KingsCrowd: Difference between revisions

No edit summary |

No edit summary |

||

| Line 1: | Line 1: | ||

'''The financial data platform for the online private market''' | '''The financial data platform for the online private market''' | ||

== | == Summary<ref name=":0" /> == | ||

* First to serve the $30B online private markets with data & analytics | * First to serve the $30B online private markets with data & analytics | ||

* $2.2M+ raised to date from 2,100+ investors | * $2.2M+ raised to date from 2,100+ investors | ||

| Line 13: | Line 7: | ||

* Serving 350,000+ retail investors and thousands of paying customers | * Serving 350,000+ retail investors and thousands of paying customers | ||

* Patent-pending AI-driven startup rating algorithm | * Patent-pending AI-driven startup rating algorithm | ||

== Problem<ref name=":0" /> == | == Problem<ref name=":0" /> == | ||

=== The online private markets have a data gap === | |||

== The online private markets have a data gap == | |||

Investment in public markets, like stocks, is driven by data. Investors take for granted that they can rely on financial information services like Bloomberg and Morningstar to make informed investments. | Investment in public markets, like stocks, is driven by data. Investors take for granted that they can rely on financial information services like Bloomberg and Morningstar to make informed investments. | ||

| Line 27: | Line 17: | ||

== Solution<ref name=":0" /> == | == Solution<ref name=":0" /> == | ||

---- | === A data-driven approach to startup investing === | ||

KingsCrowd’s investment data platform is the first of its kind for the online private markets. KingsCrowd empowers individual investors to make intelligent startup investment decisions on platforms like Republic, Wefunder, SeedInvest, Netcapital, etc., by providing institutional-grade research tools for assessing the thousands of investment opportunities available to investors at any one time. | |||

KingsCrowd leverages a patent-pending rating algorithm to interpret hundreds of data points on every investment opportunity available online. KingsCrowd tracks and rate every RegCF investment opportunity in the United States, with expansion into Reg A+, RegD 506c, and late stage secondaries underway over the next 12-to-15 months. | |||

[[File:41039-1620666443-c03143f23647677d31650fa51be4d5d31ece8696.png|left]] | |||

== Product<ref name=":0" /> == | == Product<ref name=":0" /> == | ||

=== A comprehensive platform for investors === | |||

== A comprehensive platform for investors == | |||

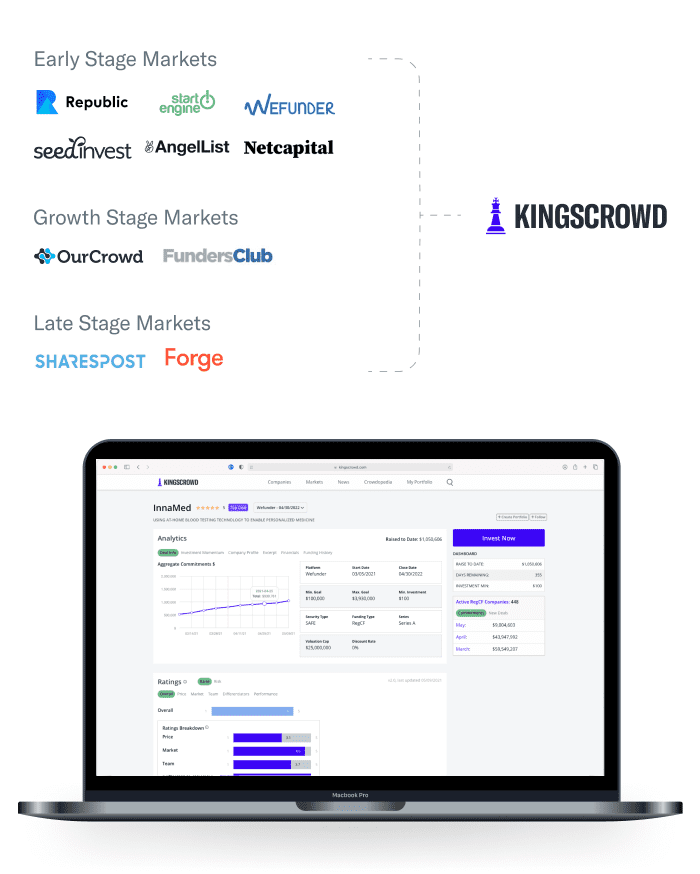

KingsCrowd provides individual and institutional investors with an array of tools to take the complexity and burden of finding, investing and tracking all of your private market investments made on platforms like Republic off of you, the investor. | KingsCrowd provides individual and institutional investors with an array of tools to take the complexity and burden of finding, investing and tracking all of your private market investments made on platforms like Republic off of you, the investor. | ||

KingsCrowd makes pre-seed to pre-IPO investing online look and feel like the public markets by leveraging various data solutions to make your startup investing life easier than ever. | |||

=== Ratings | === Ratings === | ||

[[File:-c7b2ab54a7d6f60aa6d30d89293ace04f3a0fc34.png]] | [[File:-c7b2ab54a7d6f60aa6d30d89293ace04f3a0fc34.png]] | ||

KingsCrowd has developed a patent-pending rating algorithm that benchmarks and scores all companies raising capital via the online private markets. The Merlin rating algorithm, developed by the team of ex-VCs and technologists, relies on over 170 data points sourced from | KingsCrowd has developed a patent-pending rating algorithm that benchmarks and scores all companies raising capital via the online private markets. The Merlin rating algorithm, developed by the team of ex-VCs and technologists, relies on over 170 data points sourced from regulatory filings (e.g., past 2-year financials), offering pages, and independent sources of private market data to score companies at a similar stage of development across 5 key metrics. | ||

This rating system is a first-of-its-kind data-driven rating system that helps investors to effectively manage their due diligence funnels. In time, this standardized rating system has the opportunity to power predictive analytics and index products in the private market sphere. | |||

=== Analytics === | |||

[[File:Analytics.png]] | |||

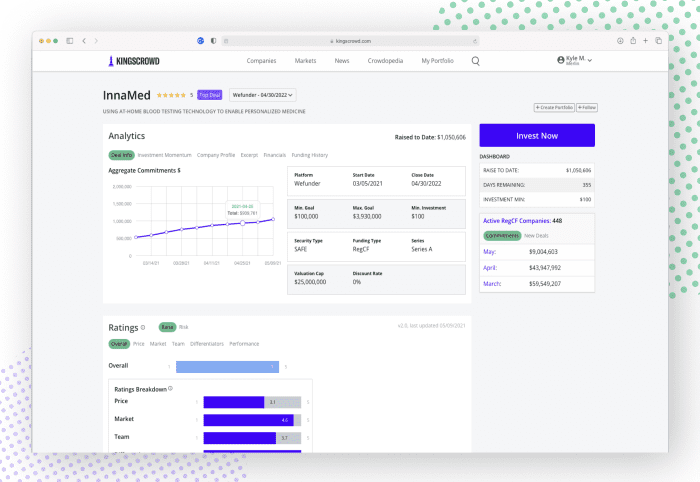

Part of intelligent investing in this new online private market sphere is understanding general market trends such as how much companies are raising on average, what their valuation metrics typically look like, where capital is being deployed, which marketplaces are performing well, etc. | |||

With KingsCrowd market analytics, investors have the types of market trends analysis available in the public markets right at their fingertips for this brand new space. | |||

=== Portfolio === | |||

[[File:41643-1621508617-e7b3215d8497cdebfec05195527acab4b05de8f4.png]] | |||

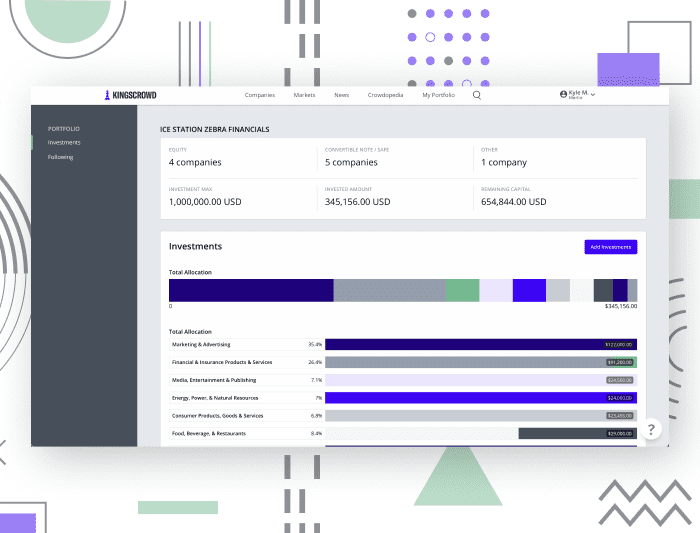

KingsCrowd provides a ‘Mint.com’ type of experience for retail investors who are building diversified portfolios of startups across various online private markets. With KingsCrowd’s portfolio tool, you can add all of your startup investments from the myriad of marketplaces into one portfolio tracking tool, with plans to provide performance tracking in the near future. | |||

