Ethereum

Ethereum logo | |

| Original author(s) | Vitalik Buterin Gavin Wood |

|---|---|

| Initial release | 30 July 2015 |

| Stable release | 1.12.2 / 13 August 2023 |

| Development status | Active |

| Software used | EVM 1 Bytecode |

| Written in | Go, Rust, C#, C++, Java, Python, Nim, TypeScript |

| Operating system | Cross-platform |

| Platform | x86-64, ARM |

| Available in | Multilingual, but primarily English |

| Type | Distributed computing |

| License | Open-source licenses |

| Active hosts | ~8,600 nodes (6 June 2023)[1] |

| Website |

|

What is Ethereum? edit edit source

- · Ethereum is a globally distributed network of computers that is powered by blockchain technology and is known as a decentralized blockchain platform and open-source software, enabling developers to create and deploy smart contracts and decentralized applications (DApps).

- · The Ethereum network acts as the foundation for communities, applications, organisations and digital assets that is accessible for creation and utilization by anyone. This decentralized network is part of the appeal of Ethereum and other cryptocurrencies. Users can exchange money without the need for a central intermediary such as a bank, and the lack of a central bank means the currency is nearly autonomous.

- · Ethereum is renowned primarily for its native cryptocurrency, Ether (ETH). Proposed by Vitalik Buterin in 2013 and launched in 2015, Ethereum expands upon the capabilities of blockchain technology beyond simple peer-to-peer transactions. It introduces the concept of smart contracts, which are self-executing agreements with terms directly written in code. These contracts run on the Ethereum Virtual Machine (EVM), ensuring secure and automated execution across the network. Ethereum's native cryptocurrency is called Ether (ETH), used for transaction fees and as a tradeable digital asset. With its flexibility and programmability, Ethereum has become a popular choice for a wide range of innovative blockchain projects and applications.

- · Ethereum was designed as the "upgrade" of Bitcoin, aiming to accomplish functionalities that Bitcoin couldn't achieve. This decentralized network is part of the appeal of Ethereum and other cryptocurrencies. Users can exchange money without the need for a central intermediary such as a bank, and the lack of a central bank means the currency is nearly autonomous. Ethereum also allows users to make transactions nearly anonymously, even if the transaction is publicly available on the blockchain.

Some popular applications built on the Ethereum blockchain are listed below:

| Application name | Application description |

|---|---|

| OpenSea | Largest NFT marketplace |

| Uniswap | Cryptocurrencies swapping platform |

| MetaMask | Most widely used crypto wallet |

| MakerDAO | Cryptocurrencies lending platform |

How does Ethereum work? edit edit source

Price edit edit source

Price of Ethereum

Ethereum’s price history reveals an eventful ride over the years. In ETH’s early days, the coin traded below $2.00 at times. The Ethereum price chart shows ETH’s price history on Cointelegraph’s Ethereum price index. ETH traded below $15.00 per coin in early 2017 and surged all the way up to around $1,400 per ETH in January of the following year.

Following that high, ETH proceeded to fall all the way back down near and below $100 at times in the subsequent months and years. The asset eventually trended back upward, surpassing the $4,000 mark in 2021. However, the post-Merge Ethereum price dropped by 55% against BTC.

What affects the Ethereum price?

The price of cryptocurrencies depends fundamentally on the supply and demand of the markets. Overall, there are a few significant factors that affect the sentiment of the ether market.

Domination of Bitcoin

Bitcoin has the most influence over the value of other cryptocurrencies. If the bitcoin price increases, the value of other cryptos tends to increase proportionally. This happens in reverse if the price of bitcoin decreases.

Besides the bitcoin price changes, what also affects the Ethereum value is which coin dominates the market. In short, for years, Bitcoin has been the number one cryptocurrency in terms of market capitalization and number of active wallet addresses. But in July 2021, Ethereum, for the first time, flipped (dominated) Bitcoin by the number of daily active addresses on its network. Should the trend continue, the Ethereum price could spike.

Ethereum is seen as a legacy coin

The cryptocurrency market offers a selection of different assets for different investor segments. “Legacy” cryptocurrencies such as Bitcoin and Ethereum are a good fit for long-term holding. These coins carry less risk than newer, smaller tokens.

Since the COVID-19-induced market crash, the volatility of both bitcoin and Ethereum has been low if we compare it to newer cryptocurrencies. In the following chart, the volatilities of Bitcoin (BTC) and Ethereum (ETH) peak in the early 2020 COVID-induced crash. Then, the volatility of both assets stays relatively low after spring 2020.

In early-to-mid 2021, younger small-cap tokens showcased escalating volatility during the bull cycle and the May correction.

