Formula for growth

SummaryEdit

Else Nutrition has a globally patented, 100% plant-based dairy- and soy-free formula, which offers a clean-label alternative for babies who are intolerant to dairy and soy and to families who are flexitarian or seeking more sustainable food options. It launched its toddler formula in August 2020 and successfully built sales infrastructure in the US during 2021, rolling out sales online and in-store. It has expanded by launching a nutritional drink for children and, more recently, a line of baby cereals, and plans to expand into Canada, Western Europe and China during H222. Its infant formula is undergoing rigorous testing before launch, expected in FY25. Momentum is clearly building, with geographic and product expansion as major catalysts for growth. Edison Investment Research forecasts a three-year revenue CAGR of c 130% and its mid-case 12-month DCF-based value is C$6.0/share.

| Year end | Revenue (C$m) | PBT*

(C$m) |

EPS*

(C$) |

DPS

(C$) |

P/E

(x) |

EV/sales

(x) |

|---|---|---|---|---|---|---|

| 12/20 | 1.5 | (8.0) | (0.10) | 0.0 | N/A | 60.7 |

| 12/21 | 4.7 | (15.5) | (0.16) | 0.0 | N/A | 19.2 |

| 12/22e | 13.6 | (17.3) | (0.17) | 0.0 | N/A | 6.6 |

| 12/23e | 33.0 | (16.8) | (0.16) | 0.0 | N/A | 2.7 |

Plant-based products in the sweet spotEdit

Plant-based diets are no longer restricted to vegans and are being adopted as part of a flexitarian lifestyle as consumers look for healthier, more sustainable options. Non-dairy milks have become ubiquitous in many markets during the last five years. Else’s products offer a solution for children with allergies and intolerances but could be adopted more widely given their clean label and minimal processing.

Q122 results: Delivering growthEdit

Q1 results demonstrated the momentum that is building in the business and validate the company’s strategy in terms of the development of its sales infrastructure. Q1 revenues were up 26% sequentially to C$1.6m, including a 40% increase in sales on Amazon.com. The business has enough cash to fund short-term plans but will require further equity or debt to support the high growth.

Edit

Edison values Else primarily on a DCF basis and flex for different scenarios. Edison's base case assumes a sales CAGR of 47% in years 4 to 10, followed by 15% in years 11–15 and 10% in years 16–20. Edison Investment Research assumes 2.0% terminal growth and a 15% terminal EBIT margin, resulting in a mid-case 12-month value of C$6.0. Edison also look at peer group analysis. Although there are not many directly comparable peers, Else trades on an FY22 EV/sales multiple of 6.6x versus a peer group of baby food and plant-based manufacturers on 3.0x. Given Else’s disruptive model, Edison believes a premium is justified. On a more bullish scenario, assuming a faster roll-out and uptake of product, its fair value is C$10.4, and on more pessimistic assumptions its fair value is C$4.2, which still represents significant upside to current levels.

Investment summaryEdit

Company description: Plant-based, non-dairy formulaEdit

Else Nutrition is looking to disrupt the baby and toddler nutrition market with its minimally processed, plant-based, dairy-free, soy-free formula. Dairy and soy have been the only sources of protein in global infant formula for decades, resulting in difficulties for babies who are allergic or intolerant. Current hypoallergenic (dairy) alternatives often have a compromised taste, resulting in unhappy babies. Else’s organic and minimal-processing credentials also appeal to families seeking flexitarian lifestyles and more sustainable food choices.

Else launched its toddler formula in August 2020 and has since rolled out to Amazon.com, a number of online retailers and 1,250 stores as of the end of Q122, with the plan to reach 4,000 stores by end 2022. In June 2021 it launched its kids nutritional drink line, and in April 2022 it added a baby and toddler cereal line. It has also developed an infant formula, which is undergoing clinical trials, opening up a substantial future market opportunity. Else is preparing to roll out its products in new geographies, with Canada being added in July and Western Europe and China during H222.

Edit

Edison values Else primarily on a DCF basis, as it effectively captures the potential growth of the business and can be flexed for different scenarios. Edison uses a 10-year standard DCF followed by a further 10-year ‘fade' or stabilisation period, before applying its terminal assumptions. Edison's model assumes a sales CAGR of 47% in years 4 to 10, followed by 15% in years 11–15 and 10% in years 16–20. Edison assumes 2.0% terminal growth and a 15% terminal EBIT margin. This results in a 12-month DCF value of C$6.0, which Edison flexes to C$10.4 under a bull case scenario. The current share price appears to be discounting significantly more bearish conditions than its slower roll-out scenario, discounting terminal growth of 0% and a WACC of 23%. Edison also looks at peer group analysis; although there are not many directly comparable peers, Else trades on an FY22 EV/sales of 6.6x versus a peer group of much more mature baby food and plant-based manufacturers on 3.0x. Edison expects Else’s growth to significantly outpace that of its peers, and hence believe Else’s current premium is justified.

FinancialsEdit

Q1 revenues were C$1.6m, up 26% versus the previous quarter, including a 40% increase in sales on Amazon.com. Management is expecting a material acceleration in Q2, and Edison forecasts full year sales of C$13.6m (management’s ambition is to build sales into the hundreds of millions over the next five years). Else is currently loss making, as it is investing in its infrastructure to develop its business and build scale. Edison notes the business is well funded, with a net cash position of C$18.6m at end March 2022 (excluding C$1.2m of restricted cash).

SensitivitiesEdit

Else operates in the fast-moving consumer goods (FMCG) space, so important factors are input costs and branding. Reputational risk is particularly high in the infant nutrition space, and regulatory barriers are higher as the segment is highly regulated globally. Else is exposed to supply chain risks as it uses contract manufacturers for production. As a disruptor to the market, it will need to establish its brand credentials in a space that is dominated by many well-established much larger brands. There is execution risk as it scales up, both in the US and as it expands to new markets, and the business will require further equity or debt to support the high growth.

