Wireless EV charging: certified hardware + software commercially available today

SummaryEdit

HEVO's wireless charging technology meets the universal safety and performance standards for wireless EV charging developed by UL and the Society of Automotive Engineering (SAE). As a first-mover introducing a commercial-ready wireless EV charging platform featuring seamlessly integrated hardware and software, HEVO is well-positioned to dominate the rapidly expanding EV charging marketplace. This is evidenced by (1) a significant, recent investment from Obsidian Investment Partners; (2) a robust business development pipeline including multiple RFQs from major auto OEMs and Tier 1 auto suppliers; and (3) HEVO’s selection as the exclusive commercialization partner for DOE-funded wireless charging technologies developed by Oak Ridge National Labs. HEVO’s charging platform is designed to support the mass scaling and adoption of electric and autonomous vehicles by creating an exceptional user experience for drivers and fleets.

- Wireless EV charging system meeting UL and SAE standards

- Tier 1 agreement paves way for software installation on thousands of EVs

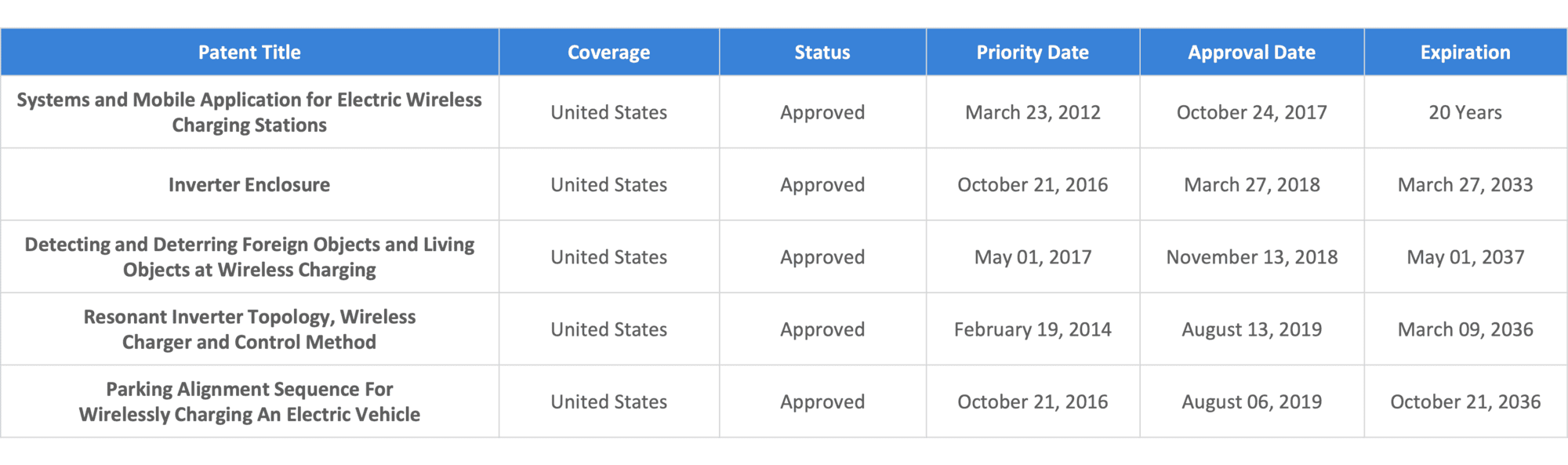

- Robust IP portfolio featuring 21 patent families

- Successful pilots with major global auto and energy companies

- Efficient cost structure, significantly below all competitors

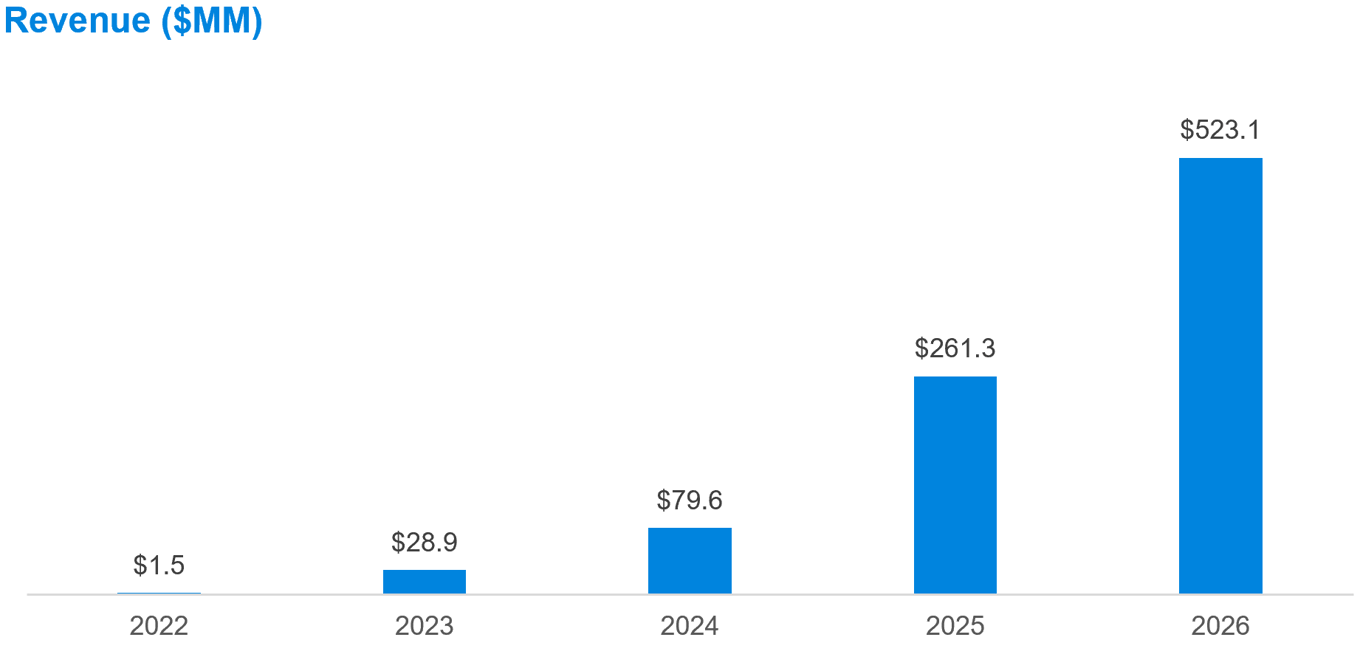

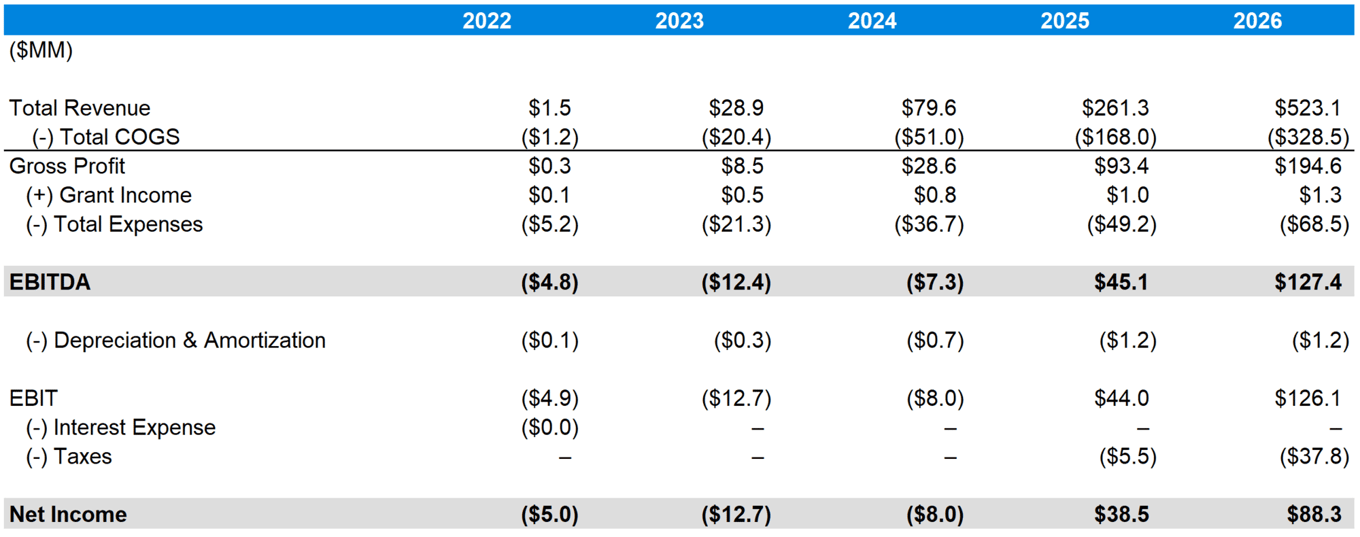

- Revenue projected to exceed $500M by 2026

ProblemEdit

Plugin EV charging has critical limitationsEdit

Competing connectorsEdit

Plugin charging lacks a universal protocol, with many charging locations requiring more than three different connector types.

Fueling costEdit

Pay-as-you-go chargers are often expensive, with opaque pricing structures; free charging is typically slow and over-utilized.

Fragmented networksEdit

There is limited interoperability between networks, requiring multiple accounts, apps, keycards, & RFID fobs to access and pay.

Limited scalabilityEdit

Plug-in charging does not easily scale with forecast global EV adoption, and is not suited for autonomous EVs.

The bottom line:Edit

Plug-in charging is a bottleneck for EV adoption and for the growth of the EV industry

SolutionEdit

A wireless EV charging networkEdit

HEVO is building the global wireless charging standard for electric vehicles—providing users with a simple charging experience and a complete, integrated EV transportation app.

Exceptional convenienceEdit

Designed for scaleEdit

Highly cost-efficientEdit

In short, its wireless charging standard will enable the company to create a durable, scalable network that supports widespread EV and autonomous vehicle adoption.

