Summary

BAE Systems plc provides defense, aerospace, and security solutions worldwide. The company operates through five segments: Electronic Systems, Cyber & Intelligence, Platforms & Services (US), Air, and Maritime. The Electronic Systems segment offers electronic warfare systems, navigation systems, electro-optical sensors, military and commercial digital engine and flight controls, precision guidance and seeker solutions, military communication systems and data links, persistent surveillance systems, space electronics, and electric drive propulsion systems. The Cyber & Intelligence segment provides solutions to modernize, maintain, and test cyber-harden aircraft, radars, missile systems, and mission applications that detect and deter threats to national security; systems engineering, integration, and sustainment services for critical weapons systems, C5ISR, and cyber security; and solutions and services to intelligence and federal/civilian agencies. It also offers data intelligence solutions to defend against national-scale threats, protect their networks, and data against attacks; security and intelligence solutions to the United Kingdom government and allied international governments; anti-fraud and regulatory compliance solutions; and enterprise-level data and digital services. The Platforms & Services (US) segment manufactures combat vehicles, weapons, and munitions, as well as provides ship repair services and the management of government-owned munitions facilities. The Air segment develops, manufactures, upgrades, and supports combat and jet trainer aircraft. The Maritime segment designs, manufactures, and supports surface ships, submarines, torpedoes, radars, and command and combat systems; and supplies naval gun systems. It also supplies naval weapon systems, missile launchers, and precision munitions. The company was founded in 1970 and is based in Farnborough, the United Kingdom.

Operations

Company History

Mission Statement[1]

BAE Systems articulates its mission as a commitment to "serve, supply and protect those who serve and protect us, in a corporate culture that is performance driven and values led" This mission statement serves as a guiding compass that shapes the company's financial strategies and operational decisions.

At its core, the mission statement highlights two fundamental objectives: providing a competitive edge to customers and fostering innovation through trusted partnerships.

In a financial context, the former objective translates into focusing on revenue streams derived from the delivery of cutting-edge solutions to customers. BAE Systems aims to generate substantial revenue by offering technologically advanced products and services that empower their clients with a competitive advantage. This revenue fuels financial growth and supports critical activities such as research and development, manufacturing, and customer support.

The phrase "trusted partnerships and innovative solutions" underscores the significance of collaboration and forward-thinking approaches. In financial terms, this means that BAE Systems must strategically allocate resources to cultivate strong relationships with partners, suppliers, and customers. These partnerships not only provide stability in the supply chain but also facilitate the exchange of ideas and resources for innovative solutions.

BAE Systems' mission statement significantly influences its financial strategies in several ways:

1. Research and Development Emphasis: A substantial portion of the company's budget is dedicated to research and development, aligning with the objective of delivering innovative solutions. This investment supports the creation of state-of-the-art technologies, enhancing the company's market position and potential for revenue growth.

2. Strategic Partnerships: The emphasis on trusted partnerships means that BAE Systems strategically allocates resources to build and maintain relationships that contribute to mutual growth and innovation. Collaborative ventures and joint ventures with partners can lead to shared costs and expanded market access.

3. Adaptive Resource Allocation: The commitment to innovation and customer value requires BAE Systems to be adaptive in resource allocation. This includes allocating resources to areas with the highest potential for creating competitive solutions and responding to evolving customer needs.

4. Risk Management through Innovation: BAE Systems' focus on innovation serves as a proactive approach to risk management. By continuously developing new solutions, the company can stay ahead of technological disruptions and shifts in customer demands.

5. Investor Confidence: The mission statement can influence investor relations by showcasing how financial strategies are aligned with the company's core values. Clear communication of how financial decisions support innovation and customer partnerships can attract investors who share BAE Systems' vision.

In essence, BAE Systems' mission statement guides its financial strategies by emphasizing customer value, innovation, and partnerships. This commitment permeates resource allocation, risk management, and collaboration efforts, contributing to the company's ongoing financial strength and competitive position in the market.

Corporate Strategy[2]

BAE Systems has a corporate strategy that builds on their vision and mission. It is comprised of six key long-term areas of focus that will help BAE achieve their vision and mission. It is centred on maintaining and growing their core franchises and securing growth opportunities through advancing their three strategic priorities.

1. Sustain and grow their defence and security businesses

- Deliver on commitments effectively and efficiently

- Develop offerings to meet the future defence and security needs

2. Continue to grow their business in adjacent markets

- Take capabilities into adjacent attractive markets

- Develop dual-use opportunities delivering civil solutions to leverage back to meet challenges for defence customers

3. Develop and expand their international business

- Mature international activities, broadening offerings to established customers

- Develop relations with additional customers

4. Inspire and develop a diverse workforce to drive success

- Ensure diversified thinking and harness the full potential of people

- Create an environment and proposition in which people will thrive

- Seek opportunities to drive efficiency, standardisation and synergies

- Identify opportunities for higher-margin offerings

6. Advance and integrate their sustainability agenda

- Emphasise the vital role played in protecting countries and civilians and supporting communities

- Progress the delivery of their decarbonisation strategy

Priorities

Serving as a bridge between the long-term strategy and short term objectives, are the strategic priorities. These priorities have been successfully demonstrated by BAE Systems.

- Drive operational excellence

- BAE Systems has been part of the F-35 programme since its inception, bringing our expertise into the development, advanced manufacture, electronic warfare systems and sustainment of the world’s largest defence programme. Led by the US, with participation from the UK, Italy, Netherlands, Australia, Canada, Denmark and Norway, this collaborative programme delivers a stealthy, multi-role combat aircraft capable of operating from land and sea to nations across the globe. As a key partner, BAE collaborates with the programme’s prime contractor, Lockheed Martin, to deliver around 15% of each aircraft (excluding propulsion), playing a major role in the development, production and sustainment of each jet.

- Continuously improve competitiveness and efficiency

- To improve production efficiency and increase capacity, BAE has embarked on the process of constructing a new, modern ship lift/ land-level ship repair complex at our Jacksonville, Florida shipyard. Once it is fully operational, the complex will feature a ship lift that can easily move vessels in excess of 25,000 tons, and the new land-level repair complex will enable the team to work on three or more ships simultaneously parked ashore with access to their hulls. The $200m (£166m) investment will bring a 300% increase to the shipyard’s current dry-docking capacity and expand the shipyard’s customer diversity by bringing in more commercial work.

- Advance and further leverage our technology

- BAE Systems is working with partners to design and deliver a new flying combat air demonstrator, which will play a critical role in the delivery of the UK’s Future Combat Air System. The flagship project is part of a suite of novel technologies being developed by Team Tempest, which will see BAE Systems engineers lead the design, test, evaluation and build process and bring together new digital engineering technologies. The first flight of the demonstrator is set to take place within the next five years.

Segments

Key programmes and franchises

Revenue by segments

Current Projects

ESG

Environmental

Similar to many other companies in the industry, BAE Systems is committed to achieving net zero emissions from company operations by 2030. They have also set a broader goal of assisting the entire aerospace sector in reaching net zero by 2050. Their strategy involves retrofitting buildings for energy efficiency, incorporating low-carbon technologies in factories, and establishing closed-loop recycling initiatives for materials.

Social

BAE Systems recognizes that its projects often have far-reaching impacts on communities, underscoring the importance of effective stakeholder engagement. The company values input from affected stakeholders and ensures regular communication among project teams to address concerns and incorporate feedback.

Identifying Stakeholders:

Stakeholders are identified and categorized based on project scopes, including groups directly or indirectly influenced by company operations and those with existing economic, social, or environmental ties. Stakeholder management involves strategies such as press releases, annual reports, industry memberships, surveys, and individual consultations.

Governance

BAE Systems operates under the guidance of an independent board of directors responsible for overseeing business operations. This board comprises both executive and non-executive directors. Executive directors oversee high-level management, led by the CEO, who handles day-to-day operations. Non-executive directors share legal responsibilities with executive directors but focus on performance assessment, target achievement, risk management, and financial controls to mitigate operational risks for BAE Systems.