Company description: Plant-based, non-dairy formulaEdit

Else Nutrition makes plant-based baby and toddler formula that is dairy, soy and gluten free. Its product has a clean label and contains three core ingredients (buckwheat, almond and tapioca), which undergo much less processing than ordinary formula to maintain more of their nutritional value, while minimising the environmental impact. Else’s products are not restricted to consumers with allergies and intolerances, and also appeal to families choosing a flexitarian lifestyle. Dairy and soy have long been the industry standard for infant milk formula, resulting in difficulties for babies who are allergic or intolerant to these ingredients. Around 50% of babies under the age of one who suffer from food allergies are allergic to cow’s milk and half of these are also allergic to soy. The hypoallergenic dairy (hydrolysed dairy protein) alternatives have often compromised on taste, thus resulting in unhappy babies and parents. Else’s products are also antibiotic and GMO free. The infant nutrition market was valued at c US$ 79.4bn in 2020 and is expected to reach US$132.4bn by 2026 (source: Mordor Intelligence, Else annual information form), a CAGR of 8.9%.

First non-dairy, non-soy and organic formulaEdit

Around 53% of babies under one year old who suffer from food allergies are allergic to cow’s milk formula and c 50% of babies who are allergic to cow’s milk are also allergic to soy (source: company presentation and presented at the American College of Allergy, Asthma and Immunology Annual Scientific Meeting, November 2018). As diagnoses of dairy allergies and intolerances are becoming more prevalent, this segment of the market is growing disproportionately. In 2020, 40% of infant milk formula sold in the US was specialty cow’s milk formula, catering to allergies/intolerances (source: US market data Euromonitor 2020).

Else has a global IP portfolio with a number of unique and exclusive patents granted in several countries for its infant, toddler and adult applications. Its patent suite includes composition-based patents, which offer the strongest protection from the competition. These have a validity of 20 years, ending in 2034. There are also a large number of patent applications that are still pending, including new patent families regarding a specific process, which were submitted in 2021 and, if granted, would provide protection for 20 years.

Else launched its Else Toddler Nutrition in August 2020, with sales rolled out on Amazon in September 2020. It became a ‘best seller’ on Amazon.com in November 2020 in the toddler formula new releases category. Shortly after launching online, Else began its roll-out across distributors and stores and is listed in US stores such as Sprouts Farmers Market, Raley’s and Natural Grocers. As of January 2022, it had agreed listing in over 1,200 stores. The online platform also continues to expand, with more online retailers being added regularly and more expected.

The product line was expanded in June 2021 to include an organic protein shake powder aimed at children over the age of three, under the Else Kids Nutrition sub-brand, which currently comes in four flavours: vanilla, chocolate, mango chia and banana chia. The shakes are typically aimed at picky eaters or those with a restricted/special diet, who are therefore at a greater risk of becoming malnourished. The market is already well developed with a wide offering though, like with infant and toddler milks, there are not many options that are free from cow’s milk, soy and gluten, while being organic and certified GMO free. In January 2022 it also launched its toddler and kids nutritional drinks on Walmart.com and Kroger.com.

In March 2022 Else further expanded its product line to include Toddler Omega Complete & Balanced, its toddler product that has added omega 3 and omega 6 fatty acids, and addresses a larger audience (it is not organic, and hence commands a lower price point than Else’s Organic Plant-Based Complete Nutrition for Toddlers). In April 2022 Else released its plant-based Else Super Cereal for babies in four flavours. It is the first and only baby cereal line in the US that has been granted the Clean Label Project Purity Award, certifying it is safe from heavy metals.

A brief history of Else NutritionEdit

In 2012, co-founder and senior infant formula industry veteran Uriel Kesler found that his granddaughter was suffering from a severe sensitivity to dairy and soy, so he and Hamutal Yitzhak, the other co-founder and former head of Abbott Infant Nutrition in Israel, started to create a minimally processed alternative to soy- and dairy-based formula. In 2018, after nearly seven years of development, Else Nutrition was founded and in June 2019 it was publicly listed on the Toronto Stock Exchange, via a reverse takeover (RTO). During 2020, the company engaged key opinion leaders and experts in the field of paediatric gastroenterology, nutrition and allergy, with several additions to its advisory board. In addition, Else raised money twice during FY20, with H&H Group leading both rounds, and a total of C$33.7m raised. H&H Group is a Hong Kong-based strategic investor: it is a global leader in advanced baby and nutrition care and premium quality vitamins and supplements. During FY21, Else expanded its product line to include a kids line and it launched a dedicated team to engage the medical channel, hiring new executives to lead its North American business and its medical marketing. It announced its intention to expand into Canada towards the end of the year, launched its products on Walmart.com and raised further capital (C$17.3m, raised via shares and warrants in October 2021). In January 2022 it moved up from the TSX-V listing to the TSX.

Still in its infancyEdit

In 2021 Else had revenues from three product lines: baby snacks, baby feeding accessories and Else Formula. In Q421, baby snacks accounted for 11% of revenue and baby feeding accessories represented c 12% of revenue. Both product lines were only sold in Israel. Else Formula thus represented 77% of revenues in Q421. Else Formula comprises product lines that are made from the proprietary 100% plant-based, dairy- and soy-free nutrition products. It includes toddler formula, kids nutrition shakes, baby cereal and toddler omega line, and, in future, is expected to include adult nutrition and infant formula.

The products currently on the market are: Else’s toddler nutrition formula; a nutritional shake for older children that comes in four flavours; a line of cereal products for babies six months and older in four flavours (natural, vanilla, mango, and banana); and a toddler Omega drink. Importantly, Else has also developed a product for infants that has not yet been launched, thus opening up a substantial market opportunity. Else claims that it has devised a disruptive and game-changing process to produce its products (which is patented): it uses enzymatic and mechanical procedures in its production thus preserving intact proteins, which are easier to digest. Its process does not involve any acids or solvents, nor any protein isolates. It transforms three main ingredients (almonds, buckwheat and tapioca starch) into a substitute for human breast milk.

DistributionEdit

At present, Else products are available in US retailers (both in-store and online) and on Amazon.com, with no prescription necessary. Stores that stock Else products include Sprouts Farmers Market, Big Y, Raley’s and Natural Grocers, among many others, with the sales velocity in Sprouts Farmers Market reaching 1.2 units of product per store per week, which was higher than the category expectation. On Amazon.com, roughly 55% of Else’s customers are repeat buyers, and c 15% have purchased Else products at least 10 times. Management stated that according to the Amazon data available to Else, these are better performance metrics than Else’s competitors. This is again a testament to the products’ quality.