On January 2022 Ethereum price decreased to 2,411.91 USD (2,231.38 EUR). However, in the following months, the price of Ethereum remained at an average of 2600 USD. Of course, Russia’s invasion of Ukraine had brought even more volatility to the crypto market. However, by the end of 2022, Ethereum had seen a significant price increase, with one ETH being worth 1,377 USD and 1,156 EUR.

Platform upgrades

If the development of Ethereum’s platform includes improvements, the price will increase to reflect the added value. And in fact, the platform has been going through a series of extensive upgrades in its platform since its creation.

The upgrades were initially divided into four main stages: Frontier, Homestead, Metropolis, and Serenity. Serenity, the following stage will concentrate on improving the platform’s efficiency, speed, and scalability.

Ethereum 2.0 is a significant upgrade to the already existing Ethereum blockchain. Namely, this upgrade aims to enable the network to address the bottlenecks and increase the number of transactions. The alternative names for Ethereum 2.0 are Eth2 or Serenity. Thanks to this upgrade, more financial institutions could start using Ethereum.

During the shift to ETH2, the network undergoes a few hard forks. For example, the Ethereum London Hard Fork is launched in August 2021. This hard fork (or change in the blockchain) evens out the ETH network fees and limits the ETH supply.

Ethereum estimates that the 2.0 network could go live by 2022 if the development is successful and goes as planned. At the same time, cautious experts say the upgrade could take years.

Ethereum Supply & Demand

In the second half of 2021, the Ethereum network will undergo a major change. So far, the supply of Ethereum has been unlimited — but that is set to change. After the Ethereum London Hard Fork, the ETH blockchain will burn the fees it charges from crypto users.

This will create deflationary pressure on ETH. In other words, it will be more likely for ETH tokens to increase in value over time since their maximum supply became limited.

Rise of NFT

Non-fungible tokens (NFTs) are yet another reason for the ETH price increase.

NFTs are a form of cryptocurrency. Their main feature is that instead of holding money, they contain assets like art. A non-fungible object, by contrast, has its distinct value, like a picture or a first edition book. And most of the NFTs are part of the Ethereum blockchain.

The NFT market value tripled in 2020, reaching more than $250 million. Therefore, an increasing amount of trades affected the ETH value.

DeFi explosion

The usage of the Ethereum network is becoming even more extensive in the wake of the decentralized finance (DeFi) explosion. Many DeFi tokens are based on the Ethereum blockchain, and their users, in turn, are paying the Ethereum gas fees. Gas fees are payments made by users to compensate for the computing energy required to process and validate transactions on the Ethereum blockchain.

DeFi, which aims to create an alternative financial system that is more accessible than the traditional one, is primarily built through decentralized applications (Dapps) on the Ethereum network.

Price: (Taken from YahooFinance.com)**

| Date | Open | High | Low | Close* | Adj. close** | Volume |

|---|---|---|---|---|---|---|

| 31 Jul 2023 | 1,448.13 | 1,458.90 | 1,448.76 | 1,451.59 | 1,451.59 | 3,740,092,160 |

| 30 Jul 2023 | 1,459.26 | 1,467.79 | 1,455.97 | 1,464.32 | 1,464.32 | 1,944,029,906 |

| 29 Jul 2023 | 1,454.39 | 1,461.51 | 1,452.40 | 1,459.40 | 1,459.40 | 2,958,875,296 |

| 28 Jul 2023 | 1,448.19 | 1,453.57 | 1,450.06 | 1,454.12 | 1,454.12 | 3,354,265,245 |

| 27 Jul 2023 | 1,440.84 | 1,457.93 | 1,433.01 | 1,448.25 | 1,448.25 | 4,472,443,770 |

| 26 Jul 2023 | 1,443.95 | 1,455.07 | 1,439.23 | 1,440.87 | 1,440.87 | 3,229,135,506 |

| 25 Jul 2023 | 1,469.70 | 1,469.14 | 1,432.45 | 1,443.93 | 1,443.93 | 4,951,796,259 |

| 24 Jul 2023 | 1,451.54 | 1,481.22 | 1,446.46 | 1,470.00 | 1,470.00 | 3,486,393,895 |

| 23 Jul 2023 | 1,471.65 | 1,475.82 | 1,442.98 | 1,450.62 | 1,450.62 | 3,190,188,291 |

| 22 Jul 2023 | 1,469.45 | 1,481.44 | 1,467.58 | 1,471.75 | 1,471.75 | 3,631,112,898 |

| 21 Jul 2023 | 1,460.18 | 1,491.72 | 1,462.71 | 1,468.97 | 1,468.97 | 5,722,811,914 |

Valuation

The total value of all cryptocurrencies is $1.23 trillion, in July 2023[3]. At the same time, ETH has a total value of $222.4 billion[4], which is approximately 18% of the market. In the near future, this percentage will continuously increase because ETH has an infinite supply, while Bitcoin is approaching its total supply limit.

