital, Riverside & Incisive Ventures.

Some of our noteworthy investors include...

- Joe Thomas, 10x NFL Pro Bowler; Likely 1st Ballot Hall of Fame

- Nate Solder, 2x NFL Super Bowl Champion & Patriots Team Co-Captain

- Bradley Beal, 3x NBA All-Star, lead the NBA as leading scorer for much of the 2021 season

- JD Martinez, 3x MLB All-Star; 3x Silver Slugger Award Winner; World Series Champion

- Aaron Eckblad, #1 overall draft pick; lead the NHL in minutes played

- Nick Martin, Houston Texas team Captain and former Notre Dame Team Captain.

- Zack Martin, 6x All-Pro in first 6 NFL seasons, Cowboys Team Captain

- Henry Akins, legendary BJJ instructor and black belt

- Barry Nalebuff, Honest Tea co-founder

- Heidi Brooks, Yale SOM organization and leadership professor

- Clayton Christopher, CAVU Co-founder, Sweat Leaf Tea founder

- Sam Corcos & Josh Clemente, Levels Health co-founders

- Shane Heath and Paul DeJoe, MUD/WTR co-founders

- Nick Green & Gunnar Lovelace, Thrive Market Co-founders

- Mike Maser, Co-founder and chairman of Zero Fasting

- Kevin Olusola, 3x Grammy winning musician

- Web Smith, founder of 2PM, co-founder of Mizzen+Main

- Peter Attia, MD, Longevity MD, leading health podcast

- Kelly LeVeque, celebrity nutritionist

- Mark Divine, founder of NavySEALs.com and SEALFIT

- Kirk Parsley, MD, Navy SEAL and Medical Doctor

- David Nurse, performance coach to NBA players

- Katie Wells, (Wellness Mama) leading mommy blogger

- Kelly and Juliet Starrett, The Ready State (formerly MobilityWOD)

- More than 500 of our top customers

Founders

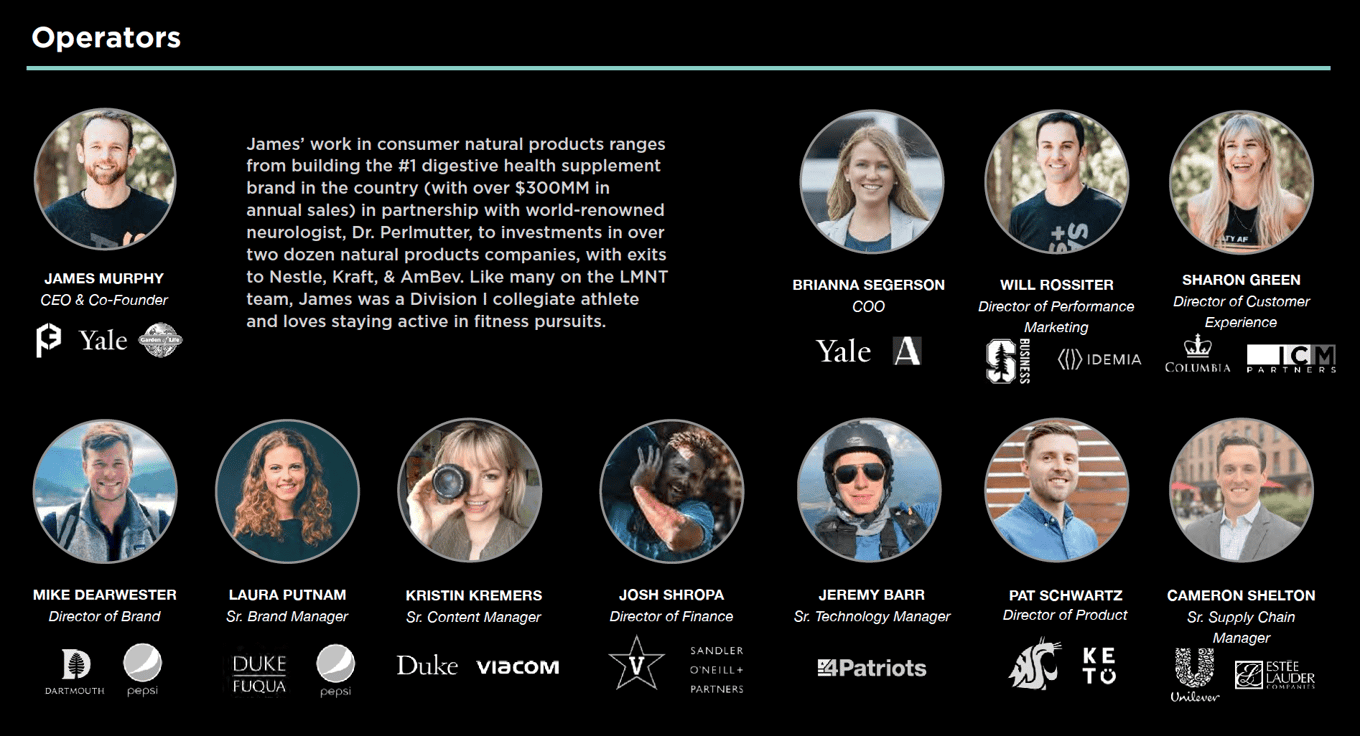

Led by committed team with a track record of success in the nutrition & natural products industry

Experienced operators and industry leading professionals who have dedicated their careers in the support of health.

