Slated: Difference between revisions

>Louis No edit summary |

>Louis No edit summary |

||

| Line 249: | Line 249: | ||

Devops | Devops | ||

[[Category:Thesis]] | |||

[[Category:Equities]] | |||

Revision as of 18:40, 22 July 2022

A leading online film packaging, financing, and distribution marketplace.

Highlights

- Matches filmmakers with talent, financing, sales, and distribution

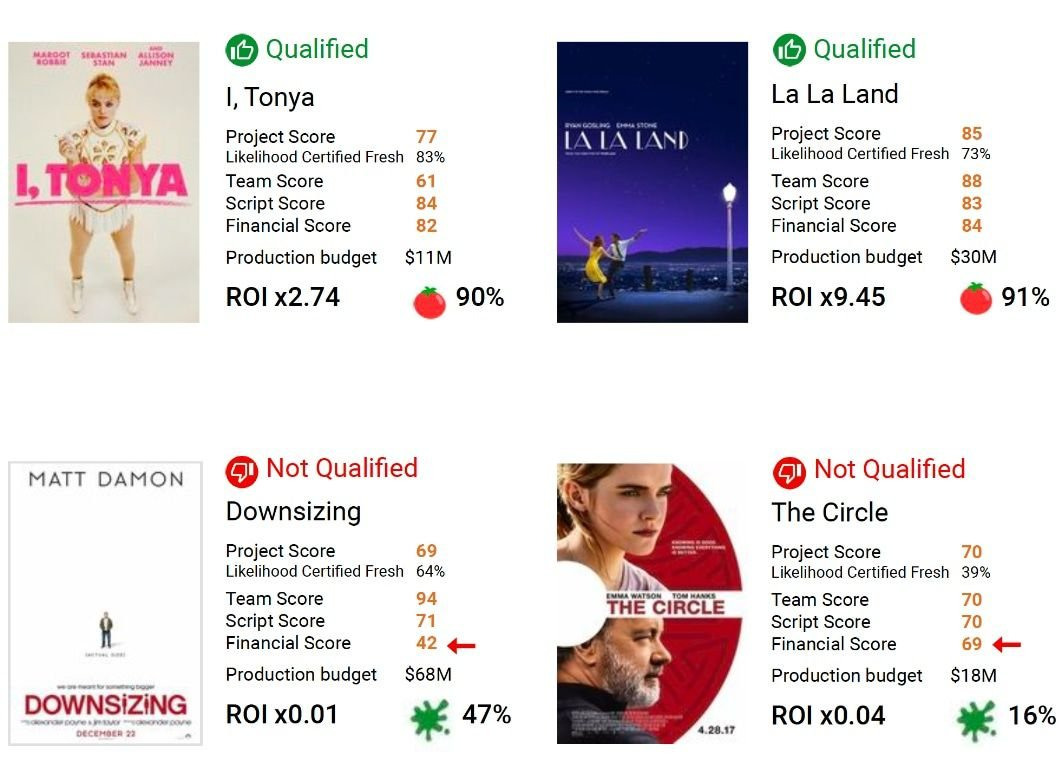

- AI-driven film performance analytics predicts 80% of "hits" and "misses"

