Oracle Corporation: Difference between revisions

No edit summary |

No edit summary |

||

| (44 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

__INDEX__ | |||

== | == Investment Thesis == | ||

We suggest adopting a long position on this stock, positioning it as an appealing option for buying due to its consistent and expanding dividend, steady growth in revenue, and the anticipated substantial growth in the cloud infrastructure sector. There are several positive aspects within the business and financial realms that we expect to yield favorable results, aspects that the investor community currently undervalues. Oracle's Cloud Infrastructure (OCI) is predicted to outperform its competitors due to its superior performance and more affordable pricing. The company is also actively reinvesting significant capital into its operations, as evidenced by its noteworthy capital expenditures and escalating research and development costs. This could effectively support its strategic acquisition approach and product range expansion. Our projected price target, based on the DCF model's base case, stands at $131.43. Furthermore, additional potential for growth is indicated by a comparable company analysis, which demonstrates that the company is currently underestimated by investors relative to its peers, particularly when considering EV/EBITDA and P/E ratios<ref name=":0">John Soursos. (2023). Applied Project (MSc in Financial Technology, Imperial College Business School).</ref>. | |||

== Business Analysis == | == Business Analysis == | ||

Oracle | Oracle provides products and services that address enterprise information technology (IT) environments. Oracle's operations are categorized into four distinct business segments: Cloud services and license assistance, Cloud License and on-premise license, Hardware, and Services. | ||

Oracle cloud services | Oracle's range of cloud services covers a diverse spectrum of offerings, encompassing Oracle Software-as-a-Service and Oracle Cloud Infrastructure, all delivered through a cloud-centric framework. Users can conveniently access these services via their preferred web browser. These Oracle cloud services have been strategically designed to expedite their implementation, leading to quicker innovation timelines. These services feature a user-friendly interface, catering to both novice and experienced users, and are engineered for simplified maintenance, reducing the effort needed for upgrades, integration, and testing. Furthermore, these services seamlessly integrate across different deployment models, enhancing flexibility among diverse IT environments. They ensure smooth compatibility, facilitating the transition of workloads between the Oracle Cloud and other IT configurations. In addition, these services are cost-efficient, requiring lower initial investments from customers. Primarily, they prioritize stringent security measures, adhere to established standards, and provide unwavering reliability. | ||

Oracle | Oracle Applications Technologies form an integral component of the cloud services and license support business division. This sector encompasses the company's Software-as-a-Service (SaaS) offerings, widely adopted by numerous global corporations, along with license support that is typically acquired by all Oracle customers. These support solutions offered by the company play a crucial role in safeguarding and augmenting the investments made by its clientele in Oracle applications. Among these provisions are proactive and personalized support services, notably Oracle Lifetime Support, in addition to unspecified license improvements and updates during the support duration. These services are meticulously crafted to ensure that customers receive all-encompassing aid and protection for their Oracle products, ultimately enhancing the value and lifespan of their investments. Over the years 2023, 2022, and 2021, revenues from Oracle Applications Technologies and license support contributed 47%, 42%, and 41%, respectively, to the overall cloud services and license support revenues. | ||

Oracle | Oracle provides its infrastructure technologies to clients through two main avenues: the cloud and license business segment, as well as the hardware business segment. Within the cloud and license business category, these infrastructure technologies encompass the renowned Oracle Database, acknowledged globally as the premier enterprise database solution. Furthermore, it encompasses Java, which holds the distinction of being the most widely utilized software development language in the computer industry. This portfolio also encompasses an array of middleware tools and development resources. These infrastructure technologies are accessible either through subscription to Oracle Cloud Infrastructure (OCI) offerings or via the acquisition of licenses, accompanied by associated license support. This affords customers the flexibility to deploy these technologies within the Oracle Cloud, integrate them into on-premise cloud services, or implement them within their own IT environments. Notably, the company's revenue from infrastructure cloud services and license support represented 53%, 58%, and 59% of total cloud services and license support earnings for the years 2023, 2022, and 2021 respectively. | ||

Oracle infrastructure technologies also | The range of Oracle's infrastructure technologies also encompasses products available via the corporation's hardware business sections. This part of the business is divided into: | ||

* Oracle servers (e.g. servers consisting of Oracle SPARC microprocessor or x86 microprocessor) | * Oracle servers (e.g. servers consisting of Oracle SPARC microprocessor or x86 microprocessor) | ||

| Line 22: | Line 21: | ||

* Oracle operating systems (e.g. Oracle Linux, Oracle Solaris) | * Oracle operating systems (e.g. Oracle Linux, Oracle Solaris) | ||

* Oracle hardware support (provides support for oracle systems though software updates of the hardware products, repairs, and technical support) | * Oracle hardware support (provides support for oracle systems though software updates of the hardware products, repairs, and technical support) | ||

The fourth business segment, known as Oracle Services, delivers advisory and training services to assist customers in optimizing the use of Oracle's applications and infrastructure technologies<ref>Oracle. (2023). Annual Report: 2023.[https://s23.q4cdn.com/440135859/files/doc_financials/2023/q4/10-K.pdf]</ref>. | |||

The fourth business segment, | |||

The revenue contribution for of the four business segments can be seen in the following table: | The revenue contribution for of the four business segments can be seen in the following table: | ||

| Line 29: | Line 27: | ||

|+ | |+ | ||

!Business Segment | !Business Segment | ||

!Revenue ( | !Revenue (in $ millions) | ||

!% of | !% of total revenue | ||

|- | |- | ||

|Cloud services and license support | |Cloud services and license support | ||

| Line 52: | Line 50: | ||

Oracle's widely used SaaS products include, among others: | Oracle's widely used SaaS products include, among others: | ||

• Oracle Fusion Cloud Enterprise Resource Planning (ERP), which is a comprehensive and unified ERP solution that aims to enhance organizational decision-making and workforce efficiency while streamlining back-office operations. It is designed to be a fully integrated and global platform, enabling businesses to benefit from a shared data and security model, along with a consistent user interface. By adopting Oracle Fusion Cloud ERP, organizations can optimize their processes and achieve improved productivity on a global scale. | |||

• Oracle Fusion Cloud Enterprise Performance Management (EPM), which is a purpose-built solution aimed at evaluating financial performance, facilitating precise and flexible financial planning, enhancing the efficiency of financial close and consolidation procedures, simplifying account reconciliation, and meeting the reporting needs of organizations. | |||

• Oracle Fusion Cloud Supply Chain and Manufacturing Management (SCM), which is a tailored offering intended to support organizations in establishing, enhancing, and digitalizing their supply chains while enabling swift product innovation. | |||

• Oracle Fusion Cloud Human Capital Management (HCM), which is a specialized solution crafted to assist organizations in sourcing, nurturing, and retaining their workforce. | |||

Oracle | • Oracle Cerner healthcare, which is a purpose-built system intended to empower healthcare professionals in providing enhanced medical services to patients. | ||

Oracle's extensively utilized infrastructure offerings encompass a variety of products, including: Familiar databases like Oracle Database and MySQL, alongside Oracle Autonomous Database, which heavily leverages machine learning to detect and rectify human errors that might otherwise remain unnoticed. | |||

== Market == | == Market == | ||

=== Total Addressable Market (TAM) === | === '''Total Addressable Market (TAM)''' === | ||

The total addressable market (TAM) for Oracle is | The total addressable market (TAM) for Oracle is characterized as the worldwide information technology industry. As per research reports, the global information technology sector expanded from $8,179 billion in 2022 to $8,852 billion in 2023, registering a compound annual growth rate (CAGR) of 8.2%. By 2027, it is anticipated that the market valuation will reach approximately $11,995 billion, demonstrating a CAGR of 7.9%. The predominant catalyst fueling this anticipated expansion is poised to be cloud computing. | ||

=== Serviceable Available Market (SAM) === | === '''Serviceable Available Market (SAM)''' === | ||

The serviceable available market (SAM) | The serviceable available market (SAM) encompassing Oracle pertains to the worldwide arena of cloud computing. As indicated by research reports, the cloud computing market is projected to escalate from $581 billion in 2023 to reach $1,243.42 billion by 2028, exhibiting a compound annual growth rate (CAGR) of 16.4%. This acceleration can be attributed to technological disruptions, particularly in areas like Artificial Intelligence and Machine Learning. Moreover, another contributing factor to this growth trajectory is the impact of the pandemic. Even post-pandemic, a portion of individuals continues to work remotely, thereby underscoring the indispensability of cloud computing for daily operations. | ||