=== News and investor education === | |||

KingsCrowd provides its users with a curated feed of online private investing news. KingsCrowd also publishes insights, commentary, and educational content to contextualize what’s happening in the market – all with the goal of empowering you the investor to feel confident in your ability to invest in the private market asset class. | |||

== Traction<ref name=":0" /> == | == Traction<ref name=":0" /> == | ||

=== Hitting its stride === | |||

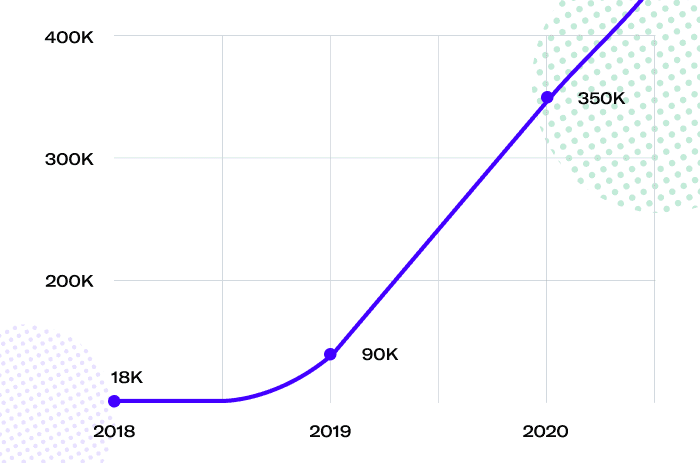

Today, KingsCrowd serves more than 350K users, including thousands of paying customers. In 2020 alone, KingsCrowd 20X’d its ARR while scaling from a few thousand users in 2019 to hundreds of thousands in 2020. KingsCrowd also added over 1,500 new equity investors in 2020, who have helped to power KingsCrowd’s product and user growth. | |||

== Hitting | |||

Today, KingsCrowd serves more than 350K users, including thousands of paying customers. In 2020 alone, | |||

[[File:Ede731e2939a32b1fe102cb4d53fa9406e6f086d.png]] | [[File:Ede731e2939a32b1fe102cb4d53fa9406e6f086d.png]] | ||

== Business model<ref name=":0" /> == | == Business model<ref name=":0" /> == | ||

-- | === Three complementary sales channels === | ||

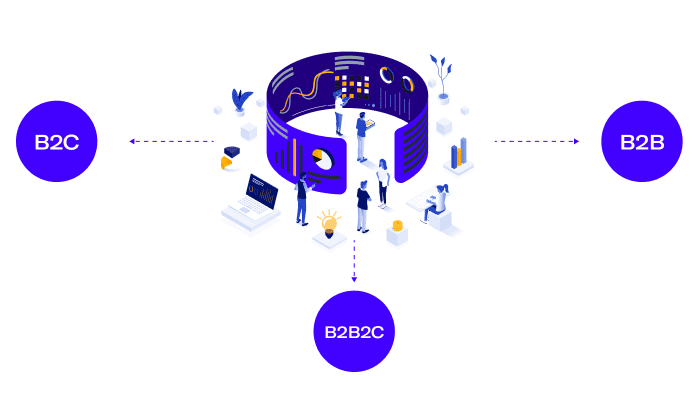

KingsCrowd aims to be the go-to integrated data solution for online private markets, as Bloomberg is for public markets. KingsCrowd has developed a core user base of individual investors, served by multi-level subscriptions. | |||

In 2021 and beyond, KingsCrowd is bringing its offerings to institutional investors. KingsCrowd has already begun its expansion with direct sales to businesses. Next, we’ll be rolling out its resale partnerships, providing KingsCrowd API access to help brokerage firms connect their clients to online private offerings. | |||

In 2021 and beyond, KingsCrowd is bringing | |||

[[File:41102-1620730779-b8e75b17321579a82e89abf2b170a9f3ace2dfb2.png]] | [[File:41102-1620730779-b8e75b17321579a82e89abf2b170a9f3ace2dfb2.png]] | ||

== Market<ref name=":0" /> == | == Market<ref name=":0" /> == | ||

=== A new private market<ref name=":0" /> === | |||

== A new private market<ref name=":0" /> == | |||

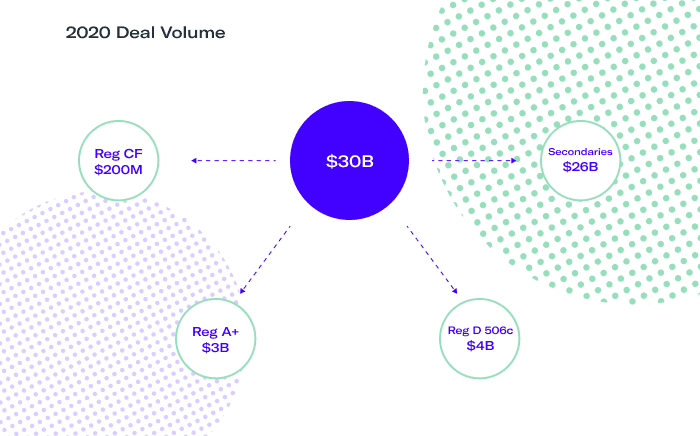

Whereas startup investing used to be limited only to millionaires and institutions, since 2016, private investing has moved online at an unprecedented rate, expanding to more than $30B in deal and trading volume annually into pre-seed through pre-IPO companies. | Whereas startup investing used to be limited only to millionaires and institutions, since 2016, private investing has moved online at an unprecedented rate, expanding to more than $30B in deal and trading volume annually into pre-seed through pre-IPO companies. | ||

| Line 77: | Line 103: | ||

== Competition<ref name=":0" /> == | == Competition<ref name=":0" /> == | ||

=== A pioneer in the online private market ecosystem === | |||

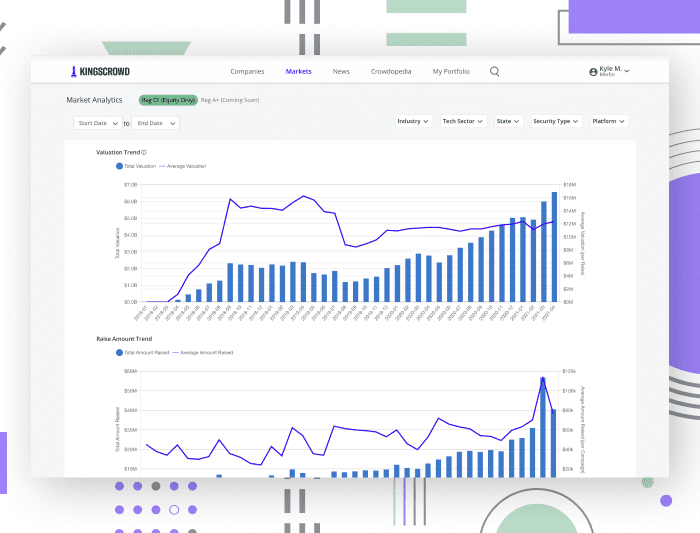

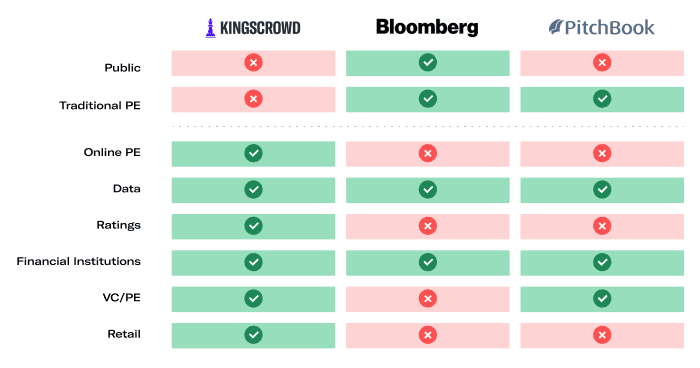

Established players like Bloomberg and Morningstar cover financial data for public markets, while PitchBook addresses traditional ‘offline’ private equity. Online private equity investing represents a significant gap, where KingsCrowd is strategically positioned. KingsCrowd also distinguishes itself by including retail investors in its target market and by providing data-driven ratings as a core part of its service. | |||

== A pioneer in the online private market ecosystem == | |||

Established players like Bloomberg and Morningstar cover financial data for public markets, while PitchBook addresses traditional ‘offline’ private equity. Online private equity investing represents a significant gap, where KingsCrowd is strategically positioned. | |||

[[File:41315-1620953828-727763f077158833c52607569e0358615059e039.png]] | [[File:41315-1620953828-727763f077158833c52607569e0358615059e039.png]] | ||

== Vision and strategy<ref name=":0" /> == | == Vision and strategy<ref name=":0" /> == | ||

- | === Become the global online private market data provider === | ||

KingsCrowd has carved out a distinct market—and now it aims to set a lasting standard. Its long-term vision is to be the global data conglomerate for private assets trading across the world. | |||

