The financial health app helping everyone build a future of wealth + health

Summary

- Founded by a behavioral scientist

- Automated coaching based on proprietary AI

- Identifies money habits, personalities, and potential risks

- Targeting young earners and Zillennials

- Leveraging strategic, affiliate, and employee partnerships

- 50,000+ Navigators, 1 employer pilot, 2 distribution pilots

- Featured in Forbes, Bloomberg, Medium, USA Today, Yahoo! Finance

Problem

We can't afford to be financially unhealthy

It's costing the next gen thousands

Zillennials lose an average of $20,000 a year due to one (or all) of these three things.

This is a potential loss of over $10 trillion in wealth over the course of the Zillennial lifetime.

There's never been more access to growing wealth ... or so much to navigate. Consumers are forced to find unconventional ways to 'hack' their financial lives. Add in a lack of personalized resources, rising student loan debt, and COVID-19, and our seemingly stable financial system starts to feel a lot less secure. Financial insecurity leads to financial stress, which negatively impacts emotional and physical health. It's a costly cycle.

Solution

Measure and correlate individual behavior and banking trend data to mitigate financial stress, improve creditworthiness, and build better behavioral outcomes

Daily habits

Build personalized habits to reduce financial stress and increase financial confidence. Your data informs your behavior change.

Personalized action

Use proprietary behavioral data to define your own roadmap and automate your way to financial freedom. Automate savings, spending, debt, and eventually investing and defi.

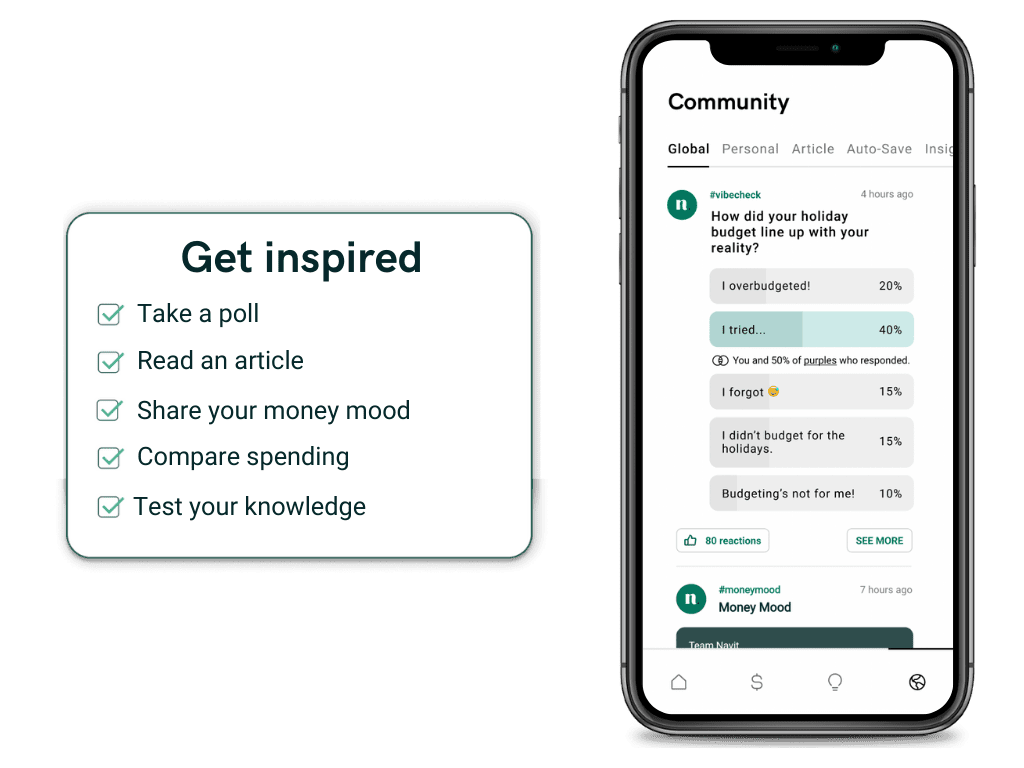

Social+

Leverage community and a sense of belonging to build generational wealth. You're not alone and this generation is changing the world.

