SummaryEdit

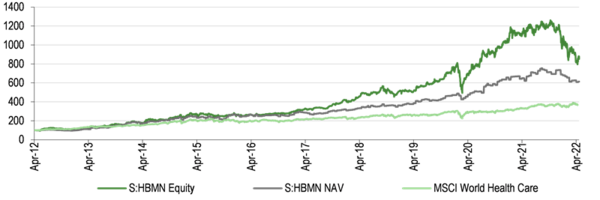

HBM Healthcare Investments (HBMN) posted its first NAV loss in a decade for FY22 (ended 31 March), but, as shown in the chart below, its long-term performance record remains very impressive. The recent fall in the share price from a premium to a discount to NAV (10.0% at 20 May) could present an opportunity for long-term investors who, like HBMN’s management team, remain convinced of the long-term opportunities afforded by careful investment in the healthcare and biotechnology space. HBMN is unusual among its peers in offering a portfolio made up of private companies, listed equities and funds, broadly spread by geography and clinical focus, with a high distribution policy (current yield of 3.8%).

Share price fall could present opportunity given strong NAV record[1]

Why invest in healthcare and biotech now?

In an environment where technology and ‘growth’ stocks in general have sold off heavily, few areas have been hit as hard as biotechnology, the engine of innovation for modern medicine. As in previous cycles, strong returns from biotech companies tend to attract generalist investors, who are then quick to retrench when markets turn down, which can lead to significant short-term volatility. However, the real drivers of long-term growth in biotech are scientific developments and clinical advances, which continue apace, underpinned by technological advances and demographic factors. An allocation to a strategy that includes conservatively valued private investments could help limit some of the NAV volatility seen in other funds.

The analyst’s view

HBMN’s strategy has evolved over two decades, but remains founded on identifying promising healthcare and biotech innovators while they are still small, and holding them for the very long term. With 70% of the listed portfolio (37% of the total portfolio) having begun in the private portfolio, it is clear that this is a fund with true private equity roots, although its ability to invest in listed companies as well means it is well placed to capitalise on value opportunities arising from the recent public market sell-off. Over the years, we have seen HBMN’s own valuation appreciate from a persistent double-digit discount to a sustained premium to NAV as investors have become more familiar with the fund’s approach and track record. In Edison Investment Research's opinion, the current 10% discount is unwarrantedly wide compared with a peer group average of 2.7%, particularly given HBMN’s superior performance record.

The fund manager: HBM PartnersEdit

The manager’s view: ‘Increasingly interesting’ opportunities

FY22 was the first time in a decade that HBMN posted a negative result for the year, but the team led by CEO Dr Andreas Wicki and CFO Erwin Troxler is undeterred, pointing to more attractive valuations in the small- and mid-cap biotech space, a continued high level of innovation, and signs of a pick-up in M&A activity as established pharma companies seek to capitalise on market falls. HBMN’s mix of private and public investments enables it to seek out interesting growth opportunities that may be at an early stage (although the managers seek ‘proof of concept’ before investing), and hold them until their value is more widely appreciated. Currently the managers are focused on growth companies in the biotech, medtech, diagnostic and healthcare IT sectors, with ‘digital health’ in particular giving exposure across the whole healthcare value chain, including in areas such as pharmacies and clinics that would otherwise be out of the fund’s scope.

With a variety of macroeconomic and geopolitical factors having weighed on sentiment towards growth stocks in general and biotechnology in particular so far in 2022, the HBMN team continues to rate the prospects for the healthcare investment universe as ‘good’, and says it intends to exploit (selectively) the ‘increasingly interesting’ investment opportunities arising in public markets in particular over the coming months.

Asset allocationEdit

Current portfolio positioning

HBMN’s portfolio concentration has increased over the past financial year, with the top 10 holdings now accounting for 52.7% of the total (end-FY21: 43.3%). However, the portfolio remains broadly diversified, with over 90 named holdings across the private, funds, ex-private and public portfolios, plus other small unnamed investments amounting to c CHF62.5m (c 3% of NAV at end-FY22). By far the largest holding currently is Cathay Biotech, a synthetic biology company based in the Shanghai region, which HBMN held for many years prior to its IPO in 2020. There is a three-year post-IPO lock-up prohibiting HBMN from selling its shares in the company, so it is likely to remain a substantial holding for some time to come, although it is worth noting that the increase in weighting during FY22 from 14.1% to 22.4% is the twin outcome of strong performance from Cathay itself (share price +36.4% in HBMN’s FY22) and declines elsewhere in the listed portfolio.

