Stockhub: Difference between revisions

(→Notes) |

No edit summary |

||

| (206 intermediate revisions by 22 users not shown) | |||

| Line 1: | Line 1: | ||

[[File:Stockhub logo icon meta tag.png|thumb]] | {{Logo Image|[[File:Stockhub logo icon meta tag.png|thumb]]}} | ||

Helping to make more money for everyone (and not just the wealthy!). | {{Short description|Helping to make more money for everyone (and not just the wealthy!).}} | ||

{| class="wikitable" | {| class="wikitable" | ||

|+ Key information | |+ Key information | ||

|- | |- | ||

| Risk/return|| High | | Risk/return|| [[Risk/return::High]] | ||

|- | |- | ||

| Price per share|| £10 | | Price per share|| [[Price per share::£10]] | ||

|- | |- | ||

| Asset class|| Equities<ref name=":0">https://find-and-update.company-information.service.gov.uk/company/13169692</ref> | | Asset class|| [[Asset class::Equities]]<ref name=":0">https://find-and-update.company-information.service.gov.uk/company/13169692</ref> | ||

|- | |- | ||

| Industry|| Fintech | | Industry|| [[Industry::Fintech]] | ||

|- | |- | ||

| Country of incorporation|| United Kingdom<ref name=":0" /> | | Country of incorporation|| [[Country of incorporation::United Kingdom]]<ref name=":0" /> | ||

|- | |- | ||

| Minimum investment amount|| £10 | | Minimum investment amount|| [[ Minimum investment amount::£10]] | ||

|- | |- | ||

| Maximum investment amount|| £500,000 | | Maximum investment amount|| [[ Maximum investment amount::£500,000]] | ||

|- | |- | ||

| Current valuation|| £4,000,000 | | Current valuation|| [[Current valuation::£4,000,000]] | ||

|- | |- | ||

| Investor type|| All | | Investor type|| [[Investor type::All]] | ||

|- | |- | ||

| Tax schemes|| SEIS/EIS | | Tax schemes|| [[Tax schemes::SEIS/EIS]] | ||

|- | |- | ||

| Bid/ask spread|| NA | | Bid/ask spread|| [[Bid/ask spread::NA]] | ||

|- | |- | ||

| Commission amount|| Zero | | Commission amount|| [[Commission amount::Zero]] | ||

|- | |- | ||

| Market|| Private<ref name=":0" /> | | Market|| [[Market::Private]]<ref name=":0" /> | ||

|} | |} | ||

| Line 37: | Line 37: | ||

* The mission of the company is to help make more money for everyone (and not just the wealthy!).<ref name=":1" /> | * The mission of the company is to help make more money for everyone (and not just the wealthy!).<ref name=":1" /> | ||

*The company is led by the former principal investment analyst of one of the world's wealthiest persons. | *The company is led by the former principal investment analyst of one of the world's wealthiest persons. | ||

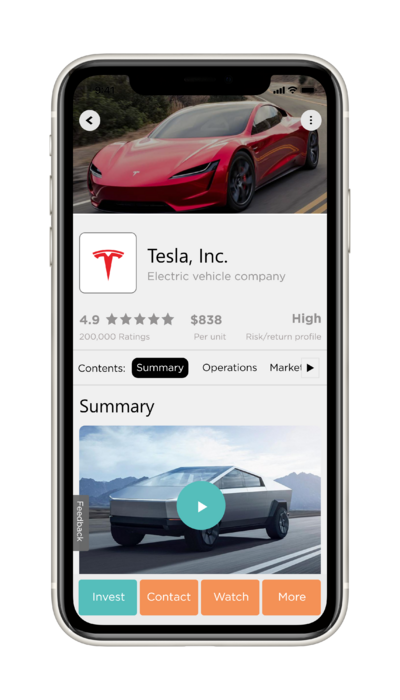

*The | *The company’s flagship product is targeted towards Active Investors, who are a group of people that are willing and able to be actively involved in the process of finding suitable investments. The product is an investment research platform. What makes the platform unique is that the research is produced open collaboratively. Evidence suggests that open collaborative investment research will, in time, result in Active Investors making better investment decisions, and, ultimately, more money. | ||

*To date, the Stockhub platform covers | *To date, the Stockhub platform covers 375 investments<ref name=":2" />, and is growing at a rate of seven investments a day<ref>The Stockhub platform was created on 1st March 2022, and the date of the calculation is 25th April 2022, so the platform has been live for 56 days. 375 investments divided by 56 days equates to 7 investments per day.</ref>. | ||

*The Stockhub company estimates that the expected return of an investment in the company over the next five years is | *The Stockhub company estimates that the expected return of an investment in the company over the next five years is 55x<ref>The calculation of the investment return figure can be found in the 'Valuation' section of this report.</ref>. In other words, an £1,000 investment in the company is expected to return £55,000 in five years time. | ||

* The degree of risk associated with an investment in Stockhub is higher than in a company that's say trading on a public market (such as, HSBC). | * The degree of risk associated with an investment in Stockhub is higher than in a company that's say trading on a public market (such as, HSBC). | ||

| Line 52: | Line 52: | ||

Stockhub Limited is a company that’s on a mission to help make more money for everyone (and not just the wealthy!).<ref name=":1">https://wiki.stockhub.co:447/main/index.php?title=Stockhub_Wiki:About</ref> | Stockhub Limited is a company that’s on a mission to help make more money for everyone (and not just the wealthy!).<ref name=":1">https://wiki.stockhub.co:447/main/index.php?title=Stockhub_Wiki:About</ref> | ||

===What's | ===What's the company's main offering(s)?=== | ||

At the moment (as of 15th April 2022), the main and only offering of the company is Stockhub. | |||

====Who’s the target audience of the company’s flagship product?==== | |||

The audience is Active Investors, who are a group of people that are willing and able to be actively involved in the process of finding suitable investments. | |||

What | ====What's the flagship product?==== | ||

The product is an investment research platform.<ref name=":2">https://wiki.stockhub.co:447/main/index.php?title=Main_Page</ref> | |||

====What makes the flagship product unique?==== | |||

What makes the platform unique is that the research is produced open collaboratively. Evidence suggests that open collaborative investment research will, in time, result in Active Investors making better investment decisions, and, ultimately, more money. | |||

[[File:Stockhub report example.png|centre|400px]] | |||

===What's the biggest achievement of the company? === | |||

As of | As of 25th April 2022, the Stockhub platform covers 375 investments.<ref>https://wiki.stockhub.co:447/main/index.php?title=Main_Page</ref> | ||

===What's the next key milestone of the company?=== | |||

The next key milestone of the company is to increase the number of investments on the platform to 1,000 investments (from | The next key milestone of the company is to increase the number of investments on the platform to 1,000 investments (from 375 investments) by 30th June 2022. | ||

==Market== | ==Market== | ||

| Line 82: | Line 84: | ||

===What's the total addressable market of the company?=== | ===What's the total addressable market of the company?=== | ||

Here, the total addressable market (TAM) is defined as the global advertising market, and based on a number of assumptions<ref group="Note" name="Note01" />, it is estimated that the size of the market as of today (14th March 2022), in terms of revenue, is $850 billion. | Here, the total addressable market (TAM) is defined as the global advertising market, and based on a number of assumptions<ref group="Note" name="Note01" />, it is estimated that the size of the market as of today (14th March 2022), in terms of revenue, is $850 billion (£635 billion). | ||

