On a mission to accelerate the world's transition to sustainable energy.

| Risk/return | Risk/return::High |

| Price per share | Price per share::$303.35[1] |

| Asset class | Asset class::Equities[2] |

| Industry | Industry::Consumer Cyclical[1] |

| Country of incorporation | Country of incorporation::United States[2] |

| Minimum investment amount | Minimum investment amount::$10[3] |

| Maximum investment amount | Maximum investment amount::$950.54 billion[1] |

| Current valuation | Current valuation::$950.54 billion[1] |

| Investor type | Investor type::All |

| Bid/ask spread (%) | Bid/ask spread::0.0015063%[1] |

| Commission amount | Commission amount::Zero[3] |

| Market | Market::Public[1] |

Summary

- Tesla is on a mission to accelerate the world's transition to sustainable energy.[4]

- The company sells and leases high-performance fully electric vehicles and energy generation and storage systems, and offers services related to its products. Tesla emphasises performance, attractive styling and the safety of its users in the design and manufacture of its products and is continuing to develop full self-driving technology for improved safety. The company also strives to lower the cost of ownership for its customers through continuous efforts to reduce manufacturing costs and by offering financial and other services tailored to its products.[5]

- Assuming that Tesla increases its share of the automotive market to 10% (from 2%) and other assumptions, the expected return of an investment in the company over the next five years is negative 24%. In other words, an £1,000 investment in the company is expected to return £760 in five years time.

- The degree of risk associated with an investment in Tesla is 'high', with the shares having a beta that is 112% above the market (2.12 vs. 1).

Operations

How did the idea of the company come about?

The idea of the company came about when the now founding team of the company realised that the current way that humankind is meeting its energy needs is unsustainable and bad for the planet.[6]

Currently, an estimated 85% of the world's energy needs are met by burning fossil fuels[7], and energy production and consumption are responsible for 76% of annual human-caused greenhouse gas emissions.[8][9]

Researching into a better way to meet the energy needs, the team concluded that the best way to do so is to move to a solar electric economy, from a mine-and-burn hydrocarbon economy.[6]

Accordingly, in the team's quest to accelerate the world’s transition to sustainable energy, the Tesla company was born.

What's the mission of the company?

Tesla is a company that's on a mission to accelerate the world's transition to sustainable energy.[4] In other words, the company's objective is to accelerate the world's transition to energy that meets the needs of the present without compromising the ability of future generations to meet their own needs.

What are the main offerings of the company?

The company's main offerings fall into two main segments: (1) automotive and (2) energy generation and storage.[5]

Automotive

The automotive segment includes the sales and leasing of electric vehicles as well as sales of automotive regulatory credits.[5] Additionally, the automotive segment is also comprised of other services including non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, sales by the company's acquired subsidiaries to third party customers and vehicle insurance revenue.[5]

Current offerings

Automotive sales

As of 2nd June 2022, the company offers four main car models: Model S, Model 3, Model X and Model Y.

Model S

Model S is the fastest accelerating and longest ranging car that Tesla provides, with a zero-to-60 miles per hour acceleration of 3.1 seconds and a maximum distance range on a single battery charge of 405 miles, respectively.[10] The price of the car in the US is $99,990.[11]

Model 3

Model 3 is the lowest priced car that Tesla provides, selling in the US at $46,990.

Model X

Model X is the largest cargo capacity car that Tesla provides, with a cargo capacity of 88 cubic feet. The price of the car in the US is $114,990.

Model Y

Model Y is the lowest price per cargo capacity and lowest price per seat car that Tesla provides, at $829 per cubic feet and $8,999 per seat, respectively. The price of the car in the US is $62,990.

A detailed comparison of the Tesla vehicles is shown in the two tables below.

| Category | Model S | Model X | Model 3 | Model Y | |||||

|---|---|---|---|---|---|---|---|---|---|

| Type | Standard[11] | Plaid[11] | Standard[12] | Plaid[12] | Rear-Wheel Drive[13] | Long Range[13] | Performance[13] | Long Range[14] | Performance[14] |

| Is the vehicle fully electric? | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| What's the top acceleration of the vehicle? | 3.1 seconds | 1.99 seconds | 3.8 seconds | 2.5 seconds | 5.8 seconds | 4.2 seconds | 3.1 seconds | 4.8 seconds | 3.5 seconds |

| What's the maximum distance range of the vehicle on a single battery charge? | 405 miles | 396 miles | 348 miles | 333 miles | 272 miles | 358 miles | 315 miles | 330 miles | 303 miles |

| What's the top speed of the vehicle? | 155 miles per hour | 200 miles per hour | 155 miles per hour | 163 miles per hour | 140 miles per hour | 145 miles per hour | 162 miles per hour | 135 miles per hour | 155 miles per hour |

| Which design type is the vehicle? | Sedan (i.e. car) | Sedan (i.e. car) | SUV (i.e. car) | SUV (i.e. car) | Sedan (i.e. car) | Sedan (i.e. car) | Sedan (i.e. car) | SUV (i.e. car) | SUV (i.e. car) |

| What is the safety rating of the vehicle? | 5 out of 5 stars | 5 out of 5 stars | 5 out of 5 stars | 5 out of 5 stars | 5 out of 5 stars | 5 out of 5 stars | 5 out of 5 stars | 5 out of 5 stars | 5 out of 5 stars |

| How many seats does the vehicle have? | 5 seats | 5 seats | 7 seats | 6 seats | 5 seats | 5 seats | 5 seats | 7 seats | 5 seats |

| What's the cargo capacity of the vehicle? | 28 cubic feet | 28 cubic feet | 88 cubic feet | 88 cubic feet | 23 cubic feet | 23 cubic feet | 23 cubic feet | 76 cubic feet | 76 cubic feet |

| Which drive wheel does the vehicle have? | All-wheel drive | All-wheel drive | All-wheel drive | All-wheel drive | Rear-wheel drive | All-wheel drive | All-wheel drive | All-wheel drive | All-wheel drive |

| What's the price of the vehicle? | $99,990 | $135,990 | $114,990 | $138,990 | $46,990 | $55,990 | $62,990 | $62,990 | $67,990 |

| What's the vehicle's price per cargo capacity? | $3,571 per cubic feet | $4,857 per cubic feet | $1,307 per cubic feet | $1,579 per cubic feet | $2,043 per cubic feet | $2,434 per cubic feet | $2,739 per cubic feet | $829 per cubic feet | $895 per cubic feet |

| What's the vehicle's price per seat? | $19,998 per seat | $27,198 per seat | $16,427 per seat | $23,165 per seat | $9,398 per seat | $11,198 per seat | $12,598 per seat | $8,999 per seat | $13,598 per seat |

| Category | Winner | Notes |

|---|---|---|

| Which Tesla car has the fastest acceleration? | Model S Plaid | The zero to 60 miles per hour acceleration of the car is 1.99 seconds. |

| Which Tesla car has the longest range? | Model S | The range of the car is 405 miles. |

| Which Tesla car has the highest top speed? | Model S Plaid | The top speed of the car is 200 miles per hour. |

| Which Tesla car has the largest cargo capacity? | Model X and Model X Plaid | The cargo capacity of the car is 88 cubic feet. |

| Which Tesla car has the most seats? | Model X and Model Y Long Range | The number of seats in the car is 7 seats. |

| Which Tesla car is the lowest priced? | Model 3 Rear-Wheel Drive | The price of the car is $46,990. |

| Which Tesla car has the lowest price per cargo capacity? | Model Y Long Range | The price per cargo capacity of the car is $829 per cubic feet. |

| Which Tesla car has the lowest price per seat? | Model Y Long Range | The price per seat of the car is $8,999 per seat. |

Automotive leasing

Tesla offers leasing and/or loan financing arrangements for its vehicles in certain jurisdictions in North America, Europe and Asia. Under certain programs, the company provides resale value guarantees or buyback guarantees, enabling customers to sell their vehicles back to the company at certain points in time at pre-determined amounts.[5]

Regulatory credits

The company earns tradable credits in the operation of its business under various regulations related to zero-emission vehicles, greenhouse gas, fuel economy and clean fuel. It sells those credits to other regulated entities that can use the credits to comply with emission standards and other regulatory requirements.[5]

Other current offerings

Service and warranty

Service

Other offerings include the servicing of Tesla vehicles, at company-owned service locations and through Tesla Mobile Service technicians.[5]

Extended service plans

The company offers extended service plans, which provide coverage beyond the new vehicle limited warranties for certain models in specified regions.[5]

Financial services

Purchase financing

The company offers loan financing arrangements for its vehicles in certain jurisdictions in North America, Europe and Asia.[5] In certain situations, Tesla provides resale value guarantees or buyback guarantees, enabling customers to sell their vehicles back to the company at certain points in time at pre-determined amounts.[5]

Insurance

As part of the company's ongoing effort to decrease the total cost of ownership, it offers insurance products on its vehicles.[5] The products are currently available in five US states (Arizona, California, Illinois, Ohio and Texas), and the company plans to offer the products into new geographical markets.[5]

Future offerings

Automotive sales

Cybertruck

Cybertruck is a truck, a motor vehicle designed to transport cargo, carry specialised payloads, or perform other utilitarian work. What will be unique about the offering is that it will be the safest vehicle that Tesla provides. The price of the offering is expected to be $39,900.[15]

Tesla Roadster

The Tesla Roadster is a car. What will be unique about the offering is that it will be the fastest accelerating and longest ranging car that Tesla provides. The price of the offering is around $200,000.[16]

Tesla Semi

Tesla Semi is a semi-trailer truck, a motor vehicle that is designed to transport large cargo, via one or more of its attached trailers. What will be unique about the offering is that it will be the largest cargo capacity vehicle that Tesla provides. The price of the offering is around $150,000.