To realize its vision, we’re building out its investment research, technology, and marketing teams to scale into new asset classes, product categories, sales channels, and geographies. | |||

To realize | |||

[[File:41503-1621371878-5d9b53e34c474578e5ed53e16cee069edfbd1e9f (1).png]] | [[File:41503-1621371878-5d9b53e34c474578e5ed53e16cee069edfbd1e9f (1).png]] | ||

== Funding<ref name=":0" /> == | == Funding<ref name=":0" /> == | ||

=== Crowdfunder supported === | |||

In its three years of operation, KingsCrowd has raised more than $2M from 2,100+ investors. KingsCrowd is proud to have the support of the online investment community, selling out a $1M online raise in March 2020 as well as three other online raises during 2018 and 2019! | |||

== Crowdfunder supported == | |||

In | |||

== Management<ref name=":0" /> == | == Management<ref name=":0" /> == | ||

=== Extensive knowledge in the fintech industry === | |||

== Extensive knowledge in the fintech industry == | |||

KingsCrowd has assembled a dedicated team combining the expertise of financiers, VCs, technologists, founders, and industry experts. The management team has decades of experience working for notable financial services firms such as Dow Jones, Bank of America, The Motley Fool, Carta, LEK Consulting, and more. | KingsCrowd has assembled a dedicated team combining the expertise of financiers, VCs, technologists, founders, and industry experts. The management team has decades of experience working for notable financial services firms such as Dow Jones, Bank of America, The Motley Fool, Carta, LEK Consulting, and more. | ||

| Line 111: | Line 129: | ||

== Advisors<ref name=":0" /> == | == Advisors<ref name=":0" /> == | ||

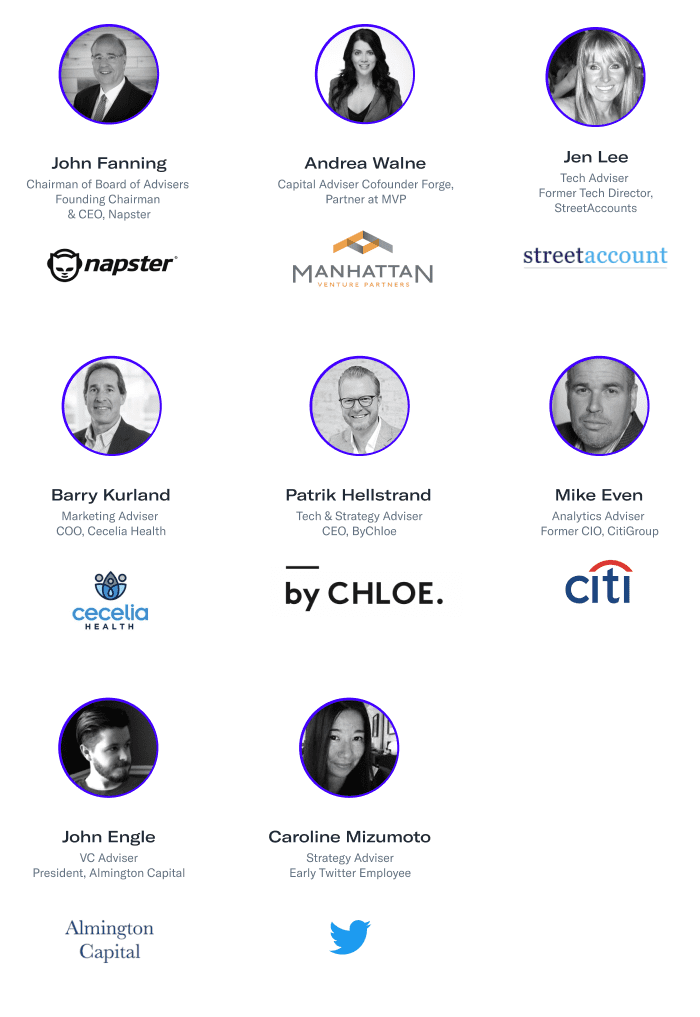

Its extensive advisory board includes Mike Even, former CIO of Citigroup Asset Management and CEO of Man Numeric; Andrea Walne, Co-Founder of Forge and Managing Director at Manhattan Venture Partners; and John Fanning, Founding Chairman & CEO of Napster. | |||

[[File:41640-1621508440-23768c98359e89772e20b12ddbfb99d75a86e9aa.png]] | [[File:41640-1621508440-23768c98359e89772e20b12ddbfb99d75a86e9aa.png]] | ||

== Risks<ref name=":0" /> == | == Risks<ref name=":0" /> == | ||

'''KingsCrowd has a history of operating losses and may not achieve or sustain profitability in the future.''' | |||

KingsCrowd was organized in December 2017 and have mostly experienced net losses and negative cash flows from operations since inception. KingsCrowd has not generated profits nor significant revenues and have sustained net losses of $1,307,477 and $493,484 during the years ended December 31, 2020 and 2019, respectively. While KingsCrowd has experienced significant revenue growth in recent periods, it is not certain whether or when it will obtain a high enough volume of subscription fee revenue to sustain or increase its growth or achieve or maintain profitability in the future. KingsCrowd also expects its costs and expenses to increase in future periods, which could negatively affect its future operating results if its revenue does not increase. In particular, KingsCrowd intends to continue to expend significant funds to retain additional qualified personnel, further develop its platform, introduce new products, and expand its marketing programs and sales teams to drive new subscribers and develop strategic partner relationships. Its efforts to grow its business may be costlier than it expects, and KingsCrowd may not be able to increase its revenue enough to offset its increased operating expenses. KingsCrowd may incur significant losses in the future for several reasons, including the other risks described herein, and unforeseen expenses, difficulties, complications, delays, and other unknown events. If KingsCrowd is unable to achieve and sustain profitability, the value of its business may significantly decrease. | |||

''' | '''Its independent registered public accounting firm has expressed in its report on its audited financial statements a substantial doubt about its ability to continue as a going concern.''' | ||

KingsCrowd has not yet generated sufficient revenues from its operations to fund its activities, and it is therefore dependent upon external sources for the financing of its operations. As a result, its independent registered public accounting firm has expressed in its report on the financial statements included as part of this offering circular a substantial doubt regarding its ability to continue as a going concern. Its financial statements do not include any adjustments that might result if KingsCrowd is unable to continue as a going concern. If KingsCrowd is unable to continue as a going concern, holders of its common stock might lose their entire investment. | |||

''' | '''Its growth will depend, in part, on its entry into strategic partnerships with financial services institutions and other financial professionals.''' | ||

One of growth strategies entails entering into partnerships or other arrangements with financial services institutions and other financial professionals that will make | One of growth strategies entails entering into partnerships or other arrangements with financial services institutions and other financial professionals that will make its products available to their customers. KingsCrowd expects that establishing strategic partner relationships with financial services institutions will require extensive sales efforts, with little predictability as to whether a relationship develops. Its small size and short operating history may prove to be impediments to these organizations entering into agreements with us. KingsCrowd also may face competition for strategic partnerships with financial services institutions and these organizations may favour its competitors’ products or services over its platform. Further, financial services institutions that KingsCrowd expects to target have significantly greater resources than it does and could choose to develop their own solutions and compete with its products directly. Moreover, certain financial services institutions may elect to focus on other market segments. If KingsCrowd is unsuccessful in establishing relationships with strategic partners, its subscriber may not grow as quickly as it expects or at all and its business and results of operations may suffer. | ||

'''The COVID-19 outbreak has materially impacted the U.S. and global economies, and could have a material adverse impact on | '''The COVID-19 outbreak has materially impacted the U.S. and global economies, and could have a material adverse impact on its employees, subscribers, and future strategic partners, which could adversely and materially impact its business, financial condition and results of operations.''' | ||

The World Health Organization has declared the outbreak of the novel coronavirus COVID-19 a pandemic and public health emergency of international concern. In March 2020, the President of the United States (U.S.) declared a State of National Emergency due to the COVID-19 outbreak. In addition, many jurisdictions in the U.S. have limited social mobility and gathering. Many business establishments have closed due to restrictions imposed by the government and many governmental authorities have closed most public establishments, including schools, restaurants and shopping malls. | The World Health Organization has declared the outbreak of the novel coronavirus COVID-19 a pandemic and public health emergency of international concern. In March 2020, the President of the United States (U.S.) declared a State of National Emergency due to the COVID-19 outbreak. In addition, many jurisdictions in the U.S. have limited social mobility and gathering. Many business establishments have closed due to restrictions imposed by the government and many governmental authorities have closed most public establishments, including schools, restaurants and shopping malls. Its employees have been, and may continue to be, negatively impacted by the shelter-in-place and other similar state and local orders, the closure of manufacturing sites and country borders, and the increase in unemployment. As the COVID-19 pandemic develops, governments (at national, state and local levels), companies and other authorities may continue to implement restrictions or policies that could adversely impact consumer spending, global capital markets and the global economy. Even after the COVID-19 pandemic has subsided, KingsCrowd may continue to experience an adverse impact to its business as a result of its global economic impact. The COVID-19 pandemic may also adversely impact its subscribers, its employees and its employee productivity. This direct impact of the virus, and the disruption on its employees and operations, may negatively impact its revenue. The disruption and volatility in the global and domestic capital markets may increase the cost of capital and limit its ability to access capital and may negatively affect stock markets, which may deter retail investing and impact the growth of its business. Both the health and economic aspects of the COVID-19 virus are highly fluid and the future course of each is uncertain. For these reasons and other reasons that may come to light if the COVID-19 pandemic and associated protective or preventative measures expand, KingsCrowd may experience a material adverse impact on its business operations, revenues and financial condition as well as some of its underlying business drivers such as customer growth and product development; however, its ultimate impact is highly uncertain and subject to change. To the extent the COVID-19 pandemic adversely affects its business and financial results, it may also have the effect of heightening many of the other risks described in this “Risk Factors” section. | ||

