Make a hedge fund with your friends.

Summary

- Pool money & invest with friends in stocks, options, cryptos, & NFTs

- Indv. & Group Trading | Investor Communities | Interactive Learning Tools

- Revolutionizing a $5T industry for retail investors & GenZ

- Raised an 8x-oversubscribed seed led by Firstminute Capital & Litquidity

- Investors include top VCs & Creators with 250M+ followers

- All-star team (prev. Robinhood, Google, FINRA, Commonstock, Uber, etc.)

- Partnered with NASDAQ, Alpaca Markets, Plaid & more

Problem

Group investing is like Fidelity in the 80s

Despite a massive shift towards socially collaborative trading, there's still no way for retail traders to actually invest together & grow with their communities.

Institutional finance has been very intentional in subjugating retail traders to individual accounts because it makes it easier to take advantage of them. In doing so, investing platforms have also failed to support collaborative & inclusive markets, locking nearly 100M Americans out of investing and perpetuating wealth inequality within communities.

Retail brokerage platforms like Robinhood have prided themselves on “democratizing” the stock market for the everyday trader – yet the vast majority of investing remains antiquated, inaccessible, and unfit for the next generation of investors. Group investing is currently done almost entirely on paper and bears little to no resemblance to the sleek, gamified mobile experience enjoyed by individual investors.

As GenZ and younger Millennials have started to enter the market, they’ve placed a profound emphasis on authentic social engagement, investment activism, and community-oriented growth – a radically different approach to investing that’s left industry incumbents, and even many relative newcomers, with products that are woefully out of date.

Despite this momentum, however, product offerings for self-directed retail investing are still geared almost exclusively towards individual trading, with most incentivizing order volume over the learning resources and support systems needed to help young investors grow. In addition to this, investing culture remains highly un-inclusive, which prevents those from historically disenfranchised populations from accessing communities that help many young investors get into investing in the first place.

Solution

Make a hedge fund with your friends

Pool money in group portfolios & collaborate in investor communities to profit together with your friends.

Hedge is a collaborative trading platform where you can make a hedge fund with your friends by pooling money & investing together. Hedge offers both individual & group investing, as well as social features, like investor communities, and interactive learning resources.

Hedge is designed to acquire users early in their investing careers and to help them grow their assets, by providing them with learning resources and the social investing tools needed to collaborate on investment decisions so communities can grow together.

The industry's focus on community-oriented growth has given rise to a number of group investing experiments—like ConstitutionDAO and last year’s “Meme-Stock” craze—that have showcased the desire of retail investors to pool capital in hopes of collective growth. These were early, sporadic, and wildly unorganized attempts at a much greater goal—multiplayer investing—which Hedge brings to fruition on a mass scale, both for the public markets and for web3 assets.

Hedge provides investing tools for young retail traders, the learning resources to help them make better decisions, and access to a network of communities to help them find investors of any background, or with any interest, to invest with. Hedge is designed to encourage users to learn and grow their investments; our decade-long expansion plan culminates in the ultimate management of these assets & with Hedge solidifying itself as a full-service investment platform comparable to Charles Schwab, Fidelity, etc.

Product

Invest. Collaborate. Learn.

Hedge is a collaborative trading platform where you can make a hedge fund with your friends by pooling money & investing together in public markets & web3 assets.

Hedge offers both individual and group investing for retail traders, along with social features, like investment communities, and interactive learning resources.