Ride-hailing service

Tesla has said that it intends to establish an autonomous Tesla ride-hailing network, enabling people to hail a ride.[5] What's unique about the ride-hailing service is that it's expected to be faster and cheaper than the alternatives. Information about the expected price of the service has yet to be disclosed.

Energy generation and storage

The energy generation and storage segment includes the sales and leasing of solar energy generation and energy storage products and related services and sales of solar energy systems incentives.[5]

Current offerings

Energy generation and storage sales

Powerwall

Powerwall is a energy storage system (i.e. a type of battery).[5] What’s unique about the offering is that it's the lowest priced energy storage system that Tesla provides, selling at $10,500. The energy capacity of the product is 13.5 kilowatt hour (kWh). To help put the capacity into perspective, in 2020, the average household in the United States consumed 29 kWh per day.[17] So, if the average household is powered from Powerwalls only, then it will require around two Powerwalls to power the whole house, at an average annual cost of $2,247.

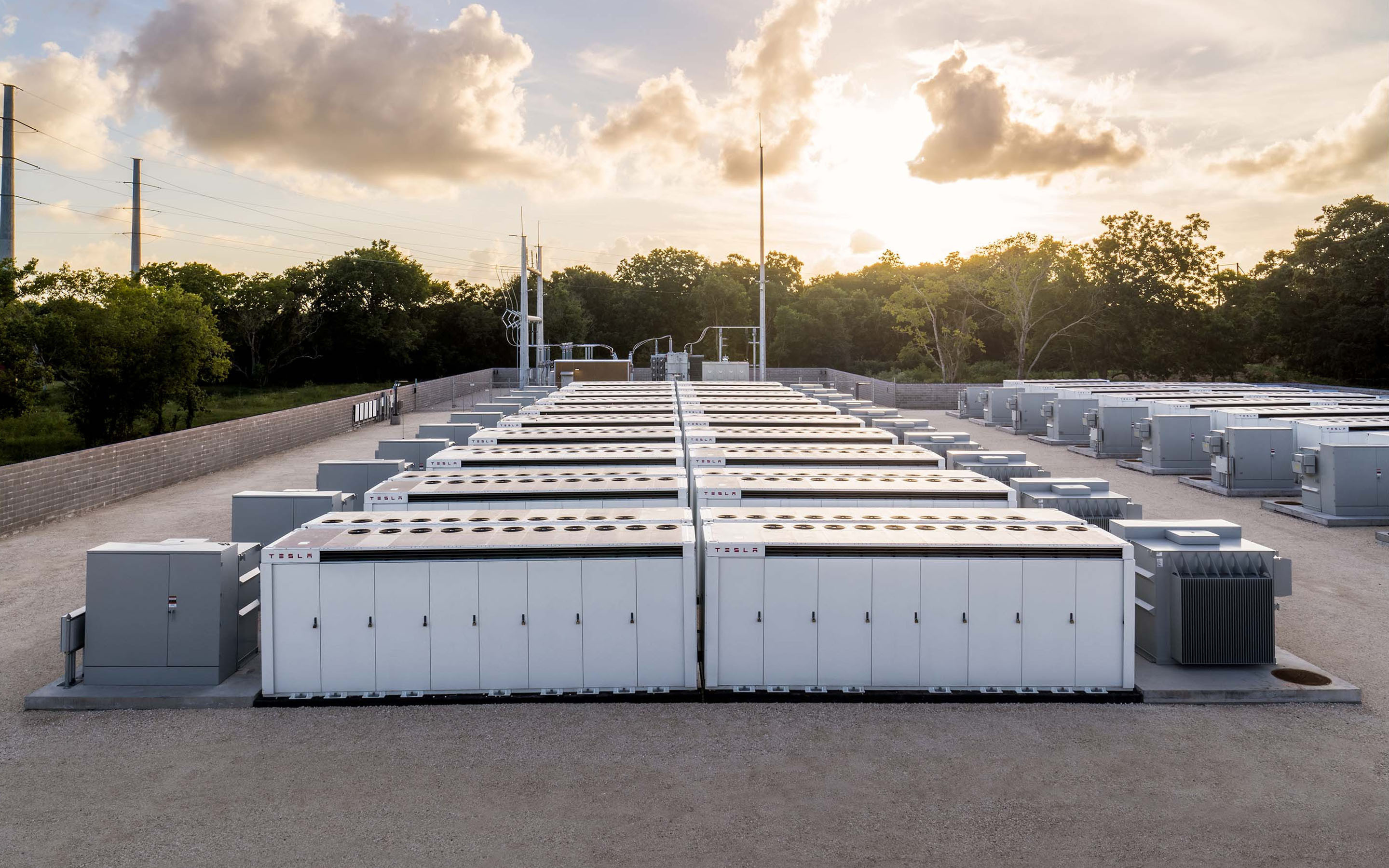

Megapack

Megapack is an energy storage system.[5] What’s unique about the offering is that it's the largest energy storage system that Tesla provides, at 3.5 megawatt hour. To help put the energy capacity into perspective, each unit has enough energy to power an average of 3,600 homes for one hour. A single Megapack sells for $1,000,000.

Solar Roof

Solar Roof is a roof tile.[5] What makes the tile unique is that it's the most aesthetically-beautiful, energy generation roof tile. In other words, it's the most beautiful roof tile that generates electricity.

For the average house in the US, the total cost of having the solar roof is $59,700, or around $3,078 per year over the expected lifetime of the roof (the key assumptions used to determine the expected cost can be found in the table below). To help put the cost into perspective, the average energy bill in the United States is $1,380 per year, so, at the moment, meeting the energy needs of the average US household using the Tesla Solar Roof is 2x more expensive than the alternative.

| Description | Price | Commentary |

|---|---|---|

| 4.98 kW Solar Roof | $40,600 | The average house in the US is 2,261 square feet in size and 2 stories in height. The warranty period of the solar roof is 25 years. Assuming that the replacement period of the solar roof is the same as the warranty period, then that equates to an annual cost of $1,624. The installation cost is included in the cost. |

| Roof Tear Off | $7,600 | Roof tear off refers to the action of 'tearing' off (or removing) the existing roof, something that is required to put on the Tesla tiles. Assuming that the cost is depreciated over the same period as the Tesla tiles (i.e. 25 years), then that equates to an annual cost of $304. |

| 1 Powerwall Battery | $11,500 | The warranty period of the battery is 10 years. Assuming that the battery needs to be replaced at the end of the warranty period, then that equates to an annual cost of $1,150. Installation cost included. |

| Total price | $59,700 | Combining all the above costs together, that equates to a total annual cost of $3,078 |

Other current offerings

Service and Warranty

Other offerings include servicing and repairs, and extended limited warranties in certain regions.[5]

Financial services

Tesla offers certain loan and power purchase agreement (PPA) options to residential or commercial customers who pair energy storage systems with solar energy systems.[5] The company offers certain financing options to its solar customers, which enable the customer to purchase and own a solar energy system, Solar Roof or integrated solar and Powerwall system.[5] Its solar PPAs, offered to commercial customers, charges a fee per kilowatt-hour based on the amount of electricity produced by its solar energy systems.[5]

From which place(s) are the offerings able to be purchased?

The main places that the offerings are able to be purchased is through the company's website (at www.tesla.com) and company's stores, which is estimated at around 400 stores in more than 35 countries.

From which place(s) are the offerings promoted?

The main way that Tesla promotes the offerings is through media coverage and word of mouth.

What's the current strategy of the company?

According to a blog post in 2016 in which the CEO of Tesla detailed the company's master plan[18], the current strategy of Tesla consists of four milestones:

- Create stunning solar roofs with seamlessly integrated battery storage;

- Expand the electric vehicle product line to address all major segments;

- Develop a self-driving capability that is 10x safer than manual, via massive fleet learning; and

- Enable your car to make money for you when you aren't using it.

