First Solar, Inc. provides photovoltaic (PV) solar energy offerings in the United States, Japan, France, Canada, India, Australia, and internationally. The company designs, manufactures, and sells cadmium telluride solar modules that converts sunlight into electricity. It serves developers and operators of systems, utilities, independent power producers, commercial and industrial companies, and other system owners. It also specialises in maintenance, operations and upkeep of solar energy systems - which further drives their revenue.

Operations

Currently, the share is trading at $169.14, up 15.9% year-to-date.[1] The current market cap is $18.03bn.[1]

| Key Financials | Q3’22 | Q3’21 |

|---|---|---|

| Net sales | $629mn | $584mn |

| CapEx | $223.3mn | $164.6mn |

| Net income | -$49.2mn | $45.2mn |

Core Product: Series 6 PV

- 0.3% degradation rate.

- 19.2% efficiency.

- Some conventional PVs have higher efficiencies of around 25%, but offer a 10-15 year warranty compared to First Solar's 30 year warranty.

[DEGRADATION IMAGE]

Industry Outlook: Renewables

- Net-zero commitments: e.g. Paris agreement & Biden administration’s vision to fully decarbonise US economy. The Inflation Reduction Act 2022 was signed by the Biden government. This act includes $369 billion in renewable energy provisions.

- Russia-Ukraine tensions: Global clean energy investment is set to rise to more than $2 trillion a year by 2030, up by half from current levels, while "international energy markets undergo a profound reorientation in the 2020s as countries adjust to the rupture of Russia-Europe (energy) flows”, the IEA said.

- Europe's Green Energy plan: Target to generate 45% of energy from renewable sources by 2030.

Industry Outlook: Solar Energy

- 85% decline in costs of PV systems.

- More solar-plus-storage buildouts increases operational efficiency and reduces storage costs.

- Inflation reduction act incentivising PV uptake.

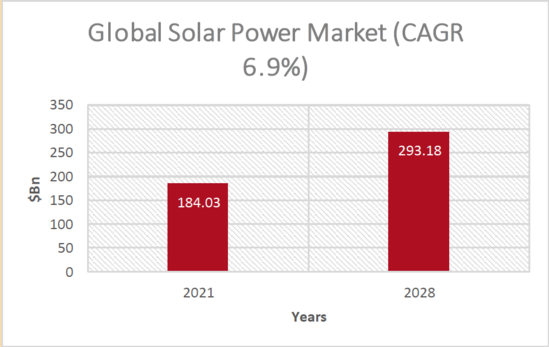

Therefore, investment in the global solar power market is set to rise by 6.9% annually till 2028.

Differentiating Factors

- Environmental: The CadTel technology us 2.5x lower carbon dioxide and 3x lower water usage than c-Si panels. Also, global recycling services can recover >90% of the material used.

- Energy: CadTel PVs have a superior Temperature Coefficient & Spectral Response, meaning they provide 4% more annual energy in hot climates and a further additional 4% in humid conditions. Also, they do not experience power loss from LID/LeTID mechanisms, which impact c-Si panels considerably.

Performance Outlook

Q3 earnings highlights:-

- Manufacturing:-->$200mn to upgrade Ohio manufacturing capacity by 0.9 GW ->$1bn for new 3.5 GW greenfield plant in southeast USA ->Building facility in India, beginning operations in late 2023

- R&D:- ->Announced $270m for a dedicated R&D line in Perrysburg, Ohio. Expected completion in 2024.

- Forecasted a thin film CadTel entitlement of 25% cell efficiency by 2025 and pathways to 28% cell efficiency by 2030.

- Vertically integrated manufacturing process -new factories in 18 months, addressing the urgency of the climate crisis.

ESG

FSLR holds an MSCI ESG rating of AA, significantly better than its competitors, such as Enphase Energy and SolarEdge Technologies - both have a rating of BBB.

- Environmental: 1st PV solar recycling program. 1st PV manufacturer to have its product included in EPEAT global registry for sustainable electronics.

- Social: Invested $11m in social welfare programs. 33% diverse Board of Directors. 25+ diversity and veteran focused recruitment sites.

- Governance: 1st PV solar manufacturer to join Responsible Business Alliance and be in the Global Electronics Council registry for sustainable electronics. Provided annual sustainability report for over 10 years.