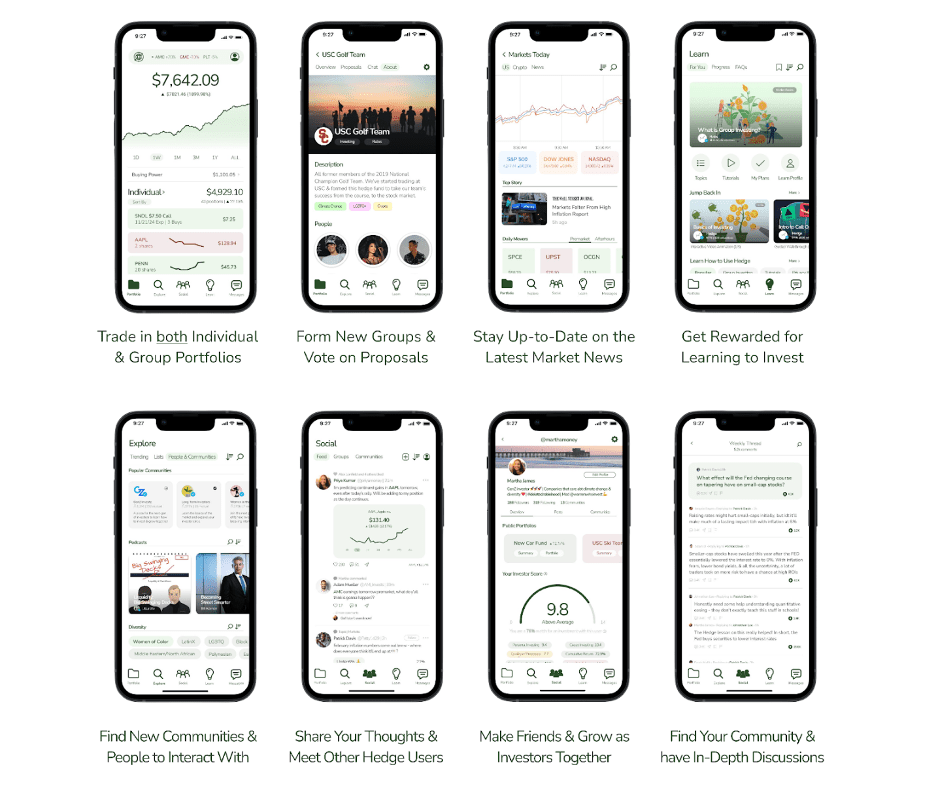

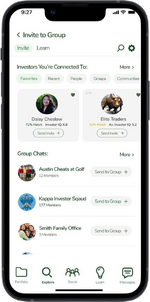

- Invest – With Hedge, you can invest by yourself, just like you're able to on platforms like Robinhood, WeBull, Public, etc. You're also able to pool capital and vote on how to invest from a group portfolio with other investors.

- Collaborate – Hedge offers a wide variety of mediums where you can interact with other users, including a social feed, a network of investor communities, group chats, and more.

- Learn – Hedge provides learning resources to promote financial literacy, and help users become better investors and make smarter decisions.

What is Group Investing?

