Buy more, sell more, rent more

Summary

musicMagpie (MMAG) provides a cost-effective and sustainable alternative to buying and selling consumer technology and physical media. Future growth is supported by the positive tailwinds of increasing awareness of sustainability issues and the growing importance of the circular economy. It has a significant growth opportunity from the rental of technology, which is expected to generate greater revenue and profit over the life of a device than an outright sale. The addition of the new recurring subscription revenue has the potential to accelerate annual revenue growth from mid- to high-single digits and significantly increase profitability (low-teens EBITDA margin from FY26). Our DCF-based valuation is 168p per share.

| Year end | Revenue (£m) | EBITDA (£m) | PBT*

(£m) |

EPS*

(p) |

DPS

(p) |

EV/EBITDA

(x) |

P/E

(x) |

|---|---|---|---|---|---|---|---|

| 11/20** | 153.4 | 13.9 | 9.2 | 10.5 | 0.0 | 3.1 | 4.3 |

| 11/21 | 145.5 | 12.2 | 7.9 | 6.1 | 0.0 | 3.5 | 7.4 |

| 11/22e | 154.7 | 9.3 | 1.8 | 1.4 | 0.0 | 4.6 | 32.8 |

| 11/23e | 166.1 | 11.3 | 1.4 | 1.0 | 0.0 | 3.8 | 43.7 |

| 11/24e | 179.9 | 15.6 | 5.6 | 3.9 | 0.0 | 2.8 | 11.6 |

An evolving business model

MMAG’s business exposure has evolved quickly with a market-leading position in the UK, and an early-stage position in the United States, focused on three main product categories/divisions, Technology, Media (disc media) and Books, all with very different growth dynamics. New initiatives such as rental of smartphones and other consumer technology, offering new Apple products and the first moves to building relationships with corporates (versus consumers) suggest the addressable markets available to MMAG will continue to increase.

Forecasts: EBITDA growth expected from FY23

The business mix, before rental income, is capable of consistent mid-single-digit revenue growth. The transition to monthly subscriptions for consumer technology should accelerate overall medium-term growth rates and profitability but compresses growth in the near-term as it moves from one-off/upfront revenue to monthly revenue recognition with a significantly higher margin. We forecast 6–8% pa revenue growth in FY22–24, but the above near-term dampening effect of the transition to rental and lower ‘outright’ Technology gross profit will lead to lower FY22 EBITDA, before we expect EBITDA growth to resume from FY23. At end-FY21, MMAG had a net cash position of £1.8m. Its future cash generation and net financial position will be sensitive to the phasing and extent of capital investment required to support the expansion of its rental services.

Our base case DCF-based valuation indicates a share price of 168p per share, significant upside from the current share price. Following a de-rating, MMAG’s FY22e EV/EBITDA of 4.6x represents a discount to other UK consumer-facing online companies, but the uniqueness of MMAG’s business model and category exposure means there are few direct peers with which to satisfactorily compare its valuation.

Investment summary

Company description: Leading online re-commerce

musicMagpie (MMAG) is a leading online consumer re-commerce company with a current focus on buying and selling across three categories: consumer technology, media (ie disc media) and books. Its growth prospects are mainly driven by increasing consumer acceptance of circular economy models, a result of increasing environmental and sustainability concerns. The main geographic presence is the UK (79% of revenue in FY21), one of the more developed consumer re-commerce markets. It is the world’s largest seller on Amazon and eBay by reference to volume of sales transacted on third-party platforms. It also has a less developed business in the United States. Over time, the product category focus has evolved and MMAG’s technology will enable this to continue as consumer engagement with re-commerce increases. Historically, MMAG’s relationship has been solely with consumers, and typically intermittent in nature. Recent initiatives indicate this is changing: the new offer of rentals of smartphones and other consumer technology aims to build recurring and more profitable revenue streams; new and enhanced digital marketing capabilities seek to stimulate new cross-selling opportunities; and the first move into corporate recycling opens up a new significant pool of potential product supply and revenue. Management guides to long-term double-digit revenue growth for Technology, countered by continued high-single-digit declines for Media, suggesting the current business mix is capable of mid-single-digit revenue growth, which may accelerate as Technology’s importance to the group increases.

