LVMH Moët Hennessy - Louis Vuitton, Société Européenne: Difference between revisions

(Undo revision 10482492 by Allan.Preston (talk)) Tag: Undo |

|||

| Line 1,241: | Line 1,241: | ||

== Growth Drivers and Catalysts == | == Growth Drivers and Catalysts == | ||

== Competitors Comparison == | == Competitors Comparison == | ||

Revision as of 18:05, 6 July 2023

Business Description

LVMH Moët Hennessy - Louis Vuitton, Société Européenne operates as a luxury goods company worldwide. The company offers champagnes, wines, and spirits under the Clos des Lambrays, Château d'Yquem, Dom Pérignon, Ruinart, Moët & Chandon, Hennessy, Veuve Clicquot, Ardbeg, Château Cheval Blanc, Glenmorangie, Krug, Mercier, Chandon, Cape Mentelle, Newton Vineyard, Cloudy Bay, Belvedere, Terrazas de los Andes, Bodega Numanthia, Cheval des Andes, Woodinville, Ao Yun, Clos19, and Volcan de mi Tierra brands. It also provides fashion and leather products under the Berluti, Celine, Christian Dior, Emilio Pucci, FENDI, Givenchy, Kenzo, Loewe, Loro Piana, Louis Vuitton, Marc Jacobs, Moynat, Patou, and RIMOWA brands. In addition, the company offers perfumes and cosmetics under the Acqua di Parma, Benefit Cosmetics, Cha Ling, Fenty Beauty by Rihanna, Fresh, Givenchy Parfums, Guerlain, KVD Beauty, Kenzo Parfums, Maison Francis Kurkdjian, Make Up For Ever, Marc Jacobs Beauty, Officine Universelle Buly, Parfums Christian Dior, and Perfumes Loewe brands; watches and jewelry under the Bulgari, Chaumet, Fred, Hublot, Repossi, TAG Heuer, Tiffany & Co., and Zenith brands; and custom-designed yachts under the Feadship brand name, as well as designs and builds luxury yachts under the Royal Van Lent brand. Further, it provides daily newspapers under the Les Échos brand; Belmond, a luxury tourism service; home other activities under the Belmond, Cheval Blanc, Connaissance des Arts, Cova, Investir, Jardin d'Acclimatation, La Samaritaine, Le Parisien, and Radio Classique brands; and selective retailing products under the DFS, La Grande Epicerie de Paris, Le Bon Marché Rive Gauche, Sephora, and Starboard Cruise Services brands, as well as operates Jardin d'Acclimatation, a leisure and amusement park. The company operates 5,556 stores. LVMH Moët Hennessy - Louis Vuitton, Société Européenne was incorporated in 1923 and is headquartered in Paris, France.

What's the mission of the company?

“Our success is only worthwhile if it is also virtuous” Success can only last if it is fair. And if it benefits everyone, then it will be even greater. What’s the point of inspiring dreams with magnificent products if they don’t meet the highest social and environmental standards? We apply those standards for the benefit of our employees and our customers of course, for our stakeholders as well, but above all for our future.” Bernard Arnault

2023 Objectives to further increase LVMH's global leadership position:

- Confidence: continue growth momentum of the company and increase their desirability.

- Creativity and excellence: focus on creativity, distribution and quality of our products with their core values always in mind.

- Digitalisation: enrich customer's experience online and in stores.

- Commitment: preserve the environment and corporate responsibilities.

- Vigilance: maintain vigilance within current economic and geopolitical context.

- Entrepreneurial spirit.

LIFE 360: LVMH environmental strategy for new luxury:

- Biodiversity: 2030 -> 5 millions hectares of flora and fauna preserved.

- Climate:

- 2026 -> 50% reduction in energy- related greenhouse gas (GHG) emissions.

- 2030 -> 55% reduction and/or avoidance of Scope 3 GHG emissions per unit of added value.

- Create circularity: 2030 -> 100% of new products covered by a sustainable design approach.

- Traceability: 2030 -> 100% of strategic chains covered by a dedicated traceability system.

Macro Analysis and Trends

LVMH operates in the luxury goods industry. This industry is characterized by high-end products that are often handmade and of the highest quality. Luxury goods are typically associated with status and exclusivity, and they are often seen as a way to express one's personal style.

The luxury goods industry is a global industry, with markets in all major regions of the world. The largest players are LVMH, Kering (which includes brands such as Bottega Veneta, Gucci, Saint Laurent), Richemont, Chanel, Burberry, Hermès, Moncler, and Prada.