| Company | Country | Clinical focus | Portfolio weight % | |

|---|---|---|---|---|

| 31 March 2022 | 31 March 2021 | |||

| Cathay Biotech* | China | Synthetic biology | 22.4 | 14.1 |

| Harmony Biosciences* | US | Narcolepsy/cataplexy | 8.6 | 7.0 |

| Swixx Biopharma** | Switzerland | Distribution | 7.5 | 2.8 |

| Neurelis** | US | Epilepsy | 2.7 | 2.6 |

| ConnectRN** | US | Digital health | 2.5 | 0.1 |

| Biohaven Pharmaceuticals | US | Neurological disorders | 1.4 | 1.6 |

| Y-mAbs* | Denmark | Cancer immunotherapy | 2.1 | 2.7 |

| HBM Genomics | N/A | Genomics fund | 1.8 | 2.2 |

| Pacira Pharmaceuticals* | US | Pain management | 2.4 | 1.4 |

| NiKang Therapeutics** | US | Oncology | 1.2 | 0.2 |

| Top 10 (% of holdings) | 52.7 | 43.3 | ||

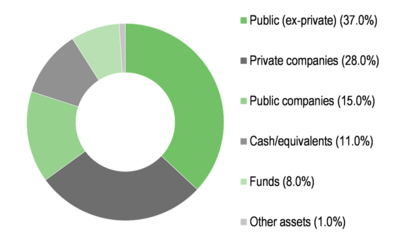

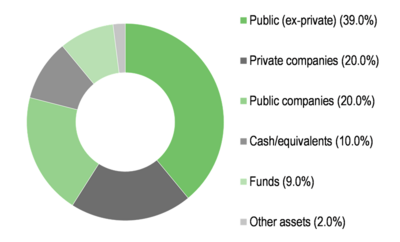

Cathay also makes up the lion’s share of the fund’s holdings in public companies originating in the private portfolio (see Exhibit 2), the largest segment of the portfolio, at 37% (in aggregate, public companies of any origin make up 52%). However, private companies remain an important part of the whole, with 11 new companies added during FY22 at a cost of CHF93m, more than offsetting the CHF55.9m value of private companies moving to the public portfolios via IPO. The largest new private investment was a $20m commitment to Upstream Bio, a US company developing an antibody to treat severe asthma. There were also significant investments in two antibody/oncology companies, CHF17m in Swiss firm Numab Therapeutics and $10m in Odyssey Therapeutics.

Exhibit 2: Asset allocation at 31 March 2022[3]

Exhibit 3: Asset allocation at 31 March 2021[3]

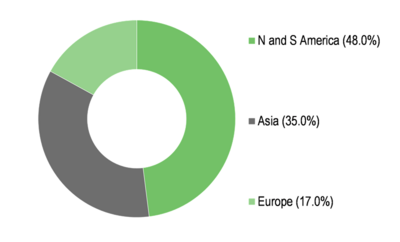

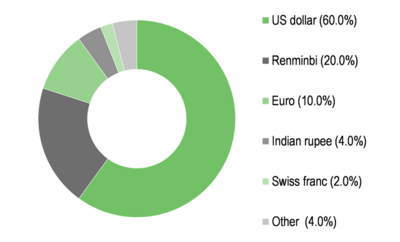

As shown in Exhibits 4 and 5, HBMN is well spread geographically, with less than half of its underlying holdings based in the Americas (the higher US dollar weighting can be attributed to the base currency of funds investing internationally). In particular there is a high weighting to Asia (35%), principally in China through holdings such as Cathay Biotech, Fangzhou (formerly Jianke), the WuXi Healthcare Ventures II fund and a new investment in Hong Kong based Hutchmed China, but also in India via names including Tata 1mg and SAI Life Sciences. Europe is also well represented, with a variety of Swiss and Nordic companies among others, including the largest private holding Swixx BioPharma (7.5% of NAV), which distributes medicines in Central and Eastern Europe. The level of geographical diversification sets HBMN apart from many of its peers, which tend to have a much greater focus on the US (an average of 72.3% for the AIC Biotechnology & Healthcare peer group).