Launches in Canada and Europe are planned for FY22, with Canada being rolled out in July 2022, and distribution in Europe in H222, initially planned via Amazon. At the start of June, Else announced that it had signed an agreement with Baozun, a leading e-commerce distributor in China. This will give Else direct access to retail buyers in China, starting in Q322, through a wide range or online shopping platforms including Tmall and JD.com.

As discussed above, Else sells its products both online and in-store. Edison believes the split is c 75% online (which includes retailer-owned online platforms) and c 25% in-store. Edison expects the online business to grow more rapidly in the short term, but the offline business to accelerate as larger retailers are added. Else is first targeting natural food and grocery retailers, which tend to be smaller, and indeed has already been successful in rolling out in this segment. It then plans to target mass and club retailers, drug stores and convenience stores. Some of these will start to roll out as early as H222. Discussions are ongoing with most major retailers, as demonstrated by Else’s listings on Walmart.com and Kroger.com during Q122.

In terms of geographical coverage, Else is currently available in the United States, on amazon.com and other websites that sell both in the US and internationally. Else recently announced that it will be launching all three of its current category segments in Canada in July. Over time, Edison would expect Else to roll out its products across geographies, with China, Australia and additional EU markets the most obvious choices, given the size of these respective markets. Indeed, in terms of its distribution, Else is in advanced discussions to sign distribution agreements for Europe via Amazon and other retailers and, as discussed above, has recently signed a distribution agreement in China.

Else is working on reimbursement protocols with one US health insurance provider, with a view to getting its products approved for reimbursement. Once reimbursement is approved by one provider, others should follow. Else has worked with Amazon.com such that Amazon now accepts payment for Else products via Electronic Benefits Transfer (EBT), making it more attractive for lower income households.

Product offeringEdit

Edison illustrates Else’s product offering on Amazon.com in Exhibit 1 and compare it to other infant and toddler formula available. For completeness, Edison includes some standard (non-hypoallergenic) formula. Edison notes that the largest infant formula brands by market share in the United States are Enfamil (owned by Mead Johnson, which was bought by Reckitt in 2017), Similac (owned by Abbott) and Gerber (owned by Nestlé). Danone is another major player in the global baby food market, with its Nutricia brand. Prices are shown as of the start of April, when formula shortages were already an issue but less acute than at present. Edison does not believe more recent pricing on Amazon is representative owing to many SKUs being out of stock or only available at inflated prices through third-party sellers.

We can see in Exhibit 1 that Else’s formula is priced at a premium versus the hypoallergenic alternatives, particularly the larger pack bundles whereby the competition gives much more significant discounts. In the hypoallergenic space, the most directly comparable products are Enfamil’s Nutramigen Toddler Formula, and Nutricia’s Neocate Junior: these are both toddler milks and both brands are recommended for children suffering from cow’s milk allergy (CMA) and are soy free. Other products either contain soy or are lactose-free, although it is important to distinguish between lactose intolerance and CMA. While some babies are lactose-intolerant, those affected by CMA are sensitive to other proteins present in the milk and hence lactose-free formula will still cause them discomfort.

Edison notes that 70% of Else’s current customers state that they have chosen Else for lifestyle reasons and not due to allergies or other nutritional conditions. In this context, therefore, Else’s direct competitors are the premium organic dairy formula products. Else is unique in that it provides a dairy-free formula: its competitors are either organic dairy formula products or hypoallergenic formula products that are still made from hydrolysed dairy protein or contain animal-based amino acids.

Edison believes that by 2025, Else aims to have a suite of products on the market encompassing:

- Infant nutrition (stage one, aimed at 0–12m) in both powder and ready-to-drink (RTD) form,

- Baby cereals (spoon feed, aimed at six months+),

- Baby high-protein complementary nutrition (bottle feed, aimed at six months+),

- Toddler complete nutrition (stage three, aimed at 12 months+),

- Kids complete nutritional drink (aimed at three years+) in both powder and RTD form, and

- Adult complete nutrition product line (aimed at the elderly) in both powder and RTD form.

| Product | Weight per pack (oz) | Number of packs in bundle | Total price (US$) | Price per oz (US$) | |

|---|---|---|---|---|---|

| Neocate Junior (1+ years) Unflavoured | 14.1 | 1 | 73.99 | 5.25 | |

| Neocate Junior (1+ years) Strawberry flavour | 14.1 | 4 | 250.00 | 4.43 | |

| Neocate Junior (1+ years) Chocolate flavour | 14.1 | 4 | 235.00 | 4.17 | |

| Neocate Nutra (6+ months) | 14.1 | 1 | 39 | 2.77 | |

| Neocate Nutra (6+ months) | 14.1 | 4 | 152 | 2.70 | |

| Enfamil Nutramigen Infant & Toddler Formula (Lactose-free) | 12.6 | 1 | 32.98 | 2.62 | |

| Gerber Extensive HA Hypoallergenic Infant Formula for Cow's Milk Allergy | 14.1 | 1 | 33.99 | 2.41 | |

| Enfamil Nutramigen Infant & Toddler Formula (Lactose-free) | 12.6 | 6 | 161.99 | 2.14 | |

| Gerber Extensive HA Hypoallergenic Infant Formula for Cow's Milk Allergy** | 22 | 1 | 34.98 | 1.59 | |

| Enfamil Nutramigen Hypoallergenic Infant Formula | 22 | 2 | 70.00 | 1.59 | |

| Else Toddler Nutrition | 22 | 4 | 136.00 | 1.55 | |

| Else Toddler Nutrition | 34.9 | 3 | 155.59 | 1.49 | |

| Else Toddler Nutrition | 20 | 1 | 28.99 | 1.45 | |

| Similac 360 Total Care Sensitive (for lactose sensitivity)* | 16 | 1 | 22.98 | 1.44 | |

| Gerber Good Start Plant-based protein infant formula (lactose free)** | 22 | 1 | 29 | 1.32 | |

| Else Kids Nutrition | 12.7 | 6 | 98.94 | 1.30 | |

| Else Toddler Omega | 30.8 | 4 | 147.84 | 1.20 | |

| Baby's Only Sensitive Toddler Formula (for lactose sensitivity)* | 14.1 | 6 | 83.94 | 0.99 | |