- $560M box office generated from 297 Slated-listed theatrical releases

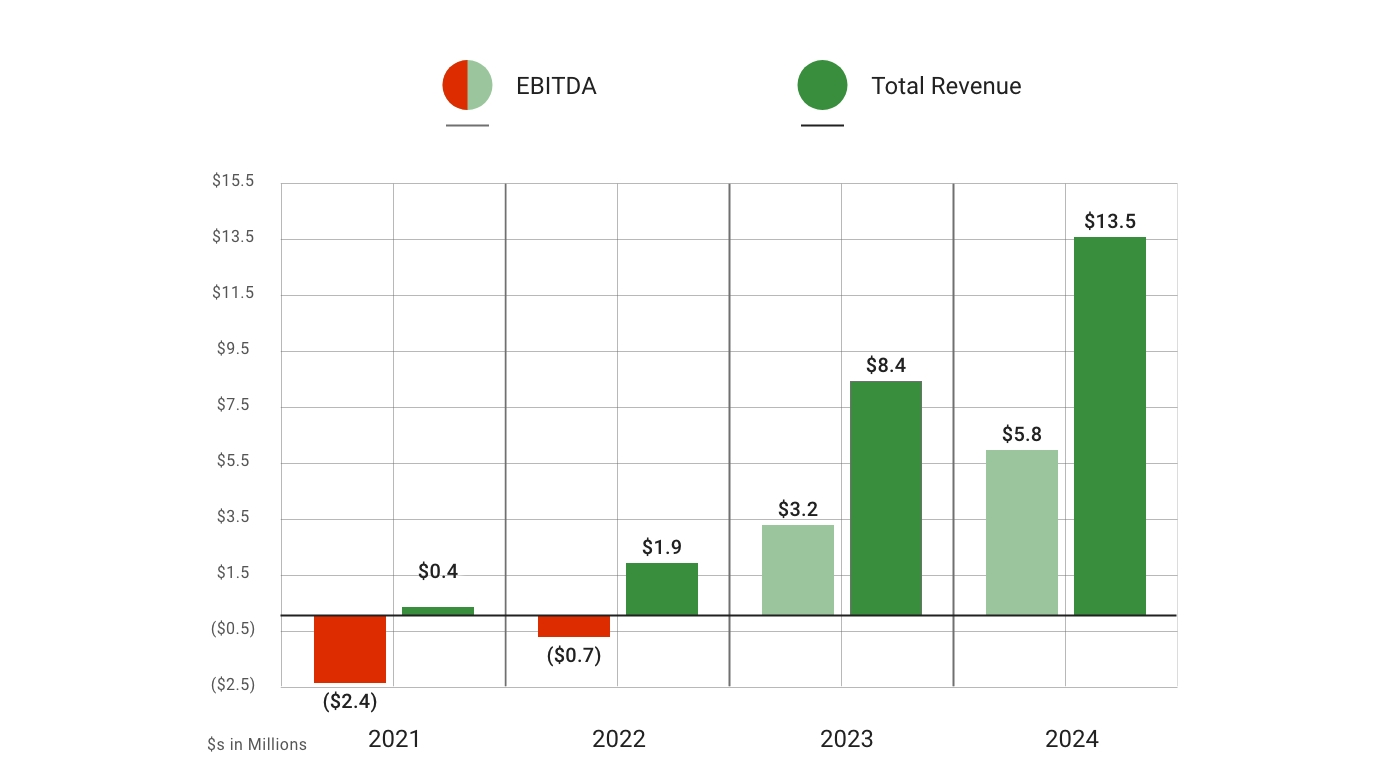

- $13.5M in contracted fees generated to date

- Multi-billion-$ hedge fund committing financing to top scoring projects

- Partnered with Bleecker Street and Round Table to release top scoring films

- In active discussions with Columbia Pictures, Tristar, Universal & more

Problem

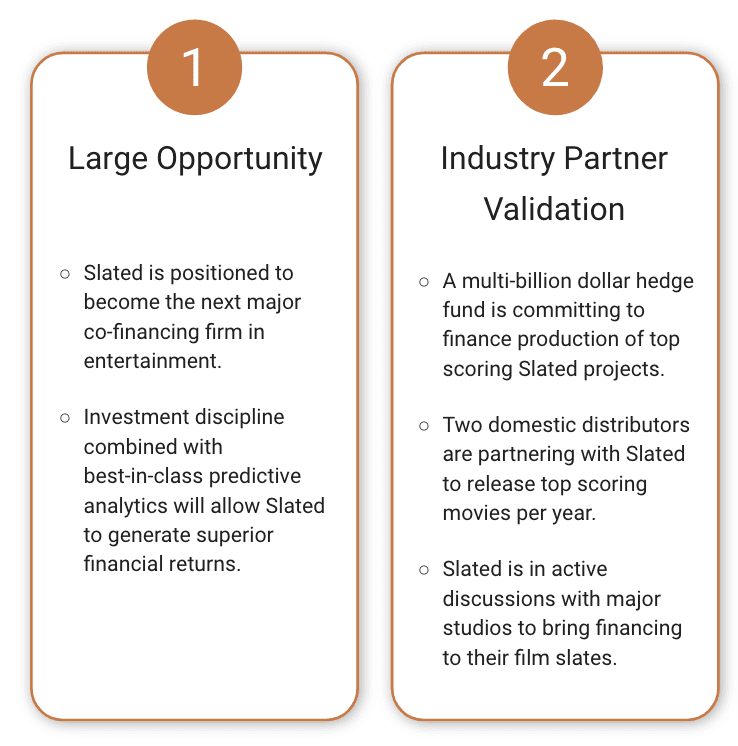

Streaming Wars = Explosive demand for content

The 2021 theatrical and home/mobile entertainment market globally was a record $99.7 billion, +24% vs 2020. Including pay TV, the value increased to a record $328 billion, beating pre-pandemic figures.* As a result, studios and streamers worldwide plan to increase content spend to a record $230 billion in 2022.**

Investing in movies remains one of the more resilient, attractive investment asset classes in the world. However, there are 2 key challenges for investors: early access to deal-flow, and analytics to identify likely “hits”.

*Motion Picture Association **Ampere Analysis

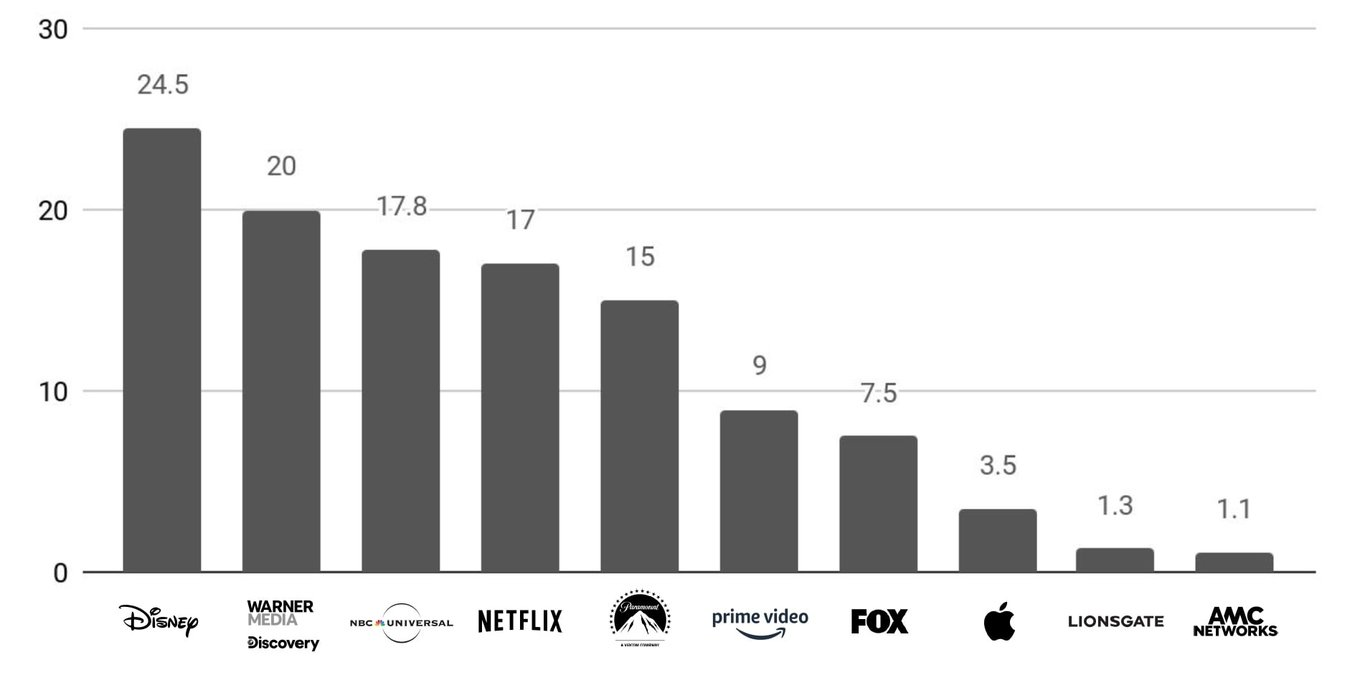

2021 Content Spend (billions)

Solution

Slated: Supplying great content at scale.