ProductEdit

A complete hardware and software solutionEdit

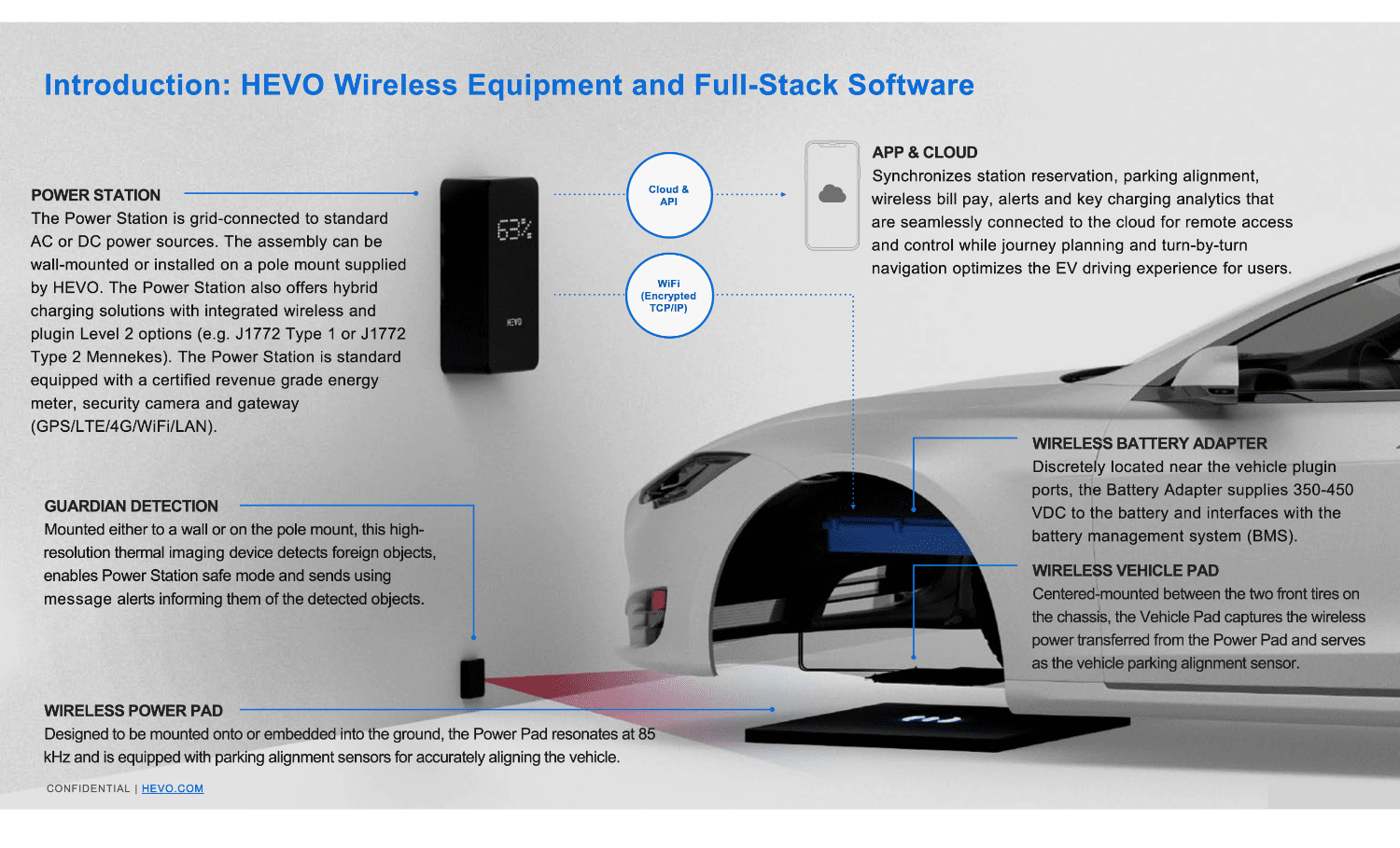

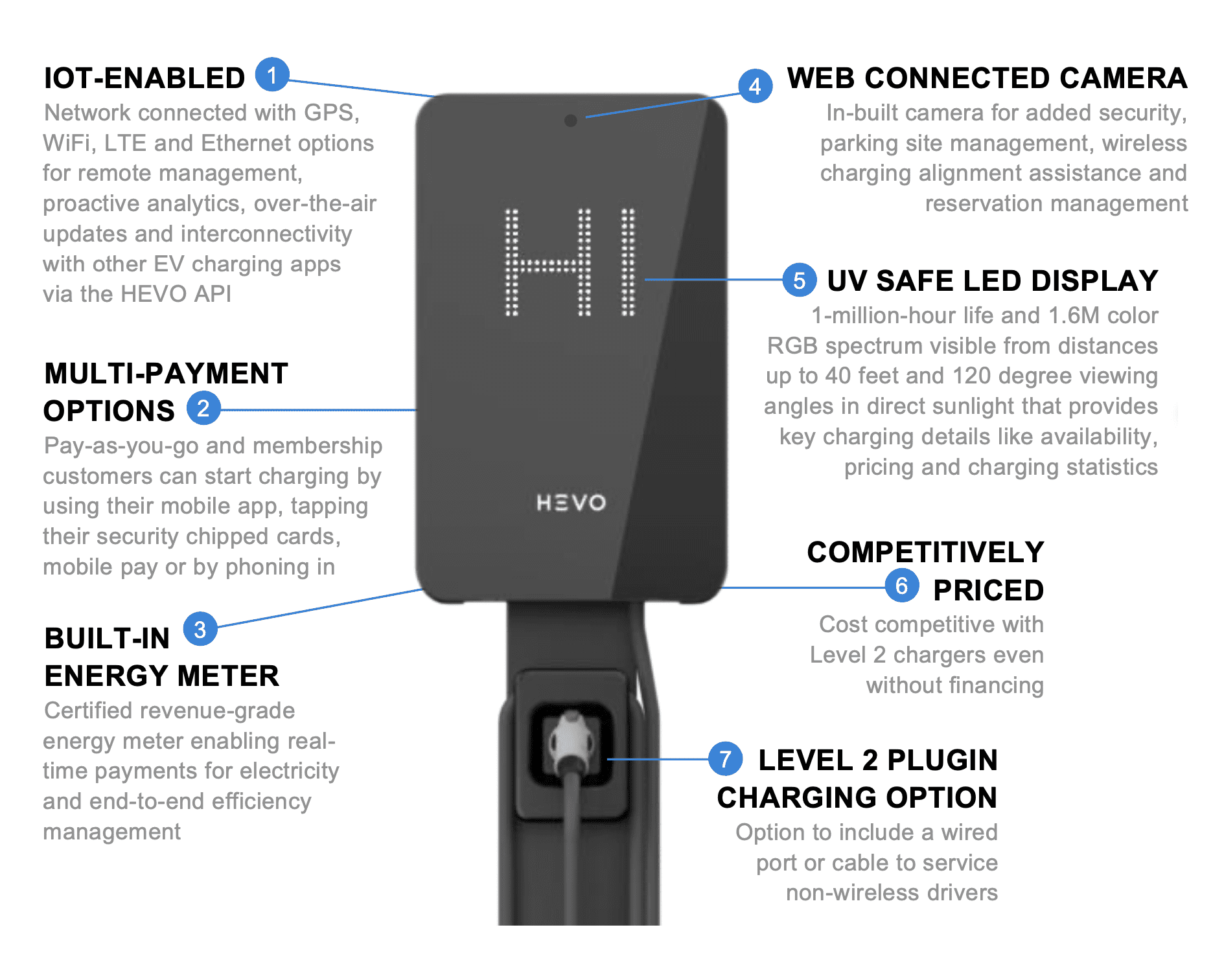

HEVO’s core product is a hardware and software solution for electric vehicle charging called Rezonant E8. It’s comprised of four main components:

- Power station—wall- or pole-mounted with the option to offer integrated wireless and plugin Level 2 charging (Level 2 charging stations plug into a 240V outlet--like a clothes dryer or oven--and deliver more power to the car to charge it faster).

- Vehicle assembly (Wireless Battery Adapter and Wireless Vehicle Pad)—can be installed on any EV

- Wireless power pad—mounted onto or embedded into the ground

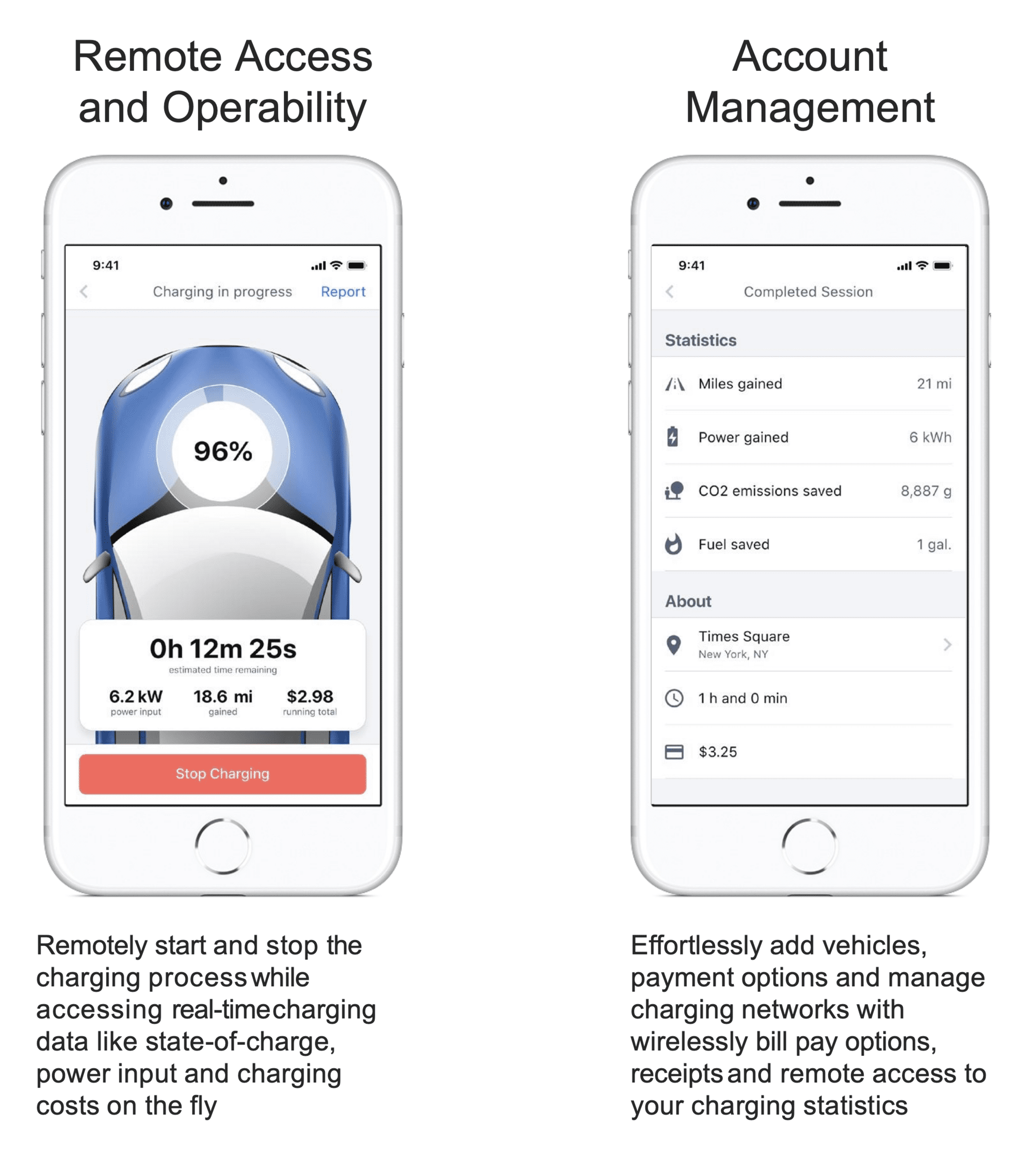

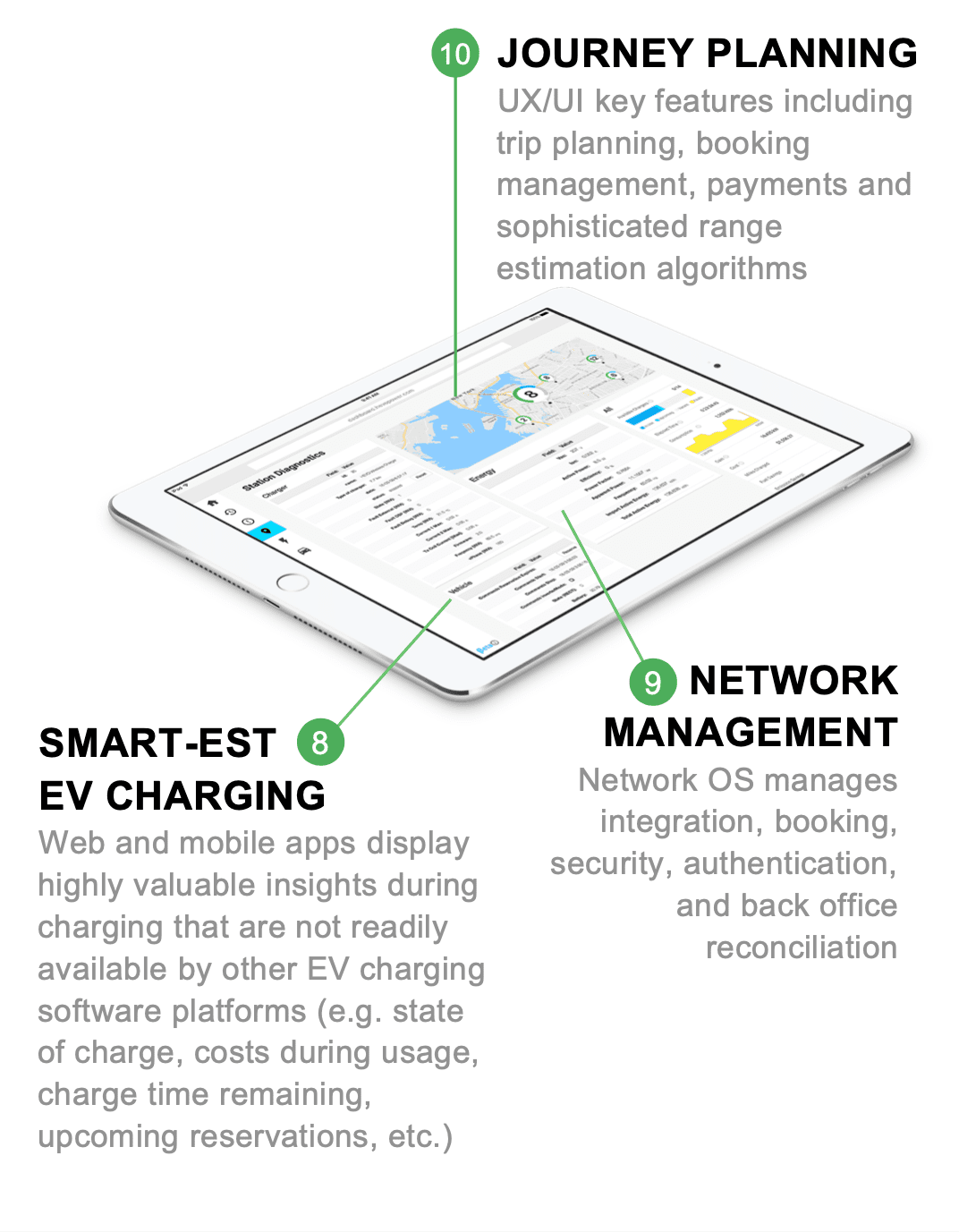

- App and cloud platform—synchronizes parking alignment, bill pay, charging analytics, and other key user services

