Ethereum: Difference between revisions

No edit summary |

No edit summary |

||

| Line 78: | Line 78: | ||

=== Risks === | === Risks === | ||

* Regulatory | |||

* Technological | |||

Revision as of 18:48, 24 July 2023

| Type | Decentralized blockchain |

| Release Date | 30 July 2015 |

| Founder | Vitalik Buterin |

| Website | ethereum.org[1]etherscan.io |

What is Ethereum?

- Ethereum is a network of computers all over the world that follow a set of rules called the Ethereum protocol[1].

- The Ethereum network acts as the foundation for communities, applications, organizations and digital assets that anyone can build and use[1].

Blockchain

The concept of blockchain is crucial in understanding Ethereum.

What can Ethereum do[1]?

- Banking: Everyone is allowed to access Ethereum, and the lending, borrowing and savings products built on it is an internet connection.

- An open internet: Users can control their own assets and identity, instead of them being controlled by a few mega-corporations.

- A peer-to-peer (p2p) network: Ethereum allows users to coordinate, make agreements or transfer digital assets directly with each other.

- Censorship-resistant: No government or company has control over Ethereum.

- Commerce guarantees: Users have a secure, built-in guarantee that funds will only change hands if they provide what was agreed.

- Composable products: All applications are built on the same blockchain with a shared global state, meaning they can build off each other. This allows for better products and experiences and assurances that no-one can remove any tools apps rely upon.

NFT

Ethereum 2.0

Ethereum vs. Bitcoin

| Ethereum[2] | Bitcoin[3] | |

|---|---|---|

| Popularity | #2 | #1 |

| Type | Decentralized blockchain | Digital currency |

| Circulating supply | 120.2M ETH | 19.4M BTC |

| Total supply | Infinite | 21M BTC |

| Market cap | $222.4B | $568.1B |

| All time high | $4,891.70 | $68,789.63 |

- Since Bitcoin stands as the pioneering and most renowned cryptocurrency, drawing a comparison between Bitcoin and Ethereum proves highly beneficial when analyzing Ethereum. As Bitcoin's primary competitor, Ethereum is ranked #2 on most cryptocurrency platforms, while Bitcoin is ranked #1.

- While this section focuses on comparing Ethereum and Bitcoin, it's essential to acknowledge that they are not of the same kind. Ethereum operates as a decentralized blockchain, where cryptocurrency is merely one of its numerous applications (financial services, games, social networks, etc.). In contrast, Bitcoin exclusively functions as a cryptocurrency, akin to the virtual counterpart of a dollar.

- The circulating supply of a cryptocurrency represents the number of tokens that have been issued and are actively available in the market. For Bitcoin, over 90% of its total supply has already been mined. On the other hand, Ethereum does not have a finite supply.

- While the concept of unlimited supply may raise concerns for Ethereum, it actually contributes to its stability as a cryptocurrency and sets it apart from becoming the next Bitcoin. This characteristic prevents scarcity-driven market behaviors and allows for a more sustainable and adaptable ecosystem for Ethereum, ensuring its continued relevance and functionality.

- Market cap is calculated by multiplying the asset's current price and its circulating supply.

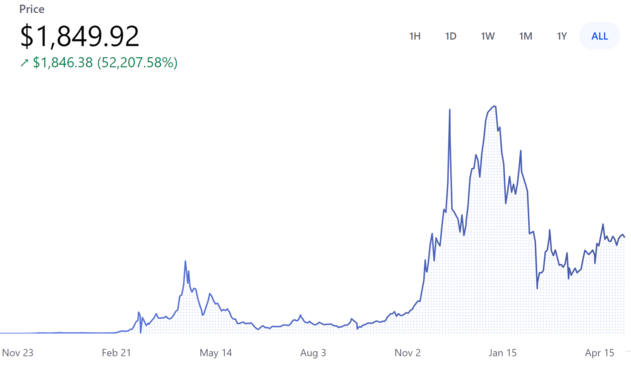

Valuation

Risks

- Regulatory

- Technological