=== Serviceable Obtainable Market (SOM) === | === '''Serviceable Obtainable Market (SOM)''' === | ||

Oracle Corporation currently holds a share of approximately 2% in the cloud computing market. The company's market presence in the Software-as-a-Service (SaaS) sector stands at around 4%, while its influence in the Infrastructure as a Service (IaaS) segment is limited (Statista, 2022). There exists substantial potential for Oracle to elevate its standing in the Infrastructure as a Service domain over the forthcoming years, mainly fueled by strategic partnerships with Intel and Red Hat, coupled with endorsements from notable entities like Uber, FedEx, Toyota, and Zoom, among others. With Oracle's OCI demonstrating cost-effectiveness (in comparison to its counterparts) and high value, it's anticipated to be widely adopted by various companies aiming to develop AI models such as ChatGPT. As a result, the company is poised to erode the market share of its rivals while concurrently increasing its own. Given its substantial market share in the SaaS segment, an expansion in the IaaS market share is projected to potentially double Oracle's overall cloud computing market share within the upcoming 5 years, potentially reaching around 5%. | |||

== Competition == | == Competition == | ||

The global cloud computing | |||

The global landscape of cloud computing is characterized by its fragmentation, leading to a landscape of intense rivalry. Established entities like Amazon, Microsoft, SAP, IBM, and Salesforce engage in fierce competition, alongside emerging startups that strive to innovate and secure their share of the market. Consequently, Oracle finds itself in the midst of rigorous competition from both established industry players and freshly established firms. Given Oracle's assertive approach to acquisitions and its pursuit of expansion into novel domains like healthcare software (as evident in its acquisition of Cerner, a healthcare software provider), the range of its competitors is poised to expand further. This includes a broader spectrum of rivals such as Epic Systems Corporation, Allscripts Healthcare Solutions, Inc., Arcadia Solutions, athenahealth, Inc., and InterSystems Corporation, among others. Below is a detailed analysis of the most important competitors of Oracle Corporation<ref name=":0" />: | |||

{| class="wikitable" | {| class="wikitable" | ||

|+ | |+ | ||

!Company | !Company | ||

! | !Description | ||

!Competition | !Competition | ||

!Market | !Market Capitalization | ||

|- | |- | ||

|Amazon | |Amazon | ||

|AWS, | |Amazon's subsidiary, AWS, stands as the foremost global provider of cloud services, presenting an extensive range of cloud computing solutions. | ||

| | |In the market for cloud infrastructure and platform services, Oracle Cloud directly rivals AWS. These two corporations compete to attract enterprises seeking to harness the benefits of cloud technology for scalability, adaptability, and cost-efficiency. | ||

|$1, | |$1,450,366 mil. | ||

|- | |- | ||

|Microsoft | |Microsoft | ||

|Microsoft | |A worldwide technology giant, Microsoft offers a diverse range of products and services. While Oracle and Microsoft vie in certain domains, their main areas of emphasis diverge. Microsoft holds a significant role in operating systems, cloud solutions, productivity applications (Office Suite), gaming (Xbox), and collaboration tools (Microsoft Teams). | ||

|Microsoft Azure | |In the domain of cloud computing, Microsoft Azure directly contends with Oracle Cloud. Both enterprises provide solutions in Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Moreover, Microsoft's Power Platform competes with Oracle's platforms for application development and low-code solutions. | ||

|$2, | |$2,407,540 mil. | ||

|- | |- | ||

|IBM | |IBM | ||

|IBM is a technology and | |IBM is a technology and advisory firm with a well-established history in multiple industries, encompassing fields like cloud offerings, artificial intelligence, and enterprise solutions. | ||

| | |Although both corporations have a track record of providing business software solutions, their rivalry extends to domains such as cloud services and the management of database systems. IBM's cloud service, IBM Cloud, goes head-to-head with Oracle Cloud, and IBM's database system, Db2, competes directly with Oracle Database. | ||

|$129, | |$129,280 mil. | ||

|- | |- | ||

|Salesforce | |Salesforce | ||

|Salesforce | |Salesforce holds a prominent position in the customer relationship management (CRM) industry. It delivers cloud-centric solutions for overseeing sales, marketing, and customer service operations. | ||

|Oracle | |Oracle directly challenges Salesforce with its Oracle CRM Cloud product. These two enterprises are in competition to secure their portion of the swiftly expanding Customer Relationship Management (CRM) arena, presenting a variety of functionalities and possibilities for customization to cater to the demands of their customers. | ||

|$ | |$206,546 mil. | ||

|- | |- | ||

|SAP | |SAP | ||

|SAP is a leading enterprise software company known for its Enterprise Resource Planning (ERP) systems and other business applications. | |SAP is a leading enterprise software company known for its Enterprise Resource Planning (ERP) systems and other business applications. Its expertise lies in aiding companies in the management of diverse operations, encompassing finance, supply chain, and human resources. | ||

| | |Oracle and SAP are significant contenders in the realm of Enterprise Resource Planning (ERP). They vie for the attention of corporate clients in search of comprehensive and unified answers to oversee their business activities. Frequently, their ERP products, namely Oracle ERP Cloud and SAP S/4HANA, directly compete against each other within the market. | ||

|$ | |$162,318 mil. | ||

|- | |- | ||

|Workday | |Workday | ||

|Workday is a cloud-based | |Workday is a company that offers enterprise software through cloud-based services, focusing on delivering solutions for managing human capital (HCM) and financial management tailored to businesses and organizations. | ||

|Workday directly competes with Oracle HCM Cloud in the HCM space. Oracle's HCM Cloud | |Workday directly competes with Oracle HCM Cloud in the HCM space. Oracle's HCM Cloud similarly presents a comprehensive array of cloud-driven human resources and talent management software, targeting the requirements of sizeable corporations and institutions. | ||