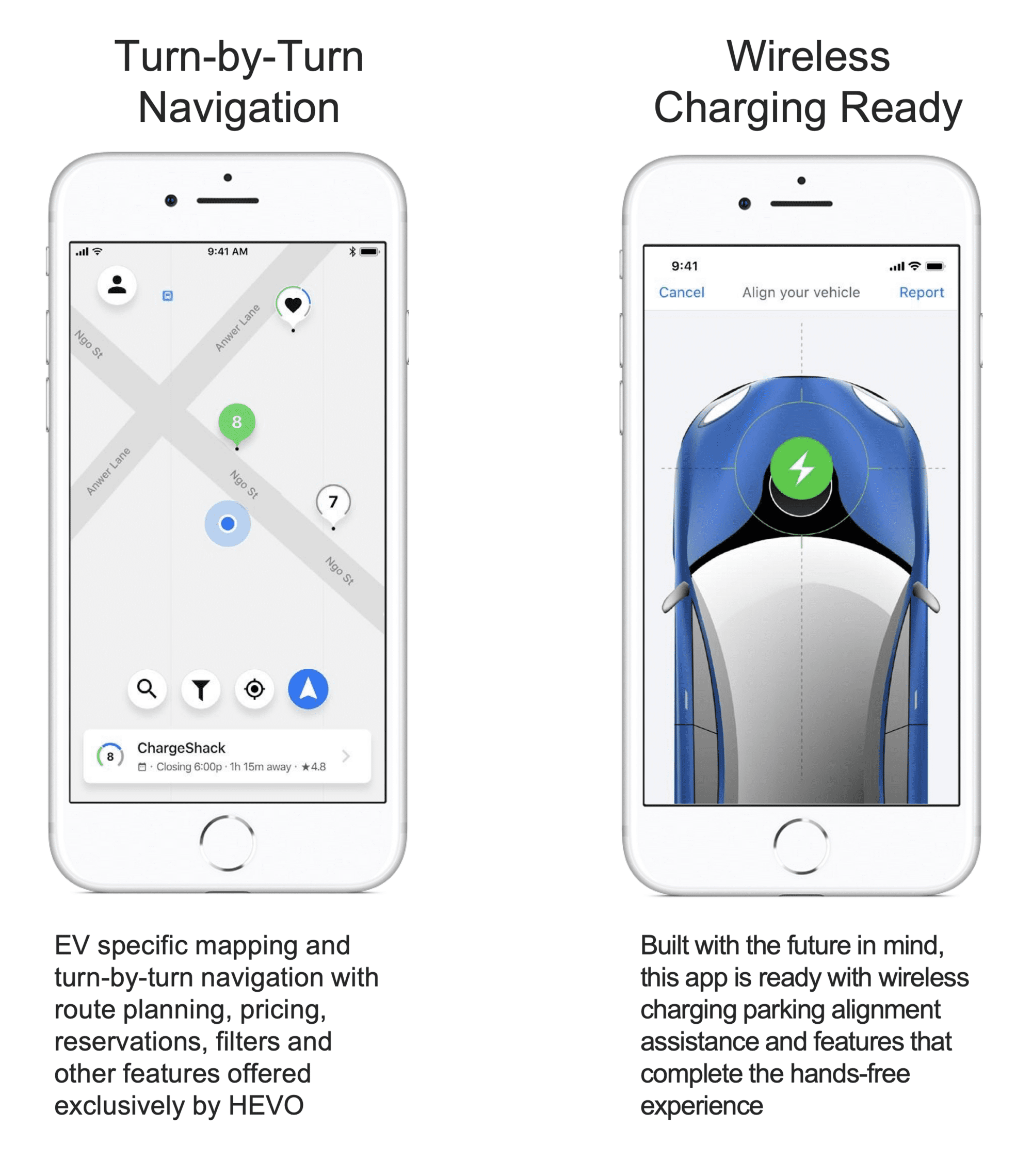

HEVO's software product for end users also works like a replacement for Maps and Waze, and includes route planning, pricing, reservations, and other travel features. This integrated approach allows the company to build its user base and community, acting as a lead generation tool.

A seamless user experienceEdit

10 key tech featuresEdit

TractionEdit

Significant traction with OEM manufacturers and Tier 1 suppliers

Completed pilotsEdit

The company has completed several pilot projects with leading multinational companies. They have either executed or are finalizing formal agreements with global automakers and Tier I auto industry suppliers—creating a potential path for the Company’s platform to become the industry standard for hundreds of thousands of EVs.

Manufacturing and shipment of the company’s commercial product commenced in 2021, and management is preparing to scale production beginning in 2022. Company revenue projections exceed $500M by 2026.