The luxury goods industry is linked to macroeconomic factors such as economic growth, exchange rates, inflation, interest rates, political stability, and technological progress. Typically, growing economies, favourable exchange rates, low interest rates, and political stability positively impact the luxury sector.[1]

However, the luxury goods industry has shown resilience in periods of economic downturns, and it is expected to deliver sustained growth in 2023, as high inflation and interest rates have a weaker impact on wealthy shoppers’ behaviour. To protect their image, luxury brand manufacturers favour high inventory levels over offering discounts. So far, inelastic demand has allowed them to pass on higher costs to customers, thus increasing their margins.

The industry has experienced significant growth in recent years, and it is expected to continue to grow in the coming years. Looking ahead, this growth will be driven by a number of macro trends:

1. The growth of the middle class in emerging markets: The growth of the middle class in emerging markets is one of the most important trends in the global economy. This trend is driving demand for luxury goods in emerging markets. Despite a disappointing first half of 2023, China still represents the largest emerging market for luxury goods its economy is expected to grow by 5.2% in 2023.[2]

2. Generational trends: Millennials are increasingly becoming the target market for luxury goods brands. This is because millennials have more disposable income than previous generations, and they are more likely to spend money on luxury goods. Additionally, “Gen Z” are expected to represent one-third of the market by 2030 and their spending is set to grow three times faster than for other generations until 2030.[3]

3. The growth of online shopping: The growth of online shopping is another important trend that is impacting the luxury goods industry. Online shopping is making it easier for consumers to buy luxury goods from around the world.

4. The demand for sustainable luxury goods: There is a growing demand for sustainable luxury goods. This is because consumers are becoming more aware of the environmental impact of luxury goods production.

Key Professionals

| Name | Title |

|---|---|

| Arnault, Bernard | Chairman & CEO |

| Guiony, Jean-Jacques | Chief Financial Officer |

| Kuhn, Bernard | General Counsel |

| Bouillonnec, Yann | Vice President of Sales |

| Gaemperle, Chantal | Group Executive Vice President of Human Resources & Synergies |

| Arnault, Antoine | Group Chief Image & Environment Officer and Director |

| Arnault, Frederic | Chief Executive Officer of TAG Heuer |

| Bazire, Nicolas | Senior VP of Development & Acquisitions and Director |

| Beaufils, Benjamin | President of North American Operations |

| Belloni, Antonio | Group MD & Director |

| Bianchi, Stephane | Head of LVHM's Watch & Jewelry Unit |

| Das, Ipsita | Managing Director of India |

| de Lapuente, Christopher | Chairman & CEO of Selective Retailing Division |

| Guerra, Andrea | Head of Hospitality & Restaurant Business |

| Mukherji, Shantanu | Managing Director od L Catterton |

| Rogers, Ian | Chief Digital Officer |

| Voisin, Jean-Baptiste | Chief Strategy Officer |

| Beccari, Pietro | Chairman & CEO of Louis Vuitton |

| Boillot, Laurent | CEO & President of Guerlain |

| Brocart, Sophie | Chief Executive Officer of Jean Patou |

| Jamet, Marc-Antoine | General Secretary |

| Schaus, Philippe Paul Auguste | Chief Executive Officer of Moët Hennessy - Wines & Spirits Division |

| Toledano, Sidney | Chairman and CEO of the Fashion Group |

| Hollis, Christopher | Director of Financial Communications |

| Stalla-Bourdillon, Bertrand | Group Vice President of Retail Development |

Board Members

| Name | Title | Type | Tenure | |

|---|---|---|---|---|

| Start date | End date | |||

| Arnault, Bernard | Chairman & CEO | Internal | 1988 | Present |

| Arnault, Antoine | Group Chief Image & Environment Officer and Director | Internal | 2006 | Present |

| Bazire, Nicolas | Senior VP of Development & Acquisitions and Director | Internal | 1999 | Present |

| Belloni, Antonio | Group MD & Director | Internal | 2002 | Present |

| Beccari, Pietro | Chairman & CEO of Louis Vuitton | Internal | 2018 | Present |

| Toledano, Sidney | Chairman and CEO of the Fashion Group | Internal | 2018 | Present |

| de Silguy, Yves-Thibault | Independent Director | External | 2009 | Present |

| Gaymard, Clara | Independent Director | External | 2016 | Present |

| Valla, Natacha | Independent Director | External | 2020 | Present |

| de Croisset, Charles | Lead Independent Director | External | 2008 | Present |

| Arthus-Bertrand, Yann | Member of Advisory Board | External | 2019 | Present |

| Aumont, Dominique | Employees Representing Director | External | 2020 | Present |