Exhibit 4: Portfolio breakdown by geography[4]

Exhibit 5: Portfolio breakdown by currency[4]

Exhibit 6 shows the development of HBMN’s sector allocation over FY22, with the biggest rise (+7.9pp in synthetic biology via Cathay Biotech) and the biggest fall (-11.0% in oncology) both largely attributable to the market performance of listed holdings. The second largest increase, in digital health, comes after an external financing round substantially increased the valuation of unlisted US nurse-sourcing platform ConnectRN, now a top 10 holding.

| Portfolio end-March 2022 | Portfolio end-March 2021 | Change (pp) | |

|---|---|---|---|

| Synthetic biology | 22.0 | 14.1 | 7.9 |

| Oncology | 17.0 | 28.0 | (11.0) |

| CNS disorders | 17.0 | 17.0 | 0.0 |

| Digital health | 7.0 | 4.0 | 3.0 |

| Immunology/inflammation | 6.0 | 8.0 | (2.0) |

| Orphan diseases | 5.0 | 6.0 | (1.0) |

| Medtech/diagnostics | 4.0 | 5.0 | (1.0) |

| Infectious diseases | 2.0 | 2.0 | 0.0 |

| Others | 20.0 | 15.9 | 4.1 |

| 100.0 | 100.0 |

It is worth noting that while the proportion of profitable companies in HBMN’s portfolio has jumped from 21% to 47% during the year, this represents the most advanced stage of development in any company’s product portfolio, and should not be taken to indicate a lack of innovation in the remaining holdings. Indeed, HBMN’s portfolio companies are expected to have a busy year of trial readouts (Phases I, II and III) and product approvals during the remainder of 2022.