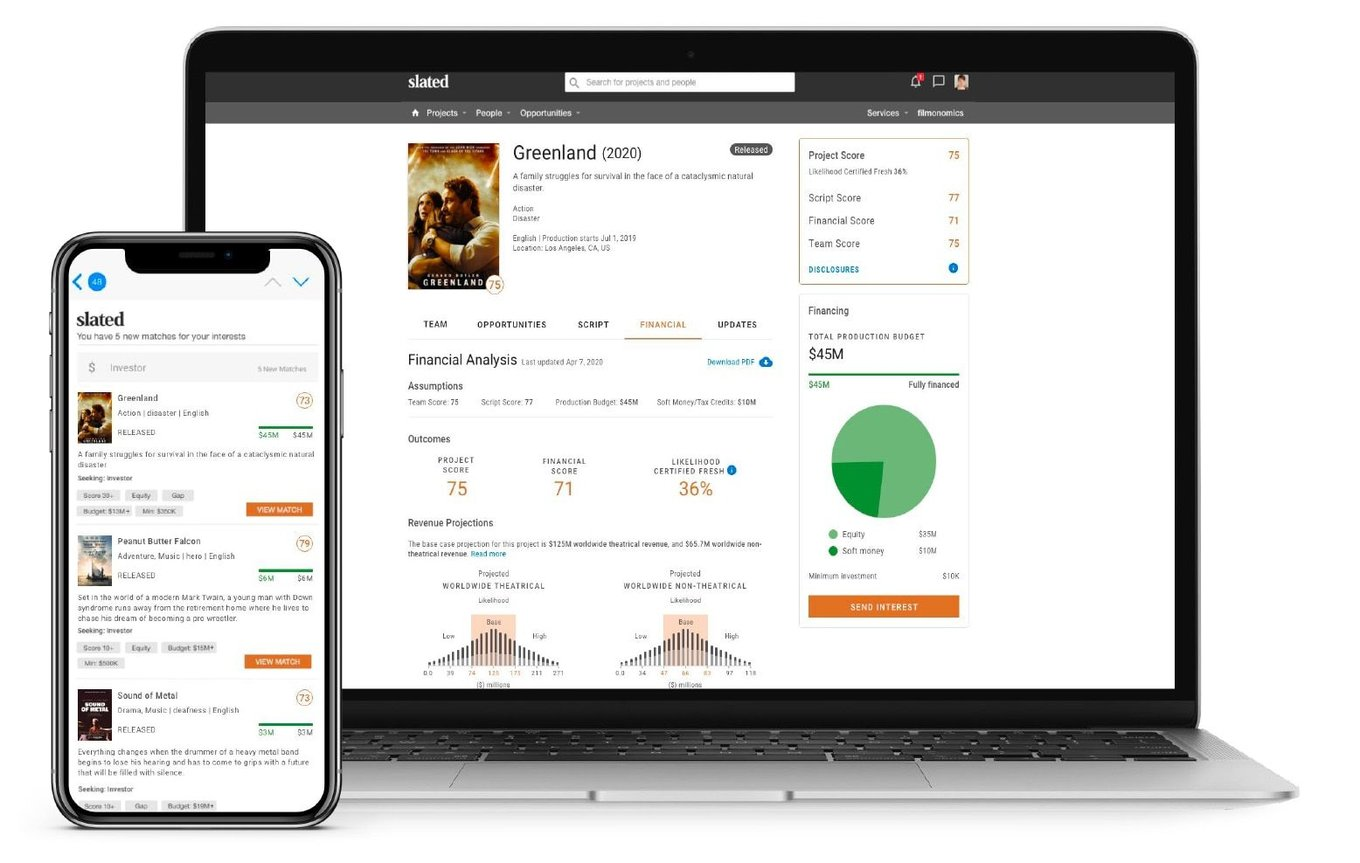

Slated is a leading online film packaging, financing and distribution marketplace, well positioned to supply the exploding global demand for great content.

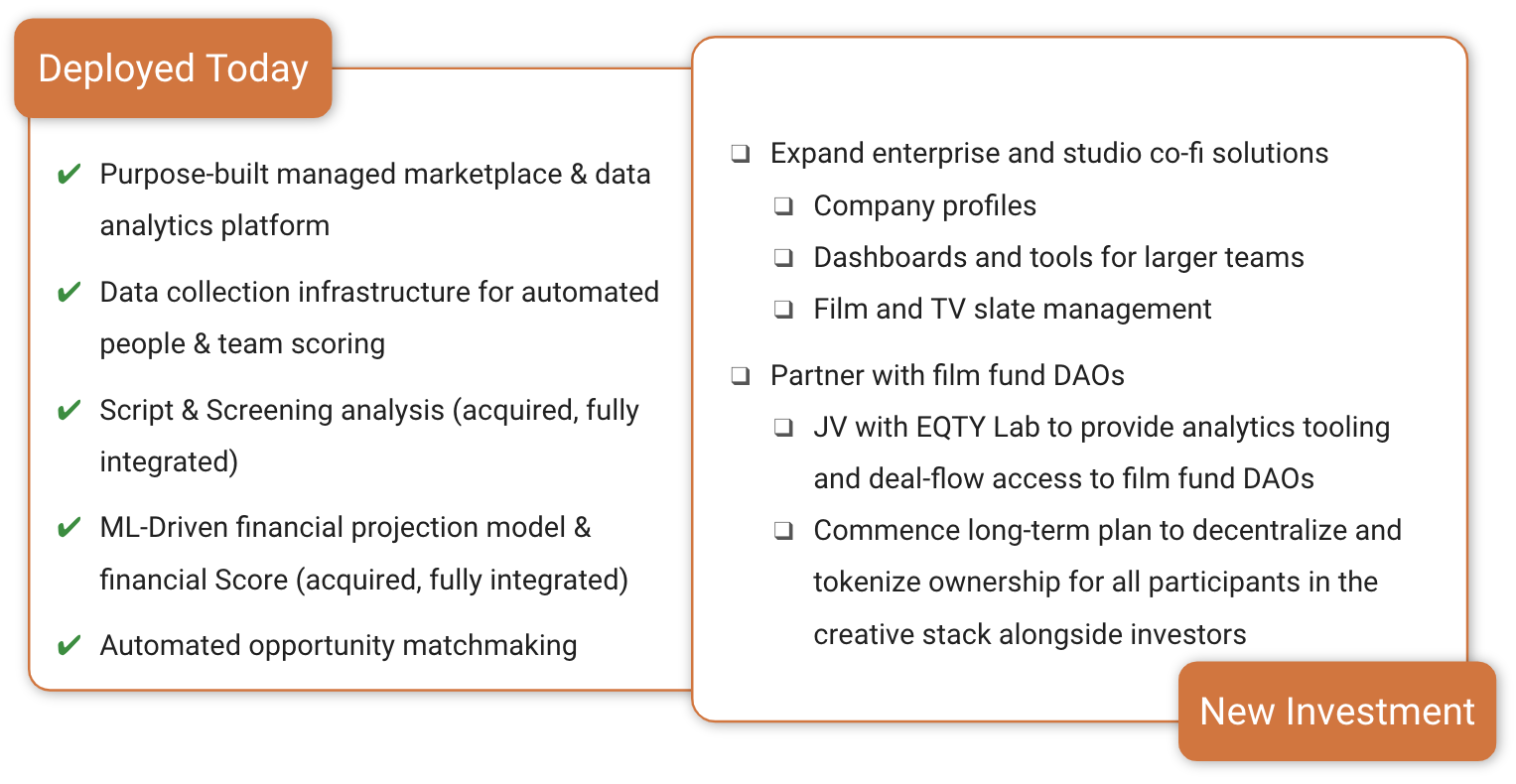

Product

Slated platform advantages

First-look advantage: Slated’s content pipeline

op talent consistently lists great projects during development. 2,000 new projects listed annually, 3 years pre-release on average.

