Making more money for everyone (and not just the limited wealthy!).

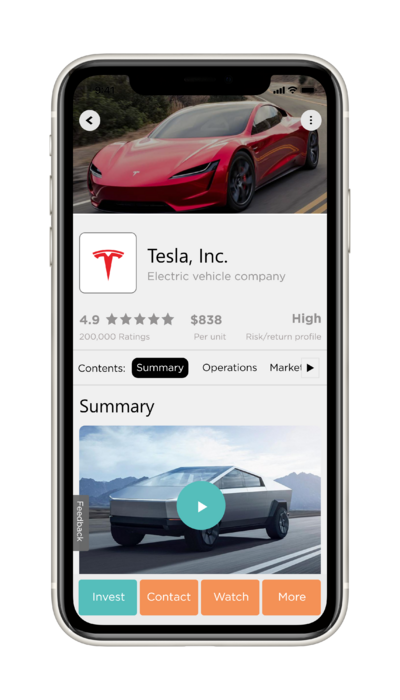

| Risk/return | High |

| Price per share | £10 |

| Asset class | Equities |

| Industry | Fintech |

| Country of incorporation | United Kingdom |

| Minimum investment amount | £10 |

| Maximum investment amount | £500,000 |

| Current valuation | £4,000,000 |

| Investor type | All |

| Tax schemes | SEIS/EIS |

| Bid/ask spread | 0% |

| Commission amount | Zero |

| Market | Private |

Summary

- The world's only investment research platform that anyone can edit.

- Evidence suggests that enabling investment research to be easily (and anonymously) edited by anyone will, in time, result in the democratising of investment researh, and, ultimately, make more money for everyone (and not just the limited few who can afford to pay the $30,000 per year charged by the liked of Goldman Sachs for investment research!).

- To date, the Stockhub platform covers 60 investments.

- The company is led by the former principal investment analyst of one of the world's wealthiest persons.

- The mission of the company is to make more money for everyone (and not just the wealthy!).

- The Stockhub company estimates that the expected return of an investment in the company over the next five years is 3,000x.

- The degree of risk associated with an investment in Stockhub is higher than in a company that's trading on a public market (such as, HSBC).

Operations

The idea of the company came to the now founder of the company when he developed a strong desire to make more money and he looked into investing as a way to do so. The problem he had was that he didn’t know what to invest in and he found himself spending a considerable amount of time researching investments. He also realised that there were many people that felt the same way as him, with the average person rating their desire to make more money at 8 out of 10. In his quest to make more money for himself and people like him, the Stockhub platform and company were born.

Stockhub Limited is a company that’s on a mission to make more money for everyone.

Its first product is a free-to-access investment research platform. What makes the platform unique is that the research on the platform can be edited by anyone.

Evidence suggests that enabling investment research to be (easily and anonymously) edited by anyone will, in time, result in free-to-access high-quality research on the largest number of investments. [1] In other words, it will result in the democratisation of investment research, and help make more money for everyone.

To date, the Stockhub platform provides investment research on 60 investments.

The link to the product can be found here: https://wiki.stockhub.co:447/main/index.php?title=Main_Page

Market

In order to help make more money for everyone (i.e. achieve the mission of the company), the company has decided that the best monetisation method of Stockhub is advertising.

Accordingly, here, the total addressable market (TAM) is defined as the global advertising market, and based on a number of assumptions, it is estimated that the market will grow, in terms of revenue, to $762 billion by 2024. For comparison purposes, it is estimated that the TAM as of 31st December 2020 is $578 billion.

Here, the serviceable available market (SAM) is defined as the global investment advertising market, and based on a number of assumptions, the company estimates that the market will grow to $183 billion by 2024.

Finally, here, the serviceable obtainable market (SOM) is defined as the global investment advertising market that is represented by the ‘Analyst’ personality type (i.e. the target audience of the Stockhub product), and based on a number of assumptions, we estimate that the market will grow to $19 billion by 2024.

Competition

The closest competitors to the Stockhub platform, in a range of key categories, is Robinhood (category: investment platform), Goldman Sachs Research (category: investment research platform), Google Search (category: general information platform) and Bloomberg Terminal (category: financial information platform).

| Stockhub | Seeking Alpha | Goldman Sachs Investment Research | Edison Investment Research | |

|---|---|---|---|---|

| How is the research produced? | ||||

| Type of production method? | Crowdsourced, fully decentralized production | End-user-paid-for, crowdsourced, centralized production | End-user-paid-for, insourced, centralized production | Sponsor-paid-for, insourced, centralized production |

| How many entities are able to contribute to the production of any specific research report? | Unlimited | One | One | One |

| How many entities are able to contribute to the production of the entire research? | Unlimited | Unlimited | One | One |

| How many entities are able to contribute to the approval of any specific research report? | Unlimited | One | One | One |

| How many entities are able to contribute to the approval of the entire research? | Unlimited | One | One | One |

| What is the estimated cost for the investment research company to produce the research on a specific investment per year? | Zero | £850 | £5,000 | £5,000 |

| What are the main features of the research? | ||||

| What is the price of the research? | Free | $179.99 per year | $30,000 per year | Free |

| How many investments are able to be covered using this method? | Unlimited | Limited | Limited | Very limited |

| What is the level of the quality of the research? | At this stage, it’s unknown, but we estimate it to be high | Medium | High | High |

Team

The company is led by the person who believes in the vision of the company the most: the creator of the vision. Combined, the members of the team have helped 342 million people - including one of the world's wealthiest persons - make better investment decisions and returns, and helped build some of the world's most renowned digital platforms.

