Make a hedge fund with your friends.

SummaryEdit

- Pool money & invest with friends in stocks, options, cryptos, & NFTs

- Indv. & Group Trading | Investor Communities | Interactive Learning Tools

- Revolutionizing a $5T industry for retail investors & GenZ

- Raised an 8x-oversubscribed seed led by Firstminute Capital & Litquidity

- Investors include top VCs & Creators with 250M+ followers

- All-star team (prev. Robinhood, Google, FINRA, Commonstock, Uber, etc.)

- Partnered with NASDAQ, Alpaca Markets, Plaid & more

ProblemEdit

Group investing is like Fidelity in the 80s

Despite a massive shift towards socially collaborative trading, there's still no way for retail traders to actually invest together & grow with their communities.

Institutional finance has been very intentional in subjugating retail traders to individual accounts because it makes it easier to take advantage of them. In doing so, investing platforms have also failed to support collaborative & inclusive markets, locking nearly 100M Americans out of investing and perpetuating wealth inequality within communities.

Retail brokerage platforms like Robinhood have prided themselves on “democratizing” the stock market for the everyday trader – yet the vast majority of investing remains antiquated, inaccessible, and unfit for the next generation of investors. Group investing is currently done almost entirely on paper and bears little to no resemblance to the sleek, gamified mobile experience enjoyed by individual investors.

As GenZ and younger Millennials have started to enter the market, they’ve placed a profound emphasis on authentic social engagement, investment activism, and community-oriented growth – a radically different approach to investing that’s left industry incumbents, and even many relative newcomers, with products that are woefully out of date.

Despite this momentum, however, product offerings for self-directed retail investing are still geared almost exclusively towards individual trading, with most incentivizing order volume over the learning resources and support systems needed to help young investors grow. In addition to this, investing culture remains highly un-inclusive, which prevents those from historically disenfranchised populations from accessing communities that help many young investors get into investing in the first place.

SolutionEdit

Make a hedge fund with your friends

Pool money in group portfolios & collaborate in investor communities to profit together with your friends.

Hedge is a collaborative trading platform where you can make a hedge fund with your friends by pooling money & investing together. Hedge offers both individual & group investing, as well as social features, like investor communities, and interactive learning resources.

Hedge is designed to acquire users early in their investing careers and to help them grow their assets, by providing them with learning resources and the social investing tools needed to collaborate on investment decisions so communities can grow together.

The industry's focus on community-oriented growth has given rise to a number of group investing experiments—like ConstitutionDAO and last year’s “Meme-Stock” craze—that have showcased the desire of retail investors to pool capital in hopes of collective growth. These were early, sporadic, and wildly unorganized attempts at a much greater goal—multiplayer investing—which Hedge brings to fruition on a mass scale, both for the public markets and for web3 assets.

Hedge provides investing tools for young retail traders, the learning resources to help them make better decisions, and access to a network of communities to help them find investors of any background, or with any interest, to invest with. Hedge is designed to encourage users to learn and grow their investments; our decade-long expansion plan culminates in the ultimate management of these assets & with Hedge solidifying itself as a full-service investment platform comparable to Charles Schwab, Fidelity, etc.

ProductEdit

Invest. Collaborate. Learn.

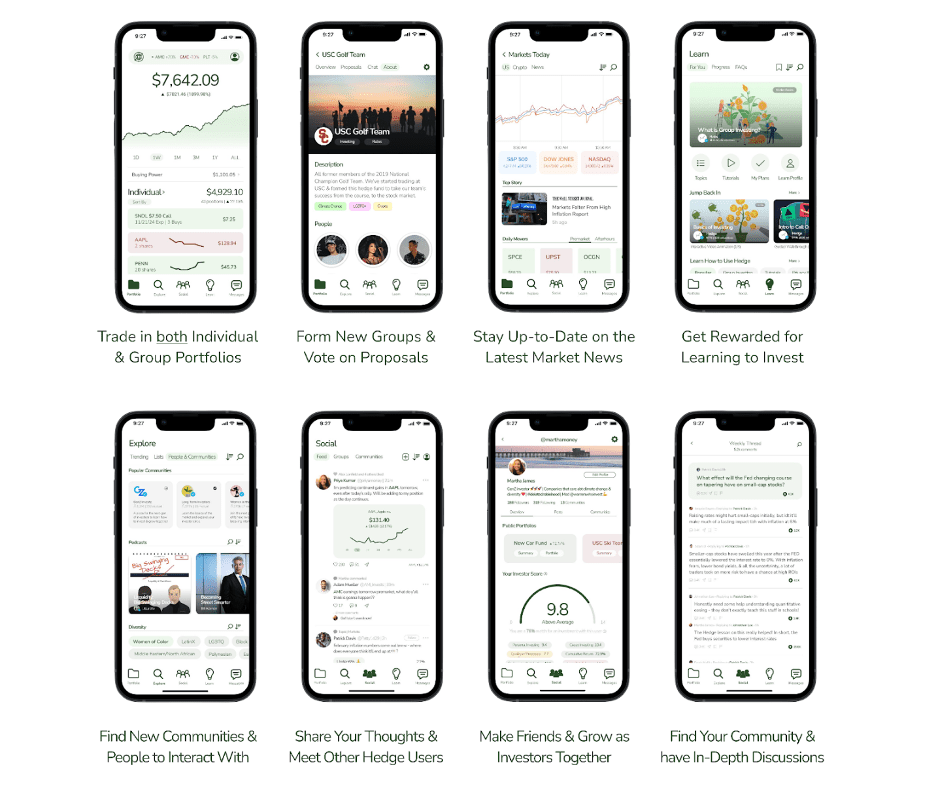

Hedge is a collaborative trading platform where you can make a hedge fund with your friends by pooling money & investing together in public markets & web3 assets.

Hedge offers both individual and group investing for retail traders, along with social features, like investment communities, and interactive learning resources.

- Invest – With Hedge, you can invest by yourself, just like you're able to on platforms like Robinhood, WeBull, Public, etc. You're also able to pool capital and vote on how to invest from a group portfolio with other investors.

- Collaborate – Hedge offers a wide variety of mediums where you can interact with other users, including a social feed, a network of investor communities, group chats, and more.

- Learn – Hedge provides learning resources to promote financial literacy, and help users become better investors and make smarter decisions.

