Stockhub: Difference between revisions

| Line 136: | Line 136: | ||

<ref>https://www.linkedin.com/in/emhalicioglu/</ref> | <ref>https://www.linkedin.com/in/emhalicioglu/</ref> | ||

===Chief Technology Officer | ===Chief Technology Officer=== | ||

[[File:Ravi Singh.png|200px]] | [[File:Ravi Singh.png|200px]] | ||

Over a period of 10 years, Ravi has helped build digital platforms at some of the world’s leading financial institutions (Barclays, Citi and BlueBay Asset Management). He studied computer science (BSc) and intelligent systems (MSc) at a world leading University (King’s College London), and was a cohort member of one of the world's leading deeptech accelerator programmes (Entrepreneur First).<ref>https://www.linkedin.com/in/ravi5ingh/</ref> | The Chief Technology Officer of the company is Ravi Singh. Over a period of 10 years, Ravi has helped build digital platforms at some of the world’s leading financial institutions (Barclays, Citi and BlueBay Asset Management). He studied computer science (BSc) and intelligent systems (MSc) at a world leading University (King’s College London), and was a cohort member of one of the world's leading deeptech accelerator programmes (Entrepreneur First).<ref>https://www.linkedin.com/in/ravi5ingh/</ref> | ||

===Business Advisor: Phil Hollingdale=== | ===Business Advisor: Phil Hollingdale=== | ||

Revision as of 16:20, 6 April 2022

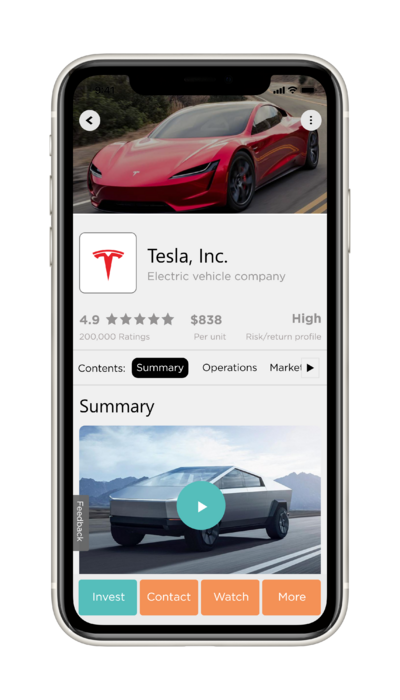

Helping to make more money for everyone (and not just the wealthy!).

| Risk/return | High |

| Price per share | £10 |

| Asset class | Equities[1] |

| Industry | Fintech |

| Country of incorporation | United Kingdom[1] |

| Minimum investment amount | £10 |

| Maximum investment amount | £500,000 |

| Current valuation | £4,000,000 |

| Investor type | All |

| Tax schemes | SEIS/EIS |

| Bid/ask spread | NA |

| Commission amount | Zero |

| Market | Private[1] |

Summary

- The mission of the company is to help make more money for everyone (and not just the wealthy!).[2]

- The company is led by the former principal investment analyst of one of the world's wealthiest persons.

- The company has developed the world's first (and only) open collaborative investment research platform. Evidence suggests that enabling investment research to be produced open collaboratively will, in time, result in the democratisation of investment research[3], and, ultimately, the making of more money for everyone (and not just the limited few who can afford to pay the $30,000 per year charged by the likes of Goldman Sachs for investment research!).[4] The target audience of the platform is people who are willing and able to be actively involved in the process of deciding which investment(s) to invest in (i.e. Active Investors).

- To date, the Stockhub platform covers 210 investments[5], and is growing at a rate of six investments a day[6].

- The Stockhub company estimates that the expected return of an investment in the company over the next five years is 623x[7]. In other words, an £1,000 investment in the company is expected to return £623,000 in five years time.

- The degree of risk associated with an investment in Stockhub is higher than in a company that's say trading on a public market (such as, HSBC).

