LVMH Moët Hennessy - Louis Vuitton, Société Européenne: Difference between revisions

(Have amended the order of the tables to be inline with the Stockhub housestyle.) |

|||

| Line 331: | Line 331: | ||

{| class="wikitable" | {| class="wikitable" | ||

!'''Key Consolidated Data ''(EUR Millions)''''' | !'''Key Consolidated Data ''(EUR Millions)''''' | ||

!'''2020''' | |||

!'''2021''' | |||

!'''2022''' | !'''2022''' | ||

|- | |- | ||

|Revenue | |Revenue | ||

|44,651 | |||

|64,215 | |||

|79,184 | |79,184 | ||

|- | |- | ||

|Profit from recurring operations | |Profit from recurring operations | ||

|8,305 | |||

|17,151 | |||

|21,055 | |21,055 | ||

|- | |- | ||

|Net profit | |Net profit | ||

|4,955 | |||

|12,698 | |||

|14,751 | |14,751 | ||

|- | |- | ||

|Net profit, Group share | |Net profit, Group share | ||

|4,702 | |||

|12,036 | |||

|14,084 | |14,084 | ||

|- | |- | ||

|Cash from operations before changes in working capital | |Cash from operations before changes in working capital | ||

|13,997 | |||

|22,621 | |||

|26770 | |26770 | ||

|- | |- | ||

|Operating investment | |Operating investment | ||

|2.478 | |||

|2,664 | |||

|4,969 | |4,969 | ||

|- | |- | ||

|Operating free cash flow | |Operating free cash flow | ||

|6,117 | |||

|13,531 | |||

|10,113 | |10,113 | ||

|- | |- | ||

|Total equity <sup>(a)</sup> | |Total equity <sup>(a)</sup> | ||

|38,829 | |||

|48,909 | |||

|56,604 | |56,604 | ||

|- | |- | ||

|Net financial debt <sup>(b)</sup> | |Net financial debt <sup>(b)</sup> | ||

|4,241 | |||

|9,607 | |||

|9201 | |9201 | ||

|- | |- | ||

|Adjusted net financial debt/Equity ratio | |Adjusted net financial debt/Equity ratio | ||

|10.9% | |||

|19.60% | |||

|14.30% | |14.30% | ||

|} | |} | ||

<small>''(a) Including minority interests''</small> | <small>''(a) Including minority interests''</small> | ||

| Line 392: | Line 392: | ||

{| class="wikitable" | {| class="wikitable" | ||

!'''Revenue by business group ''(EUR Millions)''''' | !'''Revenue by business group ''(EUR Millions)''''' | ||

!'''2020''' | |||

!'''2021''' | |||

!'''2022''' | !'''2022''' | ||

|- | |- | ||

|Wines and Spirits | |Wines and Spirits | ||

|4,755 | |||

|5,974 | |||

|7099 | |7099 | ||

|- | |- | ||

|Fashion and Leather Goods | |Fashion and Leather Goods | ||

|21,207 | |||

|30,896 | |||

|38,648 | |38,648 | ||

|- | |- | ||

|Perfumes and Cosmetics | |Perfumes and Cosmetics | ||

|5,248 | |||

|6,608 | |||

|7722 | |7722 | ||

|- | |- | ||

|Watches and Jewelry | |Watches and Jewelry | ||

|3,356 | |||

|8,964 | |||

|10,581 | |10,581 | ||

|- | |- | ||

|Selective Retailing | |Selective Retailing | ||

|10,155 | |||

|11,754 | |||

|14,852 | |14,852 | ||

|- | |- | ||

|Other activities and eliminations | |Other activities and eliminations | ||

| -70 | |||

|19 | |||

|281 | |281 | ||

|- | |- | ||

|'''Total''' | |'''Total''' | ||

|'''44,651''' | |||

|'''64,215''' | |||

|'''79,184''' | |'''79,184''' | ||

|} | |} | ||

{| class="wikitable" | {| class="wikitable" | ||

!'''Profit from recurring operations by business group''(EUR millions)''''' | !'''Profit from recurring operations by business group''(EUR millions)''''' | ||

!'''2020''' | |||

!'''2021''' | |||

!'''2022''' | !'''2022''' | ||

|- | |- | ||

|Wines and Spirits | |Wines and Spirits | ||

|1,388 | |||

|1,863 | |||

|2,155 | |2,155 | ||

|- | |- | ||

|Fashion and Leather Goods | |Fashion and Leather Goods | ||

|7,188 | |||

|12,842 | |||

|15,709 | |15,709 | ||

|- | |- | ||

|Perfumes and Cosmetics | |Perfumes and Cosmetics | ||

|80 | |||

|684 | |||

|660 | |660 | ||

|- | |- | ||

|Watches and Jewelry | |Watches and Jewelry | ||

|302 | |||

|1,679 | |||

|2,017 | |2,017 | ||

|- | |- | ||

|Selective Retailing | |Selective Retailing | ||

| -203 | |||

|534 | |||

|788 | |788 | ||

|- | |- | ||

|Other activities and eliminations | |Other activities and eliminations | ||

| -450 | |||

| -451 | |||

| -274 | | -274 | ||

|- | |- | ||

|'''Total''' | |'''Total''' | ||

|'''8,305''' | |||

|'''17,151''' | |||

|'''21,055''' | |'''21,055''' | ||

|} | |} | ||

| Line 477: | Line 477: | ||

=== LVMH's Annual Income Statement === | === LVMH's Annual Income Statement === | ||