What is Group Investing?Edit

OverviewEdit

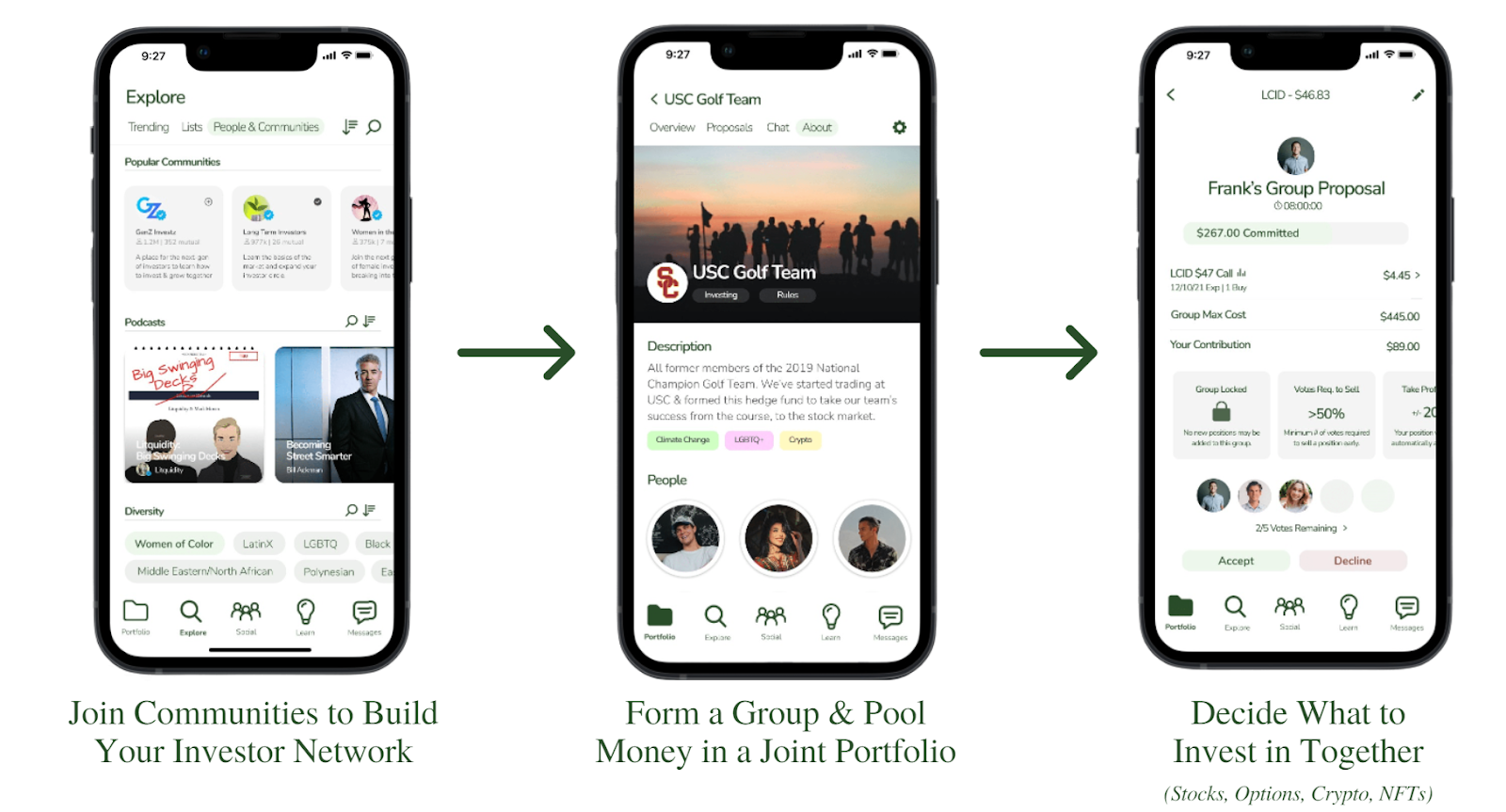

Users are able to invest together in seconds – without any extra red tape or regulatory hurdles.

- Form a group & determine the voting rules

- Pool money & propose trades

- Vote on proposals to decide what to invest in as a group

Hedge provides a painless user experience to invest together, and is rooted in flexibility, transparency, and security for the user. Rules are disclosed and agreed to upfront in a simple, accessible manner, and users are presented with data to contextualize and validate the other investors they'll be getting into a position with. Once they've accepted the position, the group is formed and trades can be executed within a matter of seconds.

Detailed WalkthroughEdit

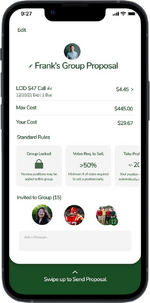

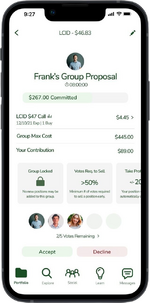

The group investing process is highly customizable and differs based on how the group wishes to invest. Users can form groups for the long-term with their friends, or for as little as a single position. Users can limit how the group invests by timeline, sector, amount, strategy, risk tolerance, and a variety of other factors. The most basic example, which will be shown here, is forming a group for a single position:

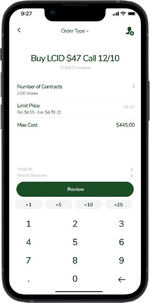

1. User builds an order for their proposal.Edit

This is very similar to filling out an order on Robinhood, Public, and other retail brokerages. The user selects the security, the strategy (shares, call, put, etc.), and sets their price.

2. User adds other users to invite to the proposed group.Edit

The user is first shown a learn page that contextualizes the risks of their position and of investing in a group. We do this because financial literacy and safe investment practices are our top priorities. Users are able to search from this page and add users to the invite queue; or they may browse an explore page that displays their friends, recent groups, communities, group chats, and other places they may send the proposal along with investor scores that contextualize who they'd be getting into bed with.

3. User sets the rules for the group.Edit

In this proposal will be the rules that will govern how the group is to be run (regarding voting, proposal time limits, automatic profit/loss, etc.). Users can customize these rules, but we recommend they choose from a standard model we provide.

4. User sends a proposal for a new group.Edit

Users who receive this proposal see the sender, their investor score, the proposed group, the rules, and the other members as well as their live votes. The users are given every possible piece of information they could need upfront in an easily digestible manner. Users can accept and swipe up to confirm to vote yes on joining the proposal. If the proposal is accepted by all users who are invited (or the threshold depending on how the group is set up), the proposal passes and the group is formed.

5. Voting to sell.

In this example, let's say the users have set a >50% threshold to sell and a +/- 20% P/L barrier. If the position passes 20% P/L at any time, it will trigger an automatic sell order and the position will be liquidated and the group (in this case of a one-position-only group) will be dissolved. If the position has not crossed this range, however, and over 50% of the group votes "YES" on a proposal to sell the position in the group – it will be sold.

Business modelEdit

A multi-phase business model designed to grow Hedge with our users.Edit

Hedge’s business model is designed in three main phases and with a 10-15 year expansion plan in mind. This is detailed below, but a key differentiator to understand is that Hedge has been designed from the beginning – both in regards to its product as well as its business model – to grow with its users. Hedge is not designed to incentivize high trading volume like its competitors, but rather provides the learning resources and community diversity to support an inclusive user base, and to help its users become better investors.

- Acquire Early Investors – In Phase 1 of its expansion model, Hedge will initially generate revenue from its investing, social, and early blockchain features.

- Expand Product & Grow User AUM – Phase 2 includes a broad expansion of Hedge’s social and blockchain lines of business to improve content, introduce new mediums, and give both our creators and our users more ways to be rewarded for their contributions to their communities. We will also incentivize users to learn and collaborate to help them become better, more proactive investors. This phase will be strategically deployed to grow each user’s AUM so we can monetize off of it by management in Phase 3.

- Manage User Capital – Hedge intends Phase 3 to be a massive expansion of investing product lines to become a full-service investment platform – with services and strategies for any user, at any stage of their lives. This will consist of professionally-managed investments (hedge funds for everyone), a wide variety of account types (retirement, 529, etc.), and the introduction of a variety of new asset types to democratize access to investment classes & strategies historically reserved for the ultra-wealthy. This will open Hedge up to hundreds of billions of dollars in additional potential annual revenue and will expand its TAM to over 200M Americans and to $50T in market size.

This is assuredly no small task to take on and becomes largely dependent on ensuring our incentives align with those of our customers. We’ve been very cognizant of this while designing our business model for Hedge. While we can be a very successful company by anyone’s standards even with just our initial product & revenue streams, by building an inclusive community and growing with our users, we increase our revenue generation potential – at scale – by tens of billions of dollars.

How will the company make money initially?Edit

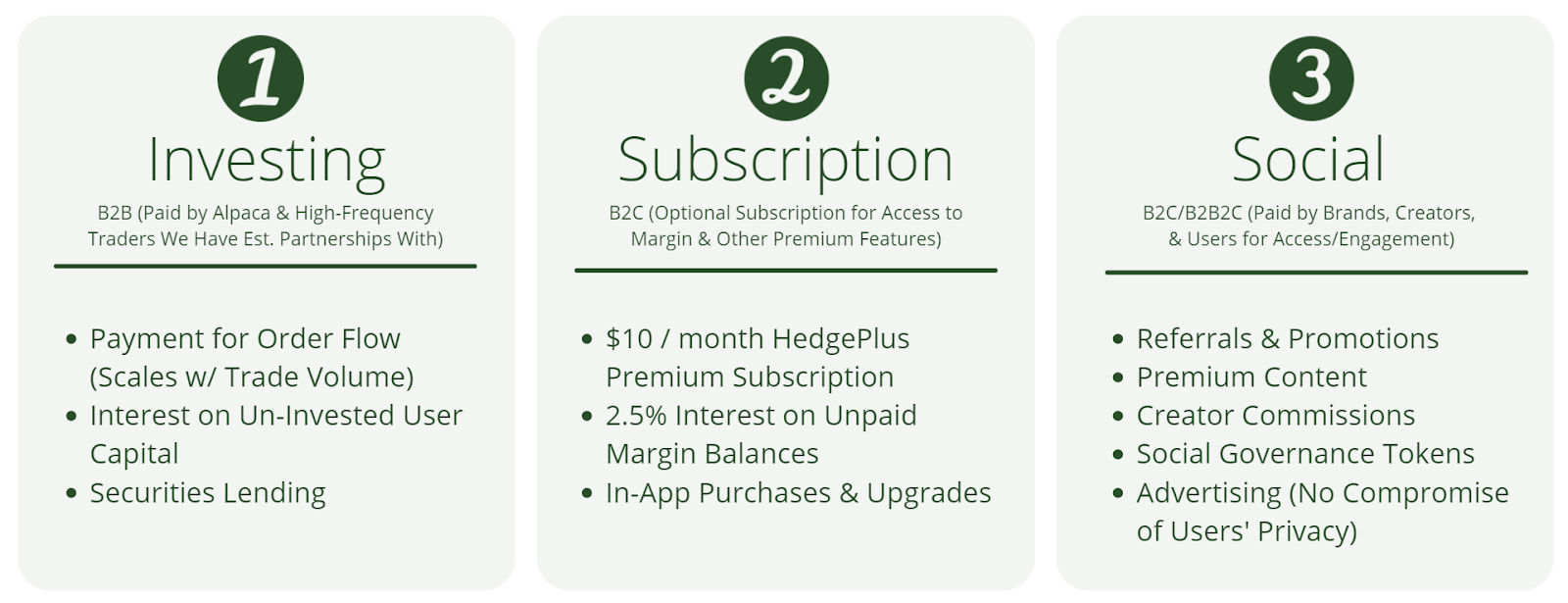

Hedge phase 1 has three main sources of revenue: investing, subscription, and social. Together, they are capable of generating a very high ARPU from Hedge's MVP alone.