Operations

How did the idea of the company come about?

The idea of the Stockhub company came to the now founder of the company when he developed a strong desire to make more money. Researching into how to make more money, he realised that one of the best ways to do so is to invest in investments. The problem he had was that he didn’t know what to invest in, and deciding what to invest in took him a considerable amount of time. He also realised that there were many people that felt the same way as him, with the average person rating their desire to make more money at 8 out of 10[8] and the main struggle experienced about making more money being a lack of time[9]. In his quest to make more money for himself and people like him, the Stockhub company was born.

What's the mission of the company?

Stockhub Limited is a company that’s on a mission to help make more money for everyone (and not just the wealthy!).[2]

What's the flagship product of the company?

Its first product is a free-to-access investment research platform.[5]

The product can be found by clicking here.

What makes the product unique?

What makes the platform unique is that the research on the platform is produced open collaboratively! Evidence suggests that enabling investment research to produced open collaboratively will, in time, result in free-to-access, high-quality research on the largest number of investments.[3] In other words, it will result in the democratisation of investment research, and, ultimately, the making of more money for everyone (and not just the limited few who can afford to pay the $30,000 per year charged by the likes of Goldman Sachs for investment research!)[4]

Who’s the target audience of the product?

The audience is Active Investors. Here, an Active Investor is anyone who is willing and able to be actively involved in the process of deciding which investment(s) to invest in.

What's the biggest achievement of the product?

As of 6th April 2022, the Stockhub platform covers 210 investments.[10]

What's the next key milestone of the product?

The next key milestone of the company is to increase the number of investments on the platform to 1,000 investments (from 210 investments) by 30th June 2022.

Market

Stockhub believes that the best monetisation method of the company is advertising. With the advertising method, advertisers pay to promote their offerings on the Stockhub platform. Research suggests that promoting an offering on the Stockhub platform will lead to increased visibility of the offering, and, ultimately, increased offering sales.

What's the total addressable market of the company?

Here, the total addressable market (TAM) is defined as the global advertising market, and based on a number of assumptions[Note 1], it is estimated that the size of the market as of today (14th March 2022), in terms of revenue, is $850 billion.

What's the serviceable available market of the company?

Here, the serviceable available market (SAM) is defined as the global, Active Investor-focused advertising market, and based on a number of assumptions[Note 2], it is estimated that the size of the market as of today (15th March 2022), in terms of revenue, is $88 billion.

What's the serviceable obtainable market of the company?

Finally, here, the serviceable obtainable market (SOM) is defined as the UK, Active Investor-focused advertising market, and based on a number of assumptions[Note 3], it is estimated that the size of the market as of today (15th March 2022), in terms of revenue, is $2.8 billion.

Competition

The closest competitors to the Stockhub platform, in a range of key categories, is Robinhood (category: investment platform), Goldman Sachs Research (category: investment research platform), Google Search (category: general information platform) and Bloomberg Terminal (category: financial information platform).

Investment research providers

| Stockhub | Seeking Alpha | Goldman Sachs Investment Research | Edison Investment Research | |

|---|---|---|---|---|

| How is the research produced? | ||||

| Type of production method? | Crowdsourced information, decentralized production | End-user-paid-for, crowdsourced information, centralized production | End-user-paid-for, insourced information, centralized production | Sponsor-paid-for, insourced information, centralized production |

| Is the information on the platform sourced from a large, relatively open, and often rapidly evolving group of participants (i.e. crowdsourced information)? | Yes | Yes | No | No |

| Is the production of the research controlled by no single entity (i.e. decentralised production)? | Yes | No | No | No |

| Are contributions able to be made anonymously? | Yes | No | No | No |

| What is the estimated cost for the investment research company to produce research on a specific investment per year? | Zero | £850 | £5,000 | £5,000 |

| What are the main features of the research for the end-user (i.e. Investors)? | ||||

| What is the price of the research? | Free | $179.99 per year | $30,000 per year | Free |

| How many investments are realistically able to be covered using this method? | Unlimited | Limited | Limited | Very limited |

| What is the expected quality level of the research? | High | Medium | High | High |

Team

The company is led by the person who believes in the vision of the company the most: the creator of the vision. Combined, the members of the team have helped 342 million people - including one of the world's wealthiest persons - make better investment decisions and returns, and helped build some of the world's most renowned digital platforms.