| Portfolio end-March 2022 | Portfolio end-March 2021 | Change (pp) | |

|---|---|---|---|

| Profitable | 47.0 | 21.0 | 26.0 |

| Market | 23.0 | 29.0 | -6.0 |

| Phase III | 7.0 | 12.0 | -5.0 |

| Phase II | 11.0 | 18.0 | -7.0 |

| Phase I | 5.0 | 16.0 | -11.0 |

| Pre-clinical | 7.0 | 4.0 | 3.0 |

| 100.0 | 100.0 |

| 12 months ending | Share price

(%) |

NAV

(%) |

MSCI World Health Care (%) | NASDAQ Biotech (%) | MSCI World (%) |

|---|---|---|---|---|---|

| 30/04/18 | 39.4 | 17.0 | 8.1 | 4.4 | 14.4 |

| 30/04/19 | 11.6 | 15.7 | 12.1 | 6.3 | (0.2) |

| 30/04/20 | 35.3 | 23.1 | 10.1 | 11.2 | (24.1) |

| 30/04/21 | 59.9 | 37.2 | 14.1 | 18.5 | 30.0 |

| 30/04/22 | (26.5) | (3.7) | 12.9 | (17.1) | 5.3 |

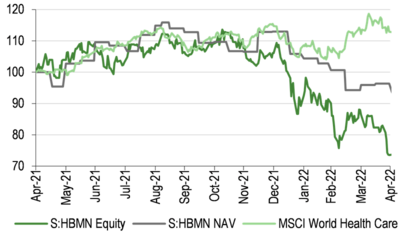

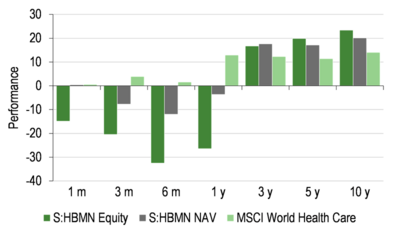

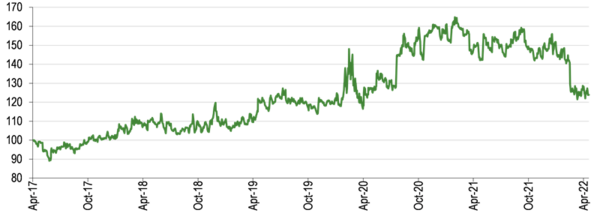

Performance: Stabilising after a more difficult yearEdit

For the financial year ended 31 March 2022, HBMN posted negative NAV and share price total returns of -3.6% and 13.2% respectively. Performance had been positive in the first three quarters of FY22 but was negatively affected in the last quarter (calendar Q1) as worries over inflation, recession, commodity prices, lockdowns in China and the Russian invasion of Ukraine caused a broad-based sell-off in ‘growth’ sectors such as technology. While the NAV has largely stabilised so far in FY23, HBMN’s share price continued to fall in April, leading to a 12-month share price total return of -26.5% versus -3.7% for the NAV (Exhibit 8). However, May has been more positive, with the share price up 7.4% and the NAV up c 1%. While focusing on one-month performance is entirely inappropriate from a long-term investment perspective, it may serve to illustrate the start of a pick-up in sentiment. On a long-term basis (Exhibit 9, right-hand chart), HBMN’s strong performance record remains very much intact, with annualised share price and NAV total returns (in Swiss francs) of c 17–23%, compared with c 11–14% pa for the MSCI World Health Care Index.

One of the benefits of holding unlisted investments is that they are not affected on a day-to-day basis by stock market gyrations. HBMN’s valuation methodology for private investments means that most are valued at book cost unless an external funding round establishes a new ‘price’. During FY22, two of the larger private investments, Swixx Biopharma and ConnectRN, saw their valuations increased by CHF75m and CHF38m, respectively, as the result of funding rounds, accounting for the majority of the CHF129m increase in the value of the private portfolio.

Exhibit 9a: Price, NAV and benchmark total return performance, one-year rebased[8]

Exhibit 9b: Price, NAV and benchmark total return performance (%)[9]

The funds portfolio declined in value by CHF35m, mainly as a result of falls in the value of funds’ listed equity holdings, while the public portfolio saw broad based declines, although the two largest (ex-private) holdings – Cathay Biotech and Harmony Biosciences – both did well, adding an aggregate CHF186m and limiting the overall loss on public holdings to CHF82m (c 3.8% of opening NAV). The majority of the losses came from oncology companies with clinical development candidates, many of which were ex-private companies that had come to the public markets via IPO in the past two years. The managers note that in most cases these losses came after significant gains in previous years, and that clinical developments are largely proceeding according to plan.

| One month | Three months | Six months | One year | Three years | Five years | 10 years | |

|---|---|---|---|---|---|---|---|

| Price relative to MSCI World Health Care | (15.4) | (23.5) | (33.5) | (34.8) | 12.3 | 44.3 | 119.4 |

| NAV relative to MSCI World Health Care | (0.2) | (11.2) | (13.3) | (14.6) | 14.8 | 28.3 | 68.6 |

| Price relative to NASDAQ Biotech | (10.6) | (15.7) | (16.0) | (11.3) | 45.7 | 104.3 | 152.8 |

| NAV relative to NASDAQ Biotech | 5.5 | (2.1) | 9.5 | 16.2 | 48.9 | 81.7 | 94.2 |

| Price relative to MSCI World | (12.0) | (17.0) | (28.5) | (28.7) | 22.3 | 52.5 | 177.4 |

| NAV relative to MSCI World | 3.8 | (3.7) | (6.7) | (6.6) | 25.1 | 35.6 | 113.2 |

Exhibit 11: NAV performance versus MSCI World Health Care Index over five years[11]

As shown in Exhibits 10 and 11, the past 12 months have been a more difficult period of relative performance versus the broad healthcare equity market and the MSCI World Index, although HBMN’s longer-term performance record versus all comparator indices remains compelling in both share price and NAV terms.

Peer group comparisonEdit

In Exhibit 12, Edison Investment Research shows HBMN alongside its Swiss counterpart BB Biotech and the UK-listed members of the AIC Biotechnology & Healthcare sector (all data in Swiss franc terms). With the broad healthcare equity market having markedly outperformed the biotechnology space (see Exhibit 8) in the past year, those funds less specifically focused on biotech have also performed better, with Polar Capital Global Healthcare the only fund in the peer group to have posted a positive return in the 12 months to 19 May 2022. HBMN’s NAV total return ranks second, with a small loss of 1.2%, but is comfortably in first place over three, five and 10 years. In spite of this – and an above-average dividend yield – the fund’s shares currently trade on the second widest discount to NAV in the group.

| % unless stated | Market cap (m) | NAV TR

1 year |

NAV TR

3 year |

NAV TR

5 year |

NAV TR

10 year |

Ongoing

charge |

Perf.

