First Solar, Inc.: Difference between revisions

No edit summary |

No edit summary |

||

| Line 40: | Line 40: | ||

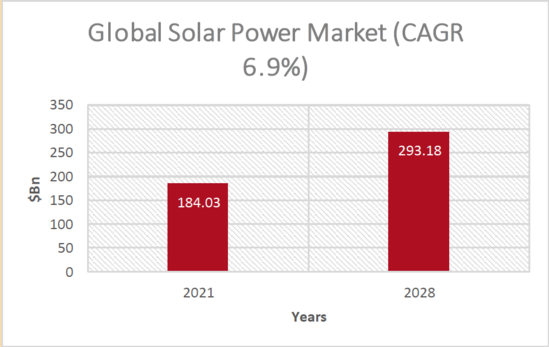

Therefore, investment in the global solar power market is set to rise by 6.9% annually till 2028. | Therefore, investment in the global solar power market is set to rise by 6.9% annually till 2028. | ||

[[File: | |||

[[File:Solar_market_CAGR.png|549x549px]] | |||

Revision as of 11:05, 2 March 2023

First Solar, Inc. provides photovoltaic (PV) solar energy solutions in the United States, Japan, France, Canada, India, Australia, and internationally. The company designs, manufactures, and sells cadmium telluride solar modules that converts sunlight into electricity. It serves developers and operators of systems, utilities, independent power producers, commercial and industrial companies, and other system owners. It also specialises in maintenance, operations and upkeep of solar energy systems - which further drives their revenue.

Currently, the share is trading at $169.14, up 15.9% year-to-date. The current market cap is $18.03bn.

| Key Financials | Q3’22 | Q3’21 |

| Net sales | $629mn | $584mn |

| CapEx | $223.3mn | $164.6mn |

| Net income | -$49.2mn | $45.2mn |

Core Product: Series 6 PV

- 0.3% degradation rate.

- 19.2% efficiency.

- Some conventional PVs have higher efficiencies of around 25%, but offer a 10-15 year warranty compared to First Solar's 30 year warranty.

[DEGRADATION IMAGE]

Industry Outlook: Renewables

- Net-zero commitments: e.g. Paris agreement & Biden administration’s vision to fully decarbonise US economy. The Inflation Reduction Act 2022 was signed by the Biden government. This act includes $369 billion in renewable energy provisions.

- Russia-Ukraine tensions: Global clean energy investment is set to rise to more than $2 trillion a year by 2030, up by half from current levels, while "international energy markets undergo a profound reorientation in the 2020s as countries adjust to the rupture of Russia-Europe (energy) flows”, the IEA said.

- Europe's Green Energy plan: Target to generate 45% of energy from renewable sources by 2030.

Industry Outlook: Solar Energy

- 85% decline in costs of PV systems.

- More solar-plus-storage buildouts increases operational efficiency and reduces storage costs.

- Inflation reduction act incentivising PV uptake.

Therefore, investment in the global solar power market is set to rise by 6.9% annually till 2028.

Differentiating Factors

- Environmental: The CadTel technology us 2.5x lower carbon dioxide and 3x lower water usage than c-Si panels. Also, global recycling services can recover >90% of the material used.

- Energy: CadTel PVs have a superior Temperature Coefficient & Spectral Response, meaning they provide 4% more annual energy in hot climates and a further additional 4% in humid conditions. Also, they do not experience power loss from LID/LeTID mechanisms, which impact c-Si panels considerably.

Performance Outlook

Q3 earnings highlights:-

- Manufacturing:-->$200mn to upgrade Ohio manufacturing capacity by 0.9 GW ->$1bn for new 3.5 GW greenfield plant in southeast USA ->Building facility in India, beginning operations in late 2023

- R&D:- ->Announced $270m for a dedicated R&D line in Perrysburg, Ohio. Expected completion in 2024.