Summary

Adobe Inc. operates as a diversified software company worldwide. It operates through three segments: Digital Media, Digital Experience, and Publishing and Advertising. The Digital Media segment offers products, services, and solutions that enable individuals, teams, and enterprises to create, publish, and promote content; and Document Cloud, a unified cloud-based document services platform. Its flagship product is Creative Cloud, a subscription service that allows members to access its creative products. This segment serves content creators, workers, marketers, educators, enthusiasts, communicators, and consumers. The Digital Experience segment provides an integrated platform and set of applications and services that enable brands and businesses to create, manage, execute, measure, monetize, and optimize customer experiences from analytics to commerce. This segment serves marketers, advertisers, agencies, publishers, merchandisers, merchants, web analysts, data scientists, developers, and executives across the C-suite. The Publishing and Advertising segment offers products and services, such as e-learning solutions, technical document publishing, web conferencing, document and forms platform, web application development, and high-end printing, as well as Advertising Cloud offerings. The company offers its products and services directly to enterprise customers through its sales force and local field offices, as well as to end users through app stores and through its website at adobe.com. It also distributes products and services through a network of distributors, value-added resellers, systems integrators, software vendors and developers, retailers, and original equipment manufacturers. The company was formerly known as Adobe Systems Incorporated and changed its name to Adobe Inc. in October 2018. Adobe Inc. was founded in 1982 and is headquartered in San Jose, California.

Mission

“Changing the world through digital experiences.” [1]

Adobe’s statement reflects how it wants to inspire, transform and move the world forward through technology. Adobe will continue to simplify and ease the life of people using concise and productive applications.

Vision

Adobe in the future wants to be the leading provider of digital media and marketing solutions, giving people tools to powerful cutting edge technology which will enable them to create and deliver engaging content.

Main Offerings

Adobe offers a multitude of products including: [2]

- Acrobat Pro

- Photoshop

- Premiere Pro

- Illustrator

- Adobe Stock

- After Effects

- Animate

Breakdown of Segments

Adobe's business is divided into three main segments: Digital Media, Digital Experience, and Publishing and Advertising. The company's focus is on two growth opportunities:

Digital Media:

- Opportunity: In today's digital world, creativity and content are crucial. Adobe sees a significant market in providing tools and services for people to create and share content on various platforms.

- Strategy: Adobe's flagship product in this segment is Adobe Creative Cloud, a subscription service that offers creative tools integrated with cloud services. The company aims to democratise creativity and enhance collaboration. They provide tools for content creation, photo editing, design, video production, and more.

- Innovation: Adobe is continuously innovating, focusing on expanding content creation across devices, improving collaboration, and empowering the creative community. They're also advancing 3D and immersive content creation.

Digital Experience:

- Opportunity: Businesses are undergoing digital transformation, seeking to provide personalised and engaging experiences to customers across various platforms.

- Strategy: Adobe Experience Cloud offers solutions for managing customer journeys, personalisation, marketing workflows, and content and commerce. The goal is to help businesses transform digitally and deliver exceptional experiences to their customers.

- AI and Innovation: Adobe Sensei, their AI and machine learning technology, enhances digital experiences by providing insights and automating processes. Adobe is also building an open ecosystem through the Adobe Experience Platform.

Publishing and Advertising:

- Legacy Products: This segment includes legacy products like eLearning solutions, technical document publishing, web conferencing, web application development, high-end printing, and Adobe Advertising Cloud for managing digital advertising.

- Market Position: Adobe provides technologies like Adobe PostScript and Adobe PDF for high-quality printing and advanced printing workflows. Adobe Advertising Cloud simplifies digital advertising management across different channels.

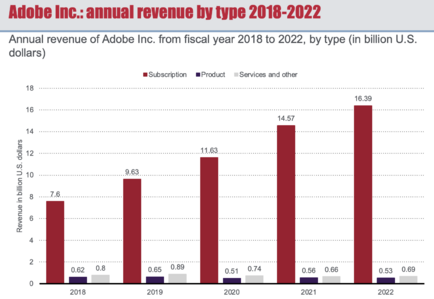

Breakdown of Sector Revenues

Subscription Revenue

- Subscription revenue includes fees for services like Creative Cloud and Adobe Experience Cloud.