| Belloeil-Melkin, Marie-Véronique | Employees Representative Director | External | 2020 | Present |

| Chassat, Sophie | Independent Director | External | 2018 | Present |

| de Chalon, Marie-Laure Sauty | Independent Director | External | 2014 | Present |

| Della Valle, Diego | Member of Advisory Board | External | 2002 | Present |

| Gancia, Delphine Arnault | Director | External | 2020 | Present |

| Kravis L.L.D., Marie- Josée | Independent Director | External | 2011 | Present |

| Mignon, Laurent | Independent Director | External | 2023 | Present |

| Powell KCMG, Charles David | Member of Advisory Board | External | 2020 | Present |

| Védrine, M. Hubert | Independent Director | External | 2004 | Present |

Committees

| Committee | Name | Title |

|---|---|---|

| Audit Committee | Gaymard, Clara | Independent Director |

| de Chalon, Marie-Laure S. | Independent Director | |

| de Croisset, Charles | Lead Independent Director | |

| de Silguy, Yves-Thibault | Independent Director | |

| Compensation Committee | Valla, Natacha | Independent Director |

| Chassat, Sophie | Independent Director | |

| de Croisset, Charles | Lead Independent Director | |

| Kravis, Marie- J. | Independent Director | |

| Corporate Governance Committee | Valla, Natacha | Independent Director |

| Chassat, Sophie | Independent Director | |

| de Croisset, Charles | Lead Independent Director | |

| Kravis, Marie- J. | Independent Director | |

| Other Committee | de Silguy, Yves-Thibault | Independent Director |

| de Chalon, Marie-Laure S. | Independent Director | |

| Gancia, Delphine A. | Director | |

| Védrine, M. H. | Independent Director |

ESG - Materiality Matrix

| Particulars | Wines and Spirits | Fashion andLeather Goods | Perfumes and Cosmetics | Watches and Jewelry | SelectiveRetailing |

|---|---|---|---|---|---|

| State of energy resources and climate change | -Grape growing and yield

-Packaging production -Distillation -Transportation of products -Soil erosion |

-Store lighting, air conditioning and location

-Transportation of products and carbon taxes -Production of resources needed to manufacture products: -Plant fibers used for textiles (cotton, etc.) Leather, including exotic leather, Fur, Wool -Customer expectations in relation to more sustainable products -Renewable energy costs |

-Packaging production

-Store lighting, air conditioning and location -Transportation of products and carbon taxes -Customer expectations in relation to more sustainable products -Renewable energy costs |

-Store lighting, air conditioning and location

-Renewable energy costs |

-Store lighting, air conditioning and location

-Transportation of products -Renewable energy costs |

| Impact on water resources | -Water consumption (vineyard irrigation in Australia, New Zealand, Argentina and California)

-Production of effluents containing organic matter during winemaking and distillation |

-Water consumption (crocodilian farms and tanneries)

-Production Ofeffluents containing organic matter |

- Water consumption (production and transformation of raw materials) | -Water consumption during the extraction of mineral resources needed to manufacture products

-Production of effluents containing mineral matter |

|

| Impact on ecosystems (including deforestation and desertification) and depletion of natural resources | -Production of plant resources needed for other production processes (grape vines, barley, rye, etc.)'

- Protecting biodiversity |

-Production of resources needed to manufacture products:

- Plantfibers used for textiles (cotton, etc.) Leather, including exotic leather Fur, Wool, Eider down -Farming and trapping practices concerning raw materials of animal origin Protecting biodiversity |

-Production of plant resources needed to manufacture products (rose, jasmine, etc.)

-Protecting biodiversity |

-Extraction of resources needed to manufacture products:

- Gems and precious metals -Exotic leather -Farming and trapping practices concerning raw materials of animal origin -Protecting biodiversity |

|

| Waste production | -Production of residues from winemaking or distillation processes and packaging waste

-Circular economy |

-Unused raw materials, obsolete and unsold products, window displays and events

-Customer expectations in relation to more sustainable products -Circular economy |

-Point-of-sale advertising, packaging waste, and obsolete and unsold products Circular economy | -Scrap metal

- Circular economy |

-Point-of-sale advertising, packaging waste, and obsolete and unsold products

-Circular economy |

Market

Total Addressable Market

Here, the total addressable market (TAM) is defined as the luxury goods global market, and based on a number of assumptions, it is estimated that the size of the market as of today (6th July 2023) in terms of revenue, is US$354.80bn, and is expected to grow at a CAGR of 3,38% in the forecast period of 2023- 2028.[4]