Team

Mark R. Widmar was appointed Chief Executive Officer in July 2016. He joined First Solar in April 2011 as Chief Financial Officer and also served as First Solar’s Chief Accounting Officer from February 2012 through June 2015. From March 2015 to June 2016, Mr. Widmar served as the Chief Financial Officer and through June 2018, served as a director on the board of the general partner of 8point3 Energy Partners LP (“8point3”), the joint yieldco formed by First Solar and SunPower Corporation in 2015 to own and operate a portfolio of selected solar generation assets. Prior to joining First Solar, Mr. Widmar served as Chief Financial Officer of GrafTech International Ltd., a leading global manufacturer of advanced carbon and graphite materials, from May 2006 through March 2011. Prior to joining GrafTech, Mr. Widmar served as Corporate Controller of NCR Inc. from 2005 to 2006, and was a Business Unit Chief Financial Officer for NCR from November 2002 to his appointment as Controller. He also served as a Division Controller at Dell, Inc. from August 2000 to November 2002. Mr. Widmar also held various financial and managerial positions with Lucent Technologies Inc., Allied Signal, Inc., and Bristol Myers/Squibb, Inc. He began his career in 1987 as an accountant with Ernst & Young. Mr. Widmar holds a Bachelor of Science in business accounting and a Master of Business Administration from Indiana University.[2]

Alexander R. Bradley was appointed Chief Financial Officer in October 2016. He joined First Solar in May 2008, and previously served as Vice President of both Treasury and Project Finance, leading or supporting the structuring, sale, and financing of over $10 billion and approximately 2.7 GWDC of the Company’s worldwide development assets, including several of the largest PV power plant projects in North America. From June 2016 to June 2018, Mr. Bradley also served as an officer and board member of the general partner of 8point3. Prior to joining First Solar, Mr. Bradley worked at HSBC in investment banking and leveraged finance, in London and New York, covering the energy and utilities sector. He received his Master of Arts from the University of Edinburgh, Scotland.[2]

Georges Antoun was appointed Chief Commercial Officer in July 2016. He joined First Solar in July 2012 as Chief Operating Officer before being appointed as President, U.S. in July 2015. Mr. Antoun has over 30 years of operational and technical experience, including leadership positions at several global technology companies. Prior to joining First Solar, Mr. Antoun served as Venture Partner at Technology Crossover Ventures (“TCV”), a private equity and venture firm that he joined in July 2011. Before joining TCV, Mr. Antoun was the Head of Product Area IP & Broadband Networks for Ericsson, based in San Jose, California. Mr. Antoun joined Ericsson in 2007, when Ericsson acquired Redback Networks, a telecommunications equipment company, where Mr. Antoun served as the Senior Vice President of World Wide Sales & Operations. After the acquisition, Mr. Antoun was promoted to Chief Executive Officer of the Redback Networks subsidiary. Prior to Redback Networks, Mr. Antoun spent five years at Cisco Systems, where he served as Vice President of Worldwide Systems Engineering and Field Marketing, Vice President of Worldwide Optical Operations, and Vice President of Carrier Sales. Prior to Cisco Systems, he was the Director of Systems Engineering at Newbridge Networks, a data and voice networking company. Mr. Antoun started his career at Nynex (now Verizon Communications), where he was part of its Science and Technology Division. Mr. Antoun serves as a member of the board of directors of Marathon Digital Holdings. He is also the Chairman of the University of Louisiana’s College of Engineering Dean’s Advisory Council board. He earned a Bachelor of Science degree in engineering from the University of Louisiana at Lafayette and a Master’s degree in information systems engineering from NYU Poly.[2]

Michael Koralewski was appointed Chief Supply Chain Officer in November 2022 and is accountable for maintaining executive oversight of First Solar’s strategic global supply chain. He previously served as First Solar’s Chief Manufacturing Operations Officer and provides over 25 years of global operational experience to the executive leadership team. Mr. Koralewski joined First Solar in 2006, serving in several senior roles in operations and quality management, including Senior Vice President, Global Manufacturing since 2015; Vice President, Global Site Operations and Plant Manager since 2011; and Vice President, Global Quality since 2009. In all of these roles Mr. Koralewski has been significantly involved since the beginning of First Solar’s manufacturing scaling and expansion from site selection through sustaining operations and supply chain development. Prior to joining First Solar, Mr. Koralewski worked at Dana Incorporated where he held several positions with global responsibility in operations and quality management. He earned a Bachelor of Science in chemical engineering from Case Western Reserve University and a Master of Business Administration from Bowling Green State University.[2]

