Manchester United plc: Difference between revisions

No edit summary |

(→Team) |

||

| Line 137: | Line 137: | ||

=== Board Members === | === Board Members === | ||

[[File:0 GettyImages-1134385429.webp|thumb|252x252px]] | |||

==== Avram Glazer – Executive Co-Chairman and Director ==== | ==== Avram Glazer – Executive Co-Chairman and Director ==== | ||

Avram Glazer is Executive Co-Chairman and a Director of the Company. He is currently a director of Red Football Limited and Co-Chairman of Manchester United Limited. Mr. Glazer served as President and Chief Executive Officer of Zapata Corporation, a US public company between from March 1995 to July 2009 and Chairman of the board of Zapata Corporation from March 2002 to July 2009. Mr. Glazer received a business degree from Washington University in St. Louis in 1982. He received a law degree from American University, Washington College of Law in 1985.<ref name=":0">https://ir.manutd.com/corporate-governance/board-of-directors.aspx</ref> | Avram Glazer is Executive Co-Chairman and a Director of the Company. He is currently a director of Red Football Limited and Co-Chairman of Manchester United Limited. Mr. Glazer served as President and Chief Executive Officer of Zapata Corporation, a US public company between from March 1995 to July 2009 and Chairman of the board of Zapata Corporation from March 2002 to July 2009. Mr. Glazer received a business degree from Washington University in St. Louis in 1982. He received a law degree from American University, Washington College of Law in 1985.<ref name=":0">https://ir.manutd.com/corporate-governance/board-of-directors.aspx</ref> | ||

[[File:Rfe3sk5wylt2heekkuui.jpg|thumb|253x253px]] | |||

==== '''Joel Glazer''' – Executive Co-Chairman and Director ==== | ==== '''Joel Glazer''' – Executive Co-Chairman and Director ==== | ||

Joel Glazer is Executive Co-Chairman and a Director of the Company. He is currently a director of Red Football Limited and Co-Chairman of Manchester United Limited. Mr. Glazer is Co-Chairman of the Tampa Bay Buccaneers. Mr. Glazer is a member of the NFL Finance, International, Media, and Legalized Sports Betting Committees. Mr. Glazer graduated from American University in Washington, D.C., in 1989 with a bachelor's degree.<ref name=":0" /> | Joel Glazer is Executive Co-Chairman and a Director of the Company. He is currently a director of Red Football Limited and Co-Chairman of Manchester United Limited. Mr. Glazer is Co-Chairman of the Tampa Bay Buccaneers. Mr. Glazer is a member of the NFL Finance, International, Media, and Legalized Sports Betting Committees. Mr. Glazer graduated from American University in Washington, D.C., in 1989 with a bachelor's degree.<ref name=":0" /> | ||

[[File:0 GettyImages-1153346563-1.webp|thumb|215x215px]] | |||

==== '''Richard Arnold''' – Chief Executive Officer and Director ==== | ==== '''Richard Arnold''' – Chief Executive Officer and Director ==== | ||

| Line 152: | Line 155: | ||

==== '''Cliff Baty''' – Chief Financial Officer and Director ==== | ==== '''Cliff Baty''' – Chief Financial Officer and Director ==== | ||

[[File:95f74f4c-d718-4966-b26b-3e8810119d36 thumb.jpg|thumb]] | |||

Cliff Baty is the Company's Chief Financial Officer. He was appointed in March 2016 and was appointed to the Board of Directors in December 2017. He is responsible for managing all aspects of financial reporting and financial control of the Company. Prior to joining the Company, Mr. Baty served as Chief Financial Officer and member of the Board of Directors of Sportech plc, a leading pool betting operator and technology supplier, from 2013 to 2016. Prior to Sportech, he worked at Ladbrokes plc from 2006 to 2013 in a number of senior finance roles including Finance Director of its eGaming and International businesses, as well as Ladbrokes businesses in Spain, Italy and South Africa. Before that he was Group Financial Controller of Hilton Group plc from 2004 to 2006. He qualified as a Chartered Accountant with Ernst & Young, where he worked for 10 years. He received a Bachelor of Arts degree in Chemistry from Oriel College, Oxford University in 1992.<ref name=":0" /> | Cliff Baty is the Company's Chief Financial Officer. He was appointed in March 2016 and was appointed to the Board of Directors in December 2017. He is responsible for managing all aspects of financial reporting and financial control of the Company. Prior to joining the Company, Mr. Baty served as Chief Financial Officer and member of the Board of Directors of Sportech plc, a leading pool betting operator and technology supplier, from 2013 to 2016. Prior to Sportech, he worked at Ladbrokes plc from 2006 to 2013 in a number of senior finance roles including Finance Director of its eGaming and International businesses, as well as Ladbrokes businesses in Spain, Italy and South Africa. Before that he was Group Financial Controller of Hilton Group plc from 2004 to 2006. He qualified as a Chartered Accountant with Ernst & Young, where he worked for 10 years. He received a Bachelor of Arts degree in Chemistry from Oriel College, Oxford University in 1992.<ref name=":0" /> | ||

==== '''Patrick Stewart''' – Chief Legal Officer / General Counsel and Director ==== | ==== '''Patrick Stewart''' – Chief Legal Officer / General Counsel and Director ==== | ||

[[File:1569690640667.jpg|thumb|184x184px|[[File:Kg-800.jpg|thumb|138x138px]]]] | |||

[[File:H7z7fugco0afmdxsu4ah.jpg|thumb|204x204px|[[File:Sqlndfgk5mca9byt7glk.jpg|thumb|235x235px]][[File:Download.jpg|thumb|222x222px]]]] | |||