'''If | '''If KingsCrowd is unable to attract new subscribers or convert free tier subscribers into paying subscribers, its revenue growth and operating results will be adversely affected.''' | ||

To increase | To increase its revenue, KingsCrowd must continue to attract new paid subscribers. As its industry evolves and new companies enter the market with new product and service offerings, or competitors introduce lower cost or differentiated products or services that are perceived to compete with its products, its ability to grow its subscriber base could be impaired. Similarly, subscriptions could be adversely affected if subscribers perceive that alternative products render out products obsolete or reduce the need for its products or if they prefer to use products offered by other companies. One of its marketing strategies is to offer a free entry level tier to its platform to generate interest in the paid subscription tiers. Many of its subscribers start by subscribing for its free tier service. Converting these subscribers to paid subscribers often requires follow-up and engagement. Most free tier subscribers never convert to a paid subscription. As a result of these and other factors, KingsCrowd may be unable to attract new paying subscribers, which would have an adverse effect on its business, revenue, gross margins, and operating results. | ||

'''If | '''If KingsCrowd is unable to retain its current subscribers or sell paid tier products to them, its revenue growth will be adversely affected.''' | ||

To increase | To increase its revenue, in addition to acquiring new subscribers, KingsCrowd must continue to retain existing subscribers and convince them to subscribe and pay for paid tiered products. Its ability to retain its subscribers and convert them to paid tier subscribers could be impaired for a variety of reasons, including customer reaction to changes in the pricing of its products or the other risks described in this offering circular. As a result, KingsCrowd may be unable to retain existing subscribers or convert them to paid tier subscribers of its platform, which would have an adverse effect on its business, revenue, gross margins, and other operating results. Its subscribers have no obligation to renew their subscriptions for its products after the expiration of their subscription period. For KingsCrowd to improve its operating results, it is important that its subscribers continue to maintain their subscriptions on the same or more favourable terms. KingsCrowd cannot accurately predict renewal or expansion rates given the diversity of its customer base. Its renewal and expansion rates may decline or fluctuate as a result of several factors, including world, national and local economic factors, customer satisfaction with its products, pricing changes, competitive conditions and factors. If its paid subscribers do not renew their subscriptions, or if they elect to renew at lower tiers at lower tier pricing, its revenue and other operating results will decline and its business will suffer. | ||

'''A decline in stock markets or other events that negatively impact the stock markets or the availability of capital for smaller companies could result in fewer people making retail investments and a smaller potential audience for | '''A decline in stock markets or other events that negatively impact the stock markets or the availability of capital for smaller companies could result in fewer people making retail investments and a smaller potential audience for its products.''' | ||

Its success will depend on retail investors’ continued interest in investing in the online private markets. Declines in stock markets or other events that negatively impact the stock market originating from virtually any source, including domestic and worldwide political or economic events; geopolitical events, such as wars or acts of terrorism; climate change; natural disasters; pandemics such as COVID-19; or other catastrophic events, may result in declines in stock markets and discourage people from investing in the deals that KingsCrowd posts on its website. In addition, any events that reduce the amount of capital available to smaller issuers, such as the severe financial crisis that affected the banking system and financial markets in 2008 and 2009, after which the credit markets did not recover for small businesses for an extended period of time, could cause small issuers to defer or abandon securities offerings, which could reduce interest in its products. Any events that reduce or curtail interest in the products that KingsCrowd offers would harm its business, growth prospects, revenue and operating results. | |||

'''If | '''If KingsCrowd loses its founder or key personnel, its business may be harmed.''' | ||

Its success and future growth depend upon the continued services of its founder and key personnel. Currently, KingsCrowd has three full-time employees, including its founder and President, Christopher Lustrino, who is critical to its overall management, as well as the continued development of its products, strategic partnerships, its culture, and its strategic direction. All of its other personnel are consultants who provide services to KingsCrowd under consulting agreements that allow KingsCrowd or the consultant to terminate the agreement with no or minimal notice. From time to time, there may be changes in its in key personnel which could disrupt its business. KingsCrowd currently does not have “key person” insurance. The loss of its founder, employees or one or more of its key consultants, including due to illness resulting from COVID-19, could harm its business, and KingsCrowd may not be able to find adequate replacements. KingsCrowd cannot ensure that it will be able to retain the services of its founder or any of its key personnel or that it would be able to timely replace these people should any of them depart. | |||

'''The failure to attract and retain additional qualified personnel and any restrictions on the movement of personnel could prevent | '''The failure to attract and retain additional qualified personnel and any restrictions on the movement of personnel could prevent KingsCrowd from executing its business strategy and growth plans.''' | ||

To execute | To execute its business strategy, KingsCrowd must attract and retain highly qualified personnel. Competition for executive officers, software developers, investment analysts, marketing professionals and other key employees in its industry is intense. KingsCrowd competes with many other companies for software developers as well as for skilled investment analysts. Nearly all of the companies with which KingsCrowd currently competes and expect to compete against in the future for experienced personnel have greater resources than KingsCrowd does and can frequently offer such personnel substantially greater compensation than it can offer. If KingsCrowd fails to identify, attract, develop and integrate new personnel, or fail to retain and motivate its current personnel, its growth prospects would be adversely affected. | ||

'''Interruptions or delays in the services provided by internet service providers could impair the delivery of | '''Interruptions or delays in the services provided by internet service providers could impair the delivery of its products and its business could suffer.''' | ||

KingsCrowd hosts its platform using third-party cloud infrastructure services. KingsCrowd therefore depends on its third-party providers’ ability to protect their data centers against damage or interruption from natural disasters, power or telecommunications failures, criminal acts and similar events. Its operations depend on protecting the cloud infrastructure hosted by such providers by maintaining their respective configuration, architecture, and interconnection specifications, as well as the information stored in these virtual data centers and transmitted by third-party internet service providers. KingsCrowd cannot assure you that it will not experience interruptions or delays in its service. KingsCrowd may also incur significant costs for using alternative equipment or taking other actions in preparation for, or in reaction to, events that damage the data storage services it uses. Any prolonged service disruption affecting its platform for any reason could damage its reputation with current and potential subscribers, cause KingsCrowd to lose subscribers, or otherwise harm its business. Currently, KingsCrowd does not have insurance that covers interruptions to its business as a result of third-party failures. Its platform is accessed by many subscribers, often at the same time. As KingsCrowd continues to expand the number of its subscribers and products available to its subscribers, it may not be able to scale its technology to accommodate the increased capacity requirements, which may result in interruptions or delays in service. In addition, the failure of data centres, internet service providers, or other third-party service providers to meet its capacity requirements could result in interruptions or delays in access to its platform or impede its ability to grow its business and scale its operations. If its third-party infrastructure service agreements are terminated, or there is a lapse of service, interruption of internet service provider connectivity, or damage to data centres, it could experience interruptions in access to its platform as well as delays and additional expense in arranging new facilities and services KingsCrowd operates in an emerging and evolving market, which may develop more slowly or differently than it expects. If its market does not grow as KingsCrowd expects, or if KingsCrowd cannot expand its platform to meet the demands of this market, its revenue may decline or fail to grow, and it may incur additional operating losses. | |||

'''Changes in government regulations could materially harm | '''Changes in government regulations could materially harm its business.''' | ||

Its business is founded upon the expansion and relaxation of the private offering exemptions to the federal securities laws to the extent that they allow issuers to solicit investors and generally advertise securities offerings and to offer and sell securities to non-accredited investors. Further, these laws provide smaller issuers with access to capital markets that were not previously available to them. The provisions allowing these activities were adopted within the last eight years and offering activities are evolving as issuers, financial institutions and investors develop techniques to utilize the new exemptions and rules. The SEC or other governmental agencies and non-governmental organizations, such as FINRA, may determine that some or all of the new practices implemented by the investment community overreach the original intent of the regulations or undermine investor protections, among other things, and amend or withdraw the offending rules and regulations or apply and interpret them in ways that are harmful to its business, including changes in laws and regulations that inhibit smaller issuers from offering securities under these exemptions. KingsCrowd and the issuers that rely on these exemptions may not be able to respond quickly or effectively to regulatory, legislative, and other developments, which may reduce or eliminate offerings made under Reg D, Reg A and Reg CF and the desirability of its products, in which case its business, operating results and financial condition could suffer. | |||