Overview

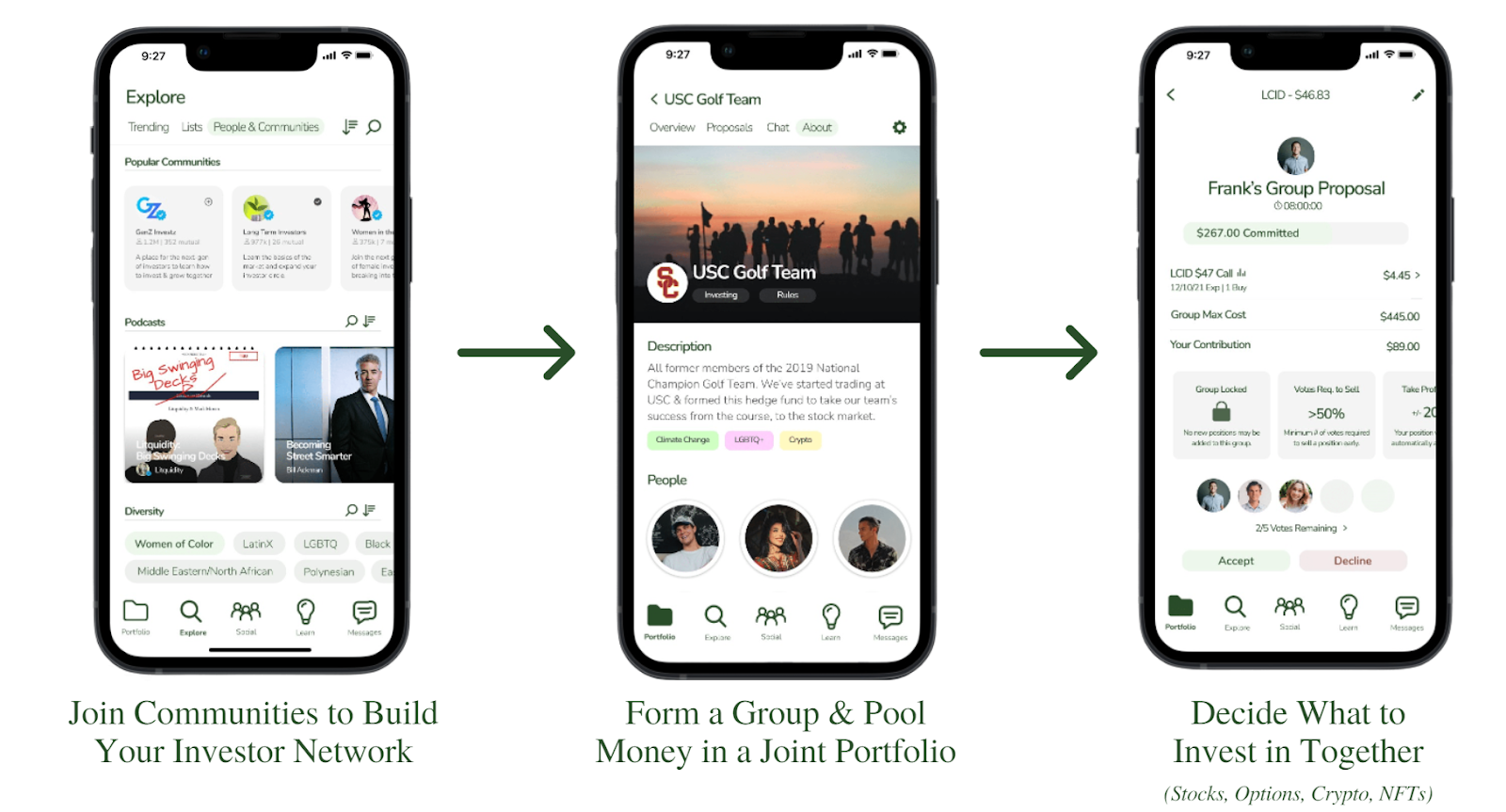

Users are able to invest together in seconds – without any extra red tape or regulatory hurdles.

- Form a group & determine the voting rules

- Pool money & propose trades

- Vote on proposals to decide what to invest in as a group

Hedge provides a painless user experience to invest together, and is rooted in flexibility, transparency, and security for the user. Rules are disclosed and agreed to upfront in a simple, accessible manner, and users are presented with data to contextualize and validate the other investors they'll be getting into a position with. Once they've accepted the position, the group is formed and trades can be executed within a matter of seconds.

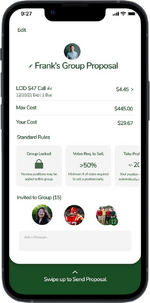

Detailed Walkthrough

The group investing process is highly customizable and differs based on how the group wishes to invest. Users can form groups for the long-term with their friends, or for as little as a single position. Users can limit how the group invests by timeline, sector, amount, strategy, risk tolerance, and a variety of other factors. The most basic example, which will be shown here, is forming a group for a single position:

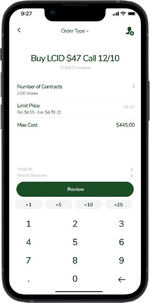

1. User builds an order for their proposal.

This is very similar to filling out an order on Robinhood, Public, and other retail brokerages. The user selects the security, the strategy (shares, call, put, etc.), and sets their price.

2. User adds other users to invite to the proposed group.

The user is first shown a learn page that contextualizes the risks of their position and of investing in a group. We do this because financial literacy and safe investment practices are our top priorities. Users are able to search from this page and add users to the invite queue; or they may browse an explore page that displays their friends, recent groups, communities, group chats, and other places they may send the proposal along with investor scores that contextualize who they'd be getting into bed with.

3. User sets the rules for the group.

In this proposal will be the rules that will govern how the group is to be run (regarding voting, proposal time limits, automatic profit/loss, etc.). Users can customize these rules, but we recommend they choose from a standard model we provide.

4. User sends a proposal for a new group.

Users who receive this proposal see the sender, their investor score, the proposed group, the rules, and the other members as well as their live votes. The users are given every possible piece of information they could need upfront in an easily digestible manner. Users can accept and swipe up to confirm to vote yes on joining the proposal. If the proposal is accepted by all users who are invited (or the threshold depending on how the group is set up), the proposal passes and the group is formed.