===What's the serviceable available market of the company?=== | ===What's the serviceable available market of the company?=== | ||

| Line 94: | Line 96: | ||

==Competition== | ==Competition== | ||

A key way to determine a product's closest competitors is by looking at other offerings that are targeting the same or similar target audience (i.e. Active Investors) and aiming to provide the same core benefit (i.e. more money), and then ranking the offerings in terms of the total amount of time spent using and/or money spent purchasing the offerings relative to other similar offerings. With that said, according to Stockhub, the closest competitors of its namesake offering are Yahoo Finance, Investing.com, CoinMarketCap, MarketWatch, Seeking Alpha, Goldman Sachs Investment Research and Edison Investment Research. A detailed comparison between Stockhub and some of its main competitors are shown in the table below. | |||

{| class="wikitable" | {| class="wikitable" | ||

|+ Competition comparison | |+Competition comparison | ||

|- | |- | ||

! !! Stockhub!!Seeking Alpha!!Goldman Sachs Investment Research!!Edison Investment Research | ! !!Stockhub!!Seeking Alpha!!Goldman Sachs Investment Research!!Edison Investment Research | ||

|- | |- | ||

| colspan="5" style="text-align: center;" |How is the research produced? | | colspan="5" style="text-align: center;" | How is the research produced? | ||

|- | |- | ||

|Type of production method?||Crowdsourced information, decentralized production||End-user-paid-for, crowdsourced information, centralized production||End-user-paid-for, insourced information, centralized production||Sponsor-paid-for, insourced information, centralized production | |Type of production method?||Crowdsourced information, decentralized production||End-user-paid-for, crowdsourced information, centralized production||End-user-paid-for, insourced information, centralized production||Sponsor-paid-for, insourced information, centralized production | ||

|- | |- | ||

|Is the information on the platform sourced from a large, relatively open, and often rapidly evolving group of participants (i.e. crowdsourced information)?|| style="background: green; color: white;" |Yes|| style="background: green; color: white;" |Yes|| style="background: red; color: white;" |No|| style="background: red; color: white;" |No | |Is the information on the platform sourced from a large, relatively open, and often rapidly evolving group of participants (i.e. crowdsourced information)? || style="background: green; color: white;" |Yes || style="background: green; color: white;" |Yes || style="background: red; color: white;" |No || style="background: red; color: white;" |No | ||

|- | |- | ||

|Is the production of the research controlled by no single entity (i.e. decentralised production)?|| style="background: green; color: white;" |Yes|| style="background: red; color: white;" |No|| style="background: red; color: white;" |No|| style="background: red; color: white;" | No | |Is the production of the research controlled by no single entity (i.e. decentralised production)? || style="background: green; color: white;" |Yes || style="background: red; color: white;" |No || style="background: red; color: white;" |No || style="background: red; color: white;" |No | ||

|- | |- | ||

|Are contributions able to be made anonymously?|| style="background: green; color: white;" |Yes|| style="background: red; color: white;" |No|| style="background: red; color: white;" |No|| style="background: red; color: white;" |No | | Are contributions able to be made anonymously? || style="background: green; color: white;" |Yes || style="background: red; color: white;" |No || style="background: red; color: white;" |No || style="background: red; color: white;" |No | ||

|- | |- | ||

| What is the estimated cost for the investment research company to produce research on a specific investment per year?|| style="background: green; color: white;" |Zero|| style="background: orange; color: white;" |£850|| style="background: red; color: white;" |£5,000|| style="background: red; color: white;" |£5,000 | |What is the estimated cost for the investment research company to produce research on a specific investment per year?|| style="background: green; color: white;" |Zero || style="background: orange; color: white;" |£850 || style="background: red; color: white;" |£5,000 || style="background: red; color: white;" |£5,000 | ||

|- | |- | ||

| colspan="5" style="text-align: center;" |What are the main features of the research for the end-user (i.e. Investors)? | | colspan="5" style="text-align: center;" |What are the main features of the research for the end-user (i.e. Investors)? | ||

|- | |- | ||

| What is the price of the research?|| style="background: green; color: white;" |Free|| style="background: orange; color: white;" | $179.99 per year|| style="background: red; color: white;" | $30,000 per year|| style="background: green; color: white;" |Free | |What is the price of the research?|| style="background: green; color: white;" |Free || style="background: orange; color: white;" |$179.99 per year|| style="background: red; color: white;" |$30,000 per year|| style="background: green; color: white;" |Free | ||

|- | |- | ||

|How many investments are realistically able to be covered using this method?|| style="background: green; color: white;" | Unlimited|| style="background: orange; color: white;" |Limited|| style="background: orange; color: white;" |Limited|| style="background: red; color: white;" |Very limited | | How many investments are realistically able to be covered using this method? || style="background: green; color: white;" |Unlimited|| style="background: orange; color: white;" |Limited || style="background: orange; color: white;" |Limited || style="background: red; color: white;" |Very limited | ||

|- | |- | ||

| What is the expected quality level of the research?|| style="background: green; color: white;" |High|| style="background: orange; color: white;" |Medium|| style="background: green; color: white;" |High|| style="background: green; color: white;" |High | |What is the expected quality level of the research?|| style="background: green; color: white;" |High || style="background: orange; color: white;" |Medium || style="background: green; color: white;" |High || style="background: green; color: white;" |High | ||

|} | |} | ||

==Team== | ==Team== | ||

The company is led by the person who believes in the | The company is led by the person who believes in the mission of the company the most: the creator of the company mission. Combined, the members of the team have helped 342 million people - including one of the world's wealthiest persons - make better investment decisions and returns, and helped build some of the world's most renowned digital platforms. | ||

===Chief Executive Officer=== | ===Chief Executive Officer=== | ||

| Line 138: | Line 137: | ||

===Chief Technology Officer=== | ===Chief Technology Officer=== | ||

[[File: | [[File:Jitesh Halai.jpg|200px]] | ||

The Chief Technology Officer of the company is | The Chief Technology Officer of the company is Jitesh Halai. Over a 23 year period, Jitesh has helped build digital platforms at leading institutions (including Just Eat, Asos and Credit Suisse). He studied Mathematical Sciences at Queen Mary University of London and an Executive Master of Business Administration at Imperial College.<ref>https://www.linkedin.com/in/jiteshhalai/</ref> | ||

===Business Advisor=== | ===Business Advisor=== | ||

| Line 147: | Line 146: | ||

The business advisor of the company is Phil Hollingdale. Phil has founded or co-founded six tech companies, with five successful exits so far. His current business is a digital workplace savings platform that has 400,000 customers and £1.7 billion assets under management (as at March 2022).<ref>https://www.linkedin.com/in/philhollingdale/</ref> | The business advisor of the company is Phil Hollingdale. Phil has founded or co-founded six tech companies, with five successful exits so far. His current business is a digital workplace savings platform that has 400,000 customers and £1.7 billion assets under management (as at March 2022).<ref>https://www.linkedin.com/in/philhollingdale/</ref> | ||

===Compliance Advisor=== | ===Compliance Advisor=== | ||

| Line 158: | Line 151: | ||

[[File:Richard Gill.png|200px]] | [[File:Richard Gill.png|200px]] | ||

The compliance advisor of the company is Richard Gill. Over a 13 year period, Richard has helped provide compliance oversight at investment research and trading companies (including Crowd for Angels, Align Research and Master Investor). He is approved by the Financial Conduct Authority to perform functions of compliance oversight (CF10) and money laundering reporting (CF11). He is also a CFA charterholder. | The compliance advisor of the company is Richard Gill. Over a 13 year period, Richard has helped provide compliance oversight at investment research and trading companies (including Crowd for Angels, Align Research and Master Investor). He is approved by the Financial Conduct Authority to perform functions of compliance oversight (CF10) and money laundering reporting (CF11). He is also a CFA charterholder and a graduate of King's College London. | ||

==Financials== | ==Financials== | ||

In keeping in-line with industry standards, the | ===What are the financial forecasts? === | ||