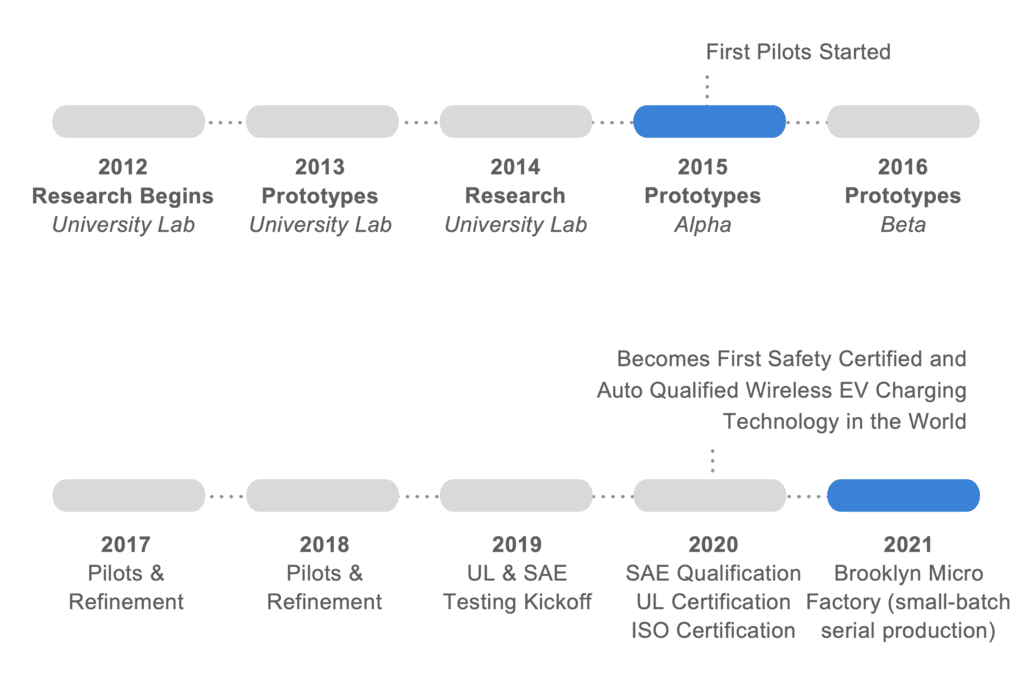

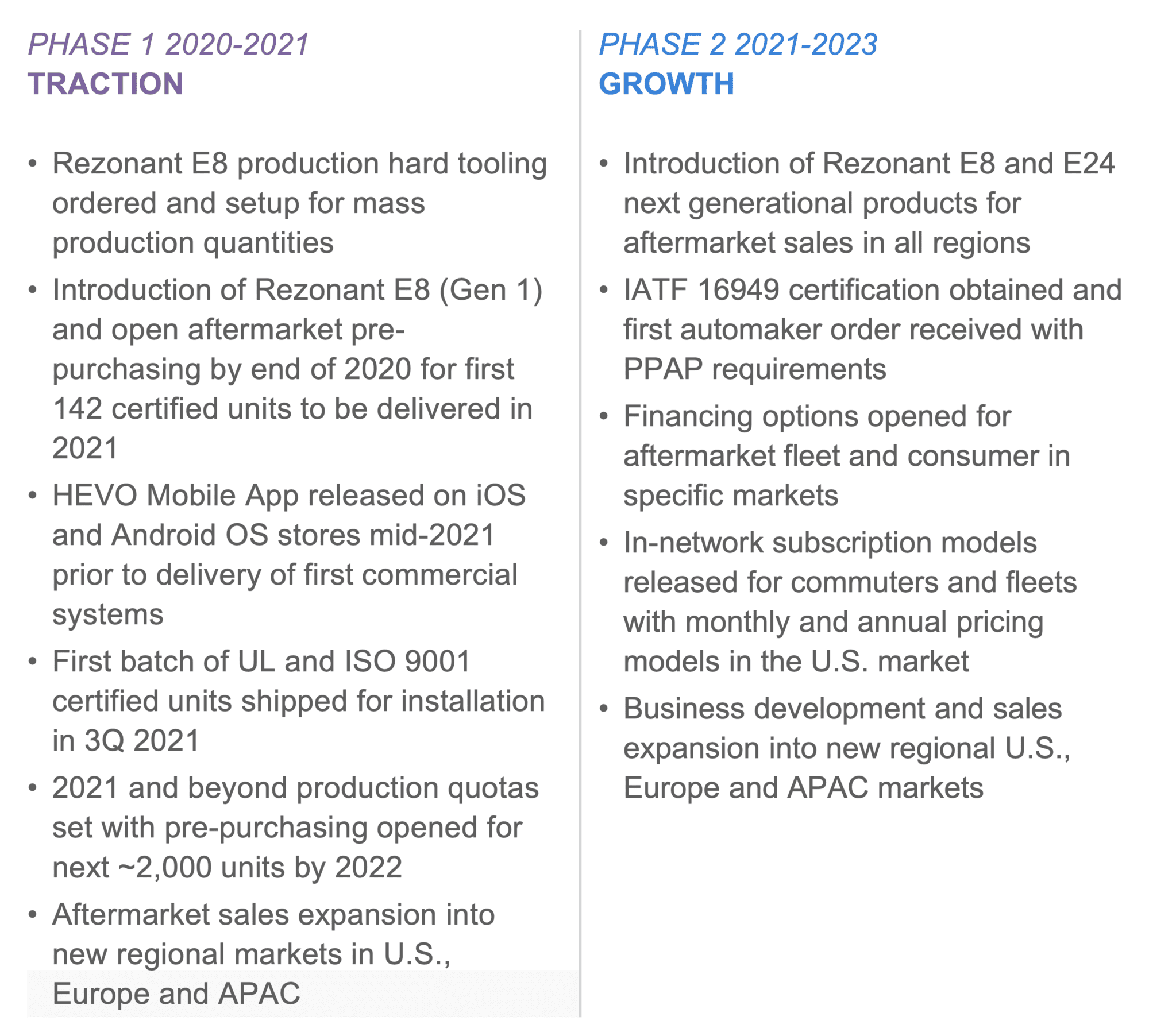

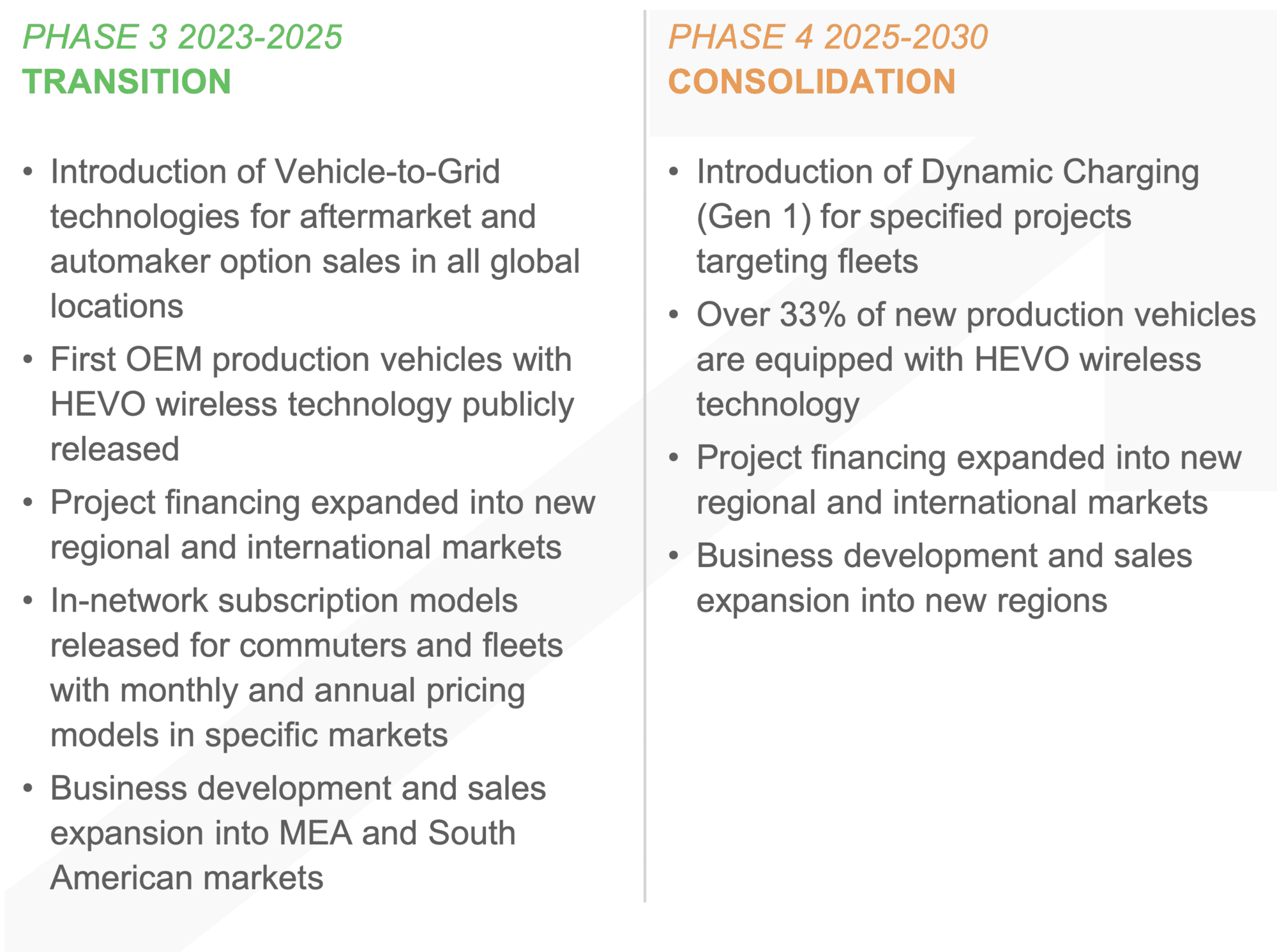

Technology timelineEdit

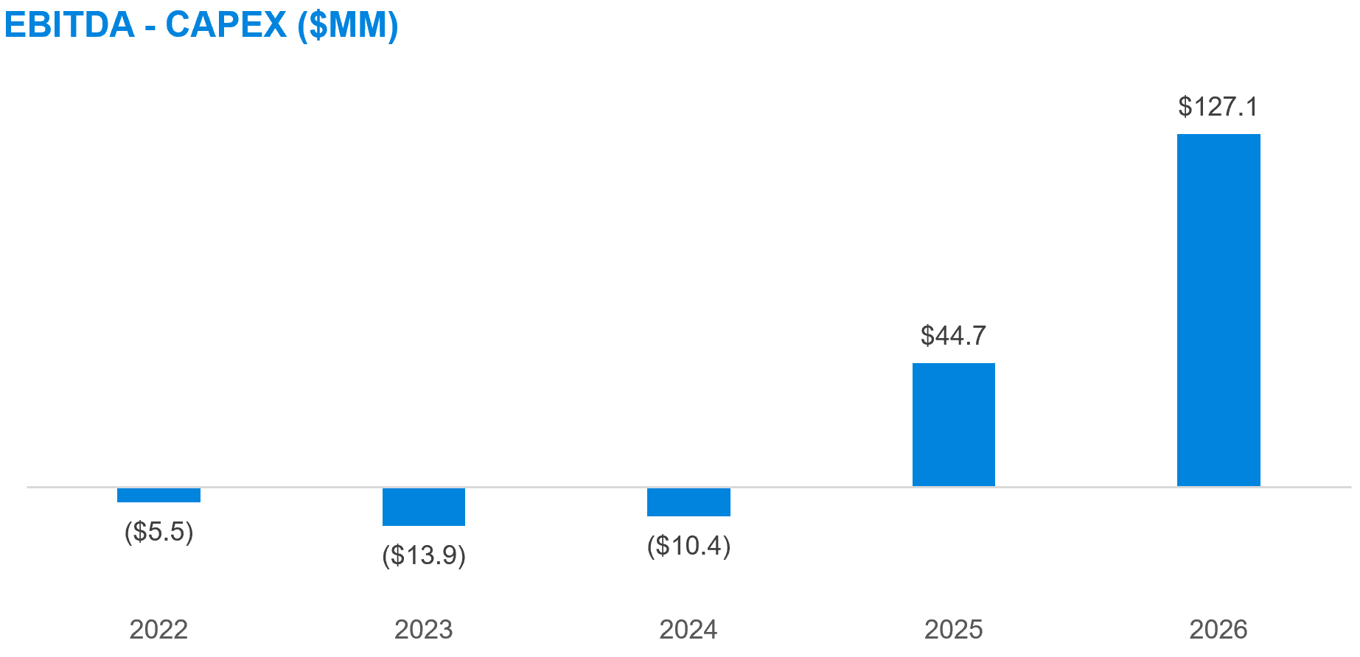

Financial overviewEdit

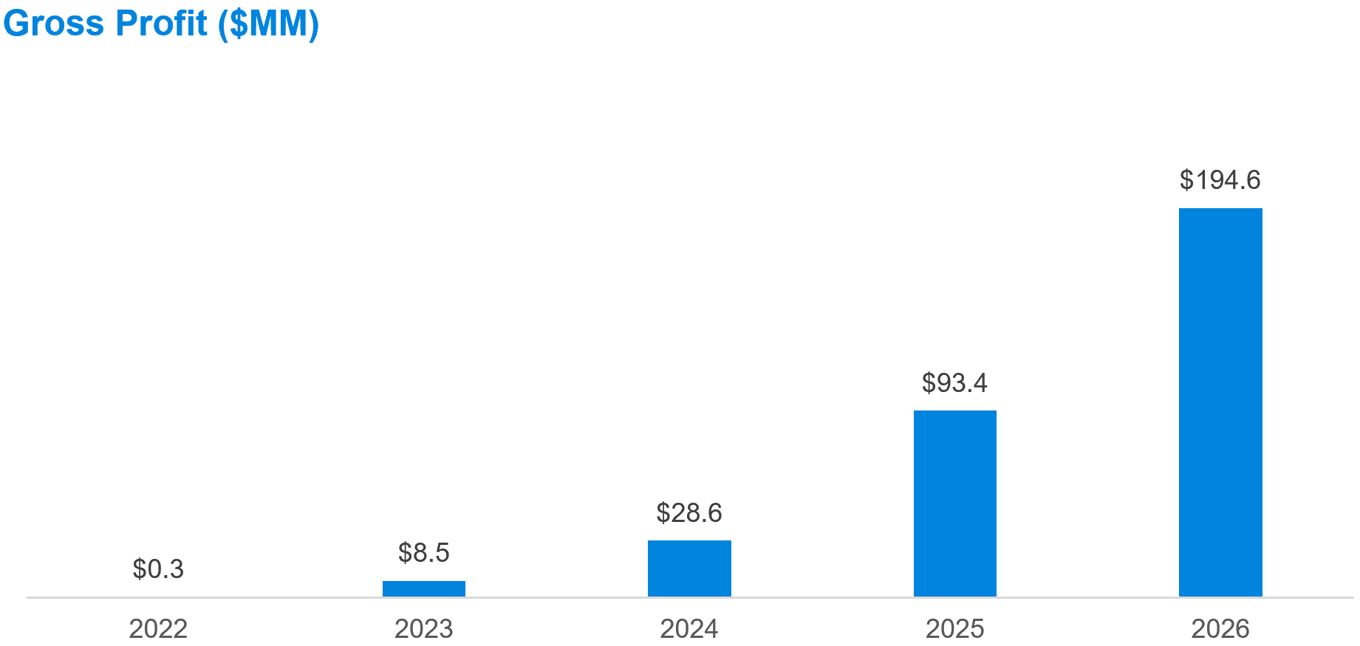

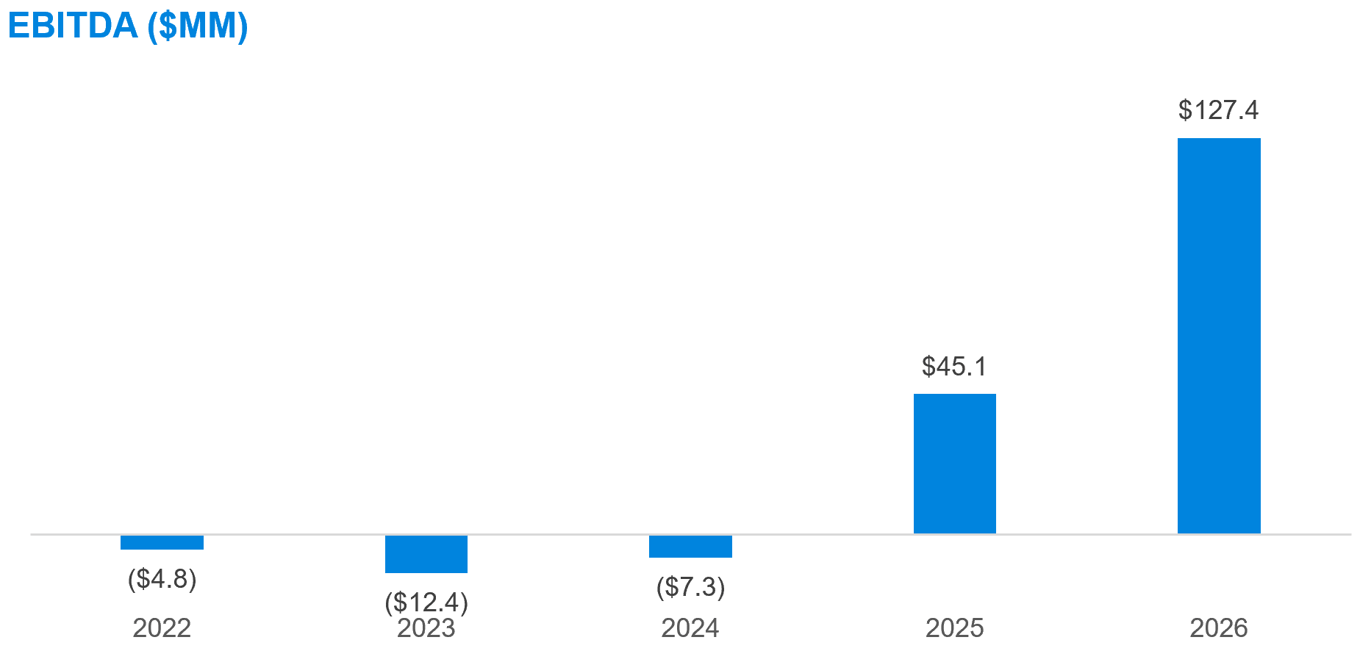

HEVO is on path for accelerated revenue and EBITDA generation through its unique business model and state-of-the-art products.

Income statementEdit

CustomersEdit

Addressing an unmet need in the EV charging marketEdit

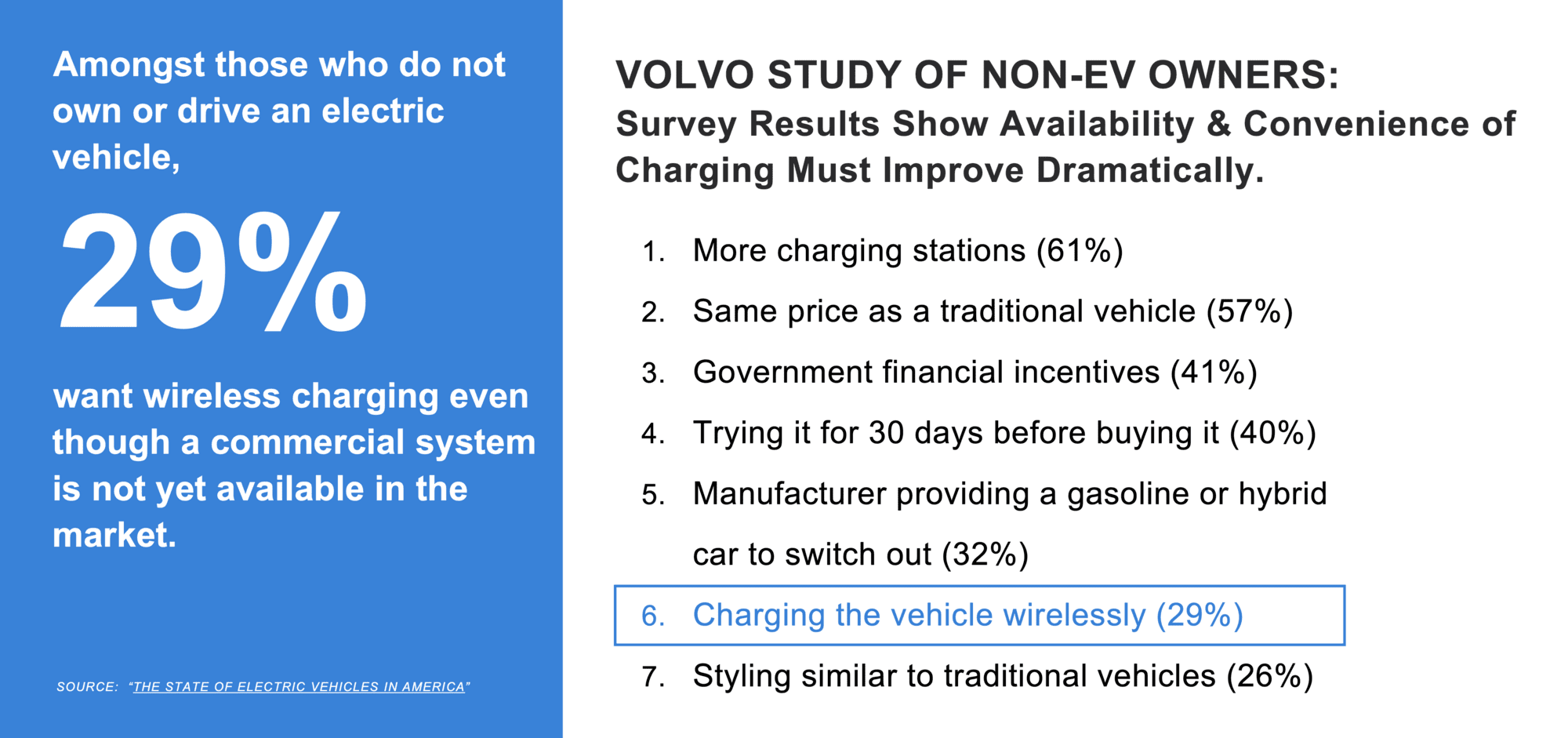

The pathway to mass adoption of EVs and the accompanying significant reduction in CO2 emissions is a simple, frictionless EV driver experience.

FleetsEdit

Fleets represent a significant near-term opportunity for the company. HEVO is actively engaging with taxi, delivery, public transportation, rental and other fleets for the aftermarket retrofit of vehicle assemblies and deployment of wireless charging stations.