5. Voting to sell.

In this example, let's say the users have set a >50% threshold to sell and a +/- 20% P/L barrier. If the position passes 20% P/L at any time, it will trigger an automatic sell order and the position will be liquidated and the group (in this case of a one-position-only group) will be dissolved. If the position has not crossed this range, however, and over 50% of the group votes "YES" on a proposal to sell the position in the group – it will be sold.

Business model

A multi-phase business model designed to grow Hedge with our users.

Hedge’s business model is designed in three main phases and with a 10-15 year expansion plan in mind. This is detailed below, but a key differentiator to understand is that Hedge has been designed from the beginning – both in regards to its product as well as its business model – to grow with its users. Hedge is not designed to incentivize high trading volume like its competitors, but rather provides the learning resources and community diversity to support an inclusive user base, and to help its users become better investors.

- Acquire Early Investors – In Phase 1 of its expansion model, Hedge will initially generate revenue from its investing, social, and early blockchain features.

- Expand Product & Grow User AUM – Phase 2 includes a broad expansion of Hedge’s social and blockchain lines of business to improve content, introduce new mediums, and give both our creators and our users more ways to be rewarded for their contributions to their communities. We will also incentivize users to learn and collaborate to help them become better, more proactive investors. This phase will be strategically deployed to grow each user’s AUM so we can monetize off of it by management in Phase 3.

- Manage User Capital – Hedge intends Phase 3 to be a massive expansion of investing product lines to become a full-service investment platform – with services and strategies for any user, at any stage of their lives. This will consist of professionally-managed investments (hedge funds for everyone), a wide variety of account types (retirement, 529, etc.), and the introduction of a variety of new asset types to democratize access to investment classes & strategies historically reserved for the ultra-wealthy. This will open Hedge up to hundreds of billions of dollars in additional potential annual revenue and will expand its TAM to over 200M Americans and to $50T in market size.

This is assuredly no small task to take on and becomes largely dependent on ensuring our incentives align with those of our customers. We’ve been very cognizant of this while designing our business model for Hedge. While we can be a very successful company by anyone’s standards even with just our initial product & revenue streams, by building an inclusive community and growing with our users, we increase our revenue generation potential – at scale – by tens of billions of dollars.

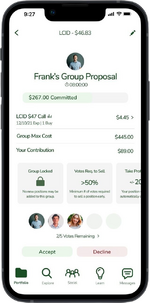

How will the company make money initially?

Hedge phase 1 has three main sources of revenue: investing, subscription, and social. Together, they are capable of generating a very high ARPU from Hedge's MVP alone.

- Investing – When users invest, Hedge makes money off of each transaction through its partnerships with Alpaca and high-frequency traders (details below). Hedge also makes revenue by engaging in securities lending and through interest on un-invested user capital.

- Subscription – Hedge charges a premium subscription fee for access to margin & level 2 data. Users will also get access to a slew of other features (to be added at a later date), including robo-advisory tools, faster customer support, and a quicker earning rate for Hedge's social governance token.

- Social – The social aspects of its platform will allow Hedge to keep earning money while the markets are closed. User safety, trust, and data privacy will be a top concern, so advertising will be extremely limited and only in very well embedded forms if offered at all. Social media revenue will instead come from referrals, promotions, exclusive content, and more. Later expansions will introduce social governance tokens and will allow creators to monetize their following through a variety of revenue streams (ie. NFT sales of posts/content, premium content, promotional posts, & more) that Hedge will take a small commission on.

This gives us a clear path towards scaling to $1B+ in annual revenue within a few years of launch, just from the revenue sources we’ve incorporated into our initial product. Our later expansions will vastly expand this model and will allow Hedge to engage in the web3 space and to expand its market share while limiting any future risk of drop-offs in volume or of precedent-setting changes to governance in retail investing.

Expansion Plans & Other Key Differentiators

Designing a large-scale, full-service investing business also eliminates many of the common challenges that retail brokerage platforms face, bolsters retention, and dramatically reduces the risk of natural churn. By reducing the risk of natural churn we mean the following:

Right now, retail brokerage platforms that cater to self-directed retail traders have a natural churn (the age at which they typically lose a user) at around 31 or 32, when their average user transitions into managed investments, either as a result of their lives becoming busier, or as any number of factors (ie. age, responsibility, financial stability) lead to a lower tolerance for risk in their investments. While it may vary as to exactly when a user makes this shift from self-directed to managed or passive investments, it is a near inevitability in the lifecycle of an investor that causes retail brokerage platforms to bleed customers and have a constant need to acquire new users.