- Revenue is recognised over the term of agreements, with some usage-based exceptions.

Product Revenue

- Product revenue includes software licenses purchased on a perpetual basis or for fixed periods.

- Revenue is recognised when the software is available to the customer.

Services and other Revenue

- This includes fees for consulting, training, maintenance, support, and advertising offerings.

- Consulting and training revenues are recognised as services are performed.

- Maintenance and support revenues are recognised notably over the arrangement's term.

- Transaction-based advertising revenue is recognised based on usage.

Competitors

Adobe offers a range of services, and therefore has a number of competitors for its services.

Creative software

For photoshop, some of the main competing softwares are GIMP, a free alternative, Affinity Photo, and Canva, which offers similar services with competitive prices.

Digital Marketing and Analytics

The main competitors are Salesforce, Oracle, Hubspot, and the Google marketing platform. All provide marketing related services such as market automation, customer relationship management, digital marketing, analytics and advertising.

Video and multimedia

For Adobe Premiere, main competitors are Final cut pro and Vegas pro in the video editing space, which may be faster than the Premiere Pro as it is easier to do light editing, but harder to edit non-traditional timelines as it is non-customisable

Web design

Sketch, Figma, Axure RP are all tools that compete with Adobe for this service, providing design tools for prototyping, user testing, and real time collaborations during web and experience designing.

In the application development field, Adobe has 60.80% with the Creative cloud, significantly higher than the second highest which is Microsoft Azure with 15%

To break this down further, Premiere Pro has possessed 23.3% of the video editing market, which is the highest, though Apple’s Final Cut Pro is very close in market shares (22.86%)

Adobe document cloud has 0.35% in market share in the data management technologies, dwarfed by the likes of G suite (68%) and office 365 (7%).

Valuation (DCF)

Balance sheet (historic and forecasted)

| Annual As Reported in Millions of U.S. Dollars | ||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Total cash and cash equivalents | 1,643.00 | 2,650.00 | 4,478.00 | 3,844.00 | 4,236.00 | 11,486.45 | 19,429.99 | 28,124.06 | 37,630.47 | 48,018.48 |

| ST Investments | 1,586.00 | 1,527.00 | 1,514.00 | 1,954.00 | 1,860.00 | 1,934.40 | 2,011.78 | 2,092.25 | 2,175.94 | 2,262.97 |

| Trade receivables | 1,331.00 | 1,544.00 | 1,408.00 | 1,894.00 | 2,088.00 | 2,244.54 | 2,413.92 | 2,597.18 | 2,795.44 | 3,009.94 |

| Doubtful Account | (15.00) | (10.00) | (10.00) | (16.00) | (23.00) | (24.15) | (25.36) | (26.63) | (27.96) | (29.35) |

| Prepaid expenses and other current assets | 268.00 | 690.00 | 675.00 | 993.00 | 835.00 | 860.05 | 885.85 | 912.43 | 939.80 | 967.99 |

| Total current assets | 4,813.00 | 6,401.00 | 8,065.00 | 8,669.00 | 8,996.00 | 16,501.29 | 24,716.18 | 33,699.29 | 43,513.70 | 54,230.03 |

| PPE | 2,525.00 | 2,954.00 | 3,056.00 | 3,124.00 | 3,477.00 | 3,768.69 | 4,079.83 | 4,411.74 | 4,765.82 | 5,140.76 |

| accumulated depreciation and amortizatio | (1,406.00) | (1,569.00) | (1,458.00) | (1,451.00) | (1,569.00) | (1,830.21) | (2,103.85) | (2,390.53) | (2,690.85) | (3,005.49) |

| Operating lease right-of-use assets, net | -- | -- | 487.00 | 443.00 | 407.00 | 415.14 | 423.44 | 431.91 | 440.55 | 449.36 |

| Goodwill | 10,581.00 | 10,691.00 | 10,742.00 | 12,668.00 | 12,787.00 | 13,042.74 | 13,303.59 | 13,569.67 | 13,841.06 | 14,117.88 |

| other intangibles | 2,068.00 | 1,719.00 | 1,359.00 | 1,820.00 | 1,449.00 | 1,492.47 | 1,537.24 | 1,583.36 | 1,630.86 | 1,679.79 |