It's worth noting that 10 years earlier than the publication of the 2016 blog post, Elon detailed the company's first master plan[6], and the company has managed to achieve all of the milestones, which were as follows:

- Build a sports car (i.e. the Tesla Model S);

- Use that money to build an affordable car (i.e. the Tesla Model 3);

- Use that money to build an even more affordable car (i.e. a cheaper version of the Tesla Model 3); and

- Provide zero emission electric power generation options (i.e. Tesla Solar Roof and Powerwall and Megapack).

Market

Total Addressable Market

Here, the total addressable market (TAM) is defined as the global automotive market, and based on a number of assumptions, it is estimated that the size of the market as of today (30th May 2022), in terms of revenue, is $3.0 trillion.

It can be strongly argued that given the company's mission, the total addressable market is actually the global energy market; and research suggests that the estimated size of that market is $6.1 trillion.[19]

Serviceable Available Market

Here, the serviceable available market (SAM) is defined as the global car market, and based on a number of assumptions, it is estimated that the size of the market as of today (30th May 2022), in terms of revenue, is $1.0 trillion.

Serviceable Obtainable Market

Here, the serviceable obtainable market (SOM) is defined as the US car market, and based on a number of assumptions, it is estimated that the size of the market as of today (30th May 2022), in terms of revenue, is $262 billion.

Competition

Automotive

Tesla believes that its vehicles compete in the market both based on their traditional segment classification as well as based on their propulsion technology. For example, Model S and Model X compete primarily with premium sedans and premium SUVs, and Model 3 and Model Y compete with small to medium-sized sedans and compact SUVs, which are extremely competitive markets. Competing products typically include internal combustion vehicles from more established automobile manufacturers; however, many established and new automobile manufacturers have entered or have announced plans to enter the market for electric and other alternative fuel vehicles. Many major automobile manufacturers have electric vehicles available today in major markets including the US, China and Europe, and other current and prospective automobile manufacturers are also developing electric vehicles. In addition, several manufacturers offer hybrid vehicles, including plug-in versions.

Tesla also believes that there is increasing competition for its vehicle offerings as a platform for delivering self-driving technologies, charging offerings and other features and services, and it expects to compete in this developing market through continued progress on its autopilot, full self-driving and neural network capabilities, Supercharger network and its infotainment offerings.

Energy generation and storage

Energy Storage Systems

The market for energy storage products is also highly competitive, and both established and emerging companies have introduced products that are similar to Tesla's product portfolio or that are alternatives to the elements of its systems. Tesla competes with these companies based on price, energy density and efficiency. Tesla believes that the things that give it a competitive advantage in its markets are: the specifications and features of its products, its strong brand and the modular, scalable nature of its energy storage products.

Solar Energy Systems

The primary competitors to its solar energy business are the traditional local utility companies that supply energy to Tesla's potential customers. Tesla competes with these traditional utility companies primarily based on price and the ease by which customers can switch to electricity generated by Tesla's solar energy systems. Tesla also competes with solar energy companies that provide products and services similar to it. Many solar energy companies only install solar energy systems, while others only provide financing for these installations.

Team

Leadership

Chief Executive Officer

Elon Musk is the Chief Executive Officer of Tesla and has served the position since October 2008 and as a member of the Board since April 2004. Elon has also served as Chief Executive Officer, Chief Technology Officer and Chairman of Space Exploration Technologies Corporation, an advanced rocket and spacecraft manufacturing and services company (“SpaceX ”), since May 2002, and served as Chairman of the Board of SolarCity Corporation, a solar installation company, from July 2006 until its acquisition by Tesla in November 2016. Elon is also a founder of The Boring Company, an infrastructure company, and of Neuralink Corp., a company focused on developing brain-machine interfaces. Prior to SpaceX, Elon co-founded PayPal, an electronic payment system, which was acquired by eBay in October 2002, and Zip2 Corporation, a provider of Internet enterprise software and services, which was acquired by Compaq in March 1999. Elon has also served on the board of directors of Endeavor Group Holdings, Inc. since April 2021. Elon holds a B.A. in physics from the University of Pennsylvania and a B.S. in business from the Wharton School of the University of Pennsylvania.

Chief Financial Officer

Zachary Kirkhorn is Chief Financial Officer of Tesla and served the position since March 2019. Previously, Zach served in various finance positions continuously since joining Tesla in March 2010, other than between August 2011 and June 2013 during which he attended business school, including most recently as Vice President, Finance, Financial Planning and Business Operations from December 2018 to March 2019. Zach holds dual B.S.E. degrees in economics and mechanical engineering and applied mechanics from the University of Pennsylvania and an M.B.A. from Harvard University.

Senior Vice President

Andrew Baglino has served as Tesla's Senior Vice President, Powertrain and Energy Engineering since October 2019. Previously, Drew served in various engineering positions continuously since joining Tesla in March 2006. Drew holds a B.S. in electrical engineering from Stanford University.

Board of Directors

Elon Musk

For information about Elon Musk, see "Chief Executive Officer" section above.

Robyn M. Denholm

Robyn M. Denholm has served as a director since August 2014 and as Chair since November 2018. Since January 2021, Ms. Denholm has been an operating partner of Blackbird Ventures, a venture capital firm. From January 2017 through June 2019, Ms. Denholm was with Telstra Corporation Limited, a telecommunications company, as Chief Financial Officer and Head of Strategy from October 2018 through June 2019, and Chief Operations Officer from January 2017 to October 2018. Prior to Telstra, from August 2007 to February 2016, Ms. Denholm was with Juniper Networks, Inc., a manufacturer of networking equipment (“Juniper”), serving first as its Executive Vice President and Chief Financial Officer and then as its Executive Vice President and Chief Financial and Operations Officer. Prior to joining Juniper, Ms. Denholm served in various executive roles at Sun Microsystems, Inc. from January 1996 to August 2007. Ms. Denholm also served at Toyota Motor Corporation Australia for seven years and at Arthur Andersen & Company for five years in various finance assignments. Ms. Denholm is a Fellow of the Institute of Chartered Accountants of Australia/New Zealand, a member of the Australian Institute of Company Directors, and holds a Bachelor’s degree in Economics from the University of Sydney and a Master’s degree in Commerce and a Doctor of Business Administration (honoris causa) from the University of New South Wales.

Ira Ehrenpreis

Ira Ehrenpreis is Founder and Managing Partner of DBL Partners, a leading impact investing venture capital firm, currently managing more than $1 billion of capital. DBL invests in companies that can deliver top-tier financial returns, while simultaneously driving social or environmental change.

Ira is a recognized leader in the venture capital industry, having served on the Board, Executive Committee, and as Annual Meeting Chairman of the National Venture Capital Association (NVCA). He currently serves as the President of the Western Association of Venture Capitalists (WAVC) and as the Chairman of the VCNetwork, the largest and most active California venture capital organization.

Ira was awarded the 2018 NACD Directorship 100 for being “one of the most influential leaders in the boardroom and corporate governance community.” In 2007, he was named one of the “Top 50 Most Influential Men Under 45" and in 2014 was inducted into the International Green Industry Hall of Fame.

Ira has served for several years as the Chairman of the Silicon Valley Technology Innovation & Entrepreneurship Forum (SVIEF). He is the Founder and Chairman of one of the most prominent annual energy innovation industry events, the World Energy Innovation Forum (WEIF), which has convened the who's-who in the industry to discuss the important energy issues and opportunities of our time. In addition, Ira has served on several industry Boards, including the Department of Energy’s (DOE) Energy Efficiency and Renewable Energy Advisory Committee (ERAC), the National Renewable Energy Laboratory (NREL) Advisory Council, the Clean-Tech Investor Summit (Chairman), the Renewable Energy Finance Forum (REFF) West (Co-Chairman), the Renewable Energy Finance Forum (REFF) Wall Street (Co-Chairman), the Cleantech Venture Network (Past Chairman of Advisory Board), and ACORE (American Council on Renewable Energy).

Ira has served as the Chairman of the Silicon Valley Technology Innovation & Entrepreneurship Forum (SVIEF) for many years. He is also an active leader at Stanford University, where he has served on the Board of Visitors of Stanford Law School and is currently an advisory board member of the Stanford Global Climate and Energy Project (GCEP) and the Stanford Precourt Institute for Energy (PIE) Advisory Council. Ira has also been a guest lecturer, including helping to teach a course on Venture Capital. In addition, Ira served for many years on the Advisory Board of the Forum for Women Entrepreneurs (FWE).