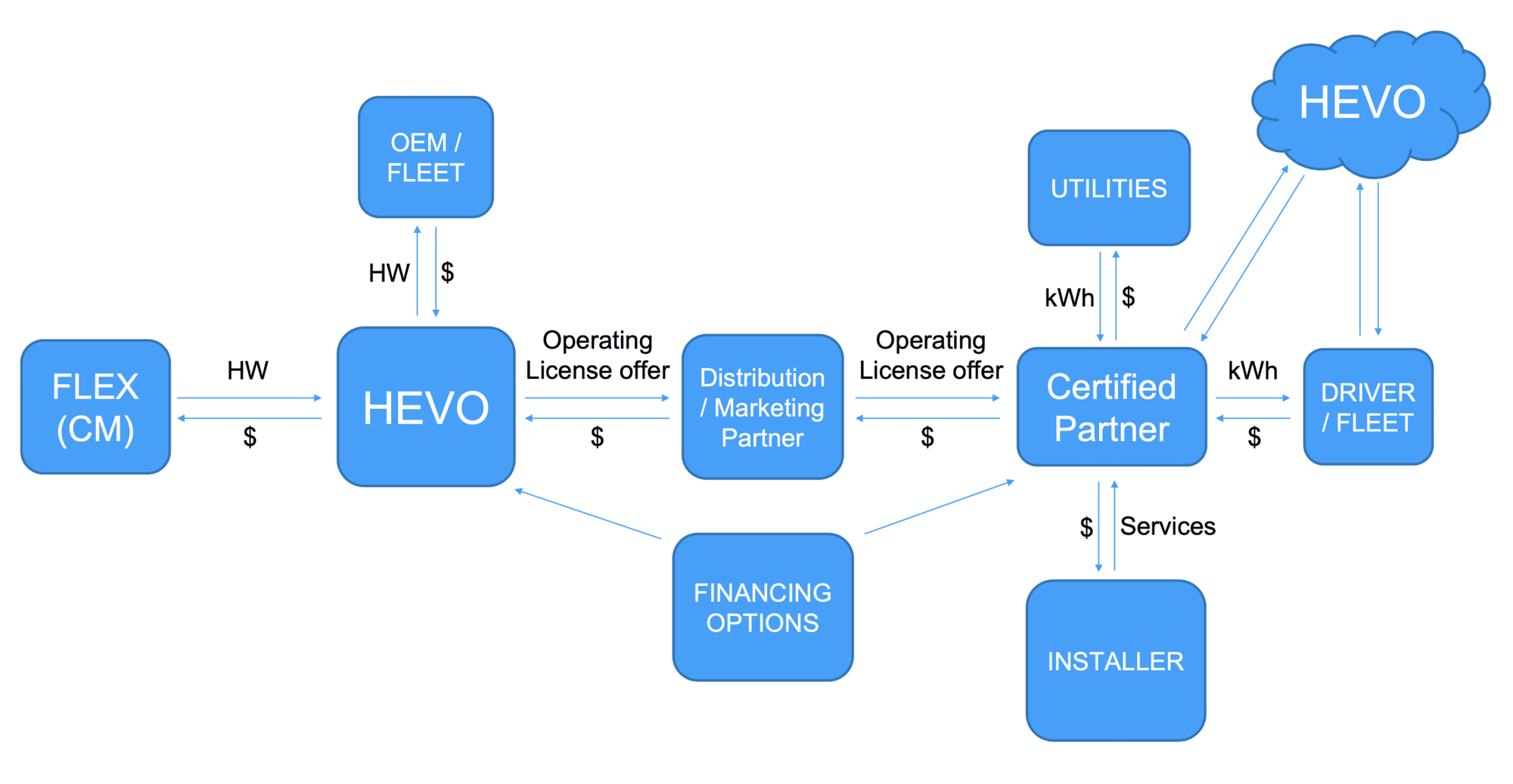

Certified PartnersEdit

Its certified partners are the installers of EV charging infrastructure for charging networks in the US, EU and Australia. Certified partners purchase EV wireless charging systems from HEVO wholesale, and then sell those systems retail to their customers. Please see the business model section for additional information.

AutomakersEdit

HEVO is in the RFI/RFP process with multiple global automotive OEMs and Tier 1 automotive suppliers. HEVO's goal is to nurture these relationships and pave the way for HEVO's wireless charging vehicle-side equipment to be factory built into multiple EV makes and models.

E-CommerceEdit

Working with dealership networks, HEVO will eventually offer an aftermarket retrofit solution to any EV driver that wants to go wireless.

Business modelEdit

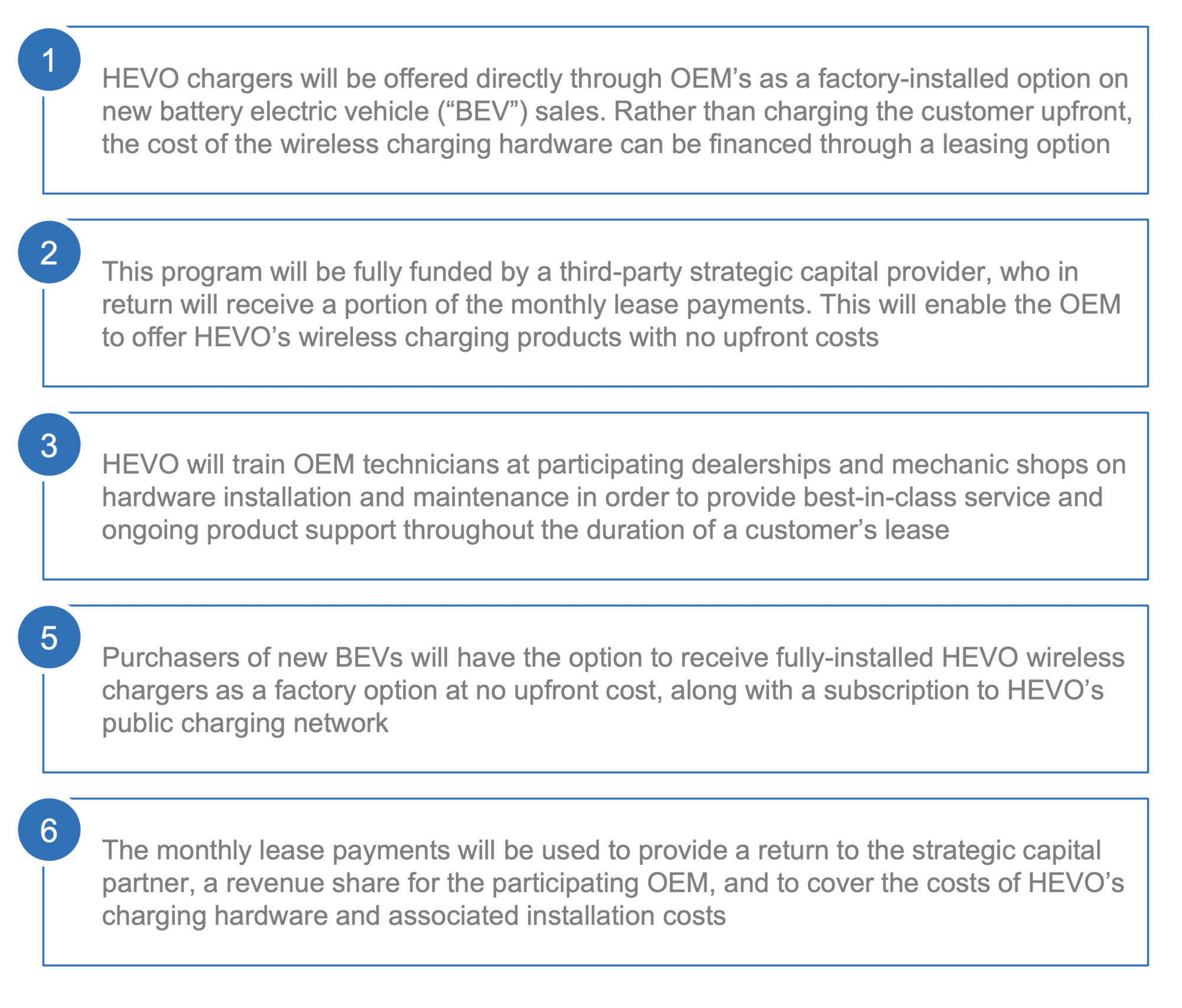

OEM lease and subscription recurring revenue opportunity

B2B Model for Fleets and CustomersEdit

While EV drivers and fleets are the ultimate end-users of HEVO products, its direct customers are its certified distributors and Automotive OEMs.

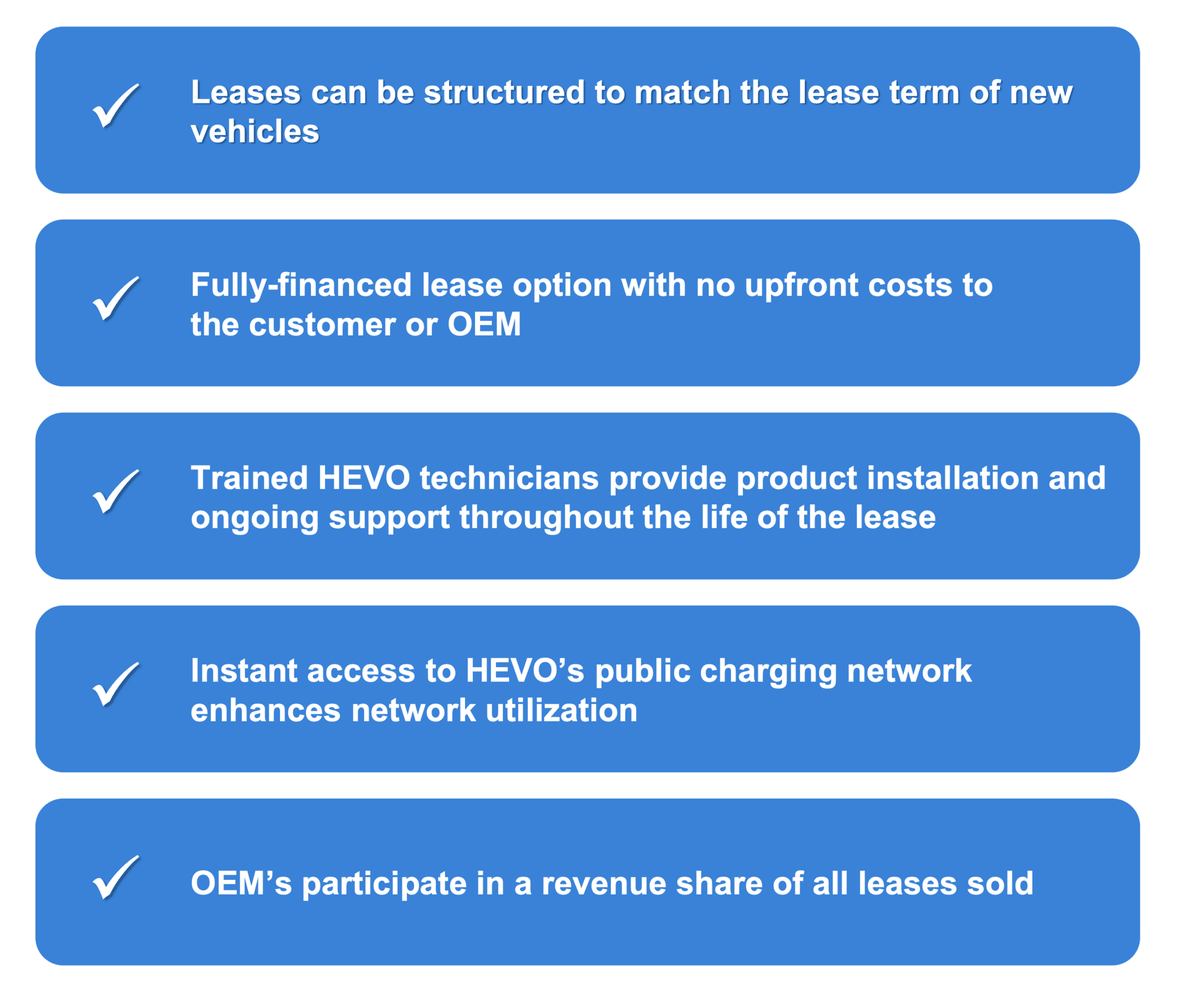

HEVO is partnering with leading OEMs to develop a unique leasing program that will enable EV buyers to lease HEVO equipment directly from the manufacturer with no upfront costs.

Lease program overviewEdit

Lease program benefitsEdit

"Certified Partner" business model mitigates uncertainty and reduces risksEdit

MarketEdit

Wireless charging market analysisEdit

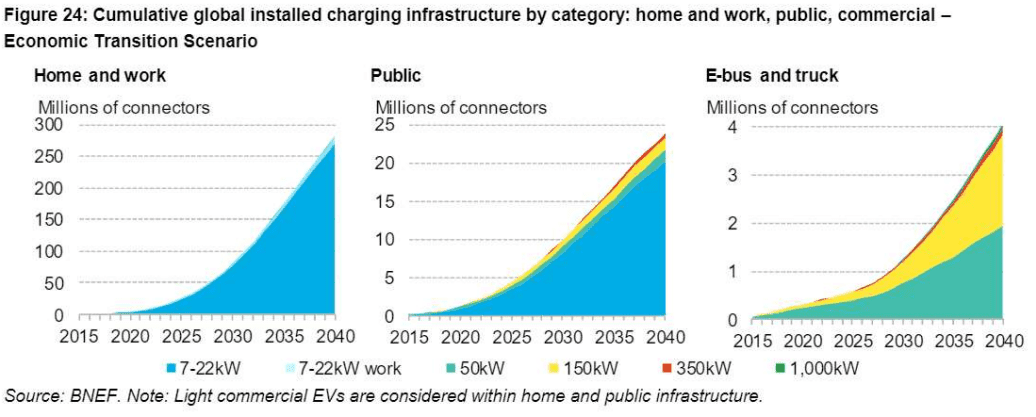

$50B EV charging infrastructure opportunity by 2030

"Representing an estimated $50 billion of cumulative capital investment through 2030. On average, a level 2 charger used in a home costs less than $1000; one used in a workplace or in public can cost between $3000 and $5000. A DCFC starts at about $25,000 and, depending on the power capacity, can rise to more than $200,000 for each unit."

"Charging Ahead: Electric Vehicle Infrastructure Demand" (McKinsey & Company)

Wireless vehicle charging TAMEdit

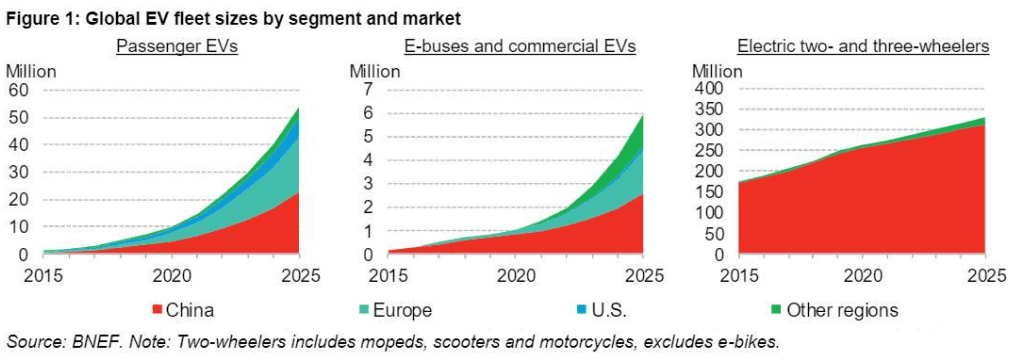

Based on HEVO's involvement in the RFI/RFQ process with multiple OEMs and Tier 1s regarding wireless charging integration, HEVO estimates that more than 2 million EVs will have SAE J2954 approved wireless hardware installed by 2025. HEVO expects the number of EVs with wireless hardware installed to greatly exceed 10 million by 2030, and approach 50 million by 2035.