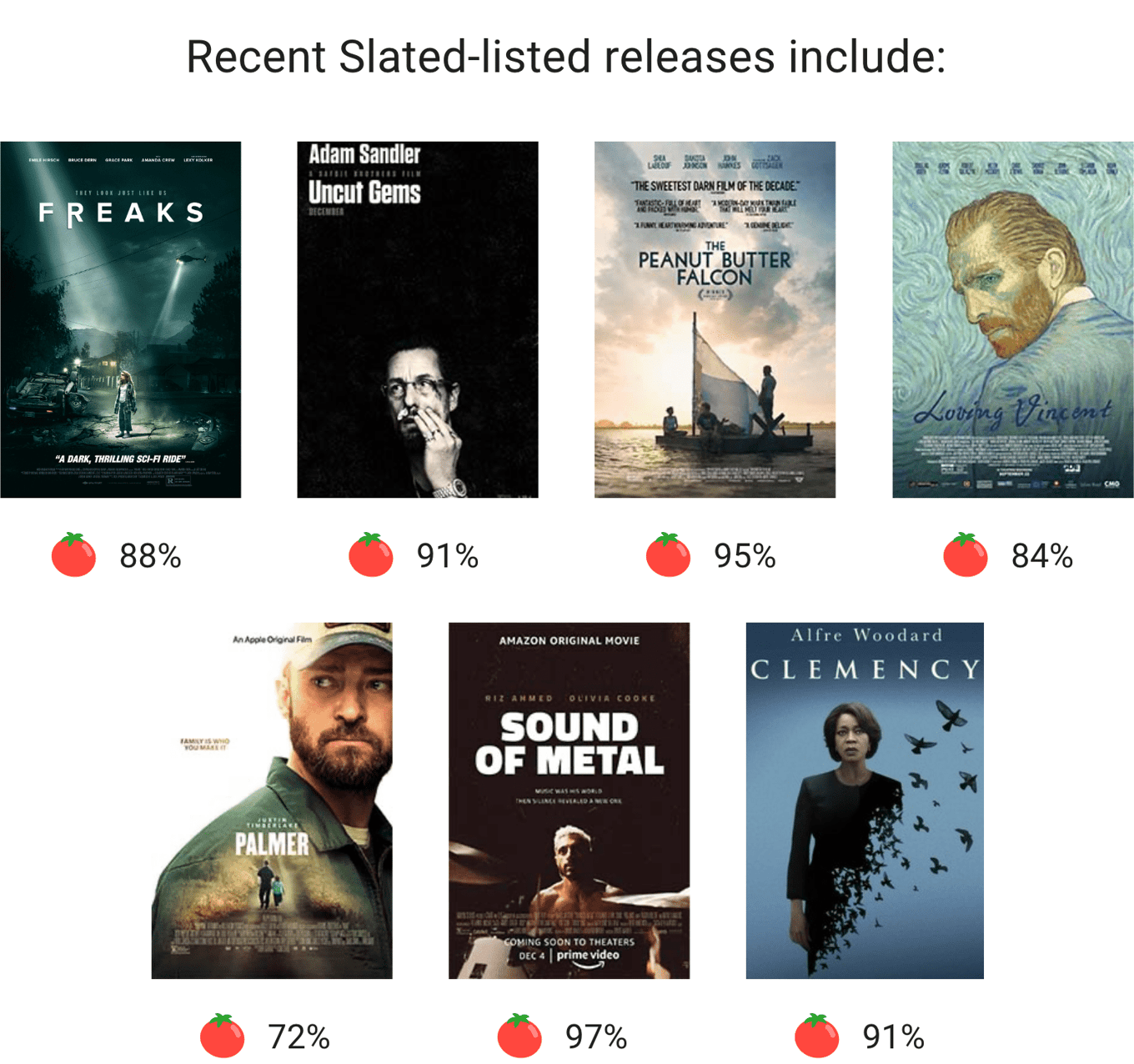

1,400+ Slated-listed films have been released, including 297 theatrical releases grossing over $560M at the box office.