{| class="wikitable" | {| class="wikitable" | ||

!'''EUR''' €, Millions, except for earnings per share data | |||

!'''2020''' | |||

!'''2021''' | |||

!'''2022''' | |||

|- | |- | ||

! Period Ending: | |||

!31-Dec | |||

!31-Dec | |||

!31-Dec | |||

|- | |- | ||

|'''Revenue''' | |'''Revenue''' | ||

|'''44,651''' | |||

|'''64,215''' | |||

|'''79,184''' | |'''79,184''' | ||

|- | |- | ||

|Revenue Growth (year to year) | |Revenue Growth (year to year) | ||

|<nowiki>-16.80%</nowiki> | |||

|43.82% | |||

|23.31% | |23.31% | ||

|- | |- | ||

|Cost of Goods and Services | |Cost of Goods and Services | ||

|<nowiki>-15,871</nowiki> | |||

|<nowiki>-20,355</nowiki> | |||

|<nowiki>-24,988</nowiki> | |<nowiki>-24,988</nowiki> | ||

|- | |- | ||

|'''Gross Margin''' | |'''Gross Margin''' | ||

|'''28,780''' | |||

|'''43,860''' | |||

|'''54,196''' | |'''54,196''' | ||

|- | |- | ||

|Marketing and selling expenses | |Marketing and selling expenses | ||

|<nowiki>-16,792</nowiki> | |||

|<nowiki>-22,308</nowiki> | |||

|<nowiki>-28,151</nowiki> | |<nowiki>-28,151</nowiki> | ||

|- | |- | ||

|General and administrative expenses | |General and administrative expenses | ||

|<nowiki>-3,641</nowiki> | |||

|<nowiki>-4,414</nowiki> | |||

|<nowiki>-5,027</nowiki> | |<nowiki>-5,027</nowiki> | ||

|- | |- | ||

|Income/(Loss) from joint ventures | |Income/(Loss) from joint ventures | ||

|<nowiki>-42</nowiki> | |||

|13 | |||

|37 | |37 | ||

|- | |- | ||

|'''Profit from recurring operations''' | |'''Profit from recurring operations''' | ||

|'''8,305''' | |||

|'''17,151''' | |||

|'''21,055''' | |'''21,055''' | ||

|- | |- | ||

|Other operating income and expenses | |Other operating income and expenses | ||

|<nowiki>-333</nowiki> | |||

|4 | |||

|<nowiki>-54</nowiki> | |<nowiki>-54</nowiki> | ||

|- | |- | ||

|'''Operating profit''' | |'''Operating profit''' | ||

|'''7,972''' | |||

|'''17,155''' | |||

|'''21,001''' | |'''21,001''' | ||

|- | |- | ||

|Cost of net financial debt | |Cost of net financial debt | ||

|<nowiki>-35</nowiki> | |||

|41 | |||

|<nowiki>-17</nowiki> | |<nowiki>-17</nowiki> | ||

|- | |- | ||

|Interest of lease liabilities | |Interest of lease liabilities | ||

|<nowiki>-281</nowiki> | |||

|<nowiki>-242</nowiki> | |||

|<nowiki>-254</nowiki> | |<nowiki>-254</nowiki> | ||

|- | |- | ||

|Other financial income and expenses | |Other financial income and expenses | ||

|<nowiki>-292</nowiki> | |||

|254 | |||

|<nowiki>-617</nowiki> | |<nowiki>-617</nowiki> | ||

|- | |- | ||

|'''Net financial income/(expense)''' | |'''Net financial income/(expense)''' | ||

|'''-608''' | |||

|'''53''' | |||

|'''-888''' | |'''-888''' | ||

|- | |- | ||

|Income Tax Expense | |Income Tax Expense | ||

|<nowiki>-2,409</nowiki> | |||

|<nowiki>-4,510</nowiki> | |||

|<nowiki>-5,362</nowiki> | |<nowiki>-5,362</nowiki> | ||

|- | |- | ||

|'''Net Income to Company''' | |'''Net Income to Company''' | ||

|'''4,955''' | |||

|'''12,698''' | |||

|'''14,751''' | |'''14,751''' | ||

|- | |- | ||

|Minority Interest in Earnings | |Minority Interest in Earnings | ||

|<nowiki>-253</nowiki> | |||

|<nowiki>-662</nowiki> | |||

|<nowiki>-667</nowiki> | |<nowiki>-667</nowiki> | ||

|- | |- | ||

|'''Net Income to Stockholders''' | |'''Net Income to Stockholders''' | ||

|'''4,702''' | |||

|'''12,036''' | |||

|'''14,084''' | |'''14,084''' | ||

|- | |- | ||

| | | | ||

| Line 583: | Line 583: | ||

|- | |- | ||

|'''Basic EPS, (EUR)''' | |'''Basic EPS, (EUR)''' | ||

|'''9.34''' | |||

|'''23.90''' | |||

|'''28.05''' | |'''28.05''' | ||

|- | |- | ||

|Basic Weighted Average Shares Outstanding | |Basic Weighted Average Shares Outstanding | ||

|503,679,272 | |||

|503,627,708 | |||

|502,120,694 | |502,120,694 | ||

|- | |- | ||

|'''Diluted EPS (EUR)''' | |'''Diluted EPS (EUR)''' | ||

|'''9.33''' | |||

|'''23.89''' | |||

|'''28.03''' | |'''28.03''' | ||

|- | |- | ||

|Diluted Weighted Average Shares Outstanding | |Diluted Weighted Average Shares Outstanding | ||

|504,210,133 | |||

|503,895,592 | |||

|502,480,100 | |502,480,100 | ||

|- | |- | ||

| | | | ||

| Line 608: | Line 608: | ||

|- | |- | ||

|'''EBITDA''' | |'''EBITDA''' | ||

|'''13,780''' | |||

|'''23,280''' | |||

|'''26,720''' | |'''26,720''' | ||

|} | |} | ||

[[File:LVMH Annual Income Statement.png|left|thumb|465x465px]] | [[File:LVMH Annual Income Statement.png|left|thumb|465x465px]] | ||