Kuntal Kumar Verma was appointed Chief Manufacturing Officer in November 2022 and previously served as First Solar’s Chief Manufacturing Engineering Officer. He is responsible for First Solar’s global manufacturing operations and engineering, including its performance and improvement roadmap, global technology scaling, new plant start-ups, and strategic initiatives. Mr. Verma joined First Solar in 2002, serving in progressively more senior roles in engineering and manufacturing, including Vice President, Global Manufacturing Engineering since 2012. Prior to joining First Solar, Mr. Verma held several engineering and operations positions at Reliance Industries Limited, India. He is a Master Black Belt in Six Sigma/Lean Manufacturing with an expert certification in Taguchi Methods (Robust Engineering) and a Certification in Production and Inventory Management from American Production and Inventory Control Society. He earned a Bachelor of Science in mechanical engineering from the National Institute of Technology in India, a Master of Science in industrial engineering from the University of Toledo, and a Master of Business Administration from Bowling Green State University.[2]

Patrick Buehler was appointed Chief Product Officer in December 2022, having previously served as Chief Quality and Reliability Officer. Mr. Buehler has over 20 years of operational and technical experience. In his role, Mr. Buehler is responsible for all aspects of product lifecycle management, including understanding market demands, technology trends, and competition to facilitate implementation of new or enhanced products. Mr. Buehler maintains global leadership responsibility for quality and reliability, environmental, health, safety, and security, recycling technology process development and operations, customer service, program management, and strategic initiatives. Mr. Buehler joined First Solar in 2006, serving in progressively more senior technical and operations roles, including Vice President, Quality and Reliability since 2019. Prior to joining First Solar, Mr. Buehler held several roles in manufacturing, engineering, maintenance, and product development at DuPont de Nemours, Inc. and Cummins, Inc. He earned a Bachelor of Science in mechanical engineering from the University of Cincinnati and a Master of Science in mechanical engineering from Purdue University.[2]

Markus Gloeckler was appointed Chief Technology Officer in November 2020 after being appointed Co-Chief Technology Officer in July 2020. He is focused on driving First Solar’s thin film PV module technology. Mr. Gloeckler has extensive experience guiding strategic research and development activities and served First Solar as Vice President and Chief Scientist before being promoted to Senior Vice President, Module Research and Development. He was instrumental in enabling First Solar’s achievement of various world records relating to conversion efficiency for CdTe solar cells. In his role as Vice President of Research, he led the thin film technology transfer from General Electric to First Solar following the intellectual property acquisition in 2013. He joined First Solar in 2005 in an engineering function supporting First Solar’s technology development after the initial launch of the Series 2 module. Mr. Gloeckler holds an undergraduate degree in microsystems engineering from the Regensburg University of Applied Sciences in Germany, and a Doctor of Philosophy in physics from Colorado State University.[2]

Caroline Stockdale joined First Solar in October 2019 as Executive Vice President, Human Resources and Communications and was appointed Chief People and Communications Officer in October 2020. Prior to joining First Solar, she served as the Chief Executive Officer for First Perform, a provider of human resources services for a variety of customers, from Fortune 100 companies to cyber start-ups. Previously, she served as Chief Human Resources Officer for Medtronic from 2010 to 2013 and Warner Music Group from 2005 to 2009. Before joining Warner Music Group, she served as the senior human resources leader in global divisions of American Express from 2002 to 2005 and General Electric from 1997 to 2002. Ms. Stockdale is a member of the Forbes Human Resources Council. Ms. Stockdale holds a Bachelor of Arts in political theories and institutions, and philosophy, from the University of Sheffield, England.[2]

Jason Dymbort joined First Solar in March 2008, serving in a broad range of legal roles before being appointed General Counsel and Secretary in July 2020. Between 2015 and 2018, Mr. Dymbort served as General Counsel and Secretary for the general partner of 8point3 Energy Partners, then a publicly-traded yieldco and affiliate of First Solar. Before joining First Solar, Mr. Dymbort was a corporate attorney at Cravath, Swaine & Moore LLP. He holds a Juris Doctor degree from the University of Pennsylvania Law School, where he was a member of the Penn Law Review, and a bachelor’s degree from Brandeis University.[2]

Competition

The solar energy and renewable energy sectors are highly competitive and continually evolving as participants in these sectors strive to distinguish themselves within their markets and compete within the larger electric power industry. Among PV solar module manufacturers, the principal method of competition is sales price per watt, which may be influenced by several module value attributes, including wattage (through a larger form factor or an improved conversion efficiency), energy yield, degradation, sustainability, and reliability. Sales price per watt may also be influenced by warranty terms and customer payment terms. First Solar faces intense competition for sales of solar modules, which may result in reduced selling prices and loss of market share. The company's primary source of competition is crystalline silicon module manufacturers, the majority of which are linked to China. Allegations of forced labour in the Chinese solar supply chain have emerged in recent years, which means the company also competes on its approach to responsible sourcing and supply chain due diligence. First Solar's differentiated technology, integrated manufacturing process, and tightly controlled supply chain helps limit the risks associated with outsourcing and the multiple supply tiers of conventional crystalline silicon module manufacturing.[2]