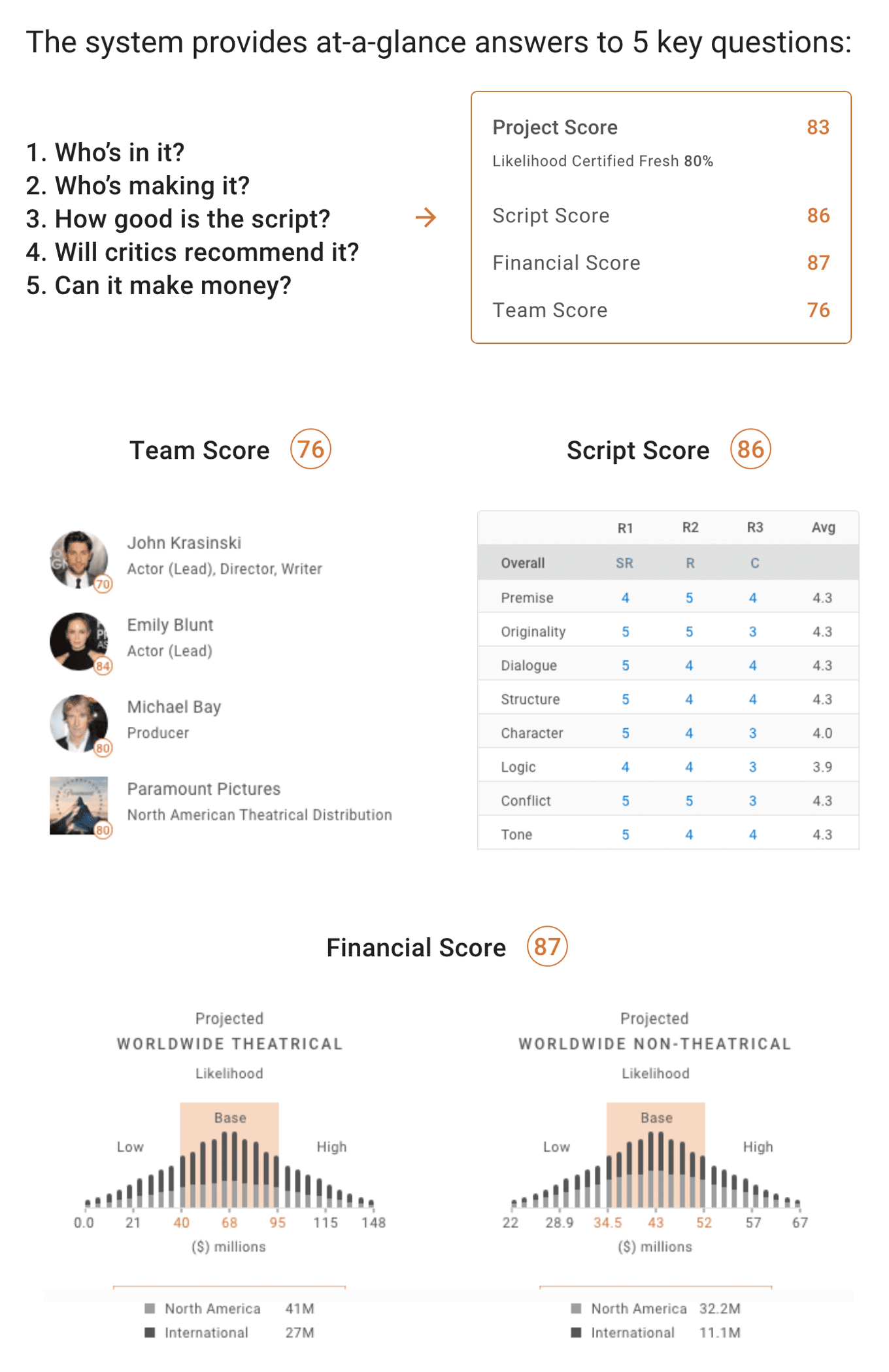

Slated’s proprietary scoring system can identify the most commercially-viable projects based on the track record of the team, the quality of the underlying material, and the project’s likelihood of commercial success.

Arbitrage advantage: Early insights for financiers & distributors

Traction

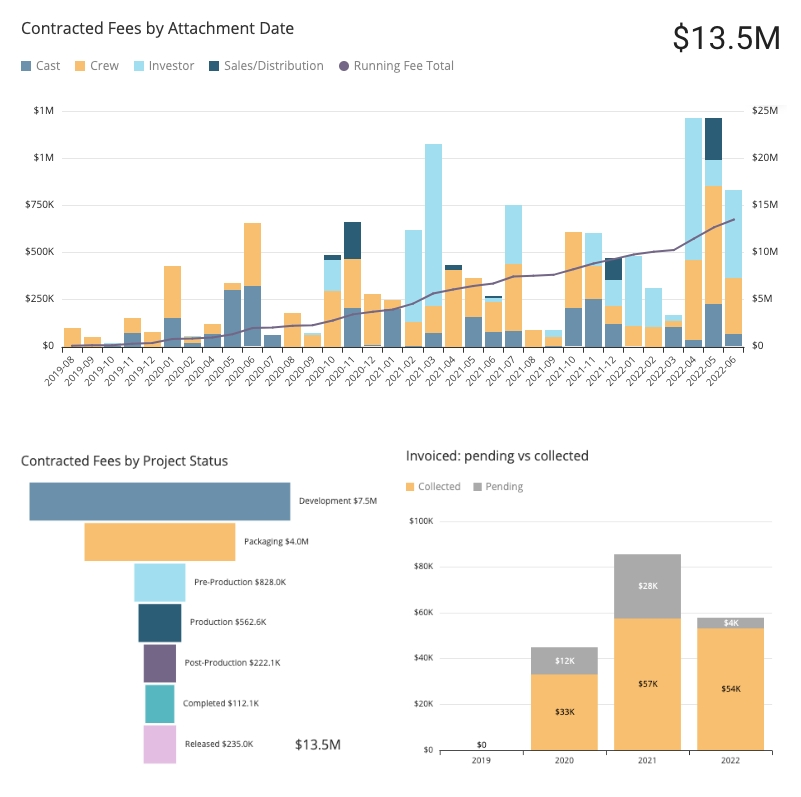

Marketplace traction: Contracted fees growing rapidly

Slated earns fees for cast, crew, investor, and sales/distribution attachments made “via Slated.” Invoicing and collections occur as projects move into production or release.

Customers

Financing & distribution partnerships

Slated is under NDA with financing and distribution companies looking to leverage our A.I. based predictive analytics and deal-flow to finance or distribute film projects with the highest potential ROI.

- Slated is currently in discussions with several multi-billion dollar hedge funds to secure a $50M debt facility to finance the production of top scoring Slated projects.

- Distribution partnerships with Bleecker Street and Round Table to release several top scoring movies per year domestically.

- Slated is in active discussions with major studios to bring $200M+ in financing to their film slates, including:

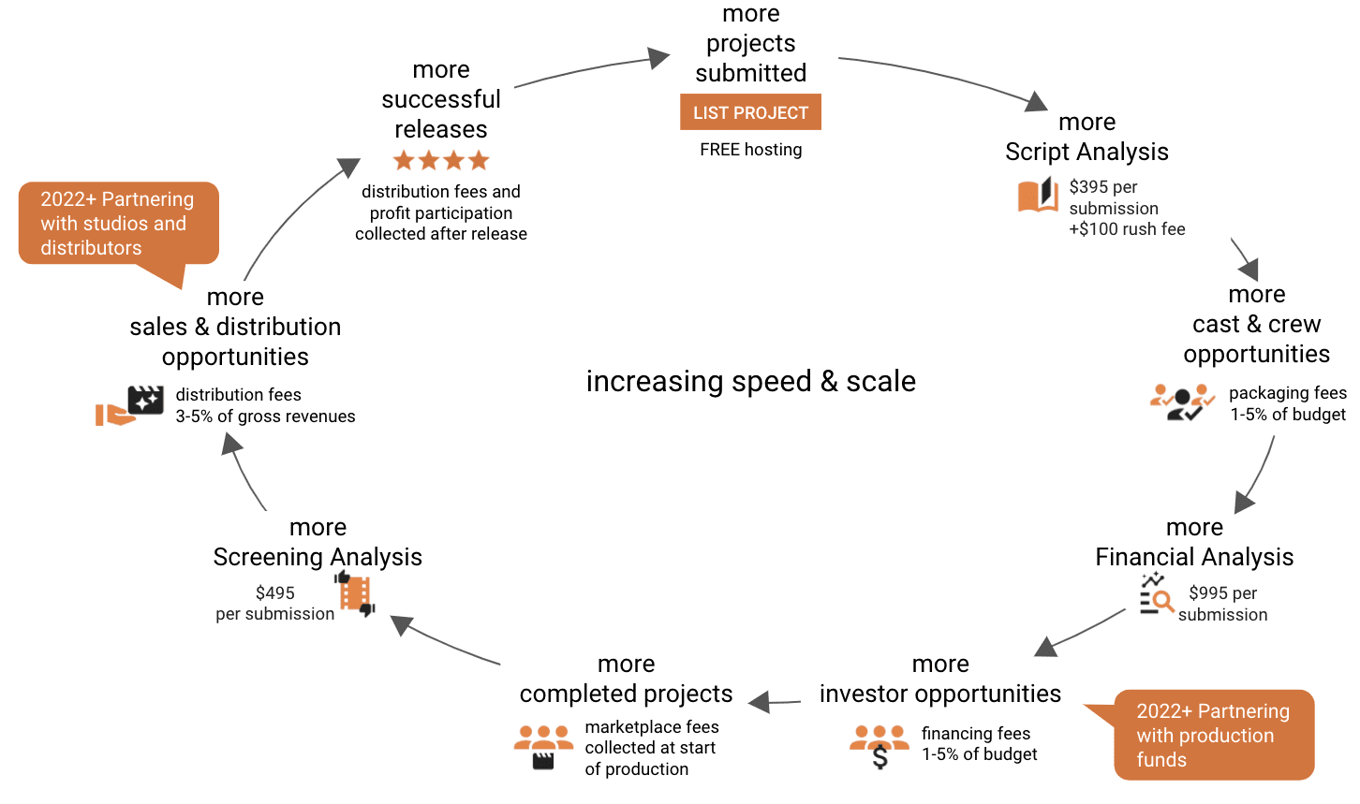

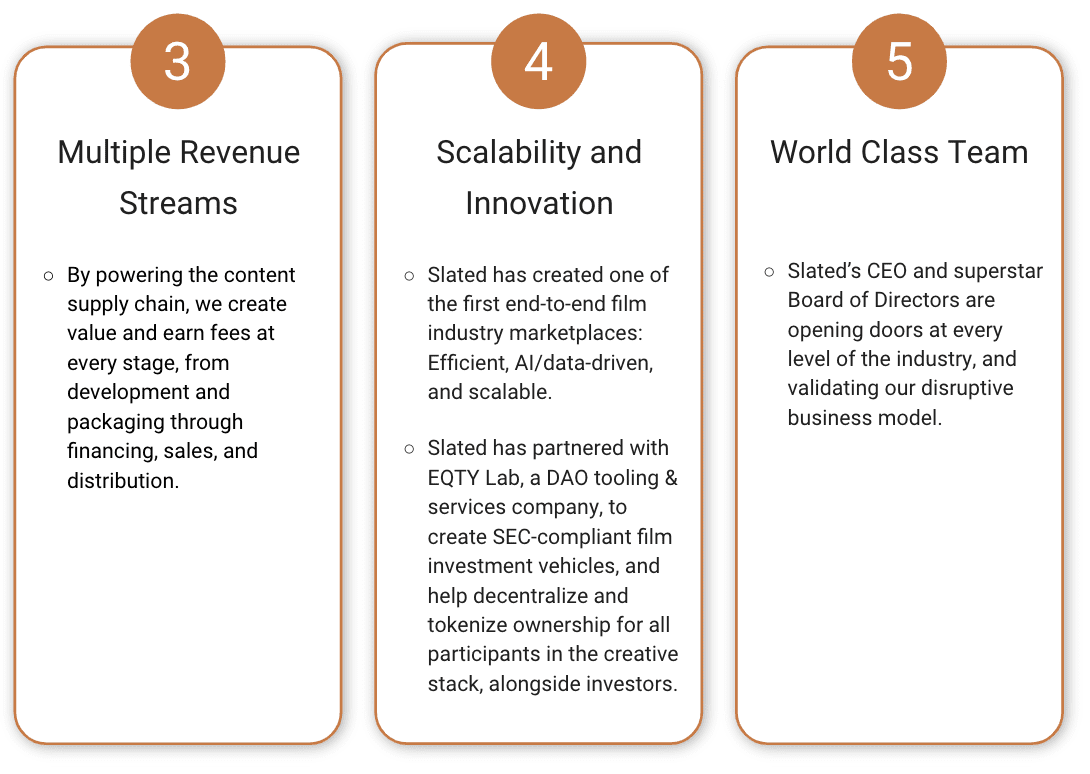

Business model

Earning fees by providing value at every stage.