| Similac Soy Isomil Infant Formula ** | 32 | 6 | 152.88 | 0.80 | |

| Pediasure Powder Grow & Gain Gluten-Free * | 8 | 12 | 24.49 | 0.26 | |

Infant formulaEdit

Infant formula does not technically require FDA approval before it can be marketed in the United States, but it cannot be marketed until the manufacturer receives a ‘no objection’ letter from the FDA. The formula must meet federal nutrient requirements and infant formula manufacturers must notify the FDA prior to marketing a new formula. The infant formula manufacturer must provide assurance that the formula will provide adequate nutrition for infants to thrive. The infant formula needs to undergo preclinical and clinical trials to this end, and the manufacturer must receive a ‘no objection’ letter from the FDA, effectively granting approval. The development of these trials has been completed, and collaborations are already in place with world-class investigators to oversee and advise on the clinical growth study protocols. Marketing and approval processes vary by country, though clinical research performed in one country can usually be used for approval elsewhere (as long as all jurisdictions’ requirements are met). Else’s clinical study is designed to meet both FDA and European Food Standards Authority (EFSA) requirements, and is planned to finish by the end of FY23. In addition, clinical research is being performed to validate clinical claims for Else’s product suite on growth, hypoallergenicity and tolerance. Edison notes there are ongoing delays in the reviewing process by the FDA and other regulatory agencies, primarily caused by the pandemic and the resulting refusal of medical centres to recruit subjects for clinical studies, the closure of testing laboratories and the imposition of restrictions. The clinical infant growth study is expected to complete by end FY23, with submission to the FDA filed thereafter. Management expects the overall cost of this to be c US$5–6m.

The current shortage of infant formula in the US market has been widely publicised. While the shortage is particularly acute in the hypoallergenic segment (it was caused by the recall of Similac hypoallergenic lines), it has caused panic-buying among consumers and thus has become more widespread. Else’s infant formula is not yet available as the company is still going through the steps to meet FDA requirements to obtain a no-objection letter, but the general lack of availability of the bigger brands of formula should serve as a tailwind for a new and disruptive brand such as Else.

Asset-light business modelEdit

Else is using third parties to manufacture its products, given its recent launch. As volumes increase, Edison expects the company’s contract manufacturing (CMO) network to expand. For the foreseeable future, however, management wishes the organisation to remain asset light. As critical mass is reached (which Edison believes to be c 2–3m lbs of dry powder per year in Else’s case), we may see dedicated lines at CMOs, but Edison does not expect a fully owned manufacturing facility to be built in the shorter term. While the asset-light strategy undoubtedly has benefits in terms of lower capital requirements, there can be higher associated costs – both with checking that each batch is manufactured to the correct specification and the time taken.

ManagementEdit

Hamutal Yitzhak, co-founder, director and CEO: Hamutal is the former head of infant nutrition at Abbott Labs Israel and is a founder and partner at the Golden Heart baby snack company.

Michael Azar, co-founder and CTO: Michael is the former CEO and chief food technologist at Materna, an Israeli infant nutrition manufacturer, acquired by Nestlé in 2009. Michael is a production expert in infant nutrition.

Uriel Kesler, co-founder, director and COO: Uriel is the former general manager of private-label infant formula at ProMedico Healthcare Group, a provider of distribution and other value-added services in the Israeli medical supply and healthcare space. Uriel is also a founder and partner at the Golden Heart baby snack company.

Reuben Halevi, VP sales operations: Reuben is the former CTO at MIND CTI, a global provider of billing and customer care solutions for voice, data, video and content services, based in Israel. Prior to that, Reuben was president of the global supply chain division at Retalix (RTLX), an Israeli software company that specialised in software products for retailers and distributors of fast-moving consumer goods.

Shay Shamir, CFO: Shay is the former CFO at Atlantium Technologies, which specialises in safe and sustainable water treatment solutions. Previously he held roles at SuperCom and Ernst & Young.

Sokhie Puar, lead director: Sokhie is the founder of Vancouver-based SNJ Capital and has over 30 years’ experience in the public markets, having worked in various capacities in both public and private companies. Between 2012 and 2017 he served as CEO, president, director and chairman of Candelaria Mining Corp.

Else also has a highly experienced scientific advisory board, which includes a group of clinical and research nutrition experts.

SensitivitiesEdit

Else’s key sensitivities include:

- Input cost inflation, both for the raw materials it purchases and for its packaging.

- Reputational risk, which is particularly high in the infant nutrition space: product standards are very high and any product imperfection or contamination could lead to a recall, which would not only be costly in the short term, but also damage the brand in the longer term.

- Supply chain risks exist as Else uses contract manufacturers, having chosen to remain as asset-light as possible.

- Regulatory risks, as infant nutrition is a highly regulated segment. Else has to run clinical trials to demonstrate its infant milk formula is a safe and suitable alternative to human breast milk and other existing products. These can be lengthy and expensive to conduct and as Else embarks on geographic expansion, different regulators may demand additional data and trials. Else has referred to ongoing delays in the reviewing process by the FDA and other regulatory agencies, primarily caused by the pandemic and the resulting closure of testing laboratories and the imposition of restrictions.

- Brand recognition, as Else is operating in a space with many well established and much larger branded players.

- As Else expands and rolls out its product to new stores, there is the risk of being delisted if the product does not satisfy the retailers’ stock turn and margin requirements.

- Accounting risks: Edison notes the FY21 financial statements contain a key audit matter relating to the valuation and existence of inventories. The auditors considered it a key audit matter given the magnitude of the inventories balance and the large number of inventory locations. In addition, Edison notes that both the FY20 and FY21 financial statements contained a statement by the auditors regarding material uncertainty as a going concern. This is due to the start-up nature of the business and hence the auditors state that the group’s ability to continue as a going concern is dependent upon its ability to generate product sales and ultimately attain and maintain profitable operations.

