First Solar, Inc.: Difference between revisions

No edit summary |

|||

| Line 109: | Line 109: | ||

==== ''Risks Related to Its Markets and Customers'' ==== | ==== ''Risks Related to Its Markets and Customers'' ==== | ||

# Competition in solar markets globally and across the solar value chain is intense and could remain that way for an extended period of time. The solar industry may experience periods of structural imbalance between global PV module supply and demand that result in periods of pricing volatility. If First Solar's competitors reduce module pricing to levels near or below their manufacturing costs, or are able to operate at minimal or negative operating margins for sustained periods of time, or if global demand for PV modules decreases relative to installed production capacity, First Solar's business, financial condition, and results of operations could be adversely affected. | # Competition in solar markets globally and across the solar value chain is intense and could remain that way for an extended period of time. The solar industry may experience periods of structural imbalance between global PV module supply and demand that result in periods of pricing volatility. If First Solar's competitors reduce module pricing to levels near or below their manufacturing costs, or are able to operate at minimal or negative operating margins for sustained periods of time, or if global demand for PV modules decreases relative to installed production capacity, First Solar's business, financial condition, and results of operations could be adversely affected.<ref name=":0">https://d18rn0p25nwr6d.cloudfront.net/CIK-0001274494/7ad6d7b0-00aa-4bb3-b61f-fd0fd17740e2.pdf</ref> | ||

# The reduction, elimination, or expiration of government subsidies, economic incentives, tax incentives, renewable energy targets, and other support for on-grid solar electricity applications, or other public policies could negatively impact demand and/or price levels for First Solar's solar modules. The imposition of tariffs on First Solar's products could materially increase its costs to perform under its contracts with customers, which could adversely affect its results of operations. | # The reduction, elimination, or expiration of government subsidies, economic incentives, tax incentives, renewable energy targets, and other support for on-grid solar electricity applications, or other public policies could negatively impact demand and/or price levels for First Solar's solar modules. The imposition of tariffs on First Solar's products could materially increase its costs to perform under its contracts with customers, which could adversely affect its results of operations.<ref name=":0" /> | ||

# The loss of any of First Solar's large customers, or the inability of First Solar's customers and counterparties to perform under their contracts with First Solar, could significantly reduce its net sales and negatively impact its results of operations. | # The loss of any of First Solar's large customers, or the inability of First Solar's customers and counterparties to perform under their contracts with First Solar, could significantly reduce its net sales and negatively impact its results of operations.<ref name=":0" /> | ||

==== ''Risks Related to Its Operations, Manufacturing, and Technology'' ==== | ==== ''Risks Related to Its Operations, Manufacturing, and Technology'' ==== | ||

# First Solar faces intense competition from manufacturers of crystalline silicon solar modules; if global supply exceeds global demand, it could lead to a further reduction in the average selling price for PV solar modules, which could reduce First Solar's net sales and adversely affect its results of operations. | # First Solar faces intense competition from manufacturers of crystalline silicon solar modules; if global supply exceeds global demand, it could lead to a further reduction in the average selling price for PV solar modules, which could reduce First Solar's net sales and adversely affect its results of operations.<ref name=":0" /> | ||

# Problems with product quality or performance may cause First Solar to incur significant and/or unexpected contractual damages and/or warranty and related expenses, damage its market reputation, and prevent us from maintaining or increasing its market share. | # Problems with product quality or performance may cause First Solar to incur significant and/or unexpected contractual damages and/or warranty and related expenses, damage its market reputation, and prevent us from maintaining or increasing its market share.<ref name=":0" /> | ||

# First Solar's failure to further refine its technology and develop and introduce improved PV products, including as a result of delays in implementing planned advancements, could render its solar modules uncompetitive and reduce its net sales, profitability, and/or market share. | # First Solar's failure to further refine its technology and develop and introduce improved PV products, including as a result of delays in implementing planned advancements, could render its solar modules uncompetitive and reduce its net sales, profitability, and/or market share.<ref name=":0" /> | ||

# Several of First Solar's key raw materials and components, in particular CdTe and substrate glass, and manufacturing equipment are either single-sourced or sourced from a limited number of suppliers, and their failure to perform could cause manufacturing delays, especially as First Solar expands or seek to expand its business, and/or impair its ability to deliver solar modules to customers in the required quality and quantities and at a price that is profitable to First Solar. | # Several of First Solar's key raw materials and components, in particular CdTe and substrate glass, and manufacturing equipment are either single-sourced or sourced from a limited number of suppliers, and their failure to perform could cause manufacturing delays, especially as First Solar expands or seek to expand its business, and/or impair its ability to deliver solar modules to customers in the required quality and quantities and at a price that is profitable to First Solar.<ref name=":0" /> | ||

# First Solar's failure to effectively manage module manufacturing production and selling costs, including costs related to raw materials and logistics services, could render its solar modules uncompetitive and reduce its net sales, profitability, and/or market share. | # First Solar's failure to effectively manage module manufacturing production and selling costs, including costs related to raw materials and logistics services, could render its solar modules uncompetitive and reduce its net sales, profitability, and/or market share.<ref name=":0" /> | ||

