Exxon Mobil Corporation: Difference between revisions

| Line 279: | Line 279: | ||

=== Comparable Company Analysis === | === Comparable Company Analysis === | ||

For the purpose of comparable company analysis, we have taken into consideration three other integrated oil and gas companies: Chevron, Shell, and BP. | For the purpose of comparable company analysis, we have taken into consideration three other integrated oil and gas companies: Chevron, Shell, and BP. | ||

{| class="wikitable" | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|LTM Financial Metrics | |||

| | |||

|- | |||

|Company | |||

|Ticker | |||

|Market Cap.($ million) | |||

|EV ($ million) | |||

|Revenue ($ million) | |||

|EV/Revenue | |||

|EV/EBITDA | |||

|EV/EBIT | |||

|- | |||

|Exxon | |||

|XOM | |||

|428942.1 | |||

|448861.1 | |||

|367977 | |||

|1.2 | |||

|4.7 | |||

|6 | |||

|- | |||

|Chevron | |||

|CVX | |||

|297358.8 | |||

|310235.8 | |||

|214672 | |||

|1.4 | |||

|5.3 | |||

|7.2 | |||

|- | |||

|BP | |||

|BP | |||

|102149.4 | |||

|148514.4 | |||

|227587 | |||

|0.7 | |||

|2.7 | |||

|3.7 | |||

|- | |||

|Shell | |||

|SHEL | |||

|199467.5 | |||

|240361.1 | |||

|358589 | |||

|0.7 | |||

|3.1 | |||

|4.1 | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Mean | |||

| | |||

| | |||

| | |||

| | |||

|1 | |||

|3.95 | |||

|5.25 | |||

|- | |||

|Mean excluding MSFT | |||

| | |||

| | |||

| | |||

| | |||

|0.933333333 | |||

|3.7 | |||

|5 | |||

|} | |||

== References == | == References == | ||

__INDEX__ | __INDEX__ | ||

Revision as of 15:45, 24 August 2023

Exxon Mobil Corporation (NYSE:XOM) is a multinational oil and gas firm and is one of the biggest publicly traded energy corporations in the world. In recent times, oil and gas companies like Exxon have reported record profits as a result of the increase in oil and gas prices, which was mostly driven by western nations' sanctions against Russia as a result of its invasion of Ukraine. In terms of market capitalisation, Exxon is the second largest in the world after Saudi Aramco.[1] In terms of revenue, it is the fourth largest in the world after Saudi Aramco, Sinopec and PetroChina respectively.[2]

Company Overview

History of the Company

The company was created as a result of the merger in 1999 between Exxon Corporation and Mobil Corporation, which were two of the world's oldest and most prominent oil companies at the time. Exxon is the largest direct existing entity of Standard Oil founded by John D. Rockefeller, which was broken up in 1911 into 43 different entities after being found as an illegal monopoly. The merger was positioned as a strategic move to enhance competitiveness, achieve cost savings through synergies, and create a stronger and leading global energy player. According to Lee Raymond and Lou Noto, chairmen and chief executive officers of Exxon and Mobil, respectively, "This merger will enhance our ability to be an effective global competitor in a volatile world economy and in an industry that is more and more competitive. "[3]

The firm is vertically integrated across the whole oil and gas sector but also includes a chemicals section that makes plastic, synthetic rubber, and other chemical products. Although ExxonMobil was formally formed in New Jersey, the company is based in Houston,Texas.

ExxonMobil is also the largest investor-owned oil company in the world. Approximately 60% of the company's shares are held by institutions, the largest of which as of 2023 were The Vanguard Group (9.7%)[4], BlackRock (7.10%)[5], and State Street Corporation (5.43%).[6]

Mission and Values of the Company

According to its website," Exxon Mobil Corporation is committed to being the world's premier petroleum and chemical manufacturing company. To that end, we must continuously achieve superior financial and operating results while adhering to high ethical standards." The goal of ExxonMobil is to address the world's expanding energy needs by delivering dependable energy in an ethical and ecological manner. Some of the guiding principles the company adopts are:

Integrity: ExxonMobil is dedicated to upholding the highest moral principles while dealing with stakeholders.