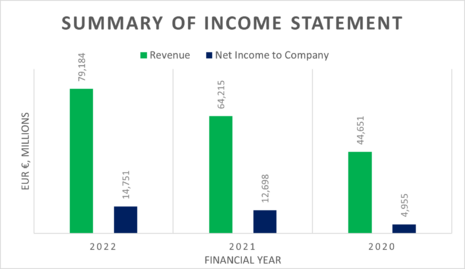

Financial Highlights

| Key Consolidated Data (EUR Millions) | 2020 | 2021 | 2022 |

|---|---|---|---|

| Revenue | 44,651 | 64,215 | 79,184 |

| Profit from recurring operations | 8,305 | 17,151 | 21,055 |

| Net profit | 4,955 | 12,698 | 14,751 |

| Net profit, Group share | 4,702 | 12,036 | 14,084 |

| Cash from operations before changes in working capital | 13,997 | 22,621 | 26770 |

| Operating investment | 2.478 | 2,664 | 4,969 |

| Operating free cash flow | 6,117 | 13,531 | 10,113 |

| Total equity (a) | 38,829 | 48,909 | 56,604 |

| Net financial debt (b) | 4,241 | 9,607 | 9201 |

| Adjusted net financial debt/Equity ratio | 10.9% | 19.60% | 14.30% |

(a) Including minority interests

(b) Excluding “Lease liabilities” and “Purchase commitments for minority interests’ shares” included in “Other non-current liabilities”

Business Group - Highlights

| Revenue by business group (EUR Millions) | 2020 | 2021 | 2022 |

|---|---|---|---|

| Wines and Spirits | 4,755 | 5,974 | 7099 |

| Fashion and Leather Goods | 21,207 | 30,896 | 38,648 |

| Perfumes and Cosmetics | 5,248 | 6,608 | 7722 |

| Watches and Jewelry | 3,356 | 8,964 | 10,581 |

| Selective Retailing | 10,155 | 11,754 | 14,852 |

| Other activities and eliminations | -70 | 19 | 281 |

| Total | 44,651 | 64,215 | 79,184 |

| Profit from recurring operations by business group(EUR millions) | 2020 | 2021 | 2022 |

|---|---|---|---|

| Wines and Spirits | 1,388 | 1,863 | 2,155 |

| Fashion and Leather Goods | 7,188 | 12,842 | 15,709 |

| Perfumes and Cosmetics | 80 | 684 | 660 |

| Watches and Jewelry | 302 | 1,679 | 2,017 |

| Selective Retailing | -203 | 534 | 788 |

| Other activities and eliminations | -450 | -451 | -274 |

| Total | 8,305 | 17,151 | 21,055 |

Financial Statements[5]

Historic

Most recent quarter

Comparing Q1 2023 to Q1 2022, in euro millions, the total LVMH group has experienced a 17% reported and organic increase in revenue from 18,003 to 21,035 respectively. The Wines & Spirits business group recorded a revenue growth of 3% with an organic revenue growth of 14% of the Champagne & Wines sector, due to a strong start to year driven by positive price effect, and a 5% organic revenue decrease of the Cognac & Spirits sector, due to China recovering from Covid impact while US impacted by softer economic environment. The Fashion & Leather Goods business group recorded a revenue growth of 18%, due to exceptional performance, driven by creativity and iconic products, specially in Louis Vuitton. The greatest revenue evolution was observed in the Selective Retailing sector, where an increase of 28% was recorded due to Sephora's strong performance, DFS benefiting from recovery in travel, notably in Asia and Le Bon Marché with its creative animations.[6]

Most recent year

For the fiscal year 2022, ending on the 31st of December, LVMH reported an annual revenue of 79.2 billion euros a 23.3% increase over the previous fiscal year, 2021, as can be seen hereunder. As well as a 17% increase in the groups share of net profit, increasing from 12.036 billion euros in 2021 to 14.084 billion euros in 2022.

Other important financial indicators include:[7]

- a decrease in operating free cash flow by 3.418 billion euros in comparison with 2021.

- dividend of 12 euros in 2022, increased by 20% compared to 2021.