In keeping in-line with industry standards, the number of years of financial forecasts shown below is five years. | |||

====Income statement==== | |||

Stockhub' | {| class="wikitable" | ||

|+Income statement<ref>Source: Stockhub Limited</ref><ref group="Note" name="Note04" /> | |||

|- | |||

!Year/Item!! Year 1!! Year 2!! Year 3!! Year 4!!Year 5 | |||

|- | |||

| Year end date||28/02/2022||28/02/2023||28/02/2024||28/02/2025||28/02/2026 | |||

|- | |||

|Revenues (£'000)||£126.169||£332.681||£842.810||£2,051.447||£4,797.544 | |||

|- | |||

|Gross profits (£'000)||£100.935||£266.145||£674.248||£1,641.158||£3,838.035 | |||

|- | |||

|Operating profits (£'000)||£25.234||£66.536||£168.562||£410.289||£959.509 | |||

|- | |||

| Net profits (£'000)||£20.439||£53.894||£136.535||£332.334||£777.202 | |||

|} | |||

=== What are the assumptions used to estimate the financial forecasts?=== | |||

=== | {| class="wikitable" | ||

|+Key inputs | |||

!Description | |||

!Value | |||

!Commentary | |||

|- | |||

| colspan="3" |<div style="text-align: center;">'''Revenue'''</div> | |||

|- | |||

|What's the estimated current size of the total addressable market? | |||

|£635,325,000,000 | |||

|Here, the total addressable market (TAM) is defined as the global advertising market, and based on a number of assumptions<ref group="Note" name="Note01" />, it is estimated that the size of the market as of today (14th March 2022), in terms of revenue, is £635 billion (or $850 billion). | |||

|- | |||

|What's the estimated terminal annual growth rate of the total addressable market? | |||

|3% | |||

|Research shows that the growth rate of the global advertising market (i.e. the total addressable market) is similar to the growth rate of global gross domestic product<ref>http://www.robertpicard.net/files/econgrowthandadvertising.pdf</ref>, which has averaged (medium) around 3% per year in the last 20 years (2001 to 2022)<ref>https://www.macrotrends.net/countries/WLD/world/gdp-growth-rate</ref>. | |||

|- | |||

|What's the estimated Stockhub peak market share? | |||

|2% | |||

|Research shows that there's an almost perfect positive correlation between the amount of adverting revenue generated on a platform and the total amount of time spent by users on the platform. In other words, the more time users spend on a platform, the more advertising revenue the platform generates. Accordingly, Stockhub believes that the best measurement unit of future advertising market share is time. In UK broadcasting, there's a limit on the amount of advertising that can be shown to viewers, and the limit is 15% of 24 hours (i.e. around 9 minutes per hour or around 216 minutes a day). Research suggests that Active Investors represent around 10.4% of the global population and that the average amount of time Active Investors spend researching investments is 30 minutes per day. Consequently, the Stockhub company estimates that the peak market share of its namesake platform is around 2%, and, therefore, suggests using the share amount here. | |||

|- | |||

|Which distribution function do you want to use to estimate Stockhub revenue? | |||

|Gaussian | |||

|Research suggests that the revenue pattern of companies is similar to the pattern produced by the Gaussian distribution function (i.e. the revenue distribution is bell shaped)<ref>http://escml.umd.edu/Papers/ObsCPMT.pdf</ref>, so Stockhub suggests using that function here. | |||

|- | |||

| What is the estimated Stockhub lifespan? | |||

|50 years | |||

|Stockhub's vision is to be a large organisation (more than 10,000 employees), and research shows that the average lifespan of a large corporation is around 50 years.<ref>Stadler, Enduring Success, 3–5.</ref> | |||

|- | |||

|What's the estimated standard deviation of Stockhub revenue? | |||

|5 years | |||

|Another way of asking this question is this way: within how many years either side of the mean does 68% of revenue occur? The Stockhub company suggests using 5 years (i.e. 68% of all sales happen within 5 years either side of the mean year), so that's what's used here. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stages</div>''' | |||

|- | |||

|How many main stages of growth is Stockhub expected to go through? | |||

|4 stages | |||

|Research suggests that a company typically goes through four distinct stages of cash flow growth.<ref>Levie J, Lichtenstein BB (2010) A terminal assessment of stages theory: Introducing a dynamic approach to entrepreneurship. Entrepreneurship: Theory & Practice 34(2): 317–350. <nowiki>https://doi.org/10.1111/j.1540-6520.2010.00377.x</nowiki></ref> Research also shows that incorporating those stages into the discounted cash flow model improves the quality of the model and, ultimately, the quality of the value estimation.<ref>Stef Hinfelaar et al.:, 2019.</ref> | |||

In addition, research shows that a key way to determine the stage which a company is in is by examining the cash flow patterns of the company.<ref>Dickinson, 2010.</ref> A summary of the economic links to cash flow patterns can be found in the appendix of this report. Stockhub estimates that with its operating and investing cash flows both negative (-) and its financing cash flows positive (+), the company is in the first stage of growth (i.e. the introduction stage), and, therefore, it has a total of four main stages of growth. | |||

| | |- | ||

|What's the expected duration of growth stage 1? | |||

|17 years | |||

|Research suggests that given the expected lifespan of the company (i.e. 50 years), 17 years is suitable for stage 1.<ref name=":6">http://escml.umd.edu/Papers/ObsCPMT.pdf</ref> | |||

|- | |||

|What's the expected duration of growth stage 2? | |||

|4 years | |||

|Research suggests that given the expected lifespan of the company (i.e. 50 years), 4 years is suitable for stage 2.<ref name=":6" /> | |||

|- | |||

|What's the expected duration of growth stage 3? | |||

|8 years | |||

|Research suggests that given the expected lifespan of the company (i.e. 50 years), 8 years is suitable for stage 3.<ref name=":6" /> | |||

|- | |||

|What's the expected duration of growth stage 4? | |||

|21 years | |||

|Research suggests that given the expected lifespan of the company (i.e. 50 years), 21 years is suitable for stage 4.<ref name=":6" /> | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stage 1</div>''' | |||

|- | |||

| Cost of goods sold margin (%) | |||

|20% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 1)<ref name=":7">http://people.stern.nyu.edu/adamodar/pdfiles/papers/younggrowth.pdf</ref>, and the margin for its peers is 20%. | |||

|- | |||

|Selling, General and Administrative expenses margin (%) | |||

|80% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 1)<ref name=":7" />, and the margin for its peers is 80%. | |||

|- | |||

|Tax rate (%) | |||

|19% | |||

|Research suggests that it's best to use the marginal tax rate of the country in which the company mainly operates. The Stockhub company mainly operates in the United Kingdom, and the marginal tax rate there is 19%. | |||

|- | |||

|Depreciation rate (%) | |||

|10% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 1)<ref name=":7" />, and the margin for its peers is 10%. | |||

|- | |||

|Fixed capital margin (%) | |||

|25% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 1)<ref name=":7" />, and the margin for its peers is 25%. | |||

|- | |||

|Change in working capital (£000) | |||

|Zero | |||

|Stockhub suggests that for simplicity, the change in working capital figure is zero. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stage 2</div>''' | |||

|- | |||

| Cost of goods sold margin (%) | |||

|20% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)<ref name=":7" />, and the margin for its peers is 20%. | |||

|- | |||

|Selling, General and Administrative expenses margin (%) | |||

|60% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)<ref name=":7" />, and the margin for its peers is 60%. | |||

|- | |||

|Tax rate (%) | |||

|19% | |||

|Research suggests that it's best to use the marginal tax rate of the country in which the company mainly operates. The Stockhub company mainly operates in the United Kingdom, and the marginal tax rate there is 19%. | |||