Risks

We may implement new lines of business or offer new products and services within existing lines of business.

We may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

We rely on other companies to provide components for our products.

We depend on suppliers and contractors to meet our contractual obligations to our customers and conduct our operations. Our ability to meet our obligations to our customers may be adversely affected if suppliers or contractors do not provide the agreed-upon supplies or services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our products may be adversely impacted if companies to whom we delegate the production of our products, or from whom we acquire such items, do not provide the products which meet required specifications and perform to our, and our customers’, expectations. Our suppliers may also be unable to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two contractors or suppliers for a particular product or service. Our products may utilize custom ingredients available from few worldwide sources. Continued availability of those products at acceptable prices, or at all, may be affected for any number of reasons, including if those suppliers decide to concentrate on the production of common products instead of products customized to meet our requirements. The supplies needed for a new or existing product could be delayed or constrained, or a key manufacturing vendor could delay shipments of completed products to us adversely affecting our business and results of operations.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company relies on certain intellectual property rights to operate its business. The Company’s intellectual property rights may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights. As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our intellectual property rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

The Company’s success depends on the experience and skill of its executive officers and key personnel.

In particular, we are dependent James Murphy, our Chief Executive Officer, Robb Wolf, our Vice President, and Brianna Segerson, our Chief Operating Officer. The Company does not have direct employment agreements with Mr. Murphy, Mr. Wolf and Ms. Segerson, and there can be no assurance that it will do so or that any or all of them will continue to provide services to the Company for a particular period of time. Mr. Murphy, Mr. Wolf and Ms. Segerson are employees of an affiliated entity, Proton Fitness, LLC, and services provided on behalf of the Company are performed under a Services Agreement. Moreover, each of our executives are involved with other initiatives and may not devote their full time to the Company. The loss of Mr. Murphy, Mr. Wolf or Ms. Segerson, or any other key personnel, could harm the Company’s business, financial condition, cash flow and results of operations.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

We have substantial reliance on Proton Fitness, LLC to provide our personnel and support services.

The Company is a party to a Services Agreement (“Proton Services Agreement”) with Proton Fitness, LLC (“Proton Fitness”). James Murphy is an officer and director of the Company as well as an owner of Proton Venture CPG, LLC, a major stockholder in the Company. Mr. Murphy is also a manager and member of Proton Fitness. Employees of Proton Fitness provide nearly all services required for the operation of the Company (including without limitation, strategic planning, accounting, information and technology, human resources/benefits, finance and audit, software and other technology development, product development, branding, marketing and sales support, website development and maintenance, procurement, insurance risk/management, and business advisory) in return for reimbursement of all direct and indirect, fully-burdened actual operating expenses for providing the services. Reimbursement payments are based on the operating expenses incurred and are made at the cost of the services provided. Proton Fitness does not profit from or receive an additional fee above costs incurred. Unless terminated, the Proton Services Agreement automatically renews for consecutive three-month periods and can be terminated by either party for any reason upon ninety days prior written notice. In the event, the Proton Services Agreement was terminated, and the employees of Proton Fitness no longer provide services required for the operation of the Company, such termination would have a material adverse effect on the Company.

In order for the Company to compete and grow, it must attract, recruit, retain and develop the necessary personnel who have the needed experience.

Recruiting and retaining highly qualified personnel is critical to our success. These demands may require us to hire additional personnel and will require our existing management and other personnel to develop additional expertise. We face intense competition for personnel, making recruitment time-consuming and expensive. The failure to attract and retain personnel or to develop such expertise could delay or halt the development and commercialization of our product candidates. If we experience difficulties in hiring and retaining personnel in key positions, we could suffer from delays in product development, loss of customers and sales and diversion of management resources, which could adversely affect operating results. Our consultants and advisors may be employed by third parties and may have commitments under consulting or advisory contracts with third parties that may limit their availability to us, which could further delay or disrupt our product development and growth plans.

Our environment is intensely competitive, demanding and rapidly changing.

To succeed in our intensely competitive industry, we must continually improve, adapt and cater our product offerings to meet the needs and demands of consumers. We must accurately anticipate changing customer needs and trends, or our business operations may be adversely affected.