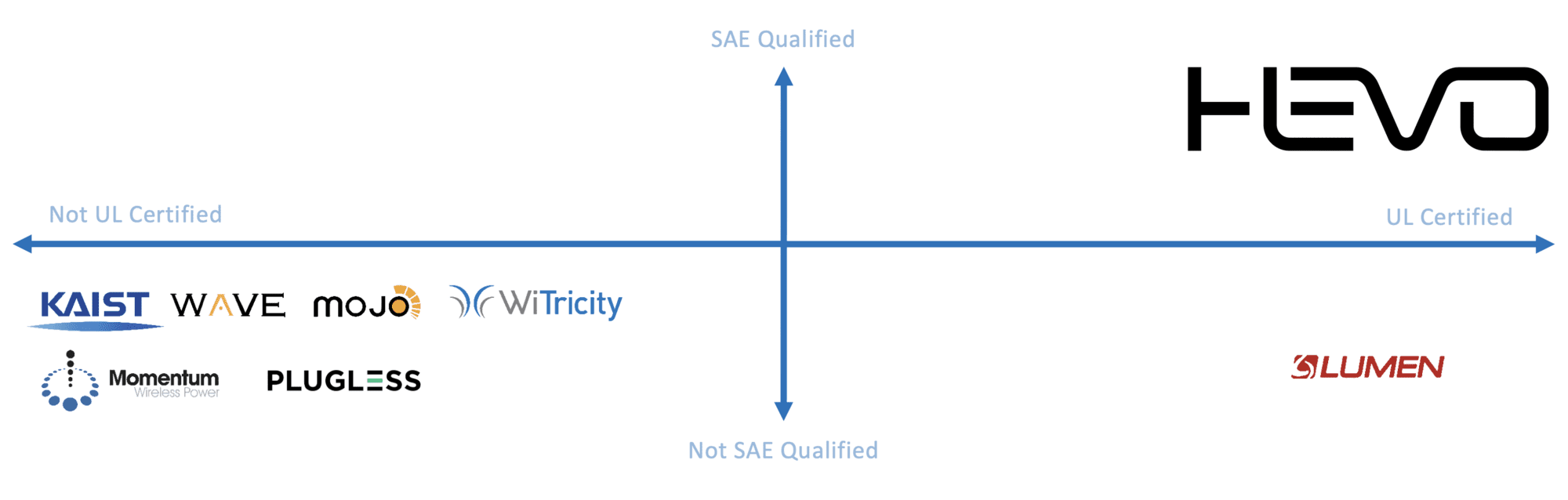

CompetitionEdit

Positioned to become a global leader of wireless EV chargingEdit

HEVO introduced a certified, commercial-ready product and software platform. Hevo began shipping certified units in mid-2021.

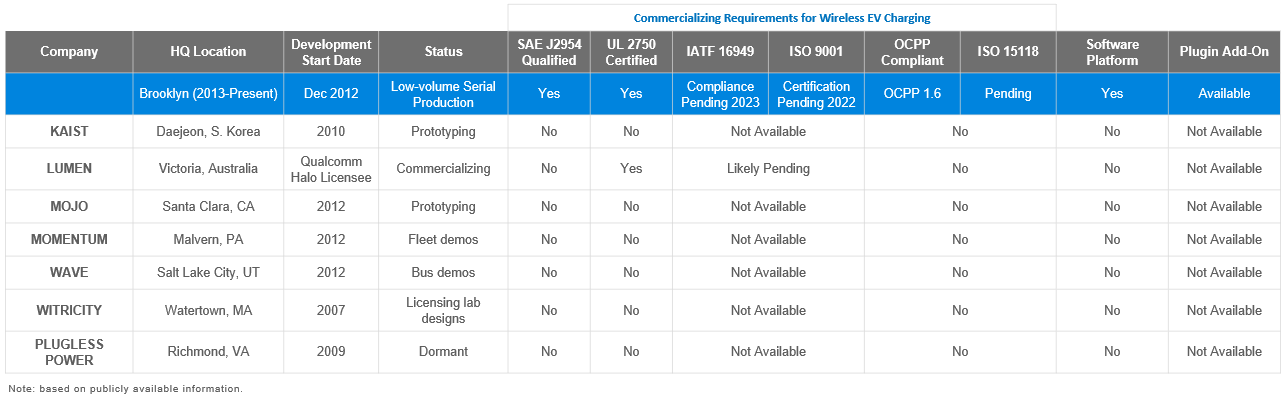

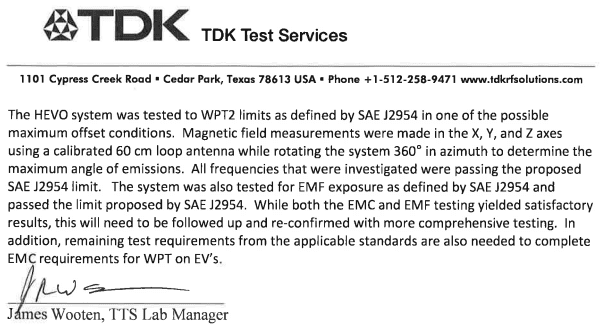

In January 2020, HEVO successfully tested below the required EMI-EMF thresholds set by the then newly established SAE J2954 (global wireless EV charging standard).

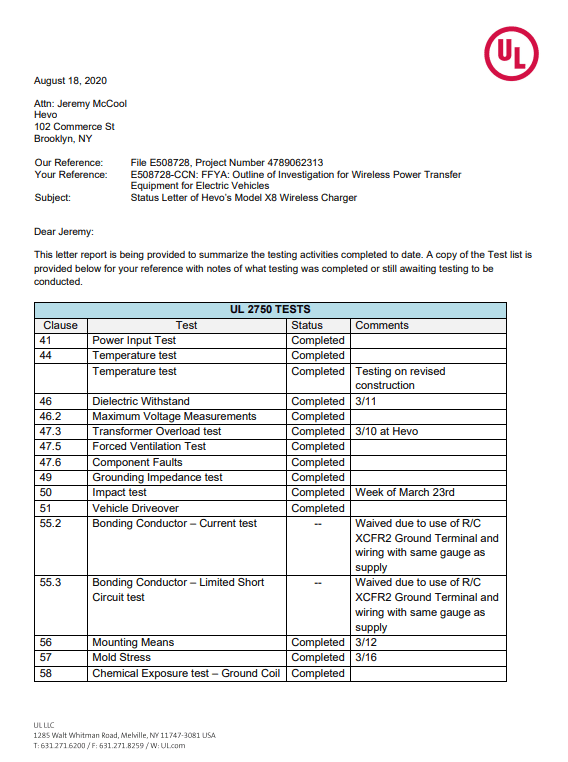

In August 2020, Hevo completed UL 2750 certification, the required global safety certification for any commercializing SAE J2954 technology.

Commercialization requirements for wireless EV chargingEdit

SAE J2954: International and universal standard for interoperability and safe operation of wireless EV Charging.

UL 2750: International and universal safety certification for wireless EV charging production, marketing and sales.

IATF 16949: International certification for automotive quality management systems required to sell and distribute automotive grade equipment.

ISO 9001: International certification for automotive quality management systems required to sell and distribute automotive grade equipment.

OCCP: International communications protocol and certification for EV charging infrastructure back office communication standardization.

ISO 15118: International communications protocol and certification for EV charging infrastructure to grid communication standardization

HEVO met the SAE J2954 requirements in January 2020Edit

UL 2750 safety certificationEdit

Intellectual property protectionEdit

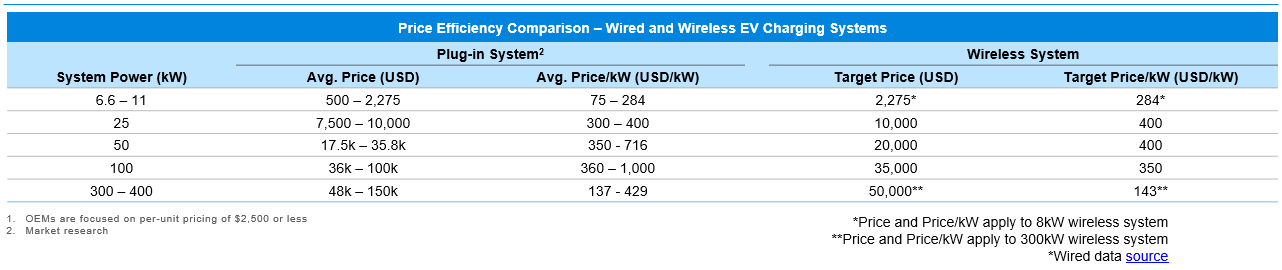

Wireless EV charging presents significant cost advantages to wired systemsEdit

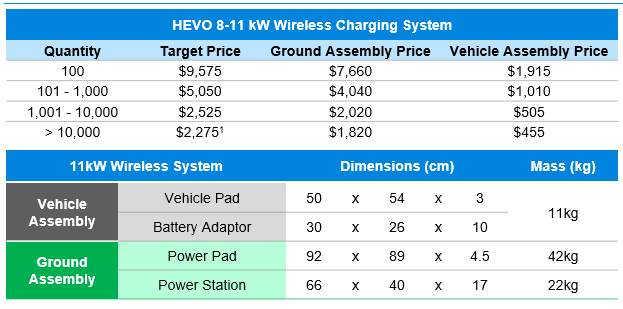

HEVO Rezonant Level 2 systemEdit

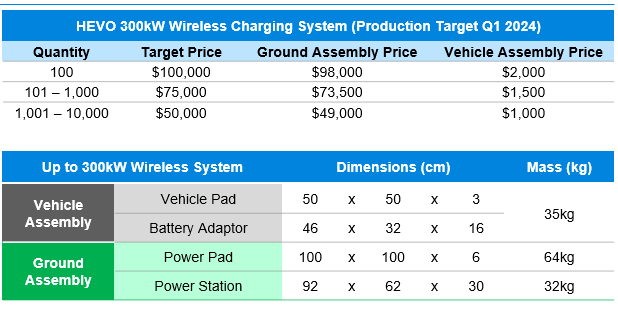

Hevo Rezonant fast charging systemEdit

Plug-in vs. wireless cost and efficiency comparisonEdit

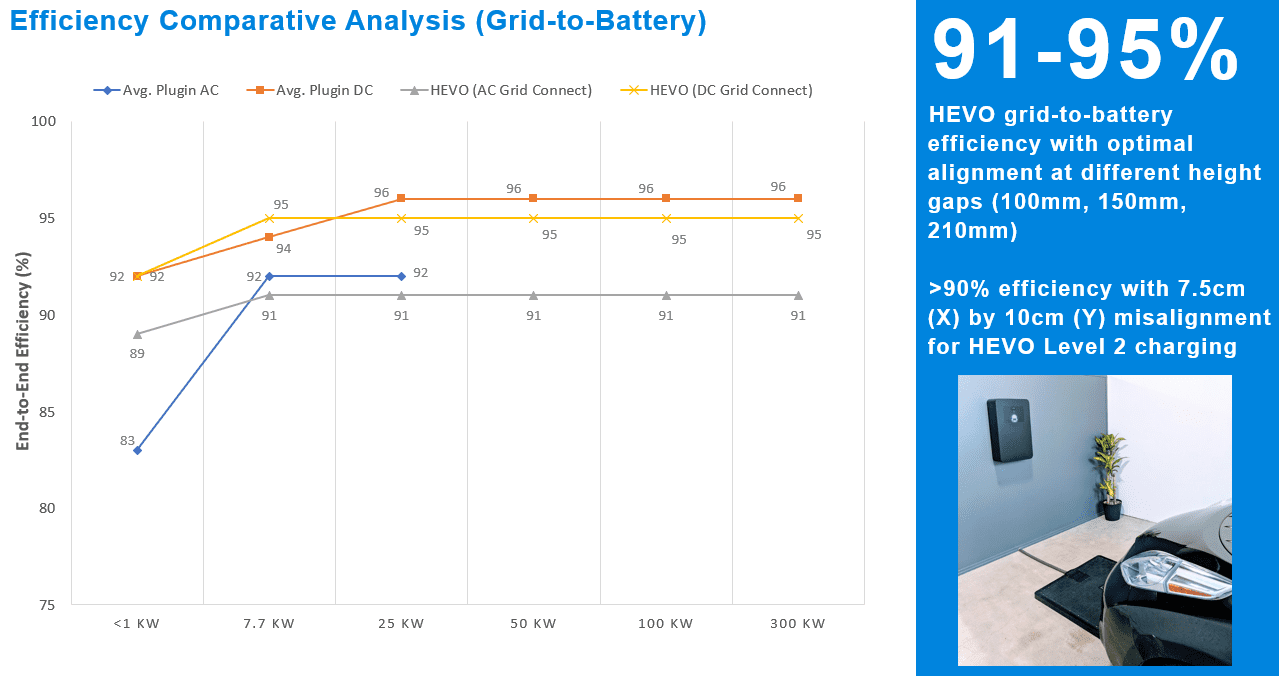

Efficiency comparative analysis (grid-to-battery)Edit

Vision and strategyEdit

Be the global unifying network for interoperable, ubiquitous EV chargingEdit

In 2022, Hevo aims to:

- Relocate HQ to >10x size of Brooklyn facilities

- Launch the Journey app

- Engage 2-5 auto OEMs and/or Tier 1s on internal projects or tech review for future factory built-in wireless solution

- Engage in 2-5 fleet projects or tech review for large follow-up orders

- Secure 2-5 aftermarket distributor agreements for fleet/consumer wireless solutions

- Recruit up to 15 new personnel for ops, engineering, BD

- Certify and commercialize 11kW system and pre-certify 25kW and V2G platforms

Go-to-market strategyEdit

Applications for HEVO's unique creativity and passionEdit

- Automation of business models and use cases such as route planning and dynamic charging travel lanes

- Seamless integration with autonomous vehicles and renewable energy for optimized grid management

- Increase EV adoption by disabled and senior drivers potentially hindered by heavy cables and cords

- Opportunistic route charging for buses, taxis and fleets improves air quality and optimizes grid utilization

FundingEdit

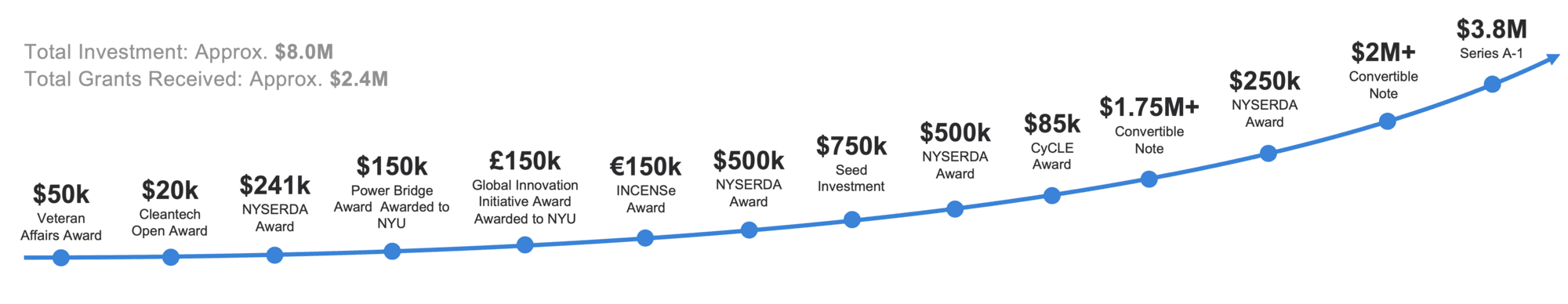

$10.4M raised to dateEdit

HEVO has raised $10.4M to date, with approximately $8.0M in dilutive equity capital and $2.4M in grant funding. We've raised capital from numerous notable investors and donors, including Veteran Affairs Award, NYSERDA Award, and the CyCLE Award.

Funding milestonesEdit

FoundersEdit

Veteran-founded

Following a 15-month tour in Baghdad as a U.S. Army officer, Jeremy McCool made a personal pledge to reduce global dependence on foreign and fossil fuels. Upon exiting the military, Jeremy entered Columbia University’s School of International and Public Affairs (SIPA) and completed his MPA with a focus in urban policy and sustainability. During his final year at Columbia, Jeremy founded HEVO in November 2011, with the vision of creating the global standard for universal and ubiquitous electric vehicle wireless charging.

RisksEdit

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

The Company has a limited operating history and lack of revenues from operations.

The Company was organized in 2011 to develop and sell products and related software to charge electric vehicles. Since its inception the Company has focused on the development of this product and software and has realized minimal revenues and lacks both significant operating history and the financial resources to fully implement its business plan. As such, the Company faces risks and uncertainties relating to its ability to successfully implement and expand its business plan, to expand its operations, and begin to generate (and grow) revenues from operations. The Company’s ability to successfully generate significant revenues from operations is dependent on a number of factors, including its ability to develop, market, and expand the distribution of its products, applications, and related services. It is likely that the Company will encounter setbacks with its business plan. Ultimately, if the Company is unable to generate significant revenues or raise additional capital to cover its operating costs and fund future growth, the Company’s results of operations and financial condition will be materially and adversely affected, and the Company could be forced to curtail or otherwise wind-up its operations.

After completion of the Offering, the Company will likely require additional capital to fully implement its business plan and support business growth; additional capital might not be available on favorable terms, or at all.

The Company expects that its on-going operations and further implementation of its business plan will likely require substantial additional financial, operational, and managerial resources. The Company has insufficient cash on-hand, accounts receivable, or revenues from operations to fully fund the development of its business plan and operations, and other capital requirements. Even if the Company is able to raise the Maximum Offering Amount, the Company will need to raise additional funds to further develop its product offerings and expand operations. When the Company needs to obtain additional funding in the future, it may have to seek debt financing or obtain additional equity capital. Additional capital may not be available, or may only be available on terms that adversely affect existing stockholders, or that restrict Company operations. For example, if the Company raises additional funds through issuances of equity or convertible securities, existing stockholders could suffer significant dilution, and any new equity securities could have rights, preferences, and privileges superior to those of existing stockholders. There can be no assurance that financing will be available to the Company on reasonable terms, if at all. The inability to raise additional funds, either through equity or debt financing, could materially impair the Company’s ability to generate revenues.

Global crises, such as COVID-19, can have a significant effect on its business operations and revenue projections.

A significant outbreak of contagious diseases, such as COVID-19, in the human population could result in a widespread health crisis that could adversely affect the economies and financial markets of many countries, including the United States where Hevo principally operates, resulting in an economic downturn that could reduce the demand for its products and services and impair its business prospects, including as a result of being unable to raise additional capital on acceptable terms to us, if at all. To the extent the COVID-19 pandemic adversely affects its business and financial results, it may also have the effect of heightening many of the other risks described in this Form C. The ultimate extent to which COVID-19 impacts its results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions taken to contain it or treat its impact.

Its future growth and success are dependent upon consumers’ willingness to adopt electric vehicles.

Its growth and future demand for its products is highly dependent upon the adoption by consumers of alternative fuel vehicles in general and electric vehicles in particular. The market for new energy vehicles is still rapidly evolving, characterized by rapidly changing technologies, competitive pricing and competitive factors, evolving government regulation and industry standards, and changing consumer demands and behaviors. If the market for electronic vehicles in general does not develop as expected, or develops more slowly than expected, its business, prospects, financial condition and operating results could be harmed.

Hevo may not be able to establish supply relationships for necessary materials, components or equipment or may be required to pay more than anticipated for components or equipment, which could delay the introduction of its product and negatively impact its business.

Hevo relies on third-party suppliers for components and equipment necessary to develop and manufacture its power stations, power pads, adapters, and chargers. Hevo is collaborating with existing suppliers but have not yet entered into long-term supply agreements for production quantities of these materials. To the extent that Hevo is unable to enter into commercial agreements with these suppliers on beneficial terms, or these suppliers experience difficulties ramping up their supply of materials to meet its requirements, the commercialization of its wireless charging product will be delayed. To the extent its suppliers experience any delays in providing or developing the necessary materials, Hevo could experience delays in delivering on its timelines. Hevo expects to incur significant costs related to procuring materials required to manufacture and assemble the various components of its wireless charging product offering. Hevo expects to need various materials in its wireless charging product that will require the company to negotiate purchase agreements and delivery lead-times on advantageous terms. Hevo may not be able to control fluctuation in the prices for these materials or negotiate agreement with suppliers on terms that are beneficial to us. Its business depends on the continued supply of certain proprietary materials for its products. Hevo is exposed to multiple risks relating to the availability and pricing of such materials and components. Substantial increases in the prices for its raw materials or components would increase its operating costs and negatively impact its prospects. Any disruption in the supply of components, equipment or materials could temporarily disrupt research and development activities or production of its various wireless charging products until an alternative supplier is able to supply the required material. Changes in business conditions, unforeseen circumstances, governmental changes, and other factors could result in an inability for the company to obtain the components and materials and components needed for its products on a timely basis. Any of the foregoing could materially and adversely affect its results of operations, financial condition and prospects.

There is no assurance that the Company will successfully implement its business plan and operations and, if successful, managing future growth.

The Company anticipates that, upon successful completion of the Offering, it will be able to continue development and improvement of its existing wireless charging product and related software and grow its pipeline of prospective customers. In addition, as the Company increases its focus on sales efforts and continues to implement its business plan, the Company may experience periods of rapid growth, including needs for increased staffing levels. Such growth may place a substantial strain on Company management, operational, financial, and other resources. The Company will need to attract, retain, train, motivate, and manage high caliber employees. Failure to do so could have a material adverse effect on the Company’s business, financial condition, and results of operations.

Hevo faces significant challenges in its on-going efforts to further develop and fully commercialize its electric vehicle wireless charging product and to produce it at high volumes with acceptable performance, yields and costs. The pace of development in the electric vehicle market is ultimately not predictable. Delays or failures in accomplishing particular further development objectives may delay or prevent successful commercialization of its product offering.

Developing the equipment and components necessary to meet the requirements for use, and potential wide adoption, by automotive OEMs is a difficult undertaking. Hevo continues to attempt to refine and improve its product offering, and face significant challenges in continuing to improve and enhance the technology and components necessary to commercialize its wireless charging equipment and related technology in commercial volumes. Even if Hevo achieves volume production of the components necessary for its wireless charging product, if the cost, performance characteristics or other specifications of its equipment and technology falls short of its targets, its sales, product pricing and margins would likely be adversely affected. In addition, any delays in the manufacturing scale-up of its wireless charging product would negatively impact its business as it will hamper its revenues and negatively impact its commercial relationships. Delays in the full commercialization of its product would materially damage its business, prospects, financial condition, operating results and brand.

If any component of the equipment necessary for its wireless charging solution fails to perform as expected, its ability to further develop, market, and sell and promote its product could be harmed.

Once commercial distribution of its wireless charging product commences, various equipment and components of the product may contain defects in design and manufacture that may cause them to not perform as expected or that may require repairs, recalls, and design changes. The equipment and components of its wireless charging product is inherently complex and incorporate technology and components that have not been used for other applications and that may contain defects and errors, particularly when first introduced. Hevo has a limited frame of reference from which to evaluate the long-term performance of its wireless charging product. There can be no assurance that Hevo will be able to detect and fix any defects in any component of its wireless charging prior to the sale (or other distribution) to potential consumers. If its product fails to perform as expected, Hevo could lose design wins and customers may delay deliveries, terminate further orders or initiate product recalls, each of which could adversely affect its sales and brand and could adversely affect its business, prospects, and results of operations.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this Form C and the accompanying exhibits.

Interruptions or performance problems associated with the Company’s application, technology and infrastructure may adversely affect the Company’s business and operating results.

The Company’s growth depends in part on the ability of existing and potential customers to utilize Company products at any time and within an acceptable amount of time. The Company may in the future experience disruptions, outages, and other performance problems due to a variety of factors, including infrastructure changes, introductions of new functionality, human or software errors, denial of service attacks, or other security related incidents. It may become increasingly difficult to maintain and improve Company performance as Company products become more complex and as user traffic increases. If Company products and applications are unavailable, or if users are unable to utilize Company products within a reasonable amount of time or at all, the Company’s business would be negatively affected. To the extent that the Company is unable to upgrade its applications and systems as needed, and continually develop Company technology and architecture to accommodate actual and anticipated changes in technology, the Company’s business and operating results may be adversely affected.

A failure to effectively expand the Company’s marketing and sales capabilities could harm its ability to initiate and increase its customer base and achieve broader market acceptance of its products.

The Company’s ability to obtain customers (and users of its product) and thereafter to increase its customer base and achieve broader market acceptance of Company applications and products will depend to a significant extent on the Company’s ability to expand its marketing and sales operations. The Company plans to expand its management team and engage additional personnel, and also plans to dedicate significant resources to sales and marketing programs. All of these efforts will continue to require that the Company invest significant financial and other resources. If the Company is unable to hire, develop, and retain talented sales personnel, if its sales personnel are unable to achieve desired productivity levels in a reasonable period of time, or if the Company’s sales and marketing programs are otherwise not effective, the Company’s ability to increase its customer base and achieve broader market acceptance of its applications and products could be harmed.

The Company relies, in part, on third-party computer hardware, software, and applications to deliver its applications to end users, any of which could cause errors, interruptions, or failures of service which are beyond the Company’s control.

The Company relies on computer hardware and software owned by third parties in order to implement and deliver certain applications and related services. Although the Company attempts to utilize products, and rely on services and components of, reputable third parties, any errors or defects in third-party hardware or software could result in errors or a failure of the Company’s service which could harm its business. Interruptions in service may reduce revenue, cause the Company to issue credits or refunds, and/or cause customers to stop using the Company’s SaaS platform and services, and as a result adversely affect renewal rates and the Company’s ability to attract new customers. The Company’s business will also be harmed if customers and potential customers believe the Company’s services are unreliable.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Changes in federal, state or local laws and government regulation could adversely impact its business.

The Company is subject to legislation and regulation at the federal and local levels and, in some instances, at the state level. New laws and regulations may impose new and significant disclosure obligations and other operational, marketing and compliance-related obligations and requirements, which may lead to additional costs, risks of non-compliance, and diversion of its management's time and attention from strategic initiatives. Additionally, federal, state and local legislators or regulators may change current laws or regulations which could adversely impact its business. Further, court actions or regulatory proceedings could also change its rights and obligations under applicable federal, state and local laws, which cannot be predicted. Modifications to existing requirements or imposition of new requirements or limitations could have an adverse impact on its business.

The market in which the Company participates is competitive, more established companies have certain competitive advantages over the Company, and if the Company does not compete effectively, its operating results could be harmed.