Chief Executive Officer

The Chief Executive Officer of the company is Manos Halicioglu. Over a period of around 11 years, Manos has helped 342 million people - including one of the world’s wealthiest persons (Jim Mellon) - make better investment decisions and returns (at the European Central Bank, Burnbrae Group and Master Investor). He graduated from a world top 6 university (Imperial College) and passed both levels 1 and 2 of the most renowned investment management qualification (Chartered Financial Analyst). Mr. Halicioglu also featured in the press, including CityAM, Bloomberg and Portfolio Institutional.

Chief Technology Officer

The Chief Technology Officer of the company is Ravi Singh. Over a period of 10 years, Ravi has helped build digital platforms at some of the world’s leading financial institutions (Barclays, Citi and BlueBay Asset Management). He studied computer science (BSc) and intelligent systems (MSc) at a world leading University (King’s College London), and was a cohort member of one of the world's leading deeptech accelerator programmes (Entrepreneur First).[12]

Business Advisor: Phil Hollingdale

Phil has founded or co-founded six tech companies, with five successful exits so far. His current business is a digital workplace savings platform that has 400,000 customers and £1.7 billion assets under management (as at March 2022).[13]

Technical Advisor: Jitesh Halai

Over a 23 year period, Jitesh has helped build digital platforms at leading institutions (including Just Eat, Asos and Credit Suisse). He studied Mathematical Sciences at Queen Mary University of London and an Executive Master of Business Administration at Imperial College.[14]

Compliance Advisor: Richard Gill

Over a 13 year period, Richard has helped provide compliance oversight at investment research and trading companies (including Crowd for Angels, Align Research and Master Investor). He is approved by the Financial Conduct Authority to perform functions of compliance oversight (CF10) and money laundering reporting (CF11). He is also a CFA charterholder.

Financials

In keeping in-line with industry standards, the time period of the financial model is five years.

There will be a number of revenue generating sources over the lifecycle of the Stockhub platform, but for simplicity, the financial model focuses purely on the main source, advertising. With that said, Stockhub forecasts that during the five year period, the peak revenue is £60 million, achieved in year 5.

Stockhub's vision is to grow fast, and it feels that in order to do so, it’s important to reinvest as much cash as reasonably possible back into the business, and, accordingly, Stockhub is forecasting that during the same five year period, the company’s peak net income grows to £6 million, again achieved in year 5.

Following the initial five year period, Stockhub expects its market share of the target market population to increase to a peak amount of around 25% (from 1%) and its selling, general and administrative expenses (SG&A) to decrease to around 45% of gross profits (from 85%), resulting in peak revenue increasing to around £1.5 billion (from £60 million) and peak net income increasing to approximately £550 million (from £6 million).

Income statement

| Year/Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Year end date | 28/02/2022 | 28/02/2023 | 28/02/2024 | 28/02/2025 | 28/02/2026 |

| Revenues (£'000) | 0 | 5,959 | 14,897 | 29,793 | 59,586 |

| Gross profits (£'000) | 0 | 5,005 | 12,513 | 25,026 | 50,053 |

| Operating profits (£'000) | (333) | 250 | 626 | 2,503 | 7,508 |

| Net profits (£'000) | (333) | 200 | 501 | 2,002 | 6,006 |

Source: Stockhub Limited. Note: all figures in the Income Statement table are estimates.

Risks

As with any investment, investing in Stockhub carries a level of risk. Overall, based on the key risks highlighted below, the degree of risk associated with an investment in Stockhub is higher than in a company that's trading on a public market (such as, HSBC).

