Royal Bank of Canada: Difference between revisions

No edit summary |

No edit summary |

||

| Line 44: | Line 44: | ||

[[File:Revenue Breakdown.png|center|thumb|500x500px]] | [[File:Revenue Breakdown.png|center|thumb|500x500px]] | ||

=== Personal and Commercial Banking === | |||

RBC’s Personal and Commercial Banking vertical provides a broad suite of financial products and services to individuals and businesses. Its operations are conducted through two businesses – Canadian banking and Caribbean and US banking. | RBC’s Personal and Commercial Banking vertical provides a broad suite of financial products and services to individuals and businesses. Its operations are conducted through two businesses – Canadian banking and Caribbean and US banking. | ||

'''KPIs:''' | '''KPIs:''' | ||

| Line 58: | Line 58: | ||

* The Personal Banking segment’s revenue rose by 5%, which is primarily due to higher interest rates. Average residential mortgages increased by 11% from FY21 primarily due to rising interest rates, changes in product mix and lower prepayment revenue. Average deposits increased by 9% from FY21 mainly due to the acquisition of new clients and an increase in activity from existing clients. | * The Personal Banking segment’s revenue rose by 5%, which is primarily due to higher interest rates. Average residential mortgages increased by 11% from FY21 primarily due to rising interest rates, changes in product mix and lower prepayment revenue. Average deposits increased by 9% from FY21 mainly due to the acquisition of new clients and an increase in activity from existing clients. | ||

* Business banking’s revenue increased by 26%, majorly due to higher interest rates, credit fees and service charges. Average loan acceptance increased by 11% and average deposits increased by 11%. | * Business banking’s revenue increased by 26%, majorly due to higher interest rates, credit fees and service charges. Average loan acceptance increased by 11% and average deposits increased by 11%. | ||

* Caribbean and US Banking revenue increased by 11%, resulting from average volume growth of 11%, higher card service revenue and higher spreads. Average loans and acceptances increased by 12% and average deposits increased by 11% primarily due to increased client activity and the impact of foreign exchange translation.__INDEX__ | * Caribbean and US Banking revenue increased by 11%, resulting from average volume growth of 11%, higher card service revenue and higher spreads. Average loans and acceptances increased by 12% and average deposits increased by 11% primarily due to increased client activity and the impact of foreign exchange translation. __INDEX__ | ||

'''Loan Mix for Q2FY23''' | |||

* [[File:Loan Mix.png|thumb|400x400px]]The loans stand at CAD 846 BN with 50% of it accounting for residential mortgages | |||

* Canadian Banking weighted average FICO Score stands at 789 with over 81% of customers with a score of more than 720 | |||

* 30–89-day delinquency rates were stable QoQ across all portfolios | |||

* In the residential mortgage portfolio, fixed-rate mortgages accounted for 68% of the mortgages. The Average Duration for Remaining Mortgage Amortization stands at 26 years. | |||

Revision as of 21:09, 27 July 2023

About

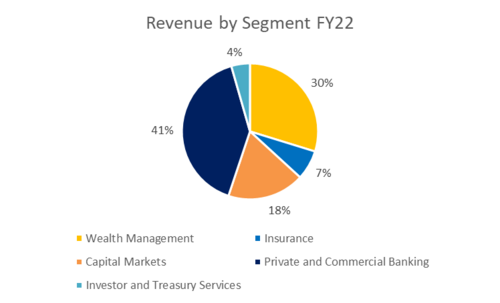

Royal Bank of Canada is a Canada-based diversified financial services company. The Company provides personal and commercial banking, wealth management services, insurance, investor services and capital markets products and services globally. Its segments include Personal & Commercial Banking, Wealth Management, Insurance, Investor and Treasury Services, Capital Markets, and Corporate Support. Personal & Commercial Banking segment provides a range of financial products and services to individuals and businesses for their day-to-day banking, investing, and financing needs through two businesses: Canadian Banking, and Caribbean and United States Banking. Wealth Management offers comprehensive investment, trust, banking, credit, and other advice-based solutions. Its insurance segment offers a range of advice and solutions for individual and business clients including life, health, wealth, home, auto, travel, annuities, and reinsurance.