fee |

Discount

(cum-fair) |

Net

gearing |

Dividend

yield |

|---|---|---|---|---|---|---|---|---|---|---|

| HBM Healthcare Investments | 1,756.6 | (1.2) | 49.9 | 119.3 | 530.2 | 1.8 | Yes | (10.0) | 100 | 3.8 |

| BB Biotech | 3,058.1 | (28.2) | (9.7) | 4.1 | 297.7 | 1.2 | No | 28.4 | 113 | 6.9 |

| Bellevue Healthcare Trust | 1,075.7 | (16.7) | 14.9 | 55.4 | -- | 1.1 | No | 0.1 | 112 | 4.3 |

| Biotech Growth Trust | 407.0 | (39.6) | 1.8 | 5.6 | 167.1 | 1.1 | No | (2.5) | 110 | 0.0 |

| International Biotechnology Trust | 308.2 | (9.5) | 10.0 | 22.9 | 207.5 | 1.2 | Yes | (4.7) | 102 | 5.3 |

| Polar Capital Glbl Healthcare | 439.4 | 10.5 | 40.4 | 55.9 | 184.3 | 0.9 | Yes | (8.9) | 107 | 0.7 |

| RTW Venture Fund | 243.9 | (26.1) | -- | -- | -- | 1.9 | Yes | (9.4) | 100 | 0.0 |

| Syncona | 1,434.9 | (2.1) | (12.4) | 49.1 | -- | 1.6 | No | (11.2) | 100 | 0.0 |

| Worldwide Healthcare Trust | 2,411.3 | (13.9) | 20.9 | 38.4 | 255.6 | 0.9 | Yes | (6.4) | 104 | 0.7 |

| Simple average (9 funds) | 1,237.2 | (14.1) | 14.5 | 43.8 | 273.7 | 1.3 | (2.7) | 105 | 2.4 | |

| HBMN rank in peer group | 3 | 2 | 1 | 1 | 1 | 2 | 8 | 7 | 4 |

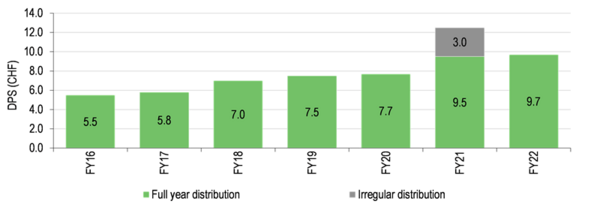

Dividends: Consistent growth record maintainedEdit

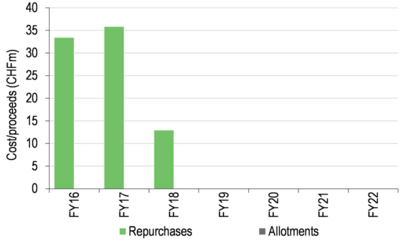

Exhibit 13: Dividend history since FY16[13]

In an environment of persistently low yields on cash and bonds, HBMN has long recognised the attractiveness to its shareholders of a regular income, even though companies in the earlier-stage healthcare and biotech space tend to be more focused on R&D spending than paying dividends to investors. As a result, since 2013 the fund has followed a policy of paying out 3–5% of NAV each year as a cash distribution, with the ambition of providing a stable to rising payout each year (CAGR of 10.8% a year from FY17 to FY22, setting aside the one-off ‘anniversary payment’ of CHF3.00 paid in respect of FY21). The CHF9.70 per share payout proposed for FY22 equates to 3.4% of NAV and is a 3.8% yield on the current share price. As in recent years, the distribution will be paid in September and treated as a reduction in the par value of the shares, which is more tax efficient for HBMN than transferring part of the par value into capital reserves and then paying it out.