- Investing – When users invest, Hedge makes money off of each transaction through its partnerships with Alpaca and high-frequency traders (details below). Hedge also makes revenue by engaging in securities lending and through interest on un-invested user capital.

- Subscription – Hedge charges a premium subscription fee for access to margin & level 2 data. Users will also get access to a slew of other features (to be added at a later date), including robo-advisory tools, faster customer support, and a quicker earning rate for Hedge's social governance token.

- Social – The social aspects of its platform will allow Hedge to keep earning money while the markets are closed. User safety, trust, and data privacy will be a top concern, so advertising will be extremely limited and only in very well embedded forms if offered at all. Social media revenue will instead come from referrals, promotions, exclusive content, and more. Later expansions will introduce social governance tokens and will allow creators to monetize their following through a variety of revenue streams (ie. NFT sales of posts/content, premium content, promotional posts, & more) that Hedge will take a small commission on.

This gives us a clear path towards scaling to $1B+ in annual revenue within a few years of launch, just from the revenue sources we’ve incorporated into our initial product. Our later expansions will vastly expand this model and will allow Hedge to engage in the web3 space and to expand its market share while limiting any future risk of drop-offs in volume or of precedent-setting changes to governance in retail investing.

Expansion Plans & Other Key DifferentiatorsEdit

Designing a large-scale, full-service investing business also eliminates many of the common challenges that retail brokerage platforms face, bolsters retention, and dramatically reduces the risk of natural churn. By reducing the risk of natural churn we mean the following:

Right now, retail brokerage platforms that cater to self-directed retail traders have a natural churn (the age at which they typically lose a user) at around 31 or 32, when their average user transitions into managed investments, either as a result of their lives becoming busier, or as any number of factors (ie. age, responsibility, financial stability) lead to a lower tolerance for risk in their investments. While it may vary as to exactly when a user makes this shift from self-directed to managed or passive investments, it is a near inevitability in the lifecycle of an investor that causes retail brokerage platforms to bleed customers and have a constant need to acquire new users.

By forfeiting their hold on investors just as many of them first start to have enough assets to charge investing service fees for, retail brokerage platforms have cornered themselves into a vicious cycle that confines them, for the most part, to the period of an investor’s life when they have the least amount of capital. This makes each user much less monetizable through traditional channels and creates a significant need for platforms to prioritize volume in order to generate revenue, without much of an incentive to help the traders that they will ultimately lose. The longer they can keep them gambling, the more revenue they can squeeze out of them.

Hedge is entirely different in that we make an investment in our users and target a monetization route that is much longer term, has significantly more upside, and aligns our incentives with our customer base. This is not to say that we can’t generate significant revenue without expansion – but rather that our ideal customer is not one that will trade 50x a day no matter whether they win or lose. Our ideal customer is someone who we can grow with. Learning resources, group investing, risk assessments, and countless resources & features of Hedge exist to support users and are more likely to cut volume, than to increase it; but they’ll also help investors make better decisions, improve their financial literacy, and grow their portfolios – and with that, our AUM. We look forward to continuing to be transparent on our business model as we move forward, and to our users keeping us honest and on track so we can all grow together.

Hedge’s expansion plans and its route to additional monetization routes along with them will open it up to tens, if not hundreds, of billions of dollars in added potential ARR.

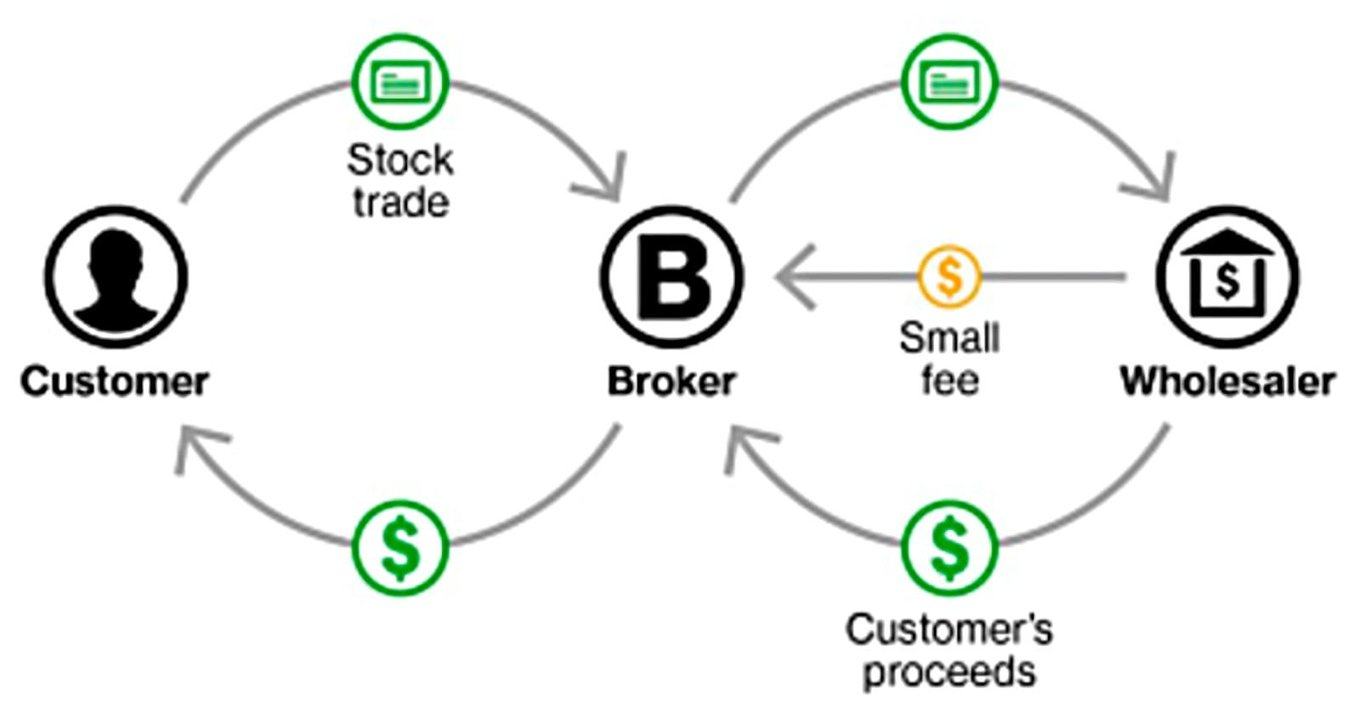

Payment For Order FlowEdit

How does payment for order flow (PFOF) work?Edit

- A customer places an order on Hedge, who routes it through its brokerage for execution.

- Hedge then sends the order through its brokerage to a high-frequency trader (HFT) who will look for a better price off-exchange. If the HFT sees another order that is better than the on-exchange price, they'll purchase it and sell the asset back to the user for the difference.

- The wholesaler is required by law to find the best execution but pays Hedge regardless of whether they’re able to find one off-exchange. This allows Hedge to rebate a portion of the PFOF revenue back to their users, either way, thus improving their overall order execution.

Will payment-for-order-flow be a significant part of your monetization plans at scale?Edit

No. At scale, this will be a fraction of our revenue. See “How do Hedge’s expansion plans and unique monetization strategies differentiate the company from other platforms?” for more information.