|$60,782 | |$59,401 mil. | ||

|} | |||

== Financials == | |||

=== Historic and projected financial statements === | |||

{| class="wikitable" | |||

|+ | |||

!Income Statement | |||

|'''2021A''' | |||

|'''2022A''' | |||

|'''2023A''' | |||

|'''2024P''' | |||

|'''2025P''' | |||

|'''2026P''' | |||

|'''2027P''' | |||

|'''2028P''' | |||

|- | |||

|'''Total revenues''' | |||

|'''40,479''' | |||

|'''42,440''' | |||

|'''49,954''' | |||

|'''53,950''' | |||

|'''58,266''' | |||

|'''62,928''' | |||

|'''67,962''' | |||

|'''73,399''' | |||

|- | |||

|'''Cost of revenues''' | |||

|'''(7,855)''' | |||

|'''(8,877)''' | |||

|'''(13,564)''' | |||

|'''(14,649)''' | |||

|'''(15,821)''' | |||

|'''(17,087)''' | |||

|'''(18,454)''' | |||

|'''(19,930)''' | |||

|- | |||

|Sales and marketing | |||

|(7,682) | |||

|(8,047) | |||

|(8,833) | |||

|(10,003) | |||

|(10,803) | |||

|(11,667) | |||

|(12,600) | |||

|(13,608) | |||

|- | |||

|R&D | |||

|(6,527) | |||

|(7,219) | |||

|(8,623) | |||

|(9,063) | |||

|(9,788) | |||

|(10,571) | |||

|(11,417) | |||

|(12,330) | |||

|- | |||

|G&A | |||

|(1,254) | |||

|(1,317) | |||

|(1,579) | |||

|(1,684) | |||

|(1,818) | |||

|(1,964) | |||

|(2,121) | |||

|(2,291) | |||

|- | |||

|Amortization of intangible assets | |||

|(1,379) | |||

|(1,150) | |||

|(3,582) | |||

|(2,994) | |||

|(2,283) | |||

|(1,620) | |||

|(664) | |||

|(635) | |||

|- | |||

|Acquisition related and other | |||

|(138) | |||

|(4,713) | |||

|(190) | |||

|(190) | |||

|(190) | |||

|(190) | |||

|(190) | |||

|(190) | |||

|- | |||

|Restructuring | |||

|(431) | |||

|(191) | |||

|(490) | |||

|(490) | |||

|(490) | |||

|(490) | |||

|(490) | |||

|(490) | |||

|- | |||

|Total operating expenses | |||

|(25,266) | |||

|(31,514) | |||

|(36,861) | |||

|(39,072) | |||

|(41,193) | |||

|(43,589) | |||

|(45,936) | |||

|(49,474) | |||

|- | |||

|'''Operating income (EBIT)''' | |||

|'''15,213''' | |||

|'''10,926''' | |||

|'''13,093''' | |||

|'''14,878''' | |||

|'''17,073''' | |||

|'''19,339''' | |||

|'''22,026''' | |||

|'''23,925''' | |||

|- | |||

|Interest expense | |||

|(2496) | |||

|(2755) | |||

|(3505) | |||

|(3,716) | |||

|(3,585) | |||

|(3,555) | |||

|(3,503) | |||

|(3,327) | |||

|- | |||

|Interest income | |||

|101 | |||

|94 | |||

|285 | |||

|196 | |||

|60 | |||

|20 | |||

|21 | |||

|22 | |||

|- | |||

|Non-operating (expenses) income, net | |||

|181 | |||

|(616) | |||

|(747) | |||

|(747) | |||

|(747) | |||

|(747) | |||

|(747) | |||

|(747) | |||

|- | |||

|Income before taxes | |||

|12,999 | |||

|7,649 | |||

|9,126 | |||

|10,612 | |||

|12,801 | |||

|15,057 | |||

|17,797 | |||

|19,873 | |||

|- | |||

|Provision for benefit from income taxes | |||

|747 | |||

|(932) | |||

|(623) | |||

|(1,009) | |||

|(1,217) | |||

|(1,431) | |||

|(1,692) | |||

|(1,889) | |||

|- | |||

|'''Net income''' | |||

|'''13,746''' | |||

|'''6,717''' | |||

|'''8,503''' | |||

|'''9,603''' | |||

|'''11,585''' | |||

|'''13,625''' | |||

|'''16,106''' | |||

|'''17,984''' | |||

|} | |||

{| class="wikitable" | |||

|+ | |||

!Balance Sheet | |||

|'''2022A''' | |||

|'''2023A''' | |||

|'''2024P''' | |||

|'''2025P''' | |||

|'''2026P''' | |||

|'''2027P''' | |||

|'''2028P''' | |||

|- | |||

|Current assets: | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Cash, cash equivalents, marketable securities | |||

|21,902 | |||

|10,187 | |||

|3,860 | |||

|748 | |||

|888 | |||

|1,039 | |||

|1,202 | |||

|- | |||

|Trade receivables, net of allowances for credit losses of $428 and $362 as of May 31, 2023 and May 31, 2022, respectively | |||

|5,953 | |||

|6,915 | |||

|7,468 | |||

|8,066 | |||

|8,711 | |||

|9,408 | |||

|10,160 | |||

|- | |||

|Prepaid expenses and other current assets | |||

|3,778 | |||

|3,902 | |||

|4,214 | |||

|4,551 | |||

|4,915 | |||

|5,309 | |||

|5,733 | |||

|- | |||

|'''Total current assets''' | |||

|'''31,633''' | |||

|'''21,004''' | |||

|'''15,542''' | |||

|'''13,365''' | |||

|'''14,514''' | |||

|'''15,755''' | |||

|'''17,096''' | |||

|- | |||

|Non-current assets: | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Property, plant and equipment, net | |||

|9,716 | |||

|17,069 | |||

|22,131 | |||

|26,726 | |||

|30,854 | |||

|33,751 | |||

|33,923 | |||

|- | |||

|Intangible assets, net | |||

|1,440 | |||

|9,837 | |||

|10,624 | |||

|11,474 | |||

|12,392 | |||

|13,383 | |||

|14,454 | |||

|- | |||

|Goodwill, net | |||

|43,811 | |||

|62,261 | |||

|67,242 | |||

|72,621 | |||

|78,431 | |||

|84,705 | |||

|91,482 | |||

|- | |||

|Deferred tax assets | |||

|12,782 | |||

|12,226 | |||

|12,226 | |||

|12,226 | |||

|12,226 | |||

|12,226 | |||

|12,226 | |||

|- | |||

|Other non-current assets | |||

|9,915 | |||

|11,987 | |||

|12,946 | |||

|13,982 | |||

|15,100 | |||

|16,308 | |||

|17,613 | |||

|- | |||

|Total non-current assets | |||

|77,664 | |||

|113,380 | |||

|125,168 | |||

|137,029 | |||

|149,003 | |||

|160,374 | |||

|169,697 | |||

|- | |||

|'''Total assets''' | |||

|'''109,297''' | |||

|'''134,384''' | |||

|'''140,710''' | |||

|'''150,394''' | |||

|'''163,517''' | |||

|'''176,129''' | |||

|'''186,793''' | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Current liabilities: | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Commercial paper/revolver | |||

|0 | |||

|563 | |||

|0 | |||

|7,325 | |||

|12,307 | |||

|14,622 | |||

|18,406 | |||

|- | |||

|Accounts payable | |||

|1,317 | |||

|1,204 | |||

|1,300 | |||

|1,404 | |||

|1,517 | |||

|1,638 | |||

|1,769 | |||

|- | |||

|Accrued compensation and related benefits | |||

|1,944 | |||

|2,053 | |||

|2,217 | |||

|2,395 | |||

|2,586 | |||

|2,793 | |||

|3,017 | |||

|- | |||

|Deferred revenues | |||

|8,357 | |||

|8,970 | |||

|9,688 | |||

|10,463 | |||

|11,300 | |||

|12,204 | |||

|13,180 | |||

|- | |||

|Other current liabilities | |||

|4,144 | |||

|6,802 | |||

|7,346 | |||

|7,934 | |||

|8,569 | |||

|9,254 | |||

|9,994 | |||

|- | |||

|'''Total current liabilities''' | |||

|'''15,762''' | |||

|'''19,592''' | |||

|'''20,551''' | |||

|'''29,520''' | |||

|'''36,279''' | |||

|'''40,510''' | |||

|'''46,366''' | |||

|- | |||

|Non-current liabilities: | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Long-term debt, plus current portion | |||

|75,859 | |||

|89,918 | |||

|85,855 | |||

|75,855 | |||

|70,161 | |||

|64,911 | |||

|54,741 | |||

|- | |||

|Income taxes payable | |||

|12,210 | |||

|11,077 | |||

|11,963 | |||

|12,920 | |||

|13,954 | |||

|15,070 | |||

|16,276 | |||

|- | |||

|Deferred tax liabilities | |||

|6,031 | |||

|5,772 | |||

|5,772 | |||

|5,772 | |||

|5,772 | |||

|5,772 | |||

|5,772 | |||

|- | |||

|Other non-current liabilities | |||

|5,203 | |||

|6,469 | |||

|6,987 | |||

|7,545 | |||

|8,149 | |||

|8,801 | |||

|9,505 | |||

|- | |||

|'''Total non-current liabilities''' | |||

|'''99,303''' | |||

|'''113,236''' | |||

|'''110,577''' | |||

|'''102,093''' | |||

|'''98,036''' | |||

|'''94,554''' | |||

|'''86,294''' | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Oracle Corporation stockholders' equity (deficit): | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Preferred stock, $0.01 par value—authorized: 1.0 shares; outstanding: none | |||

|0 | |||

|0 | |||

|0 | |||

|0 | |||

|0 | |||

|0 | |||

|0 | |||

|- | |||

|Common stock, $0.01 par value and additional paid in capital—authorized: 11,000 shares; outstanding: 2,713 shares and 2,665 shares as of May 31, 2023 and 2022, respectively | |||