<noglossary>Ira received his JD/MBA from Stanford Graduate School of Business and Stanford Law School, where he was an Associate Editor of Stanford Law Review. He holds a B.A. from the University of California, Los Angeles, graduating Phi Beta Kappa and Summa Cum Laude.</noglossary>

Larry Ellison

Lawrence J. Ellison has been a member of the Board since December 2018. Mr. Ellison is the founder of Oracle Corporation, a software and technology company, has served as its Chief Technical Officer since September 2014 and previously served as its Chief Executive Officer from June 1977 to September 2014. Mr. Ellison has also served on Oracle’s board of directors since June 1977, including as its Chairman since September 2014 and previously from May 1995 to January 2004.

Hiro Mizuno

Hiromichi Mizuno has been a member of Board since April 2020. Since January 2021, Mr. Mizuno has served as the United Nations Special Envoy on Innovative Finance and Sustainable Investments. From January 2015 to March 2020, Mr. Mizuno served as Executive Managing Director and Chief Investment Officer of Japan’s Government Pension Investment Fund, the largest pension fund in the world. Previously, Mr. Mizuno was a partner at Coller Capital, a private equity firm, from 2003. In addition to being a career-long finance and investment professional, Mr. Mizuno has served as a board member of numerous business, government and other organizations, currently including the Mission Committee of Danone S.A., a global food products company, and the World Economic Forum’s Global Future Council. Mr. Mizuno is also involved in academia, having been named to leadership or advisory roles at Harvard University, Oxford University, University of Cambridge, Northwestern University and Osaka University. Mr. Mizuno holds a B.A. in Law from Osaka City University and an M.B.A. from the Kellogg Graduate School of Management at Northwestern University.

James Murdoch

James Murdoch has been a member of the Board since July 2017. Since March 2019, Mr. Murdoch has been the Chief Executive Officer of Lupa Systems, a private investment company that he founded. Previously, Mr. Murdoch held a number of leadership roles at Twenty-First Century Fox, Inc. (“21CF”), a media company, over two decades, including its Chief Executive Officer from 2015 to March 2019, its Co-Chief Operating Officer from 2014 to 2015, its Deputy Chief Operating Officer and Chairman and Chief Executive Officer, International from 2011 to 2014 and its Chairman and Chief Executive, Europe and Asia from 2007 to 2011. Previously, he served as the Chief Executive Officer of Sky plc from 2003 to 2007, and as the Chairman and Chief Executive Officer of STAR Group Limited, a subsidiary of 21CF, from 2000 to 2003. Mr. Murdoch also formerly served on the boards of News Corporation from 2013 to July 2020, of 21CF from 2017 to 2019, of Sky plc from 2016 to 2018, of GlaxoSmithKline plc from 2009 to 2012 and of Sotheby’s from 2010 to 2012.

Kimbal Musk

Kimbal Musk is Co-Founder of The Kitchen, a growing family of businesses that pursues an America where everyone has access to real food. Kimbal is a 2017 Social Entrepreneur by the Schwab Foundation, a sister organization to the World Economic Forum, for his impactful, scalable work to bring Real Food to Everyone.

His family of restaurant concepts serve real food at every price point. They source food from American farmers, stimulating the local farm economy to the tune of millions of dollars a year. His non-profit organization builds permanent, outdoor Learning Garden classrooms in underserved schools around the U.S. reaching over 125,000 students everyday. His urban, indoor vertical farming accelerator, seeks to empower thousands of young entrepreneurs to become real food farmers.

Kimbal is on the board for Chipotle, Tesla, and SpaceX.

Kathleen Wilson-Thompson

Kathleen Wilson-Thompson has been a member of the Board since December 2018. Ms. Wilson-Thompson previously served as Executive Vice President and Global Chief Human Resources Officer of Walgreens Boots Alliance, Inc., a global pharmacy and wellbeing company, from December 2014 to January 2021, and as Senior Vice President and Chief Human Resources Officer from January 2010 to December 2014. Prior to Walgreens, Ms. Wilson-Thompson held various legal and operational roles at The Kellogg Company, a food manufacturing company, from July 2005 to December 2009, including most recently as its Senior Vice President, Global Human Resources. Ms. Wilson-Thompson also serves on the boards of directors of Wolverine World Wide, Inc. Ms. Wilson-Thompson holds an A.B. in English Literature from the University of Michigan and a J.D. and L.L.M. (Corporate and Finance Law) from Wayne State University.

Financials

Historic

Most recent quarter

During the three months ended 31st March 2022, net income increased to $3.32 billion on revenues of $18.76 billion, representing a respective increase of 7x and 81% compared to the prior year, and equating to a net income margin of 18%. The company ended the quarter with cash of $18.01 billion, representing an increase of 2% from the end of 2021.

Most recent year

For the fiscal (and calendar) year 2021, Tesla reported a net income of $5.52 billion.[20] The annual revenue was $53.8 billion, an increase of 71% over the previous fiscal year.[20]

All periods

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year end date | 31/12/2005 | 31/12/2006[22][23] | 31/12/2007 | 31/12/2008 | 31/12/2009 | 31/12/2010[23] | 31/12/2011[23] | 31/12/2012[23] | 31/12/2013[23] | 31/12/2014[23] | 31/12/2015[23] | 31/12/2016[23] | 31/12/2017[23] | 31/12/2018[23] | 31/12/2019[23] | 31/12/2020[23] | 31/12/2021[23] |

Income statement

| |||||||||||||||||

| Revenues ($'million) | 0 | 0 | 0.073 | 15 | 112 | 117 | 204 | 413 | 2,013 | 3,198 | 4,046 | 7,000 | 11,759 | 21,461 | 24,578 | 31,536 | 53,823 |

| Net profits ($'million) | -12 | -30 | -78 | -83 | −56 | −154 | −254 | −396 | −74 | −294 | −889 | −675 | −1,962 | −976 | −862 | 721 | 5,519 |

Balance sheet

| |||||||||||||||||

| Total assets ($'million) |

8 | 44 | 34 | 52 | 130 | 386 | 713 | 1,114 | 2,417 | 5,831 | 8,068 | 22,664 | 28,655 | 29,740 | 34,309 | 52,148 | 62,131 |

Other

| |||||||||||||||||

| Employees | NA | 70 | 268 | 252 | 514 | 899 | 1,417 | 2,914 | 5,859 | 10,161 | 13,058 | 17,782 | 37,543 | 48,817 | 48,016 | 70,757 | 99,290 |

Forward

What are the financial forecasts?

| Year | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year end date | 31/12/2022 | 31/12/2023 | 31/12/2024 | 31/12/2025 | 31/12/2026 | 31/12/2027 | 31/12/2028 | 31/12/2029 | 31/12/2030 | 31/12/2031 | 31/12/2032 | 31/12/2033 | 31/12/2034 | 31/12/2035 | 31/12/2036 | 31/12/2037 | 31/12/2038 | 31/12/2039 | 31/12/2040 | 31/12/2041 | 31/12/2042 | 31/12/2043 | 31/12/2044 | 31/12/2045 | 31/12/2046 | 31/12/2047 | 31/12/2048 | 31/12/2049 | 31/12/2050 | 31/12/2051 | 31/12/2052 | 31/12/2053 | 31/12/2054 | 31/12/2055 | 31/12/2056 | 31/12/2057 | 31/12/2058 | 31/12/2059 | 31/12/2060 | 31/12/2061 | 31/12/2062 | 31/12/2063 |

Income statement

| ||||||||||||||||||||||||||||||||||||||||||

| Revenues ($'million) | $78,935 | $112,257 | $154,816 | $207,049 | $268,527 | $337,721 | $411,894 | $487,157 | $558,739 | $621,448 | $670,282 | $701,078 | $711,102 | $699,445 | $667,163 | $617,116 | $553,551 | $481,510 | $406,171 | $332,253 | $263,564 | $202,749 | $151,247 | $109,414 | $76,757 | $52,217 | $34,448 | $22,038 | $13,673 | $8,226 | $4,799 | $2,715 | $1,490 | $793 | $409 | $205 | $99 | $47 | $21 | $9 | $4 | $2 |

| Gross profits ($'million) | $23,680 | $33,677 | $46,445 | $62,115 | $80,558 | $101,316 | $185,352 | $219,221 | $251,432 | $279,652 | $301,627 | $315,485 | $319,996 | $314,750 | $300,223 | $277,702 | $249,098 | $216,679 | $182,777 | $149,514 | $118,604 | $91,237 | $68,061 | $49,236 | $34,541 | $23,498 | $15,502 | $9,917 | $6,153 | $3,702 | $2,160 | $1,222 | $670 | $357 | $184 | $92 | $45 | $21 | $10 | $4 | $2 | $1 |

| Operating profits ($'million) | $11,840 | $16,839 | $23,222 | $31,057 | $40,279 | $50,658 | $123,568 | $146,147 | $167,622 | $186,434 | $201,085 | $210,323 | $213,331 | $209,834 | $200,149 | $185,135 | $166,065 | $144,453 | $121,851 | $99,676 | $79,069 | $60,825 | $45,374 | $32,824 | $23,027 | $15,665 | $10,335 | $6,612 | $4,102 | $2,468 | $1,440 | $815 | $447 | $238 | $123 | $61 | $30 | $14 | $6 | $3 | $1 | $1 |

| Net profits ($'million) | $9,354 | $13,302 | $18,346 | $24,535 | $31,820 | $40,020 | $97,619 | $115,456 | $132,421 | $147,283 | $158,857 | $166,156 | $168,531 | $165,769 | $158,118 | $146,256 | $131,192 | $114,118 | $96,263 | $78,744 | $62,465 | $48,052 | $35,846 | $25,931 | $18,191 | $12,376 | $8,164 | $5,223 | $3,240 | $1,949 | $1,137 | $643 | $353 | $188 | $97 | $48 | $24 | $11 | $5 | $2 | $1 | $0 |