| Line 631: | Line 631: | ||

=== LVMH's Annual Balance Sheet === | === LVMH's Annual Balance Sheet === | ||

{| class="wikitable" | {| class="wikitable" | ||

!'''Year end date (31/12)''' | |||

!'''2020''' | |||

!'''2021''' | |||

!'''2022''' | |||

|- | |- | ||

|'''Assets''' (EUR millions) | |'''Assets''' (EUR millions) | ||

| Line 642: | Line 642: | ||

|- | |- | ||

|Brands and other intangible assets | |Brands and other intangible assets | ||

|17,012 | |||

|24,551 | |||

|25,432 | |25,432 | ||

|- | |- | ||

|Goodwill | |Goodwill | ||

|16,042 | |||

|25,904 | |||

|24,782 | |24,782 | ||

|- | |- | ||

|Property, plant and equipment | |Property, plant and equipment | ||

|18,224 | |||

|20,193 | |||

|23,055 | |23,055 | ||

|- | |- | ||

|Right-of-use assets | |Right-of-use assets | ||

|12,521 | |||

|13,705 | |||

|14,615 | |14,615 | ||

|- | |- | ||

|Investment in joint ventures and associates | |Investment in joint ventures and associates | ||

|990 | |||

|1,084 | |||

|1,066 | |1,066 | ||

|- | |- | ||

|Non-current available for sale financial assets | |Non-current available for sale financial assets | ||

|739 | |||

|1,363 | |||

|1,109 | |1,109 | ||

|- | |- | ||

|Other non-current assets | |Other non-current assets | ||

|845 | |||

|1,054 | |||

|1,186 | |1,186 | ||

|- | |- | ||

|Deferred tax | |Deferred tax | ||

|2,325 | |||

|3,156 | |||

|3,661 | |3,661 | ||

|- | |- | ||

|'''Non-current Assets''' | |'''Non-current Assets''' | ||

|'''68,698''' | |||

|'''91,010''' | |||

|'''94,906''' | |'''94,906''' | ||

|- | |- | ||

|Inventories and work in progress | |Inventories and work in progress | ||

|13,016 | |||

|16,549 | |||

|20,319 | |20,319 | ||

|- | |- | ||

|Trade accounts receivable | |Trade accounts receivable | ||

|2,756 | |||

|3,787 | |||

|4,258 | |4,258 | ||

|- | |- | ||

|Income taxes | |Income taxes | ||

|392 | |||

|338 | |||

|375 | |375 | ||

|- | |- | ||

|Other current assets | |Other current assets | ||

|3,846 | |||

|5,606 | |||

|7,488 | |7,488 | ||

|- | |- | ||

|Cash and cash equivalents | |Cash and cash equivalents | ||

|19,963 | |||

|8,021 | |||

|7,300 | |7,300 | ||

|- | |- | ||

|'''Current Assets''' | |'''Current Assets''' | ||

|'''39,973''' | |||

|'''34,301''' | |||

|'''39,740''' | |'''39,740''' | ||

|- | |- | ||

|'''Total Assets''' | |'''Total Assets''' | ||

|'''108,671''' | |||

|'''125,311''' | |||

|'''134,646''' | |'''134,646''' | ||

|- | |- | ||

| | | | ||

| Line 732: | Line 732: | ||

|- | |- | ||

|Long-term borrowing | |Long-term borrowing | ||

|14,065 | |||

|12,165 | |||

|10,380 | |10,380 | ||

|- | |- | ||

|Non-current lease liabilities | |Non-current lease liabilities | ||

|10,665 | |||

|11,887 | |||

|12,776 | |12,776 | ||

|- | |- | ||

|Non-current provisions and other liabilities | |Non-current provisions and other liabilities | ||

|3,322 | |||

|3,980 | |||

|3,902 | |3,902 | ||

|- | |- | ||

|Deferred tax | |Deferred tax | ||

|'''5,481''' | |||

|'''6,704''' | |||

|'''6,952''' | |'''6,952''' | ||

|- | |- | ||

|Purchase commitments for minority interests' shares | |Purchase commitments for minority interests' shares | ||

|'''10,991''' | |||

|'''13,677''' | |||

|'''12,489''' | |'''12,489''' | ||

|- | |- | ||

|'''Non-current liabilities''' | |'''Non-current liabilities''' | ||

|'''44,524''' | |||

|'''48,413''' | |||

|'''46,499''' | |'''46,499''' | ||

|- | |- | ||

|Short-term borrowing | |Short-term borrowing | ||

|10,638 | |||

|8,075 | |||

|9,359 | |9,359 | ||

|- | |- | ||

|Current lease liabilities | |Current lease liabilities | ||

|2,163 | |||

|2,387 | |||

|2,632 | |2,632 | ||

|- | |- | ||

|Trade accounts receivable | |Trade accounts receivable | ||

|5,098 | |||

|7,086 | |||

|8,788 | |8,788 | ||

|- | |- | ||

|'''Income taxes''' | |'''Income taxes''' | ||

|'''721''' | |||

|'''1,267''' | |||

|'''1,211''' | |'''1,211''' | ||

|- | |- | ||

|'''Current Provisions and other liabilities''' | |'''Current Provisions and other liabilities''' | ||

|'''6,698''' | |||

|'''9,174''' | |||

|'''9,553''' | |'''9,553''' | ||

|- | |- | ||

|'''Current Liabilities''' | |'''Current Liabilities''' | ||

|'''25,318''' | |||

|'''27,989''' | |||

|'''31,543''' | |'''31,543''' | ||

|- | |- | ||

|'''Total Liabilities''' | |'''Total Liabilities''' | ||

|'''69,842''' | |||

|'''76,402''' | |||

|'''78,042''' | |'''78,042''' | ||

|- | |- | ||

|Equity, Group Share | |Equity, Group Share | ||

|37,412 | |||

|47,119 | |||

|55,111 | |55,111 | ||

|- | |- | ||

|Minority Interests | |Minority Interests | ||

|1,417 | |||

|1,790 | |||

|1,493 | |1,493 | ||

|- | |- | ||

|'''Total Equity''' | |'''Total Equity''' | ||

|'''38,829''' | |||

|'''48,909''' | |||

|'''56,604''' | |'''56,604''' | ||

|- | |- | ||

|'''Total liabilities and Equity''' | |'''Total liabilities and Equity''' | ||

|'''108,671''' | |||

|'''125,311''' | |||

|'''134,646''' | |'''134,646''' | ||

|- | |- | ||

|'''Total Debt''' | |'''Total Debt''' | ||

|'''37,531''' | |||

|'''34,514''' | |||

|'''35,147''' | |'''35,147''' | ||

|} | |} | ||

[[File:LVMH Balance Sheet.png|left|thumb|443x443px]] | [[File:LVMH Balance Sheet.png|left|thumb|443x443px]] | ||

