Starting as it means to go on

Summary

Wheaton Precious Metals (WPM) has an exceptional business model that provides it with all of the characteristics investors look for in precious metal mining companies (eg exploration blue-sky, production upside and operational gearing) with few of the commonly attendant risks (eg cost, capex, tax and regulatory regimes). Q122 results at the start of this year were closely in line with our prior forecasts, while recent mineral stream acquisitions have given it a rising production profile.

| Year end | Revenue (US$m) | PBT*

(US$m) |

EPS*

(c) |

DPS

(c) |

P/E

(x) |

Yield

(%) |

| 12/20 | 1,096.2 | 503.2 | 112 | 42 | 34.1 | 1.1 |

| 12/21 | 1,201.7 | 592.1 | 132 | 57 | 28.9 | 1.5 |

| 12/22e | 1,249.3 | 636.7 | 141 | 61 | 27.1 | 1.6 |

| 12/23e | 1,518.5 | 777.7 | 172 | 70 | 22.2 | 1.8 |

New stream acquisitions add value

Since December 2021, WPM has invested US$930m in four mineral streams (Goose, Curipamba, Marathon and Blackwater), which we estimate will increase its production profile by an average 101.9koz gold equivalent in the period FY25–31 (at Edison prices), with the possibility of adding a further 5.9koz gold pa for a US$50m investment via a non-binding agreement that it has with Rio2 regarding the Fenix project in Chile. As a result, we project that WPM’s production profile will increase from 710.2koz AuE in FY22 to 935.4koz AuE in FY26 (at standardised prices), with additional upside potential available from projects such as Pascua-Lama, Navidad and Toroparu. Within this context, WPM has also recently published its third annual sustainability report outlining how it will achieve net zero carbon emissions by 2050, alongside other long-established goals.

For the first time, we have used a CAPM-type method to value WPM. In this case, applying a nominal discount rate of 9.0% to cash flows implies a ‘terminal’ valuation for the company at end-FY26 of US$59.98 (C$77.83) per share assuming zero subsequent long-term growth in real cash flows. Alternatively, we calculate that WPM’s current share price of C$49.54 discounts a long-term compound annual average growth rate in nominal cash flows per share of just 3.2%, which is lower even than average inflation in the past nine years. Otherwise, under normal circumstances and assuming no material purchases of additional streams in the foreseeable future (which we think unlikely), we forecast a value per share for WPM of US$51.85 or C$67.29 or £42.60 in FY22, based on a 30.1x multiple of earnings, or US$62.02 or C$80.47 or £50.96 in FY26. In the meantime, WPM’s shares are trading on near-term financial ratios that are cheaper than those of its peers on at least 72% of common valuation measures if Edison forecasts are used or 61% if consensus forecasts are used. If WPM’s shares were therefore to trade at the same level as the average of its peers, then we calculate that its year one share price should be US$49.74 (C$64.55 or £40.87), based on our forecasts for FY22. Alternatively, if precious metals return to favour, then we believe that a near-term US$66.34 (C$86.08 or £54.51) per share valuation is possible.

Investment summary

Company description: Pre-eminent precious metals streamer

Wheaton Precious Metals (WPM) acquires the right to purchase streams of precious metals from producing or near-producing mines in return for a combination of a fixed upfront payment (in US dollars) and an ongoing payment per ounce of metal delivered to the company. Typically, it focuses on by-product precious metals streams as this offers the greatest arbitrage opportunity between the perceived value of the stream to the producer and the perceived value of the stream to WPM. Specifically, however, it seeks to build long-term value by entering into streaming agreements with large, financially stable counterparties operating premium high-margin projects in the lowest quartile (and certainly the lowest half) of the cost curve.

Valuation: Medium-term c US$60; potentially US$66.34 now

Using a CAPM method to value WPM and applying a nominal discount rate of 9.0% to cash flows implies a ‘terminal’ valuation for the company at end-FY26 of US$59.98 (C$77.83) per share assuming zero subsequent long-term growth in real cash flows. Otherwise, excluding FY04 (part-year), WPM’s shares have historically traded on an average P/E multiple of 30.1x current year basic underlying EPS, excluding impairments. Applying this 30.1x multiple to our EPS forecast of US$2.06 in FY26 implies a potential value per share for WPM of US$62.02 or C$80.47 in that year, which implies a long-term cash flow per share growth rate of 4.3% at that time. In the event of a return to favour of precious metals, however, we believe that a multiple of 38.6x earnings (the average of FY18, FY19, FY20 and FY21) may be supported, in which case we believe that a near-term valuation of US$66.34, or C$86.08, per share is achievable. Even at such a multiple, WPM’s shares would trade at little more than par relative to those of Franco-Nevada currently (see Exhibit 18). In the meantime, WPM is cheaper than its peers on 72% of commonly used valuation measures using Edison forecasts or 61% using consensus forecasts.

Sensitivities: Demonstrating the benefits of operational gearing

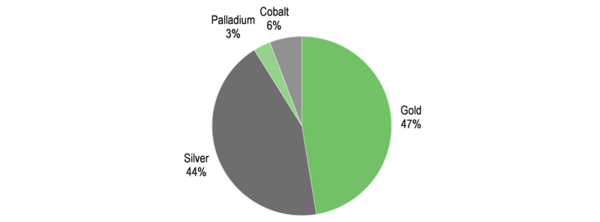

WPM is exposed to gold and silver prices in approximately equal proportion (see Exhibit 7). For every ±10% by which these move, our FY23 and FY24 EPS forecasts change by 30c (or c 17%), while our FY25 and FY26 forecasts change by 34c (or c 17%).

Financials: Debt free for as long as it wishes

At 31 March, WPM had US$376.2m in cash on its balance sheet and no debt outstanding under its US$2bn revolving credit facility. As such (including a modest US$2.7m in leases), it had US$373.5m in net cash overall after generating US$210.5m in operating cash flow during the quarter and consuming US$66.1m in investing activities. In FY22 as a whole, we estimate that WPM will generate US$913.7m from operating activities, before consuming US$382.4m in investing activities in the form of instalments relating to the acquisitions of the Santo Domingo, Blackwater, Goose, Curipamba and Marathon streams and paying out a forecast dividend of US$277.3m, to leave it with net cash of US$479.2m as at end-FY22. In FY23, we forecast that it will generate US$1,102.5m from operating activities, before consuming US$1,098.8m in investing activities, including significant instalments relating to Salobo III, Rosemont and also Kutcho and, potentially, Fenix. On this basis, we estimate that it will finish FY23 with US$166.3m in net cash, before resuming its upward trend thereafter.

