BAE Systems plc

Summary edit edit source

BAE Systems plc provides defense, aerospace, and security solutions worldwide. The company operates through five segments: Electronic Systems, Cyber & Intelligence, Platforms & Services (US), Air, and Maritime. The Electronic Systems segment offers electronic warfare systems, navigation systems, electro-optical sensors, military and commercial digital engine and flight controls, precision guidance and seeker solutions, military communication systems and data links, persistent surveillance systems, space electronics, and electric drive propulsion systems. The Cyber & Intelligence segment provides solutions to modernize, maintain, and test cyber-harden aircraft, radars, missile systems, and mission applications that detect and deter threats to national security; systems engineering, integration, and sustainment services for critical weapons systems, C5ISR, and cyber security; and solutions and services to intelligence and federal/civilian agencies. It also offers data intelligence solutions to defend against national-scale threats, protect their networks, and data against attacks; security and intelligence solutions to the United Kingdom government and allied international governments; anti-fraud and regulatory compliance solutions; and enterprise-level data and digital services. The Platforms & Services (US) segment manufactures combat vehicles, weapons, and munitions, as well as provides ship repair services and the management of government-owned munitions facilities. The Air segment develops, manufactures, upgrades, and supports combat and jet trainer aircraft. The Maritime segment designs, manufactures, and supports surface ships, submarines, torpedoes, radars, and command and combat systems; and supplies naval gun systems. It also supplies naval weapon systems, missile launchers, and precision munitions. The company was founded in 1970 and is based in Farnborough, the United Kingdom.

Operations edit edit source

Company History[1] edit edit source

BAE Systems was formed in 1999, the result of a merger between British Aerospace PLC (BAe) and Marconi Electronic Systems, which was formerly part of General Electric Company PLC. The origin of British Aerospace PLC itself dates back to 1977, with the merger of British Aircraft Corporation, Hawker Siddeley Aviation and some other firms.

Hawker Siddeley itself is yet again the result of mergers between several British aircraft companies in the 1950s and 60s, and was divided into Hawker Siddeley Aviation (aircraft production) and Hawker Siddeley Dynamics (missiles and rockets).

In 1990, BAe sold its corporate jet division to Raytheon, and became a partner in the Eurofighter Typhoon programme. In 1999, BAe finally signed a deal with General Electric to merge with its electronics business, Marconi Electronic Systems, and this resulted in the formation of BAE Systems.

Mission Statement[2] edit edit source

BAE Systems articulates its mission as a commitment to "serve, supply and protect those who serve and protect us, in a corporate culture that is performance driven and values led" This mission statement serves as a guiding compass that shapes the company's financial strategies and operational decisions.

At its core, the mission statement highlights two fundamental objectives: providing a competitive edge to customers and fostering innovation through trusted partnerships.

In a financial context, the former objective translates into focusing on revenue streams derived from the delivery of cutting-edge solutions to customers. BAE Systems aims to generate substantial revenue by offering technologically advanced products and services that empower their clients with a competitive advantage. This revenue fuels financial growth and supports critical activities such as research and development, manufacturing, and customer support.

The phrase "trusted partnerships and innovative solutions" underscores the significance of collaboration and forward-thinking approaches. In financial terms, this means that BAE Systems must strategically allocate resources to cultivate strong relationships with partners, suppliers, and customers. These partnerships not only provide stability in the supply chain but also facilitate the exchange of ideas and resources for innovative solutions.

BAE Systems' mission statement significantly influences its financial strategies in several ways:

1. Research and Development Emphasis: A substantial portion of the company's budget is dedicated to research and development, aligning with the objective of delivering innovative solutions. This investment supports the creation of state-of-the-art technologies, enhancing the company's market position and potential for revenue growth.

2. Strategic Partnerships: The emphasis on trusted partnerships means that BAE Systems strategically allocates resources to build and maintain relationships that contribute to mutual growth and innovation. Collaborative ventures and joint ventures with partners can lead to shared costs and expanded market access.

3. Adaptive Resource Allocation: The commitment to innovation and customer value requires BAE Systems to be adaptive in resource allocation. This includes allocating resources to areas with the highest potential for creating competitive solutions and responding to evolving customer needs.

4. Risk Management through Innovation: BAE Systems' focus on innovation serves as a proactive approach to risk management. By continuously developing new solutions, the company can stay ahead of technological disruptions and shifts in customer demands.

5. Investor Confidence: The mission statement can influence investor relations by showcasing how financial strategies are aligned with the company's core values. Clear communication of how financial decisions support innovation and customer partnerships can attract investors who share BAE Systems' vision.

In essence, BAE Systems' mission statement guides its financial strategies by emphasizing customer value, innovation, and partnerships. This commitment permeates resource allocation, risk management, and collaboration efforts, contributing to the company's ongoing financial strength and competitive position in the market.

Corporate Strategy[3] edit edit source

BAE Systems has a corporate strategy that builds on their vision and mission. It is comprised of six key long-term areas of focus that will help BAE achieve their vision and mission. It is centred on maintaining and growing their core franchises and securing growth opportunities through advancing their three strategic priorities.

1. Sustain and grow their defence and security businesses edit edit source

- Deliver on commitments effectively and efficiently

- Develop offerings to meet the future defence and security needs

2. Continue to grow their business in adjacent markets edit edit source

- Take capabilities into adjacent attractive markets

- Develop dual-use opportunities delivering civil solutions to leverage back to meet challenges for defence customers

3. Develop and expand their international business edit edit source

- Mature international activities, broadening offerings to established customers

- Develop relations with additional customers

4. Inspire and develop a diverse workforce to drive success edit edit source

- Ensure diversified thinking and harness the full potential of people

- Create an environment and proposition in which people will thrive

edit edit source

- Seek opportunities to drive efficiency, standardisation and synergies

- Identify opportunities for higher-margin offerings

6. Advance and integrate their sustainability agenda edit edit source

- Emphasise the vital role played in protecting countries and civilians and supporting communities

- Progress the delivery of their decarbonisation strategy

Priorities edit edit source

Serving as a bridge between the long-term strategy and short term objectives, are the strategic priorities. These priorities have been successfully demonstrated by BAE Systems.

- Drive operational excellence

- BAE Systems has been part of the F-35 programme since its inception, bringing our expertise into the development, advanced manufacture, electronic warfare systems and sustainment of the world’s largest defence programme. Led by the US, with participation from the UK, Italy, Netherlands, Australia, Canada, Denmark and Norway, this collaborative programme delivers a stealthy, multi-role combat aircraft capable of operating from land and sea to nations across the globe. As a key partner, BAE collaborates with the programme’s prime contractor, Lockheed Martin, to deliver around 15% of each aircraft (excluding propulsion), playing a major role in the development, production and sustainment of each jet.

- Continuously improve competitiveness and efficiency

- To improve production efficiency and increase capacity, BAE has embarked on the process of constructing a new, modern ship lift/ land-level ship repair complex at our Jacksonville, Florida shipyard. Once it is fully operational, the complex will feature a ship lift that can easily move vessels in excess of 25,000 tons, and the new land-level repair complex will enable the team to work on three or more ships simultaneously parked ashore with access to their hulls. The $200m (£166m) investment will bring a 300% increase to the shipyard’s current dry-docking capacity and expand the shipyard’s customer diversity by bringing in more commercial work.

- Advance and further leverage our technology

- BAE Systems is working with partners to design and deliver a new flying combat air demonstrator, which will play a critical role in the delivery of the UK’s Future Combat Air System. The flagship project is part of a suite of novel technologies being developed by Team Tempest, which will see BAE Systems engineers lead the design, test, evaluation and build process and bring together new digital engineering technologies. The first flight of the demonstrator is set to take place within the next five years.

Segments edit edit source

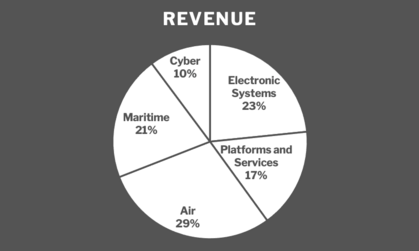

Taken from their annual report[3], BAE Systems has 5 major segments, which contribute most of its revenue, including electronic systems, platforms and services, air, maritime and cyber & intelligence.

Here is a more detailed breakdown of each segment:

Electronic Systems edit edit source

The electronic systems segment overlooks:

- Design, build and support of integrated electronic warfare systems.

- Electronic Combat Solutions designs, builds and supports integrated electronic warfare systems for platform prime and government customers, and is a trusted mission systems provider for all three electronic warfare missions: electronic attack; electronic protection; and electronic support.

- Development and production of avionics and electronic systems for military and commercial aircraft.

- Controls & Avionics Solutions develops and produces electronics for military and commercial aircraft, including fly-by-wire flight controls, full authority digital engine controls, power management solutions, cabin management systems and mission computers.

- Design and manufacture of state-of-the-art systems and technology to enable the execution of precision strike missions.

- Precision Strike & Sensing Solutions designs and manufactures state-of-the-art systems and technology that enable our customers to execute their precision strike missions.

- Next-generation threat detection, countermeasure and attack solutions.

- Countermeasure & Electromagnetic Attack Solutions provides next-generation threat detection, countermeasure, and attack solutions that deliver full-spectrum electronic warfare capabilities to enhance mission survivability.

- Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (C4ISR) systems for airborne persistent surveillance, identification systems, signals intelligence, underwater and surface warfare solutions, and space resiliency.

- C4ISR Systems provides actionable intelligence through innovative technical solutions for airborne persistent surveillance, secure communications, identification systems, signals intelligence, underwater and surface warfare solutions, and space resiliency.

- Electric and hybrid power and propulsion solutions to advance vehicle mobility, efficiency and capability.

- Power & Propulsion Solutions delivers propulsion and power management performance with innovative electrification products and solutions that advance vehicle mobility, efficiency and capability.