'''Failure to effectively develop and expand | '''Failure to effectively develop and expand its sales and marketing capabilities could harm its ability to increase its customer base and achieve broader market acceptance of its products.''' | ||

Its ability to increase subscribers and enter into strategic relationships with financial services institutions will depend to a significant extent on its ability to expand its sales and marketing efforts and to deploy its sales and marketing resources efficiently. KingsCrowd plans to continue expanding its direct-to-retail investors efforts and to begin focusing on identifying and entering into agreements with strategic partners. KingsCrowd currently dedicates significant resources to sales and marketing programs, including digital advertising through services such as Google AdWords and expect to incur increasing costs for such programs in the future. Its business and operating results will be harmed if its sales and marketing efforts do not generate significant increases in revenue. KingsCrowd may not achieve anticipated revenue growth from expanding its sales force if it is unable to hire, develop, integrate, and retain talented and effective sales personnel, if its new and existing sales personnel are unable to achieve desired productivity levels in a reasonable period of time, or if its sales and marketing programs and advertising are not effective. | |||

''' | '''KingsCrowd may not be able to successfully manage its growth, and if it is not able to grow efficiently, its business, financial condition and results of operations could be harmed.''' | ||

The growth and expansion of | The growth and expansion of its business places a continuous significant strain on its management, operational and financial resources. As its subscriber base and usage of its platform grows, KingsCrowd will need to devote additional resources to improving its platform’s capabilities, features and functionality. In addition, KingsCrowd will need to scale appropriately its internal business, IT, and financial, operating and administrative systems to serve its growing customer base, and continue to manage headcount, capital and operating processes in an efficient manner. Any failure of or delay in these efforts could result in impaired performance and reduced customer satisfaction, resulting in fewer new subscribers or a lower rate of converting non-paying subscribers to paid subscribers, which would hurt its revenue growth and its reputation. Even if KingsCrowd is successful in its expansion efforts, they will be expensive and complex, and require the dedication of significant management time and attention. KingsCrowd may also suffer inefficiencies or service disruptions as a result of its efforts to scale its internal infrastructure. KingsCrowd cannot be sure that the expansion of and improvements to its internal infrastructure will be effectively implemented on a timely basis, if at all, and such failures could harm its business, financial condition and results of operations. | ||

'''Failing to respond to technological change, keep pace with new technology developments, or adopt a successful technology strategy may negatively affect | '''Failing to respond to technological change, keep pace with new technology developments, or adopt a successful technology strategy may negatively affect its competitive position and business results.''' | ||

KingsCrowd believes the technology landscape has been changing at an accelerating rate over the past several years. Changes in technology are fundamentally changing the ways investors access data and content. Examples include the shift from local network computing to cloud-based systems, the proliferation of wireless mobile devices, rapid acceleration in the use of social media platforms, the dissemination of data through application programming interfaces (APIs) that permit real-time updating rather than raw data feeds, and the proliferation of machine learning and other artificial intelligence technologies. While some changes in technology may offer opportunities for us, KingsCrowd cannot guarantee that it will successfully adapt its product offerings to meet evolving customer needs. If KingsCrowd fails to develop and implement new technology rapidly enough, it may sacrifice new business opportunities or renewals from existing customers. KingsCrowd may also incur additional operating expense if major software projects take longer than anticipated. Its technology is also heavily dependent on the quality and comprehensiveness of its data and its ability to successfully build analytics, research, and other intellectual property around that data. Its competitive position and business results may suffer if it fails to develop new technologies to meet customer demands, if its execution speed is too slow, if KingsCrowd adopts a technology strategy that does not align with changes in the market, or if it fails to realize the value and potential of its data assets. | |||

''' | '''KingsCrowd may not be able to scale its business quickly enough to match the growth of its subscriber base, and if it is not able to scale its business efficiently, its operating results could be harmed.''' | ||

As usage of | As usage of its platform grows and in anticipation of partnering with financial services institutions, KingsCrowd will need to devote additional resources to improving and maintaining its infrastructure and computer network and integrating with third-party applications to maintain the performance of its platform. In addition, KingsCrowd will need to appropriately scale its internal business systems to serve its growing customer base. Any failure of or delay in these efforts could result in service interruptions, impaired system performance, and reduced customer satisfaction, resulting in decreased sales to new subscribers, lower subscription renewal rates by existing subscribers and impairing its ability to partner with large institutions, each of which could hurt its revenue growth. If sustained or repeated, these performance issues could reduce the attractiveness of its products to subscribers and could result in lost customer opportunities and lower renewal rates, any of which could hurt its revenue growth, customer loyalty, and its reputation. Even if KingsCrowd is successful in these efforts to scale its business, they will be expensive and complex, and require the dedication of significant management time and attention. KingsCrowd cannot be sure that the expansion and improvements to its internal infrastructure will be effectively implemented on a timely basis, if at all, and such failures could adversely affect its business, operating results and financial condition. | ||

'''If | '''If KingsCrowd fails to maintain and enhance its brand, its ability to expand its customer base will be impaired and its business, operating results, and financial condition may suffer.''' | ||

KingsCrowd believes that maintaining and enhancing its KingsCrowd brand is important to support the marketing and sale of its existing and future products to new subscribers and strategic partners. Successfully maintaining and enhancing its brand will depend largely on the effectiveness of its marketing efforts, its ability to provide reliable products at competitive prices, its ability to maintain its subscribers’ trust, its ability to continue to develop new functionality and products, and its ability to successfully differentiate its platform and products from competitive products and services. Its brand promotion activities may not generate customer awareness or yield increased revenue, and even if they do, any increased revenue may not offset the expenses KingsCrowd incurs in building its brand. If KingsCrowd fails to successfully promote and maintain its brand, its business could suffer. | |||

'''If | '''If KingsCrowd fails to adequately protect its proprietary rights in its ratings algorithms and other proprietary technologies, its competitive position could be impaired and KingsCrowd may lose valuable assets, generate less revenue and incur costly litigation to protect its rights.''' | ||

Its success is dependent, in part, upon protecting its proprietary technology, including its ratings algorithms. KingsCrowd expects to file for patent protection of its existing algorithms and for any similar technologies it develops in the future but there is no assurance that any patents ultimately will be issued. KingsCrowd also expects to file for copyrights, trademarks, service marks to protect its branding assets. KingsCrowd will continue to rely on trade secret laws and contractual provisions to establish and protect its proprietary rights. However, the steps KingsCrowd takes to protect its intellectual property may be inadequate. Any patents issued in the future may not provide KingsCrowd with competitive advantages or may be successfully challenged by third parties. Any of its patents, trademarks, or other intellectual property rights may be challenged or circumvented by others or invalidated through administrative process or litigation. There can be no guarantee that others will not independently develop similar products, duplicate any of its products, or design around its patents. Furthermore, legal standards relating to the validity, enforceability, and scope of protection of intellectual property rights are uncertain. Despite its precautions, it may be possible for unauthorized third parties to copy its products and use information that KingsCrowd regards as proprietary to create products and services that compete with ours. Failure to adequately protect its intellectual property could harm its brand, devalue its proprietary content, and affect its ability to compete in the marketplace, which could have a material adverse effect on its business, financial condition or results of operations. | |||

'''The markets in which | '''The markets in which KingsCrowd participates are competitive, and if it does not compete effectively, its operating results could be harmed.''' | ||

KingsCrowd believes that it is the first organization to offer research, analytics tools and ratings for the online private markets. KingsCrowd also believes that market for its products will continue to grow and that the growth of the market will prompt other companies to develop and market products such as those it offers. KingsCrowd expects that its competitors may range from start-up organizations to large financial services institutions that internally develop products that compete with its products directly or that are superior to ours. KingsCrowd competes on several factors, including: · breadth of coverage of the online private markets; · product features, quality, and functionality; · the accuracy of the research and ratings provided; · ease of use; · depth of data assets that will allow an organization to improve its ratings algorithms and machine learning capabilities; · brand recognition; and · pricing. KingsCrowd expects that many of its potential competitors will have greater name recognition, longer operating histories, more established customer relationships, larger marketing budgets, and greater resources than us. These competitors may be able to respond more quickly and effectively than KingsCrowd can to new or changing opportunities, technologies, standards, and customer requirements. For these reasons, KingsCrowd may not be able to compete successfully against its future competitors, which would harm its business, operating results and financial condition. | |||

'''Future acquisitions, strategic investments, partnerships, collaborations, or alliances could be difficult to identify and integrate, divert the attention of management, disrupt | '''Future acquisitions, strategic investments, partnerships, collaborations, or alliances could be difficult to identify and integrate, divert the attention of management, disrupt its business, dilute stockholder value, and adversely affect its operating results and financial condition.''' | ||