Why include PFOF at all?Edit

PFOF is generally beneficial for the consumer (better execution – see above) and we’re not going to turn the spigot off while it exists. Overall, it’s highly unlikely that PFOF is going away any time soon – the CEO of NASDAQ is on record saying that commission-free trading likely wouldn’t exist without it. It makes little sense to cut off a key source of early revenue that can support our growth over time. So as long as it exists, we’ll continue to collect PFOF.

That being said, we’re not basing our business off of PFOF, period.Edit

At best, by encouraging increased trading volume and exploiting your customers, you stand to make roughly $3-5B per year max. During Q1 & Q2 of 2021, periods that experienced some of the highest volume ever recorded in the retail markets, Robinhood was on pace to make ~$2.5B from transaction-related revenue.

We’re not looking to max out at $3B in ARR at scale – we’re looking to see how we can build Hedge’s product up to reach $10B, $50B, and maybe even $100B in ARR. We’re starting by competing with the Robinhood’s & WeBull’s of the space and building to take on Charles Schwab, Fidelity, and other incumbents of institutional finance – most of which haven’t been properly challenged in over a century.

Vision and strategyEdit

Hedge is designed to support & grow alongside our users

...and is built with a 10-15+ year plan to take on the largest, and most valuable players in investing.

Our mission is to reinvent investing to be more collaborative and more inclusive so that communities can build intergenerational wealth & grow together.

We're making strategies previously reserved exclusively for the ultra-wealthy accessible to all and bringing these investing tools, along with social features and learning resources, onto a platform that is designed to support a diverse, representative userbase from the very beginning. We want to support GenZ & other retail traders at the earliest stages and to grow with our users over the full lifecycle of their investor journey.

Hedge was founded by two GenZ retail investors that come from the same target audience that Hedge is built for. We've experienced the same pain points firsthand and came to realize that nobody already on the inside was going to fight for people like us. We're rebuilding the investing ecosystem and working to make fair, accessible markets that help our communities grow together. This is found not only in our ideals but also in the way we've planned to expand and grow with our users.

Hedge’s long-term plan is to: (i) acquire early investors, provide them with the learning resources and inclusive community access they need to start learning how to be better investors, (ii) to align community incentives through new ways to earn, and (iii) to grow their AUM so Hedge can ultimately manage their money. We envision a full-service investment business that expands both (i.) horizontally - to support investors as they grow & throughout every stage of their lives; as well as (ii.) vertically - to offer a wide variety of assets and investment strategies across public/private markets & blockchain spaces.

Our incentives are aligned with our users from the very beginning, with a business model that has been carefully plotted out to not only take on the Robinhood’s & WeBull’s of the space, but to ultimately take on Charles Schwab, Fidelity, TD Ameritrade, and other institutions that have been looked at as seemingly untouchable for far too long. We intend to level the playing field, make all investing strategies accessible to the public, to create truly inclusive markets, and to help communities grow together and build intergenerational wealth.

MarketEdit

Hedge targets socially collaborative traders, the fastest-growing population of the retail investing market. These populations are about to inherit >$68T in the next 2 decades in the largest wealth transfer in the history of the world; yet only 21% say they could ever use a current investment manager. This opportunity & market size can be looked at through both a broad examination of the retail investing market, as well as through a narrower one that zooms in on the ideal target consumer of Hedge's initial product.

Broad OverviewEdit

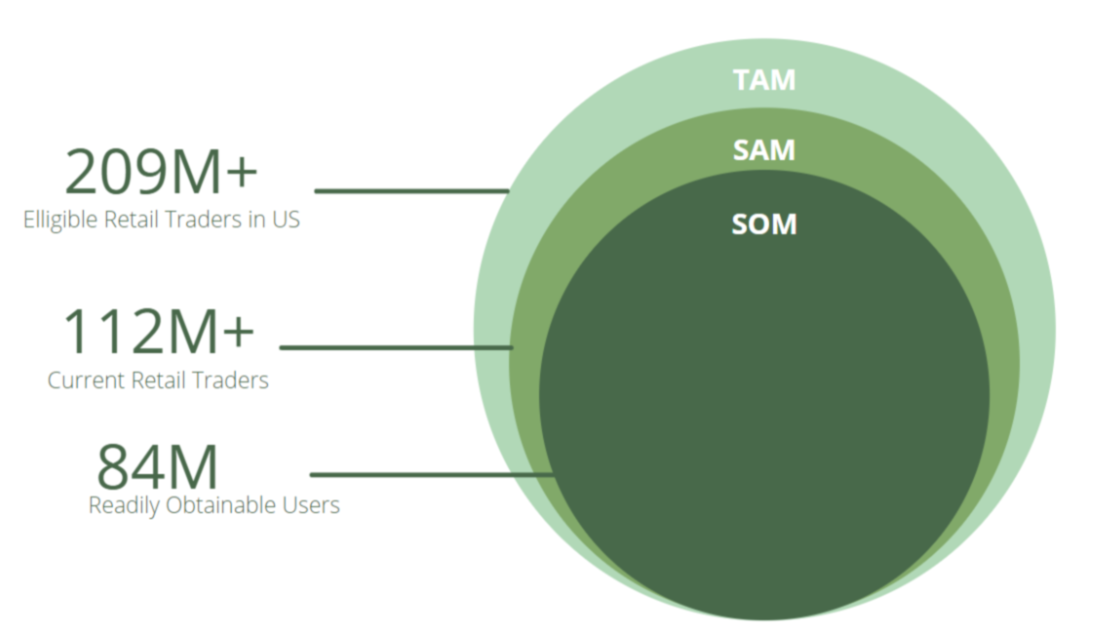

There are approximately 209M eligible retail traders in the United States. Of those, about 112M are currently investing and over two-thirds of them (72M+) are now doing so digitally. Digital retail traders, and in particular the socially collaborative ones, are the most rapidly growing sector of the retail trading market. The taboo of discussing one's personal investments has been broken down. As a result, there has been a widespread shift away from traditional media sources and outdated investment models that isolate individual traders from their community. Hedge has 84M readily obtainable users in the market today and is targeted towards socially collaborative traders (34% of the entire retail trading market already) that will grow by >50M from GenZ in the next decade.

Narrow (GenZ)Edit

GenZ is over 67M Americans, which is currently about 20% of the U.S population. The oldest members of this generation have only just started to graduate college, yet they command >$140B per year in spending power – a number that is projected to grow exponentially once they start to enter the job market and reach 25% of global income by 2030. GenZ is also set to inherit the largest wealth transfer in the history of the world, >$68 Trillion USD in the next two decades. This leaves a tremendous opportunity for companies to capitalize on a generation that is defined by revolution.

Under a quarter of GenZ is currently able to invest, and almost none have the capital to do so with. Despite this, GenZ is by far the most focused generation on finance & investing. They're already fundamentally changing the way the retail market works.

GenZ is now investing at a much higher rate and is doing so in the way they do everything – with their community. Over 20M new retail traders entered the markets in the last year, a figure that is >1/4th of the entire digital retail trading market – many of them from GenZ. >70% of these traders (14M) listed the primary way they make their investment decisions and get advice/news as social interactions with their communities & on social media. In the same period, we saw GenZ's social media presence dominate, with TikTok becoming the fastest platform ever to reach 1B users, and with younger generations rapidly moving into community-based platforms.

As a collaborative trading platform built by & for GenZ, Hedge is positioned to dominate a growing market where incumbents are abandoning antiquated brokerages and moving towards platforms that provide further opportunities for them to grow with their communities.