Q122 results

Underlying net earnings in Q122 were within 2.1% of our prior expectations. In broad terms, sales were slightly (3.8%) below our forecasts. This was matched by a similar decline in the direct costs of sales. However, there was also a sharp quarter-on-quarter decline in the depletion charge across most of WPM’s assets (implying a reassessment upwards of its assets’ mine lives), which resulted in profits before tax being US$3.0m (or 1.9%) above our prior forecasts – a variance that was then sustained to the bottom line. A summary of WPM’s underlying financial and operating results in the context of both the preceding quarter and Edison’s prior expectations is provided in the exhibit below:

| US$000s

(unless otherwise stated) |

Q120 | Q220 | Q320 | Q420 | Q121 | Q221 | Q321 | Q421 | Q122e | Q122a | Chg

**(%) |

Variance

***(%) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Silver production (koz) | 6,704 | 3,650 | 6,028 | 6,509 | 6,754 | 6,720 | 6,394 | 6,356 | 5,972 | 6,206 | -2.4 | 3.9 |

| Gold production (oz) | 94,707 | 88,631 | 91,770 | 93,137 | 77,733 | 90,290 | 85,941 | 88,321 | 88,678 | 79,087 | -10.5 | -10.8 |

| Palladium production (koz) | 5,312 | 5,759 | 5,444 | 5,672 | 5,769 | 5,301 | 5,105 | 4,733 | 4,750 | 4,488 | -5.2 | -5.5 |

| Cobalt production (klbs) | 1,161 | 380 | 370.5 | 381 | 347 | 234 | -38.6 | -32.6 | ||||

| Silver sales (koz) | 4,928 | 4,729 | 4,999 | 4,576 | 6,657 | 5,600 | 5,487 | 5,116 | 5,865 | 5,553 | 8.5 | -5.3 |

| Gold sales (oz) | 100,405 | 92,804 | 90,101 | 86,243 | 75,104 | 90,090 | 67,649 | 79,622 | 83,286 | 77,901 | -2.2 | -6.5 |

| Palladium sales (koz) | 4,938 | 4,976 | 5,546 | 4,591 | 5,131 | 3,869 | 5,703 | 4,641 | 4,731 | 4,075 | -12.2 | -13.9 |

| Cobalt sales (klbs) | 132.3 | 395 | 131.2 | 228 | 321 | 511 | 124.1 | 59.2 | ||||

| Avg realised Ag price (US$/oz) | 17.03 | 16.73 | 24.69 | 24.72 | 26.12 | 26.69 | 23.80 | 23.36 | 24.04 | 24.19 | 3.6 | 0.6 |

| Avg realised Au price (US$/oz) | 1,589 | 1,716 | 1,906 | 1,882 | 1,798 | 1,801 | 1,795 | 1,798 | 1,878 | 1,870 | 4.0 | -0.4 |

| Avg realised Pd price (US$/oz) | 2,298 | 1,917 | 2,182 | 2,348 | 2,392 | 2,797 | 2,426 | 1,918 | 2,329 | 2,339 | 21.9 | 0.4 |

| Avg realised Co price (US$/lb) | 22.19 | 19.82 | 23.78 | 28.94 | 33.78 | 34.61 | 19.6 | 2.5 | ||||

| Avg Ag cash cost (US$/oz) | 4.50 | 5.23 | 5.89 | 5.51 | 6.33 | 6.11 | 5.06 | 5.47 | 5.63 | 5.10 | -6.8 | -9.4 |

| Avg Au cash cost (US$/oz) | 436 | 418 | 428 | 433 | 450 | 450 | 464 | 472 | 430 | 477 | 1.1 | 10.9 |

| Avg Pd cash cost (US$/oz) | 402 | 353 | 383 | 423 | 427 | 503 | 468 | 340 | 419 | 394 | 15.9 | -6.0 |

| Avg Co cash cost (US$/lb) | 4.98 | 4.41 | 5.15 | 4.68 | 6.08 | 5.76 | 23.1 | -5.3 | ||||

| Sales | 254,789 | 247,954 | 307,268 | 286,213 | 324,119 | 330,393 | 268,957 | 278,197 | 319,280 | 307,244 | 10.4 | -3.8 |

| Cost of sales | ||||||||||||

| Cost of sales, excluding depletion | 66,908 | 65,211 | 70,119 | 64,524 | 78,783 | 78,445 | 62,529 | 68,190 | 72,819 | 69,994 | 2.6 | -3.9 |

| Depletion | 64,841 | 58,661 | 60,601 | 59,786 | 70,173 | 70,308 | 54,976 | 59,335 | 70,699 | 57,402 | -3.3 | -18.8 |

| Total cost of sales | 131,748 | 123,872 | 130,720 | 124,310 | 148,956 | 148,753 | 117,505 | 127,525 | 143,518 | 127,396 | -0.1 | -11.2 |

| Earnings from operations | 123,040 | 124,082 | 176,548 | 161,902 | 175,164 | 181,640 | 151,452 | 150,672 | 175,762 | 179,848 | 19.4 | 2.3 |

| Expenses and other income | ||||||||||||

| – General and administrative | 13,181 | 21,799 | 21,326 | 9,391 | 11,971 | 18,465 | 13,595 | 16,954 | 19,405 | 20,118 | 18.7 | 3.7 |

| – Foreign exchange (gain)/loss | 0 | 0 | 0 | 0 | N/A | N/A | ||||||

| – Net interest paid/(received) | 7,118 | 4,636 | 2,766 | 2,196 | 1,573 | 1,357 | 1,379 | 1,508 | 1,292 | 1,422 | -5.7 | 10.1 |

| – Other (income)/expense | -1,861 | 234 | 391 | 850 | 420 | 136 | (684) | (58) | 229 | -494.8 | N/A | |

| Total expenses and other income | 18,438 | 26,669 | 24,483 | 12,437 | 13,964 | 19,958 | 14,290 | 18,404 | 20,696 | 21,769 | 18.3 | 5.2 |

| Earnings before income taxes | 104,602 | 97,413 | 152,065 | 149,465 | 161,199 | 161,682 | 137,162 | 132,268 | 155,066 | 158,079 | 19.5 | 1.9 |

| Income tax expense/(recovery) | 8,442 | 59 | 58 | 24 | 67 | 56 | 75 | 36 | 250 | 72 | 100.0 | -71.2 |

| Marginal tax rate (%) | 8.1 | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.2 | 0.0 | N/A | -100.0 |

| Net earnings | 96,160 | 97,354 | 152,007 | 149,441 | 161,132 | 161,626 | 137,087 | 132,232 | 154,816 | 158,007 | 19.5 | 2.1 |