The development and commercialization of our products is highly competitive.

We face competition with respect to any products that we may seek to develop or commercialize in the future. Our competitors include major companies worldwide. Many of our competitors have significantly greater financial, technical and human resources than we have and superior expertise in research and development and marketing approved products and thus may be better equipped than us to develop and commercialize products. These competitors also compete with us in recruiting and retaining qualified personnel and acquiring technologies. Smaller or early stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. Accordingly, our competitors may commercialize products more rapidly or effectively than we are able to, which would adversely affect our competitive position, the likelihood that our products will achieve initial market acceptance, and our ability to generate meaningful additional revenues from our products.

We face various risks as an e-commerce retailer.

As part of our growth strategy, we have made significant investments to grow our e-commerce business. We may require additional capital in the future to grow our e-commerce business. Business risks related to our e-commerce business include our inability to keep pace with rapid technological change, failure in our security procedures or operational controls, failure or inadequacy in our systems or labor resource levels to effectively process customer orders in a timely manner, government regulation and legal uncertainties with respect to e-commerce, and collection of sales or other taxes by one or more states or foreign jurisdictions. If any of these risks materialize, they could have an adverse effect on our business. In addition, we face competition from other internet retailers, and more retailers could enter the market. Our failure to positively differentiate our product and services offerings or customer experience from these internet retailers could have a material adverse effect on our business, financial condition and results of operations.

Our inability to secure, maintain and increase our presence on e-commerce platforms could adversely impact our revenue, and in turn our business, financial condition, results of operations and prospects could be adversely affected.

Our operations include selling products to consumers through third party e-commerce platforms, including Amazon and Shopify. The success of our business is largely dependent on our continuing development of strong relationships with such platforms and abiding by their established rules and regulations for sellers. The loss of our relationship with any large e-commerce platform partner could have a significant impact on our revenue. Consequently, growth opportunities through our e-commerce and direct-to-consumer channel may be limited and our revenue, business, financial condition, results of operations and prospects could be adversely affected if we are unable to successfully establish relationships with e-commerce platforms in new or current markets.

Industry consolidation may result in increased competition, which could result in a loss of customers or a reduction in revenue.

Some of our competitors have made or may make acquisitions or may enter into partnerships or other strategic relationships to offer more comprehensive services than they individually had offered or achieve greater economies of scale. In addition, new entrants not currently considered to be competitors may enter our market through acquisitions, partnerships or strategic relationships. We expect these trends to continue as companies attempt to strengthen or maintain their market positions. The potential entrants may have competitive advantages over us, such as greater name recognition, longer operating histories, more varied services and larger marketing budgets, as well as greater financial, technical and other resources. The companies resulting from combinations or that expand or vertically integrate their business to include the market that we address may create more compelling service offerings and may offer greater pricing flexibility than we can or may engage in business practices that make it more difficult for us to compete effectively, including on the basis of price, sales and marketing programs, technology or service functionality. These pressures could result in a substantial loss of our customers or a reduction in our revenue.

Increases in raw materials, packaging, oil and natural gas costs and volatility in the commodity markets may adversely affect our results of operations.

Our financial results depend to a large extent on the costs of raw materials, packaging, oil and natural gas, and our ability to pass the costs of these materials onto our customers. Historically, market prices for commodities have fluctuated in response to a number of factors, including economic conditions such as inflation, changes in U.S. government support programs, changes in international trading policies, impacts of disease outbreaks on material sources and the potential effect on supply and demand as well as weather conditions. Fluctuations in paper and oil prices affect our costs for packaging materials. In addition, we have exposure to changes in the pricing of oil and natural gas, which affects our manufacturing, transportation and packaging costs. If there is any increase in the cost of raw materials, packaging, or oil and natural gas expenses, we may be required to charge higher selling prices for our products to avoid margin deterioration. We cannot provide any assurances regarding the timing or the extent of our ability to successfully charge higher prices for our products, or the extent to which any price increase will affect future sales volumes. Our results of operations may be materially and adversely affected by this volatility.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

The amount of capital the Company is attempting to raise in this Offering may not be enough if the Company makes substantial changes or additions to its current business plan.

The Company believes it has adequate capital to support its current business plan and near-term goals. In the event, the Company makes substantial changes or additions to its current business plan, the Company may need to procure funds in addition to the amount raised in the Offering to achieve its long-term goals. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one all or part of our plans, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We may face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

Changes in federal, state or local laws and government regulation could adversely impact our business.