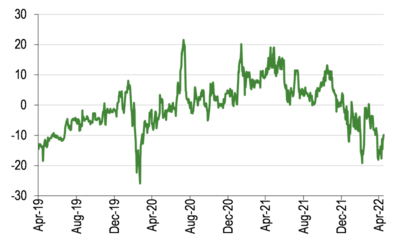

Discount: Potential to narrow after difficult spellEdit

Since the bounce back from the global market sell-off in March/April 2020 in response to the emerging COVID-19 pandemic, HBMN’s shares have broadly traded at a premium to NAV, averaging 2.9% over the two years to 20 May 2022. However, the recent declines in growth stocks generally and biotech in particular have seen the share price drift to a discount, standing at 10.0% on 20 May 2022, on the back of relatively muted falls in the NAV per share. Given its substantial holdings in unlisted companies, coupled with a conservative valuation approach, HBMN’s NAV tends to be less volatile in down markets than is the case for funds invested only in listed equities. However, despite the fund’s superior performance record, the current discount is the second widest in the peer group (see Exhibit 12), suggesting scope for a re-rating should market sentiment improve. In the past 12 months HBMN’s shares have traded in a range from a 19.0% premium to a 19.2% discount to NAV, although in aggregate the discount/premium has been relatively narrow, averaging a 1.9% premium over one year and discounts of 0.2% and 6.2%, respectively, over three and five years. As such it has not been necessary for the board to take any action to manage the discount or premium, although Edison Investment Research notes that a new share buyback facility will be proposed at the shareholders’ meeting on 10 June 2022, replacing the current programme, which has been in place (although unused) since June 2019.

Exhibit 14: Discount/premium over three years[14]

Exhibit 15: Buybacks and issuance[15]

Fund profile: Public/private healthcare investorEdit

HBMN is a Switzerland-based healthcare investment company that has been listed on the SIX Swiss Exchange since 2008. It began life in 2001 as HBM BioVentures, and has since evolved from a pure private equity investor focused on the biopharmaceutical sector, into a globally diversified portfolio of listed and private healthcare companies and private equity funds. Many of the listed holdings were originally private investments that HBMN’s management has continued to back following their stock market debuts. While its main aim is to achieve long-term capital growth for its investors, the fund also offers a high distribution policy, paying out c 3–5% of NAV each year.

HBMN measures its performance with reference to the MSCI World Health Care Index (in Swiss franc terms). However, given the significant proportion in unlisted holdings and the lack of exposure to ‘big pharma’, investors should be prepared for the fund’s performance to differ materially from that of the index (as it did on the upside in FY21 and on the downside in FY22). In particular, its conservative approach to valuing private investments can limit the volatility of returns, although it should be noted some of these companies may be earlier-stage and therefore at higher risk of disappointing clinical outcomes.

The fund publishes fortnightly NAVs, monthly summary factsheets and full portfolio valuations are available quarterly. It is overseen by a non-executive board (mainly made up of pharmaceutical industry specialists), with the fund management team being led by Chief Executive Officer Andreas Wicki and Chief Financial Officer Erwin Troxler.

Investment process: Seeking opportunities far and wideEdit

While it has its roots in private equity investment, HBMN now invests across the spectrum of smaller listed (usually sub-$2bn market cap) and unlisted companies in the healthcare and biotechnology sectors, as well as in private equity funds. The team focuses on companies with innovative platforms and drug candidates. With a significant proportion of the listed companies (70.2% at 31 March 2022) having started out in the unlisted portfolio, the fund manager now reports its listed investments in two segments (those originating as private holdings, and those bought as public companies). HBM Partners has teams specialising in private and listed equity and the teams meet with each other weekly to discuss clinical and market developments. Most of the investment team members have a life sciences background.

HBMN follows a bottom-up approach, selecting stocks from an investment universe of c 1,000 companies to build a diversified portfolio of c 60–100 investments with solid long-term growth potential. To generate investment ideas, the teams track clinical trends, attend industry conferences and communicate with a network of industry experts and executives. They then analyse potential investments both quantitatively and qualitatively, assessing the companies’ intellectual property and stakeholder involvement, and write up a summary of the opportunity, which may include a recommendation to invest.

On the private equity side, the team sources deals through its own networks, as well as via investment banks, other venture capital investors and directly, aiming typically to make eight to 12 deals each year (11 new private investments in FY22, following an exceptional 24 in FY21). HBMN seeks to be an active lead or co-lead investor, sharing entrepreneurial responsibility with a firm’s management team, and securing board representation. A clear expectation of an exit, usually either through an initial public offering (IPO) or trade sale, is inherent in all private investments. In recent times many of HBMN’s new private positions have been taken specifically as pre-IPO ‘crossover’ investments, with the expectation of flotation in a matter of months, although some private holdings have been in the portfolio for a number of years.

The private portfolio is characterised by a conservative approach to valuation, with most positions held at acquisition cost. They may be revalued up or down when a financing round with a third-party lead investor establishes a new ‘price’, and will be written down in steps of 25%, 50%, 75% or 100% in response to negative clinical or regulatory developments. Positive developments are reflected only at the point of a liquidity event, such as a third-party financing round, IPO or trade sale. The exception is where a private company has significant revenues and profits, in which case it will be valued based on appropriate sales or earnings multiples. In the listed portfolio, valuations are based on market prices and reflect positive or negative sentiment and/or developments as they occur.

