The financial data platform for the online private market

Highlights

10-24 employees

$1M+ raised

Company has previously raised over $1M in capital

- First to serve the $30B online private markets with data & analytics

- $2.2M+ raised to date from 2,100+ investors

- Experienced 20X YoY revenue growth in 2020

- Serving 350,000+ retail investors and thousands of paying customers

- Patent-pending AI-driven startup rating algorithm

Disclosures & disclaimers

Problem

The online private markets have a data gap

Investment in public markets, like stocks, is driven by data. Investors take for granted that they can rely on financial information services like Bloomberg and Morningstar to make informed investments.

No comparable research tools exist for investors in the new online private markets. The rapid growth of equity crowdfunding represents an abundance of data—without easy access, aggregation, or analysis for investors. This information gap may discourage potential investors or leave them without the resources to perform due diligence.

Solution

A data-driven approach to startup investing

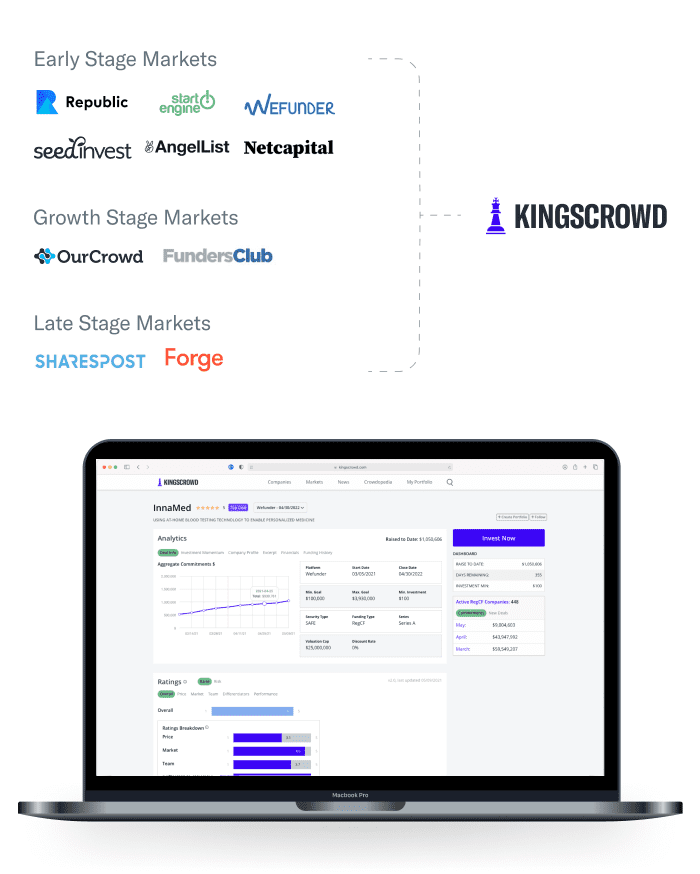

KingsCrowd’s investment data platform is the first of its kind for the online private markets. We empower individual investors to make intelligent startup investment decisions on platforms like Republic, Wefunder, SeedInvest, Netcapital, etc., by providing institutional-grade research tools for assessing the thousands of investment opportunities available to investors at any one time.

We leverage a patent-pending rating algorithm to interpret hundreds of data points on every investment opportunity available online. We track and rate every RegCF investment opportunity in the United States, with expansion into Reg A+, RegD 506c, and late stage secondaries underway over the next 12-to-15 months.

Product

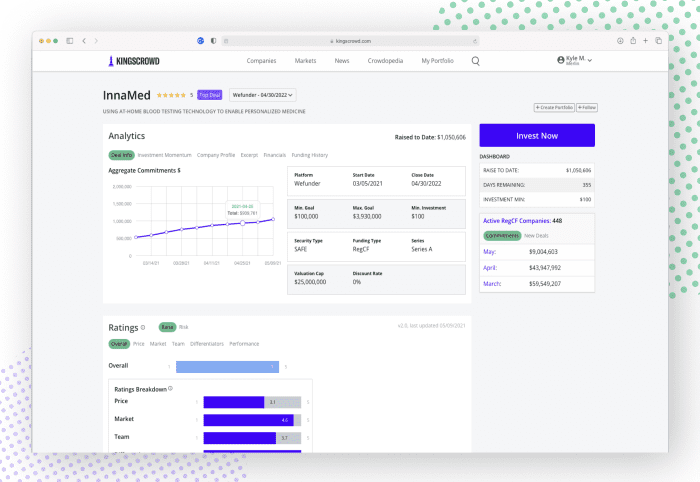

A comprehensive platform for investors

KingsCrowd provides individual and institutional investors with an array of tools to take the complexity and burden of finding, investing and tracking all of your private market investments made on platforms like Republic off of you, the investor.