| Line 841: | Line 841: | ||

=== LVMH's Cash Flow Statement === | === LVMH's Cash Flow Statement === | ||

{| class="wikitable" | {| class="wikitable" | ||

!'''EUR''' €, Millions | |||

!'''2020''' | |||

!'''2021''' | |||

!'''2022''' | |||

|- | |- | ||

|Cash flow operating activities | |Cash flow operating activities | ||

| Line 852: | Line 852: | ||

|- | |- | ||

|Operating profits | |Operating profits | ||

|7,972 | |||

|17,155 | |||

|21,001 | |21,001 | ||

|- | |- | ||

|Income/loss and dividends received from joint ventures and associates | |Income/loss and dividends received from joint ventures and associates | ||

|64 | |||

|41 | |||

|26 | |26 | ||

|- | |- | ||

|Net increase in depreciation, amortisation and provisions | |Net increase in depreciation, amortisation and provisions | ||

|3,478 | |||

|3,139 | |||

|3,219 | |3,219 | ||

|- | |- | ||

|Depreciation of right-of-use assets | |Depreciation of right-of-use assets | ||

|2,572 | |||

|2,691 | |||

|3,007 | |3,007 | ||

|- | |- | ||

|Other adjustments and computed expemses | |Other adjustments and computed expemses | ||

|<nowiki>-89</nowiki> | |||

|<nowiki>-405</nowiki> | |||

|<nowiki>-483</nowiki> | |<nowiki>-483</nowiki> | ||

|- | |- | ||

|'''Cash from operations before changes in working capital''' | |'''Cash from operations before changes in working capital''' | ||

|'''13,997''' | |||

|'''22,621''' | |||

|'''26,770''' | |'''26,770''' | ||

|- | |- | ||

|Cost of net financial debt: interest paid | |Cost of net financial debt: interest paid | ||

|<nowiki>-58</nowiki> | |||

|71 | |||

|<nowiki>-74</nowiki> | |<nowiki>-74</nowiki> | ||

|- | |- | ||

|Lease liabilites: interest paid | |Lease liabilites: interest paid | ||

|<nowiki>-290</nowiki> | |||

|<nowiki>-231</nowiki> | |||

|<nowiki>-240</nowiki> | |<nowiki>-240</nowiki> | ||

|- | |- | ||

|Tax paid | |Tax paid | ||

|<nowiki>-2,385</nowiki> | |||

|<nowiki>-4,239</nowiki> | |||

|<nowiki>-5,604</nowiki> | |<nowiki>-5,604</nowiki> | ||

|- | |- | ||

|Change in working capital | |Change in working capital | ||

|<nowiki>-367</nowiki> | |||

|426 | |||

|<nowiki>-3,019</nowiki> | |<nowiki>-3,019</nowiki> | ||

|- | |- | ||

|'''Net cash from/ (used in) operating activities''' | |'''Net cash from/ (used in) operating activities''' | ||

|'''10,897''' | |||

|'''18,648''' | |||

|'''17,833''' | |'''17,833''' | ||

|- | |- | ||

|Cash flow investing activities | |Cash flow investing activities | ||

| Line 912: | Line 912: | ||

|- | |- | ||

|Operating investments | |Operating investments | ||

|<nowiki>-2,478</nowiki> | |||

|<nowiki>-2,664</nowiki> | |||

|<nowiki>-4,969</nowiki> | |<nowiki>-4,969</nowiki> | ||

|- | |- | ||

|Purchase and proceeds from sale of consolidated investments | |Purchase and proceeds from sale of consolidated investments | ||

|<nowiki>-536</nowiki> | |||

|<nowiki>-13,226</nowiki> | |||

|<nowiki>-809</nowiki> | |<nowiki>-809</nowiki> | ||

|- | |- | ||

|Dividends received | |Dividends received | ||

|12 | |||

|10 | |||

|7 | |7 | ||

|- | |- | ||

|Tax paid relates to non-current available for sale financial assets | |Tax paid relates to non-current available for sale financial assets | ||

| Line 932: | Line 932: | ||

|- | |- | ||

|Purchase and proceeds from sale of non-current available for sale financial assets | |Purchase and proceeds from sale of non-current available for sale financial assets | ||

|63 | |||

|<nowiki>-99</nowiki> | |||

|<nowiki>-149</nowiki> | |<nowiki>-149</nowiki> | ||

|- | |- | ||

|'''Net cash from/ (used in) investing activities''' | |'''Net cash from/ (used in) investing activities''' | ||

|'''-2,939''' | |||

|'''-15,979''' | |||

|'''-5,920''' | |'''-5,920''' | ||

|- | |- | ||

|Cash flow financing activities | |Cash flow financing activities | ||

| Line 947: | Line 947: | ||

|- | |- | ||

|Interim and final dividends paid | |Interim and final dividends paid | ||

|<nowiki>-2,799</nowiki> | |||

|<nowiki>-4,161</nowiki> | |||

|<nowiki>-6,774</nowiki> | |<nowiki>-6,774</nowiki> | ||

|- | |- | ||

|Purchase and proceeds from sale of minority interests | |Purchase and proceeds from sale of minority interests | ||