By forfeiting their hold on investors just as many of them first start to have enough assets to charge investing service fees for, retail brokerage platforms have cornered themselves into a vicious cycle that confines them, for the most part, to the period of an investor’s life when they have the least amount of capital. This makes each user much less monetizable through traditional channels and creates a significant need for platforms to prioritize volume in order to generate revenue, without much of an incentive to help the traders that they will ultimately lose. The longer they can keep them gambling, the more revenue they can squeeze out of them.

Hedge is entirely different in that we make an investment in our users and target a monetization route that is much longer term, has significantly more upside, and aligns our incentives with our customer base. This is not to say that we can’t generate significant revenue without expansion – but rather that our ideal customer is not one that will trade 50x a day no matter whether they win or lose. Our ideal customer is someone who we can grow with. Learning resources, group investing, risk assessments, and countless resources & features of Hedge exist to support users and are more likely to cut volume, than to increase it; but they’ll also help investors make better decisions, improve their financial literacy, and grow their portfolios – and with that, our AUM. We look forward to continuing to be transparent on our business model as we move forward, and to our users keeping us honest and on track so we can all grow together.

Hedge’s expansion plans and its route to additional monetization routes along with them will open it up to tens, if not hundreds, of billions of dollars in added potential ARR.

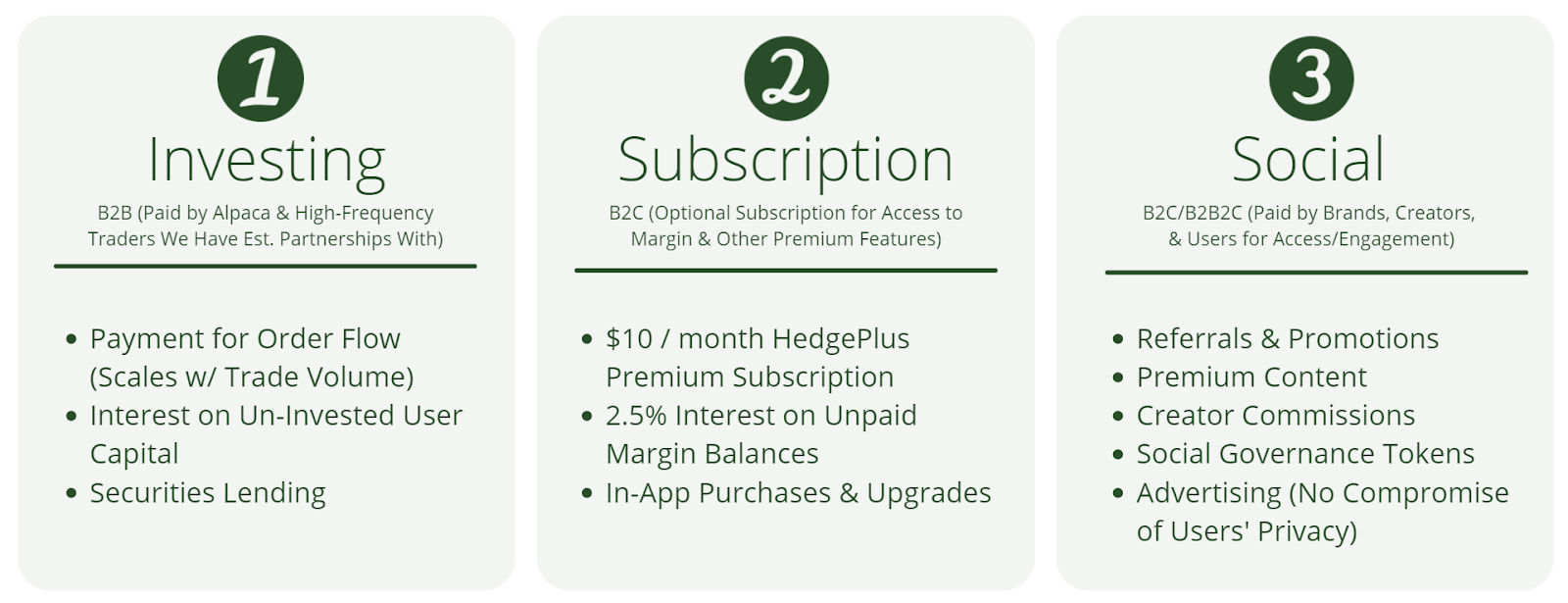

Payment For Order Flow

How does payment for order flow (PFOF) work?