| Deferred income taxes | -- | -- | 1,370.00 | 1,085.00 | 777.00 | 777.00 | 777.00 | 777.00 | 777.00 | 777.00 |

| other assets | 231.00 | 656.00 | 744.00 | 883.00 | 841.00 | 724.24 | 606.19 | 486.79 | 365.94 | 243.56 |

| Total Assets | 18,812.00 | 20,852.00 | 24,365.00 | 27,241.00 | 27,165.00 | 34,891.36 | 43,339.63 | 52,569.23 | 62,644.07 | 73,632.90 |

| Liabilities ($ Millions) | ||||||||||

| Trade payables | 186.00 | 209.00 | 306.00 | 312.00 | 379.00 | 397.95 | 417.85 | 438.74 | 460.68 | 483.71 |

| Accrued expenses | 1,163.00 | 1,367.00 | 1,418.00 | 1,736.00 | 1,790.00 | 1,879.50 | 1,973.48 | 2,072.15 | 2,175.76 | 2,284.54 |

| Debt | 0.00 | 0.00 | 0.00 | 0.00 | 500.00 | 520.00 | 540.80 | 562.43 | 584.93 | 608.33 |

| Deferred Revenue | 2,916.00 | 3,378.00 | 3,629.00 | 4,733.00 | 5,297.00 | 5,667.79 | 6,064.54 | 6,489.05 | 6,943.29 | 7,429.32 |

| Income taxes payable | 36.00 | 56.00 | 63.00 | 59.00 | 75.00 | 80.25 | 85.87 | 91.88 | 98.31 | 105.19 |

| Operating lease liabilities | 0.00 | 0.00 | 92.00 | 97.00 | 87.00 | 92.22 | 97.75 | 103.62 | 109.84 | 116.43 |

| Total current liabilities | 4,301.00 | 5,010.00 | 5,508.00 | 6,937.00 | 8,128.00 | 8,637.71 | 9,180.28 | 9,757.87 | 10,372.79 | 11,027.51 |

| Long-term liabilities: | ||||||||||

| Debt | 4,115.00 | 4,138.00 | 4,117.00 | 4,123.00 | 3,629.00 | 3,774.16 | 3,925.13 | 4,082.13 | 4,245.42 | 4,415.23 |

| Deferred revenue | 138.00 | 123.00 | 130.00 | 145.00 | 117.00 | 125.19 | 133.95 | 143.33 | 153.36 | 164.10 |

| Income taxes payable | 644.00 | 616.00 | 529.00 | 534.00 | 530.00 | 561.80 | 595.51 | 631.24 | 669.11 | 709.26 |

| Operating lease liabilities | 252.00 | 261.00 | 499.00 | 453.00 | 417.00 | 446.19 | 477.42 | 510.84 | 546.60 | 584.86 |

| Other liabilities | -- | 173.00 | 223.00 | 252.00 | 293.00 | 319.37 | 347.06 | 376.14 | 406.68 | 438.77 |

| Total liabilities | 9,450.00 | 10,321.00 | 11,006.00 | 12,444.00 | 13,114.00 | 13,864.42 | 14,659.35 | 15,501.55 | 16,393.97 | 17,339.74 |

| Stockholders’ equity: | ||||||||||

| Common stock | ||||||||||

| Additional paid-in-capital | 5,685.00 | 6,505.00 | 7,357.00 | 8,428.00 | 9,868.00 | 10,972.46 | 12,107.50 | 13,273.98 | 14,472.79 | 15,704.85 |

| Retained earnings | 11,816.00 | 14,829.00 | 19,706.00 | 23,905.00 | 28,319.00 | 34,451.27 | 41,243.23 | 48,751.30 | 57,036.24 | 66,163.44 |

| Accumulated other comprehensive income (loss) | (148.00) | (188.00) | (158.00) | (137.00) | (293.00) | (301.79) | (310.84) | (320.17) | (329.77) | (339.67) |

| Treasury stock | (7,991.00) | (10,615.00) | (13,546.00) | (17,399.00) | (23,843.00) | (24,095.00) | (24,359.60) | (24,637.43) | (24,929.15) | (25,235.46) |

| Total equity | 9,362.00 | 10,531.00 | 13,359.00 | 14,797.00 | 14,051.00 | 21,026.94 | 28,680.28 | 37,067.68 | 46,250.10 | 56,293.16 |