# First Solar's future success depends on its ability to effectively balance manufacturing production with market demand, effectively manage its cost per watt, and, when necessary, continue to build new manufacturing plants over time in response to market demand, all of which are subject to risks and uncertainties. | # First Solar's future success depends on its ability to effectively balance manufacturing production with market demand, effectively manage its cost per watt, and, when necessary, continue to build new manufacturing plants over time in response to market demand, all of which are subject to risks and uncertainties.<ref name=":0" /> | ||

# First Solar may be unable to generate sufficient cash flows or have access to the sources of external financing necessary to fund planned capital investments in manufacturing capacity and product development. | # First Solar may be unable to generate sufficient cash flows or have access to the sources of external financing necessary to fund planned capital investments in manufacturing capacity and product development.<ref name=":0" /> | ||

==== ''Risks Related to Regulations'' ==== | ==== ''Risks Related to Regulations'' ==== | ||

# First Solar expects certain financial benefits as a result of tax incentives provided by the Inflation Reduction Act of 2022. If these expected financial benefits vary significantly from First Solar's assumptions, its business, financial condition, and results of operations could be adversely affected. | # First Solar expects certain financial benefits as a result of tax incentives provided by the Inflation Reduction Act of 2022. If these expected financial benefits vary significantly from First Solar's assumptions, its business, financial condition, and results of operations could be adversely affected.<ref name=":0" /> | ||

# Existing regulations and policies, changes thereto, and new regulations and policies may present technical, regulatory, and economic barriers to the purchase and use of PV solar products, which may significantly reduce demand for First Solar's modules.< | # Existing regulations and policies, changes thereto, and new regulations and policies may present technical, regulatory, and economic barriers to the purchase and use of PV solar products, which may significantly reduce demand for First Solar's modules.<ref name=":0" /> | ||

== Reference and notes == | |||

__INDEX__ | __INDEX__ | ||

Revision as of 16:18, 10 March 2023

First Solar, Inc. provides photovoltaic (PV) solar energy solutions in the United States, Japan, France, Canada, India, Australia, and internationally. The company designs, manufactures, and sells cadmium telluride solar modules that converts sunlight into electricity. It serves developers and operators of systems, utilities, independent power producers, commercial and industrial companies, and other system owners. It also specialises in maintenance, operations and upkeep of solar energy systems - which further drives their revenue.

Currently, the share is trading at $169.14, up 15.9% year-to-date. The current market cap is $18.03bn.

| Key Financials | Q3’22 | Q3’21 |

|---|---|---|

| Net sales | $629mn | $584mn |

| CapEx | $223.3mn | $164.6mn |

| Net income | -$49.2mn | $45.2mn |

Core Product: Series 6 PV

- 0.3% degradation rate.

- 19.2% efficiency.

- Some conventional PVs have higher efficiencies of around 25%, but offer a 10-15 year warranty compared to First Solar's 30 year warranty.

[DEGRADATION IMAGE]

Industry Outlook: Renewables

- Net-zero commitments: e.g. Paris agreement & Biden administration’s vision to fully decarbonise US economy. The Inflation Reduction Act 2022 was signed by the Biden government. This act includes $369 billion in renewable energy provisions.

- Russia-Ukraine tensions: Global clean energy investment is set to rise to more than $2 trillion a year by 2030, up by half from current levels, while "international energy markets undergo a profound reorientation in the 2020s as countries adjust to the rupture of Russia-Europe (energy) flows”, the IEA said.

- Europe's Green Energy plan: Target to generate 45% of energy from renewable sources by 2030.

Industry Outlook: Solar Energy

- 85% decline in costs of PV systems.

- More solar-plus-storage buildouts increases operational efficiency and reduces storage costs.

- Inflation reduction act incentivising PV uptake.

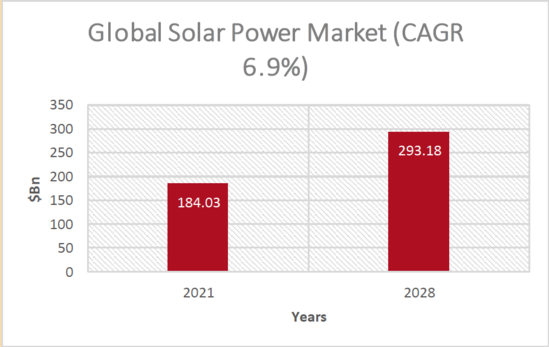

Therefore, investment in the global solar power market is set to rise by 6.9% annually till 2028.

Differentiating Factors

- Environmental: The CadTel technology us 2.5x lower carbon dioxide and 3x lower water usage than c-Si panels. Also, global recycling services can recover >90% of the material used.

- Energy: CadTel PVs have a superior Temperature Coefficient & Spectral Response, meaning they provide 4% more annual energy in hot climates and a further additional 4% in humid conditions. Also, they do not experience power loss from LID/LeTID mechanisms, which impact c-Si panels considerably.

