SummaryEdit

The financial health app helping everyone build a future of wealth + health

- Founded by a behavioral scientist

- Automated coaching based on proprietary AI

- Identifies money habits, personalities, and potential risks

- Targeting young earners and Zillennials

- Leveraging strategic, affiliate, and employee partnerships

- 50,000+ Navigators, 1 employer pilot, 2 distribution pilots

- Featured in Forbes, Bloomberg, Medium, USA Today, Yahoo! Finance

ProblemEdit

We can't afford to be financially unhealthyEdit

It's costing the next gen thousands

Zillennials lose an average of $20,000 a year due to one (or all) of these three things.

This is a potential loss of over $10 trillion in wealth over the course of the Zillennial lifetime.

There's never been more access to growing wealth ... or so much to navigate. Consumers are forced to find unconventional ways to 'hack' their financial lives. Add in a lack of personalized resources, rising student loan debt, and COVID-19, and our seemingly stable financial system starts to feel a lot less secure. Financial insecurity leads to financial stress, which negatively impacts emotional and physical health. It's a costly cycle.

SolutionEdit

Edit

Measure and correlate individual behavior and banking trend data to mitigate financial stress, improve creditworthiness, and build better behavioral outcomes

Daily habitsEdit

Build personalized habits to reduce financial stress and increase financial confidence. Your data informs your behavior change.

Personalized actionEdit

Use proprietary behavioral data to define your own roadmap and automate your way to financial freedom. Automate savings, spending, debt, and eventually investing and defi.

Social+Edit

Leverage community and a sense of belonging to build generational wealth. You're not alone and this generation is changing the world.

ProductEdit

Where wealth meets healthEdit

We're more than just a money app

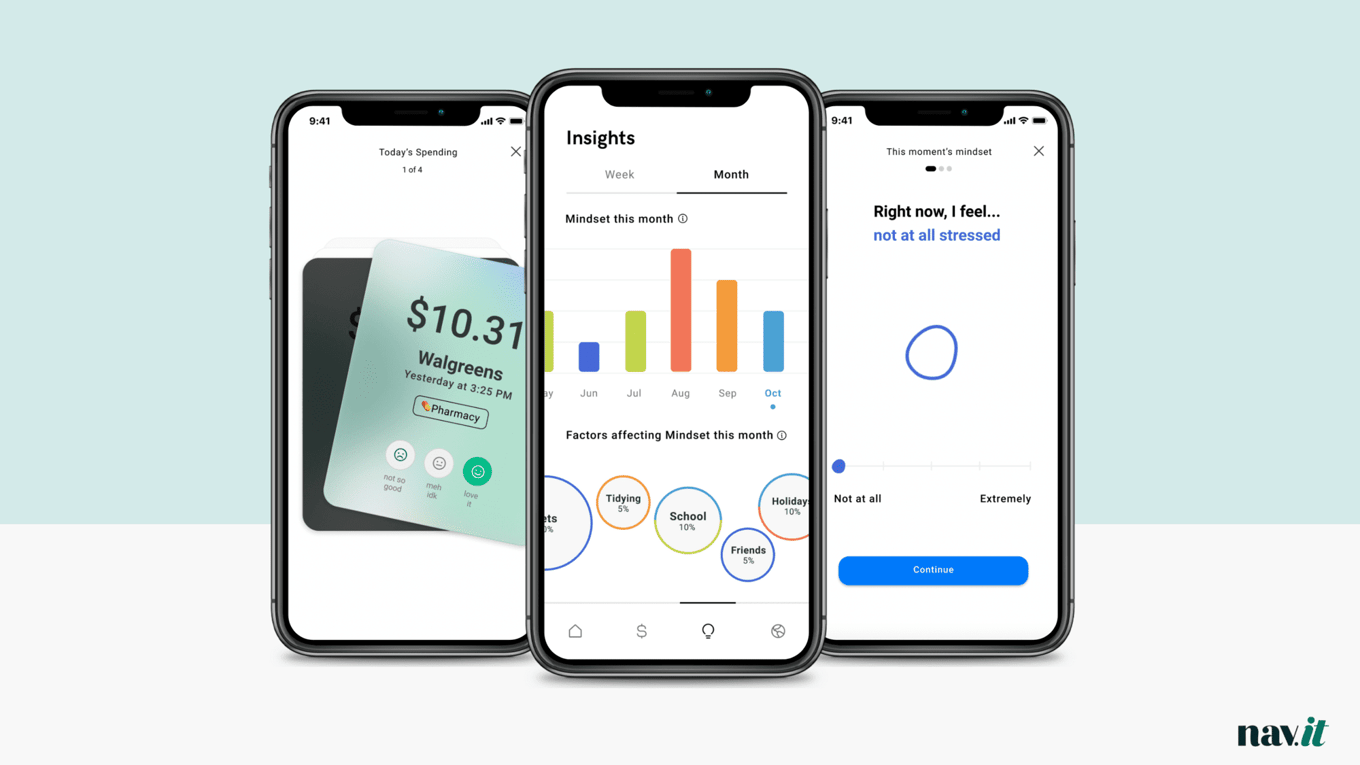

Nav.it focuses on your habits and stress levels to improve behavior alongside a community of peers striving for financial wellness.