We make pre-seed to pre-IPO investing online look and feel like the public markets by leveraging various data solutions to make your startup investing life easier than ever.

Ratings

KingsCrowd has developed a patent-pending rating algorithm that benchmarks and scores all companies raising capital via the online private markets. The Merlin rating algorithm, developed by the team of ex-VCs and technologists, relies on over 170 data points sourced from regulatory… Read more

Traction

Hitting our stride

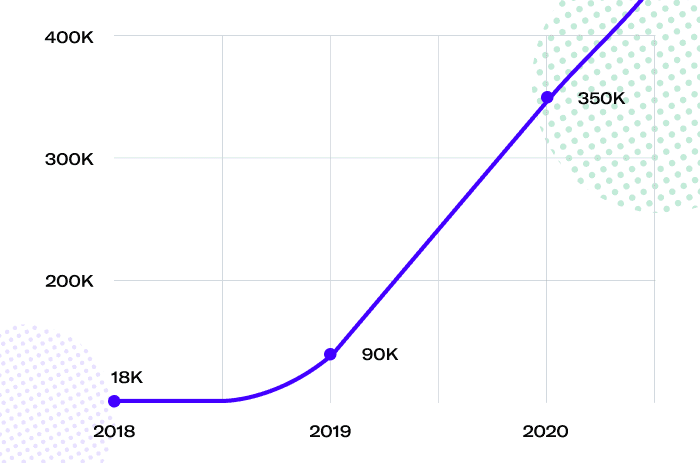

Today, KingsCrowd serves more than 350K users, including thousands of paying customers. In 2020 alone, we 20X’d our ARR while scaling from a few thousand users in 2019 to hundreds of thousands in 2020. We also added over 1,500 new equity investors in 2020, who have helped to power KingsCrowd’s product and user growth.

Business model

Three complementary sales channels

KingsCrowd aims to be the go-to integrated data solution for online private markets, as Bloomberg is for public markets. We have developed a core user base of individual investors, served by multi-level subscriptions.

In 2021 and beyond, KingsCrowd is bringing our offerings to institutional investors. We’ve already begun our expansion with direct sales to businesses. Next, we’ll be rolling out our resale partnerships, providing KingsCrowd API access to help brokerage firms connect their clients to online private offerings.

Market

A new private market

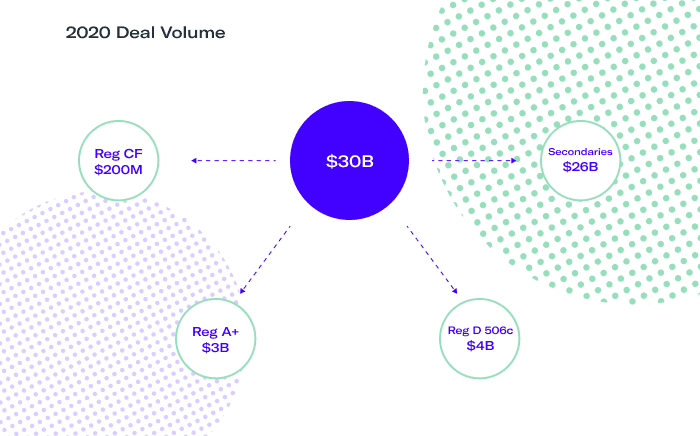

Whereas startup investing used to be limited only to millionaires and institutions, since 2016, private investing has moved online at an unprecedented rate, expanding to more than $30B in deal and trading volume annually into pre-seed through pre-IPO companies.

Retail investors on online private markets like Republic represent a significant portion of this growing investor base. These platforms hosted more than 1,000,000 individual investors in 2020, and are experiencing a surge of attention following the recent increase in fundraising limits.

Competition

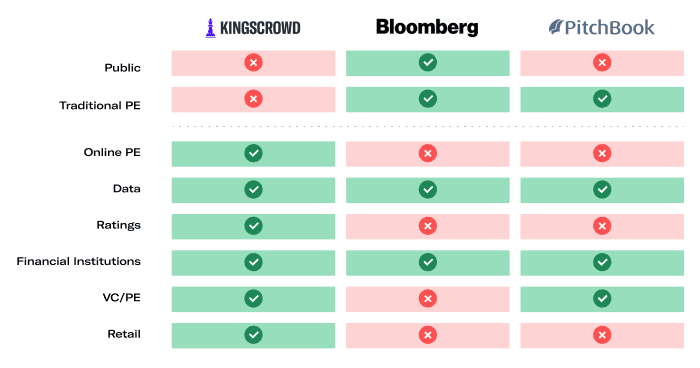

A pioneer in the online private market ecosystem

Established players like Bloomberg and Morningstar cover financial data for public markets, while PitchBook addresses traditional ‘offline’ private equity. Online private equity investing represents a significant gap, where KingsCrowd is strategically positioned. We also distinguish ourselves by including retail investors in our target market and by providing data-driven ratings as a core part of our service.