Electronic Systems' operational and strategic key points include:

- Opened state-of-the-art facilities in Manchester, New Hampshire; Cedar Rapids, Iowa; and Austin, Texas.

- Cumulatively more than 1,200 electronic warfare systems delivered on F-35 programme.

- Deliveries continue of next-generation EW Eagle Passive Active Warning Survivability System to support upgrade of US Air Force F-15 platform and testing on F-15E and F-15EX test aircraft.

- Selected to design, test and supply energy management components for GE Aviation’s megawatt class hybrid electric propulsion system supporting NASA’s Electrified Powertrain Flight Demonstration project.The Long-Range Precision Guidance Kit programme reached a critical benchmark with the successful completion of its structural survivability test in the US Army’s Extended Range Cannon Artillery.

- Delivered the 3,000th Multi-functional Information Distribution System Joint Tactical Radio System through our Data Link Solutions joint venture with Collins Aerospace

Platforms and Services edit edit source

The platforms and services segment overlooks:

- Design, manufacture, upgrade and support of tracked and amphibious combat vehicles.

- Combat Mission Systems focuses on a portfolio of tracked combat vehicles, amphibious vehicles, naval weapons, artillery systems, advanced weapons and precision munitions for the US military and international customers.

- Manufacture, maintenance, repair and upgrade of naval gun systems, artillery, advanced weapons, missile launchers and precision munitions.

- BAE Systems Bofors provides advanced land and maritime weapons and precision-guided munitions.

- Sustainment activities and services, including naval ship repair, modernisation and overhaul in the US.

- US Ship Repair is a major provider of non-nuclear ship repair, modernisation, overhaul and conversions to the US Navy and other government and commercial maritime customers across three US sites on the Atlantic and Pacific coasts.

- Management and operation of government owned munitions facilities in the US.

- Ordnance Systems is the operator of the US Army’s Holston and Radford facilities under government-owned, contractor-operated agreements, and focuses on explosives, propellants and facility modernisation.

- Production and upgrades for tracked and wheeled military vehicles for Turkish and international customers through a 49% interest in FNSS.

- FNSS, the Turkish land systems business in which BAE Systems holds a 49% interest, produces and upgrades tracked and wheeled military vehicles for Turkish and international customers.

Platforms and Services' operational and strategic key points include:

- Significant increase in order intake, largely driven by the Hägglunds business.

- US Army selected the BAE Systems Beowulf for its Cold Weather All-Terrain Vehicle (CATV) programme to replace the Small Unit Support Vehicles, with a contract estimated to be worth up to $278m (£231m) for 110 vehicles.

- Submitted a proposal for the design concept phase for the US Army’s Optionally Manned Fighting Vehicle programme.

- Our US shipyards marked continued performance improvements and secured $1.2bn (£1.0bn) in ship modernisation and repair orders.

- Received a five-year contract extension for Ordnance Systems Radford operations through to 2026 and a one-year extension through to 2024 for the Holston facility and supply contracts.

- Contract received worth $1.4bn (£1.2bn) to supply 152 CV9035 infantry fighting vehicles to replace the Slovakian Army’s infantry fighting vehicle fleet.

- Czech government selected CV90 to replace its infantry fighting vehicle fleet. Contract expected in first half of 2023.

Air edit edit source

The air segment overlooks:

- World-leading capabilities in military and commercial aircraft technology.

- A wide range of munitions, explosives, gun systems and artillery systems.

- Training to the armed forces to train the right people to the right standard, at the right time.

- Test support to commercial, military and aerospace customers.

- Design and integration of new technology and systems upgrades to existing aircraft.

- Advanced computer simulation to create realistic and immersive synthetic environments.

- Advanced radar solutions to detect threats quicker and enable faster response times.

- Design and manufacture of missiles and missile systems through a 37.5% interest in MBDA.

Air's operational and strategic key points include:

- Excellent progress on Tempest

- The governments of the UK, Japan and Italy announced a new Global Combat Air Programme (GCAP), which will bring together the Tempest and F-X programmes.

- Qatar Typhoon and Hawk programme is progressing well, with all nine Hawk aircraft accepted by the customer and eight Typhoon aircraft now delivered and in service with the Qatar Emiri Air Force.

- Work continues on the Typhoon programme and the production programme has been extended following the award of 20 further aircraft for Spain during the year, for which BAE Systems supplies major units.

- 11-year contract signed to continue to support the Royal Air Force’s fleet of Hawk fast jet trainer and Royal Air Force Aerobatic Team aircraft.

- F-35 rear fuselage production continued at full-rate levels, with 150 assemblies completed in the year.

- During the year, the Saudi British Defence Co-operation Programme was renewed for another five-year term.

- All 22 Hawk aircraft have now been completed and have entered into service with the Royal Saudi Air Force.

Maritime edit edit source

The maritime segment overlooks:

- Design, manufacture and support of submarines and complex warships.

- In-service support to surface ships and facilities management in the UK.

- Design, manufacture and support of naval gun systems, torpedoes, radars, and naval command and combat systems.

- Design and delivery of training systems and services for maritime platforms and equipment.

- Design and manufacture of ammunition, precision munitions, artillery systems and missile launchers for UK and other armed forces.

Maritime programmes include the construction of seven Astute Class submarines for the Royal Navy, as well as the design and production of the Royal Navy’s four Dreadnought Class submarines and eight Type 26 frigates. Additionally, the Maritime portfolio includes in-service support, including the delivery of training services and supporting the operation of HM Naval Base Portsmouth on behalf of the UK Ministry of Defence and the design and manufacture of combat systems, torpedoes and radars.

Land UK’s munitions business designs, develops and manufactures a comprehensive range of munitions products serving a number of customers including its main customer, the UK Ministry of Defence. Rheinmetall BAE Systems Land (RBSL) – BAE Systems’ joint venture with Rheinmetall – is a UK-based business specialising in the design, manufacture and support of military vehicles used by the British Army and international customers. Land UK also develops and manufactures cased-telescoped weapons through its CTA International joint venture.

In Australia, the business primarily delivers upgrade and support programmes for customers in the defence and commercial sectors across the air, maritime and land domains. This includes the Jindalee Operational Radar Network (JORN) upgrade. The business is also delivering the Hunter Class nine-ship Future Frigate programme. Services contracts include the provision of sustainment, training solutions and upgrades.

Maritime's operational and strategic key points include:

- The UK Ministry of Defence awarded a £4.2bn contract to BAE Systems to manufacture the next five City Class Type 26 frigates for the Royal Navy in Glasgow.

- First City Class Type 26 Frigate entered the water and is being outfitted at Scotstoun shipyard in Glasgow. – £3.4bn of further contract funding awarded as part of Delivery Phase 3 for the Dreadnought programme.

- The fifth Astute Class submarine, HMS Anson, exited our Barrow shipyard to commence sea trials in February 2023. The remaining two submarines, Agamemnon and Agincourt, are at advanced stages of construction.

- Construction of the first two Dreadnought Class submarines is well advanced and, in September 2022, build activities commenced on the third of class submarine. A formal steel cut ceremony for the third boat was held in Barrow on 9 February 2023. – RBSL’s multi-million pound investment in its Telford manufacturing site completed in 2022, with manufacturing activities due to commence in 2023.

- A$1.5bn (£0.8bn) extended ‘In Service Support’ contract for the Hawk aircraft commenced in 2022 for the Royal Australian Air Force.

Cyber & Intelligence edit edit source

The cyber & intelligence segment overlooks:

- Cyber, intelligence and security capabilities to US, UK and other government agencies to detect, deter and dissuade threats to national security.

- Engineering, integration and sustainment services for critical weapon systems, Command, Control, Communications, Computers, Cyber, Intelligence, Surveillance and Reconnaissance (C5ISR) and cyber security.

- Air and space force solutions to modernise, maintain, test, and cyber-harden aircraft, radars, strategic missile systems mission applications and information systems.

- A range of space capabilities that enable integration across cyberspace, sea, land and air, allowing secure access to intelligence.

- Mission-enabling solutions and services to intelligence and federal/civilian agencies.

Intelligence & Security comprises the three US-based businesses.

Air & Space Force Solutions focuses on providing the US Air Force, US Space Force and the combatant commands with innovative systems engineering and integration solutions to help to modernise, maintain, test and cyber-harden aircraft, radars, strategic missile systems, mission applications and information systems that detect, deter and dissuade threats to national security.

Integrated Defense Solutions provides the US Army and US Navy with systems engineering, integration, and sustainment services for critical weapons systems, C5ISR and cyber security that enhance mission effectiveness. Our solutions are deployed across platforms and networks in the air, maritime, land and cyber domains.

Intelligence Solutions provides innovative mission-enabling solutions and services to intelligence and federal/civilian agencies, as well as the provision of cost-effective synthetic training and simulation software products and components for global defence applications.

Digital Intelligence provides cyber, intelligence and security expertise to help protect nations, businesses and citizens. Our services, solutions and products span customers in law enforcement, national security, central government and government enterprises, critical national infrastructure, telecommunications, military and space.

Cyber & Intelligence's operational and strategic key points include:

Intelligence & Security

- Won a $699m (£581m) contract for operations, maintenance, and management services for the US Army’s Defense Supercomputing Resources Center.

- Awarded one of the prime positions on a multi-award $300m (£249m) Indefinite Delivery, Indefinite Quantity contract to support critical mission operations for a government customer.

- Multiple additional contract awards, including a $143m (£119m) five-year contract from the US Navy to support the integration of mission equipment, combat systems, and computer programmes for the Surface Combat Systems Center.

- Completed the acquisition of Bohemia Interactive Simulations (BISim), which has been fully integrated into BAE Systems and continues to provide cutting-edge virtual training for allied militaries, including the $9m (£7m) DVS2 contract from the UK Ministry of Defence.

Digital Intelligence

- Strong order intake and revenue growth.

- Continued integration and growth of the acquired In-Space Missions business.

- In October 2022, the business completed the sale of the financial crime detection business.