Market

Total Addressable Market:

Here, the total addressable market (TAM) is the global defence market which is valued at $2.24 trillion based on worldwide military expenditure figures for 2022[3].

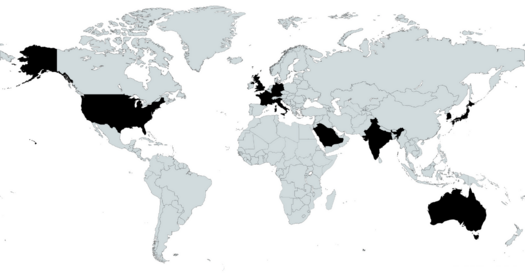

Serviceable Available Market:

Here, the serviceable available market (SAM) is the defence market in select geographical regions (shown in map) accessible to the company which is valued at $1.37 trillion based on the respective 2022 military expenditure figures[3].

Serviceable Obtainable Market:

Here, the serviceable obtainable market (SOM) is the defence market in select geographical regions (shown in map) accessible to the company which is valued at $1.28 trillion according to the 2022 BAE Systems Annual Report[3].

Region Accessible:

USA

UK

Kingdom of Saudi Arabia

Australia

India

France

Germany

South Korea

Japan

Italy

Largest Region:

USA

Market Drivers:

- Invasion of Ukraine and tensions in East Asia drive increased spending.

- Increased spending by Japan in response to perceived growing threats from China, North Korea and Russia.

- Aids and grants to Ukraine

Market Trends:

- Unmanned combat vehicles

- Autonomous fighter jets

- Edge computing

- 3D printed technology

- Use of AI in defence equipment

Competition

Competitive Advantages:

- World class defence capabilities across multiple domains - air, land, sea and undersea

- Strong customer relationships - largest defence supplier in the UK and Australia, and among top ten in the US

- Diversified Business Portfolio - wide range of mission critical electronic systems including electronic warfare systems, flight and engine controls, night vision systems, surveillance and reconnaissance sensors, and power and energy management system.

Competitors:

| Company Name | HQ | Founding Year | No. of Employees | Revenue (FY 2022) | Market Cap. |

| BAE Systems | Farnborough, United Kingdom | 1999 | 93000 | $26.3B | $29.6B |

| Lockheed Martin Corporation | Bethesda, Maryland, United States | 1995 | 116000 | $66.0B | $113.3B |

| Northrop Grumman Corp | Falls Church, Virginia, United States | 1994 | 95000 | $36.6B | $65.3B |

| General Dynamics | Reston, Virginia, United States | 1952 | 106500 | $39.4B | $61.3B |

| The Boeing Company | Arlington, Virginia, United States | 1916 | 156000 | $66.6B | $136.5B |

| RTX (Raytheon) | Arlington County, Virginia, United States | 1922 | 182000 | $67.1B | $125.4B |

Leadership

Executive Team

Group Chief Executive Officer - Charles Woodburn[6]

Charles is the Group Chief Executive Officer of BAE Systems plc. He joined the company in May 2016 as the Chief Operating Officer and became CEO on July 1, 2017. Prior to this, he held leadership roles in the oil and gas sector, including CEO of Expro Group and a 15-year tenure with Schlumberger in various global locations.

He holds a First Class Honours Degree and a PhD in Engineering from Cambridge University, along with an MBA from Erasmus University, Rotterdam. Charles is a Fellow of the Royal Academy of Engineering.

Chief Executive Officer & President - Tom Arseneault[7]

Tom Arseneault is the President and CEO of BAE Systems, Inc., overseeing an international defense and security company with 34,000 employees and operations in the U.S., UK, and Sweden. With $12.5 billion in 2021 sales revenue, BAE Systems, Inc. ranks among the top 10 U.S. Department of Defense prime contractors, offering products and services for air, land, and naval forces, advanced electronics, avionics, security, and IT solutions. Arseneault is also an Executive Director on BAE Systems plc Board of Directors and an officer director on the BAE Systems, Inc. Board. He has led critical missions, served as President of the Electronic Systems Sector, and holds an electrical engineering background with an MBA.

Group Managing Director, Digital Intelligence - Davind Armstrong[9]

David Armstrong serves as the Group Managing Director of BAE Systems Digital Intelligence. He became part of the company in January 2018 as Director Air - Europe and International, and later took on the role of Group Business Development Director in January 2019.

Before joining BAE Systems, David built a distinguished career at MBDA, culminating in his appointment as Managing Director at MBDA UK.

David is a Fellow of the Institute of Engineering and Technology and the Royal Aeronautical Society. He received an MBE for his defense service in 2007. He has also received prestigious honors, including the Grand Prix from Academie de L’Air et de L’Espace in 2009 and the Vermeil medal in 2018.

Apart from his responsibilities as Group Managing Director of BAE Systems Digital Intelligence, David is a board member of both MBDA and BNA.

Managing Director, Saudi Arabia - Simon Barnes[10]

Having joined BAE Systems in 2001, Simon has spent 25 years in the defense industry, accumulating experience in various senior program leadership and business development roles across the UK, Europe, and the Middle East. Notably, he most recently served as the Vice President of the Typhoon program.

Originating from the United Kingdom, Simon embarked on his career as an engineering apprentice. He holds an MSc in Financial Management and an MBA from the University of Manchester. He is recognized as a Chartered Project Manager, a Fellow of the CMI, and a Fellow of the Royal Aeronautical Society.

Group Managing Director, Business Development - Gabby Costigan[11]

Gabby joined BAE Systems Australia in October 2017 as CEO-designate and officially took over as CEO in January 2018.

Before BAE Systems, she was CEO of Linfox International Group.

Gabby, an Aeronautical Engineer, served 21 years in the Australian Army, retiring as a Colonel. She commanded logistic operations for Australian and US forces.

She's involved in committees supporting CSIRO, Adelaide University, UNSW, and is Chair of the Council for Women and Families United by Defence Service. She's also a Board member for the Princes Trust Veterans Council.

Gabby's military service earned her honors from the Australian and US Governments, NATO, and a 2019 MBE for UK/Australia relations.

Chief Technology & Information Officer - Julian Cracknell[12]

Beforehand, Julian occupied various high-level positions within the Company's cybersecurity division, including the role of Managing Director for Applied Intelligence. He became part of BAE Systems in July 2012.

Before joining BAE Systems, Julian served at Logica in multiple capacities, including Director of National Security and Business Unit Manager for Defence Systems.

Julian holds a First Class Honours Degree in Computer Science from the University of Dundee and serves as a trustee for Naomi House, a children's hospice in Hampshire, UK.

Group Human Resources Director - Tania Gandamihardja

Group Finance Director - Brad Greve[13]

Brad Greve currently serves as the Group Finance Director of BAE Systems, a position he assumed in April 2020 after joining the company as Group Finance Director Designate in September 2019. Brad is also a Director on the BAE Systems, Inc. Board of Directors.

Prior to joining BAE Systems, Brad accumulated a 30-year career in the energy sector at Schlumberger, holding roles across various international locations such as the UK, Romania, Nigeria, France, Brazil, and the United States.

Brad holds an MBA from the London Business School and a Finance degree from SMU in Dallas, Texas.

Group Communications Director - Caitlin Hayden[14]

Before joining BAE Systems in 2019, Caitlin served as the Senior Vice President of Communications for BAE Systems Inc, overseeing communication efforts for the company's US business.

Prior to her tenure at BAE Systems, Caitlin held senior positions at the Aerospace Industries Association (AIA) and Edelman.

With 15 years of experience in the US federal government, Caitlin's background includes roles such as Special Assistant to President Barack Obama, Senior Director for Strategic Communications and Press, and spokesperson for the National Security Council. She also held communication and policy roles within the U.S. Department of State.

Caitlin earned her bachelor's degree in public relations from the University of Alabama and a master’s degree in mass communications from the University of Georgia. She is also a member of the Steering Committee for the Leadership Council for Women in National Security.

Group ESG, Culture & Business Transformation Director - Karin Hoeing[15]

Karin Hoeing initially joined the company in February 2018 as Group Human Resources Director. Her responsibilities expanded in 2019 to include Safety, Health and Environment, as well as the Shared Services Organization.