Vision and strategy

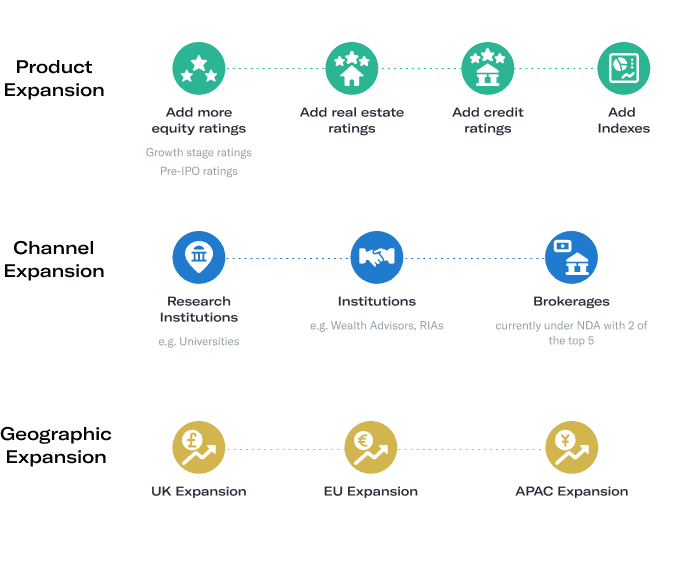

Become the global online private market data provider

KingsCrowd has carved out a distinct market—and now we aim to set a lasting standard. Our long-term vision is to be the global data conglomerate for private assets trading across the world.

To realize our vision, we’re building out our investment research, technology, and marketing teams to scale into new asset classes, product categories, sales channels, and geographies.

Funding

Crowdfunder supported

In our three years of operation, KingsCrowd has raised more than $2M from 2,100+ investors. We are proud to have the support of the online investment community, selling out a $1M online raise in March 2020 as well as three other online raises during 2018 and 2019!

Management

Extensive knowledge in the fintech industry

KingsCrowd has assembled a dedicated team combining the expertise of financiers, VCs, technologists, founders, and industry experts. The management team has decades of experience working for notable financial services firms such as Dow Jones, Bank of America, The Motley Fool, Carta, LEK Consulting, and more.

Founder and CEO Chris Lustrino has a background as a management consultant at LEK Consulting where he focused on private equity clients. He founded Simple.Innovative.Change, a discussion hub focused on alternative investment and lending firms in 2016. In 2018, he was selected as a finalist for LendIt’s FinTech Journalist of the Year before turning that blog into KingsCrowd!

Advisors

Our extensive advisory board includes Mike Even, former CIO of Citigroup Asset Management and CEO of Man Numeric; Andrea Walne, Co-Founder of Forge and Managing Director at Manhattan Venture Partners; and John Fanning, Founding Chairman & CEO of Napster.

Disclaimers

Your investment is binding and irrevocable, although we reserve the right to reject it for any reason or no reason at all. Funds committed will remain in an escrow account maintained by Prime Trust, LLC until such time as a closing occurs. We will not be issuing share certificates. Securities offered through OpenDeal Broker LLC, a registered broker dealer, member of FINRA (www.finra.org), member of SIPC (www.sipc.org). We will pay OpenDeal Broker LLC, a registered broker-dealer, a cash commission equal to 7% of the dollar value of the Offering Shares issued and a number of shares of Class A common stock equal to 1% of the Offering Shares issued to investors in this offering, plus certain offering costs. Please review OpenDeal Broker LLC’s Form CRS. OpenDeal Broker LLC may require additional documents or information from you to complete your purchase, you will be contacted by a registered representative in this event.

An offering statement relating to KingsCrowd, Inc.’s Common Stock has been filed with the Securities and Exchange Commission and became qualified on August 4, 2021. Prior to making any investment in KingsCrowd, Inc.’s Common Stock, you should review a copy of the offering circular, or contact KingsCrowd, Inc. by phone at (914) 826-4520. No offer to sell any securities, and no solicitation of an offer to buy any securities, is being made in any jurisdiction in which such offer, sale or solicitation would not be permitted by applicable law.

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured. You may lose money.