Product

Where wealth meets health

We're more than just a money app

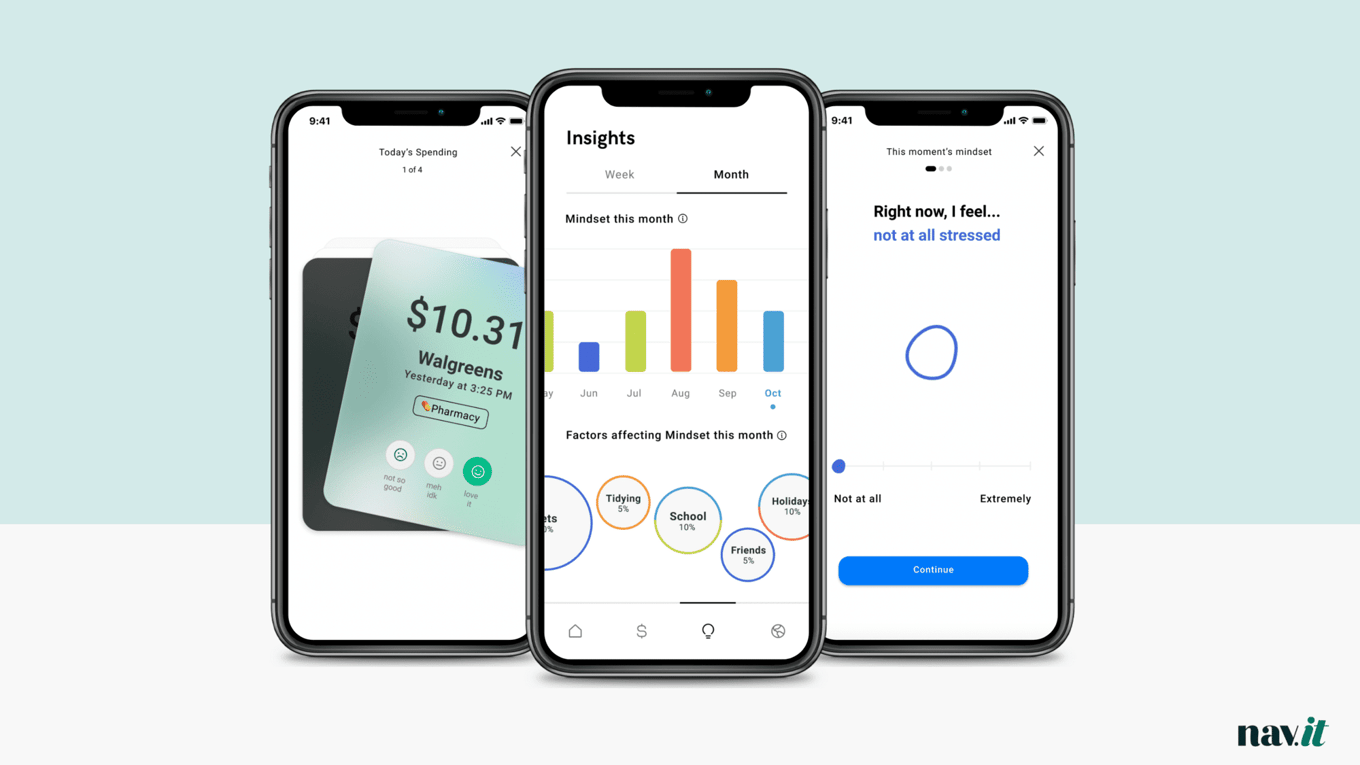

Nav.it focuses on your habits and stress levels to improve behavior alongside a community of peers striving for financial wellness.