CompetitionEdit

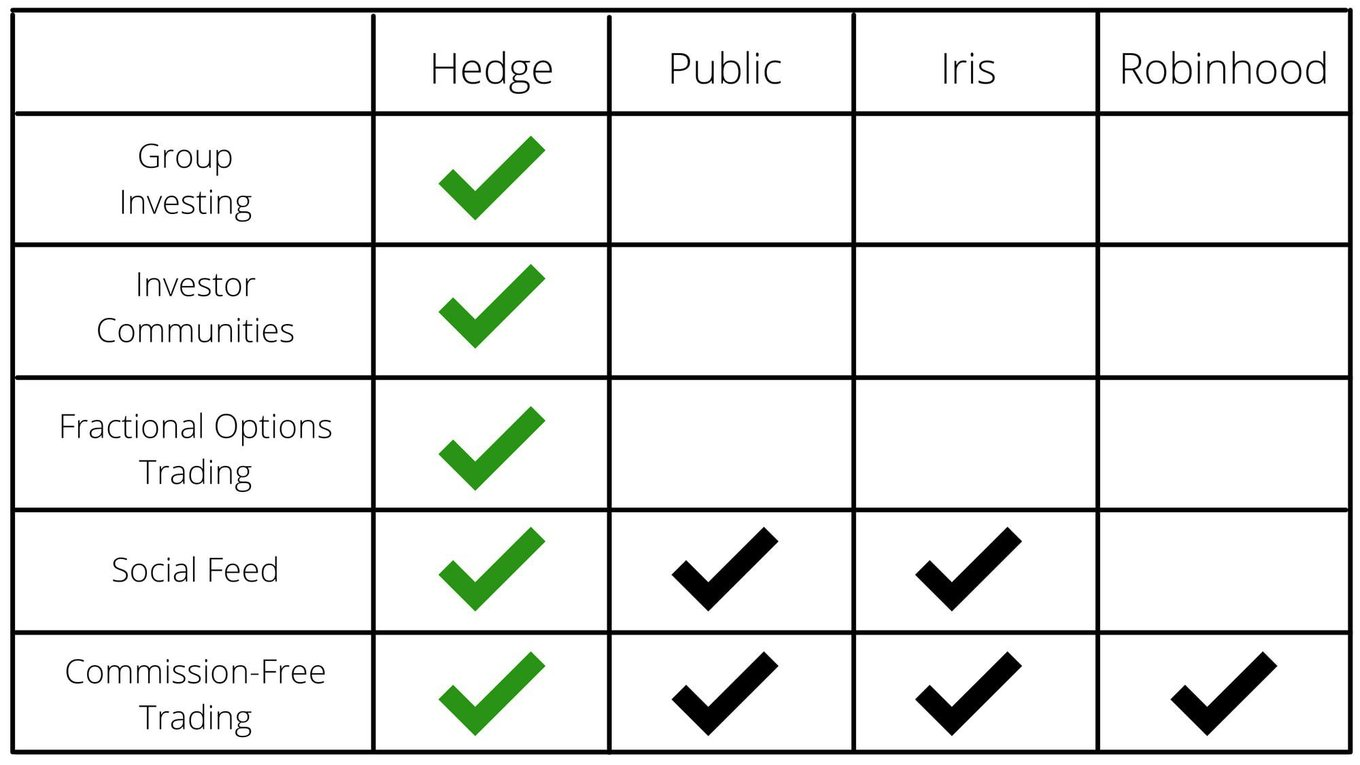

Who are the main competitors?

Hedge is a holistic solution with several new features, like group investing, that aren’t offered by any of its popular competitors. These are offered in addition to many of the standard features found in retail investing – allowing Hedge users to invest as individuals and/or with friends, to access interactive learning resources, and to collaborate with other users in a dynamic social platform introducing new mediums to social investing to help communities grow together.

Group investing:Edit

No serious competitors.

Partial Competitors:Edit

- Iris (social-only)

- Public (indv. investing + some social)

- Finary (social only)

- Robinhood (indv. investing only)

- Webull (indv. investing only)

What’s wrong with these platforms (high-level)?Edit

Market incumbents have fallen out of touch with the target demographic. Platforms like Robinhood & WeBull that offer investment services on an individual level are no longer nimble enough to shift their entire business model into something completely different. Social investment platforms (ie. Public, StockTwits, CommonStock, etc.) are incomplete solutions with limited product offerings that often exclude investing entirely and look more like a transplant of investing Twitter, than a place where investors can grow together.

What makes Hedge better?Edit

OverviewEdit

Hedge is a holistic solution with several new features that are not offered by any of our popular competitors, and brings them in addition to many of the standard features found on retail investing platforms (ie. individual investing, a social feed, group chats). We are differentiating ourselves from Day 1 and offer several brand new features not found amongst any of our key competitors.

The most significant of these include:

- Group Investing

- Interactive Learning Resources

- Investor Communities

- Web3 Assets

These are just a few of the differentiating features offered, with several of them alone representing multi-billion dollar opportunities. We also don’t intend to stop there and have carefully planned and designed our platform in accordance with a long-term plan to grow alongside our users, expand our product offerings, and retain our users over time as they evolve.

The Investing VerticalEdit

The investing side of things is pretty simple. Group investing is like Fidelity in the 80s right now. The only way to do it takes about 2 weeks and requires a printer, a fax machine, and being able to fill out dozens of pages with all of your group member’s social security numbers. Robinhood doesn’t offer a retirement account right now - let alone for users to make a hedge fund with their friends and start investing as a group.

Meanwhile, Hedge gives users the same capabilities as a Robinhood or a WeBull for individual trading, and then add on group investing, a social platform with a social feed, group chats, and investor communities; as well as an interactive learning platform, web3 assets, dynamic market and community-sourced data, and a whole lot more. We’re built by retail traders, for retail traders. Hedge helps users grow together, enables smarter investments by providing resources they can use to learn to invest, and offers a social platform that features a network of communities where anyone can expand their investor network.

The Social Side of ThingsEdit

Existing social investing apps typically offer little more than private group chats and a public social feed. While it’s true that these are two important features (which are included on Hedge as well), they alone are incapable of delivering on the intended functionality and ultimately lead to a non-inclusive culture.

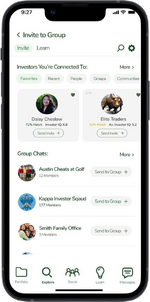

We like to describe our social platform as Reddit-style communities, layered on top of investing Twitter - with the former being one of the key differentiators missing from so many social investing competitors.

These investor communities are essential for cultivating the kinds of organic connections and deep conversations between users that will get them comfortable investing with each other without having known each other prior to Hedge. A public social feed is great for memes, polls, and other quick, instant-gratification interactions, but it fails to allow subsets of the user base to form communities for a broad variety of interests, topics, member demographics, and other segments within the broader user base. Without communities, this would ultimately limit the level of engagement that users will have and cap the growth of their investor network. Hedge is able to eliminate this problem and to facilitate many different types of engagement across a broad range of topics by allowing users to interact in various social mediums, with investor communities providing the unique benefit of helping users choose the context, topic, and audience they wish to engage with to find other investors to collaborate and invest with.

We’re also taking the clear intent from the very start of community development efforts to cultivate an inclusive community. One of the things we like to say at Hedge is - “if you don’t give a sh*t on Day 1, no one will believe you when you say you do on Day 1000”. Once a platform’s culture is established, it becomes very hard to change. This generally happens in the first 3-6 months (barring any unusual circumstances) which makes seeding the initial community with the right people incredibly important. Being in the stage that we are, actually gives Hedge a unique advantage here, as it allows us to be the first to do things right from the start, and to capitalize on a previously untapped market that is worth billions.

TractionEdit

Built to take on the best.

Partnerships

Hedge is partnered with several multi-billion dollar industry titans and over a dozen high-frequency traders. Hedge’s key partnerships include NASDAQ, Plaid, Alpaca Markets, DFP Partners, and many more.

Distribution NetworkEdit

Hedge has built out a distribution network of over 250M+ people through the dozens of content creators that have invested in Hedge. This is a massive distribution network that is unheard of for a company of this size. The CACs of competitors like Robinhood, WeBull, Acorns, & others range between ~$75-$120 for just one user. Startups in this space often spend tens of millions of venture dollars within their first 18 months on marketing.

Hedge already naturally incentivizes users to invite their friends onto the platform, but has also established a broad reach and key partnerships with influencers who will be incentivized not just to promote Hedge — but to actually bring their communities onto the product. This is a massive user-acquisition channel that will be bolstered over time by the blockchain features that Hedge plans to roll out in the next 18 months to create in-app incentives/rewards for community engagement and content creation.

TeamEdit

Hedge has built out an incredible team with backgrounds that include FINRA, Morgan Stanley, Robinhood, Uber, Google, and more. They’ve done so with a relatively low amount of capital, are highly capital-efficient given their current runway, and also have continued to recruit in the most difficult hiring environment that most employers have ever seen. They’ve successfully competed with Google, Apple, Facebook, Amazon, Stripe, and several other of the top employers in the country while building out a large team of proven, highly-capable operators.