|<nowiki>-67</nowiki> | |||

|<nowiki>-435</nowiki> | |||

|<nowiki>-351</nowiki> | |<nowiki>-351</nowiki> | ||

|- | |- | ||

|Other equity-related transaction | |Other equity-related transaction | ||

|27 | |||

|<nowiki>-552</nowiki> | |||

|<nowiki>-1,604</nowiki> | |<nowiki>-1,604</nowiki> | ||

|- | |- | ||

|Proceeds from borrowings | |Proceeds from borrowings | ||

|17,499 | |||

|251 | |||

|3,774 | |3,774 | ||

|- | |- | ||

|Repayment of borrowing | |Repayment of borrowing | ||

|<nowiki>-5,024</nowiki> | |||

|<nowiki>-6,413</nowiki> | |||

|<nowiki>-3,891</nowiki> | |<nowiki>-3,891</nowiki> | ||

|- | |- | ||

|Repayment of lease liabilities | |Repayment of lease liabilities | ||

|<nowiki>-2,302</nowiki> | |||

|<nowiki>-2,453</nowiki> | |||

|<nowiki>-2,751</nowiki> | |<nowiki>-2,751</nowiki> | ||

|- | |- | ||

|Purchase and proceeds from sale of current available for sale financial assets | |Purchase and proceeds from sale of current available for sale financial assets | ||

|69 | |||

|<nowiki>-1,393</nowiki> | |||

|<nowiki>-1,088</nowiki> | |<nowiki>-1,088</nowiki> | ||

|- | |- | ||

|'''Net cash from/ (used in) financing activities''' | |'''Net cash from/ (used in) financing activities''' | ||

|'''7,403''' | |||

|'''-15,156''' | |||

|'''-12,685''' | |'''-12,685''' | ||

|- | |- | ||

|'''Effect of exchange rate changes''' | |'''Effect of exchange rate changes''' | ||

|<nowiki>-1,052</nowiki> | |||

|498 | |||

|55 | |55 | ||

|- | |- | ||

|'''Net increase/ decrease in cash and cash equivalents''' | |'''Net increase/ decrease in cash and cash equivalents''' | ||

|18,773 | |||

|<nowiki>-43,124</nowiki> | |||

|<nowiki>-717</nowiki> | |<nowiki>-717</nowiki> | ||

|- | |- | ||

|Cash and cash equivalents at the beginning of period | |Cash and cash equivalents at the beginning of period | ||

|5,497 | |||

|19,806 | |||

|7,817 | |7,817 | ||

|- | |- | ||

|Cash and cash equivalents at end of period | |Cash and cash equivalents at end of period | ||

|19,806 | |||

|7,817 | |||

|7,100 | |7,100 | ||

|- | |- | ||

|Total tax paid | |Total tax paid | ||

|<nowiki>-2,501</nowiki> | |||

|<nowiki>-4,464</nowiki> | |||

|<nowiki>-5,933</nowiki> | |<nowiki>-5,933</nowiki> | ||

|- | |- | ||

| | | | ||

| Line 1,022: | Line 1,022: | ||

|- | |- | ||

|'''EUR''' €, Millions | |'''EUR''' €, Millions | ||

|'''2020''' | |||

|'''2021''' | |||

|'''2022''' | |'''2022''' | ||

|- | |- | ||

|Net cash from operating activities | |Net cash from operating activities | ||

|10,897 | |||

|18,648 | |||

|17,833 | |17,833 | ||

|- | |- | ||

|Operating investments | |Operating investments | ||

|<nowiki>-2,478</nowiki> | |||

|<nowiki>-2,664</nowiki> | |||

|<nowiki>-4,969</nowiki> | |<nowiki>-4,969</nowiki> | ||

|- | |- | ||

|Repayment of lease liabilities | |Repayment of lease liabilities | ||

|<nowiki>-2,302</nowiki> | |||

|<nowiki>-2,453</nowiki> | |||

|<nowiki>-2,751</nowiki> | |<nowiki>-2,751</nowiki> | ||

|- | |- | ||

|'''Operating free cash flow''' | |'''Operating free cash flow''' | ||

|'''6,117''' | |||

|'''13,531''' | |||

|'''10,113''' | |'''10,113''' | ||

|} | |} | ||

[[File:Cash Flow Statement.png|left|thumb|475x475px]] | [[File:Cash Flow Statement.png|left|thumb|475x475px]] | ||

Revision as of 16:37, 5 July 2023

Business Description

LVMH Moët Hennessy - Louis Vuitton, Société Européenne operates as a luxury goods company worldwide. The company offers champagnes, wines, and spirits under the Clos des Lambrays, Château d'Yquem, Dom Pérignon, Ruinart, Moët & Chandon, Hennessy, Veuve Clicquot, Ardbeg, Château Cheval Blanc, Glenmorangie, Krug, Mercier, Chandon, Cape Mentelle, Newton Vineyard, Cloudy Bay, Belvedere, Terrazas de los Andes, Bodega Numanthia, Cheval des Andes, Woodinville, Ao Yun, Clos19, and Volcan de mi Tierra brands. It also provides fashion and leather products under the Berluti, Celine, Christian Dior, Emilio Pucci, FENDI, Givenchy, Kenzo, Loewe, Loro Piana, Louis Vuitton, Marc Jacobs, Moynat, Patou, and RIMOWA brands. In addition, the company offers perfumes and cosmetics under the Acqua di Parma, Benefit Cosmetics, Cha Ling, Fenty Beauty by Rihanna, Fresh, Givenchy Parfums, Guerlain, KVD Beauty, Kenzo Parfums, Maison Francis Kurkdjian, Make Up For Ever, Marc Jacobs Beauty, Officine Universelle Buly, Parfums Christian Dior, and Perfumes Loewe brands; watches and jewelry under the Bulgari, Chaumet, Fred, Hublot, Repossi, TAG Heuer, Tiffany & Co., and Zenith brands; and custom-designed yachts under the Feadship brand name, as well as designs and builds luxury yachts under the Royal Van Lent brand. Further, it provides daily newspapers under the Les Échos brand; Belmond, a luxury tourism service; home other activities under the Belmond, Cheval Blanc, Connaissance des Arts, Cova, Investir, Jardin d'Acclimatation, La Samaritaine, Le Parisien, and Radio Classique brands; and selective retailing products under the DFS, La Grande Epicerie de Paris, Le Bon Marché Rive Gauche, Sephora, and Starboard Cruise Services brands, as well as operates Jardin d'Acclimatation, a leisure and amusement park. The company operates 5,556 stores. LVMH Moët Hennessy - Louis Vuitton, Société Européenne was incorporated in 1923 and is headquartered in Paris, France.