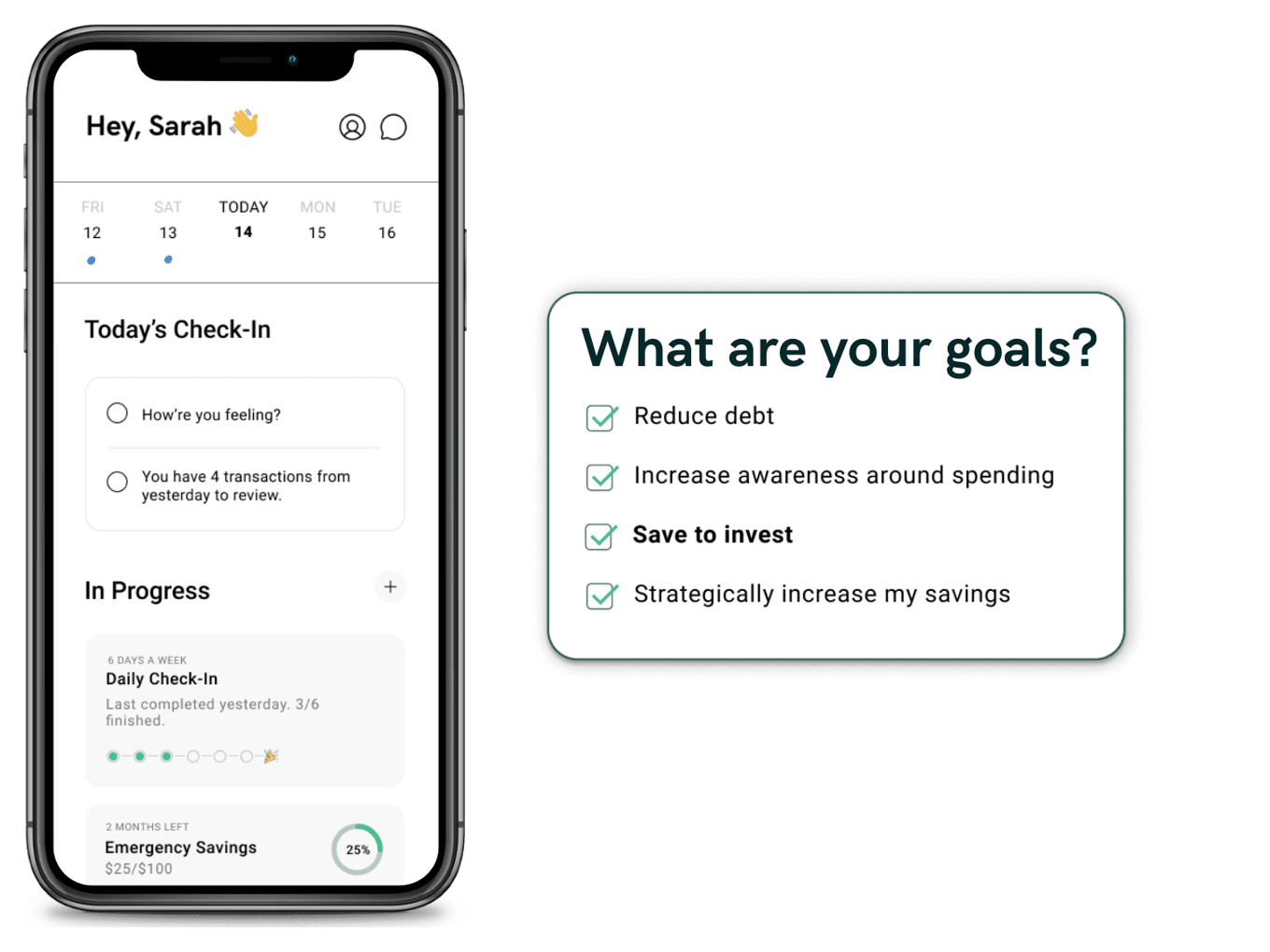

Step 1. Define your goals.

Navigators “get to know themselves” through a proprietary personality test that helps them identify their values, spending personas, and big picture goals.

Step 2. Identify existing behaviors.

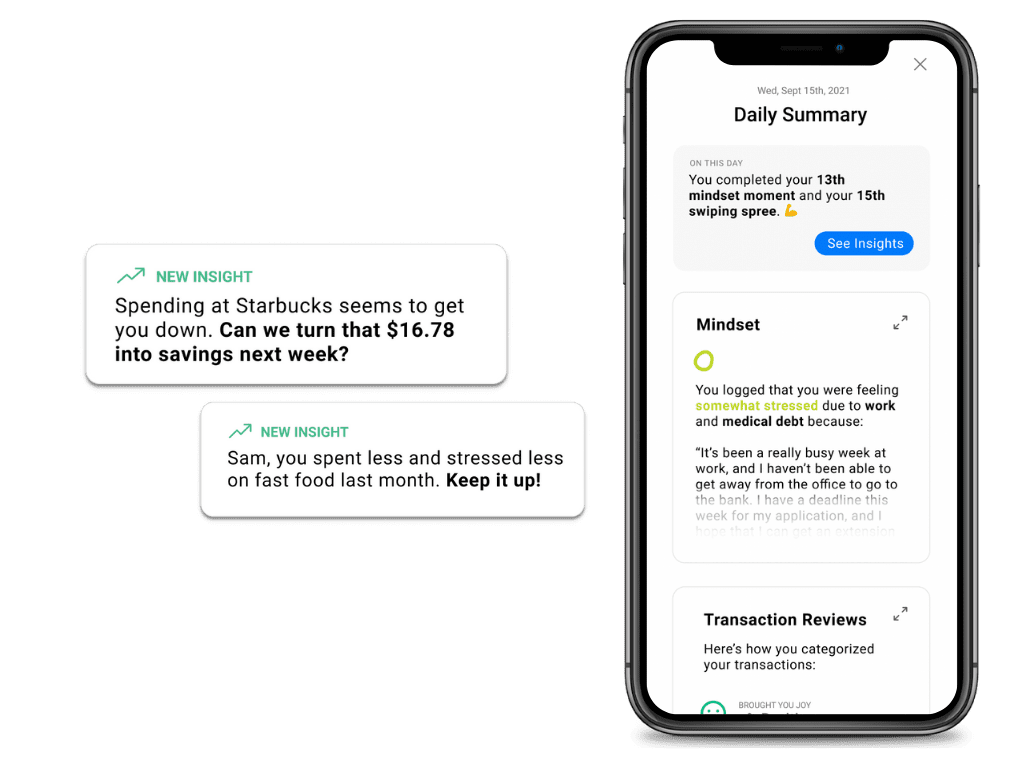

Navigators track their money habits by logging their moods and 'swiping left or right' on their expenses daily. We then surface unique insights to correlate behavioral and financial trends over time.

Step 3. Build a financial roadmap.

Insights help Navigators set up micro spending and savings goals. They can engage with others on their journey and even choose one-on-one coaching for extra support.

We are currently designing a tailored, modular roadmap based on incremental financial habit changes that result in long-term gains over time.

Step 4. It's okay to talk about money.

A sense of belonging increases confidence. We’re building a financial social network that encourages positive behavior and rejects the reinforced superficiality of other social networks.

We’ll foster open conversations about money, support healthy small group interactions, and help Navigators connect to others.

Traction

Traction to date

Changing financial behaviors, one day at a time.