- Gearing of 16% compared to a gearing of 20% in 2021. (Gearing: the ratio of a company's debt to equity)

LVMH's Annual Income Statement

| EUR €, Millions, except for earnings per share data | 2020 | 2021 | 2022 |

|---|---|---|---|

| Period Ending: | 31-Dec | 31-Dec | 31-Dec |

| Revenue | 44,651 | 64,215 | 79,184 |

| Revenue Growth (year to year) | -16.80% | 43.82% | 23.31% |

| Cost of Goods and Services | -15,871 | -20,355 | -24,988 |

| Gross Margin | 28,780 | 43,860 | 54,196 |

| Marketing and selling expenses | -16,792 | -22,308 | -28,151 |

| General and administrative expenses | -3,641 | -4,414 | -5,027 |

| Income/(Loss) from joint ventures | -42 | 13 | 37 |

| Profit from recurring operations | 8,305 | 17,151 | 21,055 |

| Other operating income and expenses | -333 | 4 | -54 |

| Operating profit | 7,972 | 17,155 | 21,001 |

| Cost of net financial debt | -35 | 41 | -17 |

| Interest of lease liabilities | -281 | -242 | -254 |

| Other financial income and expenses | -292 | 254 | -617 |

| Net financial income/(expense) | -608 | 53 | -888 |

| Income Tax Expense | -2,409 | -4,510 | -5,362 |

| Net Income to Company | 4,955 | 12,698 | 14,751 |

| Minority Interest in Earnings | -253 | -662 | -667 |

| Net Income to Stockholders | 4,702 | 12,036 | 14,084 |

| Basic EPS, (EUR) | 9.34 | 23.90 | 28.05 |

| Basic Weighted Average Shares Outstanding | 503,679,272 | 503,627,708 | 502,120,694 |

| Diluted EPS (EUR) | 9.33 | 23.89 | 28.03 |

| Diluted Weighted Average Shares Outstanding | 504,210,133 | 503,895,592 | 502,480,100 |

| EBITDA | 13,780 | 23,280 | 26,720 |

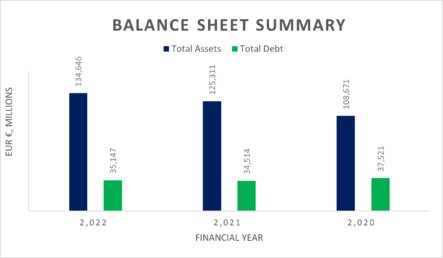

LVMH's Annual Balance Sheet

| Year end date (31/12) | 2020 | 2021 | 2022 |

|---|---|---|---|

| Assets (EUR millions) | |||

| Brands and other intangible assets | 17,012 | 24,551 | 25,432 |

| Goodwill | 16,042 | 25,904 | 24,782 |

| Property, plant and equipment | 18,224 | 20,193 | 23,055 |

| Right-of-use assets | 12,521 | 13,705 | 14,615 |

| Investment in joint ventures and associates | 990 | 1,084 | 1,066 |

| Non-current available for sale financial assets | 739 | 1,363 | 1,109 |

| Other non-current assets | 845 | 1,054 | 1,186 |

| Deferred tax | 2,325 | 3,156 | 3,661 |

| Non-current Assets | 68,698 | 91,010 | 94,906 |

| Inventories and work in progress | 13,016 | 16,549 | 20,319 |

| Trade accounts receivable | 2,756 | 3,787 | 4,258 |

| Income taxes | 392 | 338 | 375 |

| Other current assets | 3,846 | 5,606 | 7,488 |

| Cash and cash equivalents | 19,963 | 8,021 | 7,300 |

| Current Assets | 39,973 | 34,301 | 39,740 |

| Total Assets | 108,671 | 125,311 | 134,646 |

| Liabilities and Equities (EUR millions) | |||

| Long-term borrowing | 14,065 | 12,165 | 10,380 |

| Non-current lease liabilities | 10,665 | 11,887 | 12,776 |

| Non-current provisions and other liabilities | 3,322 | 3,980 | 3,902 |

| Deferred tax | 5,481 | 6,704 | 6,952 |

| Purchase commitments for minority interests' shares | 10,991 | 13,677 | 12,489 |