|- | |||

|Depreciation rate (%) | |||

|10% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)<ref name=":7" />, and the margin for its peers is 10%. | |||

|- | |||

|Fixed capital margin (%) | |||

|25% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)<ref name=":7" />, and the margin for its peers is 25%. | |||

|- | |||

|Change in working capital (£000) | |||

|Zero | |||

|Stockhub suggests that for simplicity, the change in working capital figure is zero. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stage 3</div>''' | |||

|- | |||

| Cost of goods sold margin (%) | |||

|20% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)<ref name=":7" />, and the margin for its peers is 20%. | |||

|- | |||

|Selling, General and Administrative expenses margin (%) | |||

|40% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)<ref name=":7" />, and the margin for its peers is 40%. | |||

|- | |||

|Tax rate (%) | |||

|19% | |||

|Research suggests that it's best to use the marginal tax rate of the country in which the company mainly operates. The Stockhub company mainly operates in the United Kingdom, and the marginal tax rate there is 19%. | |||

|- | |||

|Depreciation rate (%) | |||

|10% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)<ref name=":7" />, and the margin for its peers is 10%. | |||

|- | |||

|Fixed capital margin (%) | |||

|25% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)<ref name=":7" />, and the margin for its peers is 25%. | |||

|- | |||

|Change in working capital (£000) | |||

|Zero | |||

|Stockhub suggests that for simplicity, the change in working capital figure is zero. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stage 4</div>''' | |||

|- | |- | ||

|Cost of goods sold margin (%) | |||

|20% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)<ref name=":7" />, and the margin for its peers is 20%. | |||

|- | |- | ||

| | |Selling, General and Administrative expenses margin (%) | ||

|40% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)<ref name=":7" />, and the margin for its peers is 40%. | |||

|- | |- | ||

| | |Tax rate (%) | ||

|19% | |||

|Research suggests that it's best to use the marginal tax rate of the country in which the company mainly operates. The Stockhub company mainly operates in the United Kingdom, and the marginal tax rate there is 19%. | |||

|- | |- | ||

| | |Depreciation rate (%) | ||

|10% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)<ref name=":7" />, and the margin for its peers is 10%. | |||

|- | |- | ||

| | |Fixed capital margin (%) | ||

|25% | |||

|Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)<ref name=":7" />, and the margin for its peers was 25%. | |||

|- | |- | ||

| | |Change in working capital (£000) | ||

|Zero | |||

|Stockhub suggests that for simplicity, the change in working capital figure is zero. | |||

|} | |} | ||

| Line 202: | Line 353: | ||

==Valuation== | ==Valuation== | ||

===What's the expected return of an investment in Stockhub?=== | |||

The Stockhub company estimates that the expected return of an investment in the company over the next five years is 55x. In other words, an £1,000 investment in the company is expected to return £55,000 in five years time. The assumptions used to estimate the return figure can be found in the table below. | |||

Stockhub | Assuming that a suitable return level over five years is 10% per year and Stockhub achieves its expected return level (of 55x), then an investment in the Stockhub company is considered to be a 'suitable' one. | ||

For those in the UK: Stockhub is SEIS and EIS eligible, a key benefit of which is that those who invest now can claim back up to 50% of the investment amount in income tax relief. Accordingly, the estimated expected return of investing in the business is even higher for UK-citizens (than non-UK citizens). | |||

=== What are the assumptions used to estimate the return?=== | |||

= | {| class="wikitable" | ||

|+Key inputs | |||

!Description | |||

!Value | |||

!Commentary | |||

|- | |||

|Which valuation model do you want to use? | |||

|Discounted cash flow | |||

|There are two main approaches to estimate the value of an investment: | |||

#By calculating the present value of the investment's expected future cash flows (i.e. discounted cash flow valuation); and | |||

#By comparing the investment to other similar investments (i.e. relative valuation). | |||

= | Research suggests that in terms of estimating the expected return of an investment over a period of 12-months or more, the approach that is more accurate is the discounted cash flow approach<ref name=":5">Demirakos et al., 2010; Gleason et al., 2013</ref>, so that's the approach that Stockhub suggests to use here; nevertheless, for completeness purposes, separately, the valuation of the company is also estimated using the using the relative valuation approach (the valuation based on the relative approach can be found in the appendix of this report). | ||

|- | |||

|Which financial forecasts to use? | |||

|Stockhub | |||

|The only available forecasts are the ones that are supplied by the Stockhub company (the forecasts can be found in the financials section of this report), so Stockhub suggests using those. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stage 1</div>''' | |||

|- | |||

|Discount rate (%) | |||

|25% | |||

|There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity is by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. | |||

Research indicates that companies in the first stage of the business lifecycle are often held by either undiversified owners or by partially diversified venture capitalists.<ref name=":7" /> Consequently, it does not make sense to assume that the only risk that should be priced in is the market risk; the cost of equity has to incorporate some (in the case of venture capitalists) or maybe even all (for completely undiversified owners) of the firm specific risk. | |||

|- | |||

|Probability of success (%) | |||

|20% | |||

|Research suggests that a suitable rate for a company in this growth stage (i.e. stage 1) is 20%. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stage 2</div>''' | |||

|- | |||

|Discount rate (%) | |||

|15% | |||

|There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. | |||

|- | |||

|Probability of success (%) | |||

|50% | |||

|Research suggests that a suitable rate for a company in this growth stage (i.e. stage 2) is 50%. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stage 3</div>''' | |||

|- | |||

|Discount rate (%) | |||

|10% | |||

|There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. | |||

Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3). | |||

A peer that is in growth stage three (i.e. the same growth stage) is Meta Platform Inc. and its discount rate is around 10% (for further information on the discount rate, see the table in the Appendix below). | |||

|- | |||

|Probability of success (%) | |||

|100% | |||

|Research suggests that a suitable rate for a company in this growth stage (i.e. stage 3) is 100%. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Growth stage 4</div>''' | |||

|- | |||

|Discount rate (%) | |||

|10% | |||

|There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. | |||

|- | |||

|Probability of success (%) | |||

|100% | |||

|Research suggests that a suitable rate for a company in this growth stage (i.e. stage 4) is 100%. | |||

|- | |||

| colspan="3" |'''<div style="text-align: center;">Other key inputs</div>''' | |||

|- | |||

|What's the current value of the company? | |||

|£4,000,000 | |||

|As at 23rd February 2022, the Stockhub company estimates the current value of its company at £4 million. | |||

|- | |||

|Which time period do you want to use to estimate the expected return? | |||

|Between now and five years time | |||

|Research suggests that following a market crash, the average amount of time it takes for the price of a stock market to return to its pre-crash level (i.e. the recovery period) is at least three years.<ref>https://www.newyorkfed.org/mediabrary/media/medialibrary/media/research/staff_reports/research_papers/9809.pdf</ref> Accordingly, Stockhub suggests that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time. | |||

|} | |||

===Sensitive analysis=== | |||

The main inputs that result in the greatest change in the expected return of the Stockhub investment are, in order of importance (from highest to lowest): | |||

#The discount rate (the default time-weighted average rate is 15%); | |||

#The probability of success rate (the default time-weighted average rate is 71%); and | |||

#Stockhub peak market share (the default share is 2%) | |||

The impact of a 50% change in those main inputs to the expected return of the Stockhub investment is shown in the table below. | |||