| Total equity and liabilities | 18,812.00 | 20,852.00 | 24,365.00 | 27,241.00 | 27,165.00 | 34,891.36 | 43,339.63 | 52,569.23 | 62,644.07 | 73,632.90 |

| Check | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Income statement (historic and forecasted)

| Annual As Reported in Millions of U.S. Dollars | ||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Revenue: | ||||||||||

| Product | 622.00 | 648.00 | 507.00 | 555.00 | 532.00 | 563.92 | 597.76 | 633.62 | 671.64 | 711.94 |

| Subscription | 7,922.00 | 9,994.00 | 11,626.00 | 14,573.00 | 16,388.00 | 17,535.16 | 18,762.62 | 20,076.00 | 21,481.33 | 22,985.02 |

| Service and Other | 486.00 | 529.00 | 735.00 | 657.00 | 686.00 | 720.30 | 756.32 | 794.13 | 833.84 | 875.53 |

| Total Revenue | 9,030.00 | 11,171.00 | 12,868.00 | 15,785.00 | 17,606.00 | 18,819.38 | 20,116.69 | 21,503.76 | 22,986.80 | 24,572.48 |

| Cost of revenue | ||||||||||

| Subscription | -- | -- | 1,108.00 | 1,374.00 | 1,646.00 | 1,695.38 | 1,746.24 | 1,798.63 | 1,852.59 | 1,908.17 |

| Products | 46.00 | 40.00 | 36.00 | 41.00 | 35.00 | 36.05 | 37.13 | 38.25 | 39.39 | 40.57 |

| Stock-based Compensation & Service and Support | 341.00 | 411.00 | 578.00 | 450.00 | 484.00 | 508.20 | 533.61 | 560.29 | 588.31 | 617.72 |

| Total cost of revenue | 387.00 | 451.00 | 1,722.00 | 1,865.00 | 2,165.00 | 2,239.63 | 2,316.98 | 2,397.16 | 2,480.29 | 2,566.46 |

| Gross profit | 8,643.00 | 10,720.00 | 11,146.00 | 13,920.00 | 15,441.00 | 16,579.75 | 17,799.71 | 19,106.59 | 20,506.51 | 22,006.02 |

| Operating expenses: | ||||||||||

| Research & Development | 1,538.00 | 1,930.00 | 2,188.00 | 2,540.00 | 2,987.00 | 3,136.35 | 3,293.17 | 3,457.83 | 3,630.72 | 3,812.25 |

| Sales and marketing | 2,621.00 | 3,245.00 | 3,591.00 | 4,321.00 | 4,968.00 | 5,141.88 | 5,321.85 | 5,508.11 | 5,700.89 | 5,900.43 |

| General and Administrative | 588.00 | 707.00 | 776.00 | 878.00 | 1,030.00 | 1,060.90 | 1,092.73 | 1,125.51 | 1,159.27 | 1,194.05 |

| Depreciation | 157.00 | 173.00 | 192.00 | 207.00 | 189.00 | 198.45 | 208.37 | 218.79 | 229.73 | 241.22 |

| Amortization of intangibles | 91.00 | 175.00 | 162.00 | 172.00 | 169.00 | 177.45 | 186.32 | 195.64 | 205.42 | 215.69 |

| Total operating expenses | 4,995.00 | 6,230.00 | 6,909.00 | 8,118.00 | 9,343.00 | 9,715.03 | 10,102.44 | 10,505.87 | 10,926.04 | 11,363.64 |

| Operating income | 3,648.00 | 4,490.00 | 4,237.00 | 5,802.00 | 6,098.00 | 6,864.72 | 7,697.27 | 8,600.72 | 9,580.48 | 10,642.38 |

| Interest expense | (99.00) | (157.00) | (116.00) | (113.00) | (113.00) | 113.22 | 117.75 | 122.46 | 127.36 | 132.46 |

| Investment gains (losses), net | 3.00 | 52.00 | 14.00 | 16.00 | (19.00) | (19.95) | (20.95) | (21.99) | (23.09) | (24.25) |

| Other income (expense), net | 50.00 | 42.00 | 41.00 | 0.00 | 42.00 | 44.10 | 46.31 | 48.62 | 51.05 | 53.60 |