ESG edit edit source

BAE Systems has several ESG commitments[4], working to becoming a responsible business.

Environment edit edit source

Commitments edit edit source

UN ‘Race to Zero’

- Progress Net Zero program, embedding into financial planning

- Technology development

- Progress areas of sustainable technology: electrification; sustainable fuels etc

- Strategic partnerships

- Progress strategic partnerships; Cranfield University Sustainability Apprenticeships, Industrial partnerships

Achievements edit edit source

- Reduced CO2 emissions inline with 2030 Net Zero target

- 40% of our UK and US sites (incl. manufacturing) using renewable energy

- Recycled 83% of waste and 16% of water in 2021 across operations. Zero waste to landfill across Air UK sites since August 2020

- >14,000 of our electric- hybrid systems in operation, saving >30 million gallons of fuel & 335,000+ tonnes of CO2

- Hyper realism in simulator training improving safety and reducing emissions

- Graduate Sustainability Forum organised virtual event attended by more than 3000 employees, engagement through Big Switch/Big Ideas

- Improved CDP score over last 3 years

- TCFD reporting through 2021 ARA and SBTi report due for submission Q1 2023

Stated ambition: Net Zero Scope 1&2 by 2030, Scope 3 by 2050

Social edit edit source

Commitments edit edit source

Diversity & Inclusion edit edit source

- 30% women by 2030 (UK)

- 25% by 2025 female representation on EC

- Increase representation of ethnic minorities

Safety & wellbeing edit edit source

- Continuously improve workplace safety

- Employee wellbeing and mental health programmes

- Community, STEM & early careers

- Expand UK apprentice hiring programme and continued investment in STEM and early careers

- Maintain community investment

Achievements edit edit source

Diversity, Equity and Inclusion

- Increased female representation across all levels and functions; overall 22.6%

- Roadmap in place to drive systems integration & accelerate pace

- Named a ‘Best Place to Work for LGBTQ Equality’ by the Human Rights Campaign’s Corporate Equality index

- More than 20 pledges/commitments to external groups and movements supported by BAE Systems

- BAE Systems Inc inaugural DEI Impact Report charting progress over the last decade

- Established Colleagues Advancing Racial Equality (CARE) programme

Safety and wellbeing edit edit source

- Improved (reduced) recordable injuries across all sectors

- Focused safety programmes driving improvements through 2021 Leadership engagement and safety reviews key element of 2022 objectives

- All-employee safety training scheduled for 2022 with a learner centred approach and facilitated techniques

- Mental health & wellbeing awareness training, Unmind App (UK) and Sleepio (Inc) access, global Employee Assistance Programmes and Mental Health ambassadors and advocacy programmes

Stated ambition: 30% women in UK workforce by 2030

Community, Skills & Education edit edit source

- Strong support through pandemic in local communities and through national programmes • ~ 4,000 young people in learning in the UK in 2021

- Flagship apprentice programmes in UK, KSA and Australia

- 1000 applicants for RAF and RN ‘Coding Success’

- Focus on social mobility, 14,700 employees in work (deprived areas)

- Active in UK Govt Movement to Work and Kickstart programme

- > 250 employees mentors for SME through Be the Business

Governance edit edit source

Commitments edit edit source

- Exiting white phosphorus

- Progressing Real Living Wage agenda

Board diversity edit edit source

- Meet targets set by Hampton Alexander and Parker reports on gender and ethnic diversity

Robust ethics, compliance & disclosure edit edit source

- Maintain robust standards of ethics

- Meet TCFD and other disclosure requirements

- Maintain/improve external ratings

Achievements edit edit source

- Maintained MSCI Leader rating

- Top quartile in Transparency International Anti Corruption Index

- Recognition/proactive engagement from Rating Agencies

- Real Living Wage accreditation implementation

- Intention to exit smoke mortars containing white phosphorus progressed

- Robust Ethics & Compliance Programme, underpinned by revised Code of Conduct & Human Rights Statements

- Ethics contacts maintained throughout pandemic

- All employee business integrity training >95% completion

Market edit edit source

Total Addressable Market: edit edit source

Here, the total addressable market (TAM) is the global defence market which is valued at $2.24 trillion based on worldwide military expenditure figures for 2022[5].

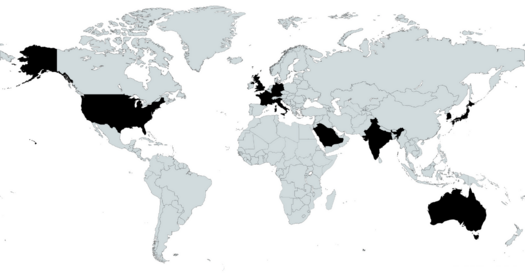

Serviceable Available Market: edit edit source

Here, the serviceable available market (SAM) is the defence market in select geographical regions (shown in map) accessible to the company which is valued at $1.37 trillion based on the respective 2022 military expenditure figures[5].

Serviceable Obtainable Market: edit edit source

Here, the serviceable obtainable market (SOM) is the defence market in select geographical regions (shown in map) accessible to the company which is valued at $1.28 trillion according to the 2022 BAE Systems Annual Report[5].

Region Accessible: edit edit source

USA

UK

Kingdom of Saudi Arabia

Australia

India

France

Germany

South Korea

Japan

Italy

Largest Region: edit edit source

USA

Market Drivers: edit edit source

- Invasion of Ukraine and tensions in East Asia drive increased spending.

- Increased spending by Japan in response to perceived growing threats from China, North Korea and Russia.

- Aids and grants to Ukraine

Market Trends: edit edit source

- Unmanned combat vehicles

- Autonomous fighter jets

- Edge computing

- 3D printed technology

- Use of AI in defence equipment

Competition edit edit source

Competitive Advantages: edit edit source

- World class defence capabilities across multiple domains - air, land, sea and undersea

- Strong customer relationships - largest defence supplier in the UK and Australia, and among top ten in the US

- Diversified Business Portfolio - wide range of mission critical electronic systems including electronic warfare systems, flight and engine controls, night vision systems, surveillance and reconnaissance sensors, and power and energy management system.

Competitors: edit edit source

| Company Name | HQ | Founding Year | No. of Employees | Revenue (FY 2022) | Market Cap. |

| BAE Systems | Farnborough, United Kingdom | 1999 | 93000 | $26.3B | $29.6B |

| Lockheed Martin Corporation | Bethesda, Maryland, United States | 1995 | 116000 | $66.0B | $113.3B |

| Northrop Grumman Corp | Falls Church, Virginia, United States | 1994 | 95000 | $36.6B | $65.3B |

| General Dynamics | Reston, Virginia, United States | 1952 | 106500 | $39.4B | $61.3B |

| The Boeing Company | Arlington, Virginia, United States | 1916 | 156000 | $66.6B | $136.5B |

| RTX (Raytheon) | Arlington County, Virginia, United States | 1922 | 182000 | $67.1B | $125.4B |

Leadership edit edit source

Executive Team edit edit source

Group Chief Executive Officer - Charles Woodburn[8] edit edit source

Charles is the Group Chief Executive Officer of BAE Systems plc. He joined the company in May 2016 as the Chief Operating Officer and became CEO on July 1, 2017. Prior to this, he held leadership roles in the oil and gas sector, including CEO of Expro Group and a 15-year tenure with Schlumberger in various global locations.

He holds a First Class Honours Degree and a PhD in Engineering from Cambridge University, along with an MBA from Erasmus University, Rotterdam. Charles is a Fellow of the Royal Academy of Engineering.

Chief Executive Officer & President - Tom Arseneault[9] edit edit source

Tom Arseneault is the President and CEO of BAE Systems, Inc., overseeing an international defense and security company with 34,000 employees and operations in the U.S., UK, and Sweden. With $12.5 billion in 2021 sales revenue, BAE Systems, Inc. ranks among the top 10 U.S. Department of Defense prime contractors, offering products and services for air, land, and naval forces, advanced electronics, avionics, security, and IT solutions. Arseneault is also an Executive Director on BAE Systems plc Board of Directors and an officer director on the BAE Systems, Inc. Board. He has led critical missions, served as President of the Electronic Systems Sector, and holds an electrical engineering background with an MBA.

Group Managing Director, Digital Intelligence - David Armstrong[10] edit edit source

David Armstrong serves as the Group Managing Director of BAE Systems Digital Intelligence. He became part of the company in January 2018 as Director Air - Europe and International, and later took on the role of Group Business Development Director in January 2019.

Before joining BAE Systems, David built a distinguished career at MBDA, culminating in his appointment as Managing Director at MBDA UK.

David is a Fellow of the Institute of Engineering and Technology and the Royal Aeronautical Society. He received an MBE for his defense service in 2007. He has also received prestigious honors, including the Grand Prix from Academie de L’Air et de L’Espace in 2009 and the Vermeil medal in 2018.

Apart from his responsibilities as Group Managing Director of BAE Systems Digital Intelligence, David is a board member of both MBDA and BNA.

Managing Director, Saudi Arabia - Simon Barnes[11] edit edit source

Having joined BAE Systems in 2001, Simon has spent 25 years in the defense industry, accumulating experience in various senior program leadership and business development roles across the UK, Europe, and the Middle East. Notably, he most recently served as the Vice President of the Typhoon program.

Originating from the United Kingdom, Simon embarked on his career as an engineering apprentice. He holds an MSc in Financial Management and an MBA from the University of Manchester. He is recognized as a Chartered Project Manager, a Fellow of the CMI, and a Fellow of the Royal Aeronautical Society.

Group Managing Director, Business Development - Gabby Costigan[12] edit edit source

Gabby joined BAE Systems Australia in October 2017 as CEO-designate and officially took over as CEO in January 2018.

Before BAE Systems, she was CEO of Linfox International Group.

Gabby, an Aeronautical Engineer, served 21 years in the Australian Army, retiring as a Colonel. She commanded logistic operations for Australian and US forces.