{| class="wikitable sortable" | {| class="wikitable sortable" | ||

|+Stockhub | |+Stockhub investment expected return sensitive analysis | ||

! Main input | |||

!50% worse | |||

!Unchanged | |||

!50% better | |||

|- | |- | ||

|The discount rate | |||

|10x | |||

|55x | |||

|412x | |||

|- | |- | ||

| | |The probability of success rate | ||

|14x | |||

|55x | |||

|88x | |||

|- | |- | ||

| | |Stockhub peak market share | ||

|27x | |||

|55x | |||

| 82x | |||

|} | |||

==Actions== | |||

To invest in Stockhub, click [mailto:hello@stockhub.co here]. | |||

To contact Stockhub, click [mailto:hello@stockhub.co here]. | |||

==Appendix== | |||

===Relative valuation approach=== | |||

====What's the expected return of an investment in Stockhub?==== | |||

The company estimates that the expected return of an investment in Stockhub over the next five years is 57x. In other words, an £1,000 investment in the company is expected to return £57,000 in five years time. | |||

Assuming that a suitable return level over five years is 10% per year and Stockhub achieves its expected return level (of 57x), then an investment in the Stockhub company is considered to be a 'suitable' one. | |||

====What are the assumptions used to estimate the return figure?==== | |||

{| class="wikitable" | |||

|+Key inputs | |||

!Description | |||

!Value | |||

!Commentary | |||

|- | |- | ||

| | |Which type of multiple do you want to use? | ||

|Growth-adjusted EV/sales | |||

|For the numerator, Stockhub believes that to account for the different financial leverage levels of its peers, it's best to use enterprise value (EV), rather than price. For the denominator, Stockhub believes that because it expects to reinvest almost all of its revenue back into the business over the five year forecast period and therefore its earnings are expected to be abnormally low over the period, it's best to use sales. Accordingly, Stockhub suggests valuing its company using the EV/sales ratio. However, Stockhub feels that to take into account the different business lifecycle stages of its peers, the most suitable valuation multiple to use is the growth-adjusted EV/sales multiple<ref group="Note" name="Note15" />, rather than the EV/sales multiple. | |||

|- | |- | ||

| | |In regards to the growth-adjusted EV/sales multiple, for the sales figure, which year to you want to use? | ||

| Year 5 | |||

|Stockhub suggests that with sales forecast to grow exponential over the five year forecast period, it's best to use forward-looking data, rather than historic data. | |||

In regards to the growth-adjusted EV/sales multiple, for the sales figure, Stockhub suggests that in order to account for the forecasted exponential growth of the business, it's best to use one at the end of the forecast period (i.e. Year 5). | |||

|- | |||

|In regards to the growth-adjusted EV/sales multiple, for the sales growth figure, which year(s) do you want to use? | |||

| Year 6 to 8, from now | |||

|Stockhub suggests that for the sales growth figure, it's best to use Year 6 to 8. | |||

|- | |- | ||

| | |In regards to the growth-adjusted EV/sales multiple, what multiple figure do you want to use? | ||

|42x | |||

|Stockhub's vision is for the Stockhub platform to be one of the most successful advertising platforms, and for that reason, it sees its closest peers as the owners of the leading advertising platforms. Those platforms are Facebook, Google Search, Youtube, Twitter, WhatsApp, Instagram and SnapChat. Note: Facebook, Instagram and WhatsApp are all owned by Meta Platforms, Inc, and Google Search and Youtube are all owned by Alphabet, Inc. The average multiple for those companies is 42x. | |||

|- | |||

|Which financial forecasts to use? | |||

|Stockhub | |||

|The only available forecasts are the ones that are supplied by the Stockhub company (the forecasts can be found in the financials section of this report), so Stockhub suggests using those. | |||

|- | |||

|What's the current value of the Stockhub company? | |||

|£4,000,000 | |||

|As at 23rd February 2022, the Stockhub company estimates the current value of its company at £4 million. | |||

|- | |||

|Which time period do you want to use to estimate the expected return? | |||

|Between now and five years time | |||

|Stockhub suggests that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time. | |||

|} | |||

====Sensitive analysis==== | |||

The main inputs that result in the greatest change in the expected return of the Stockhub investment are, in order of importance (from highest to lowest): | |||

#The growth-adjusted EV/sales ratio (the default value is 42x); | |||

#Stockhub peak market share (the default value is 2%). | |||

The impact of a 50% change in those main inputs to the expected return of the Stockhub investment is shown in the table below. | |||

{| class="wikitable sortable" | |||

|+Stockhub investment expected return sensitive analysis | |||

! Main input | |||

!50% worse | |||

!Unchanged | |||

!50% better | |||

|- | |- | ||

| | |Growth-adjusted EV/sales ratio | ||

|28x | |||

|57x | |||

|86x | |||

|- | |- | ||

| | |Stockhub peak market share | ||

|28x | |||

|57x | |||

|86x | |||

|} | |} | ||

===Stockhub peers=== | |||

{| class="wikitable sortable" | {| class="wikitable sortable" | ||

|+Valuation table | |+Valuation table | ||

|- | |- | ||

! Investments !! Industry!!Enterprise value/sales!!1-year forward revenue growth rates (%)!!Growth-adjusted enterprise value/sales ratio | !Investments!!Industry!!Enterprise value/sales!!1-year forward revenue growth rates (%)!!Growth-adjusted enterprise value/sales ratio | ||

|- | |- | ||

|Meta Platform Inc.||Internet content & communication||8.04x||19.20%|| style="background: blue; color: white;" |42x | |Meta Platform Inc.||Internet content & communication||8.04x||19.20%|| style="background: blue; color: white;" |42x | ||

|- | |- | ||

|Alphabet Inc. ||Internet content & communication||7.80x||16.80%|| style="background: blue; color: white;" |46x | |Alphabet Inc.||Internet content & communication||7.80x||16.80%|| style="background: blue; color: white;" |46x | ||

|- | |- | ||

| Snap Inc.||Internet content & communication||22.71x||39.00%|| style="background: blue; color: white;" |58x | | Snap Inc.||Internet content & communication||22.71x||39.00%|| style="background: blue; color: white;" |58x | ||

|- | |- | ||

|Twitter Inc.||Internet content & communication||8.60x||21.20%|| style="background: blue; color: white;" |41x | |Twitter Inc.||Internet content & communication||8.60x||21.20%|| style="background: blue; color: white;" |41x | ||

|- | |- | ||

|Robinhood Inc.||Software - Infrastructure||17.69x||23.30%|| style="background: blue; color: white;" |75x | |Robinhood Inc.||Software - Infrastructure||17.69x||23.30%|| style="background: blue; color: white;" |75x | ||

| Line 268: | Line 581: | ||

Note: five years after incorporation (i.e. April 2018), Robinhood’s valuation was $5.6 billion, and it was trading on a growth-adjusted EV/sales ratio of 43x. | Note: five years after incorporation (i.e. April 2018), Robinhood’s valuation was $5.6 billion, and it was trading on a growth-adjusted EV/sales ratio of 43x. | ||