What are the assumptions used to estimate the financial forecasts?

| Description | Value | Commentary |

|---|---|---|

Revenue

| ||

| What's the estimated current size of the total addressable market? | $2,975,000,000 | Here, the total addressable market (TAM) is defined as the global automotive market, and based on a number of assumptions[Note 2], it is estimated that the size of the market as of today (30th May 2022), in terms of revenue, is $2.975 trillion.

|

| What is the estimated company lifespan? | 60 years | Tesla employs around 110,000, making the company a large organisation (more than 10,000 employees), and research shows that the average lifespan of a large corporation is around 50 years.[25] |

| What's the estimated annual growth rate of the total addressable market over the lifecycle of the company? | 3% | Research shows that the growth rate of the global automotive market (i.e. the total addressable market) is similar to the growth rate of global gross domestic product[26], which has averaged (medium) around 3% per year in the last 20 years (2001 to 2022)[27]. |

| What's the estimated company peak market share? | 10% | Stockhub estimates that especially given the leadership of the company, the peak market share of Tesla is around 10%, and, therefore, suggests using the share amount here. As of 31st December 2021, Tesla's current share of the market is estimated at around 1.8%. |

| Which distribution function do you want to use to estimate company revenue? | Gaussian | Research suggests that the revenue pattern of companies is similar to the pattern produced by the Gaussian distribution function (i.e. the revenue distribution is bell shaped)[28], so Stockhub suggests using that function here. |

| What's the estimated standard deviation of company revenue? | 6 years | Another way of asking this question is this way: within how many years either side of the mean does 68% of revenue occur? Based on Tesla's current revenue amount (i.e. $54 billion) and Tesla's estimated lifespan (i.e. 60 years) and Tesla's estimated current stage of its lifecycle (i.e. growth stage), the Stockhub company suggests using 6 years (i.e. 68% of all sales happen within 6 years either side of the mean year), so that's what's used here. |

Growth stages

| ||

| How many main stages of growth is the company expected to go through? | 4 stages | Research suggests that a company typically goes through four distinct stages of cash flow growth.[29] Research also shows that incorporating those stages into the discounted cash flow model improves the quality of the model and, ultimately, the quality of the value estimation.[30]

In addition, research shows that a key way to determine the stage which a company is in is by examining the cash flow patterns of the company.[31] A summary of the economic links to cash flow patterns can be found in the appendix of this report. Stockhub estimates that with Tesla's operating cash flows positive (+), investing cash flows negative (-) and its financing cash flows positive (+), the company is in the second stage of growth (i.e. the 'growth' stage), and, therefore, it has a total of three main stages of growth. Note, to account for one-off events, the three-year average (median) amount was used to calculate the cash flows. On 7th February 2022, Tesla said it currently expects: to continue to generate net positive operating cash flow as it has done in the last four fiscal years; its capital expenditures to be between $5.00 to $7.00 billion in 2022 and each of the next two fiscal years; and its ability to be self-funding to continue as long as macroeconomic factors support current trends in its sales. Accordingly, based on forward looking statements, it appears that the company is in stage two of the business lifecycle (i.e. the 'growth' stage), and, therefore, it has a total of three main stages of growth remaining. |

| What proportion of the company lifecycle is represented by growth stage 1? | 30% | Research suggests 30%.[32] |

| What proportion of the company lifecycle is represented by growth stage 2? | 10% | Research suggests 10%.[32] |

| What proportion of the company lifecycle is represented by growth stage 3? | 20% | Research suggests 20%.[32] |

| What proportion of the company lifecycle is represented by growth stage 4? | 40% | Research suggests 40%.[32] |

Growth stage 2

| ||

| Cost of goods sold as a proportion of revenue (%) | 79% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[33], and the margin for its peers is 79%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Operating expenses as a proportion of revenue (%) | 15% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[33], and the margin for its peers is 15%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Tax rate (%) | 11% | Research suggests that it's best to use a similar rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[33], and the rate for its peers is 11%. |

| Depreciation and amortisation as a proportion of revenue (%) | 7% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[33], and the margin for its peers is 7%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Fixed capital as a proportion of revenue (%) | 10% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 2)[33], and the amount for its peers is 10%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Working capital as a proportion of revenue (%) | 15% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 2)[33], and the amount for its peers is 15%. |

| Net borrowing ($000) | Zero | Stockhub suggests that for simplicity, the net borrowing figure is zero. |

| Interest amount ($000) | Zero | Stockhub suggests that for simplicity, the interest amount figure is zero. |

Growth stage 3

| ||

| Cost of goods sold as a proportion of revenue (%) | 62% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[33], and the margin for its peers is 62%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Operating expenses as a proportion of revenue (%) | 13% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[33], and the margin for its peers is 13%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Tax rate (%) | 14% | Research suggests that it's best to use a similar rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[33], and the rate for its peers is 14%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Depreciation and amortisation as a proportion of revenue (%) | 4% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 3)[33], and the amount for its peers is 4%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Fixed capital as a proportion of revenue (%) | 3% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 3)[33], and the amount for its peers is 3%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Working capital as a proportion of revenue (%) | 10% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 4)[33], and the amount for its peers is 10%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Net borrowing ($000) | Zero | Stockhub suggests that for simplicity, the net borrowing figure is zero. |

| Interest amount ($000) | Zero | Stockhub suggests that for simplicity, the interest amount figure is zero. |

Growth stage 4

| ||

| Cost of goods sold as a proportion of revenue (%) | 99% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[33], and the margin for its peers is 99%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Operating expenses as a proportion of revenue (%) | 15% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[33], and the margin for its peers is 15%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Tax rate (%) | 0% | Research suggests that it's best to use a similar rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[33], and the rate for its peers is 0%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Depreciation and amortisation as a proportion of revenue (%) | 37% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 4)[33], and the amount for its peers is 37%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Fixed capital as a proportion of revenue (%) | 1% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 4)[33], and the amount for its peers is 1%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Working capital as a proportion of revenue (%) | 10% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 4)[33], and the amount for its peers is 10%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Net borrowing ($000) | Zero | Stockhub suggests that for simplicity, the net borrowing figure is zero. |

| Interest amount ($000) | Zero | Stockhub suggests that for simplicity, the interest amount figure is zero. |

Risks

As with any investment, investing in Tesla carries a level of risk. Overall, based on the key risks highlighted below, the degree of risk associated with an investment in Tesla is high.

- Tesla may be impacted by macroeconomic conditions resulting from the global COVID-19 pandemic.

- Tesla may experience delays in launching and ramping the production of its products and features, or Tesla may be unable to control its manufacturing costs.

- Tesla may be unable to grow its global product sales, delivery and installation capabilities and its servicing and vehicle charging networks, or Tesla may be unable to accurately project and effectively manage its growth.

- Tesla's future growth and success is dependent upon consumers’ demand for electric vehicles and specifically its vehicles in an automotive industry that is generally competitive, cyclical and volatile.

- Tesla's suppliers may fail to deliver components according to schedules, prices, quality and volumes that are acceptable to us, or Tesla may be unable to manage these components effectively.

- Tesla may be unable to meet its projected construction timelines, costs and production ramps at new factories, or Tesla may experience difficulties in generating and maintaining demand for products manufactured there.

- Tesla will need to maintain and significantly grow its access to battery cells, including through the development and manufacture of its own cells, and control its related costs.

- Tesla faces strong competition for its products and services from a growing list of established and new competitors.

- Tesla may experience issues with lithium-ion cells or other components manufactured at Gigafactory Nevada and Gigafactory Shanghai, which may harm the production and profitability of its vehicle and energy storage products.

- Tesla faces risks associated with maintaining and expanding its international operations, including unfavourable and uncertain regulatory, political, economic, tax and labour conditions.