She's involved in committees supporting CSIRO, Adelaide University, UNSW, and is Chair of the Council for Women and Families United by Defence Service. She's also a Board member for the Princes Trust Veterans Council.

Gabby's military service earned her honors from the Australian and US Governments, NATO, and a 2019 MBE for UK/Australia relations.

Chief Technology & Information Officer - Julian Cracknell[13] edit edit source

Beforehand, Julian occupied various high-level positions within the Company's cybersecurity division, including the role of Managing Director for Applied Intelligence. He became part of BAE Systems in July 2012.

Before joining BAE Systems, Julian served at Logica in multiple capacities, including Director of National Security and Business Unit Manager for Defence Systems.

Julian holds a First Class Honours Degree in Computer Science from the University of Dundee and serves as a trustee for Naomi House, a children's hospice in Hampshire, UK.

Group Human Resources Director - Tania Gandamihardja edit edit source

Tania Gandamihardja is Group Human Resources Director for BAE Systems.

Tania was previously HR Director for Total Talent having joined the Company in September 2021.

Previously, Tania spent more than 20 years in the energy sector with Schlumberger where she held a number of HR leadership roles in Europe, Asia and the United States.

Tania holds a degree in Chemistry with Management Science.

When not at work, Tania enjoys discovering new places with her family, staying active, reading and theatre.

Group General Counsel - Ed Gelsthorpe edit edit source

Ed Gelsthorpe is Group General Counsel of BAE Systems plc.

Prior to this role, Ed held a number of senior legal leadership roles within BAE Systems, including in M&A, employment and other corporate matters, and from

2013-2022 as Chief Counsel UK. Ed began his career in private practice in London, subsequently joining Marconi as an IP specialist.

Ed graduated in law from Cambridge University, with further study at Grenoble University, and is qualified as a solicitor in England and Wales.

Ed is married with two children and outside of work enjoys art, music and long distance walking.

Group Finance Director - Brad Greve[14] edit edit source

Brad Greve currently serves as the Group Finance Director of BAE Systems, a position he assumed in April 2020 after joining the company as Group Finance Director Designate in September 2019. Brad is also a Director on the BAE Systems, Inc. Board of Directors.

Prior to joining BAE Systems, Brad accumulated a 30-year career in the energy sector at Schlumberger, holding roles across various international locations such as the UK, Romania, Nigeria, France, Brazil, and the United States.

Brad holds an MBA from the London Business School and a Finance degree from SMU in Dallas, Texas.

Group Communications Director - Caitlin Hayden[15] edit edit source

Before joining BAE Systems in 2019, Caitlin served as the Senior Vice President of Communications for BAE Systems Inc, overseeing communication efforts for the company's US business.

Prior to her tenure at BAE Systems, Caitlin held senior positions at the Aerospace Industries Association (AIA) and Edelman.

With 15 years of experience in the US federal government, Caitlin's background includes roles such as Special Assistant to President Barack Obama, Senior Director for Strategic Communications and Press, and spokesperson for the National Security Council. She also held communication and policy roles within the U.S. Department of State.

Caitlin earned her bachelor's degree in public relations from the University of Alabama and a master’s degree in mass communications from the University of Georgia. She is also a member of the Steering Committee for the Leadership Council for Women in National Security.

Group ESG, Culture & Business Transformation Director - Karin Hoeing[16] edit edit source

Karin Hoeing initially joined the company in February 2018 as Group Human Resources Director. Her responsibilities expanded in 2019 to include Safety, Health and Environment, as well as the Shared Services Organization.

Previously, Karin was the President of Wireline at Schlumberger. She brings over 20 years of experience in senior line management, HR, marketing, technology, and leadership roles across Europe, the Middle East, and Asia.

Karin holds an MSc in Geophysics from the University of Hamburg, Germany. She also serves as a non-executive Director of Smiths Group plc since April 2020.

Chief Executive of BAE Systems Australia - Ben Hudson edit edit source

Prior to joining BAE Systems, Ben led the global vehicle systems portfolio for Rheinmetall, based in Germany, held senior roles with General Dynamics, based in Switzerland and served as an Officer in the Australian Army, including active service in East Timor.

Ben is a dual Australian and British national with a degree in Mechanical Engineering and holds an MBA from London Business School.

Group Managing Director Maritime and Land - Glynn Philips[17] edit edit source

Previously Glynn was Chief Executive Officer of BAE Systems Australia. Glynn’s 30-year career in BAE Systems has encompassed multiple senior finance leadership roles throughout the UK, including Finance Director for the Hawk business, International Military Aircraft business, Integrated Systems, Naval Ships and latterly for the UK Maritime Sector. Glynn also spent more than three years as Group Financial Controller for BAE Systems.

Group Managing Director for Air - Cliff Robson[18] edit edit source

Previously, Cliff was Managing Director - Submarines within the BAE Systems Maritime and Land Sector, after completing a 15 month secondment with Rolls Royce Nuclear at Derby. Cliff originally joined BAE Systems Military Aircraft in 1984. He was appointed Production Director at Brough in 1993, transferring to Warton in 1996 as Project Director working on Saudi programmes.

Cliff gained a First Class Honours Degree in Mechanical Engineering, graduating in 1983.

Cliff is a Fellow of the Royal Aeronautical Society.

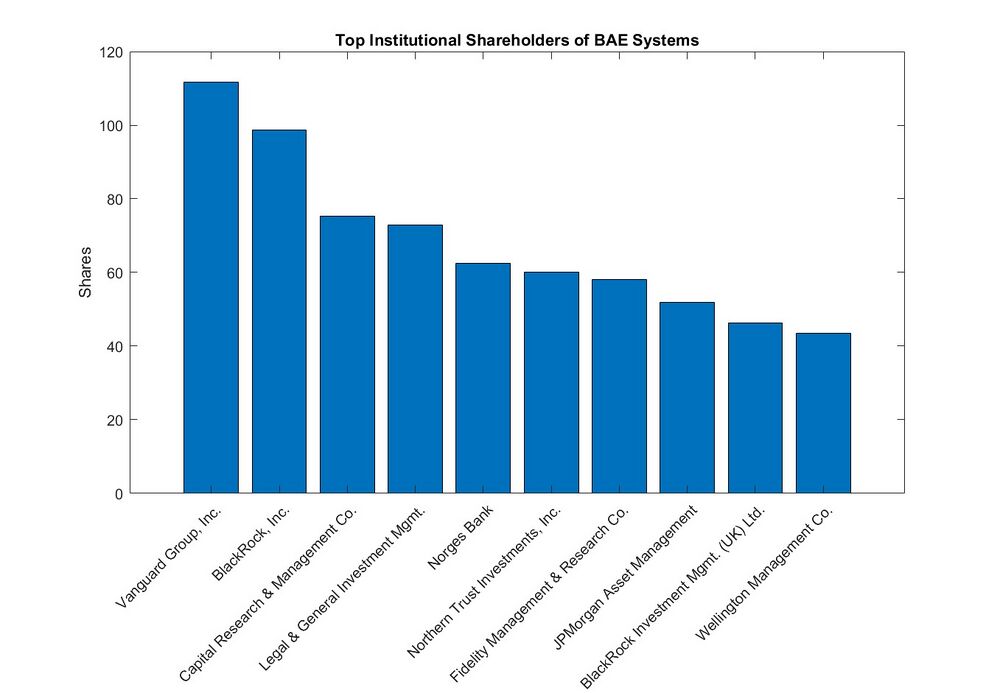

Ownership Structure edit edit source

| Beneficial Owner | Share | % Held |

|---|---|---|

| Vanguard Group, Inc. | 111.64m | 3.08% |

| BlackRock, Inc. | 98.71m | 2.73% |

| Capital Research & Management Co. | 75.32m | 2.08% |

| Legal & General Investment Mgmt. | 72.85m | 2.01% |

| Norges Bank | 62.53m | 1.72% |

| Northern Trust Investments, Inc. | 59.98m | 1.65% |

| Fidelity Management & Research Co. | 58.16m | 1.60% |

| JPMorgan Asset Management | 51.82m | 1.43% |

| BlackRock Investment Mgmt. (UK) Ltd. | 46.21m | 1.27% |

| Wellington Management Co. | 43.50m | 1.20% |

Financials edit edit source

Most recent half edit edit source

| Income Statement (£m) | H1 2023 | H1 2022 | % change |

|---|---|---|---|

| Revenue | 10997 | 9739 | 12.9% |

| Operating Income / EBIT | 1233 | 1028 | 19.9% |

| Net Income | 1005 | 647 | 55.3% |

The first half of 2023 saw a 12.9% growth in the total revenue generated, resulting in subsequent growths in operating income and net income. This comes after a £1.8bn contract from the Czech Republic to produce 246 CV90 MkIV infantry fighting vehicles. The Air sector also saw continuation with the Qatar Typhoon and Hawk programmes.

Historical data - 5 years edit edit source

| Income Statement - (£m) | FY-22 | FY-21 | FY-20 | FY-19 | FY-18 |

|---|---|---|---|---|---|

| Revenue | 21258 | 19521 | 19277 | 18305 | 16821 |

| Gross Profit | 14063 | 12468 | 12413 | 11803 | 10898 |

| Gross Margin | 66% | 64% | 64% | 64% | 65% |

| EBITDA | 2846 | 2545 | 2384 | 2259 | 1874 |

| Operating Income / EBIT | 2082 | 1844 | 1713 | 1647 | 1527 |

| Net Income | 1674 | 1912 | 1371 | 1532 | 1033 |

| Balance sheet - (£m) | FY-22 | FY-21 | FY-20 | FY-19 | FY-18 |

|---|---|---|---|---|---|

| Total assets | 31462 | 27135 | 27530 | 25630 | 24746 |

| Total liabilities | 20062 | 19467 | 22609 | 20119 | 19128 |

| Net assets | 11400 | 7668 | 4921 | 5511 | 5618 |

There has been a steady growth in the revenue generated over the past 5 years. A steady gross margin meant that the gross profit also grew and resulted in monotonically growing EBITDA and EBIT values for each year. However, slightly fluctuating interest and tax expenses meant that the net income to the company varied year-on-year. However, the main point of consideration is that the coronavirus pandemic did not cause severe decline in the revenue or the costs that BAE systems generated, a testament to their adaptiveness, but this also implies that defence is a market independent of global pandemics.