Regulatory ProgressEdit

Hedge has submitted its application to become an introducing broker-dealer and anticipates FINRA’s approval by the third quarter of this year. Hedge has built out partnerships with several of the top service providers in the industry (more on this below) and does not require FINRA-approval to offer its services, but rather to receive PFOF and other investment-based revenue. Hedge has also built out a compliance team with over 100 years of combined experience, and backgrounds that include regulatory bodies and top investment banks. Hedge also has a full external compliance team and accounting team through one of its partnerships. Hedge is currently in the final stages of internal testing of its mobile application and is gearing up for an imminent public launch. Hedge does not require FINRA approval or registration as an introducing broker-dealer to go live thanks to its impressive partnership network of financial service providers. Hedge will be able to monetize through several revenue streams immediately at launch, including through crypto transaction revenue, and will expand to securities transaction revenue following the receipt of FINRA approval & registration, anticipated in early Q4 of this year.

FundingEdit

Backed by top VCs & creators with 250M+ followers

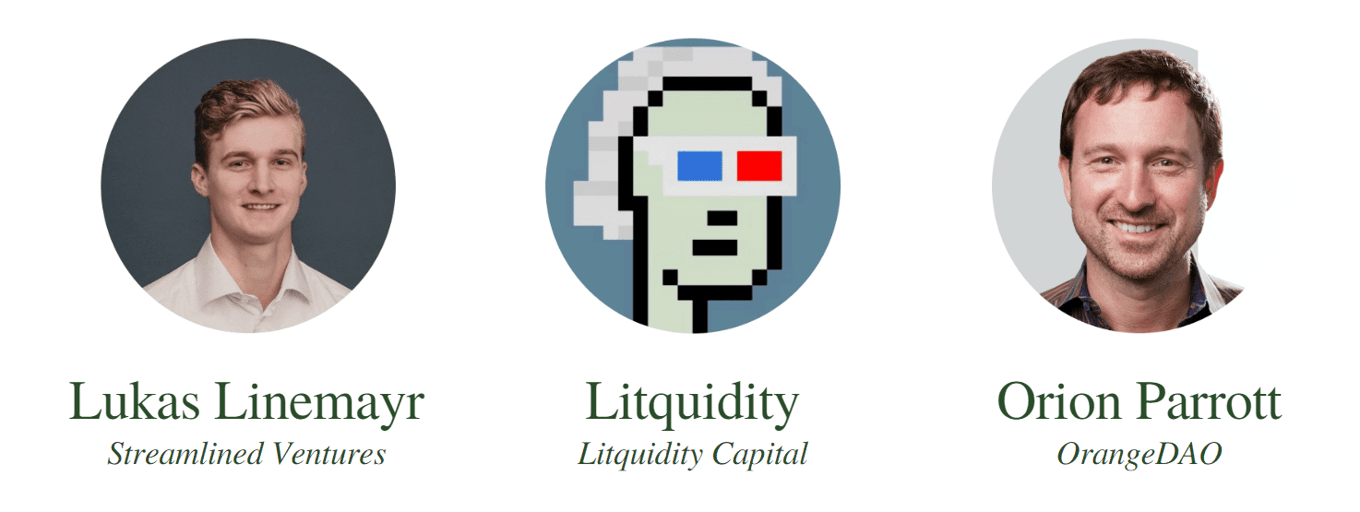

We closed an 8x-oversubscribed seed round, where we raised $1.2M from Firstminute Capital, Starting Line VC, OrangeDAO (1300+ YC founders), Creatorled Ventures, Bain Capital Ventures Scout Fund, Startupfon VC, and creators with 250M+ followers, including popular finmeme account, Litquidity, who sits on the company's advisory board.

We previously raised a pre-seed round from OnDeck's ODX Accelerator and are now raising on Republic in line with our commitment to return ownership to its community and to support young investors.

LeadershipEdit

Kyle Al-Rawi

Co-Founder, CEO

Kyle Al-Rawi is the co-founder & CEO of Hedge, a published author & researcher, and a member of the Launch House & OnDeck ODX Accelerator programs. Kyle is the CEO of Hedge, where he focuses on investor relations, fundraising, product design, and recruitment. Kyle also spearheads the design of Hedge’s legal architecture and works closely with industry regulators and compliance teams from key partners like Alpaca and NASDAQ.

Yash Khandelwal

Co-Founder, CFO

Yash Khandelwal graduated from USC with a degree in Finance and Data Analytics. Prior to co-founding Hedge, he worked in investment banking where he focused on debt financing for multi-billion dollar corporations. He then pivoted into the startup world by joining a music tech startup focused on blockchain/NFTs, where he led the finance and business operations team. Yash is also a member of the Launch House and OnDeck ODX Accelerator programs.

TeamEdit

Hedge was founded by individuals who are directly from the target demographic and have a unique insight into the future of retail investing. Hedge has also built out an 11-person team with some of the best operators and advisors in the industry, with backgrounds that include the companies shown above & many more.

Product & Technical Development TeamEdit

We currently have a 7-person development team with educational backgrounds from top schools like UChicago, Yale, and USC, and past experience working for companies like Robinhood, Commonstock, Uber, Capital One, Google, IBM, and Adidas, as well as other experience building trading platforms, social media apps, and working with Ethereum smart contracts. All developers are U.S.-based and are direct employees of Hedge.

Registered PrincipalsEdit

John Dillon (Chief Compliance Officer)

John is Hedge's Chief Compliance Officer and has an extensive compliance background with over 30 years of experience in the financial services industry. He started his career as an examiner for the New York Stock Exchange, where he worked for 12 years in the department that would later become FINRA. He later worked as an SVP, heading up compliance teams at Citigroup and Morgan Stanley in New York City, before moving to Atlanta in 2010 to become the Chief Compliance Officer for FSC Securities/AIG Advisor Group. He has also headed up compliance departments for several other broker-dealers & registered investment advisors of various sizes. John has extensive knowledge and hands-on experience with all aspects of the independent broker-dealer and advisory channels.

John Yuhas (Head of Supervision & Operations Manager)

John Yuhas is Hedge’s Head of Supervision & Operations Manager, as well as our Registered Options Principal and Municipal Securities Principal. He is responsible for the day-to-day functions of the operations department, a role that includes working with all the custodians, reviewing reports, leading the operations team, and etc. He received his undergraduate degree from Maryville College and his MBA from Mercer University. John holds Series 4, 7, 24, 53, 66, and 99 securities registrations.

Michael Chung (Financial Operations Principal)

Michael Chung is Hedge’s Financial Operations Principal (FinOp) in partnership with DFP Partners, where he is a Partner and has worked since joining in 2006. Mr. Chung started his career servicing financial industry clients. During his time at DFP Partners, P.C., Mr. Chung served as FINOP and Chief Financial Officer for a wide variety of Broker-Dealers that engage in private placements, M&A, institutional trading, and business activity under the governance of Exchange Act Rule 15a-6. Mr. Chung’s expertise lies with small to medium-sized firms, including start-ups. Mr. Chung is a CPA and FINRA Registered Financial and Operations Principal (Series 27). Mr. Chung is a member of the NYS Society of CPA’s Stock Brokerage Committee. He earned a Bachelor of Science in Accounting from CUNY – Queens College.

James Doherty (Principal Operations Officer)

James is Hedge's Principal Operations Officer (POO) and is joining Hedge in partnership with DFP, similar to Michael Chung. James has 25+ years’ experience in financial operations, has been in the senior leadership of one of the largest financial service providers of its time, and was member of the New York Stock Exchange (NYSE). After graduating from Fordham University with a B.S. in Finance, James started his career at Bear Stearns in the Stocks and Options Trade Operations Support department, before eventually working his way up to become a Vice President and the Head of Operations at Bear Stearns, before eventually becoming their Institutional Trading Vice President. After leaving Bear Stearns, James worked as an Operations manager and Compliance Officer for a large investment firm, before becoming the Director of Operations and Principal Operations Officer at DFP Partners (formerly SDDco). He holds Series 7, 15, 25, 27, 28, 55, 63, and 99 securities registrations.

Advisory BoardEdit

We also have an extensive advisory board made up of financial professionals with decades of experience running investment funds, esteemed university professors, compliance professionals, blockchain experts, and content creators with many millions of followers. This includes (i.) Orion Parrot & the co-founders of OrangeDAO — a decentralized autonomous organization made up of thousands of YC founders; (ii.) Litquidity — a finance content creator with millions of followers and exceptional engagement across a broad range of platforms and content mediums; (iii.) Lukas Linemayr — an investor at Streamlined Ventures and one of the brightest young minds in venture capital; as well as several other individuals with extensive experience in the industry.

RisksEdit

The Company’s success depends on the experience and skill of the board of directors, its executive officers and key employees.

We are dependent on our board of directors, executive officers and key employees. These persons may not devote their full time and attention to the matters of the Company. The loss of our board of directors, executive officers and key employees could harm the Company’s business, financial condition, cash flow and results of operations.