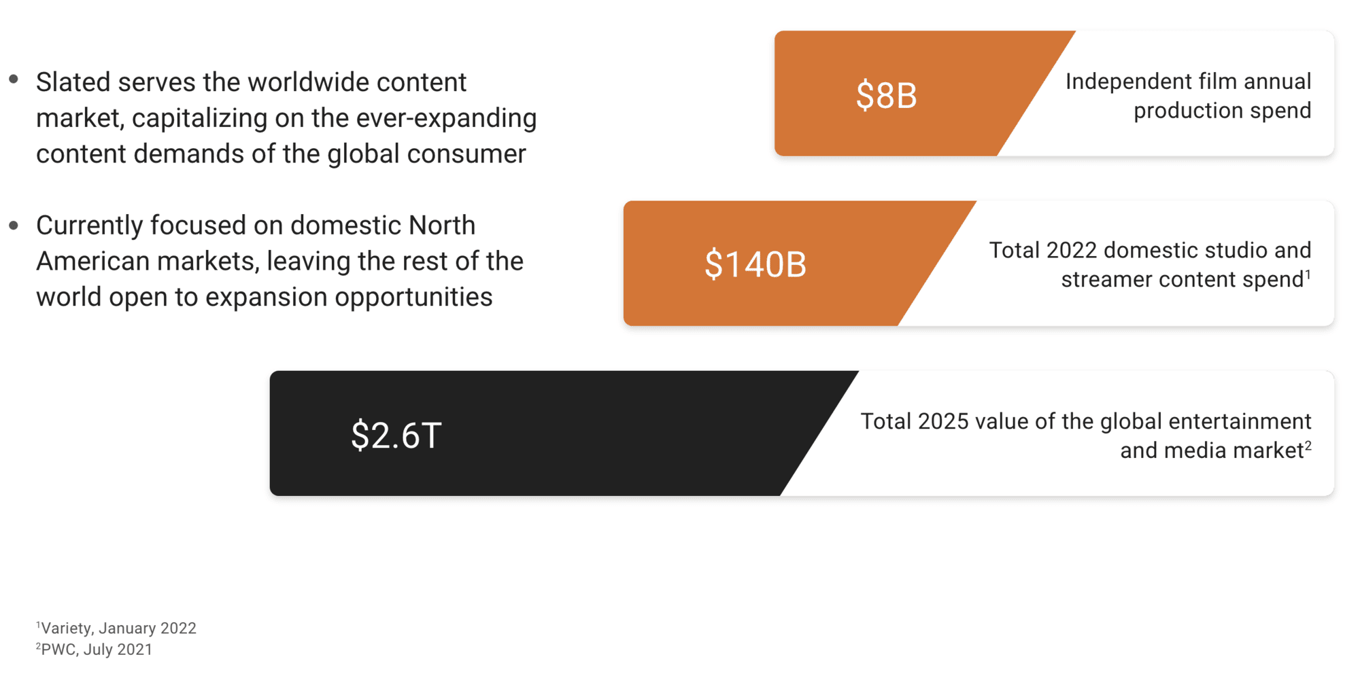

Market

Large Addressable Market

Competition

Slated's analytics and marketplace edge.

Slated is one of the first end-to-end online film packaging, financing, and distribution marketplaces: efficient, AI/data-driven, and scalable.

Vision and strategy

Platform development roadmap

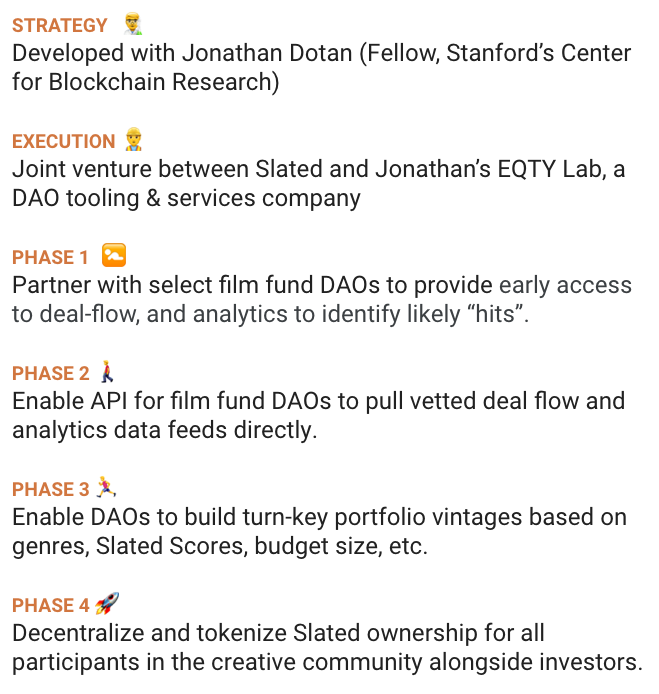

Slated’s DAO & Web3 roadmap

Streamline and transform the market for content ownership via film fund DAOs

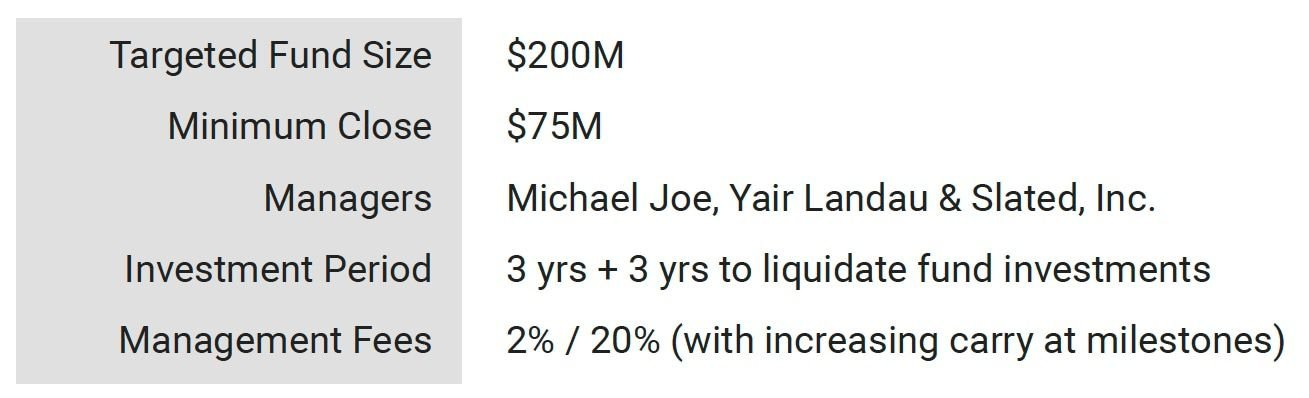

Slated Film Fund I: Production capital for studio co-financing

Slated is raising a first-of-its-kind investment fund leveraging its A.I.-based predictive analytics to finance film projects with the highest potential ROI.

Slated is seizing an unprecedented market opportunity:

- Explosive demand for content and capital requirements

- Absence of co-financing institutional capital

- Uniquely favorable studio terms (e.g. reduced fees, low execution risk)

- Streaming platforms acting as backstop to hedge against risk

- Company has engaged advisors BardiCo & HQ Digital (a Digital Currency Group company) to assist raising capital for Slated’s Studio Co-fi Fund

The fund will co-invest alongside major studios, independent distributors, and Slated marketplace films.

We are already in active discussions with:

Managers greenlight track record

Funding

Veteran Investors

Barry Silbert

- Founder and CEO of Digital Currency Group (DCG), the world’s largest cryptocurrency asset manager with $50B AUM.

- Founder and former CEO of SecondMarket, which sold to Nasdaq in 2015.

- Entrepreneur of the Year by Ernst & Young and Crain’s. Fortune’s prestigious “40 Under 40” list.

Stephan Paternot

- Co-founder & Executive Chairman of Slated

- Co-founder of PalmStar, a film production and financing company that has produced and financed over 30 films including Hereditary (2018), Collateral Beauty (2016), Sing Street (2016) and John Wick (2014).

- Early investor in Digital Currency Group, SecondMarket, LendingClub, Indiegogo, AngelList.

- Co-founder of theglobe.com, one of the first social networks. In 1998 the company had a record-setting IPO, pushing the company valuation to over $1B.

- Ernst & Young Entrepreneur of the Year

- Author of A Very Public Offering, as featured in National Geographic Television series Valley of the Boom.