|26,808 | |||

|30,215 | |||

|34,046 | |||

|38,183 | |||

|42,651 | |||

|47,477 | |||

|52,689 | |||

|- | |||

|Accumulated deficit | |||

|(31,336) | |||

|(27,620) | |||

|(23,424) | |||

|(18,363) | |||

|(12,410) | |||

|(5,373) | |||

|2,484 | |||

|- | |||

|Accumulated other comprehensive loss | |||

|(1,692) | |||

|(1,522) | |||

|(1,522) | |||

|(1,522) | |||

|(1,522) | |||

|(1,522) | |||

|(1,522) | |||

|- | |||

|Total Oracle Corporation stockholders' equity (deficit) | |||

|(6,220) | |||

|1,073 | |||

|9,099 | |||

|18,298 | |||

|28,719 | |||

|40,582 | |||

|53,651 | |||

|- | |||

|Noncontrolling interests | |||

|452 | |||

|483 | |||

|483 | |||

|483 | |||

|483 | |||

|483 | |||

|483 | |||

|- | |||

|'''Total stockholders' equity (deficit)''' | |||

|'''(5,768)''' | |||

|'''1,556''' | |||

|'''9,582''' | |||

|'''18,781''' | |||

|'''29,202''' | |||

|'''41,065''' | |||

|'''54,134''' | |||

|- | |||

|'''Total liabilities and stockholders' equity (deficit)''' | |||

|'''109,297''' | |||

|'''134,384''' | |||

|'''140,710''' | |||

|'''150,394''' | |||

|'''163,517''' | |||

|'''176,129''' | |||

|'''186,793''' | |||

|} | |} | ||

{| class="wikitable" | |||

|+ | |||

|'''Cash Flow Statement''' | |||

|'''2024P''' | |||

|'''2025P''' | |||

|'''2026P''' | |||

|'''2027P''' | |||

|'''2028P''' | |||

|- | |||

|Net income | |||

|9,603 | |||

|11,585 | |||

|13,625 | |||

|16,106 | |||

|17,984 | |||

|- | |||

|Depreciation and amortization | |||

|6,250 | |||

|5,760 | |||

|5,395 | |||

|4,767 | |||

|4,974 | |||

|- | |||

|Stock based compensation | |||

|3,831 | |||

|4,137 | |||

|4,468 | |||

|4,826 | |||

|5,212 | |||

|- | |||

|Decreases / (Increases) in working capital assets | |||

|(865) | |||

|(935) | |||

|(1,009) | |||

|(1,090) | |||

|(1,177) | |||

|- | |||

|Increases / (Decreases) in working capital liabilities | |||

|1,522 | |||

|1,644 | |||

|1,776 | |||

|1,918 | |||

|2,071 | |||

|- | |||

|Other non current assets | |||

|(9,721) | |||

|(9,548) | |||

|(9,466) | |||

|(9,138) | |||

|(9,787) | |||

|- | |||

|Other non current liabilities | |||

|1,404 | |||

|1,516 | |||

|1,637 | |||

|1,768 | |||

|1,910 | |||

|- | |||

|Cash from operating activities | |||

|12,023 | |||

|14,160 | |||

|16,426 | |||

|19,156 | |||

|21,187 | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Capital expenditures | |||

|(8,317) | |||

|(8,073) | |||

|(7,903) | |||

|(7,000) | |||

|(4,511) | |||

|- | |||

|Cash from investing activities | |||

|(8,317) | |||

|(8,073) | |||

|(7,903) | |||

|(7,000) | |||

|(4,511) | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Long term debt | |||

|(4,063) | |||

|(10,000) | |||

|(5,694) | |||

|(5,250) | |||

|(10,170) | |||

|- | |||

|Revolver | |||

|(563) | |||

|7,325 | |||

|4,983 | |||

|2,314 | |||

|3,784 | |||

|- | |||

|Share repurchases | |||

|(1,265) | |||

|(1,526) | |||

|(1,795) | |||

|(2,121) | |||

|(2,369) | |||

|- | |||

|Common dividends | |||

|(4,143) | |||

|(4,997) | |||

|(5,878) | |||

|(6,948) | |||

|(7,758) | |||

|- | |||

|Cash from financing activities | |||

|(10,034) | |||

|(9,198) | |||

|(8,384) | |||

|(12,005) | |||

|(16,513) | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|Net change in cash during period | |||

|(6,327) | |||

|(3,112) | |||

|140 | |||

|151 | |||

|163 | |||

|} | |||

=== Ratios === | |||

{| class="wikitable" | |||

|+ | |||

| | |||

|'''2021A''' | |||

|'''2022A''' | |||

|'''2023A''' | |||

|- | |||

|'''Profitability ratios''' | |||

| | |||

| | |||

| | |||

|- | |||

|Gross profit | |||

|81% | |||

|79% | |||

|73% | |||

|- | |||

|Operating profit margin | |||

|38% | |||

|26% | |||

|26% | |||

|- | |||

|Net profit margin | |||

|34% | |||

|16% | |||

|17% | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|'''Liquidity ratios''' | |||

| | |||

| | |||

| | |||

|- | |||

|Current ratio | |||

| | |||

|2.01 | |||

|1.07 | |||

|- | |||

|Quick ratio | |||

| | |||

|1.77 | |||

|0.87 | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|'''Leverage ratios''' | |||

| | |||

| | |||

| | |||

|- | |||

|Debt to Assets | |||

| | |||

|69% | |||

|67% | |||

|- | |||

|Debt to Equity | |||

| | |||

| -1315% | |||

|5815% | |||

|- | |||

|Debt to Capital | |||

| | |||

|108% | |||

|98% | |||

|- | |||

|Interest coverage ratio | |||

| | |||

|726% | |||

|510% | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|'''Efficiency ratios''' | |||

| | |||

| | |||

| | |||

|- | |||

|Asset turnover ratio | |||

| | |||

|39% | |||

|37% | |||

|- | |||

| | |||

| | |||

| | |||

| | |||

|- | |||

|'''Performance ratios''' | |||

| | |||

| | |||

| | |||

|- | |||

|Return on equity (ROE) | |||

| | |||

| -116% | |||

|546% | |||

|- | |||

|Return on assets (ROA) | |||

| | |||

|6% | |||

|6% | |||

|- | |||

|Return on invested capital (ROIC) | |||

| | |||

|20% | |||

|15% | |||

|- | |||

|Return on capital employed (ROCE) | |||

| | |||

|10% | |||

|11% | |||

|} | |||

== DCF Valuation == | |||

Our $131.43 price target represents our DCF valuation on Oracle over the next 5 years. A discount rate of 7.46% and a perpetual growth rate of 3% were used in order to calculate discounted cash flows and terminal value<ref name=":0" />. The discount rate was calculated using the Weighted Average Cost of Capital (WACC) formula. The cost of equity was calculated using the Capital Asset Pricing Model (CAPM). A beta of 0.85, a market risk premium of 5%<ref>Damodaran. (2023). Country Default Spread and Risk Premiums. [https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html]</ref> and a risk-free rate of 4.16% were used in the CAPM calculation. This target price shows a potential upside of around 16.25% when compared to the current market price. DCF is an assumption-based model and the accuracy of those assumptions can significantly impact the valuation results. The assumptions used are included in the following table: | |||

{| class="wikitable" | |||

|+ | |||

!Variable | |||

!Value | |||

!Commentary | |||

|- | |||

|Revenue growth (% change) | |||

|8% | |||

|The base case scenario assumes a revenue growth rate of 8%, given that Oracle is an established company and sell-side analysts provided this estimate (Capital IQ, 2023). Our bullish scenario assumes a revenue growth rate of 10%, whereas our bearish case assumes a revenue growth rate of 6%. | |||

|- | |||

|Gross profit margin | |||

|73% | |||

|The last observation of gross margin was used. Our bullish scenario assumes a year-on-year increase of 0.5%, whereas our bearish case scenario assumes a year-on-year decrease of 0.5%. | |||

|- | |||

|Sales & Marketing | |||

|19% | |||

|The historical average of Sales & Marketing was used. | |||

|- | |||

|R&D | |||

|17% | |||

|The historical average of R&D was used. | |||

|- | |||

|G&A | |||

|3% | |||

|The historical average of G&A was used. | |||

|- | |||

|Tax rate | |||

|10% | |||

|The historical average of tax rate was used. Our bullish scenario assumes a tax rate of 7%, whereas our bearish case assumes a tax rate of 13%. | |||

|- | |||

|Capital Expenditures | |||

|$8,317 in 2024P, $8,073 in 2025P, $7,903 in 2026P, $7,000 in 2027P, $4,511 in 2028P | |||

|For years 2024, 2025, 2026 the projections of sell-side analysts were used (Capital IQ, 2023). Subjective assumption were used for years 2027, 2028. Thereafter, it is anticipated that the capital expenses will gradually decrease to their previous levels. This is because Oracle will probably be unable to sustain its capital expenditures at such elevated rates due to substantial debt repayments and limited cash reserves. | |||

|} | |||

== Sensitivity Analysis == | |||

[[File:Screenshot 2023-08-23 1.jpg|thumb|354x354px|Table 1]] | |||

Sensitivity analysis provides valuable insights into the potential outcomes and risks associated with models which are based on a wide range of assumptions. As such, it is crucial to be implemented for models, such as the DCF. | |||

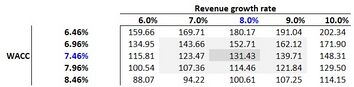

Two significant variables that have an important impact in our DCF valuation were revenue growth rate and WACC. As it is widely known, when the WACC increases, the valuation decreases as they are negatively related based on the NPV formula. For example, in the first table, when the WACC increases by only 0.5%, the intrinsic value per share falls by approximately $17. If we increase it by another 0.5%, the intrinsic value per share drops to $100.61. Revenue growth is an essential part of the valuation as well, since it significantly impacts the free cash flow of Oracle. Under our bearish case (revenue growth rate equals 6%), Oracle's share is worth $115.81, whereas under our bullish case (revenue growth rate equals 10%) Oracle's share is worth $148.31. | |||