- A customer places an order on Hedge, who routes it through its brokerage for execution.

- Hedge then sends the order through its brokerage to a high-frequency trader (HFT) who will look for a better price off-exchange. If the HFT sees another order that is better than the on-exchange price, they'll purchase it and sell the asset back to the user for the difference.

- The wholesaler is required by law to find the best execution but pays Hedge regardless of whether they’re able to find one off-exchange. This allows Hedge to rebate a portion of the PFOF revenue back to their users, either way, thus improving their overall order execution.

Will payment-for-order-flow be a significant part of your monetization plans at scale?

No. At scale, this will be a fraction of our revenue. See “How do Hedge’s expansion plans and unique monetization strategies differentiate the company from other platforms?” for more information.

Why include PFOF at all?

PFOF is generally beneficial for the consumer (better execution – see above) and we’re not going to turn the spigot off while it exists. Overall, it’s highly unlikely that PFOF is going away any time soon – the CEO of NASDAQ is on record saying that commission-free trading likely wouldn’t exist without it. It makes little sense to cut off a key source of early revenue that can support our growth over time. So as long as it exists, we’ll continue to collect PFOF.

That being said, we’re not basing our business off of PFOF, period.

At best, by encouraging increased trading volume and exploiting your customers, you stand to make roughly $3-5B per year max. During Q1 & Q2 of 2021, periods that experienced some of the highest volume ever recorded in the retail markets, Robinhood was on pace to make ~$2.5B from transaction-related revenue.

We’re not looking to max out at $3B in ARR at scale – we’re looking to see how we can build Hedge’s product up to reach $10B, $50B, and maybe even $100B in ARR. We’re starting by competing with the Robinhood’s & WeBull’s of the space and building to take on Charles Schwab, Fidelity, and other incumbents of institutional finance – most of which haven’t been properly challenged in over a century.

Vision and strategy

Hedge is designed to support & grow alongside our users

...and is built with a 10-15+ year plan to take on the largest, and most valuable players in investing.

Our mission is to reinvent investing to be more collaborative and more inclusive so that communities can build intergenerational wealth & grow together.

We're making strategies previously reserved exclusively for the ultra-wealthy accessible to all and bringing these investing tools, along with social features and learning resources, onto a platform that is designed to support a diverse, representative userbase from the very beginning. We want to support GenZ & other retail traders at the earliest stages and to grow with our users over the full lifecycle of their investor journey.

Hedge was founded by two GenZ retail investors that come from the same target audience that Hedge is built for. We've experienced the same pain points firsthand and came to realize that nobody already on the inside was going to fight for people like us. We're rebuilding the investing ecosystem and working to make fair, accessible markets that help our communities grow together. This is found not only in our ideals but also in the way we've planned to expand and grow with our users.

Hedge’s long-term plan is to: (i) acquire early investors, provide them with the learning resources and inclusive community access they need to start learning how to be better investors, (ii) to align community incentives through new ways to earn, and (iii) to grow their AUM so Hedge can ultimately manage their money. We envision a full-service investment business that expands both (i.) horizontally - to support investors as they grow & throughout every stage of their lives; as well as (ii.) vertically - to offer a wide variety of assets and investment strategies across public/private markets & blockchain spaces.

Our incentives are aligned with our users from the very beginning, with a business model that has been carefully plotted out to not only take on the Robinhood’s & WeBull’s of the space, but to ultimately take on Charles Schwab, Fidelity, TD Ameritrade, and other institutions that have been looked at as seemingly untouchable for far too long. We intend to level the playing field, make all investing strategies accessible to the public, to create truly inclusive markets, and to help communities grow together and build intergenerational wealth.