The bank reported interest income of CAD 40,771 million for the fiscal year ended October 2022 (FY2022), an increase of 44.9% over FY2021. In FY2022, the bank’s operating margin was 41.1%, compared to an operating margin of 41.5% in FY2021. In FY2022, the bank recorded a net margin of 23.6%, compared to a net margin of 27.7% in FY2021.

Key Achievements

- #1 market share in all key product categories in Canadian Banking

- 9th largest global investment bank

- Largest retail mutual fund in Canada

- #1 in market share for high net worth/ultra-high net worth in Canada

- Largest Canadian-bank owned insurance organization

- 6th largest wealth advisory firm in the US

Products and Services

RBC is a provider of banking products and related services. Its key products and services include:

- Accounts and Deposits:

- Savings and Checking Accounts

- Business Trust Accounts

- Tax-free savings account

- Cards:

- Commercial Cards

- Credit Cards

- Loans and Financing:

- Fixed and Variable Rate Mortgages

- Line of Credit and Operating loans

- Car loans

- Personal loans

- Investment Products:

- Mutual Funds and ETFs

- Equity and Fixed Income Products

- Alternative Investments

- Guaranteed Investment Certificates

- Retirement funds

- Insurance:

- Life and Non-life insurance

- Services:

- Portfolio and Investment Solutions

- Online banking and trade services

Segments

Personal and Commercial Banking

RBC’s Personal and Commercial Banking vertical provides a broad suite of financial products and services to individuals and businesses. Its operations are conducted through two businesses – Canadian banking and Caribbean and US banking.

KPIs:

- Over 14 million clients in Canadian Banking

- #1 or #2 ranking in market share for all key retail and business products

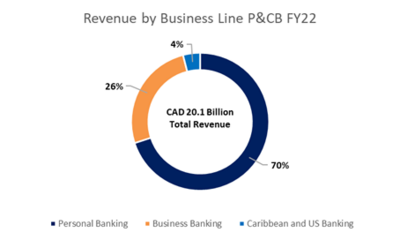

Revenue share FY22

The P&CB segment brought in CAD 20.1 billion in FY22 which is a 10% increase in revenue when compared to FY21 which was at CAD 18.3 billion.

- The Personal Banking segment’s revenue rose by 5%, which is primarily due to higher interest rates. Average residential mortgages increased by 11% from FY21 primarily due to rising interest rates, changes in product mix and lower prepayment revenue. Average deposits increased by 9% from FY21 mainly due to the acquisition of new clients and an increase in activity from existing clients.

- Business banking’s revenue increased by 26%, majorly due to higher interest rates, credit fees and service charges. Average loan acceptance increased by 11% and average deposits increased by 11%.

- Caribbean and US Banking revenue increased by 11%, resulting from average volume growth of 11%, higher card service revenue and higher spreads. Average loans and acceptances increased by 12% and average deposits increased by 11% primarily due to increased client activity and the impact of foreign exchange translation.

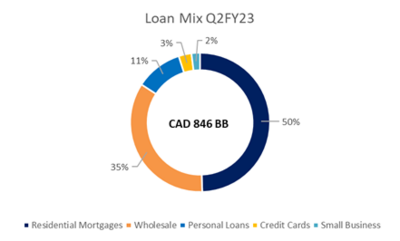

Loan Mix for Q2FY23

- The loans stand at CAD 846 BN with 50% of it accounting for residential mortgages

- Canadian Banking weighted average FICO Score stands at 789 with over 81% of customers with a score of more than 720

- 30–89-day delinquency rates were stable QoQ across all portfolios

- In the residential mortgage portfolio, fixed-rate mortgages accounted for 68% of the mortgages. The Average Duration for Remaining Mortgage Amortization stands at 26 years.