- Tesla's business may suffer if its products or features contain defects, fail to perform as expected or take longer than expected to become fully functional.

- Tesla may be required to defend or insure against product liability claims.

- Tesla will need to maintain public credibility and confidence in its long-term business prospects in order to succeed.

- Tesla may be unable to effectively grow, or manage the compliance, residual value, financing and credit risks related to, its various financing programs.

- Tesla must manage ongoing obligations under its agreement with the Research Foundation for the State University of New York relating to its Gigafactory New York.

- If Tesla is unable to attract, hire and retain key employees and qualified personnel, its ability to compete may be harmed.

- Tesla is highly dependent on the services of Elon Musk, its Chief Executive Officer.

- Tesla's information technology systems or data, or those of its service providers or customers or users could be subject to cyber-attacks or other security incidents, which could result in data breaches, intellectual property theft, claims, litigation, regulatory investigations, significant liability, reputational damage and other adverse consequences.

- Any unauthorized control or manipulation of Tesla's products’ systems could result in loss of confidence in it and its products.

- Tesla's business may be adversely affected by any disruptions caused by union activities.

- Tesla may choose to or be compelled to undertake product recalls or take other similar actions.

- Tesla's current and future warranty reserves may be insufficient to cover future warranty claims.

- Tesla's insurance coverage strategy may not be adequate to protect it from all business risks.

- Tesla's debt agreements contain covenant restrictions that may limit its ability to operate its business.

- Additional funds may not be available to Tesla when it needs or want them.

- Tesla may be negatively impacted by any early obsolescence of its manufacturing equipment.

- Tesla holds and may acquire digital assets that may be subject to volatile market prices, impairment and unique risks of loss.

- There is no guarantee that Tesla will have sufficient cash flow from its business to pay its indebtedness or that it will not incur additional indebtedness.

- Tesla is exposed to fluctuations in currency exchange rates.

- Tesla may need to defend itself against intellectual property infringement claims, which may be time-consuming and expensive.

- Increased scrutiny and changing expectations from stakeholders with respect to the company's ESG practices may result in additional costs or risks.

- Tesla's operations could be adversely affected by events outside of its control, such as natural disasters, wars or health epidemics.

- Demand for Tesla's products and services may be impacted by the status of government and economic incentives supporting the development and adoption of such products.

- Tesla is subject to evolving laws and regulations that could impose substantial costs, legal prohibitions or unfavourable changes upon its operations or products.

- Any failure by Tesla to comply with a variety of United States and international privacy and consumer protection laws may harm the company.

- Tesla could be subject to liability, penalties and other restrictive sanctions and adverse consequences arising out of certain governmental investigations and proceedings.

- Tesla may face regulatory challenges to or limitations on its ability to sell vehicles directly.

- The trading price of Tesla's common stock is likely to continue to be volatile.

- Tesla's financial results may vary significantly from period to period due to fluctuations in its operating costs and other factors.

- Tesla may fail to meet its publicly announced guidance or other expectations about its business, which could cause its stock price to decline.

- Transactions relating to Tesla's convertible senior notes may dilute the ownership interest of existing stockholders, or may otherwise depress the price of its common stock.

- If Elon Musk were forced to sell shares of Tesla's common stock that he has pledged to secure certain personal loan obligations, such sales could cause its stock price to decline.

- Anti-takeover provisions contained in Tesla's governing documents, applicable laws and its convertible senior notes could impair a takeover attempt.

Valuation

What's the expected return of an investment in the company?

Stockhub estimates that the expected return of an investment in the company over the next five years is negative 24%. In other words, an £1,000 investment in the company is expected to return £760 in five years time. The assumptions used to estimate the return figure can be found in the table below.

Assuming that a suitable return level over five years is 10% per year and Tesla achieves its expected return level (of negative 24%), then an investment in the company is considered to be an 'unsuitable' one.

What are the assumptions used to estimate the return?

| Description | Value | Commentary |

|---|---|---|

| Which valuation model do you want to use? | Discounted cash flow | There are two main approaches to estimate the value of an investment:

Research suggests that in terms of estimating the expected return of an investment over a period of 12-months or more, the approach that is more accurate is the discounted cash flow approach[34], so that's the approach that Stockhub suggests to use here; nevertheless, for completeness purposes, separately, the valuation of the company is also estimated using the using the relative valuation approach (the valuation based on the relative approach can be found in the appendix of this report). Tesla has never paid cash dividends, and on 7th February 2022, it said that it currently does not anticipate paying any cash dividends in the foreseeable future. Accordingly, Stockhub suggests using the free cash flow valuation method (rather than the dividend discount model). |

| Which financial forecasts to use? | Stockhub | The only available long-term forecasts (i.e. >15 years) are the ones that are supplied by the Stockhub company (the forecasts can be found in the financials section of this report), so Stockhub suggests using those. |

Growth stage 2

| ||

| Discount rate (%) | 15% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity is by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. |

| Probability of success (%) | 90% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 2) is 90%. |

Growth stage 3

| ||

| Discount rate (%) | 10% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity is by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. |

| Probability of success (%) | 100% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 3) is 100%. |

Growth stage 4

| ||

| Discount rate (%) | 10% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity is by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. |

| Probability of success (%) | 100% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 4) is 100%. |

Other key inputs

| ||

| What's the current value of the company? | $950.54 billion | As at 5th June 2022, the current value of the Tesla company is $950.54 billion. |

| Which time period do you want to use to estimate the expected return? | Between now and five years time | Research suggests that following a market crash, the average amount of time it takes for the price of a stock market to return to its pre-crash level (i.e. the recovery period) is at least three years.[35] Accordingly, Stockhub suggests that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time. |

Sensitive analysis

The main inputs that result in the greatest change in the expected return of the Tesla investment are, in order of importance (from highest to lowest):

- The size of the total addressable market (the default size is $3.0 trillion);

- Tesla peak market share (the default share is 10%); and

- The discount rate (the default time-weighted average rate is 10%).

The impact of a 50% change in those main inputs to the expected return of the Tesla investment is shown in the table below.

| Main input | 50% worse | Unchanged | 50% better |

|---|---|---|---|

| The size of the total addressable market | N/A | (24%) | N/A |

| Tesla peak market share | N/A | (24%) | N/A |

| The discount rate | N/A | (24%) | N/A |

Appendix

Competition

Automotive

| Category | Model S[11] | Porsche Taycan[11] |

|---|---|---|

| Is the vehicle fully electric? | Yes | Yes |

| What's the top acceleration of the vehicle? | 3.1 seconds | 5.1 seconds |

| What's the maximum distance range of the vehicle on a single battery charge? | 405 miles | 200 miles |

| What's the top speed of the vehicle? | 155 miles per hour | 143 miles per hour |

| Which design type is the vehicle? | Sedan (i.e. car) | Sedan (i.e. car) |

| What is the safety rating of the vehicle? | 5 out of 5 stars | 5 out of 5 stars |

| How many seats does the vehicle have? | 5 seats | 4 seats |

| What's the cargo capacity of the vehicle? | 28 cubic feet | 17.2 cubic feet |

| Which drive wheel does the vehicle have? | All-wheel drive | Rear-wheel drive |

| What's the price of the vehicle? | $99,990 | $86,700 |

| What's the vehicle's price per cargo capacity? | $3,571 per cubic feet | $5,041 per cubic feet |

| What's the vehicle's price per seat? | $19,998 per seat | $21,675 per seat |

| Category | Model 3[36] | Mustang Mach-E[37] |

|---|---|---|

| Is the vehicle fully electric? | Yes | Yes |

| What's the top acceleration of the vehicle? | 5.8 seconds | 5.2 seconds |

| What's the maximum distance range of the vehicle on a single battery charge? | 272 miles | 247 miles |

| What's the top speed of the vehicle? | 140 miles per hour | 124 miles per hour |

| Which design type is the vehicle? | Sedan (i.e. car) | SUV (i.e. car) |

| What is the safety rating of the vehicle? | 5 out of 5 stars | 5 out of 5 stars |

| How many seats does the vehicle have? | 5 seats | 5 seats |

| What's the cargo capacity of the vehicle? | 23 cubic feet | 59.7 cubic feet |

| Which drive wheel does the vehicle have? | Rear-wheel drive | Rear-wheel drive |

| What's the price of the vehicle? | $46,990 | $43,895 |

| What's the vehicle's price per cargo capacity? | $2,043 per cubic feet | $735 per cubic feet |

| What's the vehicle's price per seat? | $9,398 per seat | $8,779 per seat |

| Category | Model X[12] | Audi e-tron[38] |

|---|---|---|

| Is the vehicle fully electric? | Yes | Yes |

| What's the top acceleration of the vehicle? | 3.8 seconds | 5.5 seconds |

| What's the maximum distance range of the vehicle on a single battery charge? | 348 miles | 222 miles |

