Royal Bank of Canada: Difference between revisions

No edit summary |

No edit summary |

||

| Line 40: | Line 40: | ||

** Portfolio and Investment Solutions | ** Portfolio and Investment Solutions | ||

** Online banking and trade services | ** Online banking and trade services | ||

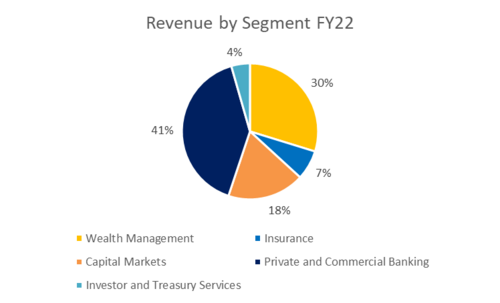

== Segments == | |||

[[File:Revenue Breakdown.png|center|thumb|500x500px]] | |||

__INDEX__ | __INDEX__ | ||

Revision as of 21:02, 27 July 2023

About

Royal Bank of Canada is a Canada-based diversified financial services company. The Company provides personal and commercial banking, wealth management services, insurance, investor services and capital markets products and services globally. Its segments include Personal & Commercial Banking, Wealth Management, Insurance, Investor and Treasury Services, Capital Markets, and Corporate Support. Personal & Commercial Banking segment provides a range of financial products and services to individuals and businesses for their day-to-day banking, investing, and financing needs through two businesses: Canadian Banking, and Caribbean and United States Banking. Wealth Management offers comprehensive investment, trust, banking, credit, and other advice-based solutions. Its insurance segment offers a range of advice and solutions for individual and business clients including life, health, wealth, home, auto, travel, annuities, and reinsurance.

The bank reported interest income of CAD 40,771 million for the fiscal year ended October 2022 (FY2022), an increase of 44.9% over FY2021. In FY2022, the bank’s operating margin was 41.1%, compared to an operating margin of 41.5% in FY2021. In FY2022, the bank recorded a net margin of 23.6%, compared to a net margin of 27.7% in FY2021.

Key Achievements

- #1 market share in all key product categories in Canadian Banking

- 9th largest global investment bank

- Largest retail mutual fund in Canada

- #1 in market share for high net worth/ultra-high net worth in Canada

- Largest Canadian-bank owned insurance organization

- 6th largest wealth advisory firm in the US

Products and Services

RBC is a provider of banking products and related services. Its key products and services include:

- Accounts and Deposits:

- Savings and Checking Accounts

- Business Trust Accounts

- Tax-free savings account

- Cards:

- Commercial Cards

- Credit Cards

- Loans and Financing:

- Fixed and Variable Rate Mortgages

- Line of Credit and Operating loans

- Car loans

- Personal loans

- Investment Products:

- Mutual Funds and ETFs

- Equity and Fixed Income Products

- Alternative Investments

- Guaranteed Investment Certificates

- Retirement funds

- Insurance:

- Life and Non-life insurance

- Services:

- Portfolio and Investment Solutions

- Online banking and trade services