FinancialsEdit

As Else Nutrition was publicly listed in June 2019 via an RTO, there is limited historical financial data, as figures before 2019 do not reflect the current shape of the business. In addition, given Else is rolling out a disruptive product, historical figures do not provide much indication of future trends. Else is currently loss making and sales are still relatively small as its first product was only launched in August 2020. During 2021, Else scaled its business and built a robust platform for growth, building an entire ecosystem to support distribution: it has expanded its channels to include both online and in-store presence, and it has increased its advocacy and communication efforts. Edison believes the business is well-positioned for growth in 2022 and beyond, as it is now turning to expanding its product offering and plans to roll out into new geographies. Revenue for FY21 was C$4.7m (FY20: C$1.5m), and there was an EBITDA loss of C$15.1m (FY20 loss: C$7.8m). Edison notes the business is well funded, with a net cash position of C$18.6m at end Q122 (excluding restricted cash), which compares to C$23.0m at end FY21.

Q122 revenues were C$1.6m, up 26% quarter-on-quarter due to the expansion of toddler products across all channels and the introduction of the Kids Total Nutrition line. Sales on Amazon.com were particularly strong, up 40% vs Q421 and marking a significant acceleration, with management indicating that the acceleration has continued into Q2. Encouragingly, sales growth came from both new and existing subscribers, with roughly 60% of Else purchasers having bought Else products at least 10 times.

ForecastsEdit

Edison details its key forecast assumptions below:

- In revenue terms, Edison splits the business into online and in-store retail. Edison believes the online side made up c 75% of the business during FY21 and would expect this to continue to account for a significant proportion of the business. As of the end of April 2022, Else products were sold in 1,250 stores in the United States and management expects to reach 4,000 stores by year-end. As the business expands into more major retailers, the number of store additions should accelerate and management expects to be selling its products in more than 20,000 stores by 2025. Edison also expects the online side to continue its expansion as Else uses online platforms such as Amazon.com to enter new markets before listing in physical stores. Else’s quarterly results show Else is mostly growing revenues sequentially in the double digits per quarter, though Q421 revenues were up 8% sequentially (ie on Q321).

- Edison expects business growth to continue to accelerate in FY22 as it rolls out to Canada, China and a few European markets. Edison forecasts a CAGR of 111% between FY22 and FY24, in line with management expectations, and for growth to remain at high levels until FY26, as Edison expects Else’s infant formula to be launched by FY25, thus providing a further boost in revenues as it is rolled out. As discussed in the valuation section, Edison then assumes a revenue CAGR of 47% in years four to 10 (FY25–31), followed by a deceleration to 15% per year in years 11–15, and then 10% per year in years 16–20.

- From a profitability perspective, Edison expects gross margins to be higher in the online business than the in-store business. Edison models gross margins for the group overall of 19% in FY22, growing to 30% by FY24. In the longer term, as the business scales up, Edison believes gross margins could eventually reach over 50%, which is the industry norm, although this would largely depend on how much manufacturing is brought in-house and its efficiency.

- While operating profits are difficult to forecast given that the company is still loss making and there are many variables, Edison expects losses to slowly narrow and for operating profit to turn positive by FY25. Edison forecasts operating margins to reach 15% by FY27 and then to remain flat thereafter, as the business prioritises revenue growth.

- Edison forecasts a tax rate of 30% once the company turns profitable (which Edison expects to be in FY26) and cash tax to be payable from FY27.

Turning to cash flow, Edison highlights the following:

- Edison assumes high working capital requirements in the near term as new products are rolled out and new stores and distributors are added. As the business expands, Edison expects an improvement in working capital as a percentage of sales. Edison forecasts 15% of sales by FY27 and 10% of sales by FY32, with the latter being fairly standard in the food manufacturing industry.

- Although CMOs are used for manufacturing, Edison expects capital expenditure to remain high for some time as capital is invested at the CMOs as the business expands. Edison assumes capex is 10% of sales until FY27, then reduces to 5% by FY32. Edison forecasts capex at 3% of sales in perpetuity, in line with other food manufacturers and FMCG companies.

- Edison assumes capex runs at 1.5x depreciation in the earlier years and tapers down to 1.1x depreciation as capital expenditure slows down.

- Edison forecasts net cash of C$5.0m at end FY22 (vs $23m at end FY21), and net debt of C$16.5m at end FY23, though Edison recognises there may be more fund-raising activity before end FY23, which is not in its forecasts.

ValuationEdit

Edison's primary valuation methodology is discounted cash flow (DCF), as it effectively captures the potential growth of the business and it can be flexed to illustrate the sensitivity to Edison's assumptions. As Else is loss making, yet growing at a fast pace, Edison uses a 10-year DCF followed by a further 10-year ‘fade’ or stabilisation period, before applying its terminal assumptions.

Edison also looks at peer group analysis, although Edison recognises there are few directly comparable peers.

Edison outlines its key DCF assumptions:

- A revenue CAGR of 47% in years four to 10 (FY25–31), as the business rolls out across new store chains and across geographies and widens the product range. Edison assumes revenue growth slows to 15% per year in years 11–15, and then 10% per year in years 16–20.

- EBIT margins reach 15% by FY27 and remain flat thereafter, as the business prioritises revenue growth. To put this in context, operating margins in the baby food space are typically around the mid-to-high teens, depending on scale and geographical and product mix.

- An initial capex requirement of 10% of revenues, as the business builds scale. Edison assumes this falls to 8% of sales in year seven and it falls further to 5% of sales in year 11. This is high compared to food manufacturing standards, where capex is typically 3% of sales.

- Capex/depreciation of c 1.1x from year 10 onwards. This is likely to be lumpy and fluctuate, but in the long term Edison would expect it to stabilise around 1.1x.

- A steady working capital outflow over time as the business grows. Working capital is currently high as manufacturing is done in short runs and the business needs enough working capital to serve new customers. Edison therefore expects the absolute level of working capital to increase, but Edison also forecasts working capital/sales to slowly decline. Edison forecasts a level of 27% in FY22, falling to 20% by year four and 10% by year 11 (FY32), which would be in line with the higher end of the food manufacturing sector. As discussed above, Edison notes that the FY21 financial statements contained a key audit matter relating to the size of the inventory.

- Ongoing effective cash tax rate of 30% from year eight (FY29) onwards. Edison expects no tax to be paid while the company is loss making then as tax losses are used up, the tax rate is likely to climb fairly rapidly.

- Terminal growth of 2.0%, in line with the rest of the consumer space.