Previously, Karin was the President of Wireline at Schlumberger. She brings over 20 years of experience in senior line management, HR, marketing, technology, and leadership roles across Europe, the Middle East, and Asia.

Karin holds an MSc in Geophysics from the University of Hamburg, Germany. She also serves as a non-executive Director of Smiths Group plc since April 2020.

Chief Executive of BAE Systems Australia - Ben Hudson

Prior to joining BAE Systems, Ben led the global vehicle systems portfolio for Rheinmetall, based in Germany, held senior roles with General Dynamics, based in Switzerland and served as an Officer in the Australian Army, including active service in East Timor.

Ben is a dual Australian and British national with a degree in Mechanical Engineering and holds an MBA from London Business School.

Group Managing Director Maritime and Land - Glynn Philips[16]

Previously Glynn was Chief Executive Officer of BAE Systems Australia. Glynn’s 30-year career in BAE Systems has encompassed multiple senior finance leadership roles throughout the UK, including Finance Director for the Hawk business, International Military Aircraft business, Integrated Systems, Naval Ships and latterly for the UK Maritime Sector. Glynn also spent more than three years as Group Financial Controller for BAE Systems.

Group Managing Director for Air - Cliff Robson[17]

Previously, Cliff was Managing Director - Submarines within the BAE Systems Maritime and Land Sector, after completing a 15 month secondment with Rolls Royce Nuclear at Derby. Cliff originally joined BAE Systems Military Aircraft in 1984. He was appointed Production Director at Brough in 1993, transferring to Warton in 1996 as Project Director working on Saudi programmes.

Cliff gained a First Class Honours Degree in Mechanical Engineering, graduating in 1983.

Cliff is a Fellow of the Royal Aeronautical Society.

President of Electronics Systems Sector - Terry Crimmins[18]

Terry Crimmins heads BAE Systems Electronic Systems sector, located in Nashua, New Hampshire, and overseeing 15,000 employees across 26 sites. His role encompasses a diverse range of responsibilities, spanning vehicle and mission-critical electronic systems, from flight controls to surveillance sensors, mobile communications, and energy management.

Crimmins joined BAE Systems in 2001, progressing from product line director to deputy general manager in the Infrared Imaging business. With a track record in Strategy, he facilitated mergers, acquisitions, and intellectual property development. His recent roles include VP and Deputy GM of the Electronic Systems sector and leadership of the Survivability, Targeting, & Sensing Solutions area.

Prior to BAE Systems, Crimmins managed consumer and medical electronics, covering engineering, offshore manufacturing, and business development. He holds a Bachelor's degree in Electrical Engineering from Cornell University.

Senior Vice President, General Counsel & Secretary - Alice Eldridge[19]

Alice Eldridge is the SVP, General Counsel, and Secretary of BAE Systems, Inc., overseeing legal affairs for the company with over 34,000 employees across the U.S., UK, Sweden, and sales of nearly $12.5 billion in 2021. Her role encompasses Contracts, Security, Ethics, Compliance, and Export Control functions. She's also a member of the BAE Systems, Inc. Board.

With over 25 years of legal experience, she was previously VP and Chief Counsel for BAE Systems, Inc. Platforms & Services sector. Here, she led legal teams supporting U.S. Government contracts and international commercial and military sales in multiple countries.

Prior to BAE Systems, she held leadership roles at Lockheed Martin, serving as General Counsel for divisions, including Ethics and Business Conduct VP. Eldridge's background also includes government contracting experience in law firms.

Eldridge holds a bachelor's degree from the University of Vermont and a Juris Doctor degree from George Washington University. She's a member of various legal associations and has been active in community boards and ethics leadership roles.

Senior Vice President of Strategy & Corporate Development - Leslie Jelalian[20]

Leslie Jelalian is the SVP of Strategy & Corporate Development at BAE Systems, Inc. In this role, she leads strategic actions and initiatives to shape the business portfolio, overseeing organic growth, acquisitions, and procurements for the $12.5 billion U.S.-based organization. With over 30 years at the company, she's held roles in engineering, program management, and strategy development. Jelalian has bachelor's and master's degrees in Electrical Engineering from the University of Massachusetts, and a master's in Systems Engineering from Johns Hopkins University. She's been recognized with leadership awards and serves on the Board of Directors for Home Health and Hospice of Southern New Hampshire.

Vice President of Internal Audit - Paige Gerelick[21]

Paige Gerelick is the VP of Internal Audit at BAE Systems, Inc., leading to uphold accountability and governance for enhanced operational effectiveness. With over 20 years of experience in operations, strategic planning, and finance, Gerelick collaborates across diverse functions to assess compliance and best practices. She's been with BAE Systems since 2008, progressing from Finance Manager to roles in Ground Vehicles and Combat Mission Systems. Gerelick holds a Bachelor's in Accounting from Arizona State University and is a Certified Public Accountant.

President of Platforms & Services Sector - Jeremy Tondreault[22]

Jeremy Tondreault leads BAE Systems Platforms & Services, overseeing combat vehicles, gun systems, munitions, and naval ship modernization. With its headquarters in Falls Church, VA, this sector operates on a global scale with 12,000 employees across 20+ sites in the U.S., Sweden, and the UK.

Tondreault's BAE Systems journey began in 1996 as a mechanical engineer, and he has since held various senior roles, including VP and GM of Combat Mission Systems. He's driven Operational Excellence, launching the Partner 2 Win program and a $100M Ramp-to-Rate effort. Tondreault holds Mechanical Engineering degrees from Syracuse University and the University of Massachusetts at Lowell, and a System Design and Management degree from MIT.

SeniorVice President & Chief Information Officer - Travis Garriss[23]

Travis Garriss is the SVP and Chief Information Officer (CIO) of BAE Systems, Inc., the U.S.-based division with 34,000 employees and $12.5 billion in 2021 sales.

As CIO, Garriss drives a comprehensive IT vision to leverage technology for organizational value and strategy. Reporting to CEO Tom Arseneault, he collaborates with IT leaders to invest in critical systems while ensuring robust security and governance.

Previously at Honeywell, Garriss established global IT architecture, compliance standards, and managed network and application operations. He served as CIO and VP of User and Functional Enablement, delivering modern infrastructure and services globally.

Earlier, Garriss integrated websites and applications at DHL, enhancing productivity. He holds a bachelor's degree from Excelsior College.

Senior Vice President of Government Relations - Shelly O’Neill Stoneman[24]

Shelly O’Neill Stoneman, SVP of Government Relations at BAE Systems, Inc., oversees legislative affairs and relations for the company with 34,000+ employees across the U.S., UK, and Sweden, generating $12.5B in 2021 revenues. She's also a BAE Systems, Inc. Board member.

Stoneman's BAE Systems journey began in 2013 as VP for Executive Branch and International Government Relations, liaising with the Executive Branch, Pentagon, State Department, Intelligence Community, and foreign embassies.

With a background in public service and non-profits, Stoneman served as Special Assistant to Secretaries of Defense and the White House Liaison. She also worked in the White House Office of Legislative Affairs, focusing on defense and national security portfolios. Prior to BAE Systems, she had a significant career with Congressman Steve Rothman (D-NJ), Senate Governmental Affairs Committee, and international work.

In the community, she serves on boards including USO of Metropolitan Washington-Baltimore and Food for Others. Stoneman holds degrees from Vassar College, U.S. Naval War College, and University of Oklahoma.

Chief Ethics Officer - Kim Kaminski[25]

Kim Kaminski is VP & Chief Ethics Officer at BAE Systems, Inc. With nearly four decades of defense industry experience, she leads the development of the company's ethics program. Her role involves policy shaping, training, monitoring, investigations, and providing ethics counsel to senior leaders. Kaminski previously played a vital role in establishing a global Business Ethics and Compliance program at a small firm and held various responsibilities during her more than two decades at Alliant Techsystems Inc. (ATK), including overseeing Government Property, Technical Publications, Facilities, Records Management, and Business Ethics and Compliance functions.