| Non-current liabilities | 44,524 | 48,413 | 46,499 |

| Short-term borrowing | 10,638 | 8,075 | 9,359 |

| Current lease liabilities | 2,163 | 2,387 | 2,632 |

| Trade accounts receivable | 5,098 | 7,086 | 8,788 |

| Income taxes | 721 | 1,267 | 1,211 |

| Current Provisions and other liabilities | 6,698 | 9,174 | 9,553 |

| Current Liabilities | 25,318 | 27,989 | 31,543 |

| Total Liabilities | 69,842 | 76,402 | 78,042 |

| Equity, Group Share | 37,412 | 47,119 | 55,111 |

| Minority Interests | 1,417 | 1,790 | 1,493 |

| Total Equity | 38,829 | 48,909 | 56,604 |

| Total liabilities and Equity | 108,671 | 125,311 | 134,646 |

| Total Debt | 37,531 | 34,514 | 35,147 |

LVMH's Cash Flow Statement

| EUR €, Millions | 2020 | 2021 | 2022 |

|---|---|---|---|

| Cash flow operating activities | |||

| Operating profits | 7,972 | 17,155 | 21,001 |

| Income/loss and dividends received from joint ventures and associates | 64 | 41 | 26 |

| Net increase in depreciation, amortisation and provisions | 3,478 | 3,139 | 3,219 |

| Depreciation of right-of-use assets | 2,572 | 2,691 | 3,007 |

| Other adjustments and computed expemses | -89 | -405 | -483 |

| Cash from operations before changes in working capital | 13,997 | 22,621 | 26,770 |

| Cost of net financial debt: interest paid | -58 | 71 | -74 |

| Lease liabilites: interest paid | -290 | -231 | -240 |

| Tax paid | -2,385 | -4,239 | -5,604 |

| Change in working capital | -367 | 426 | -3,019 |

| Net cash from/ (used in) operating activities | 10,897 | 18,648 | 17,833 |

| Cash flow investing activities | |||

| Operating investments | -2,478 | -2,664 | -4,969 |

| Purchase and proceeds from sale of consolidated investments | -536 | -13,226 | -809 |

| Dividends received | 12 | 10 | 7 |

| Tax paid relates to non-current available for sale financial assets | - | - | - |

| Purchase and proceeds from sale of non-current available for sale financial assets | 63 | -99 | -149 |

| Net cash from/ (used in) investing activities | -2,939 | -15,979 | -5,920 |

| Cash flow financing activities | |||

| Interim and final dividends paid | -2,799 | -4,161 | -6,774 |

| Purchase and proceeds from sale of minority interests | -67 | -435 | -351 |

| Other equity-related transaction | 27 | -552 | -1,604 |

| Proceeds from borrowings | 17,499 | 251 | 3,774 |

| Repayment of borrowing | -5,024 | -6,413 | -3,891 |

| Repayment of lease liabilities | -2,302 | -2,453 | -2,751 |

| Purchase and proceeds from sale of current available for sale financial assets | 69 | -1,393 | -1,088 |

| Net cash from/ (used in) financing activities | 7,403 | -15,156 | -12,685 |

| Effect of exchange rate changes | -1,052 | 498 | 55 |

| Net increase/ decrease in cash and cash equivalents | 18,773 | -43,124 | -717 |

| Cash and cash equivalents at the beginning of period | 5,497 | 19,806 | 7,817 |

| Cash and cash equivalents at end of period | 19,806 | 7,817 | 7,100 |

| Total tax paid | -2,501 | -4,464 | -5,933 |

| Alternative performance measure | |||

| EUR €, Millions | 2020 | 2021 | 2022 |

| Net cash from operating activities | 10,897 | 18,648 | 17,833 |

| Operating investments | -2,478 | -2,664 | -4,969 |

| Repayment of lease liabilities | -2,302 | -2,453 | -2,751 |

| Operating free cash flow | 6,117 | 13,531 | 10,113 |

Financial Forecast

What are the assumptions used to estimate the financial forecasts?

| Description | Value | Commentary |

|---|---|---|

| What’s the estimated current size of the total addressable market? | $354,800,000,000 | The total addressable market is defined as the luxury goods global market and , it is estimated that the size of the market as of today (6th July 2023) in terms of revenue, is US$354.80bn.[4] |

| What growth stage is the company in? | Maturity stage | Research shows that a company goes through four/ five stages of cash flow growth. A key way to determine the stage which a company is in by examining the cash flow patterns. The Stockhub users estimate that with LVMH’s cash flow patterns over the past 4 years: (+) operating cash flow, (-) investing cash flow and (+/-) but with a (-) average of it’s financing cash flow. LVMH is in its maturity stage of growth. |

| What is the estimated company lifespan?