Financials

MMAG demonstrated strong revenue growth, with a CAGR of 8% in FY18–21, ahead of market growth estimates, due to growth in consumer numbers and repeat customers. This points to growing engagement with the circular economy and market share gains, and a further boost to demand during the COVID-19 pandemic. At the same time, refinement of the buying and selling processes led to significant gross margin enhancement (from c 23% in FY18 to c 30% in FY21). We forecast 6–8% pa revenue growth in FY22–24 despite further normalisation to pre-COVID-19 levels for Media and Books. We forecast that FY22 EBITDA will decline as the transition to building rental income - which is more profitable in the medium-term - dampens near-term growth, and reflecting recent trends in Technology outright gross margin, before growth resumes in FY23.

Our primary method of valuing MMAG is a discounted cash flow (DCF) analysis, with a fair value of 168p per share. Beyond our explicit forecast period we assume 5% annual revenue growth for ‘outright’ sales, fading down to c 4% growth by our terminal year, FY31, and rentals to increase revenue growth by 2–5% pa. The higher-margin subscriptions potentially increase the EBITDA margin from 8.4% in FY21 to c 21% by FY31. We use a WACC of 10% (risk free rate of 3%, risk premium of 6%, Beta of 1.2 (limited trading history), and little debt) and a 2% terminal growth rate.

Sensitivities

MMAG operates in markets with a wide range of competitors and the structural growth dynamics of the circular economy suggest that competitive pressures are likely to remain high. It is exposed to frequently changing product cycles and some product categories that are expected to demonstrate structural declines, such as disc media. As the circular economy evolves, MMAG’s business exposure is likely to change as it seeks to increases the size of its addressable markets and the number of product categories offered. MMAG’s US business is a relatively small business in a less well-developed re-commerce market, therefore this may be more difficult and expensive to develop than expected.

Company description: Consumer re-commerce

musicMagpie is a leading consumer re-commerce company in the UK and United States with a main current focus on consumer technology (mobile phones, tablets, MacBooks, smartwatches and consoles), disc media (CDs, DVDs and games) and books. Segmental disclosure includes revenue and a number of profit measures for the three categories under three divisions, Technology, Media and Books.

In the UK, it trades as musicMagpie, and in the United States as decluttr. In FY21, the UK represented 79% of MMAG’s revenue, which reflects the UK is a more established business, and the UK consumer re-commerce market is more advanced.

MMAG’s shares were admitted to AIM on 16 April 2021 at 193p, raising gross primary proceeds of £15m. The proceeds were used to fund investment in its rental business, SMARTDrop kiosks and IT development, and repay existing debt facilities.

| Shares (m) | Gross proceeds (£m) | |

|---|---|---|

| Total shares in issue before IPO | 100.000 | |

| Primary shares | 7.772 | 15.0 |

| Secondary shares | 49.416 | 95.4 |

| Total placing shares | 57.188 | 110.4 |

| Total shares in issue post IPO | 107.772 | 208.0 |

The major shareholders before the admission and their holdings at 31 December 2021, excluding new institutional investors on the IPO, were as follows:

| Prior to admission | 31 March 2022 | |||

| Number of shares (m) | % of issued shares | Number of shares (m) | % of issued shares | |

| Northern Entities* | 34.6 | 34.6 | 17.3 | 16.1 |

| Steven Oliver** | 16.6 | 16.6 | 13.4*** | 12.4*** |

| Walter Gleeson* | 10.2 | 10.2 | 7.2 | 6.7 |

| Lloyds Development Capital | 8.0 | 8.0 | 0.0 | 0.0 |

| Ian Storey | 3.8 | 3.8 | 3.7*** | 3.4*** |

musicMagpie’s development

The company was founded in 2007 by Steve Oliver and Walter Gleeson with an initial focus on buying and selling pre-owned CDs and DVDs from and to its customers. From an online perspective the company developed its distribution by initially offering items on Amazon’s websites in the UK (2008), the United States, France and Germany (2009), and then on eBay (2011). In 2012 the company entered the consumer technology market and also launched its US business. Its own online stores (www.musicmagpie.co.uk and www.decluttr.com) were launched in 2015 and 2017, respectively. Books were introduced in 2016.