The initial release price of ETH is $0.31 per token in 2015, and it was under $1 for the major part of 2015. But by March 2016 Ether crossed the $10 mark. By 2017, ETH had gained popularity and reached $100 in May 2017. By the end of 2017, ETH had reached a value of $774.69 and within the first week of 2018, it crossed the $1000 mark. After the cryptocurrency crash in 2018, ETH was reduced to under just $100. From 2019 to 2021, ETH once again continued to rally and reached its highest price of $4,815 on November 9, 2021. During the first half of 2022, ETH's price experienced a significant drop, but since then, it has been consistently hovering around $2000 up until the current date in July 2023[5].

Ethereum price predictions

Everybody wants to hear price predictions for their favorite cryptocurrencies. Just like bitcoin, Ethereum has its maximalist fans who make optimistic price predictions. Like bitcoin, Ethereum also has its pessimistic critics.

By July 2021, Ethereum has outperformed all cryptocurrencies, including BTC, in the first six months of 2021, in terms of growth and trading volume. As a result, the Finder’s panel of crypto experts went as far as predicting that ETH price is likely to outperform BTC by the end of 2021 which didn’t happen.

According to Finder’s analysts in 2023, Ethereum’s price is expected to peak in at $2,474 per token and conclude the year at $2,184 per unit. Other expert predictions suggest that the price of Ethereum could be between $1,768.09 and $2,652.14 by the end of 2023. Meanwhile, some experts and industry analysts believe that Ethereum will come close to the $4,000 mark by the end of 2023. We will have to wait and see.

History edit edit source

Ethereum’s early days

Although the Ethereum blockchain has a number of founders, Vitalik Buterin was the one who initially published a white paper explaining the concept of Ethereum in November 2013. Following Buterin’s initial work, other brains jumped on board in various capacities to help bring the project to fruition. Vitalik Buterin, Gavin Wood, Charles Hoskinson, Amir Chetrit, Anthony Di Iorio, Jeffrey Wilcke, Joseph Lubin and Mihai Alisie are all considered co-founders of Ethereum.

Ethereum gained awareness in early 2014 when Buterin brought the concept of the blockchain project into the public eye at a Bitcoin conference in Miami, Florida. The project raised capital via an initial coin offering (ICO) later the same year, selling millions of dollars worth of ETH in exchange for funds to use for the development of the project. Between July 22 and Sept. 2, 2014, the asset sale sold over $18 million worth of ETH, paid for in Bitcoin.

Although ETH coins were purchasable in 2014, the Ethereum blockchain did not actually go live until July 30, 2015, meaning ETH buyers had to wait for the blockchain to launch before they could move or use their ETH.

Why create the Ethereum blockchain in the first place? One reason would be that the Ethereum blockchain allows for more versatility in terms of building on the blockchain and the surrounding ecosystem.

Ethereum’s stages of progress

Although the July 2015 birth of the Ethereum blockchain brought the project to life, its development would be a lengthy process spanning years. Called Frontier, the first iteration of the Ethereum blockchain simply got the chain off the ground and running, hosting smart contracts and proof-of-work (PoW) mining. The initial launch gave folks the opportunity to set up their mining apparatuses and start building on the network.

Since Ethereum’s initial launch, the blockchain has taken on many other updates as part of the blockchain’s progression, such as updates called Byzantium, Constantinople and the Beacon Chain. Each update has altered certain aspects of the blockchain. Beacon Chain, for example, launched the consensus layer (previously called Ethereum 2.0) — a shift from a proof-of-work to a proof-of-stake (PoS) consensus mechanism. Byzantium and Constantinople each brought a number of changes to the Ethereum blockchain, including a mining payout reduction down to three ETH from five (after Byzantium and preparation for the PoS transition during Constantinople).

A significant change to the Ethereum blockchain is the shift over to PoS initiated to scale the blockchain. Numerous projects have built applications on the Ethereum blockchain over the years. Still, the network struggled when traffic notably increased, such as the days of CryptoKitties — digital collectible cats underpinned by the Ethereum blockchain — in 2017.

In 2020 and 2021, decentralized finance (DeFi) projects built on Ethereum received significant attention, bringing Ethereum’s scalability issues to the forefront as high network fees plagued participants. Ethereum’s transition to the consensus layer and PoS aims to bring scalability to the well-known blockchain, although the shift occurs in stages.