Macro Analysis

Key Professionals

| Name | Title |

|---|---|

| Arnault, Bernard | Chairman & CEO |

| Guiony, Jean-Jacques | Chief Financial Officer |

| Kuhn, Bernard | General Counsel |

| Bouillonnec, Yann | Vice President of Sales |

| Gaemperle, Chantal | Group Executive Vice President of Human Resources & Synergies |

| Arnault, Antoine | Group Chief Image & Environment Officer and Director |

| Arnault, Frederic | Chief Executive Officer of TAG Heuer |

| Bazire, Nicolas | Senior VP of Development & Acquisitions and Director |

| Beaufils, Benjamin | President of North American Operations |

| Belloni, Antonio | Group MD & Director |

| Bianchi, Stephane | Head of LVHM's Watch & Jewelry Unit |

| Das, Ipsita | Managing Director of India |

| de Lapuente, Christopher | Chairman & CEO of Selective Retailing Division |

| Guerra, Andrea | Head of Hospitality & Restaurant Business |

| Mukherji, Shantanu | Managing Director od L Catterton |

| Rogers, Ian | Chief Digital Officer |

| Voisin, Jean-Baptiste | Chief Strategy Officer |

| Beccari, Pietro | Chairman & CEO of Louis Vuitton |

| Boillot, Laurent | CEO & President of Guerlain |

| Brocart, Sophie | Chief Executive Officer of Jean Patou |

| Jamet, Marc-Antoine | General Secretary |

| Schaus, Philippe Paul Auguste | Chief Executive Officer of Moët Hennessy - Wines & Spirits Division |

| Toledano, Sidney | Chairman and CEO of the Fashion Group |

| Hollis, Christopher | Director of Financial Communications |

| Stalla-Bourdillon, Bertrand | Group Vice President of Retail Development |

Board Members

| Name | Title | Type | Tenure |

|---|---|---|---|

| Arnault, Bernard | Chairman & CEO | Internal | 1988-Present |

| Arnault, Antoine | Group Chief Image & Environment Officer and Director | Internal | 2006-Present |

| Bazire, Nicolas | Senior VP of Development & Acquisitions and Director | Internal | 1999-Present |

| Belloni, Antonio | Group MD & Director | Internal | 2002-Present |

| Beccari, Pietro | Chairman & CEO of Louis Vuitton | Internal | 2018-Present |

| Toledano, Sidney | Chairman and CEO of the Fashion Group | Internal | 2018-Present |

| de Silguy, Yves-Thibault | Independent Director | External | 2009-Present |

| Gaymard, Clara | Independent Director | External | 2016-Present |

| Valla, Natacha | Independent Director | External | 2020-Present |

| de Croisset, Charles | Lead Independent Director | External | 2008-Present |

| Arthus-Bertrand, Yann | Member of Advisory Board | External | 2019-Present |

| Aumont, Dominique | Employees Representing Director | External | 2020-Present |

| Belloeil-Melkin, Marie-Véronique | Employees Representative Director | External | 2020-Present |

| Chassat, Sophie | Independent Director | External | 2018-Present |

| de Chalon, Marie-Laure Sauty | Independent Director | External | 2014-Present |

| Della Valle, Diego | Member of Advisory Board | External | 2002-Present |

| Gancia, Delphine Arnault | Director | External | 2020-Present |

| Kravis L.L.D., Marie- Josée | Independent Director | External | 2011-Present |

| Mignon, Laurent | Independent Director | External | 2023-Present |

| Powell KCMG, Charles David | Member of Advisory Board | External | 2020-Present |

| Védrine, M. Hubert | Independent Director | External | 2004-Present |

Committees

| Committee | Name | Title |

|---|---|---|

| Audit Committee | Gaymard, Clara | Independent Director |

| de Chalon, Marie-Laure S. | Independent Director | |

| de Croisset, Charles | Lead Independent Director | |

| de Silguy, Yves-Thibault | Independent Director | |

| Compensation Committee | Valla, Natacha | Independent Director |

| Chassat, Sophie | Independent Director | |

| de Croisset, Charles | Lead Independent Director | |

| Kravis, Marie- J. | Independent Director | |

| Corporate Governance Committee | Valla, Natacha | Independent Director |

| Chassat, Sophie | Independent Director | |

| de Croisset, Charles | Lead Independent Director | |

| Kravis, Marie- J. | Independent Director | |

| Other Committee | de Silguy, Yves-Thibault | Independent Director |

| de Chalon, Marie-Laure S. | Independent Director | |

| Gancia, Delphine A. | Director | |

| Védrine, M. H. | Independent Director |

ESG - Materiality Matrix

| Particulars | Wines and Spirits | Fashion andLeather Goods | Perfumes and Cosmetics | Watches and Jewelry | SelectiveRetailing |

|---|---|---|---|---|---|

| State of energy resources and climate change | -Grape growing and yield

-Packaging production -Distillation -Transportation of products -Soil erosion |

-Store lighting, air conditioning and location

-Transportation of products and carbon taxes -Production of resources needed to manufacture products: -Plant fibers used for textiles (cotton, etc.) Leather, including exotic leather, Fur, Wool -Customer expectations in relation to more sustainable products -Renewable energy costs |

-Packaging production

-Store lighting, air conditioning and location -Transportation of products and carbon taxes -Customer expectations in relation to more sustainable products -Renewable energy costs |

-Store lighting, air conditioning and location

-Renewable energy costs |

-Store lighting, air conditioning and location

-Transportation of products -Renewable energy costs |

| Impact on water resources | -Water consumption (vineyard irrigation in Australia, New Zealand, Argentina and California)

-Production of effluents containing organic matter during winemaking and distillation |

-Water consumption (crocodilian farms and tanneries)

-Production Ofeffluents containing organic matter |

- Water consumption (production and transformation of raw materials) | -Water consumption during the extraction of mineral resources needed to manufacture products

-Production of effluents containing mineral matter |

|

| Impact on ecosystems (including deforestation and desertification) and depletion of natural resources | -Production of plant resources needed for other production processes (grape vines, barley, rye, etc.)'