Early adopters pave the way for savings at scale

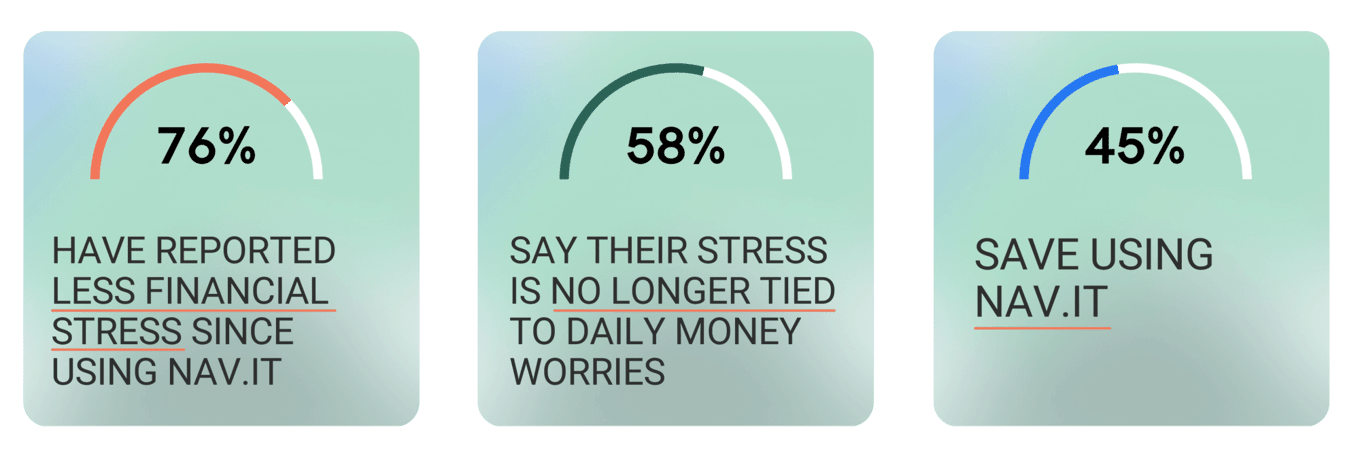

500 Navigator cohort, 12-month study duration

Our team has focused on converting high-quality users interested in connecting their emotional motivations with their financial outcomes.

Customers

Market adoption

The social+finance app that helps young earners chart the course for intergenerational wealth

"Young Earner"

We've built a brand, and feature set, for the Young Earner.

Young Earners are:

- Financially motivated

- Newly on-their-own

- Not on Wall Street or at one of the big 5 tech campuses

- Changemakers, independent thinkers, and financial hackers

Young Earners are keen to grow wealth, but know they need a solid financial foundation in order to do safely and confidently.

User testimonials

Personal finance is personal

Partnerships

Affiliate & strategic expand reach

We've already begun partnering with names across the financial health community to expand our reach and tune in growth.

- Young Alfred

- Trust & Will

- Bright Ventures

- NBKC Bank

- Juno

- Bestow

- Public

Business model

Multi-sided revenue model

Banking products, employee benefits, 1-1 coaching, premium options with creators & partners