- Edison's WACC of 12.5% is predicated on a risk-free rate of 5.0%, an equity risk premium of 5% and a beta of 1.5.

- Net reported cash of C$23m at end FY21.

- For its base case scenario, Edison uses the current diluted number of shares in issue, 107.6m. Edison notes there is a significant number of options and warrants in issue that are out of the money, although there are 3m warrants that are currently in the money and hence Edison has diluted the number of shares to reflect this.

Edison's DCF valuation, with the assumptions detailed above, leads to a base case value of C$6.0/share. Edison illustrates how its DCF valuation is sensitive to flexing the cost of capital and terminal growth rate in Exhibit 2 and the terminal growth rate and the terminal EBIT margin in Exhibit 3.

| Terminal growth | ||||||

|---|---|---|---|---|---|---|

| 1.0% | 1.5% | 2.0% | 2.5% | 3.0% | ||

| WACC | 14.0% | 4.4 | 4.5 | 4.6 | 4.7 | 4.8 |

| 13.5% | 4.8 | 4.9 | 5.0 | 5.1 | 5.2 | |

| 13.0% | 5.3 | 5.4 | 5.5 | 5.6 | 5.7 | |

| 12.5% | 5.7 | 5.9 | 6.0 | 6.2 | 6.3 | |

| 12.0% | 6.3 | 6.4 | 6.6 | 6.8 | 7.0 | |

| 11.5% | 6.9 | 7.1 | 7.3 | 7.5 | 7.7 | |

| 11.0% | 7.6 | 7.8 | 8.0 | 8.3 | 8.6 | |

| 10.5% | 8.4 | 8.6 | 8.9 | 9.2 | 9.6 | |

| EBIT margin | ||||||

|---|---|---|---|---|---|---|

| 13.0% | 14.0% | 15.0% | 16.0% | 17.0% | ||

| Terminal growth | 1.0% | 5.4 | 5.6 | 5.8 | 5.9 | 6.1 |

| 1.5% | 5.5 | 5.7 | 5.9 | 6.1 | 6.2 | |

| 2.0% | 5.6 | 5.8 | 6.0 | 6.2 | 6.4 | |

| 2.5% | 5.8 | 6.0 | 6.2 | 6.4 | 6.6 | |

| 3.0% | 5.9 | 6.1 | 6.3 | 6.5 | 6.8 | |

| 3.5% | 6.1 | 6.3 | 6.5 | 6.7 | 7.0 | |

| 4.0% | 6.2 | 6.5 | 6.7 | 7.0 | 7.2 | |

Edison now flexes its DCF assumptions to consider a number of scenarios, given the inherent uncertainty in how Else’s growth curve will develop.

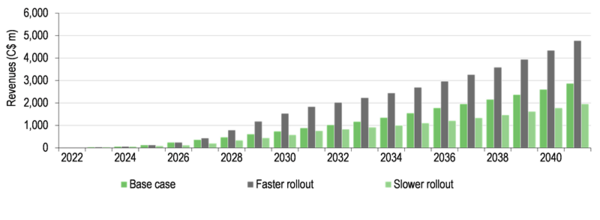

Faster and slower roll-out scenariosEdit

In terms of presence in physical stores, Else’s products are currently sold in smaller and more niche grocers that tend to have a greater focus on natural products and healthier eating. Under its faster roll-out scenario, Edison assumes there is a big win in terms of obtaining an in-store listing at a major US retailer, which leads to a successful roll-out across other US major retailers and subsequent successful expansion to other geographies. Edison notes that Else started selling its products on Walmart.com and Kroger.com in January 2022, which could pave the way for an expansion into physical stores. Successful listing in-store at a major US retailer would lead to increased sales per store, as the major retailers tend to have a wider reach, thus enhancing the target market. Edison accounts for the increased cash flow requirements to support the faster growth. Edison also assumes the infant milk formula product is more successful than in its base case scenario, thus driving faster growth from FY27. Edison assumes EBIT margins do not benefit from the greater scale and faster growth as Edison expects management would choose to reinvest in the business to continue to drive growth.

Under the slower roll-out scenario, Edison assumes uptake of the product is somewhat slower than its central assumption. Edison assumes Else products are only listed in niche retailers and health stores and it therefore continues to grow, but at a much slower pace, as it struggles to expand beyond this in terms of physical store presence. The products gain less traction with consumers and hence remain restricted to a more niche audience of babies with severe intolerances, rather than expanding also to picky eaters and families looking to adopt a flexitarian diet. Edison still assumes the infant milk formula is launched, though Edison assumes a two-year delay and hence assume this does not occur until FY27. Again, Edison accounts for the impact of the slower growth on the cash flow.

Edison illustrates its revenue assumptions under each scenario in Exhibit 4.

Exhibit 4: Revenue assumptions under various scenarios[3]

Edison now consider the valuation implications of the scenarios it has examined. Under the faster roll-out scenario, its DCF value rises to C$10.4. Edison illustrates the sensitivity to WACC and terminal growth under this scenario in Exhibit 5. Even if we apply a WACC of 14.0% to reflect higher risk, Edison's fair value reduces to C$8.0, which is still materially above the current share price (C$1.16).

Separately, Edison notes there is a significant number of options and warrants in issue (13m options and 46m warrants), many of which have demanding performance conditions attached. A large portion of warrants (32m) was issued in 2019 and will vest in stages on the business reaching certain milestones by June 2025. These include generating C$60m in revenues in a consecutive 12-month period and FDA or equivalent regulatory approval permitting marketing and sale of Else’s plant-based infant milk formula. The options and warrants have varying strike prices, between $0.0001 (for the performance warrants) and C$4.04.

| Terminal growth | ||||||

|---|---|---|---|---|---|---|

| 1.0% | 1.5% | 2.0% | 2.5% | 3.0% | ||

| WACC | 14.0% | 7.8 | 7.9 | 8.0 | 8.2 | 8.3 |

| 13.5% | 8.4 | 8.6 | 8.7 | 8.9 | 9.1 | |

| 13.0% | 9.2 | 9.3 | 9.5 | 9.7 | 10.0 | |

| 12.5% | 10.0 | 10.2 | 10.4 | 10.7 | 10.9 | |

| 12.0% | 10.9 | 11.2 | 11.4 | 11.7 | 12.1 | |

| 11.5% | 12.0 | 12.3 | 12.5 | 12.9 | 13.3 | |

| 11.0% | 13.1 | 13.5 | 13.8 | 14.3 | 14.8 | |

| 10.5% | 14.5 | 14.9 | 15.3 | 15.9 | 16.5 | |

Under the slower roll-out scenario, its DCF value falls to C$4.2. Edison illustrates the sensitivity to WACC and terminal growth under this scenario in Exhibit 6. Importantly, the current share price appears to be discounting significantly more bearish conditions than its slower roll-out scenario, and is discounting a terminal growth of 0% and a WACC of 23%.