HBMN’s managers seek to build a portfolio that is diversified by geography, clinical focus and development stage. The private equity funds portfolio has a tilt towards emerging markets, where it may be harder for the team to assess individual private opportunities. The overriding aim is to generate long-term capital growth, although there is also a focus on downside protection and the managers may use hedges in the public portfolio or to manage currency exposure (currently unhedged). Positions are continually reviewed and risk management also includes ongoing monitoring of global markets and macroeconomic developments.

HBMN’s approach to ESG

It is clear that any investment strategy targeting companies that are developing innovative solutions to intractable medical problems is helping to provide a social benefit as new treatments come to fruition, aligning it with the third UN Sustainable Development Goal, ‘Good Health and Well-Being’.

HBMN also makes the following sustainability statement in its FY22 annual report: ‘The Company primarily invests in emerging enterprises whose products are still in the development stage. These companies are mostly active in research and development. Greenhouse gas emissions and the consumption of natural resources are low compared to other industries and their negative impact on the environment is correspondingly minor. By investing exclusively in the healthcare sector, the Company provides capital for innovative businesses. These enterprises develop breakthrough therapies that help improve the health and well-being of people around the world. This also creates jobs, usually in young, dynamic companies that offer a modern working environment with equal rights and opportunities for their employees.’

On the governance side, a thorough assessment of the quality of management is fundamental to HBM Partners’ investment process, and as an active investor in earlier-stage and private companies, HBMN helps contribute to the performance of its holdings through board representation by its investment consultants at numerous portfolio companies.

Gearing: New lower-cost CHF100m bond trancheEdit

HBMN is modestly geared via two tranches of straight (ie not convertible) bonds amounting to CHF150m (equating to c 7.7% of net assets at 16 May 2022), maturing in July 2023 and July 2027. A previous CHF50m bond tranche matured in July 2021 and was replaced with a new CHF100m issue (maturing in 2027) with an effective interest rate of 1.32% (versus 2.67% for the CHF50m tranche). However, at 31 March 2022, the gearing was more than offset by cash and equivalents and HBMN had a net cash position of 3.4% (CHF74.8m).

Fees & charges: No performance fee earned in FY22Edit

HBM Partners is paid an annual management fee of 0.75% of HBMN’s NAV plus 0.75% of its market cap, calculated and paid quarterly. Based on four quarter-ends of FY22 (to 31 March 2022), Edison Investment Research calculates ongoing charges to be 1.78% at the year-end (FY21: 1.29%), reflecting declining capital values in the second half of the year. A performance fee, equal to 15% of the excess performance above the hurdle, may also be paid if the year-end NAV per share (before accounting for any performance fee) is more than 5% above the high-water mark (the year-end NAV at which a performance fee was last paid). After a particularly strong performance from the portfolio in FY21 (with the year-end NAV standing at CHF309.25, or 45.9% above the previous high-water mark), the performance fee earned by HBM Partners was substantial at CHF120.7m (5.6% of net assets), with a further CHF8.0m in variable compensation paid to the board. However, more challenging conditions in FY22 meant the NAV ended the year some 9.5% below the current high-water mark of CHF315.27, so no performance fee has been earned in respect of the year just ended.

Capital structure: Diverse base but thinner volumesEdit

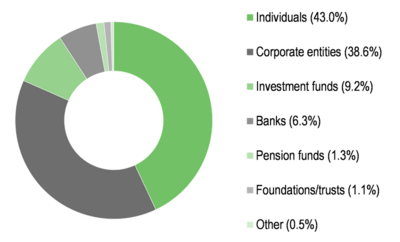

Exhibit 16: Major shareholders[16]

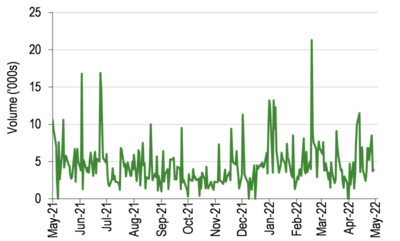

Exhibit 17: Average daily volume[17]

HBMN is structured as a closed-ended investment company with one class of share, listed on the SIX Swiss Exchange. It has 7.0m ordinary shares in issue, unchanged since the start of FY19. As shown in Exhibit 16, the fund is owned by a diverse range of shareholder types, with only one entity (Nogra Pharma Invest, which holds c 16% of the shares) having an interest of more than 3%. Exhibit 17 shows an average daily traded volume of 4,500 shares (0.06% of the share base) over the 12 months to 16 May 2022; this is down markedly from c 7,100 shares (c 0.10% of the share base) in the previous 12 months, reflecting a generally more difficult demand environment for healthcare investments, also shown in HBMN’s wider discount to NAV (see Exhibit 15).