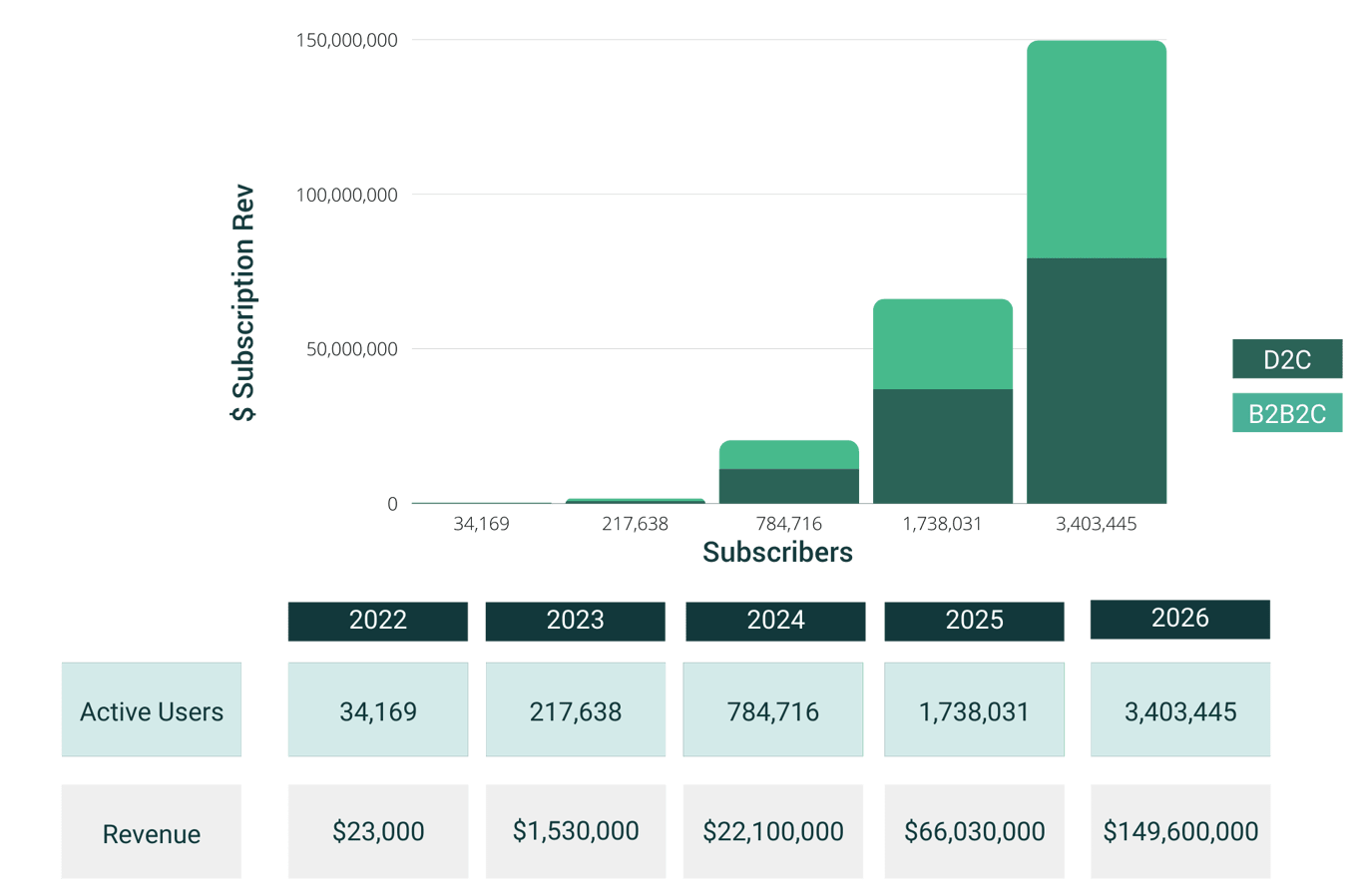

Projections

Click here for important information regarding Financial Projections which are not guaranteed.

Market

Market validation

People are having more meaningful financial conversations that go beyond trendy meme stocks.

There's never been a better time to build a money management app that can understand the root causes of financial behavior, provide quality coaching at an accessible price, and connect the millions of young people desperate for financial direction.

Market size

This is a $3B market with 4M new Young Earners graduating every year. The mobile money management market is expanding as more and more people turn to digital banking solutions.

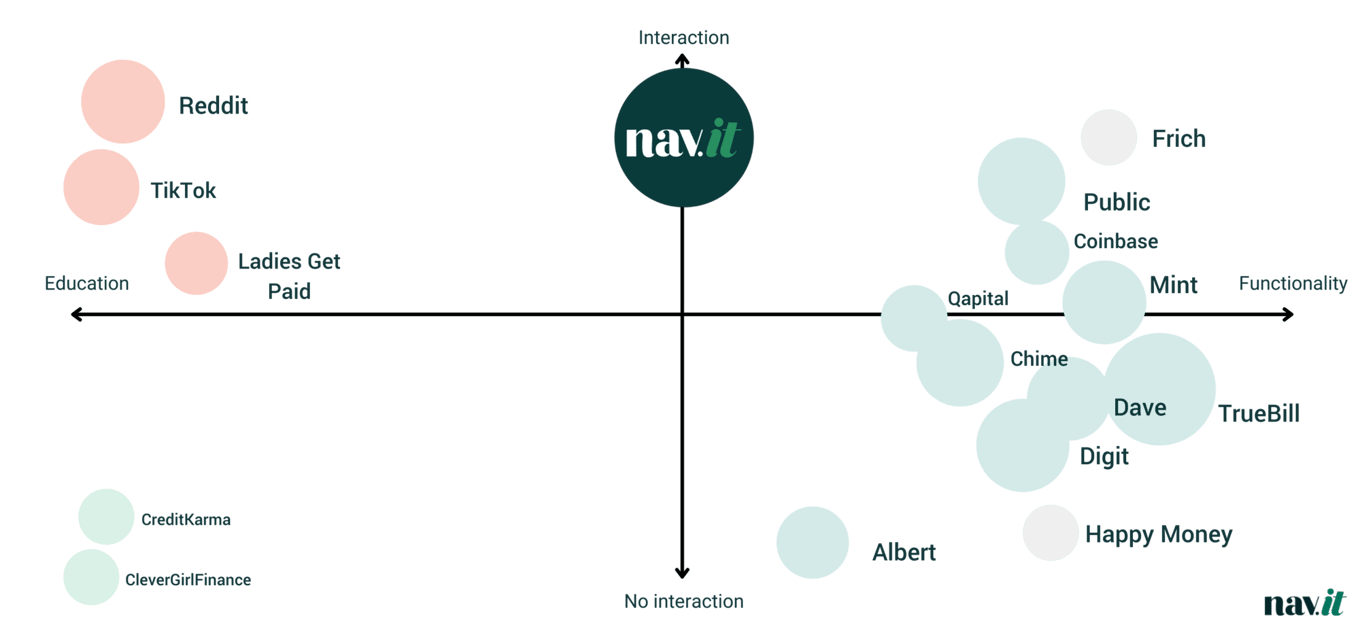

Competition

The ability to transact is not enough

Fintechs are great at functionality: streamlining age-old inefficiencies to bring more clarity to net worth and monthly balances. However, the existing competition fails to identify and solve the personal pain points of consumers.

It’s time we take the learnings from recent fintech+social apps (like Venmo and Public) and apply them to personal financial management.