Market

Hedge targets socially collaborative traders, the fastest-growing population of the retail investing market. These populations are about to inherit >$68T in the next 2 decades in the largest wealth transfer in the history of the world; yet only 21% say they could ever use a current investment manager. This opportunity & market size can be looked at through both a broad examination of the retail investing market, as well as through a narrower one that zooms in on the ideal target consumer of Hedge's initial product.

Broad Overview

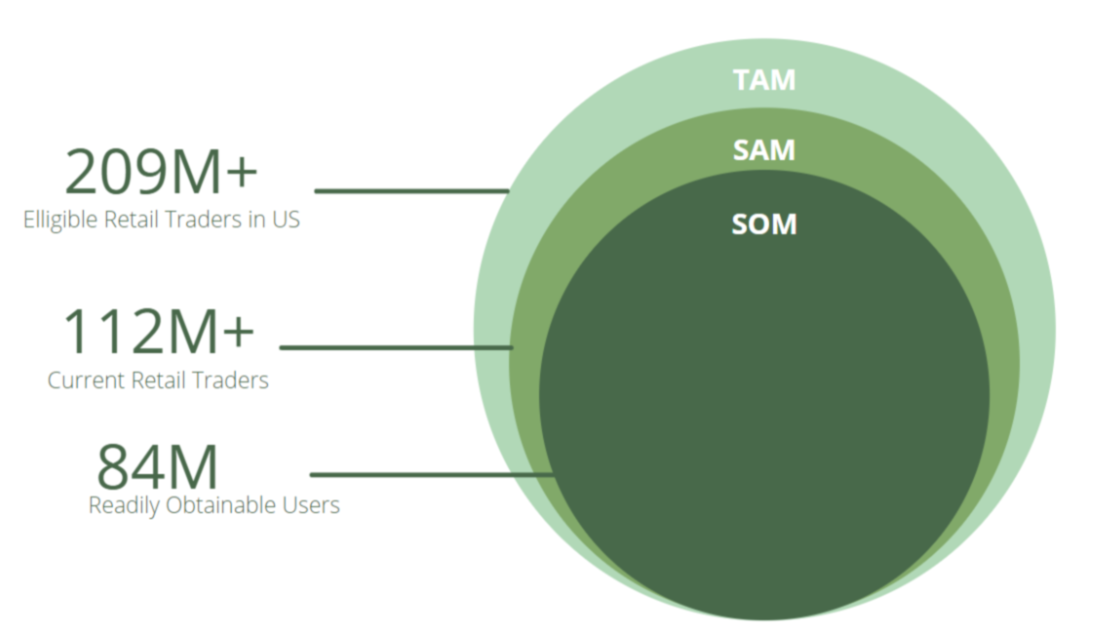

There are approximately 209M eligible retail traders in the United States. Of those, about 112M are currently investing and over two-thirds of them (72M+) are now doing so digitally. Digital retail traders, and in particular the socially collaborative ones, are the most rapidly growing sector of the retail trading market. The taboo of discussing one's personal investments has been broken down. As a result, there has been a widespread shift away from traditional media sources and outdated investment models that isolate individual traders from their community. Hedge has 84M readily obtainable users in the market today and is targeted towards socially collaborative traders (34% of the entire retail trading market already) that will grow by >50M from GenZ in the next decade.

Narrow (GenZ)

GenZ is over 67M Americans, which is currently about 20% of the U.S population. The oldest members of this generation have only just started to graduate college, yet they command >$140B per year in spending power – a number that is projected to grow exponentially once they start to enter the job market and reach 25% of global income by 2030. GenZ is also set to inherit the largest wealth transfer in the history of the world, >$68 Trillion USD in the next two decades. This leaves a tremendous opportunity for companies to capitalize on a generation that is defined by revolution.

Under a quarter of GenZ is currently able to invest, and almost none have the capital to do so with. Despite this, GenZ is by far the most focused generation on finance & investing. They're already fundamentally changing the way the retail market works.

GenZ is now investing at a much higher rate and is doing so in the way they do everything – with their community. Over 20M new retail traders entered the markets in the last year, a figure that is >1/4th of the entire digital retail trading market – many of them from GenZ. >70% of these traders (14M) listed the primary way they make their investment decisions and get advice/news as social interactions with their communities & on social media. In the same period, we saw GenZ's social media presence dominate, with TikTok becoming the fastest platform ever to reach 1B users, and with younger generations rapidly moving into community-based platforms.