[[File:Robert leitao.jpg|thumb|217x217px]] | |||

Patrick Stewart is the Company’s Chief Legal Officer / General Counsel and has been with Manchester United since 2006. He is responsible for managing the Company's legal and regulatory affairs as well as its relationships with football stakeholders. Having been nominated by the European Club Association, Patrick was appointed as an arbitrator at the Cthe company'st of Arbitration for Sport in Switzerland in 2018. Prior to joining the Company, he worked for two leading UK commercial law firms and TEAM Marketing AG, the Swiss sports marketing agency responsible for selling the commercial rights to the UEFA Champions League. Patrick studied at the University of Glasgow and the Johannes Gutenberg-Universität Mainz (Germany) and received a Bachelor of Laws (Honthe company'ss) Degree in 1994, before qualifying as a solicitor in 1997.<ref name=":0" /> | Patrick Stewart is the Company’s Chief Legal Officer / General Counsel and has been with Manchester United since 2006. He is responsible for managing the Company's legal and regulatory affairs as well as its relationships with football stakeholders. Having been nominated by the European Club Association, Patrick was appointed as an arbitrator at the Cthe company'st of Arbitration for Sport in Switzerland in 2018. Prior to joining the Company, he worked for two leading UK commercial law firms and TEAM Marketing AG, the Swiss sports marketing agency responsible for selling the commercial rights to the UEFA Champions League. Patrick studied at the University of Glasgow and the Johannes Gutenberg-Universität Mainz (Germany) and received a Bachelor of Laws (Honthe company'ss) Degree in 1994, before qualifying as a solicitor in 1997.<ref name=":0" /> | ||

| Line 179: | Line 186: | ||

==== '''Manu Sawhney''' – Independent Director ==== | ==== '''Manu Sawhney''' – Independent Director ==== | ||

[[File:1517510516206.jpg|thumb|215x215px]] | |||

Manu Sawhney is an Independent Director of the Company. With over 29 years of experience in the sports, media, entertainment and consumer industry, Mr. Sawhney recently served as the Chief Executive Officer of the International Cricket Council (ICC). ICC is the global governing body for the sport of cricket representing 105 members, the ICC governs and administrates the game and is responsible for the staging of major international tthe company'snaments including the ICC Men’s World Cup and Women’s World Cup and the ICC Men’s and Women’s T20 World Cups as well as all associated qualifying events. The ICC presides over the ICC Code of Conduct which sets the professional standards of discipline for international cricket, playing conditions, bowling reviews and other ICC regulations and appoints match officials. | Manu Sawhney is an Independent Director of the Company. With over 29 years of experience in the sports, media, entertainment and consumer industry, Mr. Sawhney recently served as the Chief Executive Officer of the International Cricket Council (ICC). ICC is the global governing body for the sport of cricket representing 105 members, the ICC governs and administrates the game and is responsible for the staging of major international tthe company'snaments including the ICC Men’s World Cup and Women’s World Cup and the ICC Men’s and Women’s T20 World Cups as well as all associated qualifying events. The ICC presides over the ICC Code of Conduct which sets the professional standards of discipline for international cricket, playing conditions, bowling reviews and other ICC regulations and appoints match officials. | ||

| Line 186: | Line 194: | ||

==== '''John Hooks''' – Independent Director ==== | ==== '''John Hooks''' – Independent Director ==== | ||

[[File:A82ea21d-a100-4ccf-99a2-c902219a5b20 medium.jpg|thumb|214x214px]] | |||

John Hooks is an Independent Director of the Company. He has been in the luxury fashion industry for over 40 years and has held positions in some of the sector's most influential companies. After graduating from Oxford University, he entered the fashion industry through Gruppo Finanziario Tessile (GFT) in Turin, Italy. For three years he was commercial director for the prêt-à-porter collection of Valentino. From 1988 to 1994, based in Hong Kong, he was responsible for the establishment of GFT's regional subsidiaries in Japan, South Korea, Taiwan, Hong Kong, Australia as well as in mainland China (in 1988, the first major foreign fashion company to establish a direct presence in that country). From 1995 to 2000 he was Commercial and Retail Director of Jil Sander in Hamburg, Germany. In 2000, Mr. Hooks joined Giorgio Armani as Group Commercial and Marketing Director, considerably expanding the company's global wholesale and retail network. He was subsequently appointed Deputy Chairman of the Giorgio Armani Group. From 2011 to 2014 he was Group President of Ralph Lauren Europe and the Middle East. Mr. Hooks is currently CEO of Pacific Global Management (PGM). He is also on the board of Miroglio Fashion and is a senior advisor to McKinsey & Company.<ref name=":0" /> | John Hooks is an Independent Director of the Company. He has been in the luxury fashion industry for over 40 years and has held positions in some of the sector's most influential companies. After graduating from Oxford University, he entered the fashion industry through Gruppo Finanziario Tessile (GFT) in Turin, Italy. For three years he was commercial director for the prêt-à-porter collection of Valentino. From 1988 to 1994, based in Hong Kong, he was responsible for the establishment of GFT's regional subsidiaries in Japan, South Korea, Taiwan, Hong Kong, Australia as well as in mainland China (in 1988, the first major foreign fashion company to establish a direct presence in that country). From 1995 to 2000 he was Commercial and Retail Director of Jil Sander in Hamburg, Germany. In 2000, Mr. Hooks joined Giorgio Armani as Group Commercial and Marketing Director, considerably expanding the company's global wholesale and retail network. He was subsequently appointed Deputy Chairman of the Giorgio Armani Group. From 2011 to 2014 he was Group President of Ralph Lauren Europe and the Middle East. Mr. Hooks is currently CEO of Pacific Global Management (PGM). He is also on the board of Miroglio Fashion and is a senior advisor to McKinsey & Company.<ref name=":0" /> | ||