The DAO hack

Some of the Ethereum blockchain’s updates over time were a planned part of Ethereum’s progression, although others were adjustments based on events or factors that called for changes to the blockchain. The decentralized autonomous organization (DAO) fork, for example, served as an effort to circumvent a hack. DAOs are a general concept in the crypto industry, whereas The DAO was a specific DAO from the crypto industry’s earlier days.

A project that launched in 2016, the DAO served as an Ethereum-based decentralized autonomous organization fund that essentially democratized the fund’s asset allocation. Users don’t have to trust anyone else in the group with DAOs, they just need to trust a DAO’s code which is completely visible and verifiable by anyone. In short, interested parties sent ETH to a pool of funds within the DAO and received DAO tokens in return. These tokens could, at the time, be used to vote on where the DAO would allocate its pool of capital. The DAO attracted about $150 million worth of ETH in 2016, given ETH’s United States dollar price at the time.

In 2016, however, the DAO suffered a hack that took over 3.6 million ETH from the DAO’s asset pool. The Ethereum community disagreed on how to handle the ordeal. Part of the community wanted to alter the Ethereum blockchain to essentially nullify the hack. Opposing community members disagreed, expressing that such a play would go against the overarching concept of blockchain technology’s immutability.

A majority of the Ethereum community agreed with the play to alter the blockchain in response to the hack, leading to a hard fork of the network. The hard fork resulted in two separate blockchains and two separate native assets on those chains. The Ethereum blockchain forked off to regain the assets lost from the hack. The resulting forked asset and blockchain is the one that now holds the Ethereum name. What is now called Ethereum Classic is the original version of the Ethereum blockchain.

The Ethereum Merge upgrade: Transition from PoW to PoS consensus

Considering the environmental concerns associated with PoW mining, the long-awaited integration of the Beacon Chain’s consensus layer with the Ethereum mainnet execution layer was proposed and carried out by the Ethereum founders and developers. So, what happened to Eth2? Ethereum Foundation has rebranded Eth2 to the consensus layer to save users from scams like swapping ETH for ETH2 tokens.

Also, it does not mean that two distinct Ethereum networks exist because Eth1 will handle transactions and their execution. At the same time, Eth2 will manage proof-of-stake consensus, but there will be only one network: Ethereum. So, is Ethereum mining dead after the Merge?

Despite the flawless implementation of the Merge, Chinese miner Chandler Guo favored miners and forked the Ethereum blockchain to preserve the PoW consensus method. This new fork is called ETHW or proof-of-work Ethereum, in which miners will continue to solve complex mathematical puzzles to receive ETH rewards (similar to Ethereum Classic).

Ethereum’s future after the Merge

Ethereum is a significant player in the crypto space, as evidenced by its market capitalization and the vast array of solutions that entities have built on the Ethereum blockchain. However, the network has faced difficulty in scaling. Its transition over to the consensus layer aims to solve its challenges. However, only time will tell regarding the results.

Moreover, Vitalik Buterin claimed the Merge would follow another four developmental phases: The Surge, The Verge, The Purge and The Splurge. Nonetheless, it remains to be seen if upcoming updates would enable Ethereum to more effectively manage a wave of arising regulatory issues over digital assets and public blockchains.

Ethereum price history: analysis & graph

Here’s a recap of the critical events in the history of Ethereum. These are mainly the important events from a financial point of view, as we have left out the technological milestones of the platform:

Mid 2014. The founder of Ethereum, Vitalik Buterin, gathers up crowdfunding (ICO, Initial Coin Offering) of 18 million dollars. Ethereum goes into the markets with a value of 31 cents per ether (USD).

May 2016. Ether places itself into the markets with a capitalization that exceeds 1.000 million US dollars.

17 June 2016. A hacker steals 3,6 million ethers, totaling around 70 million US dollars at that time. Ethereum divides into Ethereum and Ethereum Classic.

20 June 2017. Ethereum reaches a value of $376,36, which is more than 121.400% of its initial value.

13 January 2018. Ethereum reaches its historical high of 1.432,88 USD per ether.

1. That was a pretty stable year, with a slight price rally in Q2. On June 26, Ethereum reached a price of 335 USD, which is the highest price for Ethereum since August 2018.

2. Ethereum has started with a price of 127 USD in 2020. However, it has reached 741.12 USD at the end of 2020.

3. From the first days of the year, Ethereum price has increased significantly. On the 10th of May 1, ETH was 4200,86 USD. It was an all-time high up to this date.