| What's the top speed of the vehicle? | 155 miles per hour | 124 miles per hour |

| Which design type is the vehicle? | SUV (i.e. car) | SUV (i.e. car) |

| What is the safety rating of the vehicle? | 5 out of 5 stars | 5 out of 5 stars |

| How many seats does the vehicle have? | 7 seats | 5 seats |

| What's the cargo capacity of the vehicle? | 88 cubic feet | 56 cubic feet |

| Which drive wheel does the vehicle have? | All-wheel drive | All-wheel drive |

| What's the price of the vehicle? | $114,990 | $65,900 |

| What's the vehicle's price per cargo capacity? | $1,307 per cubic feet | $1,168 per cubic feet |

| What's the vehicle's price per seat? | $16,427 per seat | $13,180 per seat |

| Category | Model Y[12] | Volkswagen ID.4 |

|---|---|---|

| Is the vehicle fully electric? | Yes | Yes |

| What's the top acceleration of the vehicle? | 4.8 seconds | 8.5 seconds |

| What's the maximum distance range of the vehicle on a single battery charge? | 330 miles | 275 miles |

| What's the top speed of the vehicle? | 135 miles per hour | 100 miles per hour |

| Which design type is the vehicle? | SUV (i.e. car) | SUV (i.e. car) |

| What is the safety rating of the vehicle? | 5 out of 5 stars | 5 out of 5 stars |

| How many seats does the vehicle have? | 7 seats | 5 seats |

| What's the cargo capacity of the vehicle? | 76 cubic feet | 55.6 cubic feet |

| Which drive wheel does the vehicle have? | All-wheel drive | Rear-wheel drive |

| What's the price of the vehicle? | $62,990 | $41,230 |

| What's the vehicle's price per cargo capacity? | $829 per cubic feet | $742 per cubic feat |

| What's the vehicle's price per seat? | $8,999 per seat | $8,248 per seat |

Energy generation and storage

| Powerwall | Megapack | |

|---|---|---|

| Is the source of energy solar? | Yes | Yes |

| Is it designed for houses (i.e. smaller electricity demand)? | Yes | No |

| Is it designed for commercial buildings (i.e. greater electricity demand)? | No | Yes |

| What's the energy capacity of the product? | 13.5 kilowatt hour | 3.5 megawatt hour |

| What’s the power of the product? | 5 kilowatts | 1.54 megawatts |

| How long does it take to charge the battery if there’s sufficient solar energy? | 2.7 hours | 2.3 hours |

| What's the price of the product? | $10,500 | $1,000,000 |

| What's the price per energy capacity? | $593 per kilowatt hour | $286 per kilowatt hour |

Note: 1 megawatt is equivalent to 1,000 kilowatts.

| What's the name of the product? | Powerwall | LG Chem | SonnenCore |

|---|---|---|---|

| Is the source of energy solar? | Yes | Yes | Yes |

| What's the energy capacity of the product? | 13.5 kilowatt hour | 9.3 kilowatt hour | 10 kilowatt hour |

| What's the price of the product? | $10,500 | $7,000 | $9,500 |

| What's the price per energy capacity? | $593 per kilowatt hour | $753 per kilowatt hour | $950 per kilowatt hour |

| Solar Roof | Traditional roof tile | Other solar-energy generation roof tile | |

|---|---|---|---|

| Does it generate electricity? | Yes | No | Yes |

| Is it aesthetically beautiful? | Yes | Yes | No |

Financial statements

| Year end date | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

|---|---|---|---|---|

| Current Assets | ||||

| Cash and Cash Equivalents ($million) | $17,576 | $19,384 | $6,268 | $3,879 |

| Short-Term Investments ($million) | $131 | -- | -- | -- |

| Net Receivables ($million) | $1,913 | $1,886 | $1,324 | $949 |

| Inventory ($million) | $5,757 | $4,101 | $3,552 | $3,113 |

| Other Current Assets ($million) | $1,723 | $1,346 | $959 | $366 |

| Total Current Assets ($million) | $27,100 | $26,717 | $12,103 | $8,307 |

| Long-Term Assets | ||||

| Long-Term Investments ($million) | -- | -- | -- | $422 |

| Fixed Assets ($million) | $25,411 | $17,396 | $14,061 | $13,420 |

| Goodwill ($million) | $200 | $207 | $198 | $68 |

| Intangible Assets ($million) | $257 | $313 | $339 | $282 |

| Other Assets ($million) | $9,163 | $7,515 | $7,608 | $7,241 |

| Deferred Asset Charges ($million) | -- | -- | -- | -- |

| Total Assets ($million) | $62,131 | $52,148 | $34,309 | $29,740 |

| Current Liabilities | ||||

| Accounts Payable ($million) | $15,744 | $9,906 | $6,993 | $5,499 |

| Short-Term Debt / Current Portion of Long-Term Debt ($million) | $1,589 | $2,132 | $1,785 | $2,568 |

| Other Current Liabilities ($million) | $2,372 | $2,210 | $1,889 | $1,926 |

| Total Current Liabilities ($million) | $19,705 | $14,248 | $10,667 | $9,993 |

| Long-Term Debt ($million) | $5,245 | $9,556 | $11,634 | $9,404 |

| Other Liabilities ($million) | $3,546 | $3,330 | $2,691 | $3,039 |

| Deferred Liability Charges ($million) | $2,052 | $1,284 | $1,207 | $991 |

| Misc. Stocks ($million) | $826 | $850 | $849 | $834 |

| Minority Interest ($million) | $568 | $655 | $643 | $556 |

| Total Liabilities ($million) | $31,374 | $29,268 | $27,048 | $24,261 |

| Stock Holders Equity | ||||

| Common Stocks ($million) | $1 | $1 | $1 | -- |

| Capital Surplus ($million) | $331 | -$5,399 | -$6,083 | -$5,318 |

| Retained Earnings | -- | -- | -- | -- |

| Treasury Stock ($million) | $29,803 | $27,260 | $12,736 | $10,249 |

| Other Equity ($million) | $54 | $363 | -$36 | -$8 |

| Total Equity ($million) | $30,189 | $22,225 | $6,618 | $4,923 |

| Total Liabilities & Equity ($million) | $62,131 | $52,148 | $34,309 | $29,740 |