== Ownership Structure == | |||

== Financials == | == Financials == | ||

=== Revenue Breakdown === | |||

=== Historic === | === Historic === | ||

| Line 265: | Line 278: | ||

[[File:Net Income .png|500x500px]] | [[File:Net Income .png|500x500px]] | ||

=== '''Forecasted''' === | |||

== Risks == | == Risks == | ||

Revision as of 21:17, 7 August 2023

| |

Football stadium (Old Trafford) in Old Trafford, Greater Manchester | |

| Formerly | Newton Heath LYR Football Club (1878–1902) |

|---|---|

| Type | Public |

| ISIN | KYG5784H1065 |

| Industry | |

| Founded | January 1, 1878 in Newton Heath, Manchester, England. |

| Headquarters | Sir Matt Busby Way, Manchester , England |

Key people |

|

| Services | |

| Revenue | |

| Total assets | |

| Owner | Glazer family (10%) |

Number of employees | |

| Footnotes / references Financials as of December 31, 2022[update]. | |

With a mission to maintain its position as one of the world's leading football clubs, both on and off the pitch, Manchester United PLC aims to provide entertaining and competitive football that delights fans worldwide. The club offers a range of products and services, including match tickets, merchandise, and exclusive digital content, catering to the needs of its loyal fanbase.[1]

Manchester United PLC designs its products and services with the intention of meeting the desires and expectations of its global fanbase. The club's objectives encompass achieving sporting success by competing at the highest level, securing trophies, and maximizing commercial revenue through various avenues such as sponsorship deals, merchandising, and broadcasting rights.[2]

Assuming that Manchester United PLC continues to deliver its historic returns over the next five years, the expected return of an investment in the company is 20%, which equates to an annual return of 4%. In other words, a £100,000 investment in the company is expected to return £120,000 in five years' time.

Operations

How did the club come about?

Manchester United Football Club was founded in 1878 as Newton Heath LYR Football Club by the Carriage and Wagon department of the Lancashire and Yorkshire Railway (LYR) depot at Newton Heath. The club was established to provide recreational activities for the area's railway workers. The club gained in popularity over time, eventually becoming one of the most successful and renowned football clubs in the world.

What's the mission of the club?

Manchester United's mission is to be recognised as a leading global sports brand and to become the world's most successful football club. The club hopes to accomplish this by continuously delivering excellent performances on the pitch, developing new talent, fostering a strong team spirit, and adhering to the highest professional and ethical standards.

What are the main operations of the club?

The operations of Manchester United can be divided into three main segments: (1) Football Operations, (2) Commercial Operations, and (3) Media Operations.

Football Operations

Football Operations form the core of Manchester United's activities. It includes the management and development of the club's football team, which participates in domestic and international competitions. The key aspects of this include:

Player Recruitment and Development: Manchester United has a dedicated team that scouts, recruits, and develops potential football players from all around the world. Through its youth academy, the club pays a great emphasis on youth development.

Team Management: The coaching staff and management team of the club oversee the first-team squad's training, tactics, and general performance. They work together with players to help them reach their full potential and achieve success on the pitch.

Matchday Operations: Manchester United organises and manages all aspects of matchday operations, including ticketing, stadium operations, security, and fan engagement. The club strives to provide an exceptional matchday experience for its supporters.

Commercial Operations

Commercial Operations play a crucial role in the financial sustainability of Manchester United. This segment focuses on generating revenue through various commercial activities and partnerships. The key aspects of this include:

Sponsorships and Partnerships: Manchester United works with global sponsors and partners to secure sponsorship deals, which involve brand promotion, advertising, and merchandising. The club's strong global brand and fan base attract major sponsors across various industries, including Adidas and TeamViewer.

Merchandising and Licensing: The club sells official items, such as jerseys, clothes, accessories, and memorabilia, by leveraging its brand and fan base. Manchester United also licenses branded products to third-party manufacturers for production and distribution.

Media Operations

Media Operations involve the creation, distribution, and monetization of media content related to Manchester United. The key aspects of this includes:

Broadcasting and Media Rights: The club enters into agreements with broadcasters and digital platforms for the distribution of live matches, highlights, and other exclusive content, generating another stream of revenue.

In-house Media Production: Manchester United operates its own media production unit to create original content, including documentaries, interviews and behind-the-scenes footage. This content helps to engage fans and enhance the club's brand image.

Offerings

Manchester United offers a range of products and services that cater to football enthusiasts, fans, and commercial partners. The club's offerings can be classified into three main categories: (1) Football Products, (2) Fan Engagement, and (3) Commercial Partnerships.

Football Products

Manchester United provides match tickets for home games at Old Trafford, allowing fans to witness the team's performances live. The tickets are available for purchase through the club's official website and authorized sales channels. Season tickets offer dedicated fans the opportunity to secure their seat for all home games throughout the season. These tickets provide regular attendees with the convenience of guaranteed access to matches.

The club offers a wide range of official merchandise, including jerseys, apparel, accessories, and branded memorabilia. These products are available for purchase online and at the club's retail stores, enabling fans to show their support and loyalty.

Manchester United organizes guided tours of Old Trafford, providing fans with an opportunity to explore the iconic stadium's history, dressing rooms, and other behind-the-scenes areas. These tours offer a unique experience for football enthusiasts.

Fan Engagement

Manchester United offers a free digital membership program, allowing fans to access exclusive content, news, and updates through the club's official website and mobile applications. Digital members can engage with the club's online community and participate in interactive features.

The club provides premium hospitality packages for fans who wish to enhance their matchday experience. These packages include access to VIP lounges, fine dining, and other exclusive services, providing a luxurious and memorable experience.

Manchester United organizes official fan events, such as meet-and-greets, autograph signings, and fan festivals, where supporters can interact with players, legends, and club officials. These events foster a sense of community and strengthen the bond between the club and its fans.

Commercial Partnerships

Manchester United offers various sponsorship packages for businesses seeking to align their brand with the club. These partnerships involve brand exposure through stadium advertising, player endorsements, and collaborative marketing campaigns.