- Protecting biodiversity |

-Production of resources needed to manufacture products:

- Plantfibers used for textiles (cotton, etc.) Leather, including exotic leather Fur, Wool, Eider down -Farming and trapping practices concerning raw materials of animal origin Protecting biodiversity |

-Production of plant resources needed to manufacture products (rose, jasmine, etc.)

-Protecting biodiversity |

-Extraction of resources needed to manufacture products:

- Gems and precious metals -Exotic leather -Farming and trapping practices concerning raw materials of animal origin -Protecting biodiversity |

|

| Waste production | -Production of residues from winemaking or distillation processes and packaging waste

-Circular economy |

-Unused raw materials, obsolete and unsold products, window displays and events

-Customer expectations in relation to more sustainable products -Circular economy |

-Point-of-sale advertising, packaging waste, and obsolete and unsold products Circular economy | -Scrap metal

- Circular economy |

-Point-of-sale advertising, packaging waste, and obsolete and unsold products

-Circular economy |

Financial Highlights

| Key Consolidated Data (EUR Millions) | 2020 | 2021 | 2022 |

|---|---|---|---|

| Revenue | 44,651 | 64,215 | 79,184 |

| Profit from recurring operations | 8,305 | 17,151 | 21,055 |

| Net profit | 4,955 | 12,698 | 14,751 |

| Net profit, Group share | 4,702 | 12,036 | 14,084 |

| Cash from operations before changes in working capital | 13,997 | 22,621 | 26770 |

| Operating investment | 2.478 | 2,664 | 4,969 |

| Operating free cash flow | 6,117 | 13,531 | 10,113 |

| Total equity (a) | 38,829 | 48,909 | 56,604 |

| Net financial debt (b) | 4,241 | 9,607 | 9201 |

| Adjusted net financial debt/Equity ratio | 10.9% | 19.60% | 14.30% |

(a) Including minority interests

(b) Excluding “Lease liabilities” and “Purchase commitments for minority interests’ shares” included in “Other non-current liabilities”

Business Group - Highlights

| Revenue by business group (EUR Millions) | 2020 | 2021 | 2022 |

|---|---|---|---|

| Wines and Spirits | 4,755 | 5,974 | 7099 |

| Fashion and Leather Goods | 21,207 | 30,896 | 38,648 |

| Perfumes and Cosmetics | 5,248 | 6,608 | 7722 |

| Watches and Jewelry | 3,356 | 8,964 | 10,581 |

| Selective Retailing | 10,155 | 11,754 | 14,852 |

| Other activities and eliminations | -70 | 19 | 281 |

| Total | 44,651 | 64,215 | 79,184 |

| Profit from recurring operations by business group(EUR millions) | 2020 | 2021 | 2022 |

|---|---|---|---|

| Wines and Spirits | 1,388 | 1,863 | 2,155 |

| Fashion and Leather Goods | 7,188 | 12,842 | 15,709 |

| Perfumes and Cosmetics | 80 | 684 | 660 |

| Watches and Jewelry | 302 | 1,679 | 2,017 |

| Selective Retailing | -203 | 534 | 788 |

| Other activities and eliminations | -450 | -451 | -274 |

| Total | 8,305 | 17,151 | 21,055 |

Financial Statements

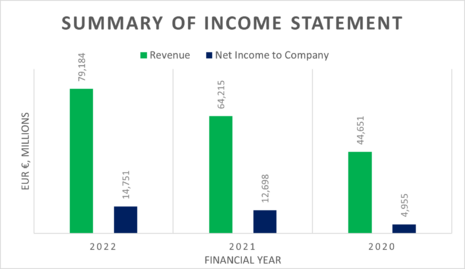

LVMH's Annual Income Statement

| EUR €, Millions, except for earnings per share data | 2020 | 2021 | 2022 |

|---|---|---|---|

| Period Ending: | 31-Dec | 31-Dec | 31-Dec |

| Revenue | 44,651 | 64,215 | 79,184 |

| Revenue Growth (year to year) | -16.80% | 43.82% | 23.31% |

| Cost of Goods and Services | -15,871 | -20,355 | -24,988 |

| Gross Margin | 28,780 | 43,860 | 54,196 |

| Marketing and selling expenses | -16,792 | -22,308 | -28,151 |

| General and administrative expenses | -3,641 | -4,414 | -5,027 |

| Income/(Loss) from joint ventures | -42 | 13 | 37 |

| Profit from recurring operations | 8,305 | 17,151 | 21,055 |

| Other operating income and expenses | -333 | 4 | -54 |

| Operating profit | 7,972 | 17,155 | 21,001 |

| Cost of net financial debt | -35 | 41 | -17 |

| Interest of lease liabilities | -281 | -242 | -254 |

| Other financial income and expenses | -292 | 254 | -617 |

| Net financial income/(expense) | -608 | 53 | -888 |

| Income Tax Expense | -2,409 | -4,510 | -5,362 |

| Net Income to Company | 4,955 | 12,698 | 14,751 |

| Minority Interest in Earnings | -253 | -662 | -667 |

| Net Income to Stockholders | 4,702 | 12,036 | 14,084 |

| Basic EPS, (EUR) | 9.34 | 23.90 | 28.05 |

| Basic Weighted Average Shares Outstanding | 503,679,272 | 503,627,708 | 502,120,694 |

| Diluted EPS (EUR) | 9.33 | 23.89 | 28.03 |

| Diluted Weighted Average Shares Outstanding | 504,210,133 | 503,895,592 | 502,480,100 |