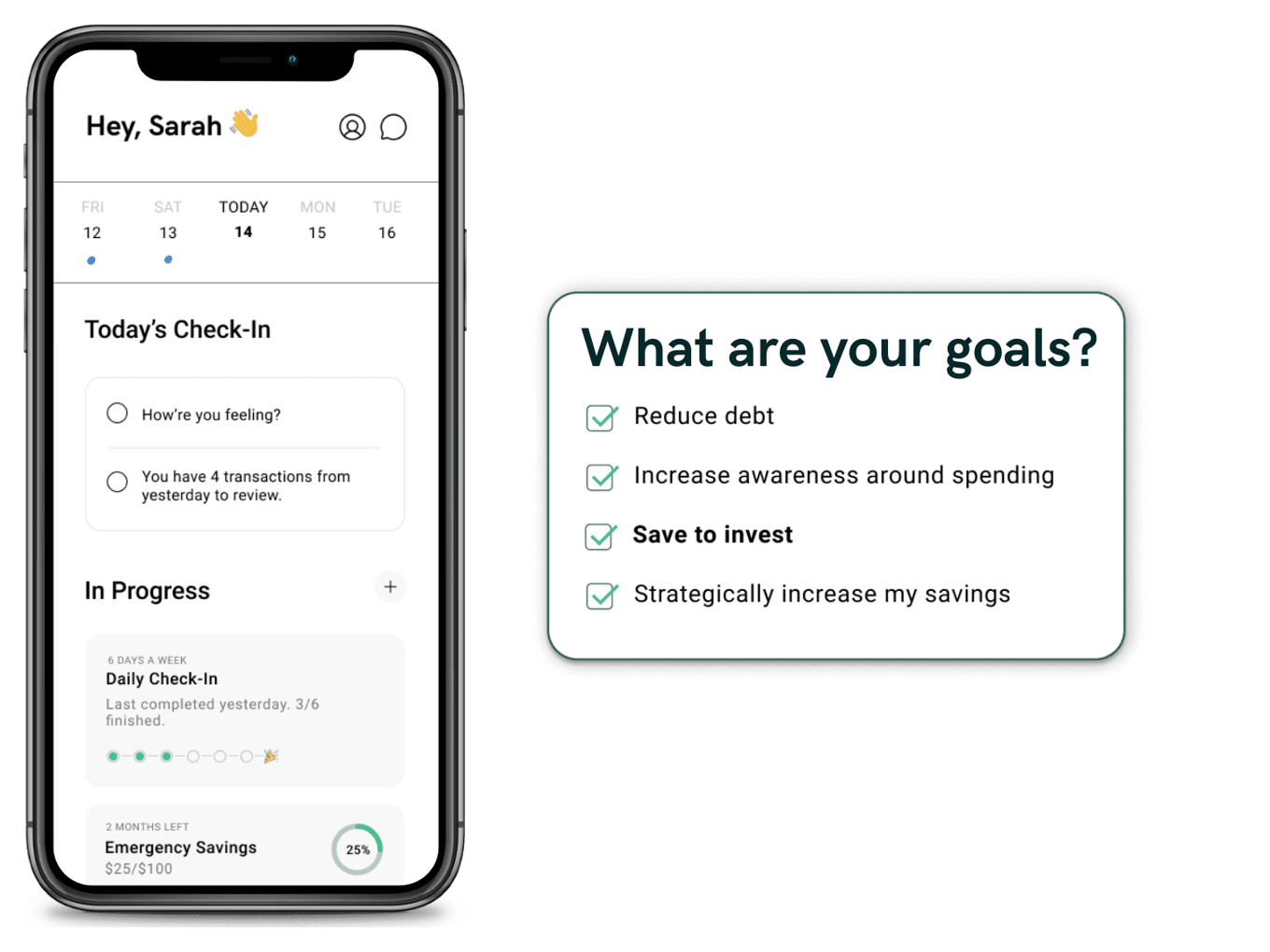

Step 1. Define your goals.

Navigators “get to know themselves” through a proprietary personality test that helps them identify their values, spending personas, and big picture goals.

Step 2. Identify existing behaviors.

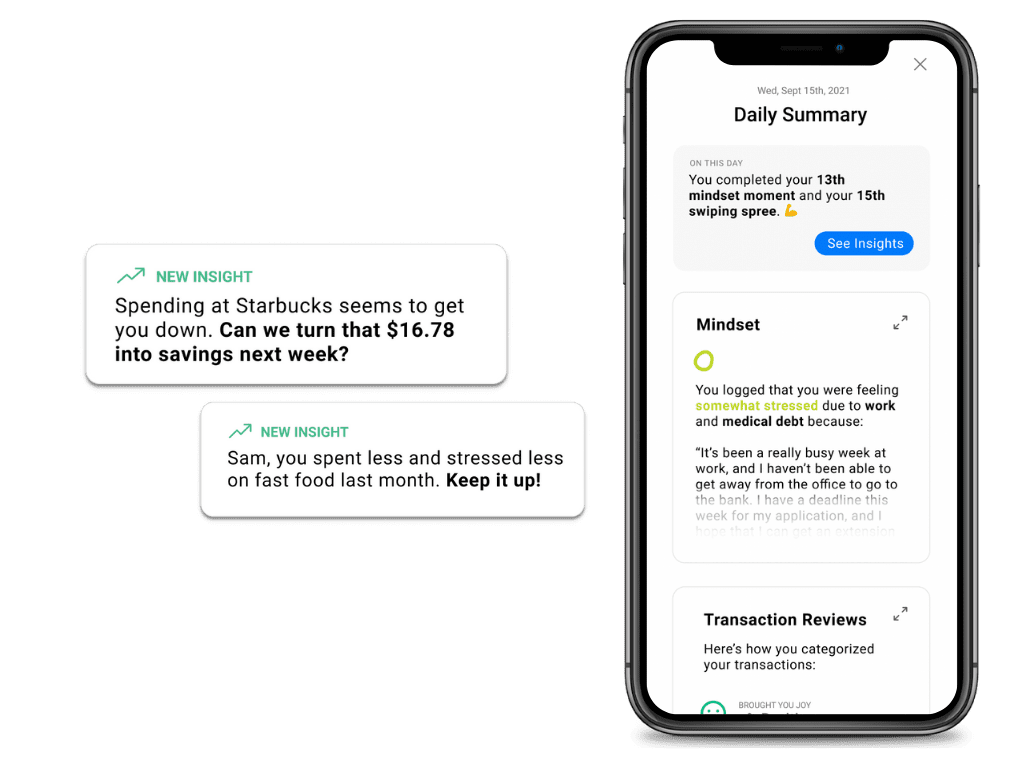

Navigators track their money habits by logging their moods and 'swiping left or right' on their expenses daily. We then surface unique insights to correlate behavioral and financial trends over time.

Step 3. Build a financial roadmap.

Insights help Navigators set up micro spending and savings goals. They can engage with others on their journey and even choose one-on-one coaching for extra support.

We are currently designing a tailored, modular roadmap based on incremental financial habit changes that result in long-term gains over time.

Step 4. It's okay to talk about money.

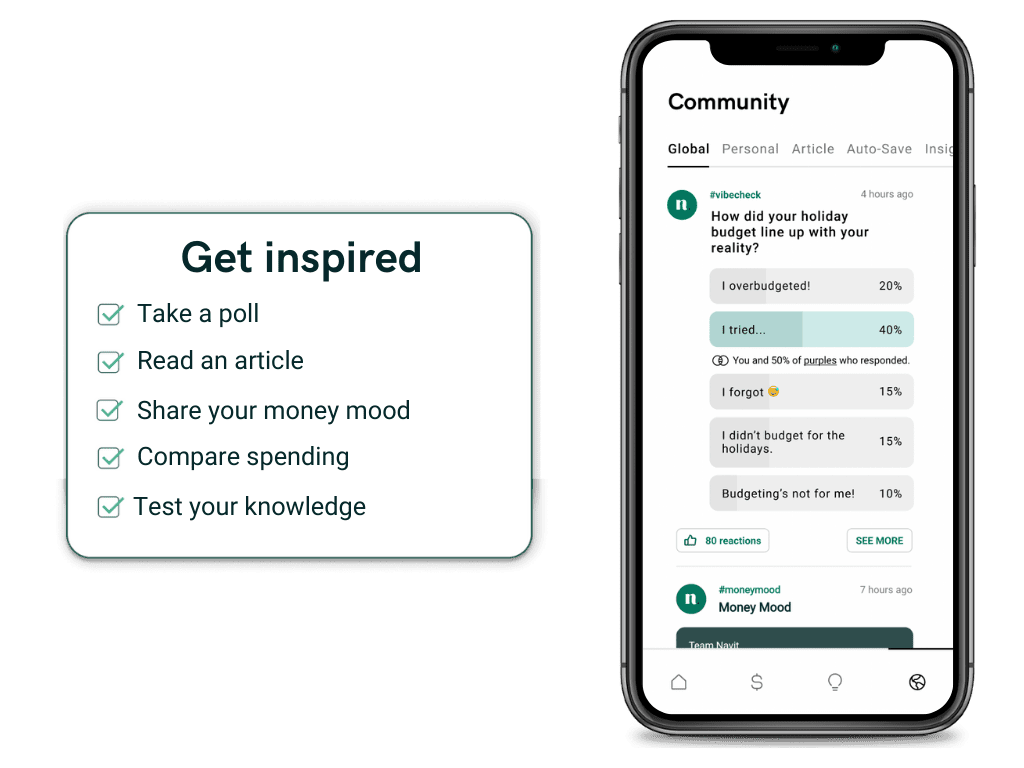

A sense of belonging increases confidence. We’re building a financial social network that encourages positive behavior and rejects the reinforced superficiality of other social networks.

We’ll foster open conversations about money, support healthy small group interactions, and help Navigators connect to others.

TractionEdit

Traction to date

Changing financial behaviors, one day at a time.