As a collaborative trading platform built by & for GenZ, Hedge is positioned to dominate a growing market where incumbents are abandoning antiquated brokerages and moving towards platforms that provide further opportunities for them to grow with their communities.

Competition

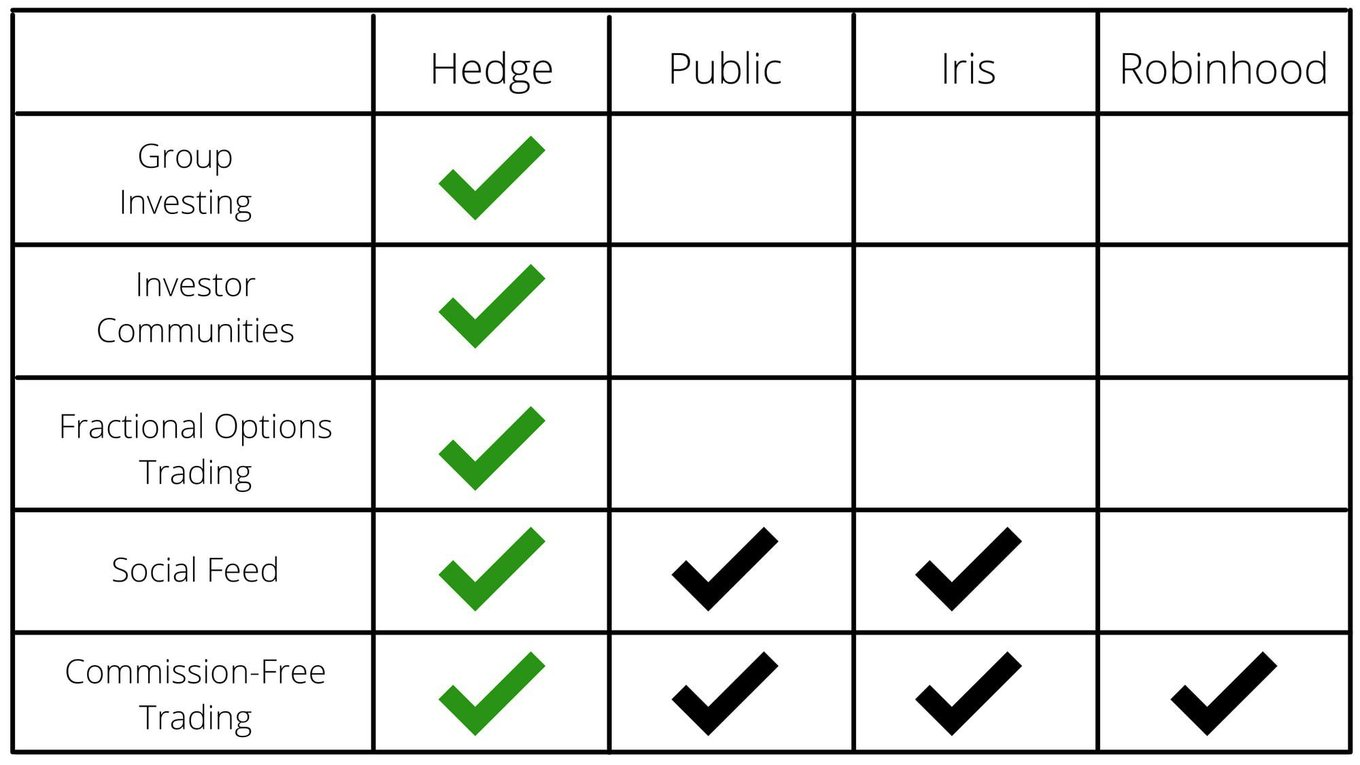

Who are the main competitors?

Hedge is a holistic solution with several new features, like group investing, that aren’t offered by any of its popular competitors. These are offered in addition to many of the standard features found in retail investing – allowing Hedge users to invest as individuals and/or with friends, to access interactive learning resources, and to collaborate with other users in a dynamic social platform introducing new mediums to social investing to help communities grow together.

Group investing:

No serious competitors.

Partial Competitors:

- Iris (social-only)

- Public (indv. investing + some social)

- Finary (social only)

- Robinhood (indv. investing only)

- Webull (indv. investing only)