| Average no. shares in issue (000s) | 447,805 | 448,636 | 449,125 | 449,320 | 449,509 | 450,088 | 450,326 | 450,614 | 450,864 | 450,915 | 0.1 | 0.0 |

| Adjusted basic EPS (US$) | 0.215 | 0.217 | 0.338 | 0.333 | 0.358 | 0.359 | 0.304 | 0.293 | 0.343 | 0.350 | 19.5 | 2.0 |

| Adjusted diluted EPS (US$) | 0.214 | 0.216 | 0.336 | 0.331 | 0.358 | 0.358 | 0.303 | 0.293 | 0.334 | 0.350 | 19.5 | 4.8 |

| DPS (US$) | 0.10 | 0.10 | 0.10 | 0.12 | 0.13 | 0.14 | 0.15 | 0.15 | 0.15 | 0.15 | 0.0 | 0.0 |

From an operational perspective, San Dimas, Penasquito, Antamina, Minto, Stratoni and Neves-Corvo all outperformed our prior expectations in terms of production and/or sales for at least the second quarter in succession. In the case of Q122, they were also joined by Constancia and 777. Production at Sudbury continued to be below normal levels on account of the closure – albeit temporary – of the Totten mine (which accounts for approximately 15–20% of Sudbury’s production); however, the operator, Vale, reports that production from Totten has now resumed and is expected to normalise in Q222. Production at WPM’s flagship asset, Salobo in Brazil (also operated by Vale), was hampered by above-average seasonal rainfall in the region as well as planned and corrective maintenance to the operation’s mill liners. In the meantime, according to Vale’s most recent performance report, physical completion of the Salobo III mine expansion was 90% at end-Q122, despite a landslide that damaged a conveyor belt and temporarily blocked access to the project site. The degree of advancement of the project during the quarter was nevertheless still comparable with recent quarters, as shown in the table below:

| Q119 | Q219 | Q319 | Q419 | Q120 | Q220 | Q320 | Q420 | Q121 | Q221 | Q321 | Q421 | Q122 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Physical completion (%) | 7 | 15 | 27 | 40 | 47 | 54 | 62 | 68 | 73 | 77 | 81 | 85 | 90 |

| Implied quarterly completion (%) | 7 | 8 | 12 | 13 | 7 | 7 | 8 | 6 | 5 | 4 | 4 | 4 | 5 |

Safety protocols in the area were subsequently re-established and a full assessment of the impact of the landslip by Vale is in the process of being concluded. Nevertheless, Salobo III is still expected to be commissioned in H222 (albeit probably Q422) to be followed by a 15-month ramp-up to full capacity.

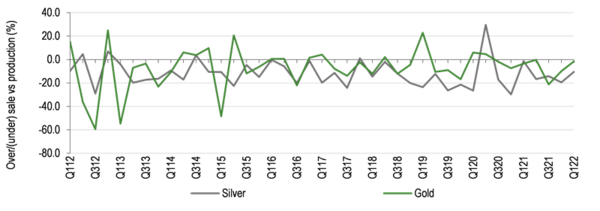

Ounces produced but not yet delivered

At 10.5% the degree of under-sale of silver during the quarter, relative to production, was in line with the long-run average of 12.0% since Q112; at 1.5% however, the under-sale of gold relative to production was noticeably lower than the long-run average of 7.3%. Significantly, the degree of under-sale of both reduced materially relative to the prior quarter, as shown in the graph below, which may demonstrate something of a delayed ‘flush through’ effect from Q421. This effect is more normally observed in the fourth quarter of any particular year, when WPM’s streaming counterparties tend to try to flush through sales ahead of the year-end.

Exhibit 3: Over/(under) sale of silver and gold as a percentage of production, Q112–Q122[4]

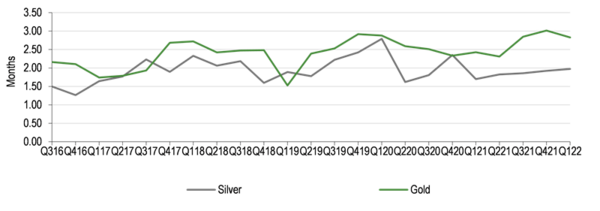

Gold and silver ounces produced but not yet delivered as at 31 March amounted to 82,350oz and 3.9Moz, respectively (cf 84,989oz and 4.2Moz at end-Q421). Both of these were less than our prior forecasts of 91,337oz and 4.3Moz (respectively), albeit in part this could be attributed to the comparable figure in the prior quarter (anyway always an estimate) being restated downwards by 956koz in the case of gold, in particular. At the period end, we estimate that ounces produced but not yet delivered will equate to 2.80 months and 1.97 months of gold and silver production for FY22, respectively (cf 3.01 months and 1.92 months as at end-Q421) and compares with WPM’s target of two to three months of gold and palladium production and two months of silver production:

Gold and silver ounces produced but not yet delivered as at 31 March amounted to 82,350oz and 3.9Moz, respectively (cf 84,989oz and 4.2Moz at end-Q421). Both of these were less than our prior forecasts of 91,337oz and 4.3Moz (respectively), albeit in part this could be attributed to the comparable figure in the prior quarter (anyway always an estimate) being restated downwards by 956koz in the case of gold, in particular. At the period end, we estimate that ounces produced but not yet delivered will equate to 2.80 months and 1.97 months of gold and silver production for FY22, respectively (cf 3.01 months and 1.92 months as at end-Q421) and compares with WPM’s target of two to three months of gold and palladium production and two months of silver production:

Exhibit 4: WPM ounces produced but not yet delivered, Q316–Q122 (months of production)[5]

Note that, for these purposes, the use of the term ‘inventory’ reflects ounces of gold and silver produced by WPM’s operating counterparties at the mines over which it has streaming agreements, but which have not yet been delivered to WPM. It in no way reflects the other use of the term in the mining industry, where it typically refers to metal in circuit and ore on stockpiles etc.

Note that, for these purposes, the use of the term ‘inventory’ reflects ounces of gold and silver produced by WPM’s operating counterparties at the mines over which it has streaming agreements, but which have not yet been delivered to WPM. It in no way reflects the other use of the term in the mining industry, where it typically refers to metal in circuit and ore on stockpiles etc.