4. Ethereum saw increased adoption by businesses, allowing for decentralized applications that could be used at scale. Many major cryptocurrency exchanges adopted Ethereum, allowing users to buy and sell the cryptocurrency easily. Meanwhile, Ethereum was officially updated with its new Proof-of-Stake consensus mechanism.

5. Ethereum’s DeFi (Decentralized Finance) ecosystem continues to grow, allowing users to access various financial services through decentralized applications.

Utility edit edit source

Utility as a Commodity

Ether is the native asset of the Ethereum platform — meaning it’s used in order to process any transaction or state change on the blockchain.Users and developers use Ether as “gas” in order to “fuel” the applications that run on Ethereum; this “gas” is sent to the miners as a reward for validating the transaction.Each computation has a set gas price — meaning the more complex the transaction, the more expensive it’ll be.

For example, sending Ether from one wallet to another is relatively inexpensive compared to doing a flash loan to take advantage of a DEX liquidity pool arbitrage opportunity.Since Ether is used as gas for the network, it intrinsically has utility vs. a pure currency / store of value like Bitcoin.Thus, people want to hold Ether — similarly how people want to hold oil in order to power machinery.As the Ethereum network is used more and more, the demand for Ether will increase. And as I mentioned previously, the network is constantly breaking ATHs in terms of network traffic and transactions.

Utility as a Base Pair

A large reason for Bitcoin’s run up in 2017 was due to it being the only base pair with other altcoins. Back then, there were few fiat on-ramps, so investors had to purchase Bitcoin and then swap with the other coin that they actually wanted.When looking at DeFi — especially DEXes on Ethereum like Uniswap and Sushiswap — the main trading pair of these new ERC20 tokens is still with ETH.The implication is that for nearly everyone who is trying to trade on a DEX, or trying to get access to a new coin that isn’t listed on centralized exchanges like Coinbase or Binance — they have to first hold ETH before swapping, if they want access to the most liquidity and thus the least amount of slippage (i.e., the ‘cheapest’ way to get that coin).

Utility as a Store of Value

Of course, it stands within reason that — with the inherent utility of ETH and the loads of upcoming news about improving Ethereum — people would see Ether as an attractive store-of-value investment in order to capitalize on the potential growth of the Ethereum platform.In the past few days, we’ve seen Ether ETFs raise hundreds of millions of dollars of capital — with the likes of CI Galaxy and prominent Canadian investment firms getting involved.Like Bitcoin, institutional investors and laypeople retail investors want to get exposure to an asset that will, in theory, be a hedge against fiat inflation.

Uses edit edit source

Investments & Institutional Usage

In April 2021, European Investment Bank (EIB) announced its plans to offer a two-year digital bond on the Ethereum blockchain. After this update, Ethereum set yet another price record.

But this piece of news was not the only reason behind the recently increasing investment into Ethereum. At the end of March 2021, payments giant Visa announced its first transactions settled with Visa in USD Coin (USDC) and transacted over the Ethereum blockchain.

In 2021, a lot of firms announced their investments in Ethereum. To summarize what happened, after every piece of news about that came out, the Ethereum price increased.

In 2022, the Ethereum Merge was finalized, marking a major milestone for the Ethereum blockchain. Ethereum was officially updated with its new Proof-of-Stake consensus mechanism, attracting many new ESG-minded investors.

Decentralized Finance (Defi): Decentralized finance is a term used to refer to financial services and products that are available and accessible to anyone that can make use of Ethereum. No authority can deny access to anything for a user or block payments, and markets are always open with Defi. Anyone can inspect the codes, and there are no longer risks of human errors as the services are now automatic and governed by code. With traditional finance, some problems that exist include:

- Denial of an individual from making use of financial services

- Financial services can prevent an individual from getting paid.

- Limitation of trading hours to specific time zones trading hours

- Centralized institutions and governments can shut down the markets at will.

- In the Defi system, the user holds and has total control over their own money, transfer of funds takes just a few minutes, it is open to anyone, and the market is always open. A user can also send money anywhere in the world, access stable currencies, borrow funds with or without collateral, trade tokes, buy insurance, and much more.

Non-Fungible Tokens (NFTs): NFTs are tokens that can be attached to unique items, and they are not interchangeable for any other item. They allow value to be given to art, music, etc., in terms of digital currency. They are secured on the Ethereum blockchain and can have only one owner at a time. A new NFT cannot be copied and pasted into existence, and no two can be the same. They are compatible with anything that is built on the Ethereum platform. NFTs can be sold anywhere, and the owners have access to the global market.

