Company Overview

Operations

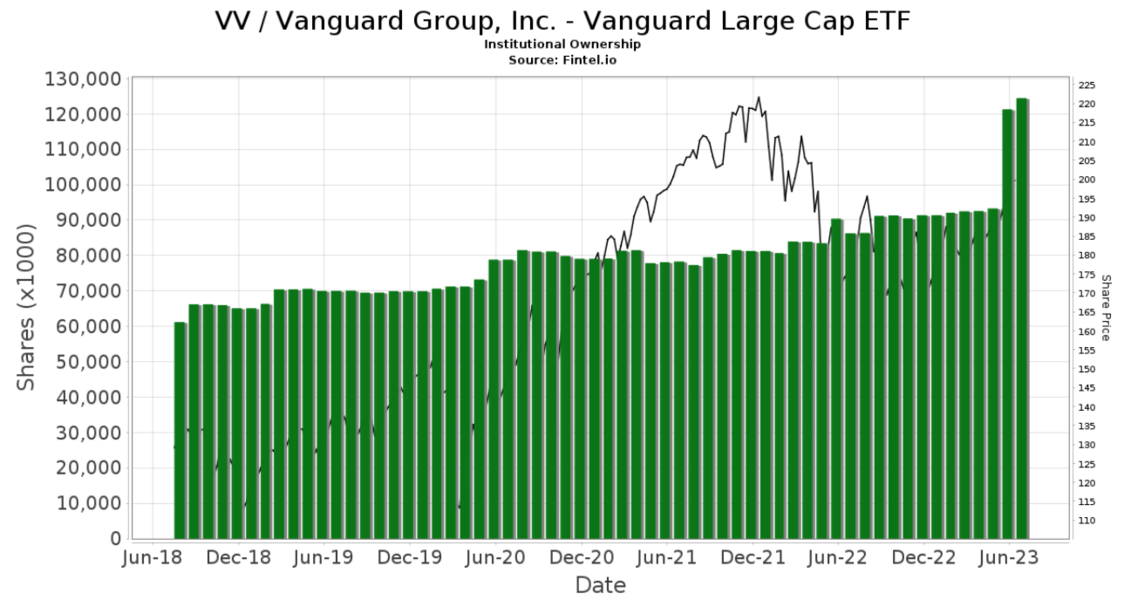

Market[1]

The Vanguard Group stands as a prominent global investment management firm renowned for its distinct focus on cost-effective index funds and exchange-traded funds (ETFs). Operating within the realm of financial services, Vanguard extends an array of investment solutions catering to individual investors, institutional clients, and financial advisors. Vanguard garners particular acclaim for its dedication to passive investing, which manifests through its expansive selection of index funds and ETFs meticulously mirroring diverse market indices like the S&P 500. Unlike active management strategies, these passive investment vehicles strive to emulate the performance of specific market benchmarks, embracing the benefits of a replicative approach rather than seeking to outperform them. This strategy has gained favor due to its typically reduced fees and potential tax efficiency compared to actively managed counterparts.

Vanguard has historically established a robust market presence through its resolute commitment to delivering economical investment avenues and its unwavering focus on client interests. By minimizing costs and sharing the advantages of economies of scale with its investors, Vanguard has amassed a substantial share of assets from both retail and institutional stakeholders.

Vanguard's reputation as a distinguished investment management entity revolves around its specialization in economical, passive investment solutions, encompassing index funds and ETFs. As a seasoned industry frontrunner, Vanguard encounters formidable competition from other major investment management enterprises. Among its key rivals are BlackRock, Fidelity Investments, State Street Global Advisors, T. Rowe Price, Charles Schwab, and Invesco. These contenders vie with Vanguard by furnishing akin investment products and services, striving to maintain their market edge through diversified portfolios, competitive fees, and exceptional customer support.

Financials

Historic

Valuation: [3]

As of 2022, Vanguard has more than $8 trillion in assets under management (AUM), second only to BlackRock, Inc ($9.5 trillion AUM). It has 204 U.S. funds and 206 international funds as of 2022. It also has one of the largest bond funds in the world, the Vanguard Total Bond Market Index Fund (VBTLX).

Risks

Market Volatility: Vanguard's investment products are subject to market fluctuations and economic cycles. Sudden shifts in market sentiment can lead to the value of assets held within their funds to decrease, impacting both investor returns and the company's overall financial health.

Regulatory Changes: Changes in financial regulations or tax policies can impact the way Vanguard operates and the profitability of its investment products. Adapting to new regulatory environments can require significant resources and may affect investor outcomes.

Competition: The investment management industry is highly competitive, with numerous firms vying for market share. Rival firms offering similar products and services could potentially attract investors away from Vanguard, affecting their growth and revenue.

Interest Rate Fluctuations: Changes in interest rates can influence the performance of fixed-income investments, which are a significant component of many Vanguard funds. Rising interest rates can lead to reduced bond values and lower returns, impacting investors' overall portfolios.

Liquidity Risks: Some Vanguard funds hold less liquid assets, such as bonds with longer maturities or less-traded securities. During times of market stress, these assets may become difficult to sell at fair prices, potentially impacting fund performance and investor redemption requests.

Operational Risks: As a large and complex organization, Vanguard is exposed to operational risks such as technology failures, cybersecurity threats, and administrative errors. These risks could disrupt operations, compromise client data, or result in financial losses.

Investor Behavior: Investor behavior can influence the flow of assets in and out of Vanguard's funds. Market downturns or perceived underperformance could trigger a wave of redemptions, forcing Vanguard to sell assets at potentially unfavorable prices.

Currency Fluctuations: Vanguard's international investments are subject to currency exchange rate fluctuations. Changes in exchange rates can impact the value of these investments when converted back to the company's reporting currency.

Economic Downturns: During economic downturns, investors may reduce their investments or shift towards more conservative options, leading to reduced inflows into Vanguard's funds and potential declines in assets under management.

Reputation Risk: Any negative publicity, whether related to the performance of specific funds, management decisions, or regulatory issues, could erode investor trust and harm Vanguard's reputation.

Legal and Litigation Risks: Legal and regulatory actions, such as lawsuits related to investment performance or fiduciary responsibilities, can lead to financial liabilities and damage to Vanguard's brand.