| Other items | (810.00) | (1,222.00) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Total non-operating income (expense), net | (856.00) | (1,285.00) | (61.00) | (97.00) | (90.00) | (94.50) | (99.23) | (104.19) | (109.40) | (114.87) |

| Net Income Before Taxes | 2,792.00 | 3,205.00 | 4,176.00 | 5,705.00 | 6,008.00 | 6,770.22 | 7,598.05 | 8,496.53 | 9,471.08 | 10,527.52 |

| Tax | 15.00 | 251.00 | (1,084.00) | 883.00 | 1,252.00 | 1,354.04 | 1,519.61 | 1,699.31 | 1,894.22 | 2,105.50 |

| Net Income | 2,591.00 | 2,951.00 | 5,260.00 | 4,822.00 | 4,756.00 | 5,416.18 | 6,078.44 | 6,797.22 | 7,576.87 | 8,422.01 |

| Basic Weighted Average Shares | 491.00 | 486.00 | 481.00 | 477.00 | 470.00 | 493.50 | 518.18 | 544.08 | 571.29 | 599.85 |

| Basic EPS | 5.28 | 6.07 | 10.94 | 10.11 | 10.12 | 10.98 | 11.73 | 12.49 | 13.26 | 14.04 |

| Diluted Weighted Average Shares | 498.00 | 492.00 | 485.00 | 481.00 | 471.00 | 494.55 | 519.28 | 545.24 | 572.50 | 601.13 |

| Diluted EPS | 5.20 | 6.00 | 10.85 | 10.02 | 10.10 | 10.95 | 11.71 | 12.47 | 13.23 | 14.01 |

Cash flow statement (historic and forecasted)

| Annual As Reported in Millions of U.S. Dollars | ||||||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Net Income | 2,590.80 | 2,951.50 | 5,260.00 | 4,822.00 | 4,756.00 | 5,416.18 | 6,078.44 | 6,797.22 | 7,576.87 | 8,422.01 |

| Depreciation | 346.50 | 736.70 | 757.00 | 788.00 | 856.00 | 898.45 | 908.37 | 918.79 | 929.73 | 941.22 |

| Reduction of operating lease right-of-use assets | -- | -- | 87.00 | 73.00 | 83.00 | 77.08 | 77.23 | 77.40 | 77.58 | 77.78 |

| Stock-based compensation | 609.60 | 787.70 | 909.00 | 1,069.00 | 1,440.00 | 848.72 | 874.18 | 900.41 | 927.42 | 955.24 |

| Other non-cash items | 7.20 | 13.80 | 40.00 | 7.00 | 10.00 | 10.50 | 11.03 | 11.58 | 12.16 | 12.76 |

| Trade receivables, net | (2.00) | (187.80) | 106.00 | (430.00) | (198.00) | (167.04) | (180.40) | (194.84) | (210.42) | (227.26) |

| Prepaid expenses and other assets | (77.20) | (531.10) | (288.00) | (475.00) | (94.00) | (125.59) | (128.55) | (131.52) | (134.50) | (137.48) |

| Trade payables | 54.90 | 23.10 | 96.00 | (20.00) | 66.00 | 18.95 | 19.90 | 20.89 | 21.94 | 23.03 |

| Accrued Expenses | 43.80 | 171.70 | 86.00 | 162.00 | 7.00 | 89.50 | 93.98 | 98.67 | 103.61 | 108.79 |

| Income taxes payable | 479.20 | 4.20 | (72.00) | 2.00 | 19.00 | 37.05 | 39.33 | 41.74 | 44.31 | 47.03 |

| Deferred revenue | 444.70 | 497.00 | 258.00 | 1,053.00 | 536.00 | 378.98 | 405.51 | 433.89 | 464.27 | 496.77 |

| Cash from Operating Activities | 4,029.40 | 4,421.90 | 5,727.00 | 7,230.00 | 7,838.00 | 7,482.78 | 8,199.00 | 8,974.24 | 9,812.94 | 10,719.90 |

| Cash Flow-Investing Activities ($ Millions) | ||||||||||

| Purchases and sales of long-term invest | (18.50) | (48.70) | (15.00) | (42.00) | (46.00) | (48.30) | (50.72) | (53.25) | (55.91) | (55.91) |