=== Meta Platform Inc. === | |||

{| class="wikitable" | |||

|+Cost of equity | |||

!Input | |||

!Input value | |||

!Additional information | |||

|- | |||

|Beta | |||

|1.33 | |||

|The figure here is taken from Yahoo Finance (https://uk.finance.yahoo.com/quote/META?p=META), on 15th September 2022. | |||

|- | |||

|Risk-free rate (%) | |||

|3.44% | |||

|Here, the risk free rate is the US 30 year treasury bond, and is calculated as at 15th September 2022. | |||

|- | |||

|Equity risk premium (%) | |||

|5.26% | |||

|Here, the equity risk premium is relation to the global region, and is calculated as at 1st January 2022 (https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html). | |||

|- | |||

|Cost of equity (%) | |||

|10.44% | |||

|Cost of equity = Risk-free rate + Beta x Equity risk premium | |||

|} | |||

===Economic links to cash flow patterns === | |||

=== | |||

=== | |||

{| class="wikitable" | {| class="wikitable" | ||

|+ | |+Economic links to cash flow patterns | ||

! | |- | ||

! | !Cash flow type!!Introduction!!Growth!!Shake out!!Mature!!Decline | ||

! | |||

! | |||

|- | |- | ||

| | |Operating|| style="background: red; color: white;" |-|| style="background: green; color: white;" |+ | ||

| | | style="background: orange; color: white;" | +/-|| style="background: green; color: white;" |+|| style="background: red; color: white;" |- | ||

| | |||

| | |||

|- | |- | ||

| | |Investing|| style="background: red; color: white;" |-|| style="background: red; color: white;" |-|| style="background: orange; color: white;" |+/-|| style="background: red; color: white;" |- | ||

| | | style="background: green; color: white;" | + | ||

| | |||

| | |||

|- | |- | ||

| | |Financing|| style="background: green; color: white;" |+|| style="background: green; color: white;" |+|| style="background: orange; color: white;" |+/-|| style="background: red; color: white;" |-|| style="background: orange; color: white;" |+/- | ||

| | |||

| | |||

| | |||

|} | |} | ||

==Notes== | ==Notes== | ||

| Line 354: | Line 656: | ||

All figures in the Income Statement table are estimates. | All figures in the Income Statement table are estimates. | ||

'''Note 5 | '''Note 5: Calculation of the growth-adjusted EV/sales ratio''' | ||

The growth-adjusted EV/sales ratio is calculated by dividing the EV/sales ratio by the 1-year forward revenue growth rate. For example, for the Meta Platforms growth-adjusted EV/sales ratio, the calculation is as follows: 8.04 dividend by 0.1920 ≈ 42. | The growth-adjusted EV/sales ratio is calculated by dividing the EV/sales ratio by the 1-year forward revenue growth rate. For example, for the Meta Platforms growth-adjusted EV/sales ratio, the calculation is as follows: 8.04 dividend by 0.1920 ≈ 42. | ||

| Line 478: | Line 662: | ||

==References== | ==References== | ||

<references /> | <references /> | ||

<references group="Note" /> | |||

[[Category:Equities]] | |||

[[Category:United Kingdom]] | |||

__NOINDEX__ | |||

Latest revision as of 13:43, 16 September 2022

Helping to make more money for everyone (and not just the wealthy!).

| Risk/return | Risk/return::High |

| Price per share | Price per share::£10 |

| Asset class | Asset class::Equities[1] |

| Industry | Industry::Fintech |

| Country of incorporation | Country of incorporation::United Kingdom[1] |

| Minimum investment amount | Minimum investment amount::£10 |

| Maximum investment amount | Maximum investment amount::£500,000 |

| Current valuation | Current valuation::£4,000,000 |

| Investor type | Investor type::All |

| Tax schemes | Tax schemes::SEIS/EIS |

| Bid/ask spread | Bid/ask spread::NA |

| Commission amount | Commission amount::Zero |

| Market | Market::Private[1] |

SummaryEdit

- The mission of the company is to help make more money for everyone (and not just the wealthy!).[2]

- The company is led by the former principal investment analyst of one of the world's wealthiest persons.

- The company’s flagship product is targeted towards Active Investors, who are a group of people that are willing and able to be actively involved in the process of finding suitable investments. The product is an investment research platform. What makes the platform unique is that the research is produced open collaboratively. Evidence suggests that open collaborative investment research will, in time, result in Active Investors making better investment decisions, and, ultimately, more money.

- To date, the Stockhub platform covers 375 investments[3], and is growing at a rate of seven investments a day[4].

- The Stockhub company estimates that the expected return of an investment in the company over the next five years is 55x[5]. In other words, an £1,000 investment in the company is expected to return £55,000 in five years time.

- The degree of risk associated with an investment in Stockhub is higher than in a company that's say trading on a public market (such as, HSBC).

OperationsEdit

How did the idea of the company come about?Edit

The idea of the Stockhub company came to the now founder of the company when he developed a strong desire to make more money. Researching into how to make more money, he realised that one of the best ways to do so is to invest in investments. The problem he had was that he didn’t know what to invest in, and deciding what to invest in took him a considerable amount of time. He also realised that there were many people who felt the same way as him, with the average person rating their desire to make more money at 8 out of 10[6] and the main struggle experienced about making more money being a lack of time[7]. In his quest to make more money for himself and people like him, the Stockhub company was born.

What's the mission of the company?Edit

Stockhub Limited is a company that’s on a mission to help make more money for everyone (and not just the wealthy!).[2]

What's the company's main offering(s)?Edit

At the moment (as of 15th April 2022), the main and only offering of the company is Stockhub.

Who’s the target audience of the company’s flagship product?Edit

The audience is Active Investors, who are a group of people that are willing and able to be actively involved in the process of finding suitable investments.

What's the flagship product?Edit

The product is an investment research platform.[3]

What makes the flagship product unique?Edit

What makes the platform unique is that the research is produced open collaboratively. Evidence suggests that open collaborative investment research will, in time, result in Active Investors making better investment decisions, and, ultimately, more money.

What's the biggest achievement of the company?Edit

As of 25th April 2022, the Stockhub platform covers 375 investments.[8]

What's the next key milestone of the company?Edit

The next key milestone of the company is to increase the number of investments on the platform to 1,000 investments (from 375 investments) by 30th June 2022.

MarketEdit

Stockhub believes that the best monetisation method of the company is advertising. With the advertising method, advertisers pay to promote their offerings on the Stockhub platform. Research suggests that promoting an offering on the Stockhub platform will lead to increased visibility of the offering, and, ultimately, increased offering sales.

What's the total addressable market of the company?Edit

Here, the total addressable market (TAM) is defined as the global advertising market, and based on a number of assumptions[Note 1], it is estimated that the size of the market as of today (14th March 2022), in terms of revenue, is $850 billion (£635 billion).

What's the serviceable available market of the company?Edit

Here, the serviceable available market (SAM) is defined as the global, Active Investor-focused advertising market, and based on a number of assumptions[Note 2], it is estimated that the size of the market as of today (15th March 2022), in terms of revenue, is $88 billion.

What's the serviceable obtainable market of the company?Edit

Finally, here, the serviceable obtainable market (SOM) is defined as the UK, Active Investor-focused advertising market, and based on a number of assumptions[Note 3], it is estimated that the size of the market as of today (15th March 2022), in terms of revenue, is $2.8 billion.

CompetitionEdit

A key way to determine a product's closest competitors is by looking at other offerings that are targeting the same or similar target audience (i.e. Active Investors) and aiming to provide the same core benefit (i.e. more money), and then ranking the offerings in terms of the total amount of time spent using and/or money spent purchasing the offerings relative to other similar offerings. With that said, according to Stockhub, the closest competitors of its namesake offering are Yahoo Finance, Investing.com, CoinMarketCap, MarketWatch, Seeking Alpha, Goldman Sachs Investment Research and Edison Investment Research. A detailed comparison between Stockhub and some of its main competitors are shown in the table below.

| Stockhub | Seeking Alpha | Goldman Sachs Investment Research | Edison Investment Research | |

|---|---|---|---|---|

| How is the research produced? | ||||

| Type of production method? | Crowdsourced information, decentralized production | End-user-paid-for, crowdsourced information, centralized production | End-user-paid-for, insourced information, centralized production | Sponsor-paid-for, insourced information, centralized production |

| Is the information on the platform sourced from a large, relatively open, and often rapidly evolving group of participants (i.e. crowdsourced information)? | Yes | Yes | No | No |

| Is the production of the research controlled by no single entity (i.e. decentralised production)? | Yes | No | No | No |

| Are contributions able to be made anonymously? | Yes | No | No | No |

| What is the estimated cost for the investment research company to produce research on a specific investment per year? | Zero | £850 | £5,000 | £5,000 |

| What are the main features of the research for the end-user (i.e. Investors)? | ||||

| What is the price of the research? | Free | $179.99 per year | $30,000 per year | Free |

| How many investments are realistically able to be covered using this method? | Unlimited | Limited | Limited | Very limited |

| What is the expected quality level of the research? | High | Medium | High | High |

TeamEdit

The company is led by the person who believes in the mission of the company the most: the creator of the company mission. Combined, the members of the team have helped 342 million people - including one of the world's wealthiest persons - make better investment decisions and returns, and helped build some of the world's most renowned digital platforms.