| Terminal growth | ||||||

|---|---|---|---|---|---|---|

| 1.0% | 1.5% | 2.0% | 2.5% | 3.0% | ||

| WACC | 14.0% | 3.1 | 3.1 | 3.2 | 3.2 | 3.3 |

| 13.5% | 3.3 | 3.4 | 3.5 | 3.5 | 3.6 | |

| 13.0% | 3.7 | 3.7 | 3.8 | 3.9 | 4.0 | |

| 12.5% | 4.0 | 4.1 | 4.2 | 4.3 | 4.4 | |

| 12.0% | 4.4 | 4.5 | 4.6 | 4.7 | 4.8 | |

| 11.5% | 4.8 | 4.9 | 5.0 | 5.2 | 5.4 | |

| 11.0% | 5.3 | 5.4 | 5.6 | 5.8 | 6.0 | |

| 10.5% | 5.8 | 6.0 | 6.2 | 6.4 | 6.7 | |

Peer group analysisEdit

Peer group analysis is not straightforward as there are few direct peers. The baby food market is diverse, with some large and well-established producers including Nestlé, Danone, Abbott and Mead Johnson, but also some privately held and more local producers, particularly in the toddler nutrition space. Nestlé has a global baby food business and uses the Gerber brand in the US market. Danone’s baby food business has strong market share outside North America (mainly in Europe and Asia). Abbott and Mead Johnson (which is owned by Reckitt but was originally part of Bristol-Myers Squibb and spun off in 2009) also compete in the global infant nutrition space. Abbott’s main formula brand is Similac and it also sells a nutrition drink under the PediaSure brand for children above the age of 12 months who are behind in growth. Mead Johnson’s main brand is Enfamil.

Else Nutrition has a unique offering and there are no direct, listed competitors operating in the plant-based space. Edison therefore uses some of the wider plant-based peer group, although it recognises that these do not directly operate in the baby and toddler nutrition space. Edison believes Else’s current premium is justified given its disruptive products, which are resulting in a far faster growth profile than its more mature and more established baby food competitors.

| Market cap (m) | EV/sales (x) | EV/EBITDA (x) | |||

|---|---|---|---|---|---|

| 2022 | 2023 | 2022 | 2023 | ||

| Nestle | CHF 315,049 | 3.7 | 3.5 | 17.6 | 16.6 |

| Danone | € 36,335 | 1.8 | 1.7 | 10.9 | 10.2 |

| Abbott Laboratories | $185,442 | 4.6 | 4.7 | 16.7 | 16.5 |

| Perrigo | $5,022 | 1.5 | 1.4 | 10.0 | 8.0 |

| RB | $43,851 | 3.8 | 3.6 | 14.5 | 13.7 |

| Oatly | $2,184 | 2.2 | 1.5 | N/A | N/A |

| Beyond Meat | $1,415 | 3.5 | 2.8 | N/A | N/A |

| Burcon Nutrascience | C$ 74 | 360.4 | 31.4 | N/A | N/A |

| Peer group average * | 47.7 | 6.3 | 13.9 | 13.0 | |

| Peer group average (ex Burcon Nutrascience) * | 3.0 | 2.7 | 13.9 | 13.0 | |

| Else | C$ 113 | 6.6 | 2.7 | N/A | N/A |

| Premium/(discount) to peer group (ex Burcon) | 119.3% | (0.7%) | N/A | N/A | |

| C$'000 | 2019 | 2020 | 2021 | 2022e | 2023e | 2024e | ||

|---|---|---|---|---|---|---|---|---|

| Year end 31 December | IFRS | IFRS | IFRS | IFRS | IFRS | IFRS | ||

| INCOME STATEMENT | ||||||||

| Revenue | 554 | 1,482 | 4,687 | 13,637 | 32,974 | 60,660 | ||

| Cost of Sales | (303) | (984) | (3,944) | (11,066) | (24,944) | (42,491) | ||

| Gross Profit | 251 | 498 | 743 | 2,571 | 8,030 | 18,169 | ||

| EBITDA | (2,681) | (7,768) | (15,135) | (16,367) | (14,424) | (8,510) | ||

| Normalised operating profit | (2,755) | (7,961) | (15,519) | (17,277) | (16,779) | (12,843) | ||

| Amortisation of acquired intangibles | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Exceptionals | (2,370) | (15,087) | 16,102 | 0 | 0 | 0 | ||

| Share-based payments | (253) | (1,056) | (2,201) | 0 | 0 | 0 | ||

| Reported operating profit | (5,378) | (24,104) | (1,618) | (17,277) | (16,779) | (12,843) | ||

| Net Interest | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Joint ventures & associates (post tax) | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Exceptionals | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Profit Before Tax (norm) | (2,755) | (7,961) | (15,519) | (17,277) | (16,779) | (12,843) | ||

| Profit Before Tax (reported) | (5,378) | (24,104) | (1,618) | (17,277) | (16,779) | (12,843) | ||

| Reported tax | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Profit After Tax (norm) | (2,755) | (7,961) | (15,519) | (17,277) | (16,779) | (12,843) | ||

| Profit After Tax (reported) | (5,378) | (24,104) | (1,618) | (17,277) | (16,779) | (12,843) | ||

| Minority interests | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Discontinued operations | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Net income (normalised) | (2,755) | (7,961) | (15,519) | (17,277) | (16,779) | (12,842) | ||

| Net income (reported) | (5,378) | (24,104) | (1,618) | (17,277) | (16,779) | (12,843) | ||

| Basic average number of shares outstanding (m) | 50 | 50 | 81 | 97 | 104 | 105 | ||