KingsCrowd may in the future seek to acquire or invest in businesses, products or technologies that it believes could complement or expand its platform, enhance its technical capabilities or otherwise offer growth opportunities. Acquisitions involve numerous risks, any of which could harm its business and negatively affect its operating results, including: · difficulties in integrating the technologies, operations, existing contracts and personnel of an acquired company; · difficulties in supporting and transitioning customers and suppliers, if any, of an acquired company; · diversion of financial and other resources and management’s attention from existing operations or alternative acquisition opportunities; · failure to realize the anticipated benefits or synergies of a transaction; · failure to identify all of the problems, liabilities or other shortcomings or challenges of an acquired company or technology, including issues related to intellectual property, regulatory compliance practices, revenue recognition or other accounting practices, or employee or customer issues; · risks of entering new markets in which KingsCrowd has limited or no experience; · potential loss of key employees, customers, vendors and suppliers from either its current business or an acquired company’s business; · inability to generate sufficient revenue to offset acquisition costs; · additional costs or equity dilution associated with funding the acquisition; and · possible write-offs or impairment charges relating to acquired businesses. | |||

''' | '''KingsCrowd may require additional capital to support the growth of its business, and this capital might not be available on acceptable terms, if at all.''' | ||

KingsCrowd has funded its operations since inception primarily through equity and debt financings and sales of subscriptions to its products. KingsCrowd cannot be certain when or if its operations will generate sufficient cash to fund fully its ongoing operations or the growth of its business. KingsCrowd intends to continue to make investments to support its business, which may require KingsCrowd to engage in equity or debt financings to secure additional funds. Additional financing may not be available on terms favourable to us, if at all. If adequate funds are not available on acceptable terms, KingsCrowd may be unable to invest in future growth opportunities, which could harm its business, operating results, and financial condition. If KingsCrowd incurs additional debt, the debt holders would have rights senior to holders of common stock to make claims on its assets, and the terms of any debt could restrict its operations, including its ability to pay dividends on its common stock. Furthermore, if KingsCrowd issues additional equity securities, stockholders will experience dilution, and the new equity securities could have rights senior to those of its common stock. Because its decision to issue securities in the future will depend on numerous considerations, including factors beyond its control, it cannot predict or estimate the amount, timing, or nature of any future issuances of debt or equity securities. As a result, its stockholders bear the risk of future issuances of debt or equity securities reducing the value of its common stock and diluting their interests. | |||

'''Natural catastrophic events, pandemics, and man-made problems such as power-disruptions, computer viruses, data security breaches, and terrorism may disrupt | '''Natural catastrophic events, pandemics, and man-made problems such as power-disruptions, computer viruses, data security breaches, and terrorism may disrupt its business.''' | ||

Natural disasters, pandemics such as COVID-19, or other catastrophic events may cause damage or disruption to | Natural disasters, pandemics such as COVID-19, or other catastrophic events may cause damage or disruption to its operations, international commerce and the global economy, and thus could harm its business. In the event of a major catastrophic event, such as an earthquake, hurricane, fire, power loss, telecommunications failure, vandalism, cyber-attack, war, or terrorist attack, KingsCrowd may be unable to continue its operations and may endure system interruptions, reputational harm, and delays in product development, all of which could harm its business, operating results, and financial condition. Additionally, as computer malware, viruses, and computer hacking, fraudulent use attempts, and phishing attacks have become more prevalent, we, and third parties upon which KingsCrowd relies, face increased risk in maintaining the performance, reliability, security, and availability of its solutions and related services and technical infrastructure to the satisfaction of its subscribers. Any computer malware, viruses, computer hacking, fraudulent use attempts, phishing attacks, or other data security breaches related to its network infrastructure or information technology systems or to computer hardware KingsCrowd leases from third parties, could, among other things, harm its reputation and its ability to retain existing subscribers and attract new subscribers. | ||

''' | '''KingsCrowd could face liability for the information and data it collects and distribute or the reports and other documents produced by its software products.''' | ||

KingsCrowd may be subject to claims for securities law violations, defamation (including libel and slander), negligence, or other claims relating to the information it publishes, including its research, rankings and ratings. For example, investors may take legal action against KingsCrowd if they rely on published information that contains an error, or a company may claim that KingsCrowd has made a defamatory statement about it or its employees. Despite disclaimers on its website that notify users of its platform that the information KingsCrowd publishes is solely for informational purposes and that its qualitative and quantitative ratings should not be considered as investment recommendations, there is the risk that subscribers may pursue claims against KingsCrowd for losses that may have some connection to its products under various legal theories, including violations of securities laws. KingsCrowd could also be subject to claims based on the content that is accessible from its website through links to other websites. KingsCrowd relies on a variety of third-party sources as the original sources for the information it incorporates in its published data. Accordingly, in addition to possible exposure for publishing incorrect information that results directly from its own errors, KingsCrowd could face liability based on inaccurate data provided to the company by others. Any claims against us, whether meritorious or not, could result in substantial costs and may divert management’s attention and resources, which might seriously harm its business, overall financial condition, and operating results and may damage its reputation and brand. In addition, an adverse outcome in any such proceeding could involve substantial awards against us. If any of these legal proceedings were to be determined adversely to KingsCrowd, or KingsCrowd were to enter into a settlement arrangement, it could be exposed to monetary damages or limits on its ability to operate its business, which could have an adverse effect on its business, financial condition and operating results. | |||

''' | '''KingsCrowd may become subject to other litigation that could be costly and time-consuming to defend.''' | ||

In addition to securities litigation, | In addition to securities litigation, KingsCrowd may become subject to legal proceedings and claims that arise in the ordinary course of business, such as claims brought by its subscribers in connection with commercial disputes or employment claims made by its current or former employees. Litigation might result in substantial costs and may divert management’s attention and financial resources from its operations, which might seriously harm its business, overall financial condition, and operating results. | ||

'''Compromises of data security of | '''Compromises of data security of its vendors could cause the company to incur unexpected expenses and may materially harm its reputation and operating results.''' | ||

KingsCrowd does not collect or store subscriber data other than the name and log on information of the subscriber. However, third party vendors with which KingsCrowd contracts collect, process and store certain personal information and other data relating to subscribers, including customer payment card information. KingsCrowd seeks to contract with reliable and trustworthy third parties to provide these services and expect that they maintain high-quality systems, software, tools and monitoring to provide security for processing, transmission and storage of personal information and other confidential information of its subscribers. In addition, any strategic partners with which KingsCrowd may partner in the future, obtain and process large amounts of sensitive data, including data related to its subscribers. There can be no assurance, however, that its vendors or strategic partners will not suffer a data compromise, that hackers or other unauthorized parties will not gain access to personal information or other data, including payment card data or confidential business information or that any such data compromise or access will be discovered in a timely fashion. The techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not identified until they are launched against a target, and its vendors may not be able to anticipate these techniques or to implement adequate preventative measures. In addition, its employees, contractors, vendors or other third parties with which KingsCrowd does business may attempt to circumvent security measures in order to misappropriate such personal information, confidential information or other data, or may inadvertently release or compromise such data. Under certain circumstances, KingsCrowd may be liable for such data security breaches. Any perceived or actual breach of security, regardless of how it occurs or the extent of the breach, could have a significant impact on its reputation as a trusted brand, cause the company to lose existing subscribers, prevent the company from obtaining new subscribers and strategic partners, require the company to expend significant funds to remedy problems caused by breaches and implement measures to prevent further breaches, and expose the company to legal risk and potential liability including those resulting from governmental or regulatory investigations, and class action litigation. Any actual or perceived security breach at a company providing services to the company or its subscribers could have similar effects. | |||

'''Since the offering is being conducted on a “best-efforts” basis with no minimum amount required to be sold before any closing, | '''Since the offering is being conducted on a “best-efforts” basis with no minimum amount required to be sold before any closing, KingsCrowd may not raise sufficient funds in this Offering for the company to undertake its business expansion and other development efforts.''' | ||

There is no minimum dollar amount of shares that must be sold in the Offering before | There is no minimum dollar amount of shares that must be sold in the Offering before KingsCrowd can hold a closing and disburse the net proceeds to us. Accordingly, the amount of proceeds KingsCrowd receives through the sale of shares of Class A common stock in this Offering may be substantially less than the amount it requires to undertake the business expansion and other development efforts described under the heading “Use of Proceeds.” KingsCrowd is relying upon the proceeds from this Offering, and the Concurrent Regulation D Offering, to fund its business plan for the next 12 to 24 months. If KingsCrowd sells less than the Maximum Amount, it will be required to seek additional funding, which may not be available. If KingsCrowd does not raise sufficient funds in this Offering, or if KingsCrowd is not able to obtain additional funding, it may be required to modify or suspend its business plan, which could result in investors losing all or most of their investments. | ||