Early adopters pave the way for savings at scaleEdit

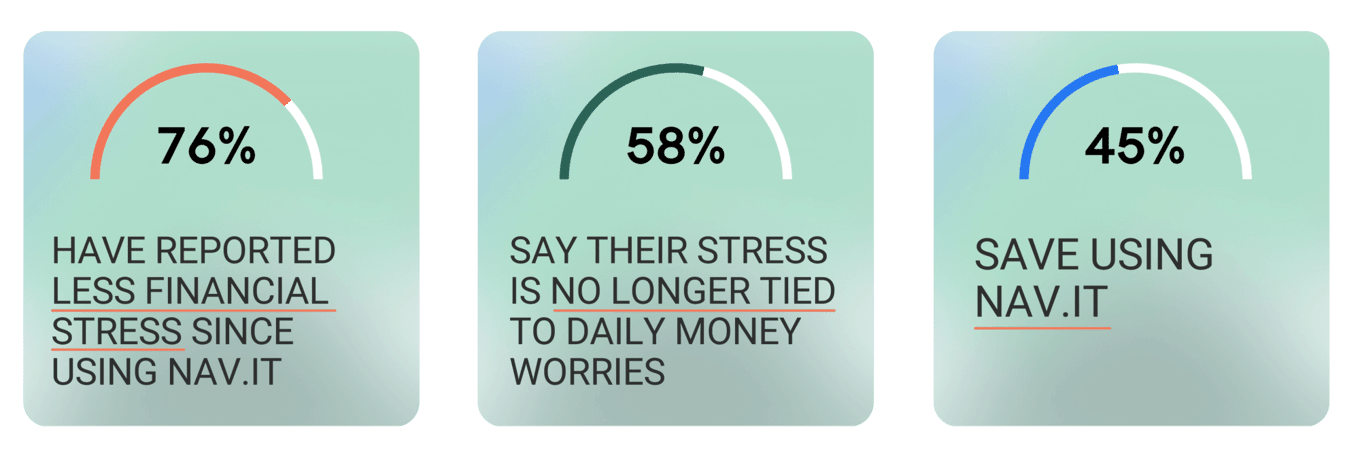

500 Navigator cohort, 12-month study duration

Our team has focused on converting high-quality users interested in connecting their emotional motivations with their financial outcomes.

CustomersEdit

Market adoptionEdit

The social+finance app that helps young earners chart the course for intergenerational wealth

"Young Earner"

We've built a brand, and feature set, for the Young Earner.

Young Earners are:

- Financially motivated

- Newly on-their-own

- Not on Wall Street or at one of the big 5 tech campuses

- Changemakers, independent thinkers, and financial hackers

Young Earners are keen to grow wealth, but know they need a solid financial foundation in order to do safely and confidently.

User testimonialsEdit

Personal finance is personal

PartnershipsEdit

Affiliate & strategic expand reach

We've already begun partnering with names across the financial health community to expand our reach and tune in growth.

- Young Alfred

- Trust & Will

- Bright Ventures

- NBKC Bank

- Juno

- Bestow

- Public

Business modelEdit

Multi-sided revenue modelEdit

Banking products, employee benefits, 1-1 coaching, premium options with creators & partners

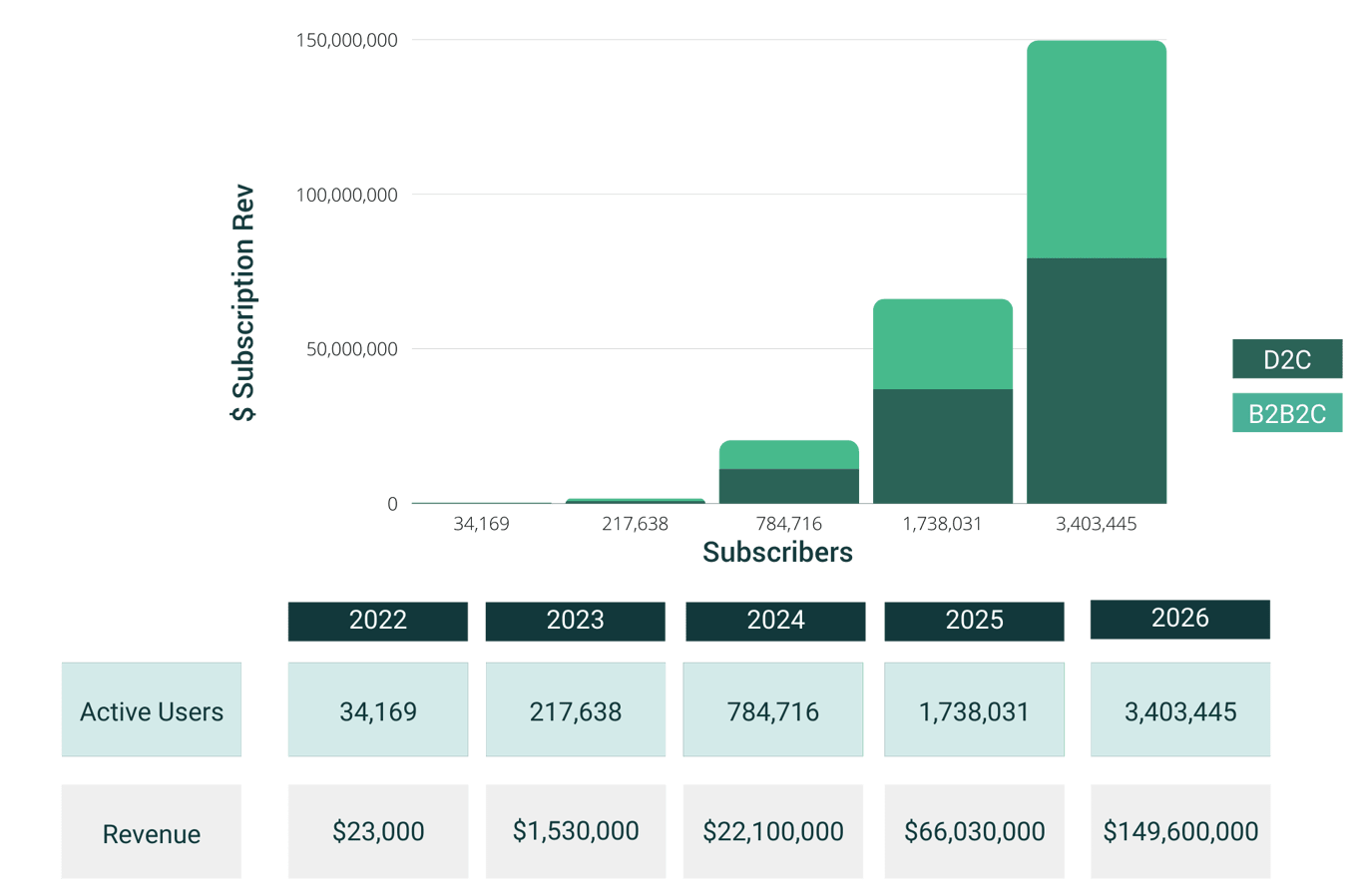

ProjectionsEdit

Click here for important information regarding Financial Projections which are not guaranteed.

MarketEdit

Market validationEdit

People are having more meaningful financial conversations that go beyond trendy meme stocks.

There's never been a better time to build a money management app that can understand the root causes of financial behavior, provide quality coaching at an accessible price, and connect the millions of young people desperate for financial direction.

Market sizeEdit

This is a $3B market with 4M new Young Earners graduating every year. The mobile money management market is expanding as more and more people turn to digital banking solutions.