She holds certifications as a Compliance and Ethics Professional and completed the Bentley College Managing Ethics in Organizations program. Kaminski earned a Bachelor of Arts degree in Marketing Management from St. Catherine’s University and an Electronic Technician degree from Northwestern Electronics Institute.

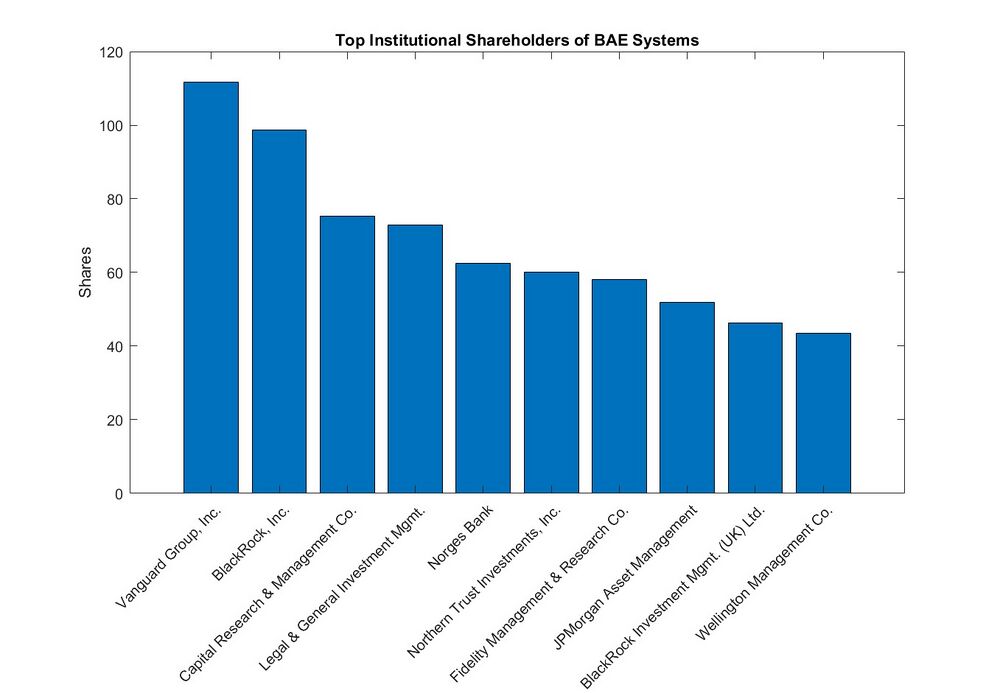

Ownership Structure

| Beneficial Owner | Share | % Held |

|---|---|---|

| Vanguard Group, Inc. | 111.64m | 3.08% |

| BlackRock, Inc. | 98.71m | 2.73% |

| Capital Research & Management Co. | 75.32m | 2.08% |

| Legal & General Investment Mgmt. | 72.85m | 2.01% |

| Norges Bank | 62.53m | 1.72% |

| Northern Trust Investments, Inc. | 59.98m | 1.65% |

| Fidelity Management & Research Co. | 58.16m | 1.60% |

| JPMorgan Asset Management | 51.82m | 1.43% |

| BlackRock Investment Mgmt. (UK) Ltd. | 46.21m | 1.27% |

| Wellington Management Co. | 43.50m | 1.20% |

Financials

Most recent half

| Income Statement (£m) | H1 2023 | H1 2022 | % change |

|---|---|---|---|

| Revenue | 10997 | 9739 | 12.9% |

| Operating Income / EBIT | 1233 | 1028 | 19.9% |

| Net Income | 1005 | 647 | 55.3% |

The first half of 2023 saw a 12.9% growth in the total revenue generated, resulting in subsequent growths in operating income and net income. This comes after a £1.8bn contract from the Czech Republic to produce 246 CV90 MkIV infantry fighting vehicles. The Air sector also saw continuation with the Qatar Typhoon and Hawk programmes.

Historical data - 5 years

| Income Statement - (£m) | FY-22 | FY-21 | FY-20 | FY-19 | FY-18 |

|---|---|---|---|---|---|

| Revenue | 21258 | 19521 | 19277 | 18305 | 16821 |

| Gross Profit | 14063 | 12468 | 12413 | 11803 | 10898 |

| Gross Margin | 66% | 64% | 64% | 64% | 65% |

| EBITDA | 2846 | 2545 | 2384 | 2259 | 1874 |

| Operating Income / EBIT | 2082 | 1844 | 1713 | 1647 | 1527 |

| Net Income | 1674 | 1912 | 1371 | 1532 | 1033 |

| Balance sheet - (£m) | FY-22 | FY-21 | FY-20 | FY-19 | FY-18 |

|---|---|---|---|---|---|

| Total assets | 31462 | 27135 | 27530 | 25630 | 24746 |

| Total liabilities | 20062 | 19467 | 22609 | 20119 | 19128 |

| Net assets | 11400 | 7668 | 4921 | 5511 | 5618 |

There has been a steady growth in the revenue generated over the past 5 years. A steady gross margin meant that the gross profit also grew and resulted in monotonically growing EBITDA and EBIT values for each year. However, slightly fluctuating interest and tax expenses meant that the net income to the company varied year-on-year. However, the main point of consideration is that the coronavirus pandemic did not cause severe decline in the revenue or the costs that BAE systems generated, a testament to their adaptiveness, but this also implies that defence is a market independent of global pandemics.

Financial forecast / projection - 5 years

| Income Statement - (£m) | FY-23 | FY-24 | FY-25 | FY-26 | FY-27 |

|---|---|---|---|---|---|

| Revenue | 24688 | 26076 | 27735 | 28967 | 29832 |

| Gross Profit | 15980 | 16878 | 17952 | 18749 | 19309 |

| Gross Margin | 65% | 65% | 65% | 65% | 65% |

| EBITDA | 3248 | 3431 | 3649 | 3811 | 3925 |

| Operating Income / EBIT | 2424 | 2534 | 2668 | 2758 | 2810 |

| Net Income | 2009 | 2125 | 2263 | 2368 | 2442 |

Over the next 5 years, it is expected that the revenue will continue growing, with a 16% jump between the 2022 and 2023 revenue. As a result, gross income, operating income and net income will all grow monotonously. Due to the slight difference between how BAE systems defined their EBIT and therefore net income, the net income projection was arrived at by first projecting the EBT including Unusual Items, which, in recent years, had an average margin of 9%. From this, the projected tax expense, at a tax rate of 12% was deducted, to arrive at the net income to the company. The net income values are not yet corrected for minority interest earnings, such as the fixed dividends paid to owners of BAE Systems' preferred stock. All data required for this projection is in the Appendix, taken from Capital IQ.

Valuation

Intrinsic Valuation (DCF)

Expected Return on Investment

The Stockhub users estimate that the expected return of an investment in BAE Systems plc over the next five years is 31%. This value was arrived at through the use of an intrinsic valuation in the form of a discounted cash flow model.

Assuming that a suitable return level of five years is 10% per year (based of the S&P 500 returns) and BAE Systems achieves its return level of 31%, then the company can be considered as undervalued.

Assumptions

| Description | Value | Commentary |

|---|---|---|

| Valuation Model | Discounted Cash Flow Model | One form of intrinsic valuation is the discounted cash flow model where future cash flows are discounted to the present value.