General and administrative expenses

At the time of its Q122 results, WPM provided guidance for non-stock general and administrative (G&A) expenses of US$47–49m or US$11.75–12.25m per quarter (cf US$42–44m or US$10.5–11.0m per quarter for FY21 and US$40–43m in FY20), including all employee-related expenses, charitable contributions, etc, but excluding performance share units (PSUs) and equity settled stock-based compensation. In the event, at US$10.2m, non-stock G&A expenses in Q122 were 13.1% below the bottom of the range implied by guidance for the fifth quarter in succession:

| Item | Q120 | Q220 | Q320 | Q420 | FY20 | Q121 | Q221 | Q321 | Q421 | FY21 | Q122 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| G&A excluding PSU* and equity settled stock-based compensation | 4,135 | 4,095 | 4,037 | 4,466 | 16,733 | 4,709 | 4,634 | 4,283 | 4,618 | 18,244 | 5,345 |

| Other (inc. depreciation, donations and professional fees) | 4,266 | 6,302 | 5,488 | 5,957 | 22,013 | 5,632 | 5,852 | 5,173 | 6,818 | 23,475 | 4,871 |

| Non-stock based G&A | 8,401 | 10,397 | 9,525 | 10,423 | 38,746 | 10,341 | 10,486 | 9,456 | 11,436 | 41,719 | 10,216 |

| Guidance | 10,000–10,750 | 10,000–10,750 | 10,000–10,750 | 10,000–10,750 | 40,000–43,000 | 10,500–11,250 | 10,500–11,250 | 10,500–11,250 | 11,717-13,717 | 42,000–44,000 | 11,750-12,250 |

| PSU* accrual | 3,277 | 10,097 | 10,482 | (2,336) | 21,520 | 305 | 6,672 | 2,824 | 4,203 | 14,004 | 8,560 |

| Equity settled stock-based compensation | 1,503 | 1,305 | 1,319 | 1,305 | 5,432 | 1,325 | 1,307 | 1,315 | 1,315 | 5,262 | 1,342 |

| Stock-based G&A | 4,780 | 11,402 | 11,801 | (1,031) | 26,952 | 1,630 | 7,979 | 4,139 | 5,518 | 19,266 | 9,902 |

| Total general & administrative | 13,181 | 21,799 | 21,326 | 9,392 | 65,698 | 11,971 | 18,465 | 13,595 | 16,954 | 60,985 | 20,118 |

| Total/Non-stock based G&A (%) | +56.9 | +109.7 | +123.9 | -9.9 | +69.6 | +15.8 | +76.1 | +43.6 | +48.3 | +46.2 | +96.9 |

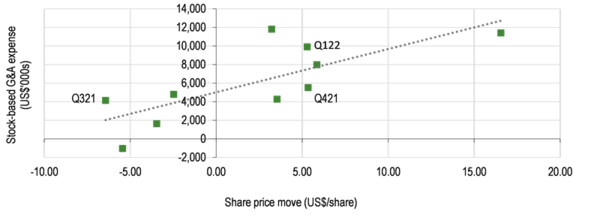

Given the US$5.29 (or 12.3%) appreciation in WPM’s share price over the quarter, stock-based G&A expenses in Q122 were slightly above our prior estimate of US$7.4m for the quarter (as shown in Exhibit 6, below), but were nevertheless within the ±US$3.1m error of estimation implied by the associated regression analysis.

Exhibit 6: Graph of historical share price move (US$/share) versus quarterly stock-based G&A expense, Q419–Q122[7]

The analysis of stock-based G&A expenses over the past nine quarters relative to the change in WPM’s share price (also in US dollars) continues to exhibit a relatively close Pearson product moment (correlation) coefficient between the two of 0.76, which remains statistically significant at the 5% level for a directional hypothesis (ie there is less than a 5% probability that this relationship occurred by random chance) and this therefore continues to form the basis of quarterly and full-year for G&A expenses in Exhibit 12.

The analysis of stock-based G&A expenses over the past nine quarters relative to the change in WPM’s share price (also in US dollars) continues to exhibit a relatively close Pearson product moment (correlation) coefficient between the two of 0.76, which remains statistically significant at the 5% level for a directional hypothesis (ie there is less than a 5% probability that this relationship occurred by random chance) and this therefore continues to form the basis of quarterly and full-year for G&A expenses in Exhibit 12.

Exceptional business plan

WPM acquires the right to purchase streams of precious metals from producing or near-producing mines in return for a combination of a fixed upfront payment (in US dollars, typically in either cash or WPM shares) and an agreed upon ongoing payment (in US$/oz). Typically, it focuses on by-product precious metals streams as this offers the greatest arbitrage opportunity between the perceived value of the stream to the producer in the equity market and the perceived value of the stream to WPM. Specifically, however, it seeks to build long-term value by entering streaming agreements with large, relatively financially stable counterparties operating premium, high-margin projects in the lowest quartile (and certainly the lowest half) of the cost curve. As well as providing comfort regarding the sustainability of the underlying operation, this strategy also helps to mitigate geopolitical and operating risks. In addition, it provides a degree of flexibility if projects are not developed according to plan (eg as evidenced by WPM’s ability to successfully renegotiate a series of amendments with Barrick regarding the latter’s Pascua-Lama project). Unlike a number of its peers, WPM has restricted itself almost exclusively to precious metals streaming agreements and does not participate in the base metal (with the single exception of one cobalt stream) or oil & gas markets. This strategy has the effect, among others, of exposing WPM to the traditional premium multiples afforded to precious metal companies compared to base metal ones. Latterly, WPM has engaged in a number of ‘early deposit’ contracts whereby it has contracted to buy gold and silver streams from the Cotabambas and Toroparu mines in South America and the Kutcho mine in British Columbia, thereby effectively becoming a relatively low-cost financing component of these projects.

In Q122, WPM’s revenue, by metal, was as shown below:

Exhibit 7: Q122 revenue, by metal (%)[8]

Streaming agreement characteristics

While royalty companies compete with WPM to some extent in the provision of capital to the mining industry, there are notable differences between the two business plans. Royalties are typically linked to tenement areas, for example, and also typically relate to a mine’s primary output, whereas streaming arrangements are governed by a commercial agreement between two companies (albeit often relating to a single mine) and typically relate to a mine’s secondary, or by-product, output. A summary of the unique features of WPM’s streaming business plan and how it is distinguished from other investment opportunities in the precious metal, precious metal mining and mining finance industries is as follows:

Compared to exchange traded funds (ETFs), WPM:

- has exposure to exploration success in the form of extended mine lives;

- has exposure to levels of production;

- is operationally geared to changes in metals prices;

- balances costs and revenues, such that inventory held is minimal at the WPM level; and

- pays a dividend.

Compared to precious metal mining companies, WPM:

- has no exposure to capital cost overruns;

- has no exposure to operating cost overruns;

- is only exposed to grade fluctuations inasmuch as they affect production levels rather than margins;

- has a predetermined level of inflation (typically 1%) applied to its own unit cash costs; and

- is unaffected by changes in a host country’s mining tax and regulatory regimes.