Financial forecast / projection - 5 years edit edit source

| Income Statement - (£m) | FY-23 | FY-24 | FY-25 | FY-26 | FY-27 |

|---|---|---|---|---|---|

| Revenue | 24688 | 26076 | 27735 | 28967 | 29832 |

| Gross Profit | 15980 | 16878 | 17952 | 18749 | 19309 |

| Gross Margin | 65% | 65% | 65% | 65% | 65% |

| EBITDA | 3248 | 3431 | 3649 | 3811 | 3925 |

| Operating Income / EBIT | 2424 | 2534 | 2668 | 2758 | 2810 |

| Net Income | 2009 | 2125 | 2263 | 2368 | 2442 |

Over the next 5 years, it is expected that the revenue will continue growing, with a 16% jump between the 2022 and 2023 revenue. As a result, gross income, operating income and net income will all grow monotonously. Due to the slight difference between how BAE systems defined their EBIT and therefore net income, the net income projection was arrived at by first projecting the EBT including Unusual Items, which, in recent years, had an average margin of 9%. From this, the projected tax expense, at a tax rate of 12% was deducted, to arrive at the net income to the company. The net income values are not yet corrected for minority interest earnings, such as the fixed dividends paid to owners of BAE Systems' preferred stock. All data required for this projection is in the Appendix, taken from Capital IQ.

Valuation edit edit source

Intrinsic Valuation (DCF) edit edit source

Expected Return on Investment edit edit source

The Stockhub users estimate that the expected return of an investment in BAE Systems plc over the next five years is 31%. This value was arrived at through the use of an intrinsic valuation in the form of a discounted cash flow model.

Assuming that a suitable return level of five years is 10% per year (based of the S&P 500 returns) and BAE Systems achieves its return level of 31%, then the company can be considered as undervalued.

Assumptions edit edit source

| Description | Value | Commentary |

|---|---|---|

| Valuation Model | Discounted Cash Flow Model | One form of intrinsic valuation is the discounted cash flow model where future cash flows are discounted to the present value.

Research has suggested that to estimate the expected return of an investment over a long-term investment horizon, a discounted cash flow model provides an accurate projection. |

| Financial Projections | Stockhub, CapitalIQ, Yahoo Finance | To improve the reliability of financial projections, a mixture of sources was used when projecting key financial metrics such as revenue. |

| Discount Rate | WACC | The weighted average cost of capital was used as the discount rate as it expresses the return that both bondholders and shareholders demand to provide the company with capital. The cost of equity and cost of debt have been calculated in the tables provided below using values taken from the company's financial statements, beta for the stock, and expected market returns. |

Free cashflow calculation edit edit source

| Current Share Price: £9.68 | |||||||||||||

| £ million | Historical | Projected | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Income Statement | |||||||||||||

| Revenue | 16787 | 17790 | 17224 | 16821 | 18305 | 19277 | 19521 | 21258 | 24688 | 26076 | 27735 | 28967 | 29832 |

| % growth | 6% | -3% | -2% | 9% | 5% | 1% | 9% | 16% | 6% | 6% | 4% | 3% | |

| Cost Of Goods Sold | 7101 | 7212 | 6085 | 5923 | 6502 | 6864 | 7053 | 7195 | 8708 | 9198 | 9783 | 10218 | 10523 |

| % of revenue | 42% | 41% | 35% | 35% | 36% | 36% | 36% | 34% | 35% | 35% | 35% | 35% | 35% |

| Gross Profit | 9686 | 10578 | 11139 | 10898 | 11803 | 12413 | 12468 | 14063 | 15980 | 16878 | 17952 | 18749 | 19309 |

| gross margin | 58% | 59% | 65% | 65% | 64% | 64% | 64% | 66% | 65% | 65% | 65% | 65% | 65% |

| Selling General & Admin Exp. | 5200 | 5838 | 6229 | 6203 | 6457 | 6681 | 6640 | 7431 | 8509 | 8988 | 9559 | 9984 | 10282 |

| % of revenue | 31% | 33% | 36% | 37% | 35% | 35% | 34% | 35% | 34% | 34% | 34% | 34% | 34% |

| Depreciation & Amort. | 351 | 333 | 263 | 269 | 511 | 543 | 513 | 549 | 553 | 584 | 621 | 648 | 668 |

| % of revenue | 2% | 2% | 2% | 2% | 3% | 3% | 3% | 3% | 2% | 2% | 2% | 2% | 2% |

| Amort. Of Goodwill and Intangibles | 0 | 0 | 82 | 78 | 101 | 128 | 188 | 215 | 272 | 313 | 361 | 406 | 447 |

| % of revenue | 0% | 0% | 0% | 0% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 2% |

| Other Operating Expense | 2872 | 2929 | 3032 | 2821 | 3087 | 3348 | 3283 | 3786 | 4222 | 4459 | 4743 | 4954 | 5101 |

| % of revenue | 17% | 16% | 18% | 17% | 17% | 17% | 17% | 18% | 17% | 17% | 17% | 17% | 17% |

| Total Operating Expenses | 8072 | 8767 | 9261 | 9024 | 9544 | 10029 | 9923 | 11217 | 12731 | 13447 | 14302 | 14938 | 15384 |

| Operating Income/ EBIT | 1263 | 1478 | 1533 | 1527 | 1647 | 1713 | 1844 | 2082 | 2424 | 2534 | 2668 | 2758 | 2810 |

| EBITDA | 1614 | 1811 | 1878 | 1874 | 2259 | 2384 | 2545 | 2846 | 3248 | 3431 | 3649 | 3811 | 3925 |

| Tax Expense | 147 | 213 | 216 | 191 | 94 | 225 | 198 | 315 | 295 | 308 | 325 | 336 | 342 |

| Effective tax rate | 12% | 14% | 14% | 13% | 6% | 13% | 11% | 15% | 12% | 12% | 12% | 12% | 12% |

| EBIAT | 1116 | 1265 | 1317 | 1336 | 1553 | 1488 | 1646 | 1767 | 2129 | 2226 | 2343 | 2422 | 2468 |

| Cashflow | |||||||||||||

| D&A | 351 | 333 | 263 | 269 | 511 | 543 | 513 | 549 | 553 | 584 | 621 | 648 | 668 |

| % of revenue | 2% | 2% | 2% | 2% | 3% | 3% | 3% | 3% | 2% | 2% | 2% | 2% | 2% |

| Amort. Of Goodwill and Intangibles | 0 | 0 | 82 | 78 | 101 | 128 | 188 | 215 | 272 | 313 | 361 | 406 | 447 |

| % of revenue | 0% | 0% | 0% | 0% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 1% | 2% |

| Capital Expenditure | -359 | -408 | -389 | -358 | -360 | -385 | -516 | -599 | -741 | -782 | -832 | -869 | -895 |

| % of revenue | 2% | 2% | 2% | 2% | 2% | 2% | 3% | 3% | 3% | 3% | 3% | 3% | 3% |

| Change in NWC | 717 | 108 | 640 | 192 | 422 | -196 | -95 | 132 | 521 | 550 | 585 | 611 | 630 |

| % of revenue | 4% | 1% | 4% | 1% | 2% | -1% | 0% | 1% | 2% | 2% | 2% | 2% | 2% |

| Unlevered FCF | 391 | 1082 | 633 | 1133 | 1383 | 1970 | 1926 | 1800 | 1692 | 1790 | 1907 | 1996 | 2059 |

Notes on projections edit edit source

Revenue projections were adapted from Capital IQ's estimates, and cross-checked with Yahoo Finance.

The COGS margin was projected by taking the average of COGS margins from 2017 onwards, as there seems to have been a stabilisation after this year.

The Selling General & Admin Expenses, Depreciation and Amortisation, Other Operating Expenses and the Tax Expenses were projected by applying average of each respective margin over the historical period and applying it to each forecast year.

Amortisation of Goodwill and Intangibles was projected as growing from 1.1% to 1.5% to model the steady increase in its margin seen in the historical period.

- Note: Upon cross-check with BAE System's Annual Report, Capital IQ presents the true depreciation expense as "Depreciation and Amortisation", and the true Amortisation Expense as "Amortisation of Goodwill and Intangibles".

Capital Expenditure was taken as having a steady 3% margin, seen from the recent step up in its value (2021, 2022)

Change in NWC was projected by taking the average of the non-negative margins from the historical data, and applying this average as the margin for each forecast year.