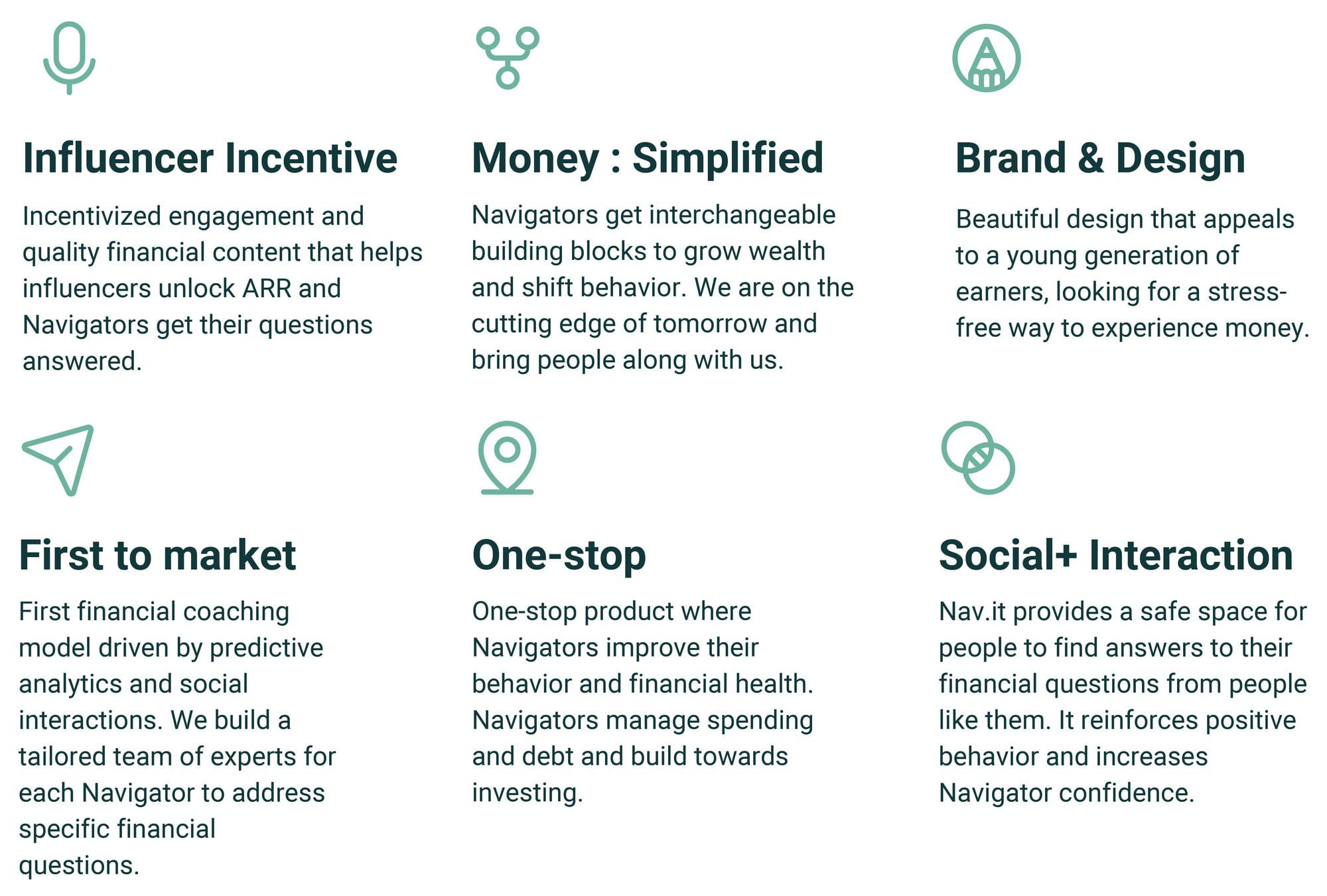

Competitive advantages

We make money simple by giving users clear steps to grow wealth

Nav.it's financial coaching model, driven by predictive analytics, serves as a one-stop product where Navigators automate their behavior and financial health.

Vision and strategy

Vision

To be the pioneering behavioral health platform that compels society to accept that financial health is a foundation for safety, security, self-confidence, and a future of wealth.