| Year end date | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

|---|---|---|---|---|

| Net Income ($million) | $5,519 | $721 | -$862 | -$976 |

| Cash Flows-Operating Activities | ||||

| Depreciation ($million) | $2,911 | $2,322 | $2,154 | $2,060 |

| Net Income Adjustments ($million) | $2,424 | $2,575 | $1,375 | $1,043 |

| Changes in Operating Activities | ||||

| Accounts Receivable ($million) | -$130 | -$652 | -$367 | -$497 |

| Changes in Inventories ($million) | -$1,709 | -$422 | -$429 | -$1,023 |

| Other Operating Activities ($million) | -$3,676 | -$1,667 | -$937 | -$504 |

| Liabilities ($million) | $6,033 | $2,925 | $1,384 | $2,082 |

| Net Cash Flow-Operating ($million) | $11,497 | $5,943 | $2,405 | $2,098 |

| Cash Flows-Investing Activities | ||||

| Capital Expenditures ($million) | -$6,514 | -$3,232 | -$1,432 | -$2,319 |

| Investments ($million) | -$132 | -- | -- | -- |

| Other Investing Activities ($million) | -$1,222 | $100 | -$4 | -$18 |

| Net Cash Flows-Investing ($million) | -$7,868 | -$3,132 | -$1,436 | -$2,337 |

| Cash Flows-Financing Activities | ||||

| Sale and Purchase of Stock ($million) | $699 | $12,675 | $1,555 | $727 |

| Net Borrowings ($million) | -$5,732 | -$2,488 | $798 | $89 |

| Other Financing Activities ($million) | -- | -- | -- | -- |

| Net Cash Flows-Financing ($million) | -$5,203 | $9,973 | $1,529 | $574 |

| Effect of Exchange Rate ($million) | -$183 | $334 | $8 | -$23 |

| Net Cash Flow ($million) | -$1,757 | $13,118 | $2,506 | $312 |

| Year end date | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

|---|---|---|---|---|

| Total Revenue | $53,823 | $31,536 | $24,578 | $21,461 |

| Cost of Revenue | $40,217 | $24,906 | $20,509 | $17,419 |

| Gross Profit | $13,606 | $6,630 | $4,069 | $4,042 |

| Operating Expenses | ||||

| Research and Development | $2,593 | $1,491 | $1,343 | $1,460 |

| Sales, General and Admin. | $4,517 | $3,145 | $2,646 | $2,835 |

| Non-Recurring Items | -$27 | -- | $149 | $135 |

| Other Operating Items | -- | -- | -- | -- |

| Operating Income | $6,523 | $1,994 | -$69 | -$388 |

| Add'l income/expense items | $191 | -$92 | $89 | $46 |

| Earnings Before Interest and Tax | $6,714 | $1,902 | $20 | -$342 |

| Interest Expense | $371 | $748 | $685 | $663 |

| Earnings Before Tax | $6,343 | $1,154 | -$665 | -$1,005 |

| Income Tax | $699 | $292 | $110 | $58 |

| Minority Interest | -- | -- | -- | -- |

| Equity Earnings/Loss Unconsolidated Subsidiary | -$125 | -$141 | -$87 | $87 |

| Net Income-Cont. Operations | $5,519 | $721 | -$862 | -$976 |

| Net Income | $5,519 | $721 | -$862 | -$976 |

| Net Income Applicable to Common Shareholders | $5,519 | $721 | -$862 | -$976 |

| Year end date | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

|---|---|---|---|---|

| Liquidity Ratios | ||||

| Current Ratio | 138% | 188% | 113% | 83% |

| Quick Ratio | 108% | 159% | 80% | 52% |

| Cash Ratio | 90% | 136% | 59% | 39% |

| Profitability Ratios | ||||

| Gross Margin | 25% | 21% | 17% | 19% |

| Operating Margin | 12% | 6% | 0% | 0% |

| Pre-Tax Margin | 12% | 4% | 0% | 0% |

| Profit Margin | 10% | 2% | 0% | 0% |

| Pre-Tax ROE | 21% | 5% | 0% | 0% |

| After Tax ROE | 18% | 3% | 0% | 0% |

Relative valuation approach

As noted earlier in this report, research suggests that in terms of estimating the expected return of an investment over a period of 12-months or more, the approach that is more accurate is the discounted cash flow approach, so that's the approach that Stockhub suggests using to determine the estimated value of the company (the valuation based on the discounted cash flow approach can be found in the valuation section of this report); nevertheless, for completeness purposes, separately, the valuation of the company is also estimated using the relative valuation approach.

What's the expected return of an investment in Tesla using the relative valuation approach?

Accordingly, Stockhub estimates that the expected return of an investment in Tesla Inc over the next five years is 4.4x. In other words, an £1,000 investment in the company is expected to return £4,400 in five years time. The assumptions used to estimate the return figure can be found in the table below.

Assuming that a suitable return level over five years is 10% per year and Tesla achieves its expected return level (of 4.4x), then an investment in the company is considered to be a 'suitable' one.

What are the assumptions used to estimate the return figure?

| Description | Value | Commentary |

|---|---|---|

| Which type of multiple do you want to use? | Growth-adjusted EV/sales | For the numerator, Stockhub believes that to account for the different financial leverage levels of its peers, it's best to use enterprise value (EV), rather than price. For the denominator, Stockhub believes that because it expects Tesla to reinvest almost all of its revenue back into the business over the five year forecast period and therefore its earnings are expected to be abnormally low over the period, it's best to use sales. Accordingly, Stockhub suggests valuing its company using the EV/sales ratio. However, Stockhub feels that to take into account the different business lifecycle stages of its peers, the most suitable valuation multiple to use is the growth-adjusted EV/sales multiple[Note 3], rather than the EV/sales multiple. |

| In regards to the growth-adjusted EV/sales multiple, for the sales figure, which year to you want to use? | Year 5 | Stockhub suggests that with sales forecast to grow exponential over the five year forecast period, it's best to use forward-looking data, rather than historic data.

|

| In regards to the growth-adjusted EV/sales multiple, for the sales growth figure, which year(s) do you want to use? | Year 6 to 8, from now | Stockhub suggests that for the sales growth figure, it's best to use Year 6 to 8. |

| In regards to the growth-adjusted EV/sales multiple, what multiple figure do you want to use? | 89x | In Stockhub's view, Tesla closest peer is Apple, Inc. Apple, Inc trades on a multiple of 89x. |

| Which financial forecasts to use? | Stockhub | The only available forecasts are the ones that are supplied by the Stockhub company (the forecasts can be found in the financials section of this report), so Stockhub suggests using those. |

| What's the current value of the Stockhub company? | $688 billion | As at 21st May 2022, the current value of its company at $688 billion. |

| Which time period do you want to use to estimate the expected return? | Between now and five years time | Stockhub suggests that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time. |

Tesla peer(s)

| Investments | Industry | Enterprise value/sales | 1-year forward revenue growth rates (%) | Growth-adjusted enterprise value/sales ratio |

|---|---|---|---|---|

| Apple, Inc | Internet content & communication | 7.27x[39] | 8.20%[39] | 89x |

| Peer | Three-year average COGS margin (%) | Three-year average SG&A margin (%) | Three-year average tax margin (%) | Three-year average depreciation rate (%) | Three-year average fixed capital margin (%) | Three-year average change in working capital ($000) | Three-year average growth stage | Discount rate |

|---|---|---|---|---|---|---|---|---|

| Rivian Automotive, Inc. | 945% | 6827% | 0% | 358% | 3262% | 7,569,000 | 1 | NA |

| Tesla, Inc. | 79% | 15% | 11% | 7% | 10% | 3,121,828 | 2 | 14.96% |

| Apple, Inc | 62% | 13% | 14% | 4% | 3% | -18,780,000 | 3 | 9.91% |

| Workhorse Group | 938% | -6077% | 0% | 58% | 411% | -2,978 | 4 | 18.75% |

| Cenntro Electric Group Limited | 90% | 209% | 0% | 37% | 0% | 138,382 | 4 | 10.44% |

| Liaoning SG Automotive Group Co | 99% | 15% | 18% | 8% | 1% | 154,153 | 4 | 6.39% |

| Growth stage | Three-year average COGS margin (%) | Three-year average SG&A margin (%) | Three-year average tax margin (%) | Three-year average depreciation rate (%) | Three-year average fixed capital margin (%) | Three-year average change in working capital ($000) | Discount rate |

|---|---|---|---|---|---|---|---|

| One | 945% | 6827% | 0% | 358% | 3262% | 7,569,000 | NA |

| Two | 79% | 15% | 11% | 7% | 10% | 3,121,828 | 14.96% |

| Three | 62% | 13% | 14% | 4% | 3% | -18,780,000 | 9.91% |

| Four | 99% | 15% | 0% | 37% | 1% | 138,382 | 10.44% |

Apple Inc.

| Input | Input value | Additional information |

|---|---|---|

| Risk-free rate (%) | 3.44% | Here, the risk free rate is the US 30 year treasury bond, and is calculated as at 15th September 2022. |

| Beta | 1.23 | The asset’s beta measures its market or systematic risk, which in theory is the sensitivity of its returns to the returns on the “market portfolio” of risky assets. Concretely, beta equals the covariance of returns with the returns on the market portfolio divided by the market portfolio’s variance of returns. In typical practice for equity valuation, the market portfolio is represented by a broad value-weighted equity market index. The asset’s beta is estimated by a least squares regression of the asset’s returns on the index’s returns.

In the typical case in which the equity risk premium is based on a national equity market index and estimated beta is based on sensitivity to that index, the assumption is being made implicitly that equity prices are largely determined by local investors. When equities markets are segmented in that sense (i.e., local market prices are largely determined by local investors rather than by investors worldwide), two issues with the same risk characteristics can have different required returns if they trade in different markets. The opposite assumption is that all investors worldwide participate equally in set- ting prices (perfectly integrated markets). That assumption results in the international CAPM (or world CAPM) in which the risk premium is relative to a world market portfolio. In practice, the international CAPM is not commonly relied on for required return on equity estimation. For estimating the required return on the equity using the Capital Asset Pricing Model, in terms of time period, and frequency of observations, the most common choice is five years of monthly data, yielding 60 observations. One study of U.S. stocks found support for five years of monthly data over alternatives. An argument can be made that the 2 years, weekly data can be especially appropriate in fast growing markets. The beta value in a future period has been found to be on average closer to the mean value of 1.0, the beta of an average-systematic-risk security, than to the value of the raw beta. Because valuation is forward looking, it is logical to adjust the raw beta so it more accurately predicts a future beta. The figure here is taken from Yahoo Finance (https://uk.finance.yahoo.com/quote/AAPL?p=AAPL&.tsrc=fin-srch), on 16th September 2022. |

| Equity risk premium (%) | 5.26 | The equity risk premium is the incremental return (premium) that investors require for holding equities rather than a risk-free asset (e.g., government bills or government bonds). Thus, it is the difference between the required return on equities and a specified expected risk-free rate of return. The equity risk premium, like the required return, depends strictly on expectations for the future because the investor’s returns depend only on the investment’s future cash flows.