The club establishes regional partnerships with companies around the world to expand its global reach and connect with fans in specific markets. These partnerships often involve localized marketing initiatives and joint promotional activities.

Manchester United grants licenses to third-party manufacturers and retailers to produce and distribute official merchandise globally. These partnerships contribute to the availability and accessibility of Manchester United branded products worldwide.

Market

Total Addressable Market

The Total Addressable Market (TAM) in this context is defined as the global sport market. According to the Sports Global Market Report 2023, the global sport market grew from $486.61 billion in 2022 to $512.14 billion in 2023, demonstrating a compound annual growth rate (CAGR) of 5.2%. The report predicts that the sport market will continue to expand, reaching $623.63 billion in 2027, with a CAGR of 5.0% from 2023 to 2027.[3]

Serviceable Available Market

The Serviceable Available Market (SAM) refers to the global football market size, which attained a value of US$ 3.2 billion in 2022 and is projected by the IMARC Group to grow to US$ 4.0 billion by 2028, showcasing a compound annual growth rate (CAGR) of 4% from 2023 to 2028.[4]

Serviceable Obtainable Market

The Serviceable Available Market (SAM) refers specifically to the lucrative English football market. This market, known for its immense popularity and widespread following, had a valuation of around 468 million British pounds in the year 2019.[5]

Competition

Domestic competitors

Manchester City: Located in the same city, Manchester City represents a significant local rival. The club has witnessed a surge in success in recent years, challenging Manchester United's dominance within the city and the English Premier League.

Liverpool: A historically successful club with a massive fan base, Liverpool consistently competes with Manchester United for league titles and trophies, both domestically and in European competitions.

Chelsea, Arsenal, and Tottenham Hotspur: These London-based clubs boast strong financial backing and competitive squads, providing consistent challenges to Manchester United's pursuit of glory.

International competitors

Real Madrid and Barcelona: These Spanish powerhouses have a rich history and global recognition, frequently competing with Manchester United for top talent and titles in European competitions.

Bayern Munich: As the most successful club in German football, Bayern Munich consistently poses a formidable challenge on the domestic and European stages.

Paris Saint-Germain: Supported by substantial financial resources, this French club has experienced a remarkable surge in prominence in recent years, establishing itself as a formidable contender in the global football landscape.

Competitive advantages

Manchester United's competitive advantages include its rich history, global reach, financial resources, strong youth development system, extensive scouting network, and iconic stadium. These factors have contributed to their success and ability to attract top talent and secure lucrative partnerships.

Team

Board Members

Avram Glazer – Executive Co-Chairman and Director

Avram Glazer is Executive Co-Chairman and a Director of the Company. He is currently a director of Red Football Limited and Co-Chairman of Manchester United Limited. Mr. Glazer served as President and Chief Executive Officer of Zapata Corporation, a US public company between from March 1995 to July 2009 and Chairman of the board of Zapata Corporation from March 2002 to July 2009. Mr. Glazer received a business degree from Washington University in St. Louis in 1982. He received a law degree from American University, Washington College of Law in 1985.[6]

Joel Glazer – Executive Co-Chairman and Director

Joel Glazer is Executive Co-Chairman and a Director of the Company. He is currently a director of Red Football Limited and Co-Chairman of Manchester United Limited. Mr. Glazer is Co-Chairman of the Tampa Bay Buccaneers. Mr. Glazer is a member of the NFL Finance, International, Media, and Legalized Sports Betting Committees. Mr. Glazer graduated from American University in Washington, D.C., in 1989 with a bachelor's degree.[6]

Richard Arnold – Chief Executive Officer and Director

Richard Arnold is the Chief Executive Officer and a Director of the Company. In his prior capacity as Group Managing Director, Mr. Arnold oversaw all commercial and operational aspects of the Company. Mr. Arnold also serves as Chairman of the Manchester United Foundation.

In his previous role as Commercial Director (until 30 June 2013) he was responsible for the management and growth of the Company’s sponsorship business, retail, merchandising, apparel & product licensing business, and digital media business. In this capacity he was nominated for SportBusiness International’s Sports innovator of the year list in 2011. In each of 2017, 2018, 2019 and 2020, Mr. Arnold has been named as an LGBT+ Executive Ally by the charity OUTstanding, in recognition of the work he has done to progress LGBT+ inclusion at Manchester United for employees and supporters. In addition to this, Mr. Arnold was named as Diversity Ally of the Year at the European Diversity Awards in 2019. Mr. Arnold was previously Deputy Managing Director of InterVoice Ltd responsible for the international channel sales and marketing division of InterVoice Inc., a NASDAQ listed technology company, between 2002 and 2007. He was nominated as a finalist for Young Director of the Year by the United Kingdom Institute of Directors in 2004 and 2005. Prior to InterVoice, he worked at Global Crossing Europe Ltd, a company in the technology sector, on its restructure between 1999 and 2002.

Prior to this he was a senior manager in the telecommunications and media practice at PricewaterhouseCoopers from 1993 to 1999, including working on the privatization of the Saudi Telecommunications Corporation and the Initial Public Offering of Orange in the United Kingdom. He received an honors Bachelor of Science degree in biology from Bristol University in 1993 and received his Chartered Accountancy qualification in 1996.[6]

Cliff Baty – Chief Financial Officer and Director

Cliff Baty is the Company's Chief Financial Officer. He was appointed in March 2016 and was appointed to the Board of Directors in December 2017. He is responsible for managing all aspects of financial reporting and financial control of the Company. Prior to joining the Company, Mr. Baty served as Chief Financial Officer and member of the Board of Directors of Sportech plc, a leading pool betting operator and technology supplier, from 2013 to 2016. Prior to Sportech, he worked at Ladbrokes plc from 2006 to 2013 in a number of senior finance roles including Finance Director of its eGaming and International businesses, as well as Ladbrokes businesses in Spain, Italy and South Africa. Before that he was Group Financial Controller of Hilton Group plc from 2004 to 2006. He qualified as a Chartered Accountant with Ernst & Young, where he worked for 10 years. He received a Bachelor of Arts degree in Chemistry from Oriel College, Oxford University in 1992.[6]