Compared to royalty companies, WPM:

- has geared exposure to metals prices; and

- typically negotiates and exploits the value differential around a secondary, or by-product, metal, rather than applying the stream to all metals including the primary one.

A key advantage for WPM compared to potential competitors is its size, scale and valuation, which allows it to raise equity on a non-dilutive basis to fund new streams, or even to issue counterparties with equity in consideration of new streams.

Cornerstone assets

WPM has five cornerstone assets (Salobo, Penasquito, Antamina, Constancia and San Dimas). The following is an analysis of the financial returns generated as a result of the application of WPM’s investment criteria to one of its cornerstone assets – Penasquito.

Penasquito

Penasquito is a gold-silver-lead-zinc mine, operated by Newmont in Mexico, and has consistently been regarded as one of WPM’s cornerstone assets. The stream relating to this asset was acquired late in 2007 for US$485m plus US$3.56m in costs and US$15.761m in capitalised interest. The first silver-bearing lead and zinc concentrate was delivered from the mine in 2009 after production at its first 50,000tpd sulphide process line was ramped up on schedule and on budget. During the ramp-up period, metal recoveries, concentrate grades and concentrate quality were within expected ranges. By this time, construction of a second 50,000tpd sulphide process line was also progressing towards planned completion in Q310. After exceeding ramp-up expectations, Penasquito became WPM’s second largest contributor of silver production in 2010 and, after further expansions, its largest in 2012 (by which time it held the title of Mexico’s largest precious metals mine, one of the world’s largest and lowest-cost gold-silver mines and one of Newmont’s most significant cash flow generators). Output of silver rose to c 7Moz pq after the mine’s production schedule was adjusted to reflect a targeted mill throughput rate of 110,000tpd, rising to in excess of 115,000tpd beyond 2015, after which Penasquito embarked on the Pyrite Leach Project to produce an additional 4–6Moz pa (of which 25% was attributable to WPM) by recovering 48% of the silver that previously reported to tailings.

Compared to an initial investment of US$504.3m, we estimate that Penasquito has yielded – and will yield – the following historical and forecast cash flows to WPM:

| Historical | Forecast | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | |

| Cash flow | 2.3 | 6.9 | 52.2 | 126.8 | 162.2 | 105.2 | 106.0 | 85.1 | 54.1 | 67.0 | 57.2 | 55.3 | 119.0 | 167.2 | 152.8 | 165.9 | 168.3 | 174.2 | 179.5 | |

On an undiscounted basis, therefore, Penasquito paid back WPM’s initial investment midway through 2014, while, on a discounted basis (at a 10% discount rate), it paid it back late in 2020 and still has a residual value of US$1.9bn (as at 1 January 2022) to the end of 2031 (the end of the mine’s life, based on current reserves).

By contrast, applying a 10% discount/hurdle rate over the life of the stream of income to end-FY31 yields a value to WPM at the start of the period of its investment of US$845.5m in 2007 money terms, which is directly comparable to the stream’s acquisition cost of US$504.3m. Stated alternatively, we estimate that the stream will provide WPM with an internal rate of return of 15.7% from the point of acquisition in 2007 until 2031. In addition, there is substantial underground potential beneath the current open pits, providing excellent opportunities for further exploration growth and expanded and/or extended silver production.

WPM’s assets

WPM currently has agreements over more than 30 major metals streams, summarised in Exhibit 9 below.

| Asset | Owner/operator | Location | Attributable production to be purchased (%) | Per ounce cash payment* (US$/oz) | Term of agreement | Date of original contract |

|---|---|---|---|---|---|---|

| Gold | ||||||

| Salobo | Vale | Brazil | 75 | 416 | Life of mine | Feb 2013 |

| Constancia | Hudbay | Peru | 50 | 412 | Life of mine | Aug 2012 |

| San Dimas | First Majestic | Mexico | Variable | 618 | Life of mine | Oct 2004 |

| Sudbury | Vale | Canada | 70 | 400 | 20 years | Feb 2013 |

| Stillwater | Sibanye | USA | 100 | 18% of spot | Life of mine | Jul 2018 |

| Other gold | ||||||

| Minto | Pembridge | Canada | 100 | 65% of spot | Life of mine | Nov 2008 |

| Rosemont | Hudbay | USA | 100 | 450 | Life of mine | Feb 2010 |

| 777 | Hudbay | Canada | 50 | 429 | Life of mine | Aug 2012 |

| Marmato | Aris | Colombia | 6.5 | 18% of spot | Life of mine | Nov 2020 |

| Santo Domingo | Capstone | Chile | 100 | 18% of spot | Life of mine | Mar 2021 |

| Fenix | Rio2 | Chile | 6 | 18% of spot | Life of mine | Nov 2021 |

| Blackwater | Artemis | Canada | 8 | 35% of spot | Life of mine | Dec 2021 |

| Marathon | Generation | Canada | 100 | 18% of spot | Life of mine | Dec 2021 |

| Curipamba | Adventus | Ecuador | 50 | 18% of spot | Life of mine | Jan 2022 |

| Goose | Sabina | Canada | 4.15 | 18% of spot | Life of mine | Feb 2022 |

| Silver | ||||||

| Penasquito | Newmont | Mexico | 25 | 4.36 | Life of mine | Jul 2007 |

| Antamina*** | Glencore | Peru | 33.75 then 22.5 | 20% of spot | Life of mine | Nov 2015 |

| Constancia | Hudbay | Peru | 100 | 6.08 | Life of mine | Aug 2012 |

| Pascua-Lama | Barrick | Chile/Argentina | 25 | 3.90 | Life of mine | Sep 2009 |

| Other silver | ||||||

| Los Filos | Equinox | Mexico | 100 | 4.53 | 25 years | Oct 2004 |

| Zinkgruvan | Lundin | Sweden | 100 | 4.53 | Life of mine | Dec 2004 |

| Yauliyacu | Glencore | Peru | 1.5Moz + 50% of excess | **8.98 | Life of mine | Mar 2006 |

| Stratoni | Eldorado | Greece | 100 | 11.54 | Life of mine | Apr 2007 |

| Neves-Corvo | Lundin | Portugal | 100 | 4.38 | 50 years | Jun 2007 |

| Aljustrel | Almina | Portugal | 100 | 50% of spot | 50 years | Jun 2007 |

| Keno Hill | Alexco | Canada | 25 | Variable | Life of mine | Oct 2008 |

| Minto | Pembridge | Canada | 100 | 4.35 | Life of mine | Nov 2008 |

| Rosemont | Hudbay | USA | 100 | 3.90 | Life of mine | Feb 2010 |

| 777 | Hudbay | Canada | 100 | 6.32 | Life of mine | Aug 2012 |

| Loma de La Plata (Navidad) | Pan American | Argentina | 12.5 | 4.00 | Life of mine | Not finalised |