More companies are entering into the electric vehicle space, including service providers and companies focused on charging solutions. The Company’s current and prospective competitors range in size from diversified global companies with significant resources to small, specialized firms whose narrower product lines may let them be more effective in deploying technical, marketing, and financial resources. The area in which the Company competes evolves rapidly with changing and disruptive technologies, shifting user needs, and frequent introductions of new products and services. The Company’s ability to become and then remain competitive depends on its success in making innovative applications that appeal to businesses and consumers. Additionally, many potential competitors enjoy substantial competitive advantages over the Company, such as greater name recognition, longer operating histories and larger marketing budgets, as well as substantially greater financial, technical and other resources. In addition, many potential competitors have established marketing relationships and access to larger customer bases, and have major distribution agreements with consultants, system integrators and resellers. As a result, competitors to the Company may be able to respond more quickly and effectively than the Company can to new or changing opportunities, technologies, standards or customer requirements. The greater capabilities of potential competitors in these areas may enable them to better withstand periodic downturns in the industry and respond more quickly to consumer demands to develop new products and services. Furthermore, because of these advantages, even when the Company’s applications and services are deemed to be more effective than those offered by its competitors, certain potential customers may express a hesitancy to purchase applications and services from an early stage company and instead may prefer applications and services from competitors in lieu of purchasing the Company’s applications and services. For all of these reasons, the Company may not be able to compete successfully against its competitors. The Company’s revenues, profitability and financial condition could be materially adversely affected as a result of the competitive nature of the industry in which the Company competes.

If the Company is unable to continually enhance its product offering, sell its products and solutions into new markets or further penetrate existing markets, its revenue may not grow as expected.

The Company’s ability to increase sales will depend in large part on its ability to enhance and improve its products and solutions, from time to time to introduce new products and solutions in a timely manner, to sell into new markets and to further penetrate existing markets. The success of any enhancement or new product or solution depends on several factors, including the timely completion, introduction and market acceptance of enhanced or new solutions, the ability to attract, retain and effectively train product development, and sales and marketing personnel (among others), the ability to develop relationships with distribution partners and automobile OEMs, developers and managers, and the effectiveness of marketing programs. Any new product or solution developed may not be introduced in a timely or cost-effective manner, and may not achieve the broad market acceptance necessary to generate significant revenue. Any new markets into which the Company attempts to sell products and solutions, including new vertical markets and new regions, may not be receptive. The Company’s ability to further penetrate existing markets depends on the quality of its products and solutions and the ability to design solutions to meet consumer demand. Moreover, the Company may be frequently required to enhance and update its products and solutions as a result of changing standards and technological developments, which likely will make it difficult to recover the cost of development and forces the Company to continually qualify new solutions with consumers. If the Company is unable to successfully develop new products and solutions, enhance existing solutions to meet consumer requirements, sell products and solutions into new markets or sell products and solutions to additional consumers in existing markets, its revenue may not grow as expected or it may decline.

The Company may not generate significant revenues as a result of its on-going and proposed research and development efforts.

The Company has made, and expects to continue to make, significant investments in research and development and related product opportunities. The Company intends to use a portion of the proceeds of the Offering for such purposes. High levels of expenditures for research and development could harm the Company’s results of operations, especially if not offset by corresponding future revenue increases. The Company believes that it must dedicate a significant amount of resources to research and development efforts to establish and enhance a competitive position. However, it is difficult to estimate when, if ever, the Company will generate significant revenues as a result of these investments.

The Company’s intellectual property rights are valuable, and any inability to protect them could reduce the value of the Company’s brand image and harm its business and operating results.

he Company has acquired, and expects to create, own, and maintain a wide array of intellectual property assets, including patents, copyrights, trademarks, trade secrets, and rights to certain domain names, which the Company believes are, or will be, among its most valuable assets. The Company has sought, and expects to seek, to protect its intellectual property assets through copyright, trade secret, trademark, and other laws of the United States, and through contractual provisions, but not through the use of patents. The efforts the Company has taken, or may take, to protect its intellectual property and proprietary rights may not be sufficient or effective at stopping unauthorized use of those rights. There may be instances where the Company is not able to fully protect or utilize its intellectual property assets in a manner to maximize competitive advantages. If the Company is unable to protect its proprietary rights from unauthorized use, the value of the Company brand may be reduced. Any impairment of the Company’s brand could negatively impact its business. In addition, protecting Company intellectual property and other proprietary rights will likely be expensive and time consuming. Any unauthorized use of Company intellectual property could make it more expensive to do business and consequently harm Company operating results.

Hevo operates in a highly regulated environment, and if Hevo is found to be in violation of any of the federal, state, or local laws or regulations applicable to us, its business could suffer.

Hevo is also subject to a wide range of federal, state, and local laws and regulations. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of its license to operate the subject business. As a result, Hevo may incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

The Company may be sued by third parties for alleged infringement of their proprietary rights, which could be costly, time-consuming, and limit the Company’s ability to use certain technologies in the future.

Although the Company believes it either owns or has the right to use all intellectual property and information utilized in the application that is a part of its product offering and services, as the developer of applications the Company may become subject to claims that its software and applications infringe upon the intellectual property or other proprietary rights of third parties. Any claims, with or without merit, could be time-consuming and expensive to defend, and could divert management’s attention away from the execution of the Company’s business plan. Moreover, any settlement or adverse judgment resulting from these claims could require the Company to pay substantial amounts or obtain a license to continue to use the disputed technology, or otherwise restrict or prohibit the Company’s use of the technology. There can be no assurance that the Company would be able to obtain a license on commercially reasonable terms, if at all, from the third party asserting the claim, or that the Company would be able to develop alternative technology on a timely basis, if at all, or that the Company would be able to obtain a license to use a suitable alternative technology to permit it to continue offering, and Company customers to continue using, affected products. An adverse determination also could prevent the Company from offering its applications and services to others. Infringement claims asserted against the Company may have a material adverse effect on the Company’s business, results of operations, and financial condition.

Failure to maintain the security of information and technology networks, including information relating to users or distributors of the Company’s product could adversely affect the Company’s reputation, business, results of operations, and financial condition.

The legal, regulatory, and contractual environment surrounding information security, privacy, and fraud is constantly evolving and companies that collect and retain such information are under increasing attack by cybercriminals around the world. The Company is dependent on information technology networks and systems, including the Internet, to process, transmit, and store electronic information and, in the normal course of business, the Company collects and retain certain information, including financial information, from and pertaining to its customers (and their customers). Security measures put in place by the Company cannot guarantee security, and the Company’s information technology infrastructure may be vulnerable to criminal cyber-attacks or data security incidents due to employee or third-party negligence, error, malfeasance, or other vulnerabilities. Cyber security attacks are increasingly sophisticated, change frequently, and often go undetected until after an attack has been launched. The Company may fail to identify these new and complex methods of attack, or fail to invest sufficient resources in security measures.

The Company is dependent on its key personnel, and the loss of any could adversely affect its business.

The Company depends on the continued performance of its management and advisory team, particularly its founder Jeremy McCool, who has contributed significantly to the Company’s products and the planning and development of its business. If the Company were to lose the services of its key personnel and were unable to locate suitable replacements for such persons in a timely manner, it could have a material adverse effect on the Company and its plan of operations.

In order for the Company to compete and grow, it must attract, recruit, retain and develop the necessary personnel who have the needed experience.

Recruiting and retaining highly qualified personnel is critical to its success. These demands may require the company to hire additional personnel and will require its existing management and other personnel to develop additional expertise. Hevo faces intense competition for personnel, making recruitment time-consuming and expensive. The failure to attract and retain personnel or to develop such expertise could delay or halt the development and commercialization of its product candidates. If Hevo experiences difficulties in hiring and retaining personnel in key positions, Hevo could suffer from delays in product development, loss of customers and sales and diversion of management resources, which could adversely affect operating results. Its consultants and advisors may be employed by third parties and may have commitments under consulting or advisory contracts with third parties that may limit their availability to us, which could further delay or disrupt its product development and growth plans.

The Company is dependent upon technological improvements.

The electric vehicle market and industry is undergoing rapid technological changes with frequent introductions of new technology-driven products and services. The Company’s future success will depend in part upon its ability to create, maintain, and update competitive technologies that will enhance its wireless charging product. There can be no assurance that the Company’s technological improvements will effectively compete with that of its competitors or that the Company will be able to effectively implement new technology-driven products and services or be successful in marketing these products and services to its customers.

Its business could be negatively impacted by cyber security threats, attacks and other disruptions.

Hevo may face advanced and persistent attacks on its information infrastructure where Hevo manages and store various proprietary information and sensitive/confidential data relating to its operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack its products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate its network security and misappropriate or compromise its confidential information or that of its customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that Hevo produces or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of its information infrastructure systems or any of its data centres as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect its business.

Security breaches of confidential customer information, or confidential employee information may adversely affect its business.

Its business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that Hevo maintains and in those maintained by third parties with whom Hevo contracts to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Its systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of its information technology systems or those of its service providers could lead to an interruption in the operation of its systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of its information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by its business, its business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect its business, including causing its business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause its business and results of operations to suffer materially. Additionally, the success of its online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine its security measures. As a result, unauthorized parties may obtain access to its data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of its customer transaction processing capabilities and personal data. If any such compromise of its security or the security of information residing with its business associates or third parties were to occur, it could have a material adverse effect on its reputation, operating results and financial condition. Any compromise of its data security may materially increase the costs Hevo incurs to protect against such breaches and could subject the company to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

Changes in employment laws or regulation could harm its performance.

Various federal and state labor laws govern its relationship with its employees and affect operating costs. These laws include minimum wage requirements, overtime pay, healthcare reform and the implementation of the Patient Protection and Affordable Care Act, unemployment tax rates, workers’ compensation rates, citizenship requirements, union membership and sales taxes. A number of factors could adversely affect its operating results, including additional government- imposed increases in minimum wages, overtime pay, paid leaves of absence and mandated health benefits, mandated training for employees, increased tax reporting and tax payment requirements for employees who receive tips, a reduction in the number of states that allow tips to be credited toward minimum wage requirements, changing regulations from the National Labor Relations Board and increased employee litigation including claims relating to the Fair Labor Standards Act.

Affiliates of the Company, including officers, directors and existing shareholders of the Company, may invest in this Offering and their funds will be counted toward the Company achieving the Minimum Amount.

There is no restriction on affiliates of the Company, including its officers, directors and existing shareholders, investing in the Offering. As a result, it is possible that if the Company has raised some funds, but not reached the Minimum Amount, affiliates can contribute the balance so that there will be a closing. The Minimum Amount is typically intended to be a protection for investors and gives investors confidence that other investors, along with them, are sufficiently interested in the Offering and the Company and its prospects to make an investment of at least the Minimum Amount. By permitting affiliates to invest in the offering and make up any shortfall between what non-affiliate investors have invested and the Minimum Amount, this protection is largely eliminated. Investors should be aware that no funds other than their own and those of affiliates investing along with them may be invested in this Offering.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts. In addition, if the Company violated federal or state securities laws in connection with a prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future.

The Company could potentially be found to have not complied with securities law in connection with this Offering related to "Testing the Waters".

Prior to filing this Form C, the Company engaged in “testing the waters” permitted under Regulation Crowdfunding (17 CFR 227.206), which allows issuers to communicate to determine whether there is interest in the Offering. All communication sent is deemed to be an offer of securities for purposes of the antifraud provisions of federal securities laws. Any Investor who expressed interest prior to the date of this Offering should read this Form C thoroughly and rely only on the information provided herein and not on any statement made prior to the Offering. The communications sent to Investors prior to the Offering are attached as Exhibit E. Some of these communications may not have included proper disclaimers required for "testing the waters".

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

You should not rely on the fact that its Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it relates to this Offering. The U.S. Securities and Exchange Commission has not reviewed this Form C, nor any document or literature related to this Offering.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may also end the Offering early.

If the Target Offering Amount is met after 21 calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least 5 business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE ((Simple Agreement for Future Equity) investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into CF Shadow Securities. The Company is under no obligation to convert the Securities into CF Shadow Securities. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities.

Investors will not have the right to vote upon matters of the Company even if and when their Securities are converted into CF Shadow Securities (the occurrence of which cannot be guaranteed). Upon such conversion, the CF Shadow Securities will have no voting rights and, in circumstances where a statutory right to vote is provided by state law, the CF Shadow Security holders or the party holding the CF Shadow Securities on behalf of the Investors are required to enter into a proxy agreement with its designee to vote their CF Shadow Securities with the majority of the holder(s) of the securities issued in the round of equity financing that triggered the conversion right. For example, if the Securities are converted in connection with an offering of Series B Preferred Stock, Investors would directly or beneficially receive CF Shadow Securities in the form of shares of Series B-CF Shadow Preferred Stock and such shares would be required to be subject to a proxy that allows a designee to vote their shares of Series B-CF Shadow Preferred Stock consistent with the majority of the Series B Preferred Stockholders. Thus, Investors will essentially never be able to vote upon any matters of the Company unless otherwise provided for by the Company.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and as a consequence holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company. The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities. In addition, the Company has certain equity grants and convertible securities outstanding. Should the Company enter into a financing that would trigger any conversion rights, the converting securities would further dilute the equity securities receivable by the holders of the Securities upon a qualifying financing.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the Conversion Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the Conversion Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company. The foregoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

There is no present market for the Securities and Hevo has arbitrarily set the price.

The Offering price was not established in a competitive market. Hevo has arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on its asset value, net worth, revenues or other established criteria of value. Hevo cannot guarantee that the Securities can be resold at the Offering price or at any other price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred stock, have been paid in full. Neither holders of the Securities nor holders of CF Shadow Securities can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.