Patrick Stewart – Chief Legal Officer / General Counsel and Director

Patrick Stewart is the Company’s Chief Legal Officer / General Counsel and has been with Manchester United since 2006. He is responsible for managing the Company's legal and regulatory affairs as well as its relationships with football stakeholders. Having been nominated by the European Club Association, Patrick was appointed as an arbitrator at the Cthe company'st of Arbitration for Sport in Switzerland in 2018. Prior to joining the Company, he worked for two leading UK commercial law firms and TEAM Marketing AG, the Swiss sports marketing agency responsible for selling the commercial rights to the UEFA Champions League. Patrick studied at the University of Glasgow and the Johannes Gutenberg-Universität Mainz (Germany) and received a Bachelor of Laws (Honthe company'ss) Degree in 1994, before qualifying as a solicitor in 1997.[6]

Kevin Glazer – Director

Kevin Glazer is a Director of the Company. He is currently a director of Red Football Limited and a director of Manchester United Limited. He is currently the Chairman of Glazer Properties. Mr. Glazer graduated from Ithaca College in 1984 with a Bachelor of Arts degree.[6]

Bryan Glazer – Director

Bryan Glazer is a Director of the Company. He is currently a director of Red Football Limited and Manchester United Limited. He is the CoChairman of the Tampa Bay Buccaneers and also serves on the NFL's Digital Media Committee. Mr. Glazer serves on the board of directors of the Glazer Children's Museum. He received a bachelor's degree from the American University in Washington, D.C., in 1986 and received his law degree from Whittier College School of Law in 1989.[6]

Darcie Glazer Kassewitz – Director

Darcie Glazer Kassewitz, is a Director of the Company. She is currently a director of Red Football Limited. Ms. Glazer Kassewitz is the President of the Glazer Vision Foundation. She graduated cum laude from the American University in 1990 and received a law degree in 1993 from Suffolk Law School.[6]

Edward Glazer – Director

Edward Glazer is a Director of the Company. He is currently a non-executive director of Red Football Limited. He is Co-Chairman of the Tampa Bay Buccaneers and Chairman of US Property Trust and US Auto Trust. Mr. Glazer is also the co-President of the Glazer Family Foundation. Mr. Glazer received a bachelor’s degree from Ithaca College in 1992.[6]

Robert Leitão – Independent Director

Robert Leitão is Managing Partner of Rothschild & Co Gestion, the top holding company of the Rothschild & Co Group, and Co-Chairman of the Rothschild & Co Group Executive Committee. He is also Head of Rothschild & Co’s Global Advisory business, worldwide, and Chief Executive of NM Rothschild & Sons.

During his 30 year career as a senior Mergers & Acquisitions banker and capital markets expert, Mr Leitão has advised clients on more than 200 transactions around the world.

Prior to joining Rothschild & Co in 1998, Mr Leitão was a Director and Head of UK M&A at Morgan Grenfell & Co. Limited. He graduated with a degree in Engineering from Imperial College, London, and qualified as a Chartered Accountant with Peat Marwick Mitchell & Co (KPMG).

Mr Leitão also serves as a Member of the Advisory Board of Lowy Family Partners, the private investment business and family office of the Lowy family; Chairman of the not-for-profit digital charity box, Pennies Foundation; and a Member of the Advisory Board of the charity, Centre of Entrepreneurs.[6]

Manu Sawhney – Independent Director

Manu Sawhney is an Independent Director of the Company. With over 29 years of experience in the sports, media, entertainment and consumer industry, Mr. Sawhney recently served as the Chief Executive Officer of the International Cricket Council (ICC). ICC is the global governing body for the sport of cricket representing 105 members, the ICC governs and administrates the game and is responsible for the staging of major international tthe company'snaments including the ICC Men’s World Cup and Women’s World Cup and the ICC Men’s and Women’s T20 World Cups as well as all associated qualifying events. The ICC presides over the ICC Code of Conduct which sets the professional standards of discipline for international cricket, playing conditions, bowling reviews and other ICC regulations and appoints match officials.

Prior to this role served as the Chief Executive Officer of the Singapore Sports Hub, one of the largest sporting Public-Private Partnerships in the world, and the city-state’s premier sporting, lifestyle and entertainment destination. Mr. Sawhney previously served as the Managing Director of ESPN STAR Sports (ESS), a 50:50 joint venture for Asia between ESPN and News Corp, and reported directly to the board of directors. He was responsible for the overall business leadership and P&L of the company across 24 countries in Asia. Mr. Sawhney led ESS’s growth and expansion across multiple platforms in various markets across Asia including business expansion in Taiwan, start-up of a new joint venture in South Korea, consolidation of business in China and securing long term strategic partnerships in India, Malaysia, Indonesia and Singapore. Prior to heading ESS’s Asia operations, Mr. Sawhney served as the Executive Vice President of Programming/Event Management/Marketing/ Network Presentation, wherein he negotiated and secured various multi-year renewals of key global and regional rights & affiliate deals. Mr. Sawhney also previously served as the Managing Director of ESS’s South Asia business based out of India.