Decentralized autonomous organizations (DAOs): DAOs are owned and governed collectively by their members, and they function based on smart contracts. They are internet-based, and they have in-built treasuries that cannot be accessed without being granted permission by the group. They make decisions by proposals and voting to ensure that everyone in the group can air their opinions. There is no CEO or CFO, and the rules that govern their spending are part of the DAO code. The codes and all their activities are transparent, and they operate a democratic system. The votes which are tallied automatically are required before any change can be implemented. Examples of DAOs are charity organizations, ventures, freelancer networks, etc.

Crypto Market in General edit edit source

Market Capitalization In The Crypto Ecosystem edit edit source

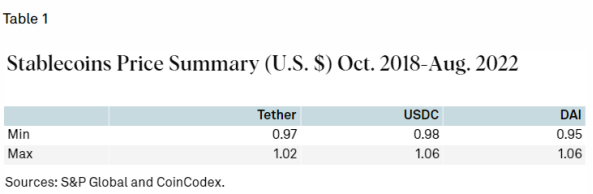

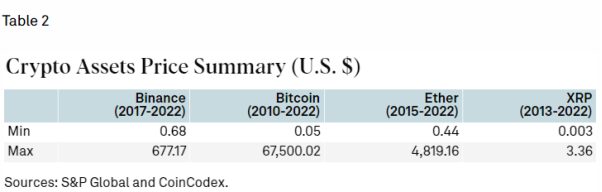

The crypto market trades 24/7. For the purpose of our study, we focused on the universal coordinated time (UTC) daily price of a selected sample of cryptocurrencies that dominate the markets. Typically, the start price at the inception of the coin is close to zero, but during their lifetime, they achieve various levels (see tables 1 and 2 below). Notably, Bitcoin achieved the highest price to date in November 2021. It has since dropped more than 60% in value.

Historical Analysis Of The Crypto Ecosystem

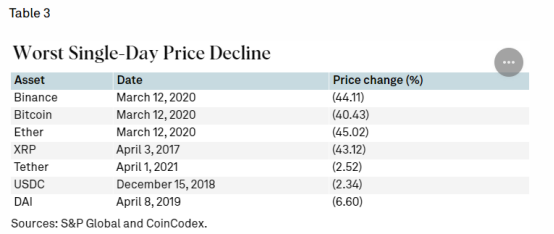

Despite considerable high returns, crypto assets have seen significant drops in value. The daily largest drop in price for Bitcoin and Ether was recorded around March 11, 2020, the date when WHO declared the COVID-19 crisis a pandemic. Table 3 below summarizes the largest price decline for the studied sample.

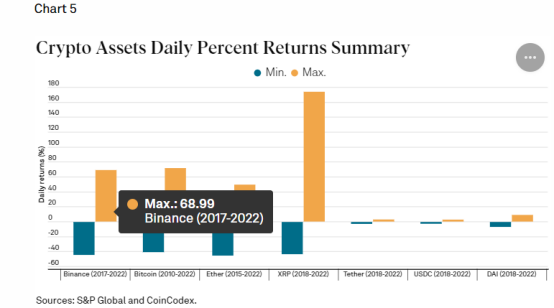

The highest 24-hour positive returns are also notable, and we show them in chart 5 below together with the largest drops in value.

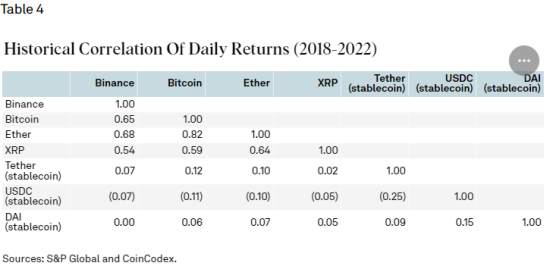

We then looked at return correlation among the cryptocurrencies to better understand the interaction within their ecosystem. Despite the fact that the genesis of each coin is independent of each other and the fact that they were created on different platforms using different protocols and at different points in time, our analysis shows (since 2018) moderate-to-high correlation among the cryptocurrencies, excluding stablecoins. The stablecoins exhibit insignificant correlation with the other cryptocurrencies (table 4), which is somewhat expected.