Chief Executive OfficerEdit

The Chief Executive Officer of the company is Manos Halicioglu. Over a period of around 11 years, Manos has helped 342 million people - including one of the world’s wealthiest persons (Jim Mellon) - make better investment decisions and returns (at the European Central Bank, Burnbrae Group and Master Investor). He graduated from a world top 6 university (Imperial College) and passed both levels 1 and 2 of the most renowned investment management qualification (Chartered Financial Analyst). Mr. Halicioglu also featured in the press, including CityAM, Bloomberg and Portfolio Institutional.

Chief Technology OfficerEdit

The Chief Technology Officer of the company is Jitesh Halai. Over a 23 year period, Jitesh has helped build digital platforms at leading institutions (including Just Eat, Asos and Credit Suisse). He studied Mathematical Sciences at Queen Mary University of London and an Executive Master of Business Administration at Imperial College.[10]

Business AdvisorEdit

The business advisor of the company is Phil Hollingdale. Phil has founded or co-founded six tech companies, with five successful exits so far. His current business is a digital workplace savings platform that has 400,000 customers and £1.7 billion assets under management (as at March 2022).[11]

Compliance AdvisorEdit

The compliance advisor of the company is Richard Gill. Over a 13 year period, Richard has helped provide compliance oversight at investment research and trading companies (including Crowd for Angels, Align Research and Master Investor). He is approved by the Financial Conduct Authority to perform functions of compliance oversight (CF10) and money laundering reporting (CF11). He is also a CFA charterholder and a graduate of King's College London.

FinancialsEdit

What are the financial forecasts?Edit

In keeping in-line with industry standards, the number of years of financial forecasts shown below is five years.

Income statementEdit

| Year/Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Year end date | 28/02/2022 | 28/02/2023 | 28/02/2024 | 28/02/2025 | 28/02/2026 |

| Revenues (£'000) | £126.169 | £332.681 | £842.810 | £2,051.447 | £4,797.544 |

| Gross profits (£'000) | £100.935 | £266.145 | £674.248 | £1,641.158 | £3,838.035 |

| Operating profits (£'000) | £25.234 | £66.536 | £168.562 | £410.289 | £959.509 |

| Net profits (£'000) | £20.439 | £53.894 | £136.535 | £332.334 | £777.202 |

What are the assumptions used to estimate the financial forecasts?Edit

| Description | Value | Commentary |

|---|---|---|

Revenue

| ||

| What's the estimated current size of the total addressable market? | £635,325,000,000 | Here, the total addressable market (TAM) is defined as the global advertising market, and based on a number of assumptions[Note 1], it is estimated that the size of the market as of today (14th March 2022), in terms of revenue, is £635 billion (or $850 billion). |

| What's the estimated terminal annual growth rate of the total addressable market? | 3% | Research shows that the growth rate of the global advertising market (i.e. the total addressable market) is similar to the growth rate of global gross domestic product[13], which has averaged (medium) around 3% per year in the last 20 years (2001 to 2022)[14]. |

| What's the estimated Stockhub peak market share? | 2% | Research shows that there's an almost perfect positive correlation between the amount of adverting revenue generated on a platform and the total amount of time spent by users on the platform. In other words, the more time users spend on a platform, the more advertising revenue the platform generates. Accordingly, Stockhub believes that the best measurement unit of future advertising market share is time. In UK broadcasting, there's a limit on the amount of advertising that can be shown to viewers, and the limit is 15% of 24 hours (i.e. around 9 minutes per hour or around 216 minutes a day). Research suggests that Active Investors represent around 10.4% of the global population and that the average amount of time Active Investors spend researching investments is 30 minutes per day. Consequently, the Stockhub company estimates that the peak market share of its namesake platform is around 2%, and, therefore, suggests using the share amount here. |

| Which distribution function do you want to use to estimate Stockhub revenue? | Gaussian | Research suggests that the revenue pattern of companies is similar to the pattern produced by the Gaussian distribution function (i.e. the revenue distribution is bell shaped)[15], so Stockhub suggests using that function here. |

| What is the estimated Stockhub lifespan? | 50 years | Stockhub's vision is to be a large organisation (more than 10,000 employees), and research shows that the average lifespan of a large corporation is around 50 years.[16] |

| What's the estimated standard deviation of Stockhub revenue? | 5 years | Another way of asking this question is this way: within how many years either side of the mean does 68% of revenue occur? The Stockhub company suggests using 5 years (i.e. 68% of all sales happen within 5 years either side of the mean year), so that's what's used here. |

Growth stages

| ||

| How many main stages of growth is Stockhub expected to go through? | 4 stages | Research suggests that a company typically goes through four distinct stages of cash flow growth.[17] Research also shows that incorporating those stages into the discounted cash flow model improves the quality of the model and, ultimately, the quality of the value estimation.[18]

In addition, research shows that a key way to determine the stage which a company is in is by examining the cash flow patterns of the company.[19] A summary of the economic links to cash flow patterns can be found in the appendix of this report. Stockhub estimates that with its operating and investing cash flows both negative (-) and its financing cash flows positive (+), the company is in the first stage of growth (i.e. the introduction stage), and, therefore, it has a total of four main stages of growth. |

| What's the expected duration of growth stage 1? | 17 years | Research suggests that given the expected lifespan of the company (i.e. 50 years), 17 years is suitable for stage 1.[20] |

| What's the expected duration of growth stage 2? | 4 years | Research suggests that given the expected lifespan of the company (i.e. 50 years), 4 years is suitable for stage 2.[20] |

| What's the expected duration of growth stage 3? | 8 years | Research suggests that given the expected lifespan of the company (i.e. 50 years), 8 years is suitable for stage 3.[20] |

| What's the expected duration of growth stage 4? | 21 years | Research suggests that given the expected lifespan of the company (i.e. 50 years), 21 years is suitable for stage 4.[20] |

Growth stage 1

| ||

| Cost of goods sold margin (%) | 20% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 1)[21], and the margin for its peers is 20%. |

| Selling, General and Administrative expenses margin (%) | 80% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 1)[21], and the margin for its peers is 80%. |

| Tax rate (%) | 19% | Research suggests that it's best to use the marginal tax rate of the country in which the company mainly operates. The Stockhub company mainly operates in the United Kingdom, and the marginal tax rate there is 19%. |

| Depreciation rate (%) | 10% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 1)[21], and the margin for its peers is 10%. |

| Fixed capital margin (%) | 25% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 1)[21], and the margin for its peers is 25%. |

| Change in working capital (£000) | Zero | Stockhub suggests that for simplicity, the change in working capital figure is zero. |