The boardEdit

| Board member | Date of appointment | Remuneration in FY22 (CHF)* | Shareholdings at end-FY22 |

| Hans Peter Hasler (chairman) | 2009 | 140,000 | 12,841 (+5,131) |

| Dr Rudolf Lanz | 2003 | 70,000 | 2,791 (+156) |

| Mario G Giuliani | 2012 | 51,367 | 1,104,132*** (+2,643) |

| Dr Stella X Xu | 2020 | 50,000 | 608 (+608) |

| Dr Elaine V Jones** | 2021 | 50,000 | 0 (0) |

Following the retirement of three long-serving board members, Prof Dr Heinz E Riesenhuber, Dr Eduard E Holdener and Robert A Ingram, at the June 2021 AGM, HBMN now has five directors – three men and two women – with an average tenure of nine years. All of the board members have relevant scientific and/or business expertise, and each director has specific responsibilities regarding the monitoring of HBMN’s portfolio and the wider market environment. The chairman, Hans Peter Hasler, covers regulatory (FDA) approval and sector and marketing strategies; Mr Giuliani monitors management, production and audit; Dr Lanz (a lawyer and corporate financier) also covers audit, as well as finance and M&A transactions; Dr Xu assesses research and development; and Dr Jones brings sector and venture capital expertise.

ActionsEdit

To invest in HBM Healthcare Investments, click here.

To contact HBM Healthcare Investments, click here.

NotesEdit

- ↑ Source: Refinitiv, Edison Investment Research. Total returns in sterling.

- ↑ Source: HBM Healthcare Investments, Edison Investment Research. Note: *Originally held in private portfolio. **Private company.

- ↑ 3.0 3.1 Source: HBM Healthcare Investments, Edison Investment Research.

- ↑ 4.0 4.1 Source: HBM Healthcare Investments, Edison Investment Research. Note: Data at 31 March 2022.

- ↑ Source: HBM Healthcare Investments, Edison Investment Research.

- ↑ Source: HBM Healthcare Investments, Edison Investment Research. Note: *Classified by most advanced development stage.

- ↑ Source: Refinitiv, HBM Healthcare Investments. Note: All % on a total return basis in Swiss francs.

- ↑ Source: Refinitiv, Edison Investment Research. Note: Three-, five- and 10-year performance figures annualised.

- ↑ Source: Refinitiv, Edison Investment Research. Note: Three-, five- and 10-year performance figures annualised.

- ↑ Source: Refinitiv, Edison Investment Research. Note: Data to end-April 2022. Geometric calculation.

- ↑ Source: Refinitiv, Edison Investment Research.

- ↑ Source: Morningstar, Edison Investment Research. Note: *Performance as at 19 May 2022 based on ex-par NAV. TR = total return. Net gearing is total assets less cash and equivalents as a percentage of net assets (100 = ungeared).

- ↑ Source: HBM Healthcare Investments, Edison Investment Research.

- ↑ Source: Refinitiv, Edison Investment Research.

- ↑ Source: Morningstar, Edison Investment Research.

- ↑ Source: HBM Healthcare Investments, as at 31 March 2022.

- ↑ Source: Refinitiv. Note 12 months to 16 May 2022.

- ↑ Source: HBM Healthcare Investments. Notes: *Board fees are made up of a fixed fees (a base fee of CHF94,000 for the chairman, CHF43,000 for the vice-chairman and CHF28,000 for the other directors, plus fees for meetings and committee attendance), plus a variable amount based on the fund’s performance (no performance-related fees in FY22). The variable fees are funded out of the performance fee received by the manager. **Appointed at June 2021 AGM. ***Shares are held mainly by Nogra Pharma Invest, in which Mario G Giuliani has a beneficial interest.