| Purchases of short-term investments | (566.10) | (699.90) | (1,071.00) | (1,533.00) | (909.00) | (954.45) | (1,002.17) | (1,052.28) | (1,104.90) | (1,160.14) |

| Proceeds from sales of short-term invest | 1,709.50 | 86.10 | 167.00 | 191.00 | 270.00 | 283.50 | 297.68 | 312.56 | 328.19 | 344.60 |

| Maturities of short-term investments | 765.90 | 699.50 | 915.00 | 877.00 | 683.00 | 717.15 | 753.01 | 790.66 | 830.19 | 871.70 |

| Purchases of property and equipment | (266.60) | (394.50) | (419.00) | (348.00) | (442.00) | (243.39) | (260.43) | (278.66) | (298.16) | (319.03) |

| Acquisitions, net of cash acquired | (6,314.40) | (100.70) | 0.00 | (2,682.00) | (126.00) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Proceeds from sale of long-term investments | 4.90 | 2.60 | 9.00 | 0.00 | 0.00 | 100.00 | 100.00 | 100.00 | 100.00 | 100.00 |

| Cash from Investing Activities | (4,685.30) | (455.60) | (414.00) | (3,537.00) | (570.00) | (145.49) | (162.63) | (180.97) | (200.59) | (218.79) |

| Cash Flow-Financing Activities ($ Millions) | ||||||||||

| Taxes paid related to net share settlements | (393.20) | (440.00) | (681.00) | (719.00) | (518.00) | (543.90) | (571.10) | (599.65) | (629.63) | (661.11) |

| Repurchases of common stock | (2,050.00) | (2,750.00) | (3,050.00) | (3,950.00) | (6,550.00) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Proceeds from re-issuance of treasury stock | 191.00 | 232.90 | 270.00 | 291.00 | 278.00 | 291.90 | 306.50 | 321.82 | 337.91 | 354.81 |

| Long Term Debt Issuance | 2,248.30 | 0.00 | 3,144.00 | 0.00 | 0.00 | 165.16 | 171.77 | 178.64 | 185.78 | 193.21 |

| Repayment of debt | (1.70) | -- | (3,150.00) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cash from Financing Activities | (5.60) | (2,946.10) | (3,488.00) | (4,301.00) | (6,825.00) | (86.84) | (92.83) | (99.19) | (105.94) | (113.09) |

| Foreign Exchange Effects | (1.70) | (12.70) | 3.00 | (26.00) | (51.00) | |||||

| Net Change in Cash | (663.20) | 1,007.50 | 1,828.00 | (634.00) | 392.00 | 7,250.45 | 7,943.54 | 8,694.07 | 9,506.41 | 10,388.01 |

| Net Cash - Beginning Balance | 2,306.10 | 1,642.80 | 2,650.00 | 4,478.00 | 3,844.00 | 4,236.00 | 11,486.45 | 19,429.99 | 28,124.06 | 37,630.47 |

| Net Cash - Ending Balance | 1,642.80 | 2,650.20 | 4,478.00 | 3,844.00 | 4,236.00 | 11,486.45 | 19,429.99 | 28,124.06 | 37,630.47 | 48,018.48 |

Valuation

| Valuation | 2023 | 2024 | 2025 | 2026 | 2027 |

| Period 1 | Period 2 | Period 3 | Period 4 | Period 5 | |

| Free cash flow | 7,239.39 | 7,938.58 | 8,695.58 | 9,514.78 | 10,400.86 |

| Terminal value | 308,367.80 | ||||

| Present value of cash flows | 6,733.83 | 6,868.51 | 6,998.08 | 7,122.61 | 221,960.62 |

| Sum of PVs | 249,683.65 | ||||

| Debt | 6,000.00 | ||||

| Number of shares | 471.00 | ||||

| Share price estimate | 542.85 | ||||

| Market value | 512.00 | ||||

| WACC | |||||

| Equity | 13 | ||||

| Debt | 6 | ||||

| Total | 19.00 | ||||

| Equity | 68% | ||||

| Debt | 32% | ||||

| tax rate | 20.84% | ||||

| Cost of debt | 6% | ||||

| Cost of equity | 8.80% | ||||

| WACC | 7.5% | ||||

| Long term growth rate | 4% |