The company also developed a physical presence with the launch of its first ‘That’s Entertainment’ retail outlet in 2009, which quickly grew to over 30 stores by 2011, before management decided to close its retail outlets in 2018 in order to focus on online. MMAG currently has wholesale partnerships with a number of high street retailers such as ASDA.

In 2020/21, MMAG launched three UK-focused initiatives that are expected to drive further revenue growth with three key aims from customers, ‘buy more, sell more, rent more’, while enhancing MMAG’s profitability. For ‘buy more’ and ‘sell more’, two initiatives are focused on increasing the potential sources of products that can be on sold: the SMARTDrop kiosk, in which sellers can easily recycle phones in partner retail locations in a quicker/more efficient way; and Magpie Circular, a first step that introduces MMAG’s trade-in offer to corporates. For ‘rent more’, the October 2020 launch of smartphone rentals, and the February 2022 expansion of the service to other consumer technology products such as tablets, gaming consoles, MacBooks and wearables, is focused on building recurring revenue, with significantly higher EBITDA over the life of the device, as opposed to the outright sale historically pursued by MMAG. Our estimates suggest MMAG’s rental activities are likely to be the most significant driver for future growth in revenue and profits.

MMAG builds brand awareness via advertising on television, online and through social media. It proactively promotes personalised offers to its existing customer base by targeted emails.

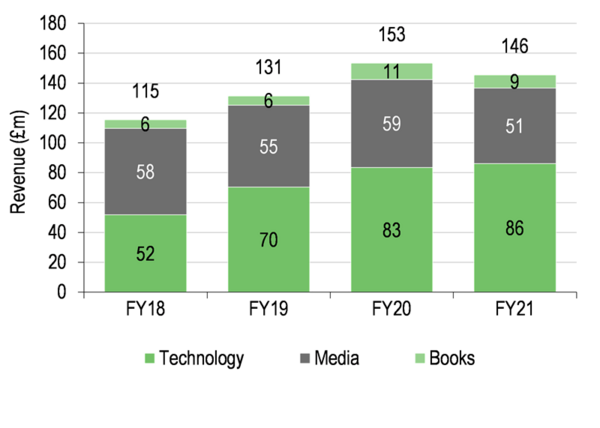

Exhibit 3: Revenue profile[4]

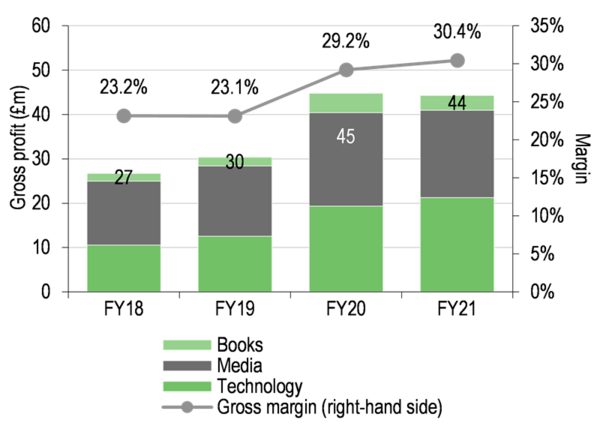

Exhibit 4: Gross profit[4]

Exhibit 4: Gross profit[4]

Since being introduced to the offer, Technology has become the largest source of revenue. At £86m in FY21 it represented c 59% of the group total, while Media and Books represented 35% and 6%, respectively. The average gross margin has improved, from 23.2% in FY18 to 30.4% in FY21, due to higher margins for all categories (except for Books in FY21) offset by mix changes. With respect to mix changes, the increasing importance of Technology (lower average percentage margin but higher cash profit) and Books (higher average percentage margin) have been positive for the overall gross profit and/or margin, offset in part by the declining importance of Media (higher average percentage margin).

musicMagpie’s business model

MMAG’s core consumer circular business model can be broken down into four constituent parts: buy, receive, refurbish and sell/rent.

References and notes

- ↑ Note: *PBT, EBITDA and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments. ** exceptional COVID impact.

- ↑ Source: musicMagpie Admission Document.

- ↑ Source: musicMagpie Admission Document and FY21 results. Note: *As defined in the admission document. **Includes concert parties. ***Includes Employee Benefit Trust.

- ↑ 4.0 4.1 Source: musicMagpie.