Our products and services rely on software and systems that are highly technical and have been, and may in the future be, subject to interruption and instability due to software errors, design defects, and other operational and technological failures, whether internal or external.

We rely on technology, including the internet and mobile services, to conduct much of our business activity and allow our customers to conduct financial transactions on our platform. Our systems and operations, as well as those of the third parties on which we rely to conduct certain key functions, are vulnerable to disruptions from natural disasters, power and service outages, interruptions or losses, computer and telecommunications failures, software bugs, cybersecurity attacks, computer viruses, malware, distributed denial of service attacks, spam attacks, phishing or other social engineering, ransomware, security breaches, credential stuffing, technological failure, human error, terrorism, improper operation, unauthorized entry, data loss, intentional bad actions, and other similar events.

Our products and internal systems also rely on software that is highly technical and complex (including software developed or maintained internally and/or by third parties) in order to collect, store, retrieve, transmit, manage and otherwise process immense amounts of data. The software on which we rely may contain errors, bugs, vulnerabilities, design defects, or technical limitations that may compromise our ability to meet our objectives.

While we have made, and continue to make, significant investments designed to correct software errors and design defects and to enhance the reliability and scalability of our platform and operations, the risk of software and system failures and design defects is always present, we do not have fully redundant systems, and we might fail to maintain, expand, and upgrade our systems and infrastructure to meet future requirements and mitigate future risks on a timely basis. It may become increasingly difficult to maintain and improve the availability of our platform, especially as our platform and product offerings become more complex and our customer base grows. We may also encounter technical issues in connection with changes and upgrades to the underlying networks of supported cryptocurrencies. Any number of technical changes, software upgrades, soft or hard forks, cybersecurity incidents, or other changes to the underlying blockchain networks may occur from time to time, causing incompatibility, technical issues, disruptions or security weaknesses to our platform. If we are unable to identify, troubleshoot, and resolve any such issues successfully, we might no longer be able to support such cryptocurrency, our customers’ assets may be frozen or lost, and our platform and technical infrastructure may be affected.

Disruptions to, destruction of, improper access to, breach of, instability of, or failure to effectively maintain our information technology systems that allow our customers to use our products and services, and any associated degradations or interruptions of service could result in damage to our reputation, loss of customers, loss of revenue, regulatory or governmental investigations, civil litigation, and liability for damages. Frequent or persistent interruptions, or perceptions of such interruptions whether true or not, in our products and services could cause customers to believe that our products and services are unreliable, leading them to switch to our competitors or to otherwise avoid our products and services.

Risks Related to Cybersecurity and Data Privacy.

We are subject to stringent laws, rules, regulations, policies, industry standards and contractual obligations regarding data privacy and security and may be subject to additional related laws and regulations in jurisdictions into which we expand. Many of these laws and regulations are subject to change and reinterpretation and could result in claims, changes to our business practices, monetary penalties, increased cost of operations, or other harm to our business.

We are subject to a variety of federal, state, local, and non-U.S. laws, directives, rules, policies, industry standards and regulations, as well as contractual obligations, relating to privacy and the collection, protection, use, retention, security, disclosure, transfer and other processing of personal data and other data, including the Gramm-Leach-Bliley Act of 1999, Section 5(c) of the Federal Trade Commission Act and state laws such as the California Consumer Privacy Act. We will also face particular privacy, data security and data protection risks if we continue to expand into the U.K. and the EU and other jurisdictions in connection with the General Data Protection Regulation and other data protection regulations. The regulatory framework for data privacy and security worldwide is continuously evolving and developing and, as a result, interpretation and implementation standards and enforcement practices are likely to remain uncertain for the foreseeable future. New laws, amendments to or reinterpretations of existing laws, regulations, standards and other obligations may require us to incur additional costs and restrict our business operations, and may require us to change how we use, collect, store, transfer or otherwise process certain types of personal data, to implement new processes to comply with those laws and our customers’ exercise of their rights thereunder, and could greatly increase the cost of providing our offerings, require significant changes to our operations, or even prevent us from providing some offerings in jurisdictions in which we currently operate and in which we might operate in the future or incur potential liability in an effort to comply with certain legislation. There is a risk of enforcement actions in response to rules and regulations promulgated under the authority of federal agencies and state attorneys general and legislatures and consumer protection agencies.

Any failure or perceived failure by us or our third-party service providers to comply with our posted privacy policies or with any applicable federal, state or similar foreign laws, rules, regulations, industry standards, policies, certifications or orders relating to data privacy and security, or any compromise of security that results in the theft, unauthorized access, acquisition, use, disclosure, or misappropriation of personal data or other customer data, could result in significant awards, fines, civil and/or criminal penalties or judgments, proceedings or litigation by governmental agencies or customers, including class action privacy litigation in certain jurisdictions and negative publicity and reputational harm, one or all of which could have an adverse effect on our reputation, business, financial condition and results of operations.

Risks Related to Cryptocurrency Products and Services.

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early stage companies. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

With shelter-in-place orders and non-essential business closings potentially happening throughout 2022 and into the future due to COVID-19, the Company’s revenue may be adversely affected.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an Investor to lose all or a portion of their investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. Our business currently does not generate any sales and future sources of revenue may not be sufficient to meet our future capital requirements. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We may not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

Currently, our authorized capital stock consists of 11,000,000 shares of common stock, of which 10,340,647 shares of common stock are issued and outstanding. Unless we increase our authorized capital stock, we may not have enough authorized common stock to be able to obtain funding by issuing shares of our common stock or securities convertible into shares of our common stock. We may also not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

We rely on other companies to provide components and services for our products.

We depend on suppliers and contractors to meet our contractual obligations to our customers and conduct our operations. Our ability to meet our obligations to our customers may be adversely affected if suppliers or contractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Our products may utilize custom components available from only one source. Continued availability of those components at acceptable prices, or at all, may be affected for any number of reasons, including if those suppliers decide to concentrate on the production of common components instead of components customized to meet our requirements. The supply of components for a new or existing product could be delayed or constrained, or a key manufacturing vendor could delay shipments of completed products to us adversely affecting our business and results of operations.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company relies on certain intellectual property rights to operate its business. The Company’s intellectual property rights may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights. As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets, and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We continue to face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Security breaches of confidential customer information or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. Further, we have no current intention to sell any personally identifying information to third parties, including for such purposes as target advertising. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

Our business may be harmed by changes in business, economic, or political conditions that impact global financial markets, or by a systemic market event.

As we are a financial services company, our business, results of operations, and reputation are directly affected by elements beyond our control, such as economic and political conditions including unemployment rates, inflation and tax rates, financial market volatility (such as we experienced during the COVID-19 pandemic), significant increases in the volatility or trading volume of particular securities or cryptocurrencies, broad trends in business and finance, changes in volume of securities or cryptocurrencies trading generally, changes in the markets in which such transactions occur, and changes in how such transactions are processed. These elements can arise suddenly and the full impact of such conditions could remain uncertain indefinitely. A prolonged market weakness, such as a slowdown causing reduced trading volume in securities, derivatives, or cryptocurrency markets, could result in reduced revenues and adversely affect our business, financial condition, and results of operations. Significant downturns in such markets or in general economic and political conditions could also cause individuals to be reluctant to make their own investment decisions and thus decrease the demand for our products and services and could also result in our customers reducing their engagement with our platform. Conversely, significant upturns in such markets or conditions may cause individuals to be less proactive in seeking ways to improve the returns on their trading or investment decisions and, thus, decrease the demand for our products and services. Any of these changes could cause our future performance to be uncertain or unpredictable, and could have an adverse effect on our business results.

Our business is subject to extensive, complex and changing laws and regulations, and related regulatory proceedings and investigations. Changes in these laws and regulations, or our failure to comply with these laws and regulations, could harm our business.

The securities industry is subject to extensive regulation by federal, state and non-U.S. regulators and SROs, and broker-dealers and financial services companies are subject to laws and regulations covering all aspects of the securities industry. The substantial costs and uncertainties related to complying with these regulations continue to increase, and our introduction of new products or services, expansion of our business into new jurisdictions or subindustries, acquisitions of other businesses that operate in similar regulated spaces, or other actions that we may take might subject us to additional laws, regulations, or other government or regulatory scrutiny. Regulations are intended to ensure the integrity of financial markets, to maintain appropriate capitalization of broker-dealers and other financial services companies, and to protect customers and their assets. These regulations could limit our business activities through capital, customer protection, and market conduct requirements, as well as restrictions on the activities that we are authorized to conduct.