Health and Safety: To stop accidents from happening and to keep people safe, the company works hard to establish a strong safety culture.

Environmental Responsibility: The company tries to appropriately manage its environmental footprint and invests in research and technology to create cleaner, more effective energy solutions.

Excellence: The company consistently aims to innovate, perform better, and produce remarkable results in all areas of its operations.

Main Offerings and Operations of the Company

The three main business divisions of Exxon are:

Upstream: This division is responsible for providing reliable and affordable energy solutions. Exploration, development, production, and marketing are all part of the company's upstream activities. Five distinct value chains make up the upstream division: Conventional, Deepwater, LNG, Heavy Oil, and Unconventional.

Product Solutions: This division is a combination of the Chemical and Downstream businesses. By combining the two, Exxon established the world’s largest integrated chemical, fuels, and lubricants company. A portfolio of well-known brands and premium goods, like its Mobil 1 synthetic lubricant, make up its downstream business area. Olefins, polyolefins, aromatics, and a wide range of other petrochemicals are all part of the Chemical segment's diverse product line.

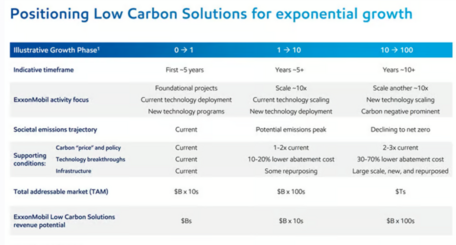

Low Carbon Solutions: Exxon has recently achieved significant progress in reducing the emissions intensity of its operational assets, and has also boosted anticipated investments in lower-emission programmes to roughly $17 billion from 2022 to 2027.[7]

Recent Developments: ExxonMobil began oil production from the Liza field offshore Guyana in late 2019.

In 2020, ExxonMobil increased production of vital goods including polypropylene, which is used to manufacture protective masks, gowns, and wipes, as well as isopropyl alcohol, which is used to make hand sanitizer in reaction to the COVID-19 epidemic.

In order to commercialise its enormous portfolio of low-carbon technologies, ExxonMobil established a new company in 2021. ExxonMobil Low Carbon Solutions, the newly launched company, will first concentrate on carbon capture and storage, one of the crucial technologies necessary to reach net zero emissions and the climate targets set forth in the Paris Agreement. ExxonMobil is dedicating resources to build infrastructure for capturing, moving, and storing carbon dioxide. These investments allow them to assist clients in reducing carbon footprints by sending captured carbon through pipelines to storage hubs. The company sees CCS as a significant business potential, which could drive substantial expansion for its low-carbon solutions platform.

Industry Overview

Key Trends and Opportunities

The oil and gas (O&G) sector made record-breaking profits in 2022, giving them more than enough cash flow to implement their goals in 2023. O&G businesses have also been on a mission to guarantee supply in the short term while transitioning to cleaner energy in the long run, despite the geopolitical risks and macroeconomic volatility that they have to face.

One of the current trends in the industry is focus on sustainability and resurgence of natural gas.

A lot of O&G companies are currently working on reducing their environmental footprint. Environmental firms are also aiding oil refineries in recycling hazardous materials through methods like thermal desorption, offering sustainable approaches for handling secondary oil-based materials.Production and process companies are developing solutions to enhance ESG practices in the oil and gas sector too. For instance, they're designing air compressor systems that replace methane-emitting pneumatic controls with compressed instrument air systems.

While oil remains a prevalent energy source, it comes with notable drawbacks. The extraction process demands significant energy and resources, with fossil fuels being used for extraction. However, companies are changing their approach nowadays. Natural gas has emerged as a cleaner alternative to traditional sources like coal and gasoline and emits roughly half the greenhouse gases per megawatt hour as compared to petroleum-based fuels, enhancing its sustainability and environmental friendliness due to reduced emissions.