[[File:Screenshot 2023-08-23 2.jpg|thumb|355x355px|Table 2]] | |||

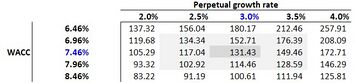

The second table includes another variable that can potentially alter our valuation result a lot, which is the perpetual growth rate. Here, under our base case, the company is expected to grow by 3% in perpetuity. This figure is most of the times tied up with the global GPD growth. However, it is worth noting that a perpetually growing economy is an idealized assumption and may not reflect the reality of economic cycles and fluctuations. | |||

== Comparable Company Analysis == | |||

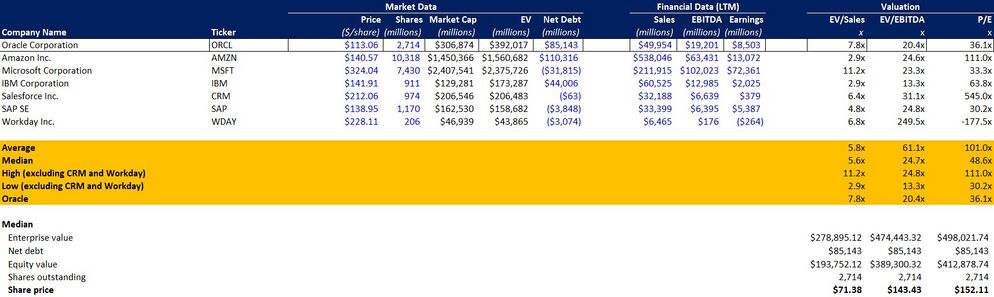

Our second method for valuing Oracle was comparable company analysis. Price/earnings, Enterprise Value/EBITDA, and Enterprise Value/Revenue ratios were used. The companies selected were the direct competitors, as mentioned above. | |||

[[File:Screenshot 2023-08-23 3.jpg|thumb|994x994px|Comparables table|left]] | |||

To begin, the EV/Sales metric was employed. This involved taking the revenue from the past year and multiplying it by the median EV/Sales ratio of competing firms. As a result, the estimated enterprise value stood at $278,895 million. After accounting for net debt, it became evident that the equity value equated to $193,752 million or $71.38 per share. Consequently, based on this ratio, the company appears to be overvalued compared to its peers. | |||

Moving on, the EV/EBITDA ratio was employed. By taking the EBITDA over the last 12 months and multiplying it by the median EV/EBITDA ratio among rivals, the implied enterprise value reached $474,443 million. Deducting net debt led us to an equity value of $389,300 million. Dividing this amount by the outstanding shares yielded an implied value of $143.43 per share. Thus, according to this multiple, the company seems to be undervalued compared to its industry counterparts. | |||

Lastly, the P/E ratio was brought into consideration. Earnings from the past year were multiplied by the median P/E ratio of the six comparable companies. The estimated equity value stood at $412,878 million. Dividing this sum by the total outstanding shares of 2,714 million resulted in a fair share value of $152.11. Once again, the company's valuation appears to be lower when compared to its peers. These outcomes suggest that investors might not be fully acknowledging the company's potential for earnings or growth relative to its competitors, leading to a lower valuation at present. | |||

== Risks == | |||

'''Operational risk''' | |||

Given the cloud-based nature of many of Oracle's services, operational risk becomes a significant consideration. Cloud services are reliant on stable and resilient infrastructure. Any technical issues, outages, or disruptions in data centers or networks could lead to service downtime and impact customer satisfaction. Furthermore, Oracle's cloud services need to be scalable and able to handle increased demand. Inadequate infrastructure to accommodate growth or surges in usage could result in performance issues and customer dissatisfaction. | |||

'''Share repurchase risk''' | |||

There is no guarantee that Oracle will keep buying back common stock like he did in the previous 3 years. In fact, it is expected from the company to suspend or reduce its share repurchase program given that it resulted in equity deficit in 2022. Furthermore, the company stated in its annual report that it is not going to increase its share repurchases until their gross debt is reduced below some unspecified level. | |||

'''Reputational risk''' | |||

Oracle holds vast amounts of sensitive data from its customers. Any breach of this data could lead to significant reputational damage, legal consequences, and loss of customer trust. In case customers lose their trust, they may stop buying products or continue using them. This could result in a revenue loss and high lawsuit expenses. | |||

'''Acquisitions-related risks''' | |||

Oracle has followed an aggressive acquisition strategy throughout the years. That can be seen by the large number of acquisitions that have been completed, such as Cerner, Adi Insights, FOEX, Federos, FarApp, among others. An aggressive acquisition strategy, while potentially beneficial in expanding a company's market presence and diversifying its offerings, also comes with several risks. The most important risk is the challenge of integrating the products and workforce of all these companies into Oracle's existing operations. Poor integration can lead to inefficiencies and cultural clashes. | |||

'''Leverage levels''' | |||

The company's debt level is really high compared to its competitors, which can be seen by its debt to equity and debt to capital ratios. This is a result of its share repurchase program as well as the aggressive acquisition strategy which involves a lot of debt. The company might have to suspend its repurchase program or reduce its capital expenditures in order to be able to reduce its debt levels. S&P has assigned a credit rating of BBB, which is low when compared to its competitors (e.g. Microsoft, Salesforce). Such a low credit rating can potentially lead to higher cost of debt moving forward<ref name=":0" />. | |||

<references /> | |||

Latest revision as of 20:35, 23 August 2023

Investment ThesisEdit

We suggest adopting a long position on this stock, positioning it as an appealing option for buying due to its consistent and expanding dividend, steady growth in revenue, and the anticipated substantial growth in the cloud infrastructure sector. There are several positive aspects within the business and financial realms that we expect to yield favorable results, aspects that the investor community currently undervalues. Oracle's Cloud Infrastructure (OCI) is predicted to outperform its competitors due to its superior performance and more affordable pricing. The company is also actively reinvesting significant capital into its operations, as evidenced by its noteworthy capital expenditures and escalating research and development costs. This could effectively support its strategic acquisition approach and product range expansion. Our projected price target, based on the DCF model's base case, stands at $131.43. Furthermore, additional potential for growth is indicated by a comparable company analysis, which demonstrates that the company is currently underestimated by investors relative to its peers, particularly when considering EV/EBITDA and P/E ratios[1].

Business AnalysisEdit

Oracle provides products and services that address enterprise information technology (IT) environments. Oracle's operations are categorized into four distinct business segments: Cloud services and license assistance, Cloud License and on-premise license, Hardware, and Services.

Oracle's range of cloud services covers a diverse spectrum of offerings, encompassing Oracle Software-as-a-Service and Oracle Cloud Infrastructure, all delivered through a cloud-centric framework. Users can conveniently access these services via their preferred web browser. These Oracle cloud services have been strategically designed to expedite their implementation, leading to quicker innovation timelines. These services feature a user-friendly interface, catering to both novice and experienced users, and are engineered for simplified maintenance, reducing the effort needed for upgrades, integration, and testing. Furthermore, these services seamlessly integrate across different deployment models, enhancing flexibility among diverse IT environments. They ensure smooth compatibility, facilitating the transition of workloads between the Oracle Cloud and other IT configurations. In addition, these services are cost-efficient, requiring lower initial investments from customers. Primarily, they prioritize stringent security measures, adhere to established standards, and provide unwavering reliability.

Oracle Applications Technologies form an integral component of the cloud services and license support business division. This sector encompasses the company's Software-as-a-Service (SaaS) offerings, widely adopted by numerous global corporations, along with license support that is typically acquired by all Oracle customers. These support solutions offered by the company play a crucial role in safeguarding and augmenting the investments made by its clientele in Oracle applications. Among these provisions are proactive and personalized support services, notably Oracle Lifetime Support, in addition to unspecified license improvements and updates during the support duration. These services are meticulously crafted to ensure that customers receive all-encompassing aid and protection for their Oracle products, ultimately enhancing the value and lifespan of their investments. Over the years 2023, 2022, and 2021, revenues from Oracle Applications Technologies and license support contributed 47%, 42%, and 41%, respectively, to the overall cloud services and license support revenues.