Performance Outlook

Q3 earnings highlights:-

- Manufacturing:-->$200mn to upgrade Ohio manufacturing capacity by 0.9 GW ->$1bn for new 3.5 GW greenfield plant in southeast USA ->Building facility in India, beginning operations in late 2023

- R&D:- ->Announced $270m for a dedicated R&D line in Perrysburg, Ohio. Expected completion in 2024.

- Forecasted a thin film CadTel entitlement of 25% cell efficiency by 2025 and pathways to 28% cell efficiency by 2030.

- Vertically integrated manufacturing process -new factories in 18 months, addressing the urgency of the climate crisis.

ESG

FSLR holds an MSCI ESG rating of AA, significantly better than its competitors, such as Enphase Energy and SolarEdge Technologies - both have a rating of BBB.

- Environmental: 1st PV solar recycling program. 1st PV manufacturer to have its product included in EPEAT global registry for sustainable electronics.

- Social: Invested $11m in social welfare programs. 33% diverse Board of Directors. 25+ diversity and veteran focused recruitment sites.

- Governance: 1st PV solar manufacturer to join Responsible Business Alliance and be in the Global Electronics Council registry for sustainable electronics. Provided annual sustainability report for over 10 years.

Risks

Quantitative Risks

| Risk Metric | First Solar | Enphase Energy | Solar Edge Technologies |

|---|---|---|---|

| Beta | 1.27 | 1.47 | 1.28 |

| Sharpe Ratio | 0.80 | 0.41 | -0.18 |

| VaR | 23.15% | 60.34% | 47.50% |

Qualitative Risks

The following is a summary of the principal risks and uncertainties that could materially adversely affect the business, financial condition, and results of operations and make an investment in the stock speculative or risky.

Risks Related to Its Markets and Customers

- Competition in solar markets globally and across the solar value chain is intense and could remain that way for an extended period of time. The solar industry may experience periods of structural imbalance between global PV module supply and demand that result in periods of pricing volatility. If First Solar's competitors reduce module pricing to levels near or below their manufacturing costs, or are able to operate at minimal or negative operating margins for sustained periods of time, or if global demand for PV modules decreases relative to installed production capacity, First Solar's business, financial condition, and results of operations could be adversely affected.[1]

- The reduction, elimination, or expiration of government subsidies, economic incentives, tax incentives, renewable energy targets, and other support for on-grid solar electricity applications, or other public policies could negatively impact demand and/or price levels for First Solar's solar modules. The imposition of tariffs on First Solar's products could materially increase its costs to perform under its contracts with customers, which could adversely affect its results of operations.[1]

- The loss of any of First Solar's large customers, or the inability of First Solar's customers and counterparties to perform under their contracts with First Solar, could significantly reduce its net sales and negatively impact its results of operations.[1]

Risks Related to Its Operations, Manufacturing, and Technology

- First Solar faces intense competition from manufacturers of crystalline silicon solar modules; if global supply exceeds global demand, it could lead to a further reduction in the average selling price for PV solar modules, which could reduce First Solar's net sales and adversely affect its results of operations.[1]

- Problems with product quality or performance may cause First Solar to incur significant and/or unexpected contractual damages and/or warranty and related expenses, damage its market reputation, and prevent us from maintaining or increasing its market share.[1]

- First Solar's failure to further refine its technology and develop and introduce improved PV products, including as a result of delays in implementing planned advancements, could render its solar modules uncompetitive and reduce its net sales, profitability, and/or market share.[1]

- Several of First Solar's key raw materials and components, in particular CdTe and substrate glass, and manufacturing equipment are either single-sourced or sourced from a limited number of suppliers, and their failure to perform could cause manufacturing delays, especially as First Solar expands or seek to expand its business, and/or impair its ability to deliver solar modules to customers in the required quality and quantities and at a price that is profitable to First Solar.[1]

- First Solar's failure to effectively manage module manufacturing production and selling costs, including costs related to raw materials and logistics services, could render its solar modules uncompetitive and reduce its net sales, profitability, and/or market share.[1]

- First Solar's future success depends on its ability to effectively balance manufacturing production with market demand, effectively manage its cost per watt, and, when necessary, continue to build new manufacturing plants over time in response to market demand, all of which are subject to risks and uncertainties.[1]

- First Solar may be unable to generate sufficient cash flows or have access to the sources of external financing necessary to fund planned capital investments in manufacturing capacity and product development.[1]

Risks Related to Regulations

- First Solar expects certain financial benefits as a result of tax incentives provided by the Inflation Reduction Act of 2022. If these expected financial benefits vary significantly from First Solar's assumptions, its business, financial condition, and results of operations could be adversely affected.[1]

- Existing regulations and policies, changes thereto, and new regulations and policies may present technical, regulatory, and economic barriers to the purchase and use of PV solar products, which may significantly reduce demand for First Solar's modules.[1]