Early-stage investment

Stockhub Limited is at one of the earliest stages of the business lifecycle, and the failure rate of companies at that stage is usually much higher than those at a later stage.

Illiquid investment

The number of transactions in shares of private companies is usually significantly lower than in public companies, typically resulting in it taking longer to sell shares in private companies at a price that is at least equal to the price that the shares were bought at. Accordingly, the Stockhub investment opportunity is considered to be higher risk than more liquid companies.

Valuation

As at 23rd February 2022, the Stockhub company estimates the current value of its company at £4 million.

Which time period to use to estimate the expected return?

Stockhub suggests that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time.

Which valuation approach to use?

One of the simplest ways to estimate the value a company is to use the relative valuation approach, which bases the valuation of the company on the valuation of similar companies.

Relative valuation approach

Which type of multiple to use?

For the numerator, Stockhub believes that to account for the different financial leverage levels of its peers, it's best to use enterprise value (EV), rather than price. For the denominator, Stockhub believes that because it expects to reinvest almost all of its revenue back into the business over the five year forecast period and therefore its earnings are expected to be abnormally low over the period, it's best to use sales. Accordingly, Stockhub suggests valuing its company using the EV/sales ratio. However, Stockhub feels that to take into account the different business lifecycle stages of its peers, the most suitable valuation multiple to use is the growth-adjusted EV/sales multiple[Note 4], rather than the EV/sales multiple.

Stockhub suggests that with sales forecast to grow exponential over the five year forecast period, it's best to use forward-looking data, rather than historic data.

In regards to the growth-adjusted EV/sales multiple, for the sales figure, Stockhub suggests that in order to account for the forecasted exponential growth of the business, it's best to use one at the end of the forecast period (i.e. Year 5). Stockhub also suggests that for the sales growth figure, it's best to use Year 6 to 8.

Which are the peers?

Stockhub's vision is for the Stockhub platform to be one of the most successful advertising platforms, and for that reason, it sees its closest peers as the owners of the leading advertising platforms.

Those platforms are Facebook, Google Search, Youtube, Twitter, WhatsApp, Instagram and SnapChat.

Note: Facebook, Instagram and WhatsApp are all owned by Meta Platforms, Inc, Google Search and Youtube are all owned by Alphabet, Inc.

| Platform | Platform owner |

|---|---|

| Meta Platforms, Inc | |

| Google Search | Alphabet, Inc. |

| Youtube | Alphabet, Inc. |

| Twitter, Inc | |

| WhatsApp, | Meta Platforms, Inc |

| Meta Platforms, Inc | |

| SnapChat | Snap, Inc. |

| Investments | Industry | Enterprise value/sales | 1-year forward revenue growth rates (%) | Growth-adjusted enterprise value/sales ratio |

|---|---|---|---|---|

| Meta Platform Inc. | Internet content & communication | 8.04x | 19.20% | 42x |

| Alphabet Inc. | Internet content & communication | 7.80x | 16.80% | 46x |

| Snap Inc. | Internet content & communication | 22.71x | 39.00% | 58x |

| Twitter Inc. | Internet content & communication | 8.60x | 21.20% | 41x |

| Robinhood Inc. | Software - Infrastructure | 17.69x | 23.30% | 75x |

Note: five years after incorporation (i.e. April 2018), Robinhood’s valuation was $5.6 billion, and it was trading on a growth-adjusted EV/sales ratio of 43x.

For those in the UK: Stockhub is SEIS and EIS eligible, a key benefit of which is that those who invest now can claim back up to 50% of the investment amount in income tax relief. Accordingly, the estimated expected return of investing in the business is even higher for UK-citizens (than non-UK citizens).

Which forecasts to use?

The only available forecasts are the ones that are supplied by the Stockhub company, so Stockhub suggests using those.

What's the expected return?