Before joining ESS, Mr. Sawhney worked for 3 years with ITC Global Holdings based out of Vietnam and India. Mr. Sawhney holds a Bachelor’s degree in Mechanical Engineering from the Birla Institute of Technology & Science, Pilani, India, and received his Masters in International Business from the Indian Institute of Foreign Trade, New Delhi, India. Mr. Sawhney also served on the Steering Committee of the 28th South East Asian Games and is a member of the Young Presidents Organisation (YPO).[6]

John Hooks – Independent Director

John Hooks is an Independent Director of the Company. He has been in the luxury fashion industry for over 40 years and has held positions in some of the sector's most influential companies. After graduating from Oxford University, he entered the fashion industry through Gruppo Finanziario Tessile (GFT) in Turin, Italy. For three years he was commercial director for the prêt-à-porter collection of Valentino. From 1988 to 1994, based in Hong Kong, he was responsible for the establishment of GFT's regional subsidiaries in Japan, South Korea, Taiwan, Hong Kong, Australia as well as in mainland China (in 1988, the first major foreign fashion company to establish a direct presence in that country). From 1995 to 2000 he was Commercial and Retail Director of Jil Sander in Hamburg, Germany. In 2000, Mr. Hooks joined Giorgio Armani as Group Commercial and Marketing Director, considerably expanding the company's global wholesale and retail network. He was subsequently appointed Deputy Chairman of the Giorgio Armani Group. From 2011 to 2014 he was Group President of Ralph Lauren Europe and the Middle East. Mr. Hooks is currently CEO of Pacific Global Management (PGM). He is also on the board of Miroglio Fashion and is a senior advisor to McKinsey & Company.[6]

Ownership Structure

Financials

Revenue Breakdown

Historic

Most recent year

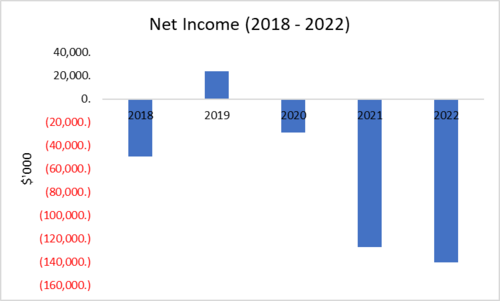

For the fiscal year 2022, Manchester United recorded a net loss of $153.75 million. The annual revenue was $776.3 million, an increase of approximately 17% on the last fiscal year.

Previous Three Years

Over the last three years (2020-2022), total revenues has grown at a cumulative annual growth rate (CAGR) of 6%. However, over the same period, the firm has consistently recorded a net loss, growing at a CAGR of 73%. Operating income has been consistently negative over this period, indicating that the income generated isn't enough to cover operating expenses.

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

|---|---|---|---|---|---|---|---|---|---|---|

| Year end date | 6/30/2013 | 6/30/2014 | 6/30/2015 | 6/30/2016 | 6/30/2017 | 6/30/2018 | 6/30/2019 | 6/30/2020 | 6/30/2021 | 6/30/2022 |

| Income Statement | ||||||||||

| Revenues ($'000) | 569,682 | 704,556 | 622,666 | 764,346 | 737,336 | 794,281 | 811,592 | 641,601 | 665,714 | 776,289 |

| Net Income ($'000) | 229,401 | 38,768 | (1,410) | 53,945 | 49,738 | (50,678) | 24,435 | (29,283) | (124,241) | (153,753) |

| Balance Sheet | ||||||||||

| Total Assets ($'000) | 1,696,467 | 2,079,560 | 2,045,236 | 1,934,323 | 1,992,273 | 2,039,617 | 1,901,726 | 1,712,974 | 1,740,639 | 1,571,985 |

Forecasted

Risks

Risks Related to the Business

The COVID-19 pandemic has had, and may continue to have, a material impact on the company's business, results of operations, financial position and cash flows.[7]

If the company is unable to maintain and enhance its brand and reputation, particularly in new markets, or if events occur that damage the company's brand and reputation, the company's ability to expand the company's follower base, sponsors, and commercial partners or to sell significant quantities of the company's products may be impaired.[7]

The company's business is dependent upon the company's ability to attract and retain key personnel, including players.[7]

The company is dependent upon the performance and popularity of the company's men’s first team.[7]

It may not be possible to renew or replace key commercial agreements on similar or better terms, or attract new sponsors.[7]

Negotiation, pricing and terms of key media contracts are outside of the company's control and those contracts may change in the future.[7]

European competitions cannot be relied upon as a source of income.[7]

The company's business depends in part on relationships with certain third parties.[7]

The company is exposed to credit related losses in the event of non-performance by counterparties to Premier League and UEFA media contracts as well as the company's key commercial and transfer contracts.[7]

Matchday revenue from the company's supporters is a significant portion of overall revenue.[7]

The markets in which the company operates are highly competitive, both within Europe and internationally, and increased competition could cause the company's profitability to decline.[7]

A cyber-attack on, or disruption to, the company's IT systems or other systems utilized in the company's operations could compromise the company's operations, adversely impact the company's reputation and subject us to liability.[7]

The company is subject to special rules and regulations regarding insolvency and bankruptcy.[7]

Premier League voting rules may allow other clubs to take action contrary to the company's interests.[7]

The company's digital media strategy may not generate the revenue that the company anticipates.[7]

Serious injuries to or losses of playing staff may affect the company's performance, and therefore the company's results of operations and financial condition.[7]

Inability to renew the company's insurance policies could expose us to significant losses.[7]

The company's international expansion and operations in foreign markets expose us to risks associated with international sales and operations.[7]

Fluctuations in exchange rates may adversely affect the company's results of operations.[7]

Failure to adequately protect the company's intellectual property and curb the sale of counterfeit merchandise could injure the company's brand.[7]

The company is subject to governmental regulation and other legal obligations related to privacy, data protection, data security and safeguarding. The company's actual or perceived failure to comply with such obligations could harm the company's business.[7]

Piracy and illegal live streaming may adversely impact the company's Broadcasting revenue.[7]

Changes in consumer viewing habits and the emergence of new content distribution platforms could adversely affect the company's business.[7]

The company's operating results may fluctuate due to seasonality.[7]

The company is subject to tax in multiple jurisdictions, and changes in tax laws (or in the interpretations thereof) in the United States, United Kingdom or in other jurisdictions could have an adverse effect on us.[7]