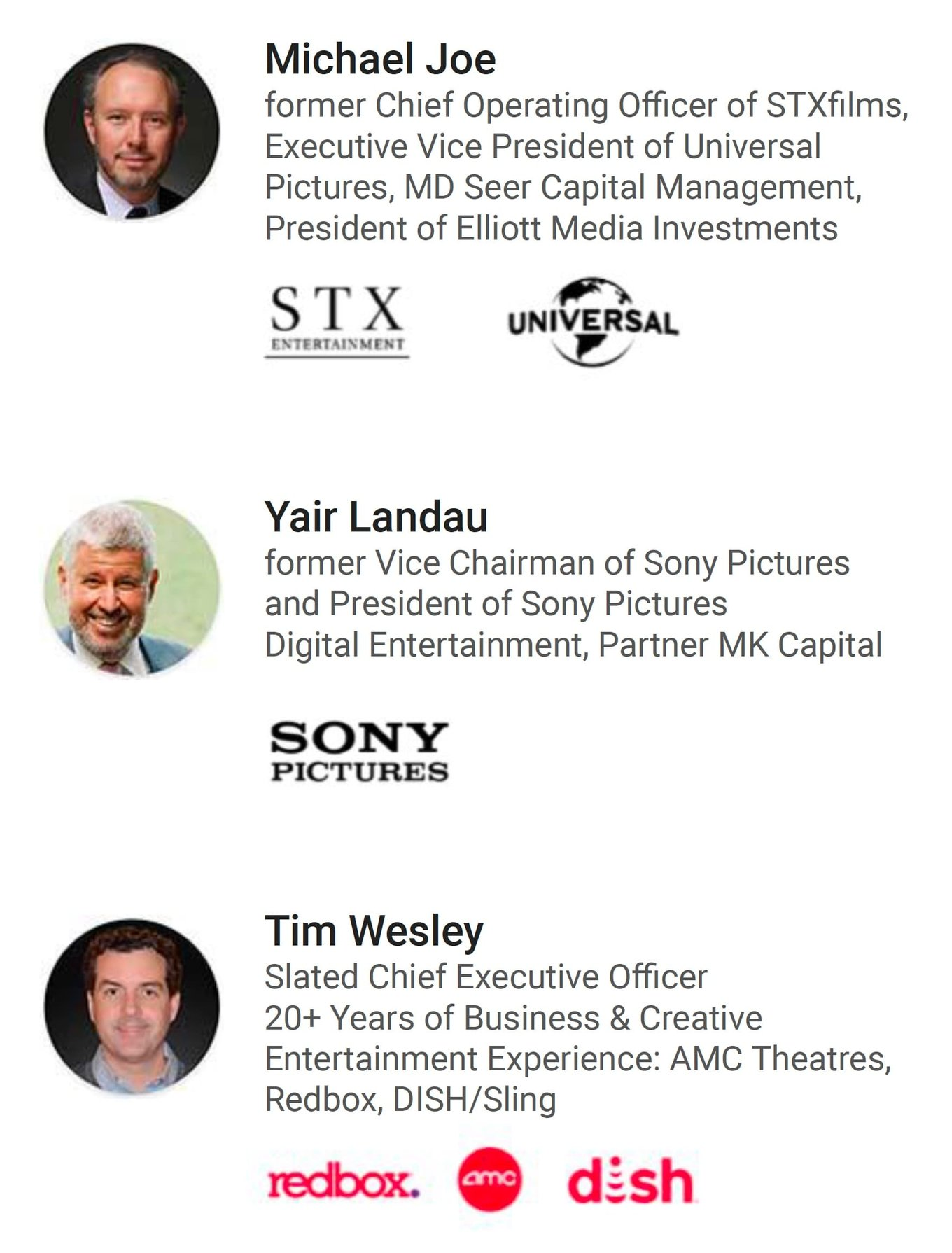

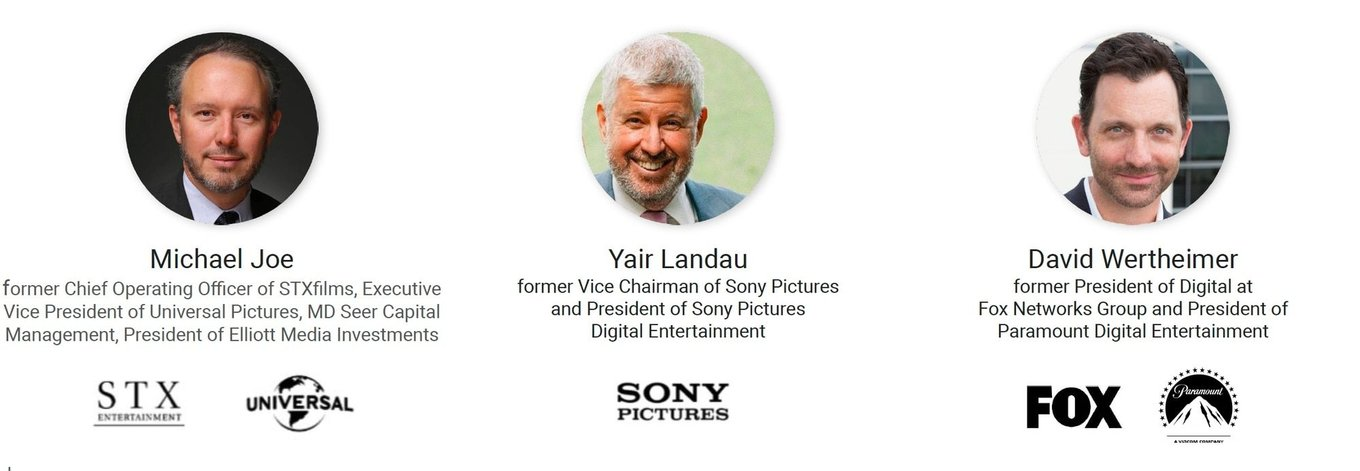

Leadership

CEO & Board of Directors

Our leadership team is opening doors at every level of the film industry

Summary

Why invest in Slated today?

Slated Team

Ann Nguyen

Chief Technical Officer

Greg Gertmenian

Head of Film Development

Jay Burnley

Head of Film Finance

Alex N

Head Architect

Alexander Z

QA Manager/Scrum Master

Alina P

QA

Anton L

Backend Engineer

Ben S

Marketing Associate

Chandler F

Development Assistant

Chelsea T

VP of Development

Dan S

Data Scientist

Dima M

Frontend Manager

Ivan B

Frontend Engineer

Jess H

Social Media Manager

Kris R

Manager of Documentary Films

Kristina M

Marketing

Mirela G

Backend Engineer

Mitchell S

EP Services Manager

Sara B

Sr Data Scientist

Sara S

Accounting

Thien H

Devops