'''The offering price for the Class A common stock was determined arbitrarily.''' | '''The offering price for the Class A common stock was determined arbitrarily.''' | ||

The offering price of the shares of Class A common stock offered hereby has been determined by management, and bears no relationship to | The offering price of the shares of Class A common stock offered hereby has been determined by management, and bears no relationship to its assets, book value, potential earnings, net worth or any other recognized criteria of value. KingsCrowd cannot assure that price of the shares is the fair market value of the shares or that investors will earn any profit on them. | ||

'''There is no public market for | '''There is no public market for its Class A common stock or any of its securities and KingsCrowd does not currently intend to create one.''' | ||

Although under Reg A the shares of Class A common stock sold in this offering are not restricted, they are highly illiquid securities. There currently is no public market for any of | Although under Reg A the shares of Class A common stock sold in this offering are not restricted, they are highly illiquid securities. There currently is no public market for any of its securities and KingsCrowd does not currently intend to create a market for any of its securities. If you decide that you want to resell these securities in the future, you may not be able to find a buyer or obtain a price for the shares that you deem reasonable. You should be prepared to hold your shares of Class A common stock for an indefinite period. | ||

'''The dual class structure of | '''The dual class structure of its common stock will have the effect of concentrating voting control in two stockholders whose directors or managers are directors of its Company, which will limit or preclude your ability to influence corporate matters.''' | ||

Its Class A common stock, which is the stock KingsCrowd is offering in this offering, has one vote per share, and its Class B common stock has ten votes per share. Following this offering, Nantascot and NCI, entities that are affiliated with two of its existing directors, together will hold approximately 72.84% of the voting power of its capital stock. These entities have entered into a Stockholders Agreement whereby each party agreed to vote for the other party’s nominee to the board of directors. Because of the ten-to-one voting ratio between its Class B and Class A common stock, these entities will continue to control a majority of the combined voting power of its common stock and therefore be able to control all matters submitted to its stockholders for approval. This concentrated control will limit or preclude your ability to influence corporate matters for the foreseeable future, including the election of directors, amendments to its organizational documents, and any merger, consolidation, sale of all or substantially all of its assets, or other major corporate transaction requiring stockholder approval. In addition, this may prevent or discourage unsolicited acquisition proposals or offers for its capital stock that you may feel are in your best interest as one of its stockholders. See “Principal and Selling Stockholders” and “Description of Securities.” | |||

'''Anti-takeover provisions in | '''Anti-takeover provisions in its charter documents and under Delaware law could make an acquisition of its company more difficult, limit attempts by its stockholders to replace or remove its current management and affect the market price of its common stock.''' | ||

Provisions in | Provisions in its certificate of incorporation and bylaws may have the effect of delaying or preventing a change of control or changes in its management. Its certificate of incorporation and bylaws include provisions that: · specify that special meetings of its stockholders can be called only by its board of directors or the chairperson of its board of directors; · prohibit cumulative voting in the election of directors; and · provide that vacancies on its board of directors may be filled only by a majority vote of directors then in office, even though less than a quorum. These provisions, alone or together, could discourage, delay, or prevent a transaction involving a change in control of its Company. These provisions could also discourage proxy contests and make it more difficult for stockholders to elect directors of their choosing and to cause the company to take other corporate actions they desire, any of which, under certain circumstances, could limit the opportunity for its stockholders to receive a premium for their shares of its Class A common stock, and could also affect the price that some investors are willing to pay for its Class A common stock. See “Description of Securities.” | ||

'''Future sales and issuances of | '''Future sales and issuances of its Class A common stock or rights to purchase its Class A common stock, including pursuant to its equity incentive plan, or other equity securities or securities convertible into its Class A common stock could result in additional dilution of the percentage ownership of its stockholders.''' | ||

KingsCrowd may issue additional securities following the closing of this offering. In the future, KingsCrowd may sell Class A common stock, convertible securities or other equity securities, including preferred securities, in one or more transactions at prices and in a manner it determines from time to time. KingsCrowd also expects to issue Class A common stock to employees, consultants and directors pursuant to its equity incentive plan. If KingsCrowd sells Class A common stock, convertible securities or other equity securities in subsequent transactions, or Class A common stock is issued pursuant to equity incentive plans, investors may be materially diluted. | |||

'''Future issuances of debt securities, which would rank senior to | '''Future issuances of debt securities, which would rank senior to its capital stock upon its bankruptcy or liquidation, may adversely affect the level of return you may be able to achieve from an investment in its securities.''' | ||

In the future, | In the future, KingsCrowd may attempt to increase its capital resources by offering debt securities. Upon bankruptcy or liquidation, holders of its debt securities, and lenders with respect to other borrowings KingsCrowd may make, would receive distributions of its available assets prior to any distributions being made to holders of its capital stock. Moreover, if KingsCrowd issues additional equity securities, the holders of such equity securities could be entitled to preferences over existing holders of common stock and equity securities in respect of the payment of dividends and the payment of liquidating distributions. Because its decision to issue debt or preferred securities in any future offering, or borrow money from lenders, will depend in part on market conditions and other factors beyond its control, KingsCrowd cannot predict or estimate the amount, timing or nature of any such future offerings or borrowings. You must bear the risk that any future offerings KingsCrowd conducts or borrowings it makes may adversely affect the level of return you may be able to achieve from an investment in its securities. | ||

'''If you purchase shares of | '''If you purchase shares of its Class A common stock in this offering, you will incur immediate and substantial dilution.''' | ||

The offering price of | The offering price of its Class A common stock is substantially higher than the $(0.015) net tangible book value per share of its outstanding common stock paid by holders of its Class A common stock, who paid an average of $0.03 per share cash on its common stock. As a result, you will incur immediate and substantial dilution in net tangible book value when you buy its Class A common stock in this offering. This means that you will pay a higher price per share than the amount of its total tangible assets, less its total liabilities, divided by the number of shares of all of its common stock outstanding. In addition, you may also experience additional dilution if options or other rights to purchase its common stock that are outstanding or that KingsCrowd may issue in the future are exercised or converted or it issues additional shares of its common stock at prices lower than its net tangible book value at such time. Please see the section entitled “Dilution.” | ||

''' | '''KingsCrowd has never paid cash dividends on its capital stock and it does not intend to pay dividends for the foreseeable future.''' | ||

KingsCrowd has paid no cash dividends on its class of common stock to date and it does not anticipate paying cash dividends in the near term. For the foreseeable future, KingsCrowd intends to retain any earnings to finance the development and expansion of its business, and it does not anticipate paying any cash dividends on its stock. Accordingly, investors must be prepared to rely on sales of their shares after price appreciation to earn an investment return, which may never occur. Investors seeking cash dividends should not purchase its shares. Any determination to pay dividends in the future will be made at the discretion of its board of directors and will depend on its results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors its Board deems relevant. | |||

''' | '''KingsCrowd is offering its Class A common stock pursuant to Tier 2 of Regulation A and it cannot be certain if the reduced disclosure requirements applicable to Tier 2 issuers will make its shares less attractive to investors as compared to a traditional initial public offering.''' | ||

As a Tier 2 issuer, | As a Tier 2 issuer, KingsCrowd is subject to scaled disclosure and reporting requirements which may make an investment in its interests less attractive to investors who are accustomed to enhanced disclosure and more frequent financial reporting. The differences between disclosures for Tier 2 issuers versus those for emerging growth companies include, without limitation, only needing to file final semi-annual reports as opposed to quarterly reports and far fewer circumstances where a current disclosure would be required. In addition, given the relative lack of regulatory precedent regarding the recent amendments to Regulation A, there is some regulatory uncertainty in regard to how the Commission or the individual state securities regulators will regulate both the offer and sale of its securities, as well as any ongoing compliance that it may be subject to. If its scaled disclosure and reporting requirements, or regulatory uncertainty regarding Regulation A, reduces the attractiveness of its securities, KingsCrowd may be unable to raise the funds necessary to fund its expansion and other plans. | ||

''' | '''KingsCrowd will be subject to ongoing public reporting requirements that are less rigorous than rules for more mature public companies, and its stockholders will receive less information.''' | ||