| Marmato | Aris | Colombia | 100 | 18% of spot | Life of mine | Nov 2020 |

| Cozamin | Capstone | Mexico | 50 | 10% of spot | Life of mine | Dec 2020 |

| Blackwater | Artemis | Canada | 50 | 18% of spot | Life of mine | Dec 2021 |

| Curipamba | Adventus | Ecuador | 75 | 18% of spot | Life of mine | Jan 2022 |

| Palladium | ||||||

| Stillwater | Sibanye | USA | 4.4 | 18% of spot | Life of mine | Jul 2018 |

| Cobalt | ||||||

| Voisey’s Bay | Vale | Canada | 42.4 | 18% of spot | Life of mine | Jun 2018 |

| Platinum | ||||||

| Marathon | Generation | Canada | 22 | 18% of spot | Life of mine | Dec 2021 |

Readers should note that, while the above table is accurate at the time of publication, in reality an increasing number of WPM’s precious metals purchase agreements (PMPA) have terms that vary, albeit not so much that they change the fundamental economic nature of the underlying contract. WPM’s PMPA with Adventus regarding the Curipamba project in Ecuador, announced on 17 January 2022, is a case in point:

- Under the PMPA, WPM will purchase 50% of Curipamba’s payable gold production until 145,000oz have been delivered, thereafter dropping to 33% of payable gold production for the life of the mine and 75% of the payable silver production until 4.6Moz have been delivered, thereafter dropping to 50% for the life of mine. Under the terms of the agreement, WPM is committed to pay Adventus a total upfront cash consideration of US$175.5m, of which US$13m is available pre-construction and US$0.5m will be paid to support certain local community development initiatives around Curipamba. The remainder will be payable in four staged instalments during construction, subject to various customary conditions being satisfied. In addition, WPM will make ongoing production payments for the gold and silver ounces delivered equal to 18% of the spot prices of gold and silver until the aggregate value of gold and silver delivered, net of the production payment, is equal to the upfront consideration of US$175.5m, at which point the production payment will increase to 22% of the spot prices.

Contracts may vary in other respects. Almost all historical, fixed cost now have an inflationary clause included in their contracts, for example typically that the production payment will increase by 1% per annum.

In addition, WPM has a number of early deposit mineral stream agreements with counterparties. These represent agreements relative to early stage development projects whereby WPM can choose not to proceed with the agreement once certain documentation has been received, including (but not limited to) feasibility studies, environmental studies and impact assessment studies. At the current time, these include:

| Asset | Owner/operator | Location | Attributable production to be purchased (%) | Per ounce cash payment* | Term of agreement | Date of original contract | ||

|---|---|---|---|---|---|---|---|---|

| Silver | Gold | Silver | Gold | |||||

| Toroparu | GCM | Guyana | 50 | 10 | 3.90 | 400 | Life of mine | Nov 2013 |

| Cotabambas | Panoro | Peru | 100 | 25 | 5.90 | 450 | Life of mine | Mar 2016 |

| Kutcho | Kutcho | Canada | 100 | 100 | 20% of spot | 20% of spot | Life of mine | Dec 2017 |

Finally, WPM has two royalty interests:

- On 5 January 2021, the company paid US$3.0m for an existing 2.0% net smelter return royalty interest on the first 600,000oz of gold mined from ore extracted from the Brewery Creek quartz mineral claims located in the Yukon Territories (Canada), owned by Golden Predator (a subsidiary of Sabre Gold Mines) and a 2.75% net smelter royalty thereafter.

- A 0.5% net smelter return royalty interest with Chesapeake Gold in the Metates properties in Mexico for the life of the mine. Note that the company also has the right of first refusal on any silver streaming, royalty or any other transaction on the Metates properties.

In contrast to its other agreements however, to date, neither revenue nor depletion have yet been recognised with respect to either of these royalty agreements.

Market potential

WPM is ostensibly a precious metals streaming company (plus one cobalt stream). Considering only the silver component of its investible universe, WPM estimates the size of the potential market open to it to be the lower half of the cost curve of the 70% of global silver production of c 1,092Moz that is forecast to be produced in CY22 (source: the Silver Institute) as a by-product of either gold or base metal mines (ie approximately 382Moz pa). This compares with WPM’s production in FY21 of 26.0Moz silver – that is, WPM estimates that, to date, it has penetrated less than 7% of its potential market. Inevitably, WPM’s investible universe may be further refined by the requirement for the operations to be located in good mining jurisdictions, with relatively low political risk. Nevertheless, such figures serve to illustrate the fact that WPM’s marketplace is very far from being either saturated or mature.

Similarly, considering only the gold component of its investible universe, WPM’s potential market may be considered to be at least the lower half of the cost curve of the 33% of global gold production of 114.5Moz that was produced in CY21 (source: World Gold Council) as a by-product of other metal mines (ie approximately 18.9Moz pa), which compares with WPM’s production in FY21 of 342.5koz gold (ie just 1.8% of its potential market).

Within this context, WPM effectively has two types of client within the mining industry: those seeking ‘balance sheet repair’ and those seeking ‘development’. The former tend to be larger in size (eg representing streams in excess of US$1bn in value) but less numerous. Until recently, the majority of new business offered to WPM has been of this type. Recently, however, WPM reports that it has observed a shift to the latter. Typically, these ‘development’ opportunities are smaller than ‘balance sheet repair’ type opportunities (eg in the range US$100–400m), but more numerous (WPM estimates that it has seen at least 150 such opportunities over the past three to four years).