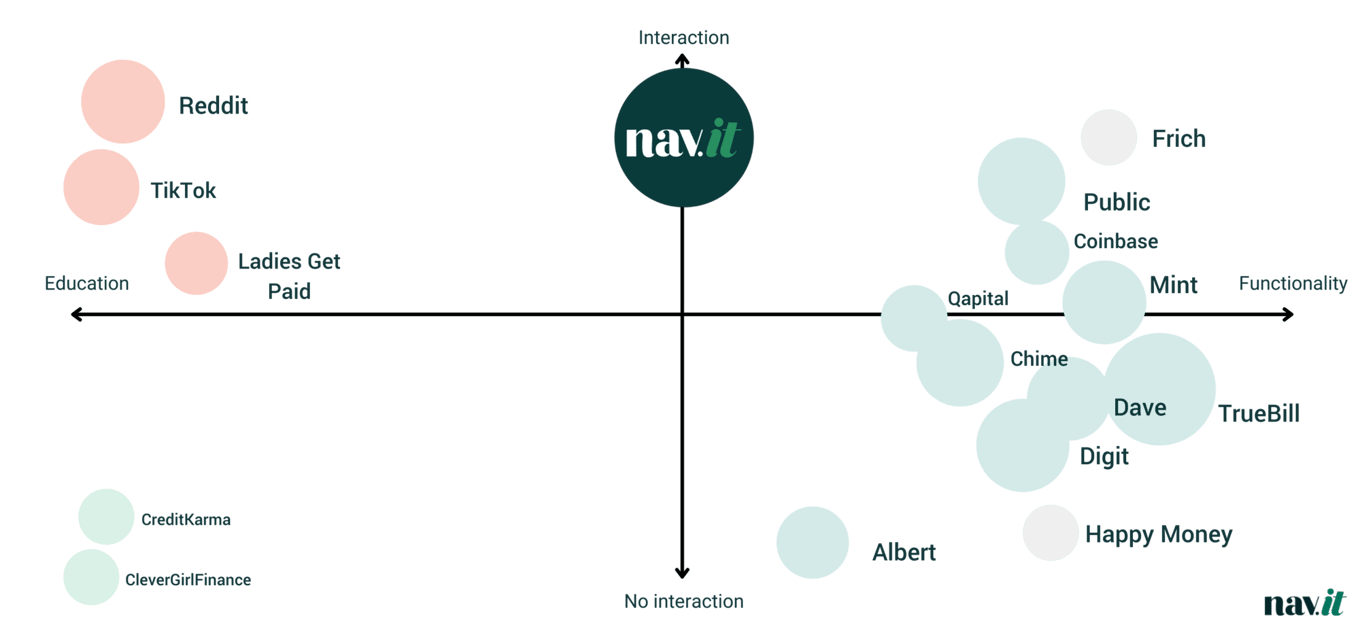

CompetitionEdit

The ability to transact is not enoughEdit

Fintechs are great at functionality: streamlining age-old inefficiencies to bring more clarity to net worth and monthly balances. However, the existing competition fails to identify and solve the personal pain points of consumers.

It’s time we take the learnings from recent fintech+social apps (like Venmo and Public) and apply them to personal financial management.

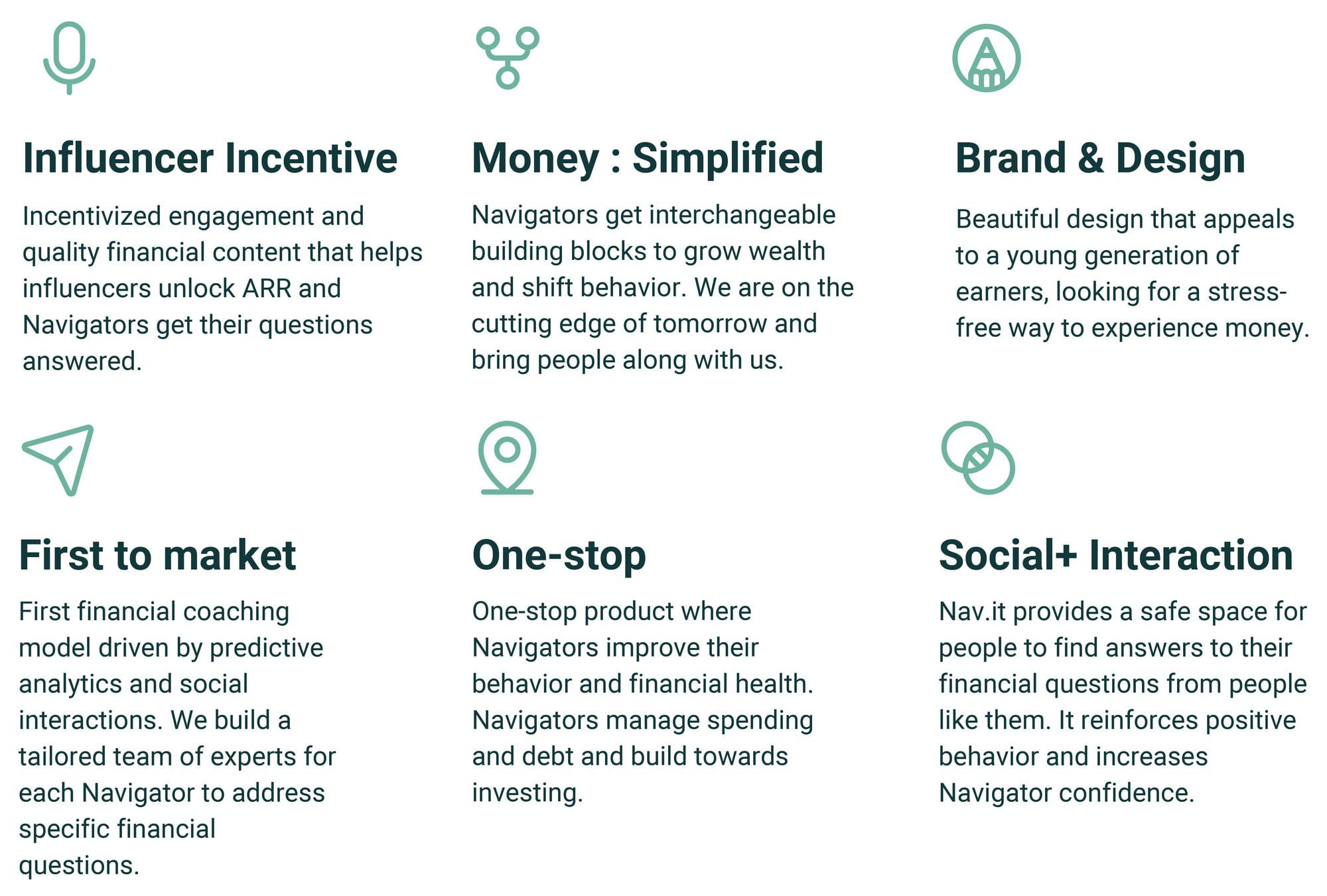

Competitive advantagesEdit

We make money simple by giving users clear steps to grow wealth

Nav.it's financial coaching model, driven by predictive analytics, serves as a one-stop product where Navigators automate their behavior and financial health.

Vision and strategyEdit

VisionEdit

To be the pioneering behavioral health platform that compels society to accept that financial health is a foundation for safety, security, self-confidence, and a future of wealth.