KingsCrowd will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for public companies reporting under the Securities Exchange Act of 1934, as amended, or the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Annual reports are due within 120 calendar days after the end of the issuer’s fiscal year, and semiannual reports are due within 90 calendar days after the end of the first six months of the issuer’s fiscal year. KingsCrowd may elect to become a public reporting company under the Exchange Act. If KingsCrowd elects to do so, it will be required to publicly report on an ongoing basis as an emerging growth company (as defined in the JOBS Act) under the reporting rules set forth under the Exchange Act. For so long as KingsCrowd remains an emerging growth company, it may take advantage of certain exemptions from various reporting requirements that are applicable to other Exchange Act reporting companies that are not emerging growth companies, including but not limited to: · not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act; · being permitted to comply with reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements; and · being exempt from the requirement to hold a non-binding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. If KingsCrowd were to elect to take advantage of the benefits of this extended transition period, its financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards. KingsCrowd would expect to take advantage of these reporting exemptions until KingsCrowd is no longer an emerging growth company. KingsCrowd would remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which its total annual gross revenues exceed $1.07 billion, (ii) the date that KingsCrowd becomes a large accelerated filer as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of its common shares that is held by non-affiliates exceeds $700 million as of the last business day of its most recently completed second fiscal quarter or (iii) the date on which KingsCrowd has issued more than $1 billion in non-convertible debt during the preceding three year period. Under the less rigorous reporting requirement under Regulation A compared to the Exchange Act, its stockholders will receive less information about its Company than they would receive from companies the shares of which are subject to the reporting requirement of ethe Exchange Act. | |||

'''The requirements of complying on an ongoing basis with Regulation A may strain | '''The requirements of complying on an ongoing basis with Regulation A may strain its resources and divert management’s attention.''' | ||

In connection with | In connection with its compliance with the ongoing reporting requirements of Regulation A, KingsCrowd will incur legal and financial compliance costs, which may impose strain on its operating budget and divert management’s time and attention from operational activities. The requirements of Regulation A may also make it significantly more expensive for the company to obtain director and officer liability insurance. These factors could also make it difficult for the company to attract and retain qualified officers or members of its board of directors. Moreover, as a result of the disclosure of information in this Offering circular and in other public filings KingsCrowd makes, its business operations, operating results and financial condition will become more visible, including to competitors and other third parties. | ||

'''Limitations on liability and indemnification matters.''' | '''Limitations on liability and indemnification matters.''' | ||

As permitted by the corporate laws of the state of Delaware, | As permitted by the corporate laws of the state of Delaware, its certificate of incorporation includes a provision to eliminate the personal liability of its directors for monetary damages for breach or alleged breach of their fiduciary duties as directors, subject to certain exceptions. In addition, its bylaws provide that KingsCrowd is required to indemnify its officers and directors under certain circumstances, including those circumstances in which indemnification would otherwise be discretionary, and it will be required to advance expenses to its officers and directors as incurred in connection with proceedings against them for which they may be indemnified. If KingsCrowd is required to indemnify, both for the costs of their defense in any action or to pay monetary damages upon a finding of a court or in any settlement, its business and financial condition could be materially and adversely affected. | ||

== References and Notes == | == References and Notes == | ||

Revision as of 23:27, 9 July 2022

The financial data platform for the online private market

Summary[1]

- First to serve the $30B online private markets with data & analytics

- $2.2M+ raised to date from 2,100+ investors

- Experienced 20X YoY revenue growth in 2020

- Serving 350,000+ retail investors and thousands of paying customers

- Patent-pending AI-driven startup rating algorithm

Problem[1]

The online private markets have a data gap

Investment in public markets, like stocks, is driven by data. Investors take for granted that they can rely on financial information services like Bloomberg and Morningstar to make informed investments.

No comparable research tools exist for investors in the new online private markets. The rapid growth of equity crowdfunding represents an abundance of data—without easy access, aggregation, or analysis for investors. This information gap may discourage potential investors or leave them without the resources to perform due diligence.

Solution[1]

A data-driven approach to startup investing

KingsCrowd’s investment data platform is the first of its kind for the online private markets. KingsCrowd empowers individual investors to make intelligent startup investment decisions on platforms like Republic, Wefunder, SeedInvest, Netcapital, etc., by providing institutional-grade research tools for assessing the thousands of investment opportunities available to investors at any one time.

KingsCrowd leverages a patent-pending rating algorithm to interpret hundreds of data points on every investment opportunity available online. KingsCrowd tracks and rate every RegCF investment opportunity in the United States, with expansion into Reg A+, RegD 506c, and late stage secondaries underway over the next 12-to-15 months.

Product[1]

A comprehensive platform for investors

KingsCrowd provides individual and institutional investors with an array of tools to take the complexity and burden of finding, investing and tracking all of your private market investments made on platforms like Republic off of you, the investor.

KingsCrowd makes pre-seed to pre-IPO investing online look and feel like the public markets by leveraging various data solutions to make your startup investing life easier than ever.

Ratings

KingsCrowd has developed a patent-pending rating algorithm that benchmarks and scores all companies raising capital via the online private markets. The Merlin rating algorithm, developed by the team of ex-VCs and technologists, relies on over 170 data points sourced from regulatory filings (e.g., past 2-year financials), offering pages, and independent sources of private market data to score companies at a similar stage of development across 5 key metrics.

This rating system is a first-of-its-kind data-driven rating system that helps investors to effectively manage their due diligence funnels. In time, this standardized rating system has the opportunity to power predictive analytics and index products in the private market sphere.

Analytics

Part of intelligent investing in this new online private market sphere is understanding general market trends such as how much companies are raising on average, what their valuation metrics typically look like, where capital is being deployed, which marketplaces are performing well, etc.

With KingsCrowd market analytics, investors have the types of market trends analysis available in the public markets right at their fingertips for this brand new space.

Portfolio

KingsCrowd provides a ‘Mint.com’ type of experience for retail investors who are building diversified portfolios of startups across various online private markets. With KingsCrowd’s portfolio tool, you can add all of your startup investments from the myriad of marketplaces into one portfolio tracking tool, with plans to provide performance tracking in the near future.

News and investor education

KingsCrowd provides its users with a curated feed of online private investing news. KingsCrowd also publishes insights, commentary, and educational content to contextualize what’s happening in the market – all with the goal of empowering you the investor to feel confident in your ability to invest in the private market asset class.

Traction[1]

Hitting its stride

Today, KingsCrowd serves more than 350K users, including thousands of paying customers. In 2020 alone, KingsCrowd 20X’d its ARR while scaling from a few thousand users in 2019 to hundreds of thousands in 2020. KingsCrowd also added over 1,500 new equity investors in 2020, who have helped to power KingsCrowd’s product and user growth.

Business model[1]

Three complementary sales channels

KingsCrowd aims to be the go-to integrated data solution for online private markets, as Bloomberg is for public markets. KingsCrowd has developed a core user base of individual investors, served by multi-level subscriptions.

In 2021 and beyond, KingsCrowd is bringing its offerings to institutional investors. KingsCrowd has already begun its expansion with direct sales to businesses. Next, we’ll be rolling out its resale partnerships, providing KingsCrowd API access to help brokerage firms connect their clients to online private offerings.

Market[1]

A new private market[1]

Whereas startup investing used to be limited only to millionaires and institutions, since 2016, private investing has moved online at an unprecedented rate, expanding to more than $30B in deal and trading volume annually into pre-seed through pre-IPO companies.

Retail investors on online private markets like Republic represent a significant portion of this growing investor base. These platforms hosted more than 1,000,000 individual investors in 2020, and are experiencing a surge of attention following the recent increase in fundraising limits.

Competition[1]

A pioneer in the online private market ecosystem

Established players like Bloomberg and Morningstar cover financial data for public markets, while PitchBook addresses traditional ‘offline’ private equity. Online private equity investing represents a significant gap, where KingsCrowd is strategically positioned. KingsCrowd also distinguishes itself by including retail investors in its target market and by providing data-driven ratings as a core part of its service.

Vision and strategy[1]

Become the global online private market data provider

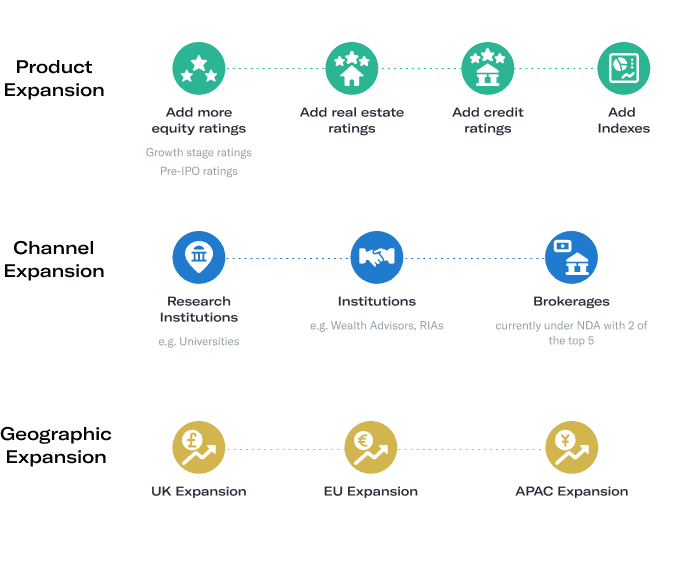

KingsCrowd has carved out a distinct market—and now it aims to set a lasting standard. Its long-term vision is to be the global data conglomerate for private assets trading across the world.

To realize its vision, we’re building out its investment research, technology, and marketing teams to scale into new asset classes, product categories, sales channels, and geographies.

Funding[1]

Crowdfunder supported