Group - LVMH |

80 years | LVMH employees approximately 196,000, making the company a large organisation, research has proven that the average life span of a large company is approximately 50 years.[8] Due to LVMHs exponential revenue growth in the last 36 years, and assuming that the company is in the maturity stage of growth which is approximately 50% of a companies lifecycle,[9] I am going to assume a life span of 80 years. |

| What is the estimated annual growth of the total addressable market over the lifecycle of the company? | 3.38% | The market is estimated to grow at a 3.38% CAGR (Compound Annual Growth Rate) in the forecast period of 2023- 2028.[4] |

| What is the estimated company peak market share? | Approximately 25% | Take LVMH’s revenue as the revenue specified at the end of 2022, which was 79.2 billion euros. Assuming a currency exchange rate as of 31st Dec 2022 EUR/USD of 1.07. Resulting in a companies annual revenue of 84.744 billion USD. |

| Which distribution function do you want to use to estimate company revenue? | Gaussian | Research has suggested that the revenue pattern of companies is similar to the pattern produced by the gaussian distribution.[9] |

| What is the estimated standard deviation of company revenue? | ||

Economic links to cash flow patters

| Cash flow type | Introduction | Growth | Shake out | Mature | Decline |

|---|---|---|---|---|---|

| Operating | - | + | +/- | + | - |

| Investing | - | - | +/- | - | + |

| Financing | + | + | +/- | - | +/- |

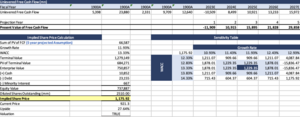

Valuation

[[File:Screenshot 2023-07-06 at 11.10.01.png|thumb|Unlevered Free Cash Flow [[File:Screenshot 2023-07-06 at 11.10.11.png|thumb|Fixed Assets[[File:Screenshot 2023-07-06 at 11.10.21.png|thumb|Net Working Capital[[File:Screenshot 2023-07-06 at 11.10.54.png|thumb|Weighted Average of Capital

]]]]]]]]

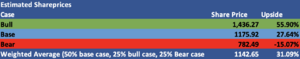

In the following section, there are 2 valuation methods, DCF model and the relative valuation.

For the DCF model, the base case implied share price is $1175.92, which has a 27.64% potential upside; the bull case implied share is 1436.27, which has a 55.90% upside; the bear case implied share is 782.49, which has a 15.07% downside. Therefore, for a weighted average of 50% bull case, 25% bull case and 25% bear case, we get 1142.65, which has a 31.09% upside. We take these weighted average percentage is because the inflation rate remains high, the FED has 95% chance to increase the interested rate in the next FOMC meeting, due to this uncertainty, a conservative prediction is applied. Also, we assumed that all the growth is constant in the next 5 years of projection, taking the average from the past 5 years for the base case. The bull case and bear case is calculated with the earnings in EV/EBITDA and Net Debt/EBITDA, and the Free Cash Flow Equity Yield based on their free cash flow, both earning price target and the FCFE price target are weighted 50% each. Throughout the calculation, we obtained the WACC with 13.33% and the CAPM is 14.08%.

For the relative valuation,

Growth Drivers and Catalysts

Competitors Comparison

LVMH Overview: In 2023, LVMH reported a Q1 FY 2023 revenue of 21 billion euros, showing a significant increase of 17% compared to the same period in 2022. LVMH's strength lies in its high level of customer loyalty and diverse portfolio of 75 prestigious brands across various luxury sectors.

Richemont Overview: Richemont, a key competitor of LVMH, reported a sales revenue of 19.95 billion euros in the first quarter of FY 2023. Richemont's focus on watches and jewelry, particularly through brands like Cartier, IWC, and Van Cleef & Arpels, has contributed to its continued growth.

Kering Overview: Kering, another significant competitor of LVMH, reported a revenue of 5.077 billion euros in the first quarter of FY 2023. Kering's most prominent brand, Gucci, contributes significantly to its overall revenue. However, Kering has a weak growth rate of 1% compared to Q1 2022 suggests that its performance is not as strong as that of LVMH and Richemont.

Strengths of Richemont:

1. Focus on watches and jewelry: Richemont's specialization in these sectors has allowed it to become a leader in the industry, attracting customers who specifically seek luxury timepieces and high-end jewelry, and its emphasis on core businesses resonates well with customers who value the culture, history, and pioneer status in the industry.

2. Extensive collection of luxury brands: With 26 luxury brands and businesses in its portfolio, Richemont offers a wide range of options to cater to different consumer preferences.

3. Richemont's commitment to environmental, social, and governance (ESG) practices in this year is highly attractive to customers and aligns with current policies and expectations.

Strengths of Kering:

1. Customer loyalty to specific brands: Kering has built strong brand loyalty, particularly with Gucci, Bottega Veneta, and Saint Laurent. This customer loyalty contributes to a consistent customer base and brand recognition.