| EBITDA | 13,780 | 23,280 | 26,720 |

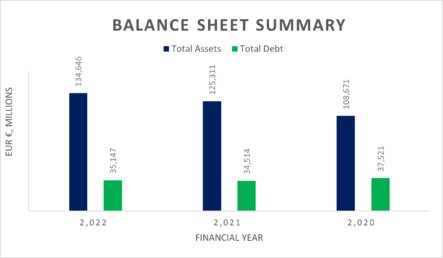

LVMH's Annual Balance Sheet

| Year end date (31/12) | 2020 | 2021 | 2022 |

|---|---|---|---|

| Assets (EUR millions) | |||

| Brands and other intangible assets | 17,012 | 24,551 | 25,432 |

| Goodwill | 16,042 | 25,904 | 24,782 |

| Property, plant and equipment | 18,224 | 20,193 | 23,055 |

| Right-of-use assets | 12,521 | 13,705 | 14,615 |

| Investment in joint ventures and associates | 990 | 1,084 | 1,066 |

| Non-current available for sale financial assets | 739 | 1,363 | 1,109 |

| Other non-current assets | 845 | 1,054 | 1,186 |

| Deferred tax | 2,325 | 3,156 | 3,661 |

| Non-current Assets | 68,698 | 91,010 | 94,906 |

| Inventories and work in progress | 13,016 | 16,549 | 20,319 |

| Trade accounts receivable | 2,756 | 3,787 | 4,258 |

| Income taxes | 392 | 338 | 375 |

| Other current assets | 3,846 | 5,606 | 7,488 |

| Cash and cash equivalents | 19,963 | 8,021 | 7,300 |

| Current Assets | 39,973 | 34,301 | 39,740 |

| Total Assets | 108,671 | 125,311 | 134,646 |

| Liabilities and Equities (EUR millions) | |||

| Long-term borrowing | 14,065 | 12,165 | 10,380 |

| Non-current lease liabilities | 10,665 | 11,887 | 12,776 |

| Non-current provisions and other liabilities | 3,322 | 3,980 | 3,902 |

| Deferred tax | 5,481 | 6,704 | 6,952 |

| Purchase commitments for minority interests' shares | 10,991 | 13,677 | 12,489 |

| Non-current liabilities | 44,524 | 48,413 | 46,499 |

| Short-term borrowing | 10,638 | 8,075 | 9,359 |

| Current lease liabilities | 2,163 | 2,387 | 2,632 |

| Trade accounts receivable | 5,098 | 7,086 | 8,788 |

| Income taxes | 721 | 1,267 | 1,211 |

| Current Provisions and other liabilities | 6,698 | 9,174 | 9,553 |

| Current Liabilities | 25,318 | 27,989 | 31,543 |

| Total Liabilities | 69,842 | 76,402 | 78,042 |

| Equity, Group Share | 37,412 | 47,119 | 55,111 |

| Minority Interests | 1,417 | 1,790 | 1,493 |

| Total Equity | 38,829 | 48,909 | 56,604 |

| Total liabilities and Equity | 108,671 | 125,311 | 134,646 |

| Total Debt | 37,531 | 34,514 | 35,147 |

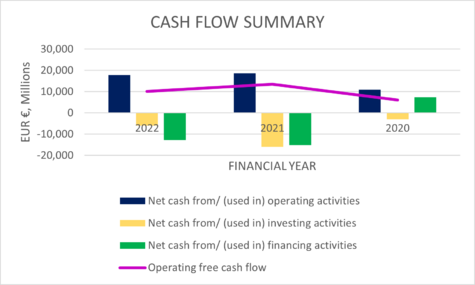

LVMH's Cash Flow Statement

| EUR €, Millions | 2020 | 2021 | 2022 |

|---|---|---|---|

| Cash flow operating activities | |||

| Operating profits | 7,972 | 17,155 | 21,001 |

| Income/loss and dividends received from joint ventures and associates | 64 | 41 | 26 |

| Net increase in depreciation, amortisation and provisions | 3,478 | 3,139 | 3,219 |

| Depreciation of right-of-use assets | 2,572 | 2,691 | 3,007 |

| Other adjustments and computed expemses | -89 | -405 | -483 |

| Cash from operations before changes in working capital | 13,997 | 22,621 | 26,770 |

| Cost of net financial debt: interest paid | -58 | 71 | -74 |

| Lease liabilites: interest paid | -290 | -231 | -240 |

| Tax paid | -2,385 | -4,239 | -5,604 |

| Change in working capital | -367 | 426 | -3,019 |

| Net cash from/ (used in) operating activities | 10,897 | 18,648 | 17,833 |

| Cash flow investing activities | |||

| Operating investments | -2,478 | -2,664 | -4,969 |

| Purchase and proceeds from sale of consolidated investments | -536 | -13,226 | -809 |

| Dividends received | 12 | 10 | 7 |

| Tax paid relates to non-current available for sale financial assets | - | - | - |

| Purchase and proceeds from sale of non-current available for sale financial assets | 63 | -99 | -149 |

| Net cash from/ (used in) investing activities | -2,939 | -15,979 | -5,920 |

| Cash flow financing activities | |||

| Interim and final dividends paid | -2,799 | -4,161 | -6,774 |

| Purchase and proceeds from sale of minority interests | -67 | -435 | -351 |

| Other equity-related transaction | 27 | -552 | -1,604 |

| Proceeds from borrowings | 17,499 | 251 | 3,774 |

| Repayment of borrowing | -5,024 | -6,413 | -3,891 |

| Repayment of lease liabilities | -2,302 | -2,453 | -2,751 |

| Purchase and proceeds from sale of current available for sale financial assets | 69 | -1,393 | -1,088 |

| Net cash from/ (used in) financing activities | 7,403 | -15,156 | -12,685 |

| Effect of exchange rate changes | -1,052 | 498 | 55 |

| Net increase/ decrease in cash and cash equivalents | 18,773 | -43,124 | -717 |

| Cash and cash equivalents at the beginning of period | 5,497 | 19,806 | 7,817 |

| Cash and cash equivalents at end of period | 19,806 | 7,817 | 7,100 |

| Total tax paid | -2,501 | -4,464 | -5,933 |

| Alternative performance measure | |||

| EUR €, Millions | 2020 | 2021 | 2022 |

| Net cash from operating activities | 10,897 | 18,648 | 17,833 |

| Operating investments | -2,478 | -2,664 | -4,969 |

| Repayment of lease liabilities | -2,302 | -2,453 | -2,751 |

| Operating free cash flow | 6,117 | 13,531 | 10,113 |