Growth stage 2

| ||

| Cost of goods sold margin (%) | 20% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[21], and the margin for its peers is 20%. |

| Selling, General and Administrative expenses margin (%) | 60% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[21], and the margin for its peers is 60%. |

| Tax rate (%) | 19% | Research suggests that it's best to use the marginal tax rate of the country in which the company mainly operates. The Stockhub company mainly operates in the United Kingdom, and the marginal tax rate there is 19%. |

| Depreciation rate (%) | 10% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[21], and the margin for its peers is 10%. |

| Fixed capital margin (%) | 25% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[21], and the margin for its peers is 25%. |

| Change in working capital (£000) | Zero | Stockhub suggests that for simplicity, the change in working capital figure is zero. |

Growth stage 3

| ||

| Cost of goods sold margin (%) | 20% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[21], and the margin for its peers is 20%. |

| Selling, General and Administrative expenses margin (%) | 40% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[21], and the margin for its peers is 40%. |

| Tax rate (%) | 19% | Research suggests that it's best to use the marginal tax rate of the country in which the company mainly operates. The Stockhub company mainly operates in the United Kingdom, and the marginal tax rate there is 19%. |

| Depreciation rate (%) | 10% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[21], and the margin for its peers is 10%. |

| Fixed capital margin (%) | 25% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[21], and the margin for its peers is 25%. |

| Change in working capital (£000) | Zero | Stockhub suggests that for simplicity, the change in working capital figure is zero. |

Growth stage 4

| ||

| Cost of goods sold margin (%) | 20% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[21], and the margin for its peers is 20%. |

| Selling, General and Administrative expenses margin (%) | 40% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[21], and the margin for its peers is 40%. |

| Tax rate (%) | 19% | Research suggests that it's best to use the marginal tax rate of the country in which the company mainly operates. The Stockhub company mainly operates in the United Kingdom, and the marginal tax rate there is 19%. |

| Depreciation rate (%) | 10% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[21], and the margin for its peers is 10%. |

| Fixed capital margin (%) | 25% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[21], and the margin for its peers was 25%. |

| Change in working capital (£000) | Zero | Stockhub suggests that for simplicity, the change in working capital figure is zero. |

RisksEdit

As with any investment, investing in Stockhub carries a level of risk. Overall, based on the key risks highlighted below, the degree of risk associated with an investment in Stockhub is higher than in a company that's trading on a public market (such as, HSBC).

Early-stage investmentEdit

Stockhub Limited is at one of the earliest stages of the business lifecycle, and the failure rate of companies at that stage is usually much higher than those at a later stage.

Illiquid investmentEdit

The number of transactions in shares of private companies is usually significantly lower than in public companies, typically resulting in it taking longer to sell shares in private companies at a price that is at least equal to the price that the shares were bought at. Accordingly, the Stockhub investment opportunity is considered to be higher risk than more liquid companies.

ValuationEdit

What's the expected return of an investment in Stockhub?Edit

The Stockhub company estimates that the expected return of an investment in the company over the next five years is 55x. In other words, an £1,000 investment in the company is expected to return £55,000 in five years time. The assumptions used to estimate the return figure can be found in the table below.

Assuming that a suitable return level over five years is 10% per year and Stockhub achieves its expected return level (of 55x), then an investment in the Stockhub company is considered to be a 'suitable' one.

For those in the UK: Stockhub is SEIS and EIS eligible, a key benefit of which is that those who invest now can claim back up to 50% of the investment amount in income tax relief. Accordingly, the estimated expected return of investing in the business is even higher for UK-citizens (than non-UK citizens).

What are the assumptions used to estimate the return?Edit

| Description | Value | Commentary |

|---|---|---|

| Which valuation model do you want to use? | Discounted cash flow | There are two main approaches to estimate the value of an investment:

Research suggests that in terms of estimating the expected return of an investment over a period of 12-months or more, the approach that is more accurate is the discounted cash flow approach[22], so that's the approach that Stockhub suggests to use here; nevertheless, for completeness purposes, separately, the valuation of the company is also estimated using the using the relative valuation approach (the valuation based on the relative approach can be found in the appendix of this report). |

| Which financial forecasts to use? | Stockhub | The only available forecasts are the ones that are supplied by the Stockhub company (the forecasts can be found in the financials section of this report), so Stockhub suggests using those. |

Growth stage 1

| ||

| Discount rate (%) | 25% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity is by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital.

Research indicates that companies in the first stage of the business lifecycle are often held by either undiversified owners or by partially diversified venture capitalists.[21] Consequently, it does not make sense to assume that the only risk that should be priced in is the market risk; the cost of equity has to incorporate some (in the case of venture capitalists) or maybe even all (for completely undiversified owners) of the firm specific risk. |

| Probability of success (%) | 20% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 1) is 20%. |

Growth stage 2

| ||

| Discount rate (%) | 15% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. |

| Probability of success (%) | 50% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 2) is 50%. |

Growth stage 3

| ||

| Discount rate (%) | 10% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital.

|

| Probability of success (%) | 100% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 3) is 100%. |

Growth stage 4

| ||

| Discount rate (%) | 10% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. |

| Probability of success (%) | 100% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 4) is 100%. |

Other key inputs

| ||

| What's the current value of the company? | £4,000,000 | As at 23rd February 2022, the Stockhub company estimates the current value of its company at £4 million. |

| Which time period do you want to use to estimate the expected return? | Between now and five years time | Research suggests that following a market crash, the average amount of time it takes for the price of a stock market to return to its pre-crash level (i.e. the recovery period) is at least three years.[23] Accordingly, Stockhub suggests that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time. |

Sensitive analysisEdit

The main inputs that result in the greatest change in the expected return of the Stockhub investment are, in order of importance (from highest to lowest):

- The discount rate (the default time-weighted average rate is 15%);

- The probability of success rate (the default time-weighted average rate is 71%); and

- Stockhub peak market share (the default share is 2%)

The impact of a 50% change in those main inputs to the expected return of the Stockhub investment is shown in the table below.

| Main input | 50% worse | Unchanged | 50% better |

|---|---|---|---|

| The discount rate | 10x | 55x | 412x |

| The probability of success rate | 14x | 55x | 88x |

| Stockhub peak market share | 27x | 55x | 82x |

ActionsEdit

To invest in Stockhub, click here.

To contact Stockhub, click here.

AppendixEdit

Relative valuation approachEdit

What's the expected return of an investment in Stockhub?Edit

The company estimates that the expected return of an investment in Stockhub over the next five years is 57x. In other words, an £1,000 investment in the company is expected to return £57,000 in five years time.

Assuming that a suitable return level over five years is 10% per year and Stockhub achieves its expected return level (of 57x), then an investment in the Stockhub company is considered to be a 'suitable' one.

What are the assumptions used to estimate the return figure?Edit

| Description | Value | Commentary |

|---|---|---|

| Which type of multiple do you want to use? | Growth-adjusted EV/sales | For the numerator, Stockhub believes that to account for the different financial leverage levels of its peers, it's best to use enterprise value (EV), rather than price. For the denominator, Stockhub believes that because it expects to reinvest almost all of its revenue back into the business over the five year forecast period and therefore its earnings are expected to be abnormally low over the period, it's best to use sales. Accordingly, Stockhub suggests valuing its company using the EV/sales ratio. However, Stockhub feels that to take into account the different business lifecycle stages of its peers, the most suitable valuation multiple to use is the growth-adjusted EV/sales multiple[Note 5], rather than the EV/sales multiple. |

| In regards to the growth-adjusted EV/sales multiple, for the sales figure, which year to you want to use? | Year 5 | Stockhub suggests that with sales forecast to grow exponential over the five year forecast period, it's best to use forward-looking data, rather than historic data.

|

| In regards to the growth-adjusted EV/sales multiple, for the sales growth figure, which year(s) do you want to use? | Year 6 to 8, from now | Stockhub suggests that for the sales growth figure, it's best to use Year 6 to 8. |