Research has suggested that to estimate the expected return of an investment over a long-term investment horizon, a discounted cash flow model provides an accurate projection. |

| Financial Projections | Stockhub, CapitalIQ, Yahoo Finance | To improve the reliability of financial projections, a mixture of sources was used when projecting key financial metrics such as revenue. |

| Discount Rate | WACC | The weighted average cost of capital was used as the discount rate as it expresses the return that both bondholders and shareholders demand to provide the company with capital. The cost of equity and cost of debt have been calculated in the tables provided below using values taken from the company's financial statements, beta for the stock, and expected market returns. |

Free cashflow calculation

| Current Share Price: £9.68 | |||||||||||||

| £ million | Historical | Projected | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Income Statement | |||||||||||||

| Revenue | 16787 | 17790 | 17224 | 16821 | 18305 | 19277 | 19521 | 21258 | 24688 | 26076 | 27735 | 28967 | 29832 |

| % growth | 6% | -3% | -2% | 9% | 5% | 1% | 9% | 16% | 6% | 6% | 4% | 3% | |

| Cost Of Goods Sold | 7101 | 7212 | 6085 | 5923 | 6502 | 6864 | 7053 | 7195 | 8708 | 9198 | 9783 | 10218 | 10523 |

| % of revenue | 42% | 41% | 35% | 35% | 36% | 36% | 36% | 34% | 35% | 35% | 35% | 35% | 35% |

| Gross Profit | 9686 | 10578 | 11139 | 10898 | 11803 | 12413 | 12468 | 14063 | 15980 | 16878 | 17952 | 18749 | 19309 |

| gross margin | 58% | 59% | 65% | 65% | 64% | 64% | 64% | 66% | 65% | 65% | 65% | 65% | 65% |

| Selling General & Admin Exp. | 5200 | 5838 | 6229 | 6203 | 6457 | 6681 | 6640 | 7431 | 8509 | 8988 | 9559 | 9984 | 10282 |

| % of revenue | 31% | 33% | 36% | 37% | 35% | 35% | 34% | 35% | 34% | 34% | 34% | 34% | 34% |

| Depreciation & Amort. | 351 | 333 | 263 | 269 | 511 | 543 | 513 | 549 | 553 | 584 | 621 | 648 | 668 |

| % of revenue | 2% | 2% | 2% | 2% | 3% | 3% | 3% | 3% | 2% | 2% | 2% | 2% | 2% |

| Amort. Of Goodwill and Intangibles | 0 | 0 | 82 | 78 | 101 | 128 | 188 | 215 | 272 | 313 | 361 | 406 | 447 |

| % of revenue | 0% | 0% | 0% | 0% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 2% |

| Other Operating Expense | 2872 | 2929 | 3032 | 2821 | 3087 | 3348 | 3283 | 3786 | 4222 | 4459 | 4743 | 4954 | 5101 |

| % of revenue | 17% | 16% | 18% | 17% | 17% | 17% | 17% | 18% | 17% | 17% | 17% | 17% | 17% |

| Total Operating Expenses | 8072 | 8767 | 9261 | 9024 | 9544 | 10029 | 9923 | 11217 | 12731 | 13447 | 14302 | 14938 | 15384 |

| Operating Income/ EBIT | 1263 | 1478 | 1533 | 1527 | 1647 | 1713 | 1844 | 2082 | 2424 | 2534 | 2668 | 2758 | 2810 |

| EBITDA | 1614 | 1811 | 1878 | 1874 | 2259 | 2384 | 2545 | 2846 | 3248 | 3431 | 3649 | 3811 | 3925 |

| Tax Expense | 147 | 213 | 216 | 191 | 94 | 225 | 198 | 315 | 295 | 308 | 325 | 336 | 342 |

| Effective tax rate | 12% | 14% | 14% | 13% | 6% | 13% | 11% | 15% | 12% | 12% | 12% | 12% | 12% |

| EBIAT | 1116 | 1265 | 1317 | 1336 | 1553 | 1488 | 1646 | 1767 | 2129 | 2226 | 2343 | 2422 | 2468 |

| Cashflow | |||||||||||||

| D&A | 351 | 333 | 263 | 269 | 511 | 543 | 513 | 549 | 553 | 584 | 621 | 648 | 668 |

| % of revenue | 2% | 2% | 2% | 2% | 3% | 3% | 3% | 3% | 2% | 2% | 2% | 2% | 2% |

| Amort. Of Goodwill and Intangibles | 0 | 0 | 82 | 78 | 101 | 128 | 188 | 215 | 272 | 313 | 361 | 406 | 447 |

| % of revenue | 0% | 0% | 0% | 0% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 2% |

| Capital Expenditure | -359 | -408 | -389 | -358 | -360 | -385 | -516 | -599 | -741 | -782 | -832 | -869 | -895 |

| % of revenue | 2% | 2% | 2% | 2% | 2% | 2% | 3% | 3% | 3% | 3% | 3% | 3% | 3% |

| Change in NWC | 717 | 108 | 640 | 192 | 422 | -196 | -95 | 132 | 521 | 550 | 585 | 611 | 630 |

| % of revenue | 4% | 1% | 4% | 1% | 2% | -1% | 0% | 1% | 2% | 2% | 2% | 2% | 2% |

| Unlevered FCF | 391 | 1082 | 633 | 1133 | 1383 | 1970 | 1926 | 1800 | 1692 | 1790 | 1907 | 1996 | 2059 |

Notes on projections

Revenue projections were adapted from Capital IQ's estimates, and cross-checked with Yahoo Finance.

The COGS margin was projected by taking the average of COGS margins from 2017 onwards, as there seems to have been a stabilisation after this year.

The Selling General & Admin Expenses, Depreciation and Amortisation, Other Operating Expenses and the Tax Expenses were projected by applying average of each respective margin over the historical period and applying it to each forecast year.

Amortisation of Goodwill and Intangibles was projected as growing from 1.1% to 1.5% to model the steady increase in its margin seen in the historical period.

- Note: Upon cross-check with BAE System's Annual Report, Capital IQ presents the true depreciation expense as "Depreciation and Amortisation", and the true Amortisation Expense as "Amortisation of Goodwill and Intangibles".

Capital Expenditure was taken as having a steady 3% margin, seen from the recent step up in its value (2021, 2022)

Change in NWC was projected by taking the average of the non-negative margins from the historical data, and applying this average as the margin for each forecast year.

Calculation of the discount rate (WACC)

| WACC | Notes | |

|---|---|---|

| Weights | ||

| Total Debt | 6610 | |

| Market Cap | 29363 | |

| Total | 35973 | |

| Wd | 18% | Weight of debt calculated as the total debt as a proportion of total capital. |

| We | 82% | Weight of equity calculated as the market cap as a proportion of total capital |

| Debt | ||

| Total Debt | 6610 | Cost of debt was calculated by taking interest expenses from the income statement and dividing this by the total debt making note of the fact that debt is a tax deductable item. |

| Interest Expense | -233 | |

| Rate | 3.5% | |

| Effective Tax Rate | 12% | |

| Rd(1-t) | 3.1% | |

| Equity | ||

| Risk Free Rate | 4.05% | Capital asset pricing model was used to calculate the cost of equity. Risk free rate of the US Treasury 10 Year was used. |

| Beta | 0.57 | Beta for the stock was found from Yahoo Finance |

| Market Rate | 10% | Current market rate was calculated as the average returns of the S&P 500 over the past 50 years. |

| Re | 7.4% | |

| Discount Rate | 6.6% | This is the value used for the WACC |

| Perpetuity Growth Rate | 2.0% | A perpetuity growth rate of 2% was used as this is sufficiently low to ensure that the company is not projected to increase in size far faster than the global economy in the very long term. |

Cashflow projection

| £ millions | 2023 | 2024 | 2025 | 2026 | 2027 | Terminal Value (Perpetuity Growth) | Notes | |

|---|---|---|---|---|---|---|---|---|

| 1692 | 1790 | 1907 | 1996 | 2059 | 45229 | The terminal value of the company was calculated using the Gordon Growth Model.[26] | ||

DCF

| Present Value of FCF | 7769 |

|---|---|

| Terminal Value | 45229 |

| Net Present Value of TV | 32791 |

| Enterprise Value | 40559 |

| Net Debt | 1866 |

| Equity Value | 38693 |

| Shares Out | 3050 |

| Equity Value per Share | £12.69 |

| Current share price | £9.68 |

| Difference | 31% |

Sensitivity Analysis

A sensitivity analysis was also conducted to reflect how changes in the discount rate and perpetuity growth rate would affect the intrinsic value of the company.

| £12.69 | Perpetuity Growth | |||||

|---|---|---|---|---|---|---|

| 1.0% | 1.5% | 2.0% | 2.5% | 3.0% | ||

| WACC | 5.5% | £13.61 | £15.12 | £17.07 | £19.66 | £23.30 |

| 6.0% | £12.17 | £13.36 | £14.84 | £16.75 | £19.30 | |

| 6.5% | £10.99 | £11.95 | £13.11 | £14.57 | £16.44 | |

| 6.6% | £10.69 | £11.59 | £12.69 | £14.04 | £15.77 | |

| 7.0% | £10.01 | £10.79 | £11.73 | £12.87 | £14.30 | |

| 7.5% | £9.18 | £9.83 | £10.60 | £11.51 | £12.64 | |

| 8.0% | £8.47 | £9.02 | £9.65 | £10.40 | £11.31 | |

Relative Valuation

Expected Return on Investment

The Stockhub users estimate that the expected return of an investment in BAE Systems plc over the next five years is 15%. This value was arrived at through the use of a relative valuation method in the form of a comparable company analysis.