Federal, state and non-U.S. regulators and SROs, including the SEC and FINRA, can among other things investigate, censure or fine us, issue cease-and-desist orders or otherwise restrict our operations, require changes to our business practices, products or services, limit our acquisition activities or suspend or expel a broker-dealer or any of its officers or employees. Similarly, state attorneys general and other state regulators, including state securities and financial services regulators, can bring legal actions on behalf of the citizens of their states to assure compliance with state laws. In addition, criminal authorities such as state attorneys general or the U.S. Department of Justice may institute civil or criminal proceedings against us for violating applicable laws, rules, or regulations. We operate in a highly regulated industry and, despite our efforts to comply with applicable legal requirements, like all companies in our industry, we must adapt to frequent changes in laws and regulations, and face complexity in interpreting and applying evolving laws and regulations to our business, heightened scrutiny of the conduct of financial services firms and increasing penalties for violations of applicable laws and regulations. We might fail to establish and enforce procedures that comply with applicable legal requirements and regulations. We might be adversely affected by new laws or regulations, changes in the interpretation of existing laws or regulations, or more rigorous enforcement. We also may be adversely affected by other regulatory changes related to our obligations with regard to suitability of financial products, supervision, sales practices, application of fiduciary or best interest standards (including the interpretation of what constitutes an “investment recommendation” for the purposes of the SEC’s “Regulation Best Interest” and state securities laws) and best execution in the context of our business and market structure, any of which could limit our business, increase our costs and damage our reputation.

Risks Related to Attracting, Retaining, and Engaging Customers.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

If we fail to provide and monetize new and innovative products and services that are adopted by customers, our business may become less competitive and our revenue might decline.

Our ability to attract, engage, and retain our customers and to increase our revenue depends heavily on our ability to evolve our existing products and services and to create and monetize new products and services that are adopted by customers. Rapid and significant technological changes continue to confront the financial services industry, including developments in the methods in which securities are traded and developments in cryptocurrencies. To keep pace or to innovate we might introduce significant changes to our existing products and services or acquire or introduce new and unproven products and services, including using technologies with which we have little or no prior development or operating experience. Our efforts might be inhibited by industry-wide standards, legal restrictions, incompatible customer expectations, demands, and preferences, or third-party intellectual property rights. Our efforts to innovate might also be delayed or blocked by new or enhanced regulatory scrutiny or technical complications. Incorporating new technologies into our products and services might require substantial expenditures and take considerable time, and we might not be successful in realizing a return on these development efforts in a timely manner or at all. It might be difficult to monetize products in a manner consistent with our brand’s focus on low prices. If we fail to innovate and deliver products and services with market fit and differentiation, or fail to do so quickly enough as compared to our competitors, we might fail to attract and retain customers and maintain customer engagement, causing our revenue to decline.

Risks Related to Our Platform, Systems, and Technology.

Cryptocurrency laws, regulations, and accounting standards are often difficult to interpret and are rapidly evolving in ways that are difficult to predict. Changes in these laws and regulations, or our failure to comply with them, could negatively impact cryptocurrency trading on our platform.

In the United States, cryptocurrencies are regulated by both federal and state authorities, depending on the context of their usage. Cryptocurrency market disruptions and resulting governmental interventions are unpredictable, and may make cryptocurrencies, or certain cryptocurrency business activities, illegal altogether. As regulation of cryptocurrencies continues to evolve, there is a substantial risk of inconsistent regulatory guidance among federal and state agencies and among state governments which, along with potential accounting and tax issues or other requirements relating to cryptocurrencies, could impede the growth of our cryptocurrency operations. Additionally, regulation in response to the climate impact of cryptocurrency mining could negatively impact cryptocurrency trading on our platform.

The cryptocurrency accounting rules and regulations that we must comply with are complex and subject to interpretation by the Financial Accounting Standards Board (“FASB”), the SEC, and various bodies formed to promulgate and interpret accounting principles. A change in these rules and regulations or interpretations could have a significant effect on our reported financial results and financial position, and could even affect the reporting of transactions completed before the announcement or effectiveness of a change. Further, there are a limited number of precedents for the financial accounting treatment of cryptocurrency assets (including related issues of valuation and revenue recognition), and no official guidance has been provided by the FASB or the SEC. Accordingly, there remains significant uncertainty as to the appropriate accounting for cryptocurrency asset transactions, cryptocurrency assets, and related revenues. Uncertainties in or changes in regulatory or financial accounting standards could result in the need to change our accounting methods and/or restate our financial statements, and could impair our ability to provide timely and accurate financial information, which could adversely affect our financial statements, and result in a loss of investor confidence.

From time to time, we may encounter technical issues in connection with changes and upgrades to the underlying networks of supported cryptocurrencies, which could adversely affect the success of our business, financial condition and results of operations.

Any number of technical changes, software upgrades, soft or hard forks, cybersecurity incidents or other changes to the underlying blockchain networks may occur from time to time, causing incompatibility, technical issues, disruptions or security weaknesses to our platform. If we are unable to identify, troubleshoot and resolve any such issues successfully, we might no longer be able to support such cryptocurrency, our customers’ assets may be frozen or lost, and our platform and technical infrastructure may be affected, all of which could cause trading volumes and transaction-based revenue to decline and expose us to potential liability for customer losses.

The prices of cryptocurrencies are extremely volatile. Fluctuations in the price of various cryptocurrencies may cause uncertainty in the market and could negatively impact trading volumes of cryptocurrencies, which would adversely affect the success of our business, financial condition and results of operations.

The price of each cryptocurrency is based in part on market adoption and future expectations, which might or might not be realized. As a result, the prices of cryptocurrencies are highly speculative. The prices of cryptocurrencies have been subject to dramatic fluctuations, which have impacted, and will continue to impact, our trading volumes and operating results and may adversely impact our growth strategy and business. Several factors could affect a cryptocurrency’s price, including, but not limited to:

- Global cryptocurrency supply, including various alternative currencies which exist, and global cryptocurrency demand, which can be influenced by the growth or decline of retail merchants’ and commercial businesses’ acceptance of cryptocurrencies as payment for goods and services, the security of online cryptocurrency exchanges and digital wallets that hold cryptocurrencies, the perception that the use and holding of digital currencies is safe and secure, and regulatory restrictions on their use.

- Changes in the software, software requirements or hardware requirements underlying a blockchain network, such as a fork. Forks in the future are likely to occur and could result in a sustained decline in the market price of cryptocurrencies.

- Changes in the rights, obligations, incentives, or rewards for the various participants in a blockchain network.

- The maintenance and development of the software protocol of cryptocurrencies.

- Cryptocurrency exchanges’ deposit and withdrawal policies and practices, liquidity on such exchanges and interruptions in service from or failures of such exchanges.

- Regulatory measures, if any, that affect the use and value of cryptocurrencies.

- Competition for and among various cryptocurrencies that exist and market preferences and expectations with respect to adoption of individual currencies.

- Actual or perceived manipulation of the markets for cryptocurrencies.

- Actual or perceived connections between cryptocurrencies (and related activities such as mining) and adverse environmental effects or illegal activities.

- Social media posts and other public communications by high-profile individuals relating to specific cryptocurrencies, or listing or other business decisions by cryptocurrency companies relating to specific cryptocurrencies.

- Expectations with respect to the rate of inflation in the economy, monetary policies of governments, trade restrictions, and currency devaluations and revaluations.

While we have observed a positive trend in the total market capitalization of cryptocurrency assets historically, driven by increased adoption of cryptocurrency trading by both retail and institutional investors as well as continued growth of various non-investing use cases, historical trends are not indicative of future adoption, and it is possible that the rate of adoption of cryptocurrencies may slow or decline, which would negatively impact our business, financial condition, and results of operations.

While we currently support twenty-one cryptocurrencies for trading, market interest in particular cryptocurrencies can also be volatile and there are many cryptocurrencies in the market that we do not support. Our business could be adversely affected, and growth in our net revenue earned from cryptocurrency transactions could slow or decline, if the markets for the cryptocurrencies we support deteriorate or if demand moves to other cryptocurrencies not supported by our platform.

Volatility in the values of cryptocurrencies caused by the factors described above or other factors may impact our regulatory net worth requirements as well as the demand for our services and therefore have an adverse effect on our business, financial condition and results of operations.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts.

In addition, if the Company violated federal or state securities laws in connection with a prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future.