The Company is subject to legislation and regulation at the federal and local levels and, in some instances, at the state level. New laws and regulations may impose new and significant disclosure obligations and other operational, marketing and compliance-related obligations and requirements, which may lead to additional costs, risks of non-compliance, and diversion of our management's time and attention from strategic initiatives. Additionally, federal, state and local legislators or regulators may change current laws or regulations which could adversely impact our business. Further, court actions or regulatory proceedings could also change our rights and obligations under applicable federal, state and local laws, which cannot be predicted. Modifications to existing requirements or imposition of new requirements or limitations could have an adverse impact on our business.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we may incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

Changes in employment laws or regulation could harm our performance.

Various federal and state labor laws govern our relationship with our employees and affect operating costs. These laws include minimum wage requirements, overtime pay, healthcare reform and the implementation of the Patient Protection and Affordable Care Act, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect our operating results, including additional government- imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, increased tax reporting and tax payment requirements for employees who receive tips, a reduction in the number of states that allow tips to be credited toward minimum wage requirements, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

The Company has sales and use tax liability exposure.

The Company has determined that it was required to pay sales and use tax on products sold to end-use consumers in various state jurisdictions. Accordingly, the Company recorded liabilities of $413,000 as of December 31, 2021 and $94,000 as of December 31, 2020, for the amount it estimates that it did not collect from customers at the time of sale, which includes estimated penalties and interest. The Company is in the process of filing voluntary disclosure agreements with certain jurisdictions, filing back returns and remitting the estimated sale and use tax that it did not collect from customers. If these jurisdictions determine that additional amounts of sales and use tax are necessary, the Company will be required to pay accordingly, which could impact our financial results.

Affiliates of the Company, including officers, directors and existing shareholders of the Company, may invest in this Offering and their funds will be counted toward the Company achieving the Minimum Amount.

There is no restriction on affiliates of the Company, including its officers, directors and existing shareholders, investing in the Offering. As a result, it is possible that if the Company has raised some funds, but not reached the Minimum Amount, affiliates can contribute the balance so that there will be a closing. The Minimum Amount is typically intended to be a protection for investors and gives investors confidence that other investors, along with them, are sufficiently interested in the Offering and the Company and its prospects to make an investment of at least the Minimum Amount. By permitting affiliates to invest in the offering and make up any shortfall between what non-affiliate investors have invested and the Minimum Amount, this protection is largely eliminated. Investors should be aware that no funds other than their own and those of affiliates investing along with them may be invested in this Offering.

Global crises, such as COVID-19, can have a significant effect on our business operations and revenue projections.

A significant outbreak of contagious diseases in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, including the United States where we principally operate, resulting in an economic downturn that could reduce the demand for our products and services and impair our business prospects, including as a result of being unable to raise additional capital on acceptable terms to us, if at all.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts. In addition, if the Company violated federal or state securities laws in connection with a prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future.

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

You should not rely on the fact that our Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it relates to this Offering. The U.S. Securities and Exchange Commission has not reviewed this Form C, nor any document or literature related to this Offering.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this Form C and the accompanying exhibits.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

The Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may also end the Offering early.

If the Target Offering Amount is met after 21 calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least 5 business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE (Simple Agreement for Future Equity) investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into CF Shadow Securities. The Company is under no obligation to convert the Securities into CF Shadow Securities. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities.

Investors will not have the right to vote upon matters of the Company even if and when their Securities are converted into CF Shadow Securities (the occurrence of which cannot be guaranteed). Upon such conversion, the CF Shadow Securities will have no voting rights and, in circumstances where a statutory right to vote is provided by state law, the CF Shadow Security holders or the party holding the CF Shadow Securities on behalf of the Investors are required to enter into a proxy agreement with its designee to vote their CF Shadow Securities with the majority of the holder(s) of the securities issued in the round of equity financing that triggered the conversion right. For example, if the Securities are converted in connection with an offering of Series B Preferred Stock, Investors would directly or beneficially receive CF Shadow Securities in the form of shares of Series B-CF Shadow Preferred Stock and such shares would be required to be subject to a proxy that allows a designee to vote their shares of Series B-CF Shadow Preferred Stock consistent with the majority of the Series B Preferred Stockholders. Thus, Investors will essentially never be able to vote upon any matters of the Company unless otherwise provided for by the Company.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and as a consequence holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company. The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities. In addition, the Company has certain equity grants and convertible securities outstanding. Should the Company enter into a financing that would trigger any conversion rights, the converting securities would further dilute the equity securities receivable by the holders of the Securities upon a qualifying financing.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the First Equity Financing Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the First Equity Financing Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company. The foregoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

There is no present market for the Securities and we have arbitrarily set the price.

The Offering price was not established in a competitive market. We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our asset value, net worth, revenues or other established criteria of value. We cannot guarantee that the Securities can be resold at the Offering price or at any other price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred stock, have been paid in full. Neither holders of the Securities nor holders of CF Shadow Securities can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.