Assuming that BAE Systems achieves its return level of 15%, then the company can be considered as undervalued.

Comparable company analysis

| Market Data | Financials | Valuation Ratios | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company | Ticker | Share Price | Currency | Shares Out /millions | Equity Value /millions | Net Debt /millions | Enterprise Value /millions | EPS | Revenue /millions | EBITDA /millions | Net Income /millions | EV/Revenue | EV/EBITDA | P/E | ||

| BAE Systems plc | LSE: BA | 9.62 | GBP | 3050 | 29341 | 3406 | 32747 | 0.50 | 22516 | 2776 | 1941 | 1.45 | 11.80 | 19.24 | ||

| Rolls-Royce Holdings plc | LSE: RR | 2.56 | GBP | 8362 | 21408 | 3732 | 25140 | 0.25 | 19665 | 2180 | 1514 | 1.28 | 11.53 | 10.24 | ||

| Safran SA | ENXTPA: SAF | 155.98 | EUR | 420 | 65527 | -81 | 65447 | 8.00 | 24065 | 4477 | 3166 | 2.72 | 14.62 | 19.50 | ||

| Thales S.A. | ENXTPA: HO | 140.78 | EUR | 209 | 29353 | 915 | 30267 | 6.08 | 19607 | 2499 | 1203 | 1.54 | 12.11 | 23.15 | ||

| Leonardo S.p.a. | BIT: LDO | 13.95 | EUR | 575 | 8025 | 4110 | 12135 | 1.62 | 16347 | 1536 | 857 | 0.74 | 7.90 | 8.61 | ||

| Airbus SE | ENXTPA: AIR | 137.79 | EUR | 789 | 108744 | -4661 | 104083 | 5.33 | 67010 | 7702 | 3872 | 1.55 | 13.51 | 25.85 | ||

| Northrop Grumman Corporation | NYSE: NOC | 430.17 | USD | 151 | 65085 | 13726 | 78811 | 30.23 | 37881 | 7243 | 4649 | 2.08 | 10.88 | 14.23 | ||

| Hensoldt AG | XTRA: 5UH | 31.63 | EUR | 105 | 3321 | 632 | 3953 | 0.80 | 1904 | 251 | 77 | 2.08 | 15.74 | 39.54 | ||

| Dassault Aviation societe anonyme | ENXTPA: AM | 185.32 | EUR | 79 | 14640 | -8190 | 6451 | 10.61 | 6850 | 733 | 806 | 0.94 | 8.80 | 17.47 | ||

| Rheinmetall AG | XTRA: RHM | 271.23 | EUR | 43 | 11771 | 828 | 12599 | 11.71 | 7175 | 1004 | 474 | 1.76 | 12.55 | 23.16 | ||

| L3Harris Technologies, Inc. | NYSE: LHX | 181.48 | USD | 189 | 34318 | 9158 | 43476 | 4.19 | 17988 | 2760 | 802 | 2.42 | 15.75 | 43.31 | ||

| Raytheon | NYSE: RTX | 85.47 | USD | 1460 | 124786 | 31532 | 156318 | 3.74 | 70573 | 12088 | 5562 | 2.21 | 12.93 | 22.85 | ||

| BAE Systems plc valuation | EV/Revenue | EV/EBITDA | P/E |

|---|---|---|---|

| Average Comparable Ratio | 1.76 | 12.39 | 22.54 |

| Revenue | 22516 | NA | NA |

| EBITDA | NA | 2776 | NA |

| EPS | NA | NA | 0.5 |

| Implied Enterprise Value | 39553 | 34404 | NA |

| Net Debt | 3406 | 3406 | NA |

| Implied Equity Value | 36147 | 30998 | NA |

| Shares Outstanding | 3050 | 3050 | NA |

| Implied Value Per Share | 11.85 | 10.16 | 11.27 |

| Average | £11.09 | ||

| Current Share Price | £9.68 | ||

| Difference | 14.6% | ||

Risks[2]

BAE Systems believes that managing risks effectively is key to successfully delivering on their strategies and strategic priorities. They employ a thorough, multifaceted, top to bottom risk management framework, which aims to mitigate any risk to their strategy that is identified. The Board has the overall responsibility, advised by the Audit, ESG and Executive Committees. The basis of the framework is:

Identify, Analyse, Evaluate, Mitigate

All risks primarily affect their future revenue and financial health.

Government customers, defence spending and terms of trade risks

These risks affect strategies 1, 2, 3, 5

- 95% of sales in 2022 were in defence. Government expenditure on defence can vary based on policy, politics, budgetary constraints as well as national security threats, and some governments have already faced constraints. However, BAE has a geographically well-spread market, many countries within which have announced plans to defence spending in response to the currently elevated global threats. BAE also benefits from a large order backlog, as well as establishment with long-term projects.

- BAE systems faces threats to their ability to secure and maintain government contracts. Financial reviews can lead to budgetary reconsiderations and premature termination of contracts. However, BAE is established as being a major contributor to the industrial capabilities of the countries within its market.

- BAE also faces a risk with the fact that its cashflows depend on the timing and success in being awarded contracts as well as when they receive the corresponding cash. Not receiving cashflow on time can lead to an inability to focus on their own expenditure without requiring external funding - impacting credit rating. However, BAE manages their balance sheet conservatively, to ensure flexibility, as well as monitoring liquidity to ensure the retrieval of cash needed for operations.

International market risks

These risks affect strategies 1,2,3,5

- The risks of operating in international markets include: social and political changes impacting the business environment, economic downturns, political instability and civil disturbances, the imposition of restraints on the movement of capital, the introduction of burdensome taxes or tariffs, change of export control, tax and other government policy and regulations in the UK, US and all other relevant jurisdictions, and the inability to obtain or maintain the necessary export licences. Similar to the risk on fluctuations in government expenditure, BAE has a geographically well-spread market, many countries within which have announced plans to defence spending in response to the currently elevated global threats. BAE also benefits from a large order backlog, as well as establishment with long-term projects.

- They are exposed to volatility arising from movements in currency exchange rates, particularly in respect of the US dollar, euro, Saudi riyal and Australian dollar. There has been volatility in currency exchange rates in 2022.

- Brexit can still affect BAE System's ability to participate in, and receive contracts for, European Union-funded projects. However, BAE has a major role in certain European programmes, such as the Eurofighter, and is also supporting the UK government in maintaining the UK's role in European security and defence.

Contract risk, execution and supply chain risks

These risks affect strategies 1,2,4,5

- There is a risk associated with the costs of fixed-price contracts exceeding the contract amount, and hence resulting in a local loss. The price is agreed based on a projection of the inflation rate, and hence is subject to fluctuation. It is important for BAE systems to maintain tight tolerances on quality, time and cost, in a reliable, predictable and repeatable manner. They have also limited fixed-price contracts regarding design and development, which tend to have more associated risk.

- Like any business associated with product manufacturing. BAE system relies on its supply chain, which has intrinsic risk. There are lead-time and availability issues, as well as pricing pressures from inflationary increases in labour, energy and key materials.

Cyber security risks

These risks affect strategies 1,3,4

- Cyber threats can cause business and operational disruption. BAE Systems faces risks potential cybersecurity threats in the form of:

- Attacks impacting availability of its information technology and operational technology infrastructure and systems

- Attempts to gain access to or delete proprietary and classified information, of BAE Systems as well as its customers, partners and suppliers.