Calculation of the discount rate (WACC) edit edit source

| WACC | Notes | |

|---|---|---|

| Weights | ||

| Total Debt | 6610 | |

| Market Cap | 29363 | |

| Total | 35973 | |

| Wd | 18% | Weight of debt calculated as the total debt as a proportion of total capital. |

| We | 82% | Weight of equity calculated as the market cap as a proportion of total capital |

| Debt | ||

| Total Debt | 6610 | Cost of debt was calculated by taking interest expenses from the income statement and dividing this by the total debt making note of the fact that debt is a tax deductable item. |

| Interest Expense | -233 | |

| Rate | 3.5% | |

| Effective Tax Rate | 12% | |

| Rd(1-t) | 3.1% | |

| Equity | ||

| Risk Free Rate | 4.05% | Capital asset pricing model was used to calculate the cost of equity. Risk free rate of the US Treasury 10 Year was used. |

| Beta | 0.57 | Beta for the stock was found from Yahoo Finance |

| Market Rate | 10% | Current market rate was calculated as the average returns of the S&P 500 over the past 50 years. |

| Re | 7.4% | |

| Discount Rate | 6.6% | This is the value used for the WACC |

| Perpetuity Growth Rate | 2.0% | A perpetuity growth rate of 2% was used as this is sufficiently low to ensure that the company is not projected to increase in size far faster than the global economy in the very long term. |

Cashflow projection edit edit source

| £ millions | 2023 | 2024 | 2025 | 2026 | 2027 | Terminal Value (Perpetuity Growth) | Notes | |

|---|---|---|---|---|---|---|---|---|

| 1692 | 1790 | 1907 | 1996 | 2059 | 45229 | The terminal value of the company was calculated using the Gordon Growth Model.[19] | ||

DCF edit edit source

| Present Value of FCF | 7769 |

|---|---|

| Terminal Value | 45229 |

| Net Present Value of TV | 32791 |

| Enterprise Value | 40559 |

| Net Debt | 1866 |

| Equity Value | 38693 |

| Shares Out | 3050 |

| Equity Value per Share | £12.69 |

| Current share price | £9.68 |

| Difference | 31% |

Sensitivity Analysis edit edit source

A sensitivity analysis was also conducted to reflect how changes in the discount rate and perpetuity growth rate would affect the intrinsic value of the company.

| £12.69 | Perpetuity Growth | |||||

|---|---|---|---|---|---|---|

| 1.0% | 1.5% | 2.0% | 2.5% | 3.0% | ||

| WACC | 5.5% | £13.61 | £15.12 | £17.07 | £19.66 | £23.30 |

| 6.0% | £12.17 | £13.36 | £14.84 | £16.75 | £19.30 | |

| 6.5% | £10.99 | £11.95 | £13.11 | £14.57 | £16.44 | |

| 6.6% | £10.69 | £11.59 | £12.69 | £14.04 | £15.77 | |

| 7.0% | £10.01 | £10.79 | £11.73 | £12.87 | £14.30 | |

| 7.5% | £9.18 | £9.83 | £10.60 | £11.51 | £12.64 | |

| 8.0% | £8.47 | £9.02 | £9.65 | £10.40 | £11.31 | |

Relative Valuation edit edit source

Expected Return on Investment edit edit source

The Stockhub users estimate that the expected return of an investment in BAE Systems plc over the next five years is 15%. This value was arrived at through the use of a relative valuation method in the form of a comparable company analysis.

Assuming that BAE Systems achieves its return level of 15%, then the company can be considered as undervalued.

Comparable company analysis edit edit source

| Market Data | Financials | Valuation Ratios | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company | Ticker | Share Price | Currency | Shares Out /millions | Equity Value /millions | Net Debt /millions | Enterprise Value /millions | EPS | Revenue /millions | EBITDA /millions | Net Income /millions | EV/Revenue | EV/EBITDA | P/E | ||

| BAE Systems plc | LSE: BA | 9.62 | GBP | 3050 | 29341 | 3406 | 32747 | 0.50 | 22516 | 2776 | 1941 | 1.45 | 11.80 | 19.24 | ||

| Rolls-Royce Holdings plc | LSE: RR | 2.56 | GBP | 8362 | 21408 | 3732 | 25140 | 0.25 | 19665 | 2180 | 1514 | 1.28 | 11.53 | 10.24 | ||

| Safran SA | ENXTPA: SAF | 155.98 | EUR | 420 | 65527 | -81 | 65447 | 8.00 | 24065 | 4477 | 3166 | 2.72 | 14.62 | 19.50 | ||

| Thales S.A. | ENXTPA: HO | 140.78 | EUR | 209 | 29353 | 915 | 30267 | 6.08 | 19607 | 2499 | 1203 | 1.54 | 12.11 | 23.15 | ||

| Leonardo S.p.a. | BIT: LDO | 13.95 | EUR | 575 | 8025 | 4110 | 12135 | 1.62 | 16347 | 1536 | 857 | 0.74 | 7.90 | 8.61 | ||

| Airbus SE | ENXTPA: AIR | 137.79 | EUR | 789 | 108744 | -4661 | 104083 | 5.33 | 67010 | 7702 | 3872 | 1.55 | 13.51 | 25.85 | ||

| Northrop Grumman Corporation | NYSE: NOC | 430.17 | USD | 151 | 65085 | 13726 | 78811 | 30.23 | 37881 | 7243 | 4649 | 2.08 | 10.88 | 14.23 | ||

| Hensoldt AG | XTRA: 5UH | 31.63 | EUR | 105 | 3321 | 632 | 3953 | 0.80 | 1904 | 251 | 77 | 2.08 | 15.74 | 39.54 | ||

| Dassault Aviation societe anonyme | ENXTPA: AM | 185.32 | EUR | 79 | 14640 | -8190 | 6451 | 10.61 | 6850 | 733 | 806 | 0.94 | 8.80 | 17.47 | ||

| Rheinmetall AG | XTRA: RHM | 271.23 | EUR | 43 | 11771 | 828 | 12599 | 11.71 | 7175 | 1004 | 474 | 1.76 | 12.55 | 23.16 | ||

| L3Harris Technologies, Inc. | NYSE: LHX | 181.48 | USD | 189 | 34318 | 9158 | 43476 | 4.19 | 17988 | 2760 | 802 | 2.42 | 15.75 | 43.31 | ||

| Raytheon | NYSE: RTX | 85.47 | USD | 1460 | 124786 | 31532 | 156318 | 3.74 | 70573 | 12088 | 5562 | 2.21 | 12.93 | 22.85 | ||

| BAE Systems plc valuation | EV/Revenue | EV/EBITDA | P/E |

|---|---|---|---|

| Average Comparable Ratio | 1.76 | 12.39 | 22.54 |

| Revenue | 22516 | NA | NA |

| EBITDA | NA | 2776 | NA |

| EPS | NA | NA | 0.5 |

| Implied Enterprise Value | 39553 | 34404 | NA |

| Net Debt | 3406 | 3406 | NA |

| Implied Equity Value | 36147 | 30998 | NA |

| Shares Outstanding | 3050 | 3050 | NA |

| Implied Value Per Share | 11.85 | 10.16 | 11.27 |

| Average | £11.09 | ||

| Current Share Price | £9.68 | ||

| Difference | 14.6% | ||

Risks[3] edit edit source

BAE Systems believes that managing risks effectively is key to successfully delivering on their strategies and strategic priorities. They employ a thorough, multifaceted, top to bottom risk management framework, which aims to mitigate any risk to their strategy that is identified. The Board has the overall responsibility, advised by the Audit, ESG and Executive Committees. The basis of the framework is:

Identify, Analyse, Evaluate, Mitigate

All risks primarily affect their future revenue and financial health.

Government customers, defence spending and terms of trade risks edit edit source

These risks affect strategies 1, 2, 3, 5

- 95% of sales in 2022 were in defence. Government expenditure on defence can vary based on policy, politics, budgetary constraints as well as national security threats, and some governments have already faced constraints. However, BAE has a geographically well-spread market, many countries within which have announced plans to defence spending in response to the currently elevated global threats. BAE also benefits from a large order backlog, as well as establishment with long-term projects.

- BAE systems faces threats to their ability to secure and maintain government contracts. Financial reviews can lead to budgetary reconsiderations and premature termination of contracts. However, BAE is established as being a major contributor to the industrial capabilities of the countries within its market.

- BAE also faces a risk with the fact that its cashflows depend on the timing and success in being awarded contracts as well as when they receive the corresponding cash. Not receiving cashflow on time can lead to an inability to focus on their own expenditure without requiring external funding - impacting credit rating. However, BAE manages their balance sheet conservatively, to ensure flexibility, as well as monitoring liquidity to ensure the retrieval of cash needed for operations.

International market risks edit edit source

These risks affect strategies 1,2,3,5

- The risks of operating in international markets include: social and political changes impacting the business environment, economic downturns, political instability and civil disturbances, the imposition of restraints on the movement of capital, the introduction of burdensome taxes or tariffs, change of export control, tax and other government policy and regulations in the UK, US and all other relevant jurisdictions, and the inability to obtain or maintain the necessary export licences. Similar to the risk on fluctuations in government expenditure, BAE has a geographically well-spread market, many countries within which have announced plans to defence spending in response to the currently elevated global threats. BAE also benefits from a large order backlog, as well as establishment with long-term projects.

- They are exposed to volatility arising from movements in currency exchange rates, particularly in respect of the US dollar, euro, Saudi riyal and Australian dollar. There has been volatility in currency exchange rates in 2022.

- Brexit can still affect BAE System's ability to participate in, and receive contracts for, European Union-funded projects. However, BAE has a major role in certain European programmes, such as the Eurofighter, and is also supporting the UK government in maintaining the UK's role in European security and defence.

Contract risk, execution and supply chain risks edit edit source

These risks affect strategies 1,2,4,5

- There is a risk associated with the costs of fixed-price contracts exceeding the contract amount, and hence resulting in a local loss. The price is agreed based on a projection of the inflation rate, and hence is subject to fluctuation. It is important for BAE systems to maintain tight tolerances on quality, time and cost, in a reliable, predictable and repeatable manner. They have also limited fixed-price contracts regarding design and development, which tend to have more associated risk.

- Like any business associated with product manufacturing. BAE system relies on its supply chain, which has intrinsic risk. There are lead-time and availability issues, as well as pricing pressures from inflationary increases in labour, energy and key materials.

Cyber security risks edit edit source

These risks affect strategies 1,3,4

- Cyber threats can cause business and operational disruption. BAE Systems faces risks potential cybersecurity threats in the form of:

- Attacks impacting availability of its information technology and operational technology infrastructure and systems

- Attempts to gain access to or delete proprietary and classified information, of BAE Systems as well as its customers, partners and suppliers.

These threats are mitigated through constant monitoring, as well as cyber security training for its personnel.

Competition in international markets edit edit source

These risks affect strategies 1,3,5

- BAE systems need to be able to win contracts for new and high-quality programmes, while depending on UK and US government support. However, their multi-market and international presence, balanced business portfolio and their capable and reliable track record of delivery is a factor that combats this risk. BAE systems also invests in research and development, to ensure cutting-edge technology that puts them in line with, or ahead of, the competition.