The oil and gas sector is increasingly utilising AI and data science to tackle intricate issues across upstream, midstream, and downstream operations. AI-powered platforms aid decision-making and supports petroleum engineers and industry managers in devising and implementing fresh exploration and production strategies, boosting ROI. AI algorithms enhance competitiveness and productivity, while advanced robotics and data management practices speed up processing and reduce reliance on human labor.

Key Challenges

While the oil and gas industry has encountered supply chain disruptions and price fluctuations before, the present circumstances present a unique scenario. The issue of insufficient investment has been exacerbated by a combination of economic, geopolitical, trade, policy, and financial factors. This convergence has also prompted a reevaluation within the broader energy market. Consequently, a complex set of challenges has emerged, affecting three key aspects of a well-rounded energy equation: the assurance of energy security, the need for diversified supply sources, and the pursuit of a low-carbon transition.

Balancing long-term energy goals and immediate citizen needs also presents a huge challenge. Environmental and social activists are pressuring the oil and gas industry, impacting the reputation and investments into these companies. Activist investors favour green energy. This pressure compels oil and gas companies to adjust strategies and investments.

Due to an ageing workforce, the oil and gas industry has also long struggled with a talent deficit. Young and bright people opt to avoid the sector since it is frequently portrayed negatively in the media.

Key Players

The key players in the oil and industry can be divided into two main types: integrated and national oil companies. The integrated O&G companies which include Exxon, Chevron, BP, and Shell to name a few. Since Mexico nationalised its oil industry in 1938, other nations have either established private state-owned oil businesses or bought sizeable stakes in publicly traded oil firms. Oil nationalisation is becoming more popular as a means of countering historical international oil firms' exploitation of national resources and as a political ploy to control access to and decisions made about such resources. Some notable examples include Saudi Aramco, National Iranian Oil Company, Gazprom, and China National Petroleum Corporation.

Leadership[8]

Management Committee:

Chief Executive Officer - Darren W. Woods

Mr. Woods joined Exxon Company International in 1992 as a planning analyst. In 2014, he became senior vice president and effective January 1, 2016, Mr. Woods was elected president of Exxon Mobil Corporation and a member of the board of directors. In January 2017, Mr. Woods was elected as Chairman and Chief Executive Officer. He holds a Bachelor of Science degree in electrical engineering from Texas A&M and a Master of Business Administration degree from Northwestern's Kellogg School of Management.

Chief Financial Officer - Kathryn A. Mikells

In August 2021, Mikells started working for Exxon as senior vice president and chief financial officer. Prior to this, she served as chief financial officer at Diageo, Plc. She holds a Bachelor of Science from the University of Illinois and a Master of Business Administration in Finance from the University of Chicago.

Board of Directors:

The Board of Directors includes CEO Darren W.Woods and independent directors such as Angela F. Braly, Gregory J.Goff, and Susan K.Avery among others. To assist in performing its obligations, the Board establishes Committees. Board Committees, in particular, work on important matters in more detail than is possible at full Board sessions. To assist in performing its obligations, the Board establishes Committees. Board Committees, in particular, work on important matters in more detail than is possible at full Board sessions. The main committees are: audit; compensation; finance; executive; environment, safety and public policy; and nominating and governance.

Financials

Historic and Future Key Financials[9][10]

As of June 30th 2023, Exxon has a total revenue of USD 367.97 billion. As of 22nd August 2023, Exxon has a market cap of USD 432.75 billion and an enterprise value of USD 452.66 billion. It also has an ESG Risk Rating of 41.70 which is severe risk as of 07th April 2023.

| For the Fiscal Period Ending | 12 months

Dec-31-2019A |

12 months

Dec-31-2020A |

12 months

Dec-31-2021A |

12 months

Dec-31-2022A |

LTM²

12 months Jun-30-2023A |

12 months†

Dec-31-2023E |

12 months

Dec-31-2024E |

12 months

Dec-31-2025E |

| Currency | USD | USD | USD | USD | USD | USD | USD | USD |

| Total Revenue | 259,497.0 | 179,784.0 | 278,981.0 | 402,217.0 | 367,977.0 | 347,539.13 | 344,282.93 | 324,825.91 |