Oracle provides its infrastructure technologies to clients through two main avenues: the cloud and license business segment, as well as the hardware business segment. Within the cloud and license business category, these infrastructure technologies encompass the renowned Oracle Database, acknowledged globally as the premier enterprise database solution. Furthermore, it encompasses Java, which holds the distinction of being the most widely utilized software development language in the computer industry. This portfolio also encompasses an array of middleware tools and development resources. These infrastructure technologies are accessible either through subscription to Oracle Cloud Infrastructure (OCI) offerings or via the acquisition of licenses, accompanied by associated license support. This affords customers the flexibility to deploy these technologies within the Oracle Cloud, integrate them into on-premise cloud services, or implement them within their own IT environments. Notably, the company's revenue from infrastructure cloud services and license support represented 53%, 58%, and 59% of total cloud services and license support earnings for the years 2023, 2022, and 2021 respectively.

The range of Oracle's infrastructure technologies also encompasses products available via the corporation's hardware business sections. This part of the business is divided into:

- Oracle servers (e.g. servers consisting of Oracle SPARC microprocessor or x86 microprocessor)

- Oracle storage

- Oracle industry-specific hardware offerings (products designed for particular industries such as food and beverage, hotel and retail)

- Oracle operating systems (e.g. Oracle Linux, Oracle Solaris)

- Oracle hardware support (provides support for oracle systems though software updates of the hardware products, repairs, and technical support)

The fourth business segment, known as Oracle Services, delivers advisory and training services to assist customers in optimizing the use of Oracle's applications and infrastructure technologies[2].

The revenue contribution for of the four business segments can be seen in the following table:

| Business Segment | Revenue (in $ millions) | % of total revenue |

|---|---|---|

| Cloud services and license support | 35,307 | 71% |

| Cloud license and on-premise license | 5,779 | 12% |

| Hardware | 3,274 | 7% |

| Services | 5,594 | 11% |

Main ProductsEdit

Oracle's widely used SaaS products include, among others:

• Oracle Fusion Cloud Enterprise Resource Planning (ERP), which is a comprehensive and unified ERP solution that aims to enhance organizational decision-making and workforce efficiency while streamlining back-office operations. It is designed to be a fully integrated and global platform, enabling businesses to benefit from a shared data and security model, along with a consistent user interface. By adopting Oracle Fusion Cloud ERP, organizations can optimize their processes and achieve improved productivity on a global scale.

• Oracle Fusion Cloud Enterprise Performance Management (EPM), which is a purpose-built solution aimed at evaluating financial performance, facilitating precise and flexible financial planning, enhancing the efficiency of financial close and consolidation procedures, simplifying account reconciliation, and meeting the reporting needs of organizations.

• Oracle Fusion Cloud Supply Chain and Manufacturing Management (SCM), which is a tailored offering intended to support organizations in establishing, enhancing, and digitalizing their supply chains while enabling swift product innovation.

• Oracle Fusion Cloud Human Capital Management (HCM), which is a specialized solution crafted to assist organizations in sourcing, nurturing, and retaining their workforce.

• Oracle Cerner healthcare, which is a purpose-built system intended to empower healthcare professionals in providing enhanced medical services to patients.

Oracle's extensively utilized infrastructure offerings encompass a variety of products, including: Familiar databases like Oracle Database and MySQL, alongside Oracle Autonomous Database, which heavily leverages machine learning to detect and rectify human errors that might otherwise remain unnoticed.

MarketEdit

Total Addressable Market (TAM)Edit

The total addressable market (TAM) for Oracle is characterized as the worldwide information technology industry. As per research reports, the global information technology sector expanded from $8,179 billion in 2022 to $8,852 billion in 2023, registering a compound annual growth rate (CAGR) of 8.2%. By 2027, it is anticipated that the market valuation will reach approximately $11,995 billion, demonstrating a CAGR of 7.9%. The predominant catalyst fueling this anticipated expansion is poised to be cloud computing.

Serviceable Available Market (SAM)Edit

The serviceable available market (SAM) encompassing Oracle pertains to the worldwide arena of cloud computing. As indicated by research reports, the cloud computing market is projected to escalate from $581 billion in 2023 to reach $1,243.42 billion by 2028, exhibiting a compound annual growth rate (CAGR) of 16.4%. This acceleration can be attributed to technological disruptions, particularly in areas like Artificial Intelligence and Machine Learning. Moreover, another contributing factor to this growth trajectory is the impact of the pandemic. Even post-pandemic, a portion of individuals continues to work remotely, thereby underscoring the indispensability of cloud computing for daily operations.

Serviceable Obtainable Market (SOM)Edit

Oracle Corporation currently holds a share of approximately 2% in the cloud computing market. The company's market presence in the Software-as-a-Service (SaaS) sector stands at around 4%, while its influence in the Infrastructure as a Service (IaaS) segment is limited (Statista, 2022). There exists substantial potential for Oracle to elevate its standing in the Infrastructure as a Service domain over the forthcoming years, mainly fueled by strategic partnerships with Intel and Red Hat, coupled with endorsements from notable entities like Uber, FedEx, Toyota, and Zoom, among others. With Oracle's OCI demonstrating cost-effectiveness (in comparison to its counterparts) and high value, it's anticipated to be widely adopted by various companies aiming to develop AI models such as ChatGPT. As a result, the company is poised to erode the market share of its rivals while concurrently increasing its own. Given its substantial market share in the SaaS segment, an expansion in the IaaS market share is projected to potentially double Oracle's overall cloud computing market share within the upcoming 5 years, potentially reaching around 5%.

CompetitionEdit

The global landscape of cloud computing is characterized by its fragmentation, leading to a landscape of intense rivalry. Established entities like Amazon, Microsoft, SAP, IBM, and Salesforce engage in fierce competition, alongside emerging startups that strive to innovate and secure their share of the market. Consequently, Oracle finds itself in the midst of rigorous competition from both established industry players and freshly established firms. Given Oracle's assertive approach to acquisitions and its pursuit of expansion into novel domains like healthcare software (as evident in its acquisition of Cerner, a healthcare software provider), the range of its competitors is poised to expand further. This includes a broader spectrum of rivals such as Epic Systems Corporation, Allscripts Healthcare Solutions, Inc., Arcadia Solutions, athenahealth, Inc., and InterSystems Corporation, among others. Below is a detailed analysis of the most important competitors of Oracle Corporation[1]:

| Company | Description | Competition | Market Capitalization |

|---|---|---|---|

| Amazon | Amazon's subsidiary, AWS, stands as the foremost global provider of cloud services, presenting an extensive range of cloud computing solutions. | In the market for cloud infrastructure and platform services, Oracle Cloud directly rivals AWS. These two corporations compete to attract enterprises seeking to harness the benefits of cloud technology for scalability, adaptability, and cost-efficiency. | $1,450,366 mil. |

| Microsoft | A worldwide technology giant, Microsoft offers a diverse range of products and services. While Oracle and Microsoft vie in certain domains, their main areas of emphasis diverge. Microsoft holds a significant role in operating systems, cloud solutions, productivity applications (Office Suite), gaming (Xbox), and collaboration tools (Microsoft Teams). | In the domain of cloud computing, Microsoft Azure directly contends with Oracle Cloud. Both enterprises provide solutions in Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Moreover, Microsoft's Power Platform competes with Oracle's platforms for application development and low-code solutions. | $2,407,540 mil. |

| IBM | IBM is a technology and advisory firm with a well-established history in multiple industries, encompassing fields like cloud offerings, artificial intelligence, and enterprise solutions. | Although both corporations have a track record of providing business software solutions, their rivalry extends to domains such as cloud services and the management of database systems. IBM's cloud service, IBM Cloud, goes head-to-head with Oracle Cloud, and IBM's database system, Db2, competes directly with Oracle Database. | $129,280 mil. |

| Salesforce | Salesforce holds a prominent position in the customer relationship management (CRM) industry. It delivers cloud-centric solutions for overseeing sales, marketing, and customer service operations. | Oracle directly challenges Salesforce with its Oracle CRM Cloud product. These two enterprises are in competition to secure their portion of the swiftly expanding Customer Relationship Management (CRM) arena, presenting a variety of functionalities and possibilities for customization to cater to the demands of their customers. | $206,546 mil. |

| SAP | SAP is a leading enterprise software company known for its Enterprise Resource Planning (ERP) systems and other business applications. Its expertise lies in aiding companies in the management of diverse operations, encompassing finance, supply chain, and human resources. | Oracle and SAP are significant contenders in the realm of Enterprise Resource Planning (ERP). They vie for the attention of corporate clients in search of comprehensive and unified answers to oversee their business activities. Frequently, their ERP products, namely Oracle ERP Cloud and SAP S/4HANA, directly compete against each other within the market. | $162,318 mil. |

| Workday | Workday is a company that offers enterprise software through cloud-based services, focusing on delivering solutions for managing human capital (HCM) and financial management tailored to businesses and organizations. | Workday directly competes with Oracle HCM Cloud in the HCM space. Oracle's HCM Cloud similarly presents a comprehensive array of cloud-driven human resources and talent management software, targeting the requirements of sizeable corporations and institutions. | $59,401 mil. |