Outbreak of contagious disease edit edit source

These risks affect strategies 1,2,3,4,5

- Similar to that of COVID-19, new pandemics can cause sever disruption to its operations, as well as its market. However, having been through the coronavirus pandemic, it is expected that the experience in dealing with such an event can minimise the impact of future pandemics, experience including safe working practices and effectively implementing working from home.

Climate change and the environment edit edit source

These risks affect strategies 1,2,3,4,5,6

- BAE systems could face rigorous environmental laws and regulations, regarding air emissions, waste handling, use and handling of hazardous materials, remediation of soil and groundwater, contamination and the prevention of pollution through greenhouse gas emission. This could affect operations, as well as an ability to sell. Harsh environmental conditions could directly affect operations, through natural disasters and accidents arising from the environment. Furthermore, the adjustment to a low-carbon economy could mean increased tariffs and compliance costs, as well as a potentially reduced demand base, driven by politics and morality. However, BAE systems are working towards the target of achieving net zero across operations by 2030.

Laws and regulations edit edit source

These risks affect strategies 1,2,3,4,5,6

- Their operations are within a highly regulated environment across multiple jurisdictions, and is therefore subject to regulations related to import-export controls, money laundering, false accounting, anti-bribery and anti-boycott provisions. It is crucial that BAE systems maintains responsible business and financial practices. They may also be affected by export restrictions, affecting their ability to sell their products.

Acquisitions edit edit source

These risks affect strategies 1,2,3,5

- BAE Systems believes in the virtue of investing in value-enhancing acquisitions, where such an acquisition brings them closer to their strategised goals. They must ensure successful migration and integration of acquired business, as well as perform post-acquisition monitoring of its expected benefits

References edit edit source

- ↑ https://www.britannica.com/topic/BAE-Systems

- ↑ https://www.baesystems.com/en/our-company/our-purpose

- ↑ 3.0 3.1 3.2 3.3 https://investors.baesystems.com/~/media/Files/B/BAE-Systems-Investor/documents/bae-ar-complete-2022-new.pdf

- ↑ https://investors.baesystems.com/~/media/Files/B/BAE-Systems-Investor/investors/shareholder-information/reports-and-presentations/esg-update-and-digital-intelligence-overview.pdf

- ↑ 5.0 5.1 5.2 https://www.sipri.org/sites/default/files/2023-04/2304_fs_milex_2022.pdf

- ↑ https://www.researchandmarkets.com/reports/5720994/defense-global-market-opportunities-and

- ↑ https://www.baesystems.com/en/our-company/about-us

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-chief-executive-officer

- ↑ https://www.baesystems.com/en-us/our-company/our-people/inc-leadership/tom-arseneault-old

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-managing-director-digital-intelligence

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/managing-director-bae-systems-saudi-arabia

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-managing-director-business-development

- ↑ https://www.baesystems.com/en/our-people/executive-committee/chief-technology-and-information-officer

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-finance-director

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-communications-director

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-esg-culture-and-business-transformation-director

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-managing-director-maritime-and-land

- ↑ https://www.baesystems.com/en/our-company/our-people/executive-committee/group-managing-director-air

- ↑ https://www.investopedia.com/terms/t/terminalvalue.asp

Appendix edit edit source

| For the Fiscal Period Ending | Reclassified

12 months Dec-31-2015 |

Reclassified

12 months Dec-31-2016 |

Restated

12 months Dec-31-2017 |

12 months

Dec-31-2018 |

12 months

Dec-31-2019 |

12 months

Dec-31-2020 |

12 months

Dec-31-2021 |

12 months

Dec-31-2022 |

LTM

12 months Jun-30-2023 |

| Currency | GBP | GBP | GBP | GBP | GBP | GBP | GBP | GBP | GBP |

| Revenue | 16,787.0 | 17,790.0 | 17,224.0 | 16,821.0 | 18,305.0 | 19,277.0 | 19,521.0 | 21,258.0 | 22,516.0 |

| Other Revenue | - | - | - | - | - | - | - | - | - |

| Total Revenue | 16,787.0 | 17,790.0 | 17,224.0 | 16,821.0 | 18,305.0 | 19,277.0 | 19,521.0 | 21,258.0 | 22,516.0 |

| Cost Of Goods Sold | 7,101.0 | 7,212.0 | 6,085.0 | 5,923.0 | 6,502.0 | 6,864.0 | 7,053.0 | 7,195.0 | 8,305.0 |

| Gross Profit | 9,686.0 | 10,578.0 | 11,139.0 | 10,898.0 | 11,803.0 | 12,413.0 | 12,468.0 | 14,063.0 | 14,211.0 |

| Selling General & Admin Exp. | 5,200.0 | 5,838.0 | 6,229.0 | 6,203.0 | 6,457.0 | 6,681.0 | 6,640.0 | 7,431.0 | 7,393.0 |

| R & D Exp. | - | - | - | - | - | - | - | - | - |

| Depreciation & Amort. | 351.0 | 333.0 | 263.0 | 269.0 | 511.0 | 543.0 | 513.0 | 549.0 | 549.0 |

| Amort. of Goodwill and Intangibles | - | - | 82.0 | 78.0 | 101.0 | 128.0 | 188.0 | 215.0 | 215.0 |

| Other Operating Expense/(Income) | 2,872.0 | 2,929.0 | 3,032.0 | 2,821.0 | 3,087.0 | 3,348.0 | 3,283.0 | 3,786.0 | 3,742.0 |

| Other Operating Exp., Total | 8,423.0 | 9,100.0 | 9,606.0 | 9,371.0 | 10,156.0 | 10,700.0 | 10,624.0 | 11,981.0 | 11,899.0 |

| Operating Income | 1,263.0 | 1,478.0 | 1,533.0 | 1,527.0 | 1,647.0 | 1,713.0 | 1,844.0 | 2,082.0 | 2,312.0 |

| Interest Expense | (175.0) | (208.0) | (202.0) | (204.0) | (235.0) | (240.0) | (249.0) | (269.0) | (268.0) |

| Interest and Invest. Income | 17.0 | 10.0 | 24.0 | 26.0 | 27.0 | 17.0 | 39.0 | 35.0 | 35.0 |

| Net Interest Exp. | (158.0) | (198.0) | (178.0) | (178.0) | (208.0) | (223.0) | (210.0) | (234.0) | (233.0) |

| Income/(Loss) from Affiliates | 110.0 | 90.0 | 107.0 | 140.0 | 168.0 | 69.0 | 139.0 | 180.0 | 193.0 |

| Currency Exchange Gains (Loss) | (26.0) | (364.0) | 308.0 | (211.0) | 154.0 | 127.0 | 35.0 | (524.0) | (524.0) |

| Other Non-Operating Inc. (Exp.) | (36.0) | 140.0 | (311.0) | 111.0 | (105.0) | (170.0) | (39.0) | 400.0 | 575.0 |

| EBT Excl. Unusual Items | 1,153.0 | 1,146.0 | 1,459.0 | 1,389.0 | 1,656.0 | 1,516.0 | 1,769.0 | 1,904.0 | 2,323.0 |

| Merger & Related Restruct. Charges | - | - | - | - | - | (20.0) | (3.0) | (16.0) | (16.0) |

| Impairment of Goodwill | (75.0) | - | (384.0) | - | - | - | - | - | - |

| Gain (Loss) On Sale Of Invest. | 1.0 | - | - | - | - | 6.0 | - | - | - |

| Gain (Loss) On Sale Of Assets | 45.0 | 17.0 | (3.0) | 9.0 | (18.0) | 41.0 | 350.0 | 104.0 | 104.0 |

| Asset Writedown | (34.0) | (9.0) | 1.0 | (64.0) | (12.0) | (4.0) | (19.0) | (3.0) | (3.0) |

| Other Unusual Items | - | (3.0) | - | (110.0) | - | 57.0 | 13.0 | - | - |

| EBT Incl. Unusual Items | 1,090.0 | 1,151.0 | 1,073.0 | 1,224.0 | 1,626.0 | 1,596.0 | 2,110.0 | 1,989.0 | 2,408.0 |

| Income Tax Expense | 147.0 | 213.0 | 216.0 | 191.0 | 94.0 | 225.0 | 198.0 | 315.0 | 376.0 |

| Earnings from Cont. Ops. | 943.0 | 938.0 | 857.0 | 1,033.0 | 1,532.0 | 1,371.0 | 1,912.0 | 1,674.0 | 2,032.0 |

| Earnings of Discontinued Ops. | - | - | - | - | - | - | - | - | - |

| Extraord. Item & Account. Change | - | - | - | - | - | - | - | - | - |

| Net Income to Company | 943.0 | 938.0 | 857.0 | 1,033.0 | 1,532.0 | 1,371.0 | 1,912.0 | 1,674.0 | 2,032.0 |

| Minority Int. in Earnings | (25.0) | (25.0) | (30.0) | (33.0) | (56.0) | (72.0) | (154.0) | (83.0) | (91.0) |

| Net Income | 918.0 | 913.0 | 827.0 | 1,000.0 | 1,476.0 | 1,299.0 | 1,758.0 | 1,591.0 | 1,941.0 |

| Pref. Dividends and Other Adj. | - | - | - | - | - | - | - | - | - |

| NI to Common Incl Extra Items | 918.0 | 913.0 | 827.0 | 1,000.0 | 1,476.0 | 1,299.0 | 1,758.0 | 1,591.0 | 1,941.0 |

| NI to Common Excl. Extra Items | 918.0 | 913.0 | 827.0 | 1,000.0 | 1,476.0 | 1,299.0 | 1,758.0 | 1,591.0 | 1,941.0 |

| Per Share Items | |||||||||

| Basic EPS | 0.29 | 0.29 | 0.26 | 0.31 | 0.46 | 0.41 | 0.55 | 0.51 | 0.63 |

| Basic EPS Excl. Extra Items | 0.29 | 0.29 | 0.26 | 0.31 | 0.46 | 0.41 | 0.55 | 0.51 | 0.63 |