FY22 and five-year and 10-year guidance

WPM has provided a detailed production outlook for FY22 as well as longer-term guidance to FY31. This is summarised below and compared with Edison’s equivalent forecasts (now including Marathon, Curipamba and Goose, but not yet Fenix, which, at the current time, is non-binding):

| FY22e | Implied *FY23–26 average | FY22–31 average | |

| Current Edison forecast | |||

| Silver production (Moz) | 23.7 | ||

| Gold production (koz) | 349.4 | ||

| Cobalt production (klb) | 1,274 | ||

| Palladium production (koz) | 19 | ||

| Gold equivalent (koz) | 710.2 | 871 | 849 |

| WPM updated guidance | |||

| Silver production (Moz) | 23.0–25.0 | ||

| Gold production (koz) | 350–380 | ||

| Cobalt & palladium production (koz AuE) | 44–48 | ||

| Palladium production (koz) | N/A | ||

| Gold equivalent (koz) | 700–760 | 880 | 910 |

WPM’s updated five-year and 10-year guidance is based on standardised pricing assumptions of US$1,800/oz Au, US$24.00/oz Ag (cf US$25.00/oz previously), US$2,100/oz palladium (cf US$2,300/oz previously) and US$33.00/lb cobalt (cf US$17.75/lb previously). Of note in this context is an implied gold/silver ratio of 75x, which compares with its current ratio of 86.2x and a long-term average of 61.5x (since gold was demonetised in August 1971). Self-evidently, at the standardised prices indicated, our gold equivalent production forecast of 710.2koz AuE for FY22e lies well within WPM’s guidance range of 700–760koz AuE.

Otherwise, readers will note that Edison’s medium-term production forecasts are within 2% of WPM’s (implied) guidance for the period FY23–26 and within 7% of its longer-term guidance for FY22–31 (albeit this estimate necessarily excludes potential future stream acquisitions).

Short-term organic growth opportunities

In the short term, First Majestic is in the process of increasing production at San Dimas by restarting mining operations at the past-producing Tayoltita mine to add another 300tpd (12%) to throughput. In addition, it is investigating installing a 3,000tpd high-intensity grinding mill circuit and an autogenous grinding mill to improve recoveries and reduce operating costs. Production of palladium and gold at Stillwater (operated by Sibanye-Stillwater) will similarly increase under the influence of the Fill-the-Mill project at East Boulder (although the Blitz project has now been delayed by two years, to 2024, following the suspension of growth capital activities owing to COVID-19).

Longer-term outlook

Salobo

On 24 October 2018, Vale announced the approval of the Salobo III brownfields mine expansion, intended to increase processing capacity at Salobo from 24Mtpa to 36Mtpa, with start-up at that point scheduled for H222 and an estimated ramp-up time of 15 months. According to its agreement with Vale, depending on the grade of the material processed, WPM will be required to make a payment to Vale for this expansion, which WPM estimates will be in the range US$550–670m in FY23, in return for which it will be entitled to its full 75% attributable share of expanded gold production. This compares to WPM’s purchase of a 25% stream from Salobo in August 2016 for a consideration of US$800m (see our note Going for gold, published on 30 August 2016), the US$900m it paid for a similar stream in March 2015 (when the gold price averaged US$1,179/oz) and the US$1.33bn it paid for its original 25% stream in February 2013.

According to Vale’s Q122 performance report, the Salobo III mine expansion is now 90% complete (see Exhibit 2) and remains on schedule for start-up in H222 (probably Q422). Once Salobo III has been completed, however, WPM believes reserves and resources could support a further 33% capacity increase at Salobo, from 90ktpd to 120ktpd (denoted Salobo IV). In addition to its long-term underground mining potential, WPM believes such an expansion could still be supported by output from the open pit. Under the terms of its agreement with Vale, there would be no additional payment due from WPM in respect of this expansion, although Vale could exercise a right to alter the timing of the incremental payment due for Salobo III.

Pascua-Lama

WPM’s contract with Barrick provided for a completion test that, if unfulfilled by 30 June 2020, would result in WPM being entitled to the return of its upfront cash consideration of US$625m less a credit for any silver delivered up to that date from three other Barrick mines (at which point it would have no further streaming interest in the mine). Given the test was unfulfilled, WPM had the right to an estimated US$252.3m (the carrying value of Pascua-Lama in WPM’s accounts) repayment from Barrick in FY20. Given the long-term optionality provided by the Pascua-Lama project, however, WPM instead opted not to enforce the repayment of its entitlement and to instead maintain its streaming interest in the project (which was originally expected to deliver an attributable 1.7–12.0Moz silver pa, averaging 5.2Moz Ag pa, to WPM at a cost of US$3.90/oz inflating at 1% per year).

Rosemont

Another major project with which WPM has a streaming agreement for attributable gold and silver production is Rosemont copper in Arizona.

Rosemont is near a number of large porphyry-type producing copper mines and will be one of the largest copper mines in the United States, with initial output of c 86,000t copper per year from mined sources, accounting for c 8% of total US copper production, rising to c 101,000tpa after 16 years. Total by-product production of silver attributable to WPM is estimated to be c 1.7Moz Ag pa for Phase I, followed by c 2.4Moz Ag pa for Phase II.

Rosemont’s operator, Hudbay, received both a Mine Plan of Operations from the US Forest Service and a Section 404 Water Permit from the US Army Corps of Engineers in March 2019, which was effectively the final material administrative step before the mine could start development. Subsequently, Hudbay indicated it would seek board approval to start construction work by the end of CY19, which would have enabled first production ‘by the end of 2022’. In the meantime, it started early works to run concurrently with financing activities (including a potential joint venture partner).

On 31 July 2019, however, the US District Court for the District of Arizona issued a ruling relating to a number of lawsuits challenging the US Forest Service’s issuance of the Final Record of Decision effectively halting construction, saying that:

- the US Forest Service ‘abdicated its duty to protect the Coronado National Forest’ when it failed to consider whether the mining company held valid unpatented mining claims; and

- the Forest Service had ‘no factual basis to determine that Rosemont had valid unpatented mining claims’ on 2,447 acres and the claims were invalid under the Mining Law of 1872.

Hudbay responded by saying that it believed the ruling to be without precedent and that the court had misinterpreted federal mining laws and Forest Service regulations as they applied to Rosemont. It pointed out that the Forest Service issued its decision in 2017 after a ‘thorough process of 10 years involving 17 co-operating agencies at various levels of government, 16 hearings, over 1,000 studies, and 245 days of public comment resulting in more than 36,000 comments’ and with a long list of studies that have examined the potential effects of the proposed mine on the environment. Hudbay also pointed out that various agencies had accepted the company could operate the mine in compliance with environmental laws. As a result, Hudbay appealed the ruling to the Ninth Circuit Court of Appeals, which was delivered on 24 May 2022 to the effect that it affirmed the US District Court for the District of Arizona’s decision in July 2019. In the decision, the Court of Appeals agreed with the District Court’s ruling that the US Forest Service had relied on incorrect assumptions regarding its legal authority and the validity of Rosemont’s unpatented mining claims in the issuance of Rosemont’s Final Environmental Impact Statement. Hudbay is in the process of reviewing the decision.