The company establishes tax provisions, where appropriate, on the basis of amounts expected to be paid to (and recovered from) tax authorities and, as a result, changes in tax laws (or in the interpretations thereof) could have an adverse effect on us.[7]

Business interruptions due to natural disasters, terrorist incidents and other events, such as the COVID-19 pandemic or any other pandemic, epidemic or outbreak of an infectious disease, could adversely affect us and Old Trafford.[7]

The company is subject to risks relating to weather and climate change.[7]

If the company fails to properly manage the company's anticipated growth, the company's business could suffer.[7]

Non-compliance with health and safety legislation could lead to physical harm.[7]

Risks Related to the Industry

An economic downturn or other adverse economic conditions may harm the company's business.[7]

The departure of the United Kingdom from the European Union may adversely affect the company's operations and financial results.[7]

An increase in the relative size of salaries or transfer costs could adversely affect the company's business.[7]

UEFA, Premier League and FIFA regulations could negatively affect the company's business.[7]

The company could be negatively affected by current and future Premier League, FA, UEFA, FIFA or other regulations.[7]

There could be a decline in the company's popularity or the popularity of football.[7]

Risk Related to the Company's Indebtedness

The company's indebtedness could adversely affect the company's financial health and competitive position.[7]

To service the company's indebtedness, the company requires cash, and the company's ability to generate cash is subject to many factors beyond the company's control.[7]

The company's indebtedness may restrict the company's ability to pursue the company's business strategies.[7]

The company's variable rate indebtedness subjects us to interest rate risk, which could cause the company's debt service obligations to increase significantly, as well as risks related to the phasing out of LIBOR.[7]

Because of their increased voting rights, the holders of the company's Class B shares will be able to exert control over us and the company's significant corporate decisions.[7]

As a foreign private issuer within the meaning of the New York Stock Exchange’s corporate governance rules, the company is permitted to, and the company does, rely on exemptions from certain of the New York Stock Exchange corporate governance standards and shareholder approval requirements. The company's reliance on such exemptions may afford less protection to holders of the company's Class A ordinary shares.[7]

The obligations associated with being a public company require significant resources and management attention.[7]

We may lose the company's foreign private issuer status in the future, which could result in significant additional costs and expenses.[7]

Anti-takeover provisions in the company's organizational documents and Cayman Islands law may discourage or prevent a change of control, even if an acquisition would be beneficial to the company's shareholders, which could depress the price of the company's Class A ordinary shares and prevent attempts by the company's shareholders to replace or remove the company's current management.[7]

The price of the company's Class A ordinary shares might fluctuate significantly, and you could lose all or part of your investment.[7]

Future sales of the company's Class A ordinary shares, or the perception in the public markets that these sales may occur, may depress the company's stock price.[7]

The company's ability to pay regular dividends is subject to restrictions in the company's revolving facilities, the company's secured term loan facility, the note purchase agreement governing the senior secured notes, results of operations, distributable reserves and solvency requirements; the company's Class A ordinary shares have no guaranteed dividends and holders of the company's Class A ordinary shares have no recourse if dividends are not declared.[7]

The rules of the Premier League and the company's amended and restated memorandum and articles of association impose certain limitations on shareholders’ ability to invest in more than one football club.[7]

Exchange rate fluctuations may adversely affect the foreign exchange value of the Class A ordinary shares and any dividends.[7]

The rights afforded to shareholders are governed by the laws of the Cayman Islands.[7]

The company reports as a US domestic corporation for US federal corporate income tax purposes.[7]

Withholding under the Foreign Account Tax Compliance Act may apply to the company's dividends.[7]

If securities or industry analysts do not publish research or reports or publish unfavourable research about the company's business, the company's stock price and trading volume could decline.[7]

It may be difficult to enforce a US judgment against us, the company's directors and officers and certain experts named in this Annual Report outside the United States, or to assert US securities law claims outside of the United States.[7]

Valuation

What's the Current Value of Manchester United

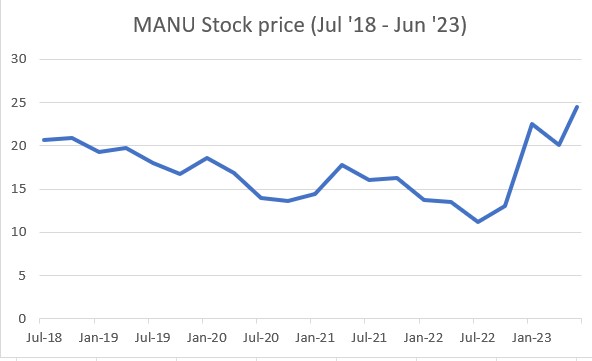

As at 30th June 2023, the stock (NYSE: MANU) closed at $24.38 per share. Given the current takeover negotiations with external bidders, we have seen increased price movement (mostly positive) as investors are excited by the potential sale to either the Qatari family of Jim Ratcliffe. As as the time of writing this report, no clear winner has emerged. That said, a plain vanilla valuation approach of the total market capitalization plus the net debt is shown in the table below to get what we understand as the current Enterprise Value.

| MANU Current Valuation - June 2023 | |||

|---|---|---|---|

| Share Price (@30/06) | [$] | 24.4 | |

| Shares Outstanding | [#M] | 163 | |

| Equity Value | [$M] | 3,974 | |

| Add:

Net Debt at June 2022 |

[$M] | 631 | |

| Enterprise Value | [$M] | 4,605 | |

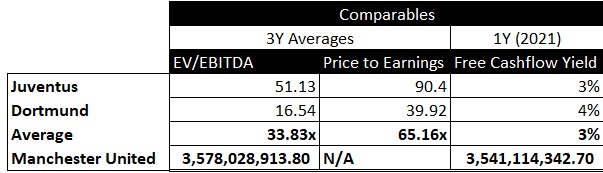

Ideally, multiple valuation methods such as the Discounted Cashflow, trading comps, Dividend Discount Model, Residual Income, etc. are employed to arrive at an acceptable valuation range for a firm. However, given the peculiarities of the Sports and Entertainment Industry which Manchester United operates in, we cannot accurately apply the aforementioned valuation techniques for the following reasons:

- Discounted Cashflow: Relies on a company generating positive cashflows, and in this case, Manchester United hasn't consistently generated positive cashflows in the last five years.