Accordingly, the company estimates that the expected return of an investment in Stockhub over the next five years is 623x. In other words, an £1,000 investment in the company is expected to return £623,000 in five years time.

The return figure estimate is based on the following key assumptions: an industry (online advertising) standard growth-adjusted enterprise value/sales multiple of 41.5x, Stockhub's year-5 revenue estimate (of £60 million), Stockhub's year-6 to year-8 compound annual growth rate estimate (of 100%) and the current estimated company valuation (of £4 million).

The calculation is as follows: (41.5 x £60 million x 1) / £4 million = 623x.

What's the conclusion?

Assuming that a suitable return level over 5 years is 10% per year and Stockhub achieves its expected return level (of 623x), then an investment in the Stockhub company is considered to be a 'suitable' one.

Actions

To invest in Stockhub, click here.

To contact Stockhub, click here.

Notes

Note 1: Calculation of the global advertising market size

Global advertising revenue = World nominal Gross Domestic Product (GDP) x Advertising revenue as a share of GDP = $85,000 billion (2020, The World Bank) x 1% (2015, Federal Reserve Bank of Philadelphia) = $850 billion.

Other key assumptions: World nominal Gross Domestic Product and advertising revenue as a share of GDP are unchanged since 2020 and 2015, respectively.

Note 2: Calculation of the global, Active Investor-focused advertising market size

Global, Active Investor-focused advertising revenue = Global advertising revenue x Active Investors as a proportion of the total population = $850 billion (2022, Stockhub) x 10.4% (2022, Stockhub) = $88.4 billion.

Other key assumptions: Global advertising revenue and Active Investors as a proportion of the total population are unchanged since 2022 and 2022, respectively.

Note 3: Calculation of the UK, Active Investor-focused advertising market size

UK, Active Investor-focused advertising market size = UK nominal Gross Domestic Product (GDP) x Advertising revenue as a share of GDP x Active Investors as a proportion of the total population =2,708 billion (2020, The World Bank) x 1% (2015, Federal Reserve Bank of Philadelphia) x 10.4% (2022, Stockhub) = $2.8 billion.

Other key assumptions: UK nominal Gross Domestic Product, advertising revenue as a share of GDP and Active Investors as a proportion of the total population are unchanged since 2020, 2015 and 2022, respectively.

Note 4: Calculation of the growth-adjusted EV/sales ratio

The growth-adjusted EV/sales ratio is calculated by dividing the EV/sales ratio by the 1-year forward revenue growth rate. For example, for the Meta Platforms growth-adjusted EV/sales ratio, the calculation is as follows: 8.04 dividend by 0.1920 ≈ 42.

References

- ↑ 1.0 1.1 1.2 https://find-and-update.company-information.service.gov.uk/company/13169692

- ↑ 2.0 2.1 https://wiki.stockhub.co:447/main/index.php?title=Stockhub_Wiki:About

- ↑ 3.0 3.1 http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.706.5770&rep=rep1&type=pdf

- ↑ 4.0 4.1 https://web.stanford.edu/~pista/FGMP.pdf

- ↑ 5.0 5.1 https://wiki.stockhub.co:447/main/index.php?title=Main_Page

- ↑ The Stockhub platform was created on 1st March 2022, and the date of the calculation is 6th April 2022, so the platform has been live for 37 days. 210 investments divided by 37 days equates to 6 investments per day.

- ↑ The calculation of the investment return figure can be found in the 'Valuation' section of this report.

- ↑ Stockhub survey.

- ↑ Stockhub survey.

- ↑ https://wiki.stockhub.co:447/main/index.php?title=Main_Page

- ↑ https://www.linkedin.com/in/emhalicioglu/

- ↑ https://www.linkedin.com/in/ravi5ingh/

- ↑ https://www.linkedin.com/in/philhollingdale/

- ↑ https://www.linkedin.com/in/jiteshhalai/

Cite error: <ref> tags exist for a group named "Note", but no corresponding <references group="Note"/> tag was found