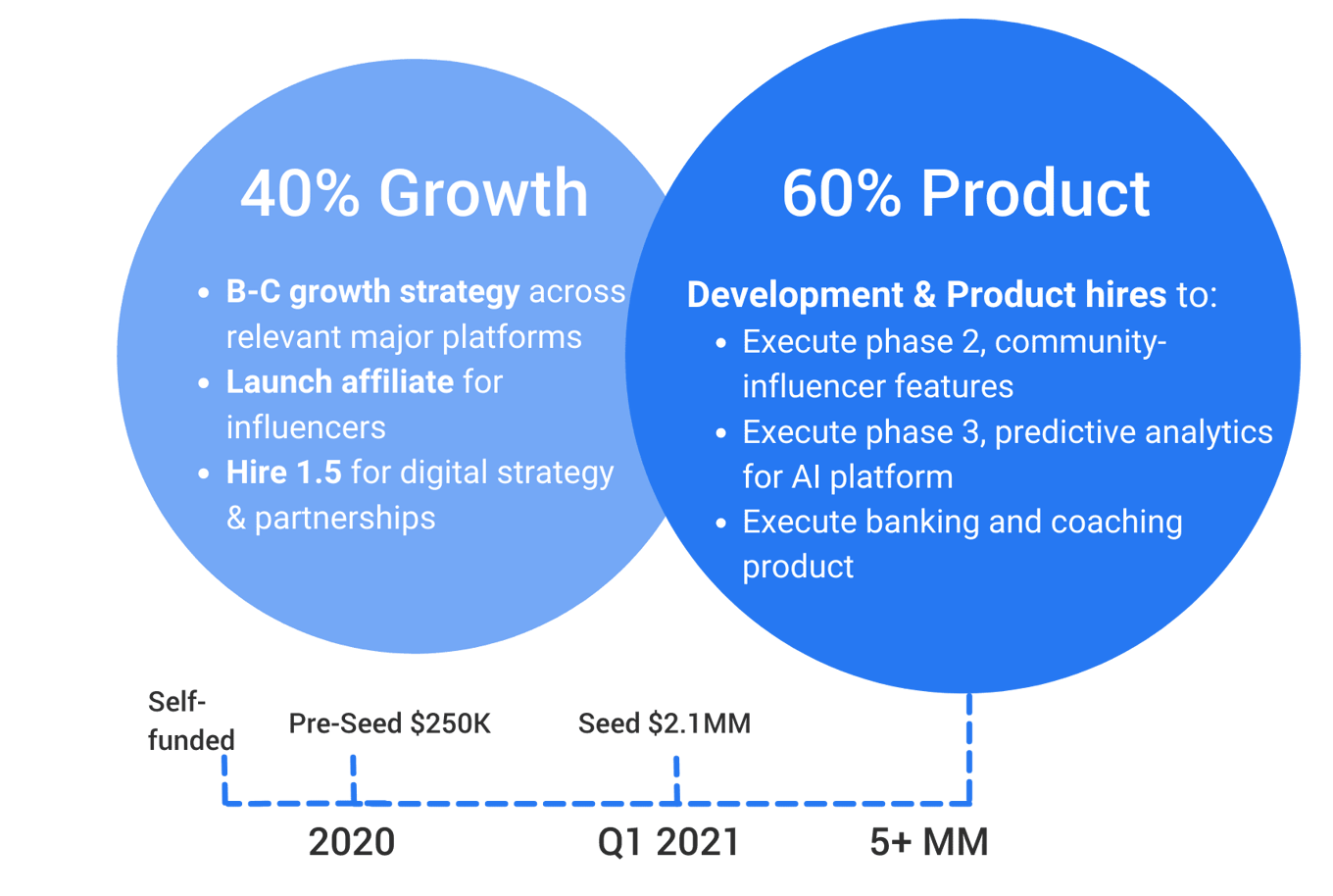

Use of FundsEdit

Edit

Banking with your financial wellness in mind

EmployersEdit

As an essential health benefit, employers can pay for Nav.it

Loss of productivity combined with absenteeism from financial stress costs employers more than an estimated $2,100 per year, per employee.

68% of employees would prioritize financial wellness benefits above an extra week of vacation. Employees expect their health care to be comped; employers are willing to pay for a healthy workforce.

We'll seek to emulate the success of health tech brands (like Talkspace, Calm, Headspace, and Noom) that penetrated the B2B2C channel through a bottom-up approach.

FundingEdit

Primary investorsEdit

A successful over-subscription of our Seed round, and beyond

- Silicon Valley fintech venture firm, ThirdStream Partners

- NY-based Copper Wire Ventures

- San Francisco-based Gravity Capital

- the Co-founder of Petal

- an influential group of angel investors

Invest in a financially healthy future for all with Nav.it.

FoundersEdit

Erin Papworth

Founder & CEO

2x Entrepreneur, Behavioral Scientist, MPH, Int'l Economics and Management

Maia Monell

Co-founder & CGO

Growth Marketing, Business Development Expert, MS in Marketing Strategy & Innovation

C- Suite BiosEdit

Erin PapworthEdit

Erin is the CEO and co-founder of Nav.it. A two-time entrepreneur, she spent over a decade living and working overseas, managing multi-million dollar programs and working for organizations like Johns Hopkins University, Doctors without Borders, the United Nations, and the United States Government. During her tenure, Erin established the West Africa Regional Office for JHU. She led the development and actualization of implementation science programs. These programs increased access to health services for over 100,000 people and directly facilitated positive behavior change among highly vulnerable populations. In 2015, Erin successfully built Avery Franklin Consulting, LLC, a consulting firm with significant expertise in epidemiological field research, behavior change assessments and programming, data science, and policy analysis, especially in countries experiencing trauma. Upon return to the States, Erin became passionate about increasing access to financial resources for financially coping populations in order to help them take advantage of the American financial system and grow intergenerational wealth.

Maia MonellEdit

Before co-founding Nav.it in 2019, Maia was a founding team member of BridgeAthletic, the elite performance technology leveraging prescriptive AI to change the game of coaching, training delivery and reporting. While at Bridge, Maia built the B2B2C offering, scaling 250+% ARR. Having seen the detrimental effects poor financial and mental health have on performance, Maia teamed up with Erin Papworth to bring a prescriptive, behavioral approach to finance. Maia leads the growth team at Nav.it. Under her leadership, the brand has grown over 150% in the last year and has launched two new distribution channels: Nav.it at Work and Nav.it on Campus, to meet the growing burden of financial stress at work and on campus. Outside of Nav.it, Maia’s the founding partner of MoDa Partners, a group investing in the economic and educational empowerment of women. She’s also a board member of her family’s two foundations. Maia has a MS in Marketing Strategy & Innovation from Bayes Business School (formerly Cass Business School) and a BA in English from Wake Forest University.

Naozer DadachanjiEdit

Naozer Dadachanji is the COO of Nav.it, a pioneer in coaching people through behavior change to improve their financial wellness. Naozer Dadachanji was a member of the senior management team at Barclays Global Investors (BGI), the industry leader in the field of systematic, quantitative investing until its sale to BlackRock in 2009. Working with the CEO and other C-Suite members, he was instrumental in developing and executing on a business plan that increased the company’s valuation from $430mm in 1996 to $13.5B in 2009. During a 12-year tenure, he held positions that included Chief Operating Officer for the Active Businesses (revenues of $2.5B), Global Co-Head of Active Equities (AUM $100B+), Global Head of Product, Investment, and Capital Markets for iShares. Since leaving BGI/BlackRock in 2012, Naozer has been an investor in, and advisor to early-stage companies, actively engaging with leadership teams, inside and outside the boardroom.

Edit

Erin Papworth

Founder & CEO

2x Entrepreneur, Behavioral Scientist, MPH, International Economics and Management

Maia Monell

Co-founder & CGO

Growth Marketing, Business Development Expert, MS in Marketing Strategy & Innovation

Naozer Dadachanji

President & COO

Barclays Global Investments, M&A to BlackRock, iShares executive, MS in Mathematical Science

Toby Miller

CTO

Jen Sapel, ChFC, WMCP

Director of Education

Paul Campbell

Head of Product

Kaitlyn Ranze

Sr. Communications & Education Manager

Morgen Quintus

Lead Product Designer

Erin Peczynski

Marketing Manager

Sami Miller

Digital Marketing Director

Kenneth Medford

Contributor & Podcast Co-Host

Robert Zwink

Advisor: ClickSWITCH CTO, BillGO EVP

David Ehrich

Advisor: Co-founder, Petal

Christopher Trepel, Ph.D.

Advisor: Operating Partner, Fenway Summer Ventures

RisksEdit

There is no assurance that our revenue and business model will be successful.

We are continually refining our revenue and business model, which is premised on creating a virtuous cycle for our customers to engage in more products across our platform. There is no assurance that these efforts will be successful or that we will generate revenues commensurate with our efforts and expectations or become profitable. We may be forced to make significant changes to our revenue and business model to compete with our competitors’ offerings, and even if such changes are undertaken, there is no guarantee that they will be successful.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early stage companies. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

With shelter-in-place orders and non-essential business closings happening throughout 2020, 2021 and potentially happening throughout 2022 and into the future due to COVID-19, the Company’s revenue has been adversely affected. In December 2019, a novel strain of coronavirus was reported in China. Since then, the novel corona virus, SARS-COV2, has spread globally including across North America and the United States. The spread of SARS-COV2 from China to other countries has resulted in the World Health Organization (WHO) declaring the outbreak of the diseases caused by SARS-COV2, termed “COVID-19”, as a “pandemic,” or a worldwide spread of a new disease, on March 11, 2020. Many countries around the world, including the United States, have imposed quarantines and restrictions on travel and mass gatherings to slow the spread of the virus, and have closed non-essential businesses.