FinancialsEdit

Historic and projected financial statementsEdit

| Income Statement | 2021A | 2022A | 2023A | 2024P | 2025P | 2026P | 2027P | 2028P |

|---|---|---|---|---|---|---|---|---|

| Total revenues | 40,479 | 42,440 | 49,954 | 53,950 | 58,266 | 62,928 | 67,962 | 73,399 |

| Cost of revenues | (7,855) | (8,877) | (13,564) | (14,649) | (15,821) | (17,087) | (18,454) | (19,930) |

| Sales and marketing | (7,682) | (8,047) | (8,833) | (10,003) | (10,803) | (11,667) | (12,600) | (13,608) |

| R&D | (6,527) | (7,219) | (8,623) | (9,063) | (9,788) | (10,571) | (11,417) | (12,330) |

| G&A | (1,254) | (1,317) | (1,579) | (1,684) | (1,818) | (1,964) | (2,121) | (2,291) |

| Amortization of intangible assets | (1,379) | (1,150) | (3,582) | (2,994) | (2,283) | (1,620) | (664) | (635) |

| Acquisition related and other | (138) | (4,713) | (190) | (190) | (190) | (190) | (190) | (190) |

| Restructuring | (431) | (191) | (490) | (490) | (490) | (490) | (490) | (490) |

| Total operating expenses | (25,266) | (31,514) | (36,861) | (39,072) | (41,193) | (43,589) | (45,936) | (49,474) |

| Operating income (EBIT) | 15,213 | 10,926 | 13,093 | 14,878 | 17,073 | 19,339 | 22,026 | 23,925 |

| Interest expense | (2496) | (2755) | (3505) | (3,716) | (3,585) | (3,555) | (3,503) | (3,327) |

| Interest income | 101 | 94 | 285 | 196 | 60 | 20 | 21 | 22 |

| Non-operating (expenses) income, net | 181 | (616) | (747) | (747) | (747) | (747) | (747) | (747) |

| Income before taxes | 12,999 | 7,649 | 9,126 | 10,612 | 12,801 | 15,057 | 17,797 | 19,873 |

| Provision for benefit from income taxes | 747 | (932) | (623) | (1,009) | (1,217) | (1,431) | (1,692) | (1,889) |

| Net income | 13,746 | 6,717 | 8,503 | 9,603 | 11,585 | 13,625 | 16,106 | 17,984 |

| Balance Sheet | 2022A | 2023A | 2024P | 2025P | 2026P | 2027P | 2028P |

|---|---|---|---|---|---|---|---|

| Current assets: | |||||||

| Cash, cash equivalents, marketable securities | 21,902 | 10,187 | 3,860 | 748 | 888 | 1,039 | 1,202 |

| Trade receivables, net of allowances for credit losses of $428 and $362 as of May 31, 2023 and May 31, 2022, respectively | 5,953 | 6,915 | 7,468 | 8,066 | 8,711 | 9,408 | 10,160 |

| Prepaid expenses and other current assets | 3,778 | 3,902 | 4,214 | 4,551 | 4,915 | 5,309 | 5,733 |

| Total current assets | 31,633 | 21,004 | 15,542 | 13,365 | 14,514 | 15,755 | 17,096 |

| Non-current assets: | |||||||

| Property, plant and equipment, net | 9,716 | 17,069 | 22,131 | 26,726 | 30,854 | 33,751 | 33,923 |

| Intangible assets, net | 1,440 | 9,837 | 10,624 | 11,474 | 12,392 | 13,383 | 14,454 |

| Goodwill, net | 43,811 | 62,261 | 67,242 | 72,621 | 78,431 | 84,705 | 91,482 |

| Deferred tax assets | 12,782 | 12,226 | 12,226 | 12,226 | 12,226 | 12,226 | 12,226 |

| Other non-current assets | 9,915 | 11,987 | 12,946 | 13,982 | 15,100 | 16,308 | 17,613 |

| Total non-current assets | 77,664 | 113,380 | 125,168 | 137,029 | 149,003 | 160,374 | 169,697 |

| Total assets | 109,297 | 134,384 | 140,710 | 150,394 | 163,517 | 176,129 | 186,793 |

| Current liabilities: | |||||||

| Commercial paper/revolver | 0 | 563 | 0 | 7,325 | 12,307 | 14,622 | 18,406 |

| Accounts payable | 1,317 | 1,204 | 1,300 | 1,404 | 1,517 | 1,638 | 1,769 |

| Accrued compensation and related benefits | 1,944 | 2,053 | 2,217 | 2,395 | 2,586 | 2,793 | 3,017 |

| Deferred revenues | 8,357 | 8,970 | 9,688 | 10,463 | 11,300 | 12,204 | 13,180 |

| Other current liabilities | 4,144 | 6,802 | 7,346 | 7,934 | 8,569 | 9,254 | 9,994 |

| Total current liabilities | 15,762 | 19,592 | 20,551 | 29,520 | 36,279 | 40,510 | 46,366 |

| Non-current liabilities: | |||||||

| Long-term debt, plus current portion | 75,859 | 89,918 | 85,855 | 75,855 | 70,161 | 64,911 | 54,741 |

| Income taxes payable | 12,210 | 11,077 | 11,963 | 12,920 | 13,954 | 15,070 | 16,276 |

| Deferred tax liabilities | 6,031 | 5,772 | 5,772 | 5,772 | 5,772 | 5,772 | 5,772 |

| Other non-current liabilities | 5,203 | 6,469 | 6,987 | 7,545 | 8,149 | 8,801 | 9,505 |

| Total non-current liabilities | 99,303 | 113,236 | 110,577 | 102,093 | 98,036 | 94,554 | 86,294 |

| Oracle Corporation stockholders' equity (deficit): | |||||||

| Preferred stock, $0.01 par value—authorized: 1.0 shares; outstanding: none | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Common stock, $0.01 par value and additional paid in capital—authorized: 11,000 shares; outstanding: 2,713 shares and 2,665 shares as of May 31, 2023 and 2022, respectively | 26,808 | 30,215 | 34,046 | 38,183 | 42,651 | 47,477 | 52,689 |

| Accumulated deficit | (31,336) | (27,620) | (23,424) | (18,363) | (12,410) | (5,373) | 2,484 |

| Accumulated other comprehensive loss | (1,692) | (1,522) | (1,522) | (1,522) | (1,522) | (1,522) | (1,522) |

| Total Oracle Corporation stockholders' equity (deficit) | (6,220) | 1,073 | 9,099 | 18,298 | 28,719 | 40,582 | 53,651 |

| Noncontrolling interests | 452 | 483 | 483 | 483 | 483 | 483 | 483 |

| Total stockholders' equity (deficit) | (5,768) | 1,556 | 9,582 | 18,781 | 29,202 | 41,065 | 54,134 |

| Total liabilities and stockholders' equity (deficit) | 109,297 | 134,384 | 140,710 | 150,394 | 163,517 | 176,129 | 186,793 |

| Cash Flow Statement | 2024P | 2025P | 2026P | 2027P | 2028P |

| Net income | 9,603 | 11,585 | 13,625 | 16,106 | 17,984 |

| Depreciation and amortization | 6,250 | 5,760 | 5,395 | 4,767 | 4,974 |

| Stock based compensation | 3,831 | 4,137 | 4,468 | 4,826 | 5,212 |

| Decreases / (Increases) in working capital assets | (865) | (935) | (1,009) | (1,090) | (1,177) |

| Increases / (Decreases) in working capital liabilities | 1,522 | 1,644 | 1,776 | 1,918 | 2,071 |

| Other non current assets | (9,721) | (9,548) | (9,466) | (9,138) | (9,787) |

| Other non current liabilities | 1,404 | 1,516 | 1,637 | 1,768 | 1,910 |

| Cash from operating activities | 12,023 | 14,160 | 16,426 | 19,156 | 21,187 |

| Capital expenditures | (8,317) | (8,073) | (7,903) | (7,000) | (4,511) |

| Cash from investing activities | (8,317) | (8,073) | (7,903) | (7,000) | (4,511) |