Weaknesses of LVMH in comparison to Richemont:

1. Less competitive in the jewelry industry: LVMH's presence in the jewelry sector is relatively weaker compared to Richemont. To capture a larger market share and increase profitability, LVMH should consider expanding its focus on jewelry.

2. Sustainability focus: Customers are increasingly concerned about sustainability, and products marketed as environmentally friendly have gained traction.

Conclusion:

1. Richemont could be a big competitor: Based on the revenue data and performance analysis, LVMH remains the market leader in the luxury industry. However, it faces major challenges from Richemont, each with its own strengths and weaknesses. LVMH should focus on expanding its presence in the jewelry industry to compete more effectively with Richemont. Besides, The decision of Richemont to reject the acquisition proposal from LVMH could potentially impact Richemont's stock and attract more attention, particularly from investors who value the "more boutique in core business" mindset.

2. Geographical Factor: LVMH has a strong geographical presence in the Asia Pacific region, with most sectors and revenue generated from Asia in 2022. Particularly in China, where the Covid policies have allowed for reopening, the spending power of Chinese consumers continues to rise. The total revenue in Asia will be very significant in 2023. Richemont also generates a significant portion of its revenue from the Asian market. The 2023 total revenue in Asia Pacific of Richemont would be positive to be expected. On the other hand, Kering's performance has been negative, experiencing a decline of 7% from Q1 2022 to Q4 2022. The pace of growth was well below that of competitors.

Overall, LVMH's performance is expected to continue to increase, and there is optimism regarding its total revenue for 2023.

Risks

Investing in any company, including LVMH Moët Hennessy, carries various risk factors. These risks should be carefully considered by potential investors before making a decision. Some risks specifically associated with LVMH Moët Hennessy might include:

- Economic Fluctuations: As a luxury goods company, LVMH's success is strongly correlated with the global economy's performance. During periods of economic downturn, consumer spending, especially on luxury items, often decreases. This could negatively impact LVMH's revenues and profits.

- Foreign Exchange Risk: Since LVMH operates worldwide, it's exposed to fluctuations in various currencies. If the euro strengthens against other currencies, it could reduce the company's profits when overseas earnings are converted back into euros.

- Fashion Trends and Consumer Preferences: The fashion industry is notably fickle, with trends and consumer tastes constantly changing. If LVMH fails to anticipate or adapt to these changes, its brands might lose popularity, impacting the company's financial performance.

- Regulatory Risks: As a global company, LVMH must comply with a wide array of regulations and laws across multiple jurisdictions. Changes in these regulations, including import/export laws, environmental laws, and taxation policies, could affect its operations.

- Brand Reputation: The value of LVMH's brands is one of its key assets. Any events that damage these brands' reputations – such as product quality issues, scandals involving brand ambassadors, or negative environmental or social impacts – could harm LVMH's business.

- Competition: The luxury goods market is highly competitive. LVMH competes with other large luxury groups, as well as smaller, more nimble brands and emerging digital-native brands. If LVMH can't maintain its competitive advantage, it could lose market share.

- Supply Chain Disruptions: LVMH relies on a complex global supply chain. Disruptions to this chain – such as those caused by natural disasters, geopolitical events, or pandemics – could impact its ability to produce and distribute its products.

- Intellectual Property Risks: As with many companies in the fashion industry, LVMH faces risks from counterfeiting and other intellectual property violations, which could harm its brands and its financial performance.

References and notes

- ↑ https://www.mckinsey.com/industries/retail/our-insights/state-of-fashion

- ↑ https://www.reuters.com/markets/asia/sp-global-cuts-china-2023-growth-forecast-52-55-2023-06-26/

- ↑ https://www.bain.com/about/media-center/press-releases/2022/global-luxury-goods-market-takes-2022-leap-forward-and-remains-poised--for-further-growth-despite-economic-turbulence/#:~:text=Global%20luxury%20goods%20market%20takes%202022%20leap%20forward,60%25%2B%20market%20growth%20to%202030%20...%20More%20items

- ↑ 4.0 4.1 4.2 Luxury Goods - Worldwide | Statista Market Forecast

- ↑ lvmh_2022_annual-report.pdf (lvmh-static.com)

- ↑ Présentation PowerPoint (lvmh-static.com)

- ↑ Présentation PowerPoint (lvmh-static.com)

- ↑ Stadler, Enduring Success, 3–5.

- ↑ 9.0 9.1 http://escml.umd.edu/Papers/ObsCPMT.pdf