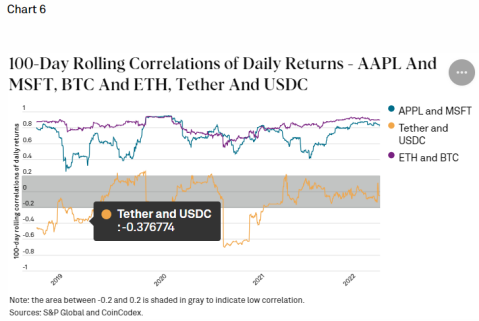

Next, we took a closer look at the 100-day correlation between Bitcoin and Ether and between Tether and USDC to break down the historical data into shorter periods. Chart 6 shows that the interconnectivity between BTC and ETH is consistently high, as is the overall historical correlation. As a comparison, we added on the same graph the rolling correlation between the two largest holdings in S&P 500, which are for Apple (AAPL) and for Microsoft (MSFT). The two largest stocks exhibit medium-to-high correlation, as do the two largest cryptocurrencies (BTC and ETH) (see chart 6).

Ethereum vs. Bitcoin

| Ethereum[4] | Bitcoin[7] | |

|---|---|---|

| Popularity | #2 | #1 |

| Rating | 4.4 | 4.5 |

| Type | Decentralized blockchain | Digital currency |

| Circulating supply | 120.2M ETH | 19.4M BTC |

| Total supply | Infinite | 21M BTC |

| Market cap | $222.4B | $568.1B |

| All time high | $4,891.70 | $68,789.63 |

| Mining method | Proof of Stake (PoS) | Proof of Work (PoW) |

- Since Bitcoin stands as the pioneering and most renowned cryptocurrency, drawing a comparison between Bitcoin and Ethereum proves highly beneficial when analyzing Ethereum. As Bitcoin's primary competitor, ETH is ranked #2 on most cryptocurrency platforms, while Bitcoin is ranked #1.

- While this section focuses on comparing Ethereum and Bitcoin, it's essential to acknowledge that they are not of the same kind. Ethereum operates as a decentralized blockchain, where cryptocurrency is merely one of its numerous applications (financial services, games, social networks, etc.). In contrast, Bitcoin exclusively functions as a cryptocurrency, akin to the virtual counterpart of a dollar.

- The circulating supply of a cryptocurrency represents the number of tokens that have been issued and are actively available in the market. For Bitcoin, over 90% of its total supply has already been mined. On the other hand, ETH has an infinite supply.

- While the concept of unlimited supply may raise concerns for ETH, it actually contributes to its stability as a cryptocurrency. This characteristic prevents scarcity-driven market behaviours and allows for a more sustainable and adaptable ecosystem for Ethereum, ensuring its continued relevance and functionality.

- Vitalik Buterin, the founder of Ethereum, envisioned the creation of Ethereum with the goal of harnessing blockchain technology and extend its applications far beyond just being a digital currency like Bitcoin.[8].

- Ethereum uses the PoS mining method wherein miners' scores are determined by the amount of tokens in their digital wallets and the duration they have held them. The miner with the highest stake has a better chance of being selected to validate a transaction and receive a reward[9]. Bitcoin uses the PoW mining method, where miners are rewarded for the computational work they perform[10].

Does Ethereum follow ESG mandate? edit edit source

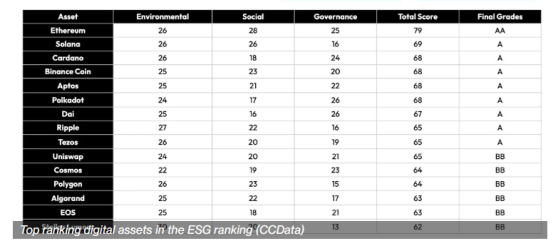

Table 1: ESG ASSETS toplist

Ethereum topped the first institutional-grade crypto ESG ranking followed by Solana and Cardano, while Bitcoin lagged due to its heavy energy usage, according to crypto data firm CCData’s research.

The role of environmental, social and governance (ESG) mandates in investments is becoming increasingly prevalent, especially among institutional investors and large asset management firms. ESG-related assets under management could reach 33.9 trillion by 2026, a fifth of all investments globally, global accounting firm PricewaterhouseCooper (PwC) forecasted in a report late last year.

The benchmark measured environmental, social and governance risks for and opportunities of digital assets, taking into account a range of metrics including decentralization, energy consumption, community engagement. Then, the points for each metric were aggregated and weighted for an overall score of maximum 100 points, making up the final grade from AA (best) and E (worst).

Assets with a BB or better grade were considered top-tier in the report.

Ethereum was the only blockchain that earned an AA grade, performing well in all three ESG factors. This is partly attributed to the network’s recent transition to proof-of-stake technology, according to the report, which slashed energy consumption and made miners obsolete.

Solana, Cardano and Polkadot excelled in decentralization, granting them a top-tier A grade.