Chief Executive Officer: Manos Halicioglu

Over a period of around 11 years, Manos has helped 342 million people - including one of the world’s wealthiest persons (Jim Mellon) - make better investment decisions and returns (at the European Central Bank, Burnbrae Group and Master Investor). He graduated from a world top 6 university (Imperial College) and passed both levels 1 and 2 of the most renowned investment management qualification (Chartered Financial Analyst). Mr. Halicioglu also featured in the press, including CityAM, Bloomberg and Portfolio Institutional.

Chief Technology Officer: Ravi Singh

Over a period of 10 years, Ravi has helped build digital platforms at some of the world’s leading financial institutions (Barclays, Citi and BlueBay Asset Management). He studied computer science (BSc) and intelligent systems (MSc) at a world leading University (King’s College London), and was a cohort member of one of the world's leading deeptech accelerator programmes (Entrepreneur First).

Business Advisor: Phil Hollingdale

Phil is the co-founder of a company that has 400,000 customers and £1.7 billion assets under management.

Technical Advisor: Jitesh Halai

Over a 23 year period, Jitesh has helped build digital platforms at leading institutions (including Just Eat, Asos and Credit Suisse). He studied Mathematical Sciences at Queen Mary University of London and Leadership, Strategy & Innovation at Imperial College.

Compliance Advisor: Richard Gill

Over a 13 year period, Richard has helped provide compliance oversight at investment research and trading companies (including Crowd for Angels, Align Research and Master Investor). He is approved by the Financial Conduct Authority to perform functions of compliance oversight (CF10) and money laundering reporting (CF11). He is also a CFA charterholder.

Financials

| Year/Item | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Year end date | 28/02/2022 | 28/02/2023 | 28/02/2024 | 28/02/2025 | 28/02/2026 |

| Revenues (£'000) | 0 | 5,959 | 14,897 | 29,793 | 59,586 |

| Gross profits (£'000) | 0 | 5,005 | 12,513 | 25,026 | 50,053 |

| Operating profits (£'000) | (333) | 250 | 626 | 2,503 | 7,508 |

| Net profits (£'000) | (333) | 200 | 501 | 2,002 | 6,006 |

Source: Stockhub Limited. Note: all figures are estimates.

Risks

As with any investment, investing in Stockhub carries a level of risk. Overall, based on the key risks highlighted below, the degree of risk associated with an investment in Stockhub is higher than in a company that's trading on a public market (such as, HSBC).

Early-stage investment

Stockhub Limited is at one of the earliest stages of the business lifecycle, and the failure rate of companies at that stage is usually much higher than those at a later stage.

Illiquid investment

The number of transactions in shares of private companies is usually significantly lower than in public companies, typically resulting in it taking longer to sell shares in private companies at a price that is at least equal to the price that the shares were bought at. Accordingly, the Stockhub investment opportunity is considered to be higher risk than more liquid companies.

Valuation

As at 23rd February 2022, the Stockhub company estimates the current value of its company at £4 million.

One of the simplest ways to value a company is to use the relative valuation approach.

For the numerator, Stockhub believes that to account for the different financial leverage levels of its peers, it's best to use enterprise Value (EV), rather than price. For the denominator, Stockhub believes that given that Stockhub's earnings are expected to be abnormally low over the five year forecast period, it's best to use sales. Accordingly, Stockhub suggests valuing its company using the EV/sales ratio. However, Stockhub feels that to take into account the different business lifecycle stages of its peers, the most suitable valuation multiple to use is the growth-adjusted EV/sales multiple, rather than the EV/sales multiple.

The growth-adjusted EV/sales ratio is calculated by dividing the EV/sales ratio by the 1-year forward revenue growth rate. For example, for the Meta Platforms growth-adjusted EV/sales ratio, the calculation is as follows: 8.04 dividend by 0.1920 ≈ 42.

Stockhub suggests that with sales expected to grow exponential, it's best to use forward-looking data, rather than historic data. Furthermore, Stockhub suggests that to account for general market cyclicality, it's best to estimate the expected return of the company between now and five years time.

In regards to the growth-adjusted EV/sales multiple, for the sales figure, Stockhub suggests using the one that is 5 years from now (i.e. Year 5). Stockhub also suggests that for the sales growth figure, it's best to use Year 6 to 8.

Accordingly, the company estimates that the expected return of an investment in Stockhub over the next five years is 3,000x. In other words, an £1,000 in the company is expected to return £3.0 million in five years time.

The return figure estimate is based on the following key assumptions: an industry (online advertising) standard growth-adjusted enterprise value/sales multiple of 41.5x, Stockhub's year-5 revenue estimate, Stockhub's year-6 to year-8 compound annual growth rate estimate (of 100%) and the current estimated company valuation (of £4 million).

| Investments | Industry | Enterprise value/sales | 1-year forward revenue growth rates (%) | Growth-adjusted Enterprise value/sales ratio |

|---|---|---|---|---|

| Meta Platform Inc. | Internet content & communication | 8.04x | 19.20% | 42x |

| Alphabet Inc. | Internet content & communication | 7.80x | 16.80% | 46x |

| Snap Inc. | Internet content & communication | 22.71x | 39.00% | 58x |

| Twitter Inc. | Internet content & communication | 8.60x | 21.20% | 41x |

| Robinhood Inc. | Software - Infrastructure | 17.69x | 23.30% | 75x |

Note: five years after incorporation (i.e. April 2018), Robinhood’s valuation was $5.6 billion, and it was trading on a growth-adjusted EV/sales ratio of 43x.

For those in the UK: Stockhub is SEIS and EIS eligible, a key benefit of which is that those who invest now can claim back up to 50% of the investment amount in income tax relief. Accordingly, the estimated expected return of investing in the business is even higher for UK-citizens (than non-UK citizens).

Other

To invest in Stockhub or learn more about the company, click here.