These threats are mitigated through constant monitoring, as well as cyber security training for its personnel.

Competition in international markets

These risks affect strategies 1,3,5

- BAE systems need to be able to win contracts for new and high-quality programmes, while depending on UK and US government support. However, their multi-market and international presence, balanced business portfolio and their capable and reliable track record of delivery is a factor that combats this risk. BAE systems also invests in research and development, to ensure cutting-edge technology that puts them in line with, or ahead of, the competition.

Outbreak of contagious disease

These risks affect strategies 1,2,3,4,5

- Similar to that of COVID-19, new pandemics can cause sever disruption to its operations, as well as its market. However, having been through the coronavirus pandemic, it is expected that the experience in dealing with such an event can minimise the impact of future pandemics, experience including safe working practices and effectively implementing working from home.

Climate change and the environment

These risks affect strategies 1,2,3,4,5,6

- BAE systems could face rigorous environmental laws and regulations, regarding air emissions, waste handling, use and handling of hazardous materials, remediation of soil and groundwater, contamination and the prevention of pollution through greenhouse gas emission. This could affect operations, as well as an ability to sell. Harsh environmental conditions could directly affect operations, through natural disasters and accidents arising from the environment. Furthermore, the adjustment to a low-carbon economy could mean increased tariffs and compliance costs, as well as a potentially reduced demand base, driven by politics and morality. However, BAE systems are working towards the target of achieving net zero across operations by 2030.

Laws and regulations

These risks affect strategies 1,2,3,4,5,6

- Their operations are within a highly regulated environment across multiple jurisdictions, and is therefore subject to regulations related to import-export controls, money laundering, false accounting, anti-bribery and anti-boycott provisions. It is crucial that BAE systems maintains responsible business and financial practices. They may also be affected by export restrictions, affecting their ability to sell their products.

Acquisitions

These risks affect strategies 1,2,3,5

- BAE Systems believes in the virtue of investing in value-enhancing acquisitions, where such an acquisition brings them closer to their strategised goals. They must ensure successful migration and integration of acquired business, as well as perform post-acquisition monitoring of its expected benefits

References

- ↑ https://www.baesystems.com/en/our-company/our-purpose

- ↑ 2.0 2.1 2.2 https://investors.baesystems.com/~/media/Files/B/BAE-Systems-Investor/documents/bae-ar-complete-2022-new.pdf

- ↑ 3.0 3.1 3.2 https://www.sipri.org/sites/default/files/2023-04/2304_fs_milex_2022.pdf

- ↑ https://www.researchandmarkets.com/reports/5720994/defense-global-market-opportunities-and

- ↑ https://www.baesystems.com/en/our-company/about-us

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-chief-executive-officer

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/tom-arseneault-old

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/tom-arseneault-old

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-managing-director-digital-intelligence

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/managing-director-bae-systems-saudi-arabia

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-managing-director-business-development

- ↑ https://www.baesystems.com/en/our-people/executive-committee/chief-technology-and-information-officer

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-finance-director

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-communications-director

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-esg-culture-and-business-transformation-director

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-managing-director-maritime-and-land

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-managing-director-air

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/terry-crimmins-old

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/alice-eldridge-old

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/leslie-jelalian-old

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/paige-gerelick-old

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/jeremy-tondreault-old

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/travis-garriss-old

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/shelly-oneill-stoneman-old

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/kimberly-kaminski-old

- ↑ https://www.investopedia.com/terms/t/terminalvalue.asp

Appendix

| For the Fiscal Period Ending | Reclassified

12 months Dec-31-2015 |

Reclassified

12 months Dec-31-2016 |

Restated

12 months Dec-31-2017 |

12 months

Dec-31-2018 |

12 months

Dec-31-2019 |

12 months

Dec-31-2020 |

12 months

Dec-31-2021 |

12 months

Dec-31-2022 |

LTM

12 months Jun-30-2023 |

| Currency | GBP | GBP | GBP | GBP | GBP | GBP | GBP | GBP | GBP |

| Revenue | 16,787.0 | 17,790.0 | 17,224.0 | 16,821.0 | 18,305.0 | 19,277.0 | 19,521.0 | 21,258.0 | 22,516.0 |

| Other Revenue | - | - | - | - | - | - | - | - | - |

| Total Revenue | 16,787.0 | 17,790.0 | 17,224.0 | 16,821.0 | 18,305.0 | 19,277.0 | 19,521.0 | 21,258.0 | 22,516.0 |

| Cost Of Goods Sold | 7,101.0 | 7,212.0 | 6,085.0 | 5,923.0 | 6,502.0 | 6,864.0 | 7,053.0 | 7,195.0 | 8,305.0 |

| Gross Profit | 9,686.0 | 10,578.0 | 11,139.0 | 10,898.0 | 11,803.0 | 12,413.0 | 12,468.0 | 14,063.0 | 14,211.0 |

| Selling General & Admin Exp. | 5,200.0 | 5,838.0 | 6,229.0 | 6,203.0 | 6,457.0 | 6,681.0 | 6,640.0 | 7,431.0 | 7,393.0 |

| R & D Exp. | - | - | - | - | - | - | - | - | - |

| Depreciation & Amort. | 351.0 | 333.0 | 263.0 | 269.0 | 511.0 | 543.0 | 513.0 | 549.0 | 549.0 |

| Amort. of Goodwill and Intangibles | - | - | 82.0 | 78.0 | 101.0 | 128.0 | 188.0 | 215.0 | 215.0 |

| Other Operating Expense/(Income) | 2,872.0 | 2,929.0 | 3,032.0 | 2,821.0 | 3,087.0 | 3,348.0 | 3,283.0 | 3,786.0 | 3,742.0 |

| Other Operating Exp., Total | 8,423.0 | 9,100.0 | 9,606.0 | 9,371.0 | 10,156.0 | 10,700.0 | 10,624.0 | 11,981.0 | 11,899.0 |

| Operating Income | 1,263.0 | 1,478.0 | 1,533.0 | 1,527.0 | 1,647.0 | 1,713.0 | 1,844.0 | 2,082.0 | 2,312.0 |

| Interest Expense | (175.0) | (208.0) | (202.0) | (204.0) | (235.0) | (240.0) | (249.0) | (269.0) | (268.0) |

| Interest and Invest. Income | 17.0 | 10.0 | 24.0 | 26.0 | 27.0 | 17.0 | 39.0 | 35.0 | 35.0 |

| Net Interest Exp. | (158.0) | (198.0) | (178.0) | (178.0) | (208.0) | (223.0) | (210.0) | (234.0) | (233.0) |

| Income/(Loss) from Affiliates | 110.0 | 90.0 | 107.0 | 140.0 | 168.0 | 69.0 | 139.0 | 180.0 | 193.0 |

| Currency Exchange Gains (Loss) | (26.0) | (364.0) | 308.0 | (211.0) | 154.0 | 127.0 | 35.0 | (524.0) | (524.0) |

| Other Non-Operating Inc. (Exp.) | (36.0) | 140.0 | (311.0) | 111.0 | (105.0) | (170.0) | (39.0) | 400.0 | 575.0 |

| EBT Excl. Unusual Items | 1,153.0 | 1,146.0 | 1,459.0 | 1,389.0 | 1,656.0 | 1,516.0 | 1,769.0 | 1,904.0 | 2,323.0 |

| Merger & Related Restruct. Charges | - | - | - | - | - | (20.0) | (3.0) | (16.0) | (16.0) |

| Impairment of Goodwill | (75.0) | - | (384.0) | - | - | - | - | - | - |

| Gain (Loss) On Sale Of Invest. | 1.0 | - | - | - | - | 6.0 | - | - | - |

| Gain (Loss) On Sale Of Assets | 45.0 | 17.0 | (3.0) | 9.0 | (18.0) | 41.0 | 350.0 | 104.0 | 104.0 |

| Asset Writedown | (34.0) | (9.0) | 1.0 | (64.0) | (12.0) | (4.0) | (19.0) | (3.0) | (3.0) |