| EPS - basic normalised (C$) | (0.05) | (0.10) | (0.16) | (0.17) | (0.16) | (0.12) | ||

| EPS - diluted normalised (C$) | (0.05) | (0.10) | (0.16) | (0.17) | (0.16) | (0.12) | ||

| EPS - basic reported (C$) | (0.11) | (0.30) | (0.02) | (0.17) | (0.16) | (0.12) | ||

| Dividend (C$) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| Revenue growth (%) | N/A | 167.5 | 216.3 | 191.0 | 141.8 | 84.0 | ||

| Gross Margin (%) | 45.3 | 33.6 | 15.9 | 18.9 | 24.4 | 30.0 | ||

| EBITDA Margin (%) | N/A | N/A | N/A | -120.0 | -43.7 | -14.0 | ||

| Normalised Operating Margin | N/A | N/A | N/A | -126.7 | -50.9 | -21.2 | ||

| BALANCE SHEET | ||||||||

| Fixed Assets | 585 | 881 | 1,784 | 2,414 | 3,838 | 6,230 | ||

| Intangible Assets | 51 | 395 | 344 | 344 | 344 | 344 | ||

| Tangible Assets | 434 | 253 | 484 | 1,242 | 2,969 | 6,146 | ||

| Investments & other | 100 | 233 | 956 | 828 | 525 | (260) | ||

| Current Assets | 3,944 | 28,438 | 31,138 | 19,809 | 11,248 | 8,955 | ||

| Stocks | 157 | 2,424 | 4,546 | 7,193 | 14,967 | 25,495 | ||

| Debtors | 506 | 369 | 694 | 4,773 | 9,892 | 18,198 | ||

| Cash & cash equivalents | 2,909 | 21,538 | 23,047 | 4,991 | (16,461) | (37,588) | ||

| Other | 372 | 4,107 | 2,851 | 2,851 | 2,851 | 2,851 | ||

| Current Liabilities | (839) | (2,019) | (3,317) | (9,719) | (18,880) | (31,163) | ||

| Creditors | (301) | (1,235) | (1,898) | (8,300) | (17,461) | (29,744) | ||

| Tax and social security | (110) | (8) | (8) | (8) | (8) | (8) | ||

| Short term borrowings | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Other | (428) | (776) | (1,411) | (1,411) | (1,411) | (1,411) | ||

| Long Term Liabilities | (32) | (16,092) | (2,833) | (2,833) | (2,833) | (2,833) | ||

| Long term borrowings | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Other long term liabilities | (32) | (16,092) | (2,833) | (2,833) | (2,833) | (2,833) | ||

| Net Assets | 3,658 | 11,208 | 26,772 | 9,671 | (6,627) | (18,810) | ||

| Minority interests | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Shareholders' equity | 3,658 | 11,208 | 26,772 | 9,671 | (6,627) | (18,810) | ||

| CASH FLOW | ||||||||

| Op Cash Flow before WC and tax | (2,681) | (7,768) | (15,135) | (16,367) | (14,424) | (8,510) | ||

| Working capital | (326) | (1,030) | (1,385) | (324) | (3,731) | (6,551) | ||

| Exceptional & other | (55) | (794) | 730 | 0 | 0 | 0 | ||

| Tax | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Net operating cash flow | (3,062) | (9,592) | (15,790) | (16,692) | (18,155) | (15,061) | ||

| Capex | (56) | (230) | (287) | (1,364) | (3,297) | (6,066) | ||

| Acquisitions/disposals | (452) | 0 | 0 | 0 | 0 | 0 | ||

| Net interest | 2 | 5 | 27 | 0 | 0 | 0 | ||

| Equity financing | 6,639 | 31,858 | 16,013 | 0 | 0 | 0 | ||

| Dividends | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Other | (132) | (3,115) | 2,265 | 0 | 0 | 0 | ||

| Net Cash Flow | 2,939 | 18,926 | 2,228 | (18,056) | (21,453) | (21,127) | ||

| Opening net debt/(cash) | (10) | (2,909) | (21,538) | (23,047) | (4,991) | 16,461 | ||

| FX | (40) | (297) | (719) | 0 | 0 | 0 | ||

| Other non-cash movements | 0 | 0 | 0 | 0 | 0 | 0 | ||

| Closing net debt/(cash) | (2,909) | (21,538) | (23,047) | (4,991) | 16,461 | 37,588 | ||

Management teamEdit

Co-founder and CEO: Hamutal Yitzhak Cohen

Hamutal is the former head of infant nutrition at Abbott Labs Israel and is a founder and partner at the Golden Heart baby snack company.

Co-founder and CTO: Michael Azar

Michael is the former CEO and chief food technologist at Materna, an Israeli infant formula manufacturer, acquired by Nestlé in 2009. Michael is a production expert in infant nutrition.

Co-founder and COO: Uriel Kesler

Uriel is the former general manager of private-label infant formula at ProMedico Healthcare Group. Uriel is also a founder and partner at the Golden Heart baby snack company.

VP sales and operations: Reuben Halevi

Reuben is the former CTO at MIND CTI, a global provider of billing and customer care solutions. Before that, he was president, global supply chain at Retalix, an Israeli software company.

CFO: Shay Shamir

Shay is the former CFO at Atlantium Technologies, which specialises in safe and sustainable water treatment solutions. Previously he held roles at SuperCom and Ernst & Young.

Lead director: Sokhie Puar

Sokhie has over 30 years’ experience in the public markets, having worked in various capacities in both public and private companies. Between 2012 and 2017 he served as CEO, president, director and chairman of Candelaria Mining Corp.

Edit

| Principal shareholders | (%) |

|---|---|

| Hamutal Yitzhak | 12.7 |

| Uriel Kesler | 12.7 |

| NewH2 | 10.25 |

ReferencesEdit

- ↑ Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments.

- ↑ Source: Edison Investment Research, amazon.com. Note: Prices at 7 April 2022. *Contains milk. **Contains soy.

- ↑ 3.0 3.1 3.2 3.3 3.4 Source: Edison Investment Research.

- ↑ Source: Edison Investment Research, Refinitiv. Note: Priced at 13 June 2022. *The EV/EBITDA average excludes the peers with negative multiples, hence marked as N/A.

- ↑ Source: Edison Investment Research, company data.