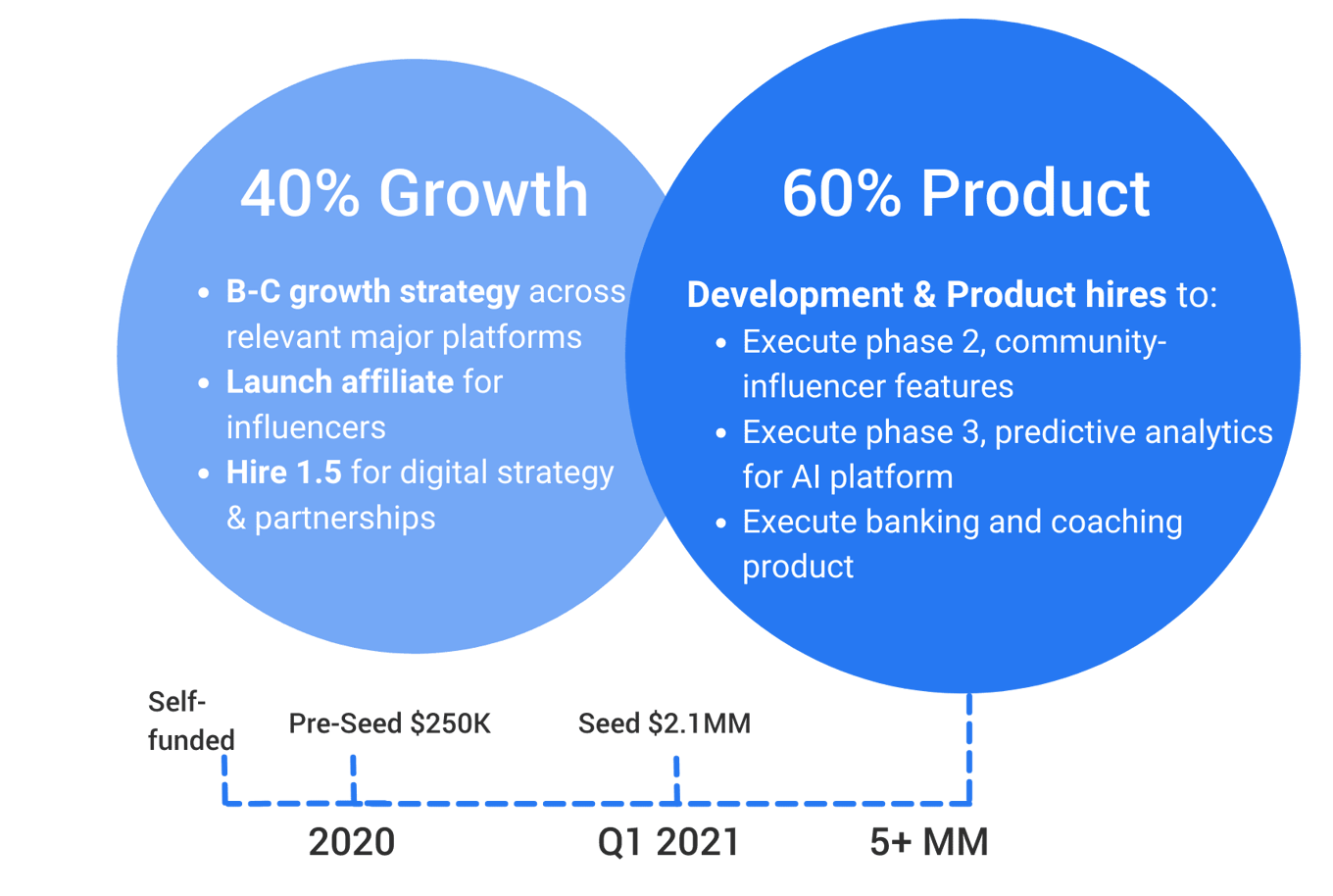

Use of Funds

Banking with your financial wellness in mind

Employers

As an essential health benefit, employers can pay for Nav.it

Loss of productivity combined with absenteeism from financial stress costs employers more than an estimated $2,100 per year, per employee.

68% of employees would prioritize financial wellness benefits above an extra week of vacation. Employees expect their health care to be comped; employers are willing to pay for a healthy workforce.

We'll seek to emulate the success of health tech brands (like Talkspace, Calm, Headspace, and Noom) that penetrated the B2B2C channel through a bottom-up approach.

Funding

Primary investors

A successful over-subscription of our Seed round, and beyond

- Silicon Valley fintech venture firm, ThirdStream Partners

- NY-based Copper Wire Ventures

- San Francisco-based Gravity Capital

- the Co-founder of Petal

- an influential group of angel investors

Invest in a financially healthy future for all with Nav.it.

Founders

Erin Papworth

Founder & CEO

2x Entrepreneur, Behavioral Scientist, MPH, Int'l Economics and Management

Maia Monell

Co-founder & CGO

Growth Marketing, Business Development Expert, MS in Marketing Strategy & Innovation

<youtube>https://youtu.be/tulWxDe8EkU</youtube>

C- Suite Bios

Erin Papworth

Erin is the CEO and co-founder of Nav.it. A two-time entrepreneur, she spent over a decade living and working overseas, managing multi-million dollar programs and working for organizations like Johns Hopkins University, Doctors without Borders, the United Nations, and the United States Government. During her tenure, Erin established the West Africa Regional Office for JHU. She led the development and actualization of implementation science programs. These programs increased access to health services for over 100,000 people and directly facilitated positive behavior change among highly vulnerable populations. In 2015, Erin successfully built Avery Franklin Consulting, LLC, a consulting firm with significant expertise in epidemiological field research, behavior change assessments and programming, data science, and policy analysis, especially in countries experiencing trauma. Upon return to the States, Erin became passionate about increasing access to financial resources for financially coping populations in order to help them take advantage of the American financial system and grow intergenerational wealth.