Specifically, at the time this Memorandum is prepared, we caution that our business could be materially and adversely affected by the risks, or the public perception of the risks, related to the outbreak of COVID-19. The risk of a pandemic, or public perception of the risk, could cause customers to avoid public places and could cause temporary or long-term disruptions in the supply chains and/or delays in the delivery of inventory to our vendors and service providers. Such risks could also adversely affect our customers’ financial condition, resulting in reduced spending on our services. “Shelter-in-place” or other such orders by governmental entities could also disrupt our operations, if our employees or the employees of our vendors and service providers that cannot perform their responsibilities from home, are not able to report to work. Risks related to an epidemic, pandemic or other health crisis, such as COVID-19, could also lead to the complete or partial closure of one or more of our facilities or operations of our vendors and service providers.

The spread of SARS-COV2, which has caused a broad impact globally, may materially affect us economically. While the potential economic impact brought by, and the duration of, the COVID-19 health crisis may be difficult to assess or predict, a widespread pandemic could result in significant disruption of global financial markets, reducing our and our clients’ ability to access capital, which could in the future negatively affect our and our clients’ liquidity. In addition, a recession or market correction resulting from the spread of COVID-19 could materially affect our business prospects.

The global outbreak of COVID-19 continues to rapidly evolve. The extent to which COVID-19 may impact our business, operations and financial performance will depend on future developments, including the duration of the outbreak, travel restrictions and social distancing in the United States and other countries, changes to the regulatory regimes under which we operate, the effectiveness of actions taken in the United States and other countries to contain and treat the disease and whether the United States and additional countries are required to move to complete lock-down status. The ultimate long-term impact of COVID-19 is highly uncertain and cannot be predicted with confidence.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an Investor to lose all or a portion of their investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. Our business currently generates limited sales and future sources of revenue may not be sufficient to meet our future capital requirements. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We may not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

Currently, our authorized capital stock consists of 30,000,000 shares of common stock, of which 1,520,000 shares of common stock are issued and outstanding. Unless we increase our authorized capital stock, we may not have enough authorized common stock to be able to obtain funding by issuing shares of our common stock or securities convertible into shares of our common stock. We may also not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract customers or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

We rely on other companies to provide components and services for our products.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract customers or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract customers or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

The Company’s success depends on the experience and skill of the board of directors, its executive officers and key employees.

We are dependent on our board of directors, executive officers and key employees, particularly the Company’s co-founders and executive officers, Erin Papworth and Maia Monell, and advisor and fractional Chief Operating Officer, Naozer Dadachanji. The Company’s directors, executive officers and key employees may not devote their full time and attention to the matters of the Company. Experienced personnel in the software, mobile technologies, data science, data security, and software as a service industries are in high demand and competition for their talents is intense. Also, as the Company strives to continue to adapt to technological change and introduce new and enhanced products and business models, we must be able to secure, maintain and develop the right quality and quantity of engaged and committed talent. The incentives the Company has available to attract, retain, and motivate employees provided by its equity awards may become less effective over time, and if the Company were to issue significant equity to attract additional directors, executive officers and key employees, the ownership of its existing stockholders would be diluted.

Although we desire for the Company to be an employer of choice, it may not be able to continue to successfully attract, retain and develop key personnel, which may cause its business to suffer. Without the services of Erin Papworth, Maia Monell, and Naozer Dadachanji (and any other executive officers and key employees acquired by the Company), the growth, progress, and overall success of the Company’s business, financial condition, cash flow and results of operations may be adversely affected.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Future growth could strain our resources, and if we are unable to manage our growth, we may not be able to successfully implement our business plan.

We hope to experience rapid growth in our operations, which will place a significant strain on our management, administrative, operational and financial infrastructure. Our future success will depend in part upon the ability of our management to manage growth effectively. This will require that we hire and train additional personnel to manage our expanding operations. In addition, we must continue to improve our operational, financial and management controls and our reporting systems and procedures. If we fail to successfully manage our growth, we may be unable to execute upon our business plan.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

Our reputation and the quality of our brand are critical to our business and success in existing markets and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our potential customers will require a high degree of reliability in the delivery of our services, and if we cannot meet their expectations for any reason, demand for our products and services will suffer.

Our success depends in large part on our ability to assure generally error-free services, uninterrupted operation of our network and software infrastructure, and a satisfactory experience for our end users when they use Internet-based communications services. To achieve these objectives, we depend on the quality, performance and scalability of our products and services, the responsiveness of our technical support and the capacity, reliability and security of our network operations. We also depend on third parties over which we have no control. For example, our ability to serve our customers is based solely on our network access agreement with one service provider and on that service provider's ability to provide reliable Internet access. Due to the high level of performance required for critical communications traffic, any failure to deliver a satisfactory experience to end users, whether or not caused by our own failures could reduce demand for our products and services.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

Concerns about the current privacy and cybersecurity environment, generally, could deter current and potential customers from adopting our products and services and damage our reputation.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

Litigation, regulatory actions and compliance issues could subject us to significant fines, penalties, judgments, remediation costs, negative publicity, changes to our business model, and requirements resulting in increased expenses.

Our business is subject to increased risks of litigation and regulatory actions as a result of a number of factors and from various sources, including as a result of the highly regulated nature of the financial services industry and the focus of state and federal enforcement agencies on the financial services industry.

From time to time, we may be involved in, or the subject of, reviews, requests for information, investigations and proceedings (both formal and informal) by state and federal governmental agencies and self-regulatory organizations, regarding our business activities and our qualifications to conduct our business in certain jurisdictions, which could subject us to significant fines, penalties, obligations to change our business practices and other requirements resulting in increased expenses and diminished earnings. Our involvement in any such matter also could cause significant harm to our reputation and divert management attention from the operation of our business, even if the matters are ultimately determined in our favor. Moreover, any settlement, or any consent order or adverse judgment in connection with any formal or informal proceeding or investigation by a government agency, may prompt litigation or additional investigations or proceedings as other litigants or other government agencies begin independent reviews of the same activities.

In addition, a number of participants in the financial services industry have been the subject of: putative class action lawsuits; state attorney general actions and other state regulatory actions; federal regulatory enforcement actions, including actions relating to alleged unfair, deceptive or abusive acts or practices; violations of state licensing and lending laws, including state usury laws; actions alleging discrimination on the basis of race, ethnicity, gender or other prohibited bases; and allegations of noncompliance with various state and federal laws and regulations relating to originating and servicing consumer finance loans.

The current regulatory environment, increased regulatory compliance efforts and enhanced regulatory enforcement have resulted in significant operational and compliance costs and may prevent us from providing certain products and services. There is no assurance that these regulatory matters or other factors will not, in the future, affect how we conduct our business and, in turn, have a material adverse effect on our business. In particular, legal proceedings brought under state consumer protection statutes or under several of the various federal consumer financial services statutes may result in a separate fine for each violation of the statute, which, particularly in the case of class action lawsuits, could result in damages substantially in excess of the amounts we earned from the underlying activities.

In addition, from time to time, through our operational and compliance controls, we identify compliance and other issues that require us to make operational changes and, depending on the nature of the issue, result in financial remediation to impacted customers. These self-identified issues and voluntary remediation payments could be significant, depending on the issue and the number of customers impacted, and also could generate litigation or regulatory investigations that subject us to additional risk.

Our future growth depends significantly on our marketing efforts, and if our marketing efforts are not successful, our business and results of operations will be harmed.