In the meantime however, Hudbay has continued to explore in and around the area of the mine and, on 22 September 2021, announced the intersection of additional high-grade copper sulphide and oxide mineralisation predominantly located on its wholly owned patented mining claims (denoted Copper World). To date, seven deposits have been identified at Copper World with a combined strike length of over 7km and, on 15 December 2021, Hudbay announced a maiden mineral resource at Copper World of 272Mt in the indicated category and 142Mt in the inferred category, both at an average grade of 0.36% copper. The mineralisation consists of both skarn and porphyry copper sulphides with a significant oxidised component along a regional fault along the west side of the Rosemont, Bolsa and Broad Top Butte deposits known as the Backbone Fault. As a consequence of this exploration, it was determined that approximately 33Mt of inferred mineral resources at the Bolsa deposit, which were previously considered to be waste in the resource pit shell used for Rosemont’s NI 43-101 feasibility study, could now potentially be converted into reserves, which would result in less waste being mined at Rosemont, thereby reducing costs and energy consumption per tonne of ore mined. In addition, the Rosemont deposit also contains oxide mineralisation that was previously classified as waste, which could be processed with the oxide mineralisation at Copper World, and it is expected that further synergies will be identified as Hudbay continues to close the drilling gap between Bolsa and Rosemont. Note, the Copper World discovery is included in WPM’s area of interest under its PMPA with Hudbay.

As a result of these discoveries, Hudbay has adjusted its plan to develop the district. Among other things, it has now acquired a private land package totalling approximately 4,500 acres to support an operation on private lands. The initial technical studies for Copper World were incorporated into a preliminary economic assessment (PEA) investigating the development of the Copper World deposits in conjunction with an alternative plan for the Rosemont deposit, which was announced to the market on 8 June, and proposed a two-phase mine plan to develop the project. The first phase of the mine plan requires only state and local permits and reflects an approximate 16-year mine life. The second phase then extends the mine life to 44 years and incorporates an expansion onto federal lands to mine the entire Rosemont and Copper World deposits. The second phase of the mine plan would be subject to the federal permitting process and the company expects that it will be able to pursue the federal permits within the constraints imposed by the courts’ most recent legal decisions if any subsequent appeals are not successful.

Within this context, on 24 May, Hudbay received a favourable decision from the US District Court for the District of Arizona on all issues relating to the development of Copper World, including that Copper World and Rosemont are not connected under the National Environmental Policy Act (NEPA) and, therefore, that the Army Corps of Engineers (ACOE) does not have an obligation to include Copper World as part of its NEPA review of Rosemont. The District Court also granted Hudbay’s motion to dismiss the Copper World preliminary injunction request filed by the plaintiffs in the two lawsuits challenging the Section 404 Clean Water Act permit for Rosemont on the basis that the lawsuits were moot after the company surrendered its 404 permit back to the ACOE in April 2022. The ACOE has never determined that there are jurisdictional waters of the US on the Copper World site and Hudbay has independently concluded through its own scientific analysis that there are no such waters in the area. In this respect, Hudbay believes the District Court’s decision, together with the 12 May decision, clarifies the permitting path for Copper World, including the requirements to receive federal permits for the second phase only under existing mining regulations.

Resources were reported to have expanded materially to 792Mt in the measured category, 381Mt in the indicated category and 262Mt in the inferred category at the time Hudbay’s PEA at an average grade of 0.40% copper. In April 2022, the company commenced early works at Copper World with initial grading and clearing activities at site. It expects to advance a pre-feasibility study (PFS) for Phase I of the Copper World project in H222, which will focus on converting the remaining inferred mineral resources to measured and indicated status and the evaluation of many of the project’s optimisation and upside opportunities. It will then complete a definitive feasibility study (DFS) as well as receiving all required state and local permits during 2023, while simultaneously evaluating a variety of financing options, including a potential minority joint venture partner, prior to project sanction potentially as early as 2024. In the meantime, it is continuing exploration and technical work at site with seven drill rigs conducting infill drilling to support the feasibility studies.

Other potential future growth opportunities

At the time of its Q122 results, WPM reported that its corporate development team had been ‘exceptionally busy’. While the majority of potential deals were reported to be with development companies in the US$100–300m range (with fewer ‘balance sheet repair’ opportunities), it was also reported there had been a number of approaches made by producing companies for transactions to fund expansion and even to fund M&A activity. In the first instance, WPM would fund any such transactions via the US$2bn available under its revolving credit facility, plus US$376.2m in cash (at end-Q122) and, potentially, its US$300m at-the-market equity programme.

While it is difficult, or impossible, to predict potential future stream acquisition targets with any degree of certainty, it is possible to highlight two that may be of interest to WPM in due course for which it already has strong, existing counterparty relationships:

- the platinum group metal by-product stream at Sudbury (operated by Vale); and

- the 30% of the gold output at Constancia that is not currently subject to any streaming arrangement.

FY22 guidance and forecasts

WPM’s guidance for FY22 remains unchanged at 350–380koz of gold production, 23.0–25.0Moz of silver production and 44–48koz gold equivalent ounces in other metals to result in total gold equivalent production of 700–760koz for the year.

In the light of Q122 results, recent moves in metals prices, forex rates and WPM’s share price, Edison has updated its quarterly estimates for WPM for FY22 as follows:

- ↑ Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles and exceptional items.

- ↑ Source: WPM, Edison Investment Research. Note: *As reported by WPM, excluding exceptional items. **Q122 versus Q421. ***Q122 actual versus Q122 estimate.

- ↑ Source: Vale, Edison Investment Research.

- ↑ Source: Edison Investment Research, WPM. Note: As reported.

- ↑ Source: Edison Investment Research, WPM. Note: As reported.

- ↑ Source: WPM, Edison Investment Research. Note: *Performance share units.

- ↑ Exhibit 6: Graph of historical share price move (US$/share) versus quarterly stock-based G&A expense, Q419–Q122.

- ↑ Source: Edison Investment Research (underlying data: Wheaton Precious Metals).

- ↑ Source: Edison Investment Research, Wheaton Precious Metals. Note: Mine life forecast to extend until 2031 (not shown here).

- ↑ Source: Wheaton Precious Metals, Edison Investment Research. Note: Most recent published terms. *Historical fixed cost contracts subject to an annual inflationary adjustment with the exception of Loma de La Plata and Sudbury. **Variable. ***WPM is entitled to 33.75% of silver production at Antamina until 140Moz have been delivered and 22.5% thereafter, for a 50-year term that can be extended in increments of 10 years at the company’s discretion.

- ↑ Source: Wheaton Precious Metals, Edison Investment Research. Note: *Subject to an annual inflationary adjustment.

- ↑ Source: WPM, Edison Investment Research forecasts. Note: *Edison forecasts include Salobo III from FY23e and Rosemont from FY26e.