- Trading Comps: There aren't many direct public comparables to Manchester United. However, we managed to apply the multiples from the closest comps that we could find and got a decent result. Results from the trading comps estimated the Enterprise value at $3.5B.

- Dividend Discount Model: While MANU has managed to pay dividends consistently between 2017 and 2021, dividends are flat at $0.09/share, hence, it can not be used to arrive at a near accurate valuation for the stock. In addition, dividends have not been consistent in 2022 which makes it even harder to estimate the stock value using the DDM.

For the reasons mentioned above, we have identified quantitative factors to be considered in the valuation of Manchester United. We find the following factors to be crucial in the valuation of Manchester United and other related companies:

- Brand Value - According to Brand Finance 2023[8], Manchester United is now the fourth most valuable football brand in the world behind only Manchester City, Real Madrid, and FC Barcelona. The brand is valued at €1.4 billion, with a Brand Strength Index (BSI) of 92.5/100 and an AAA+ rating. For context, the brand is defined as the trademark and associated intellectual property[9].

- Size of Fanbase - According to Footgoal[10] and as at June 2023, Manchester United has the third largest social media following in the world clocking at around 209.4M across all platforms. This is behind only the Spanish giants; Real Madrid and FC Barcelona in first and second place consecutively.

- Performance on the pitch - While this is factored into the brand value and net income calculations, the significance of on-pitch performance of football clubs can not be overstated. In the last season (22/23), we saw Manchester City complete the treble and that had a massive effect on the brand value propelling them into the most valuable football brand in the world. From an acquisition point of view, if the acquirer thinks he can build a team to achieve similar on-pitch performances, then a higher premium would be attached to the Enterprise value.

While the factors mentioned above are hard to quantify, we clearly see why different investors with varying rationales might be willing to pay a hefty premium to own a MANU stock. It's a prestigious asset to own.

What's the expected return of an Investment in the Company?

Based on historic returns, the Stockhub users estimate that the expected capital appreciation of an investment in the company over the next five years is ≈20%. In other words, a £1,000 investment in the company is expected to return £1,200 in five years. The capital appreciation includes the share price appreciation (≈17%) and an estimated dividend payout (≈3%). Between 2018 and 2021, dividends were paid biannually at $0.09 per share. However, the last dividends was declared in H1 2022, and no dividends have been paid since then. For simplicity, we have assumed that dividends paid were not reinvested.

Given the risk profile of the firm, the Stockhub users estimate that a suitable rate of return on an investment in MANU is 10% per annum. Should Manchester United continue with it's historic returns of only ≈20% over five years, then an investment in the company is considered to be 'unsuitable'.

What are the assumptions used to estimate the return?

The weighted Average Cost of Capital (WACC) was used to calculate the minimum return expected by an investor in MANU, given it's risk profile.

| Description | Value | Commentary |

|---|---|---|

| Cost of Equity (%) | 11% | Given the risk profile and capital structure of MANU, the CoE represents how much return an equity holder would expect. The Capital Asset Pricing Model was used to estimate this. |

| Cost of Debt (%) | 4% | As with the cost of equity, the capital structure and interest expenses paid on total debts was used to estimate the Cost of Debt. |

| Corporate Tax Rate (%) | 25% | According to the Financials, the UK Corporate tax rate of 25% was applied. The UK Corporate tax rate was increased from 19% to 25% effective April 2023. |

Appendix

Valuation

Comparables

References

- ↑ https://www.manutd.com/

- ↑ https://www.nyse.com/quote/XNYS:MANU

- ↑ https://www.globenewswire.com/en/news-release/2023/05/03/2660537/28124/en/Global-Sports-Market-Forecast-to-2032-Sector-is-Expected-to-Reach-623-63-Billion-in-2027-at-a-CAGR-of-5.html#:~:text=The%20global%20sports%20market%20grew,(CAGR)%20of%205.2%25.

- ↑ https://www.imarcgroup.com/football-market

- ↑ https://www.statista.com/topics/3156/football-in-the-uk/#topicOverview

- ↑ 6.00 6.01 6.02 6.03 6.04 6.05 6.06 6.07 6.08 6.09 6.10 6.11 https://ir.manutd.com/corporate-governance/board-of-directors.aspx

- ↑ 7.00 7.01 7.02 7.03 7.04 7.05 7.06 7.07 7.08 7.09 7.10 7.11 7.12 7.13 7.14 7.15 7.16 7.17 7.18 7.19 7.20 7.21 7.22 7.23 7.24 7.25 7.26 7.27 7.28 7.29 7.30 7.31 7.32 7.33 7.34 7.35 7.36 7.37 7.38 7.39 7.40 7.41 7.42 7.43 7.44 7.45 7.46 7.47 7.48 7.49 7.50 7.51 7.52 7.53 7.54 https://www.sec.gov/Archives/edgar/data/1549107/000110465923035593/manu-20230630x20f.htm#TOC

- ↑ https://brandirectory.com/rankings/football/

- ↑ https://www.statista.com/statistics/234493/football-clubs-in-europe-by-brand-value/

- ↑ https://footgoal.pro/top-10-football-clubs-with-most-fans-in-the-world-in-2021/

- ↑ https://uk.finance.yahoo.com/quote/MANU/history?period1=1530316800&period2=1690675200&interval=capitalGain%7Cdiv%7Csplit&filter=div&frequency=1mo&includeAdjustedClose=true