| Long term debt | (4,063) | (10,000) | (5,694) | (5,250) | (10,170) |

| Revolver | (563) | 7,325 | 4,983 | 2,314 | 3,784 |

| Share repurchases | (1,265) | (1,526) | (1,795) | (2,121) | (2,369) |

| Common dividends | (4,143) | (4,997) | (5,878) | (6,948) | (7,758) |

| Cash from financing activities | (10,034) | (9,198) | (8,384) | (12,005) | (16,513) |

| Net change in cash during period | (6,327) | (3,112) | 140 | 151 | 163 |

RatiosEdit

| 2021A | 2022A | 2023A | |

| Profitability ratios | |||

| Gross profit | 81% | 79% | 73% |

| Operating profit margin | 38% | 26% | 26% |

| Net profit margin | 34% | 16% | 17% |

| Liquidity ratios | |||

| Current ratio | 2.01 | 1.07 | |

| Quick ratio | 1.77 | 0.87 | |

| Leverage ratios | |||

| Debt to Assets | 69% | 67% | |

| Debt to Equity | -1315% | 5815% | |

| Debt to Capital | 108% | 98% | |

| Interest coverage ratio | 726% | 510% | |

| Efficiency ratios | |||

| Asset turnover ratio | 39% | 37% | |

| Performance ratios | |||

| Return on equity (ROE) | -116% | 546% | |

| Return on assets (ROA) | 6% | 6% | |

| Return on invested capital (ROIC) | 20% | 15% | |

| Return on capital employed (ROCE) | 10% | 11% |

DCF ValuationEdit

Our $131.43 price target represents our DCF valuation on Oracle over the next 5 years. A discount rate of 7.46% and a perpetual growth rate of 3% were used in order to calculate discounted cash flows and terminal value[1]. The discount rate was calculated using the Weighted Average Cost of Capital (WACC) formula. The cost of equity was calculated using the Capital Asset Pricing Model (CAPM). A beta of 0.85, a market risk premium of 5%[3] and a risk-free rate of 4.16% were used in the CAPM calculation. This target price shows a potential upside of around 16.25% when compared to the current market price. DCF is an assumption-based model and the accuracy of those assumptions can significantly impact the valuation results. The assumptions used are included in the following table:

| Variable | Value | Commentary |

|---|---|---|

| Revenue growth (% change) | 8% | The base case scenario assumes a revenue growth rate of 8%, given that Oracle is an established company and sell-side analysts provided this estimate (Capital IQ, 2023). Our bullish scenario assumes a revenue growth rate of 10%, whereas our bearish case assumes a revenue growth rate of 6%. |

| Gross profit margin | 73% | The last observation of gross margin was used. Our bullish scenario assumes a year-on-year increase of 0.5%, whereas our bearish case scenario assumes a year-on-year decrease of 0.5%. |

| Sales & Marketing | 19% | The historical average of Sales & Marketing was used. |

| R&D | 17% | The historical average of R&D was used. |

| G&A | 3% | The historical average of G&A was used. |

| Tax rate | 10% | The historical average of tax rate was used. Our bullish scenario assumes a tax rate of 7%, whereas our bearish case assumes a tax rate of 13%. |

| Capital Expenditures | $8,317 in 2024P, $8,073 in 2025P, $7,903 in 2026P, $7,000 in 2027P, $4,511 in 2028P | For years 2024, 2025, 2026 the projections of sell-side analysts were used (Capital IQ, 2023). Subjective assumption were used for years 2027, 2028. Thereafter, it is anticipated that the capital expenses will gradually decrease to their previous levels. This is because Oracle will probably be unable to sustain its capital expenditures at such elevated rates due to substantial debt repayments and limited cash reserves. |

Sensitivity AnalysisEdit

Sensitivity analysis provides valuable insights into the potential outcomes and risks associated with models which are based on a wide range of assumptions. As such, it is crucial to be implemented for models, such as the DCF. Two significant variables that have an important impact in our DCF valuation were revenue growth rate and WACC. As it is widely known, when the WACC increases, the valuation decreases as they are negatively related based on the NPV formula. For example, in the first table, when the WACC increases by only 0.5%, the intrinsic value per share falls by approximately $17. If we increase it by another 0.5%, the intrinsic value per share drops to $100.61. Revenue growth is an essential part of the valuation as well, since it significantly impacts the free cash flow of Oracle. Under our bearish case (revenue growth rate equals 6%), Oracle's share is worth $115.81, whereas under our bullish case (revenue growth rate equals 10%) Oracle's share is worth $148.31.

The second table includes another variable that can potentially alter our valuation result a lot, which is the perpetual growth rate. Here, under our base case, the company is expected to grow by 3% in perpetuity. This figure is most of the times tied up with the global GPD growth. However, it is worth noting that a perpetually growing economy is an idealized assumption and may not reflect the reality of economic cycles and fluctuations.

Comparable Company AnalysisEdit

Our second method for valuing Oracle was comparable company analysis. Price/earnings, Enterprise Value/EBITDA, and Enterprise Value/Revenue ratios were used. The companies selected were the direct competitors, as mentioned above.

To begin, the EV/Sales metric was employed. This involved taking the revenue from the past year and multiplying it by the median EV/Sales ratio of competing firms. As a result, the estimated enterprise value stood at $278,895 million. After accounting for net debt, it became evident that the equity value equated to $193,752 million or $71.38 per share. Consequently, based on this ratio, the company appears to be overvalued compared to its peers.

Moving on, the EV/EBITDA ratio was employed. By taking the EBITDA over the last 12 months and multiplying it by the median EV/EBITDA ratio among rivals, the implied enterprise value reached $474,443 million. Deducting net debt led us to an equity value of $389,300 million. Dividing this amount by the outstanding shares yielded an implied value of $143.43 per share. Thus, according to this multiple, the company seems to be undervalued compared to its industry counterparts.

Lastly, the P/E ratio was brought into consideration. Earnings from the past year were multiplied by the median P/E ratio of the six comparable companies. The estimated equity value stood at $412,878 million. Dividing this sum by the total outstanding shares of 2,714 million resulted in a fair share value of $152.11. Once again, the company's valuation appears to be lower when compared to its peers. These outcomes suggest that investors might not be fully acknowledging the company's potential for earnings or growth relative to its competitors, leading to a lower valuation at present.

RisksEdit

Operational risk

Given the cloud-based nature of many of Oracle's services, operational risk becomes a significant consideration. Cloud services are reliant on stable and resilient infrastructure. Any technical issues, outages, or disruptions in data centers or networks could lead to service downtime and impact customer satisfaction. Furthermore, Oracle's cloud services need to be scalable and able to handle increased demand. Inadequate infrastructure to accommodate growth or surges in usage could result in performance issues and customer dissatisfaction.

Share repurchase risk

There is no guarantee that Oracle will keep buying back common stock like he did in the previous 3 years. In fact, it is expected from the company to suspend or reduce its share repurchase program given that it resulted in equity deficit in 2022. Furthermore, the company stated in its annual report that it is not going to increase its share repurchases until their gross debt is reduced below some unspecified level.

Reputational risk

Oracle holds vast amounts of sensitive data from its customers. Any breach of this data could lead to significant reputational damage, legal consequences, and loss of customer trust. In case customers lose their trust, they may stop buying products or continue using them. This could result in a revenue loss and high lawsuit expenses.

Acquisitions-related risks

Oracle has followed an aggressive acquisition strategy throughout the years. That can be seen by the large number of acquisitions that have been completed, such as Cerner, Adi Insights, FOEX, Federos, FarApp, among others. An aggressive acquisition strategy, while potentially beneficial in expanding a company's market presence and diversifying its offerings, also comes with several risks. The most important risk is the challenge of integrating the products and workforce of all these companies into Oracle's existing operations. Poor integration can lead to inefficiencies and cultural clashes.

Leverage levels

The company's debt level is really high compared to its competitors, which can be seen by its debt to equity and debt to capital ratios. This is a result of its share repurchase program as well as the aggressive acquisition strategy which involves a lot of debt. The company might have to suspend its repurchase program or reduce its capital expenditures in order to be able to reduce its debt levels. S&P has assigned a credit rating of BBB, which is low when compared to its competitors (e.g. Microsoft, Salesforce). Such a low credit rating can potentially lead to higher cost of debt moving forward[1].