Maia Monell

Before co-founding Nav.it in 2019, Maia was a founding team member of BridgeAthletic, the elite performance technology leveraging prescriptive AI to change the game of coaching, training delivery and reporting. While at Bridge, Maia built the B2B2C offering, scaling 250+% ARR. Having seen the detrimental effects poor financial and mental health have on performance, Maia teamed up with Erin Papworth to bring a prescriptive, behavioral approach to finance. Maia leads the growth team at Nav.it. Under her leadership, the brand has grown over 150% in the last year and has launched two new distribution channels: Nav.it at Work and Nav.it on Campus, to meet the growing burden of financial stress at work and on campus. Outside of Nav.it, Maia’s the founding partner of MoDa Partners, a group investing in the economic and educational empowerment of women. She’s also a board member of her family’s two foundations. Maia has a MS in Marketing Strategy & Innovation from Bayes Business School (formerly Cass Business School) and a BA in English from Wake Forest University.

Naozer Dadachanji

Naozer Dadachanji is the COO of Nav.it, a pioneer in coaching people through behavior change to improve their financial wellness. Naozer Dadachanji was a member of the senior management team at Barclays Global Investors (BGI), the industry leader in the field of systematic, quantitative investing until its sale to BlackRock in 2009. Working with the CEO and other C-Suite members, he was instrumental in developing and executing on a business plan that increased the company’s valuation from $430mm in 1996 to $13.5B in 2009. During a 12-year tenure, he held positions that included Chief Operating Officer for the Active Businesses (revenues of $2.5B), Global Co-Head of Active Equities (AUM $100B+), Global Head of Product, Investment, and Capital Markets for iShares. Since leaving BGI/BlackRock in 2012, Naozer has been an investor in, and advisor to early-stage companies, actively engaging with leadership teams, inside and outside the boardroom.

Erin Papworth

Founder & CEO

2x Entrepreneur, Behavioral Scientist, MPH, International Economics and Management

Maia Monell

Co-founder & CGO

Growth Marketing, Business Development Expert, MS in Marketing Strategy & Innovation

Naozer Dadachanji

President & COO

Barclays Global Investments, M&A to BlackRock, iShares executive, MS in Mathematical Science

Toby Miller

CTO

Jen Sapel, ChFC, WMCP

Director of Education

Paul Campbell

Head of Product

Kaitlyn Ranze

Sr. Communications & Education Manager

Morgen Quintus

Lead Product Designer

Erin Peczynski

Marketing Manager

Sami Miller

Digital Marketing Director

Kenneth Medford

Contributor & Podcast Co-Host

Robert Zwink

Advisor: ClickSWITCH CTO, BillGO EVP

David Ehrich

Advisor: Co-founder, Petal

Christopher Trepel, Ph.D.

Advisor: Operating Partner, Fenway Summer Ventures

Risks

There is no assurance that our revenue and business model will be successful.

We are continually refining our revenue and business model, which is premised on creating a virtuous cycle for our customers to engage in more products across our platform. There is no assurance that these efforts will be successful or that we will generate revenues commensurate with our efforts and expectations or become profitable. We may be forced to make significant changes to our revenue and business model to compete with our competitors’ offerings, and even if such changes are undertaken, there is no guarantee that they will be successful.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

We may face potential difficulties in obtaining capital.

We may not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

We may implement new lines of business or offer new products and services within existing lines of business.

We rely on other companies to provide components and services for our products.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company’s success depends on the experience and skill of the board of directors, its executive officers and key employees.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

Future growth could strain our resources, and if we are unable to manage our growth, we may not be able to successfully implement our business plan.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

Our potential customers will require a high degree of reliability in the delivery of our services, and if we cannot meet their expectations for any reason, demand for our products and services will suffer.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Concerns about the current privacy and cybersecurity environment, generally, could deter current and potential customers from adopting our products and services and damage our reputation.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

Litigation, regulatory actions and compliance issues could subject us to significant fines, penalties, judgments, remediation costs, negative publicity, changes to our business model, and requirements resulting in increased expenses.

Our future growth depends significantly on our marketing efforts, and if our marketing efforts are not successful, our business and results of operations will be harmed.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

If we fail to retain existing users or add new users, or if our users decrease their level of engagement with our products or do not convert to paying users, our revenue, financial results and business may be significantly harmed.

The financial technology industry is highly competitive, with low switching costs and a consistent stream of new products and entrants, and innovation by our competitors may disrupt our business.

Distribution and marketing of, and access to, our products depends, in significant part, on a variety of third-party publishers and platforms. If these third parties limit, prohibit or otherwise interfere with or change the terms of the distribution, use or marketing of our products in any material way, it could materially adversely affect our business, financial condition and results of operations.

Access to our products depends on mobile app stores and other third parties such as data center service providers, as well as third party payment aggregators, computer systems, internet transit providers and other communications systems and service providers. If third parties such as the Apple App Store or Google Play Store adopt and enforce policies that limit, prohibit or eliminate our ability to distribute or update our applications through their stores, it could materially adversely affect our business, financial condition and results of operations.

Our user metrics and other estimates are subject to inherent challenges in measurement, and real or perceived inaccuracies in those metrics may seriously harm and negatively affect our reputation and our business.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

The Company has the right to extend the Offering Deadline.

The Company may also end the Offering early.

The Company has the right to conduct multiple closings during the Offering.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will be unable to declare the Security in “default” and demand repayment.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

There is no present market for the Securities and we have arbitrarily set the price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

There is no guarantee of a return on an Investor’s investment.