We have dedicated and intend to continue to dedicate significant resources to marketing efforts. Our ability to attract customers depends in large part on the success of these marketing efforts and the success of the marketing channels we use to promote our products and services. Our marketing channels include, but are not limited to, social media, traditional media such as the press, online affiliations, search engine optimization, and search engine marketing.

While our goal remains to increase the strength, recognition and trust in our brand by increasing our customer base and expanding our products and services, if any of our current marketing channels becomes less effective, if we are unable to continue to use any of these channels, if the cost of using these channels was to significantly increase or if we are not successful in generating new channels, we may not be able to attract new customers in a cost-effective manner or increase the platform activity of our customers. If we are unable to recover our marketing costs through increases in the size, value or overall number of refinancings we originate, or other product selection and utilization, it could have a material adverse effect on our business, financial condition, results of operations, cash flows and future prospects.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, financial services, data privacy and security, digital content, consumer protection, real estate, billing, e-commerce, promotions, quality of services, intellectual property ownership and infringement, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations, and we expect these costs to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

If we fail to retain existing users or add new users, or if our users decrease their level of engagement with our products or do not convert to paying users, our revenue, financial results and business may be significantly harmed.

The size of our user base and our users’ level of engagement are critical to our success. Our financial performance will be significantly determined by our success in adding, retaining and engaging users of our products and converting users into paying subscribers or in-app purchasers. We expect that the size of our user base will fluctuate or decline in one or more markets from time to time. If people do not perceive our products to be useful, reliable, and/or trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. A number of other financial technology companies that achieved early popularity have since experienced slower growth or declines in their user bases or levels of engagement. There is no guarantee that we will not experience a similar erosion of our user base or engagement levels. User engagement can be difficult to measure, particularly as we introduce new and different products and services. Any number of factors can negatively affect user retention, growth, and engagement, including if:

•

users increasingly engage with other competitive products or services;

•

user behavior on any of our products changes, including decreases in the quality of the user base and frequency of use of our products and services;

•

users feel that their experience is diminished as a result of the decisions we make with respect to the frequency, prominence, format, size and quality of ads that we display;

•

there are decreases in user sentiment due to questions about the quality of our user data practices or concerns related to privacy and the sharing of user data;

•

there are decreases in user sentiment due to questions about the quality or usefulness of our products or concerns related to safety, security, well-being or other factors;

•

users are no longer willing to pay for subscriptions or in-app purchases;

•

users have difficulty installing, updating or otherwise accessing our products on mobile devices as a result of actions by us or third parties that we rely on to distribute our products and deliver our services;

•

we fail to introduce new features, products or services that users find engaging or if we introduce new products or services, or make changes to existing products and services, that are not favorably received;

•

we fail to keep pace with evolving online, market and industry trends (including the introduction of new and enhanced digital services);

•

initiatives designed to attract and retain users and engagement are unsuccessful or discontinued, whether as a result of actions by us, third parties or otherwise;

•

there is a decrease in user retention as a result of users finding interesting and meaningful content on our platform and no longer needing to engage with our products;

•

third-party initiatives that may enable greater use of our products, including low-cost or discounted data plans, are discontinued;

•

we adopt terms, policies or procedures related to areas such as user data or advertising that are perceived negatively by our users or the general public;

•

we fail to combat inappropriate or abusive activity on our platform;

•

we fail to provide adequate customer service to users, marketers or other partners;

•

we fail to protect our brand image or reputation;

•

we, our partners or companies in our industry are the subject of adverse media reports or other negative publicity, including as a result of our or their user data practices;

•

technical or other problems prevent us from delivering our products in a rapid and reliable manner or otherwise affect the user experience, such as security breaches, distributed denial-of-service attacks or failure to prevent or limit spam or similar content;

•

there is decreased engagement with our products as a result of internet shutdowns or other actions by governments that affect the accessibility of our products in any of our markets;

•

there is decreased engagement with our products, or failure to accept our terms of service, as part of changes that we have implemented, or may implement, in the future in connection with regulations, regulatory actions or otherwise;

•

there is decreased engagement with our products as a result of changes in prevailing social, cultural or political preferences in the markets where we operate; or

•

there are changes mandated by legislation, regulatory authorities or litigation that adversely affect our products or users.

From time to time, certain of these factors may negatively affected user retention, growth, and engagement to varying degrees. If we are unable to maintain or increase our user base and user engagement, our revenue and financial results may be materially adversely affected. Any decrease in user retention, growth or engagement could render our products less attractive to users, which is likely to have a material and adverse impact on our revenue, business, financial condition and results of operations. If our user growth rate slows or declines, we will become increasingly dependent on our ability to maintain or increase levels of user engagement and monetization in order to drive revenue growth.

The financial technology industry is highly competitive, with low switching costs and a consistent stream of new products and entrants, and innovation by our competitors may disrupt our business.

The financial technology industry is highly competitive, with a consistent stream of new products and entrants. Some of our competitors may enjoy better competitive positions in certain geographical regions, user demographics or other key areas that we currently serve or may serve in the future. These advantages could enable these competitors to offer products that are more appealing to users and potential users than our products, or to respond more quickly and/or cost-effectively than us to new or changing opportunities.

In addition, within the financial technology industry generally, costs for consumers to switch between products are low, and consumers have a propensity to use multiple fintech products at the same time. As a result, new products, entrants and business models are likely to continue to emerge. It is possible that a new product could gain rapid scale at the expense of existing brands through harnessing a new technology, or a new or existing distribution channel, creating a new or different approach.

Potential competitors include larger companies that could devote greater resources to the promotion or marketing of their products and services, take advantage of acquisition or other opportunities more readily or develop and expand their products and services more quickly than we do. Potential competitors also include established social media companies that may develop products, features, or services that may compete with ours or operators of mobile operating systems and app stores. These social media and mobile platform competitors could use strong or dominant positions in one or more markets, and ready access to existing large pools of potential users and personal information regarding those users, to gain competitive advantages over us. These may include offering different product features, services or pricing models that users may prefer, which may enable them to acquire and engage users at the expense of our user growth or engagement.

If we are not able to compete effectively against our current or future competitors and products that may emerge, the size and level of engagement of our user base may decrease, which could materially adversely affect our business, financial condition and results of operations.

Distribution and marketing of, and access to, our products depends, in significant part, on a variety of third-party publishers and platforms. If these third parties limit, prohibit or otherwise interfere with or change the terms of the distribution, use or marketing of our products in any material way, it could materially adversely affect our business, financial condition and results of operations.

We market and distribute our products (including related mobile applications) through a variety of third-party publishers and distribution channels. Our ability to market our brand on any given property or channel is subject to the policies of the relevant third party. There is no guarantee that mobile device users will use our products rather than competing products. We are dependent on the interoperability of our products with popular mobile operating systems, networks, technologies, products, and standards that we do not control, such as the Android and iOS operating systems. Any changes, bugs, or technical issues in such systems, or changes in our relationships with mobile operating system partners, handset manufacturers, or mobile carriers, or in their terms of service or policies that degrade our products’ functionality, reduce or eliminate our ability to update or distribute our products, give preferential treatment to competitive products, limit our ability to deliver, target, or measure the effectiveness of ads, or charge fees related to the distribution of our products or our delivery of ads could materially adversely affect the usage of our products on mobile devices. For example, the release of iOS 14 brought with it a number of new changes, including the need for app users to opt in before their identifier for advertisers (“IDFA”) can be accessed by an app. Apple’s IDFA is a string of numbers and letters assigned to Apple devices which advertisers use to identify app users to deliver personalized and targeted advertising. App users’ opt-in rates to grant IDFA access has been approximately 20% based on various reports. As a consequence, the ability of advertisers to accurately target and measure their advertising campaigns at the user level has become significantly more limited and app developers have experienced increased costs per registration.