| Growth Over Prior Year | (7.7%) | (30.7%) | 55.2% | 44.2% | 3.7% | (15.99%) | (0.94%) | (5.65%) |

| Gross Profit | 81,066.0 | 57,157.0 | 90,045.0 | 133,715.0 | 126,506.0 | - | - | - |

| Margin % | 31.2% | 31.8% | 32.3% | 33.2% | 34.4% | 40.70% | 41.05% | 42.10% |

| EBITDA | 34,443.0 | 17,016.0 | 46,187.0 | 91,128.0 | 83,739.0 | 72,526.37 | 72,499.86 | 69,314.15 |

| Margin % | 13.3% | 9.5% | 16.6% | 22.7% | 22.8% | 20.87% | 21.06% | 21.34% |

| EBIT | 15,545.0 | (3,982.0) | 26,780.0 | 71,588.0 | 66,072.0 | 50,806.39 | 46,829.44 | 37,899.25 |

| Margin % | 6.0% | (2.2%) | 9.6% | 17.8% | 18.0% | 14.62% | 13.60% | 11.67% |

| Net Income | 14,340.0 | (22,440.0) | 23,040.0 | 55,740.0 | 51,720.0 | 36,345.17 | 34,849.84 | 32,845.21 |

| Margin % | 5.5% | (12.5%) | 8.3% | 13.9% | 14.1% | 10.46% | 10.12% | 10.11% |

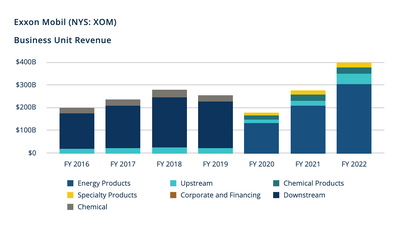

Business Unit Revenue[11]

In Fiscal Year 2022, 76.75% of Exxon's total revenue came from its energy products, 11.33% from Upstream, 6.93% from Chemical Products, and 4.99% from Speciality Products.

Valuation

Comparable Company Analysis

For the purpose of comparable company analysis, we have taken into consideration three other integrated oil and gas companies: Chevron, Shell, and BP.

| LTM Financial Metrics | |||||||

| Company | Ticker | Market Cap.($ million) | EV ($ million) | Revenue ($ million) | EV/Revenue | EV/EBITDA | EV/EBIT |

| Exxon | XOM | 428942.1 | 448861.1 | 367977 | 1.2 | 4.7 | 6 |

| Chevron | CVX | 297358.8 | 310235.8 | 214672 | 1.4 | 5.3 | 7.2 |

| BP | BP | 102149.4 | 148514.4 | 227587 | 0.7 | 2.7 | 3.7 |

| Shell | SHEL | 199467.5 | 240361.1 | 358589 | 0.7 | 3.1 | 4.1 |

| Mean | 1 | 3.95 | 5.25 | ||||

| Mean excluding MSFT | 0.933333333 | 3.7 | 5 |

References

- ↑ https://companiesmarketcap.com/oil-gas/largest-oil-and-gas-companies-by-market-cap/

- ↑ https://companiesmarketcap.com/oil-gas/largest-oil-and-gas-companies-by-revenue/

- ↑ https://corporate.exxonmobil.com/who-we-are/our-global-organization/our-history

- ↑ https://simplywall.st/stocks/us/energy/nyse-xom/exxon-mobil/news/with-60-ownership-of-the-shares-exxon-mobil-corporation-nyse

- ↑ https://fintel.io/so/us/xom/blackrock

- ↑ https://fintel.io/so/us/xom/state-street

- ↑ https://d1io3yog0oux5.cloudfront.net/_0525f46847911a3ef8ef04b23fb23196/exxonmobil/db/2301/22049/annual_report/2022-Annual-Report.pdf

- ↑ https://corporate.exxonmobil.com/corporate-governance/board-of-directors

- ↑ https://www.capitaliq.com/CIQDotNet/Financial/KeyStats.aspx?CompanyId=406338

- ↑ https://my.pitchbook.com/profile/11566-63/company/profile

- ↑ https://my.pitchbook.com/profile/11566-63/company/profile