First Solar also expects to compete with future entrants into the PV solar industry and existing market participants that offer new or differentiated technological offerings.[2]

Certain of First Solar's existing or future competitors, including many linked to China, may have direct or indirect access to sovereign capital or other forms of state support, which could enable such competitors to operate at minimal or negative operating margins for sustained periods of time. First Solar's results of operations could be adversely affected if competitors reduce module pricing to levels below their costs, bid aggressively low prices for module sale agreements, or are able to operate at minimal or negative operating margins for sustained periods of time. First Solar believes that the solar industry may experience periods of structural imbalance between supply and demand, which could lead to periods of pricing volatility.[2]

| First Solar | Enphase Energy | Solar Edge Technologies | |

|---|---|---|---|

| Sales price per watt | ? | ? | ? |

Qualitative Risks

Risks

Quantitative Risks

| Risk Metric | First Solar | Enphase Energy | Solar Edge Technologies |

|---|---|---|---|

| Beta | 1.27 | 1.47 | 1.28 |

| Sharpe Ratio | 0.80 | 0.41 | -0.18 |

| VaR | 23.15% | 60.34% | 47.50% |

Qualitative Risks

The following is a summary of the principal risks and uncertainties that could materially adversely affect the business, financial condition, and results of operations and make an investment in the stock speculative or risky.

Risks Related to Its Markets and Customers

- Competition in solar markets globally and across the solar value chain is intense and could remain that way for an extended period of time. The solar industry may experience periods of structural imbalance between global PV module supply and demand that result in periods of pricing volatility. If First Solar's competitors reduce module pricing to levels near or below their manufacturing costs, or are able to operate at minimal or negative operating margins for sustained periods of time, or if global demand for PV modules decreases relative to installed production capacity, First Solar's business, financial condition, and results of operations could be adversely affected.[2]

- The reduction, elimination, or expiration of government subsidies, economic incentives, tax incentives, renewable energy targets, and other support for on-grid solar electricity applications, or other public policies could negatively impact demand and/or price levels for First Solar's solar modules. The imposition of tariffs on First Solar's products could materially increase its costs to perform under its contracts with customers, which could adversely affect its results of operations.[2]

- The loss of any of First Solar's large customers, or the inability of First Solar's customers and counterparties to perform under their contracts with First Solar, could significantly reduce its net sales and negatively impact its results of operations.[2]

Risks Related to Its Operations, Manufacturing, and Technology

- First Solar faces intense competition from manufacturers of crystalline silicon solar modules; if global supply exceeds global demand, it could lead to a further reduction in the average selling price for PV solar modules, which could reduce First Solar's net sales and adversely affect its results of operations.[2]

- Problems with product quality or performance may cause First Solar to incur significant and/or unexpected contractual damages and/or warranty and related expenses, damage its market reputation, and prevent us from maintaining or increasing its market share.[2]

- First Solar's failure to further refine its technology and develop and introduce improved PV products, including as a result of delays in implementing planned advancements, could render its solar modules uncompetitive and reduce its net sales, profitability, and/or market share.[2]

- Several of First Solar's key raw materials and components, in particular Cadmium Telluride (CdTe) and substrate glass, and manufacturing equipment are either single-sourced or sourced from a limited number of suppliers, and their failure to perform could cause manufacturing delays, especially as First Solar expands or seek to expand its business, and/or impair its ability to deliver solar modules to customers in the required quality and quantities and at a price that is profitable to First Solar.[2]

- First Solar's failure to effectively manage module manufacturing production and selling costs, including costs related to raw materials and logistics services, could render its solar modules uncompetitive and reduce its net sales, profitability, and/or market share.[2]

- First Solar's future success depends on its ability to effectively balance manufacturing production with market demand, effectively manage its cost per watt, and, when necessary, continue to build new manufacturing plants over time in response to market demand, all of which are subject to risks and uncertainties.[2]

- First Solar may be unable to generate sufficient cash flows or have access to the sources of external financing necessary to fund planned capital investments in manufacturing capacity and product development.[2]

Risks Related to Regulations

- First Solar expects certain financial benefits as a result of tax incentives provided by the Inflation Reduction Act of 2022. If these expected financial benefits vary significantly from First Solar's assumptions, its business, financial condition, and results of operations could be adversely affected.[2]

- Existing regulations and policies, changes thereto, and new regulations and policies may present technical, regulatory, and economic barriers to the purchase and use of PV solar products, which may significantly reduce demand for First Solar's modules.[2]