| Weighted Avg. Basic Shares Out. | 3,161.0 | 3,171.0 | 3,182.0 | 3,192.0 | 3,183.0 | 3,191.0 | 3,187.0 | 3,112.0 | 3,066.0 |

| Diluted EPS | 0.29 | 0.29 | 0.26 | 0.31 | 0.46 | 0.41 | 0.55 | 0.51 | 0.63 |

| Diluted EPS Excl. Extra Items | 0.29 | 0.29 | 0.26 | 0.31 | 0.46 | 0.41 | 0.55 | 0.51 | 0.63 |

| Weighted Avg. Diluted Shares Out. | 3,171.0 | 3,185.0 | 3,197.0 | 3,201.0 | 3,201.0 | 3,210.0 | 3,211.0 | 3,153.0 | 3,109.5 |

| Normalized Basic EPS | 0.22 | 0.22 | 0.28 | 0.26 | 0.31 | 0.27 | 0.3 | 0.36 | 0.44 |

| Normalized Diluted EPS | 0.22 | 0.22 | 0.28 | 0.26 | 0.31 | 0.27 | 0.3 | 0.35 | 0.44 |

| Dividends per Share | 0.21 | 0.21 | 0.22 | 0.22 | 0.23 | 0.24 | 0.25 | 0.27 | 0.28 |

| Payout Ratio % | 71.4% | 73.4% | 82.7% | 70.3% | 49.1% | 57.4% | 44.2% | 50.4% | 42.8% |

| Shares per Depository Receipt | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 | 4.0 |

| Supplemental Items | |||||||||

| EBITDA | 1,614.0 | 1,767.0 | 1,823.0 | 1,804.0 | 1,945.0 | 2,061.0 | 2,224.0 | 2,521.0 | 2,776.0 |

| EBITA | 1,367.0 | 1,514.0 | 1,560.0 | 1,535.0 | 1,651.0 | 1,750.0 | 1,925.0 | 2,189.0 | 2,424.0 |

| EBIT | 1,263.0 | 1,478.0 | 1,533.0 | 1,527.0 | 1,647.0 | 1,713.0 | 1,844.0 | 2,082.0 | 2,312.0 |

| EBITDAR | 1,871.0 | 2,051.0 | 2,118.0 | 2,091.0 | 1,980.0 | 2,087.0 | 2,247.0 | 2,551.0 | NA |

| As Reported Total Revenue* | 16,787.0 | 17,790.0 | 17,224.0 | 16,821.0 | NA | NA | NA | NA | NA |

| Effective Tax Rate % | 13.5% | 18.5% | 20.1% | 15.6% | 5.8% | 14.1% | 9.4% | 15.8% | 15.6% |

| Current Domestic Taxes | 92.0 | 45.0 | 153.0 | 66.0 | 180.0 | 115.0 | 18.0 | 116.0 | 116.0 |

| Current Foreign Taxes | 6.0 | 169.0 | 120.0 | 141.0 | (89.0) | 118.0 | 199.0 | 369.0 | 369.0 |

| Total Current Taxes | 98.0 | 214.0 | 273.0 | 207.0 | 91.0 | 233.0 | 217.0 | 485.0 | 485.0 |

| Deferred Domestic Taxes | (11.0) | (18.0) | (54.0) | (30.0) | 1.0 | (4.0) | (34.0) | (12.0) | (12.0) |

| Deferred Foreign Taxes | 60.0 | 17.0 | (3.0) | 14.0 | 2.0 | (4.0) | 15.0 | (158.0) | (158.0) |

| Total Deferred Taxes | 49.0 | (1.0) | (57.0) | (16.0) | 3.0 | (8.0) | (19.0) | (170.0) | (170.0) |

| Normalized Net Income | 695.6 | 691.3 | 881.9 | 835.1 | 979.0 | 875.5 | 951.6 | 1,107.0 | 1,360.9 |

| Interest on Long Term Debt | NA | 212.0 | NA | NA | 48.0 | 44.0 | 43.0 | 48.0 | NA |

| Non-Cash Pension Expense | 211.0 | 198.0 | 184.0 | 251.0 | 154.0 | 26.0 | 88.0 | 47.0 | - |

| Filing Date | Mar-28-2017 | Mar-27-2018 | Mar-27-2019 | Apr-03-2020 | Mar-30-2021 | Mar-30-2022 | Mar-29-2023 | Mar-29-2023 | Aug-02-2023 |

| Restatement Type | RC | RC | RS | NC | NC | NC | NC | O | O |

| Calculation Type | REP | REP | REP | REP | REP | REP | REP | REP | LTM |

| Supplemental Operating Expense Items | |||||||||

| R&D Exp. | 1,263.0 | 1,426.0 | 1,608.0 | 1,507.0 | 1,510.0 | 1,605.0 | 1,600.0 | 2,000.0 | 2,000.0 |

| Net Rental Exp. | 257.0 | 284.0 | 295.0 | 287.0 | 35.0 | 26.0 | 23.0 | 30.0 | NA |

| Imputed Oper. Lease Interest Exp. | 97.5 | 111.6 | 110.7 | 110.5 | 14.4 | 8.5 | 6.8 | 9.6 | - |

| Imputed Oper. Lease Depreciation | 159.5 | 172.4 | 184.3 | 176.5 | 20.6 | 17.5 | 16.2 | 20.4 | - |

| Stock-Based Comp., COGS | 44.0 | 55.0 | 61.0 | 63.0 | 74.0 | 74.0 | 92.0 | 101.0 | 101.0 |

| Stock-Based Comp., Unallocated | - | - | - | 1.0 | - | - | - | - | 5.0 |

| Stock-Based Comp., Total | 44.0 | 55.0 | 61.0 | 64.0 | 74.0 | 74.0 | 92.0 | 101.0 | 106.0 |

| Balance Sheet as of: | Dec-31-2015 | Dec-31-2016 | Restated

Dec-31-2017 |

Reclassified

Dec-31-2018 |

Dec-31-2019 | Dec-31-2020 | Restated

Dec-31-2021 |

Dec-31-2022 | Jun-30-2023 |

| Currency | GBP | GBP | GBP | GBP | GBP | GBP | GBP | GBP | GBP |

| ASSETS | |||||||||

| Cash And Equivalents | 2,537.0 | 2,769.0 | 3,271.0 | 3,232.0 | 2,587.0 | 2,768.0 | 2,917.0 | 3,107.0 | 3,204.0 |

| Trading Asset Securities | 58.0 | 53.0 | 12.0 | 87.0 | 7.0 | 9.0 | 8.0 | 23.0 | - |

| Total Cash & ST Investments | 2,595.0 | 2,822.0 | 3,283.0 | 3,319.0 | 2,594.0 | 2,777.0 | 2,925.0 | 3,130.0 | 3,204.0 |

| Accounts Receivable | 2,398.0 | 2,769.0 | 3,234.0 | 3,825.0 | 4,117.0 | 4,269.0 | 3,759.0 | 5,064.0 | 6,380.0 |

| Other Receivables | 292.0 | 285.0 | 326.0 | 408.0 | 505.0 | 582.0 | 693.0 | 726.0 | 111.0 |

| Total Receivables | 2,690.0 | 3,054.0 | 3,560.0 | 4,233.0 | 4,622.0 | 4,851.0 | 4,452.0 | 5,790.0 | 6,491.0 |

| Inventory | 726.0 | 744.0 | 733.0 | 774.0 | 835.0 | 858.0 | 811.0 | 976.0 | 1,047.0 |

| Prepaid Exp. | 254.0 | 256.0 | 704.0 | 1,025.0 | 855.0 | 646.0 | 444.0 | 509.0 | - |

| Other Current Assets | 67.0 | 153.0 | 103.0 | 225.0 | 338.0 | 274.0 | 186.0 | 229.0 | 203.0 |

| Total Current Assets | 6,332.0 | 7,029.0 | 8,383.0 | 9,576.0 | 9,244.0 | 9,406.0 | 8,818.0 | 10,634.0 | 10,945.0 |

| Gross Property, Plant & Equipment | 4,576.0 | 5,405.0 | 5,444.0 | 5,713.0 | 6,967.0 | 7,194.0 | 7,601.0 | 8,716.0 | - |

| Accumulated Depreciation | (2,878.0) | (3,307.0) | (3,214.0) | (3,348.0) | (3,392.0) | (3,486.0) | (3,658.0) | (4,056.0) | - |

| Net Property, Plant & Equipment | 1,698.0 | 2,098.0 | 2,230.0 | 2,365.0 | 3,575.0 | 3,708.0 | 3,943.0 | 4,660.0 | 4,642.0 |

| Long-term Investments | 311.0 | 512.0 | 407.0 | 562.0 | 558.0 | 546.0 | 744.0 | 1,033.0 | 805.0 |

| Goodwill | 9,840.0 | 10,902.0 | 9,996.0 | 10,239.0 | 9,984.0 | 10,846.0 | 10,910.0 | 11,819.0 | - |

| Other Intangibles | 277.0 | 320.0 | 354.0 | 387.0 | 353.0 | 863.0 | 769.0 | 775.0 | 12,132.0 |

| Accounts Receivable Long-Term | - | - | - | - | 91.0 | 70.0 | 54.0 | 44.0 | - |

| Deferred Tax Assets, LT | 985.0 | 1,251.0 | 702.0 | 702.0 | 726.0 | 972.0 | 622.0 | 338.0 | 326.0 |

| Deferred Charges, LT | - | 42.0 | 28.0 | 32.0 | 34.0 | 36.0 | 37.0 | 50.0 | - |

| Other Long-Term Assets | 640.0 | 822.0 | 937.0 | 883.0 | 1,065.0 | 1,083.0 | 1,238.0 | 2,109.0 | 2,113.0 |