Further, certain publishers and channels have, from time to time, limited or prohibited advertisements for fintech products for a variety of reasons, including as a result of poor behavior by other industry participants. There is no assurance that we will not be limited or prohibited from using certain current or prospective marketing channels in the future. If this were to happen in the case of a significant marketing channel and/or for a significant period of time, our business, financial condition and results of operations could be materially adversely affected.

Finally, many users have historically registered for (and logged into) applications such as ours through their Facebook profiles or their Apple IDs. While we have other methods that allow users to register for (and log into) our products, no assurances can be provided that users will use these other methods. Facebook and Apple have broad discretion to change their terms and conditions in ways that could limit, eliminate or otherwise interfere with our ability to use Facebook or Apple as a registration method or to allow Facebook or Apple to use such data to gain a competitive advantage. If Facebook or Apple did so, our business, financial condition and results of operations could be materially adversely affected. Additionally, if security on Facebook or Apple is compromised, if our users are locked out from their accounts on Facebook or Apple or if Facebook or Apple experiences an outage, our users may be unable to access our products. As a result, user growth and engagement on our service could be materially adversely affected, even if for a temporary period. We also rely on Facebook for targeted advertisement and performance marketing. In the event that we are no longer able to conduct targeted advertisement and performance marketing through Facebook, our user acquisition and revenue stream may be materially adversely affected. Any of these events could materially adversely affect our business, financial condition and results of operations.

Access to our products depends on mobile app stores and other third parties such as data center service providers, as well as third party payment aggregators, computer systems, internet transit providers and other communications systems and service providers. If third parties such as the Apple App Store or Google Play Store adopt and enforce policies that limit, prohibit or eliminate our ability to distribute or update our applications through their stores, it could materially adversely affect our business, financial condition and results of operations.

Our products depend on mobile app stores and other third parties such as data center service providers, as well as third party payment aggregators, computer systems, internet transit providers and other communications systems and service providers. Our mobile applications will be almost exclusively accessed through and depend on the Apple App Store and the Google Play Store. While our mobile applications will be generally free to download from these stores, we may offer our users the opportunity to purchase subscriptions and certain à la carte features through these applications. We determine the prices at which these subscriptions and features are sold. Purchases of these subscriptions and features via our mobile applications will be mainly processed through the in-app payment systems provided by Apple and Google. We will pay Apple and Google, as applicable, a meaningful share (which may be 30% or more) of the revenue we receive from transactions processed through in-app payment systems.

Both Apple and Google have broad discretion to make changes to their operating systems or payment services or change the manner in which their mobile operating systems function and their respective terms and conditions applicable to the distribution of our applications, including the amount of, and requirement to pay, certain fees associated with purchases required to be facilitated by Apple and Google through our applications, and to interpret their respective terms and conditions in ways that may limit, eliminate or otherwise interfere with our products, our ability to distribute our applications through their stores, our ability to update our applications, including to make bug fixes or other feature updates or upgrades, the features we provide, the manner in which we market our in-app products, our ability to access native functionality or other aspects of mobile devices, and our ability to access information about our users that they collect. To the extent either or both of them do so, our business, financial condition and results of operations could be materially adversely affected.

Our user metrics and other estimates are subject to inherent challenges in measurement, and real or perceived inaccuracies in those metrics may seriously harm and negatively affect our reputation and our business.

We must regularly review metrics to evaluate growth trends, measure our performance, and make strategic decisions. These metrics may be calculated using internal company data and data received from independent third parties. While we anticipate that these metrics will be based on what we believe to be reasonable estimates of our user base for the applicable period of measurement, there will be inherent challenges in measuring how our products are used across large populations. Our user metrics may also be affected by technology on certain mobile devices that automatically runs in the background of our application when another phone function is used, and this activity can cause our system to miscount the user metrics associated with such account. The methodologies used to measure these metrics will require significant judgment and are also susceptible to algorithm or other technical errors. In addition, as we seek to improve our estimates of our user base, such estimates may change due to improvements or changes in our methodology.

Errors or inaccuracies in our metrics or data could also result in incorrect business decisions and inefficiencies. For instance, if a significant understatement or overstatement of active users were to occur, we may expend resources to implement unnecessary business measures or fail to take required actions to attract a sufficient number of users to satisfy our growth strategies. We plan to continually seek to address technical issues in our ability to record such data and improve our accuracy but given the complexity of the systems involved and the rapidly changing nature of mobile devices and systems, we expect these issues to continue. If our partners do not perceive our user, geographic, or other demographic metrics to be accurate representations of our user base, or if we discover material inaccuracies in our user, geographic, or other demographic metrics, our reputation may be materially adversely impacted.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts.

Specifically, the Company filed a Form D with the U.S. Securities and Exchange Commission via its EDGAR filing system on April 1, 2021. The Form D was filed in connection with the issuance of SAFEs (Simple Agreements for Future Equity) to investors (including conversion of certain promissory notes into SAFEs) since 2020. The Form D was not filed within 15 days after the first sale of the securities referenced therein as required by Regulation D of the Securities Act. Furthermore, the offering of SAFEs is expected to continue after the first anniversary of the filing date of the Form D, which requires an amendment thereto to be filed with the Securities and Exchange Commission. This amendment filing was not filed on or before the one-year anniversary of the original Form D filing as required by Regulation D of the Securities Act for continuing offerings, but the amendment filing has been completed as of the date of this Form C. Lastly, certain states where SAFE investors reside may require notice filings with their respective secretary of states (or the other appropriate securities regulatory agency in that state) pursuant to that state’s securities laws applicable to Regulation D offerings conducted in that state. The Company didn’t file the notice filings within 15 days after the first sale of SAFEs in some of the applicable states as required by the applicable securities laws of such states; however, such state filings have been made prior to the date of this Form C as deemed necessary by the Company’s securities counsel.

If the Company were ever deemed to have violated federal or state securities laws in connection with the above referenced SAFE offering or any other prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future.

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

You should not rely on the fact that our Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it relates to this Offering. The U.S. Securities and Exchange Commission has not reviewed this Form C, nor any document or literature related to this Offering.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this Form C and the accompanying exhibits.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may also end the Offering early.

If the Target Offering Amount is met after 21 calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least 5 business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE ((Simple Agreement for Future Equity) investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into CF Shadow Securities. The Company is under no obligation to convert the Securities into CF Shadow Securities. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities.

Investors will not have the right to vote upon matters of the Company even if and when their Securities are converted into CF Shadow Securities (the occurrence of which cannot be guaranteed). Upon such conversion, the CF Shadow Securities will have no voting rights and, in circumstances where a statutory right to vote is provided by state law, the CF Shadow Security holders or the party holding the CF Shadow Securities on behalf of the Investors are required to enter into a proxy agreement with its designee to vote their CF Shadow Securities with the majority of the holder(s) of the securities issued in the round of equity financing that triggered the conversion right. For example, if the Securities are converted in connection with an offering of Series B Preferred Stock, Investors would directly or beneficially receive CF Shadow Securities in the form of shares of Series B-CF Shadow Preferred Stock and such shares would be required to be subject to a proxy that allows a designee to vote their shares of Series B-CF Shadow Preferred Stock consistent with the majority of the Series B Preferred Stockholders. Thus, Investors will essentially never be able to vote upon any matters of the Company unless otherwise provided for by the Company.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and as a consequence holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company.

The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities.

In addition, the Company has certain equity grants and convertible securities outstanding. Should the Company enter into a financing that would trigger any conversion rights, the converting securities would further dilute the equity securities receivable by the holders of the Securities upon a qualifying financing.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the First Equity Financing Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the First Equity Financing Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company.

The forgoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

There is no present market for the Securities and we have arbitrarily set the price.

The Offering price was not established in a competitive market. We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our asset value, net worth, revenues or other established criteria of value. We cannot guarantee that the Securities can be resold at the Offering price or at any other price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred stock, have been paid in full. Neither holders of the Securities nor holders of CF Shadow Securities can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.