Bitcoin received a B grade, earning high scores in social and governance aspects but slammed for its heavy energy consumption and hardware need

Competitors edit edit source

Examples of Ethereum competitors

Ethereum inspired many developers to create competing smart contract blockchains. However, only a few ETH killers have become crypto market leaders. Some of the largest "Ethereum Killers" by market cap are Solana, Cardano, Polkadot, Avalanche and Algorand. All of these projects have lower gas fees and process more transactions per second than Ethereum. However, Ethereum may be a stronger technology when it comes to security or decentralization. Additionally, technologies that are composable with Ethereum have released recently, improving it as a whole.

Ethereum vs. competitors: Will Ethereum survive?

Despite the rise in Ethereum killers, most crypto analysts don't believe Ethereum will "die" anytime soon. As the world's first smart contract blockchain, Ethereum has a significant lead over its competitors. Most cryptos in Web3 are still concentrated on Ethereum protocols, and there's a large community of developers and validators on the Ethereum blockchain.

At the time of writing, Ethereum has a total of $31.5 billion locked in its DeFi protocols, representing more than 50% of the total value locked (TVL) in all DeFi applications.

Although Ethereum has a strong community, it has significant scalability issues. Most Ethereum replacements attract users and developers with the promise of cheaper fees and quicker transaction speeds. Even with Ethereum's recent upgrade to PoS, the main Ethereum blockchain is slower and more expensive than alternatives.

Also, as more chains like Polkadot introduce blockchain interoperability, it's unclear whether Ethereum will maintain its competitive advantage. Some crypto enthusiasts see interoperability as the future of Web3, which may mean Ethereum competitors gain a larger share of the TVL.

Whether Ethereum remains the dominant smart contract blockchain will largely depend on the success of Ethereum's recent upgrades.

Ethereum layer-2 scaling solutions

In addition to Ethereum's post-Merge upgrades, there are many layer-2 blockchains that are already making it cheaper and faster to interact with Ethereum. Unlike ETH killers, these layer-2 blockchains are built on top of Ethereum and are focused on making the main blockchain more convenient. These include products such as Polygon, Arbitrum and Optimism.

The growth in layer-2 scaling solutions may keep Ethereum competitive even as ETH killers steal some of the crypto market share.

Risks edit edit source

- Volatility: The value of ETH can experience rapid and substantial fluctuations as shown in the previous section, leading to potential losses for investors and users.

- Regulatory: ETH subject to regulatory scrutiny in various jurisdictions. Changes in government regulations or policies can impact the adoption, usage, and value of Ethereum[11].

- Collapsing of Bitcoin: Bitcoin remains the leading cryptocurrency, valued highly for its position in the market, but it lacks versatility beyond its use as a digital currency. The potential for a collapse of Bitcoin is a real concern, and such an event could have a significant impact on all other cryptocurrencies, including ETH. A similar situation occurred in 2018 when the market experienced a downturn.

To conclude, there is no denying the rise in Ethereum competitors, but Ethereum still dominates as the leading smart contract platform. ETH killers may have faster transaction speeds and lower fees, but each has unique strengths and weaknesses. Also, as Ethereum moves forward with its post-Merge upgrades, it might erase some of its competitors' value propositions.While Ethereum may lose market share as more competitors enter the market, it still has a significant lead in the smart contract space. Plus, thanks to the growth in layer-2 scaling solutions, it's becoming easier for users to interact with Ethereum without paying exorbitant fees.

References and notes edit edit source

- ↑

- ↑ https://www.makeuseof.com/best-dapps-ethereum-eth/

- ↑ https://www.coingecko.com/en/global-charts

- ↑ 4.0 4.1 https://www.coinbase.com/price/ethereum

- ↑ https://www.globaldata.com/data-insights/financial-services/ethereums-price-history/

- ↑ https://www.statista.com/statistics/806453/price-of-ethereum/

- ↑ https://www.coinbase.com/price/bitcoin

- ↑ https://time.com/6158182/vitalik-buterin-ethereum-profile/

- ↑ https://www.mckinsey.com/featured-insights/mckinsey-explainers/what-is-proof-of-stake

- ↑ https://www.investopedia.com/terms/p/proof-work.asp

- ↑ https://www.axios.com/2022/07/27/regulatory-risk-ethereum-security-model-proof-of-stake-sec

11. https://www.bankrate.com/investing/what-is-ethereum/

12.https://cointelegraph.com/learn/history-of-ethereum-blockchain

13. https://coinmotion.com/ethereum-price/

15.https://medium.com/coinmonks/the-power-and-utility-of-eth-8a6f6858a2b6

![ETH's price history 2015-2023. Source: Statista[6]](/images/4/4e/Ethpricenew.PNG)