| Other Unusual Items | - | (3.0) | - | (110.0) | - | 57.0 | 13.0 | - | - |

| EBT Incl. Unusual Items | 1,090.0 | 1,151.0 | 1,073.0 | 1,224.0 | 1,626.0 | 1,596.0 | 2,110.0 | 1,989.0 | 2,408.0 |

| Income Tax Expense | 147.0 | 213.0 | 216.0 | 191.0 | 94.0 | 225.0 | 198.0 | 315.0 | 376.0 |

| Earnings from Cont. Ops. | 943.0 | 938.0 | 857.0 | 1,033.0 | 1,532.0 | 1,371.0 | 1,912.0 | 1,674.0 | 2,032.0 |

| Earnings of Discontinued Ops. | - | - | - | - | - | - | - | - | - |

| Extraord. Item & Account. Change | - | - | - | - | - | - | - | - | - |

| Net Income to Company | 943.0 | 938.0 | 857.0 | 1,033.0 | 1,532.0 | 1,371.0 | 1,912.0 | 1,674.0 | 2,032.0 |

| Minority Int. in Earnings | (25.0) | (25.0) | (30.0) | (33.0) | (56.0) | (72.0) | (154.0) | (83.0) | (91.0) |

| Net Income | 918.0 | 913.0 | 827.0 | 1,000.0 | 1,476.0 | 1,299.0 | 1,758.0 | 1,591.0 | 1,941.0 |

| Pref. Dividends and Other Adj. | - | - | - | - | - | - | - | - | - |

| NI to Common Incl Extra Items | 918.0 | 913.0 | 827.0 | 1,000.0 | 1,476.0 | 1,299.0 | 1,758.0 | 1,591.0 | 1,941.0 |

| NI to Common Excl. Extra Items | 918.0 | 913.0 | 827.0 | 1,000.0 | 1,476.0 | 1,299.0 | 1,758.0 | 1,591.0 | 1,941.0 |

| Per Share Items | |||||||||

| Basic EPS | 0.29 | 0.29 | 0.26 | 0.31 | 0.46 | 0.41 | 0.55 | 0.51 | 0.63 |

| Basic EPS Excl. Extra Items | 0.29 | 0.29 | 0.26 | 0.31 | 0.46 | 0.41 | 0.55 | 0.51 | 0.63 |

| Weighted Avg. Basic Shares Out. | 3,161.0 | 3,171.0 | 3,182.0 | 3,192.0 | 3,183.0 | 3,191.0 | 3,187.0 | 3,112.0 | 3,066.0 |

| Diluted EPS | 0.29 | 0.29 | 0.26 | 0.31 | 0.46 | 0.41 | 0.55 | 0.51 | 0.63 |

| Diluted EPS Excl. Extra Items | 0.29 | 0.29 | 0.26 | 0.31 | 0.46 | 0.41 | 0.55 | 0.51 | 0.63 |

| Weighted Avg. Diluted Shares Out. | 3,171.0 | 3,185.0 | 3,197.0 | 3,201.0 | 3,201.0 | 3,210.0 | 3,211.0 | 3,153.0 | 3,109.5 |

| Normalized Basic EPS | 0.22 | 0.22 | 0.28 | 0.26 | 0.31 | 0.27 | 0.3 | 0.36 | 0.44 |

| Normalized Diluted EPS | 0.22 | 0.22 | 0.28 | 0.26 | 0.31 | 0.27 | 0.3 | 0.35 | 0.44 |

| Dividends per Share | 0.21 | 0.21 | 0.22 | 0.22 | 0.23 | 0.24 | 0.25 | 0.27 | 0.28 |

| Payout Ratio % | 71.4% | 73.4% | 82.7% | 70.3% | 49.1% | 57.4% | 44.2% | 50.4% | 42.8% |

| Shares per Depository Receipt | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 |

| Supplemental Items | |||||||||

| EBITDA | 1,614.0 | 1,767.0 | 1,823.0 | 1,804.0 | 1,945.0 | 2,061.0 | 2,224.0 | 2,521.0 | 2,776.0 |

| EBITA | 1,367.0 | 1,514.0 | 1,560.0 | 1,535.0 | 1,651.0 | 1,750.0 | 1,925.0 | 2,189.0 | 2,424.0 |

| EBIT | 1,263.0 | 1,478.0 | 1,533.0 | 1,527.0 | 1,647.0 | 1,713.0 | 1,844.0 | 2,082.0 | 2,312.0 |

| EBITDAR | 1,871.0 | 2,051.0 | 2,118.0 | 2,091.0 | 1,980.0 | 2,087.0 | 2,247.0 | 2,551.0 | NA |

| As Reported Total Revenue* | 16,787.0 | 17,790.0 | 17,224.0 | 16,821.0 | NA | NA | NA | NA | NA |

| Effective Tax Rate % | 13.5% | 18.5% | 20.1% | 15.6% | 5.8% | 14.1% | 9.4% | 15.8% | 15.6% |

| Current Domestic Taxes | 92.0 | 45.0 | 153.0 | 66.0 | 180.0 | 115.0 | 18.0 | 116.0 | 116.0 |

| Current Foreign Taxes | 6.0 | 169.0 | 120.0 | 141.0 | (89.0) | 118.0 | 199.0 | 369.0 | 369.0 |

| Total Current Taxes | 98.0 | 214.0 | 273.0 | 207.0 | 91.0 | 233.0 | 217.0 | 485.0 | 485.0 |

| Deferred Domestic Taxes | (11.0) | (18.0) | (54.0) | (30.0) | 1.0 | (4.0) | (34.0) | (12.0) | (12.0) |

| Deferred Foreign Taxes | 60.0 | 17.0 | (3.0) | 14.0 | 2.0 | (4.0) | 15.0 | (158.0) | (158.0) |

| Total Deferred Taxes | 49.0 | (1.0) | (57.0) | (16.0) | 3.0 | (8.0) | (19.0) | (170.0) | (170.0) |

| Normalized Net Income | 695.6 | 691.3 | 881.9 | 835.1 | 979.0 | 875.5 | 951.6 | 1,107.0 | 1,360.9 |

| Interest on Long Term Debt | NA | 212.0 | NA | NA | 48.0 | 44.0 | 43.0 | 48.0 | NA |

| Non-Cash Pension Expense | 211.0 | 198.0 | 184.0 | 251.0 | 154.0 | 26.0 | 88.0 | 47.0 | - |

| Filing Date | Mar-28-2017 | Mar-27-2018 | Mar-27-2019 | Apr-03-2020 | Mar-30-2021 | Mar-30-2022 | Mar-29-2023 | Mar-29-2023 | Aug-02-2023 |

| Restatement Type | RC | RC | RS | NC | NC | NC | NC | O | O |

| Calculation Type | REP | REP | REP | REP | REP | REP | REP | REP | LTM |

| Supplemental Operating Expense Items | |||||||||

| R&D Exp. | 1,263.0 | 1,426.0 | 1,608.0 | 1,507.0 | 1,510.0 | 1,605.0 | 1,600.0 | 2,000.0 | 2,000.0 |

| Net Rental Exp. | 257.0 | 284.0 | 295.0 | 287.0 | 35.0 | 26.0 | 23.0 | 30.0 | NA |

| Imputed Oper. Lease Interest Exp. | 97.5 | 111.6 | 110.7 | 110.5 | 14.4 | 8.5 | 6.8 | 9.6 | - |

| Imputed Oper. Lease Depreciation | 159.5 | 172.4 | 184.3 | 176.5 | 20.6 | 17.5 | 16.2 | 20.4 | - |

| Stock-Based Comp., COGS | 44.0 | 55.0 | 61.0 | 63.0 | 74.0 | 74.0 | 92.0 | 101.0 | 101.0 |

| Stock-Based Comp., Unallocated | - | - | - | 1.0 | - | - | - | - | 5.0 |

| Stock-Based Comp., Total | 44.0 | 55.0 | 61.0 | 64.0 | 74.0 | 74.0 | 92.0 | 101.0 | 106.0 |