BP p.l.c.: Difference between revisions

No edit summary |

|||

| Line 83: | Line 83: | ||

|22,729,410 | |22,729,410 | ||

|0.78% | |0.78% | ||

|£ | |£ 107.46 M | ||

|- | |- | ||

|Arrowstreet Capital LP | |Arrowstreet Capital LP | ||

|22,601,056 | |22,601,056 | ||

|0.77& | |0.77& | ||

|£ | |£ 106.86 M | ||

|- | |- | ||

|Fisher Asset Management | |Fisher Asset Management | ||

|16,988,964 | |16,988,964 | ||

|0.58% | |0.58% | ||

|£ | |£ 80.32 M | ||

|- | |- | ||

|Acadian Asset Management | |Acadian Asset Management | ||

|13,121,799 | |13,121,799 | ||

|0.45% | |0.45% | ||

|£ | |£ 62.04 M | ||

|- | |- | ||

|Dimensional Fund Advisors LP | |Dimensional Fund Advisors LP | ||

|11,042,101 | |11,042,101 | ||

|0.38% | |0.38% | ||

|£ | |£ 52.21 M | ||

|- | |- | ||

|Boston Partners Global Investors | |Boston Partners Global Investors | ||

|9,243,957 | |9,243,957 | ||

|0.32% | |0.32% | ||

|£ | |£ 43.71 M | ||

|- | |- | ||

|Wellington Management Co. LLP | |Wellington Management Co. LLP | ||

|9,149,979 | |9,149,979 | ||

|0.31% | |0.31% | ||

|£ | |£ 43.26 M | ||

|- | |- | ||

|Goldman Sachs Asset Management LP | |Goldman Sachs Asset Management LP | ||

|7,165,086 | |7,165,086 | ||

|0.25% | |0.25% | ||

|£ | |£ 33.88 M | ||

|- | |- | ||

|Two Sigma Advisers LP | |Two Sigma Advisers LP | ||

|7,044,126 | |7,044,126 | ||

|0.24% | |0.24% | ||

|£ | |£ 33.30 M | ||

|- | |- | ||

|Morgan Stanley Smith Barney | |Morgan Stanley Smith Barney | ||

|7,021,946 | |7,021,946 | ||

|0.24% | |0.24% | ||

|£ | |£ 33.20 M | ||

|} | |} | ||

Revision as of 16:08, 19 August 2023

Company Overview

BP p.l.c. engages in the energy business worldwide. It operates through Gas & Low Carbon Energy, Oil Production & Operations, Customers & Products, and Rosneft segments. It produces and trades in natural gas; offers biofuels; operates onshore and offshore wind power, and solar power generating facilities; and provides de-carbonization solutions and services, such as hydrogen and carbon capture and storage. The company is also involved in the convenience and mobility business, which manages the sale of fuels to retail customers, convenience products, aviation fuels, and Castrol lubricants; and refining and trading of oil products, as well as operation of electric vehicle charging facilities. In addition, it produces and refines oil and gas; and invests in upstream, downstream, and alternative energy companies, as well as in advanced mobility, bio and low carbon products, carbon management, digital transformation, and power and storage areas. The company was founded in 1908 and is headquartered in London, the United Kingdom.

Industry Overview

BP operates in the global energy industry, where it is one of the leaders. It operates in all 3 major areas of the industry: power generations, transmission and distribution networks along with metering and sales.

Industry drivers

- Growing economy - an increasing number of factories, offices and other industrial institutions need energy supply.

- Growing population - increased usage of electricity, more vehicles being purchased and used all contribute to an increased demand for energy.

- Rise in urbanisation - increasing number of people move into cities and adopt a lifestyle with which energy consumption is higher.

Total Addressable Market

Here the total addressable market (TAM) is defined as the global power generation market and is estimated to be $1.94 trillion in size.

Serviceable Available Market

Here the serviceable available market (SAM) is defined as the global oil refinery market and is estimated to be $1.45 trillion in size.

Serviceable Obtainable Market

Here the serviceable obtainable market (SOM) is defined as the global oil refinery market and is estimated to be $1.45 trillion in size.

Competition

BP's main competitors include Equinor ASA, ConocoPhillips, Marathon Petroleum, Phillips 66 and Valero energy. With a market cap of $103.57 billion BP is second compared to it's competitors, losing only to ConocoPhillips with a market cap of $138.3 billion.

| Company | Market cap ($ billion) | P/E ratio | Revenue ($ billion) | 1 year price performance |

|---|---|---|---|---|

| BP | 103.57 | 5.87 | 241.4 | +14.70% |

| Equinor ASA | 95.31 | 3.98 | 150.81 | -19.7% |

| ConocoPhillips | 138.30 | 11.13 | 82.16B | +14.5% |

| Marathon Petroleum | 57.03 | 5.17 | 179.95B | +46.3% |

| Phillips 66 | 50.51 | 4.92 | 175.70B | +26.7% |

| Valero energy | 46.31 | 4.52 | 176.38B | +15.6% |

Operations

Management

Ownership Structure

| Name | Equities | % | Valuation |

|---|---|---|---|

| SSgA fund management | 22,729,410 | 0.78% | £ 107.46 M |

| Arrowstreet Capital LP | 22,601,056 | 0.77& | £ 106.86 M |

| Fisher Asset Management | 16,988,964 | 0.58% | £ 80.32 M |

| Acadian Asset Management | 13,121,799 | 0.45% | £ 62.04 M |

| Dimensional Fund Advisors LP | 11,042,101 | 0.38% | £ 52.21 M |

| Boston Partners Global Investors | 9,243,957 | 0.32% | £ 43.71 M |

| Wellington Management Co. LLP | 9,149,979 | 0.31% | £ 43.26 M |

| Goldman Sachs Asset Management LP | 7,165,086 | 0.25% | £ 33.88 M |

| Two Sigma Advisers LP | 7,044,126 | 0.24% | £ 33.30 M |

| Morgan Stanley Smith Barney | 7,021,946 | 0.24% | £ 33.20 M |

Financials

Historical Financials

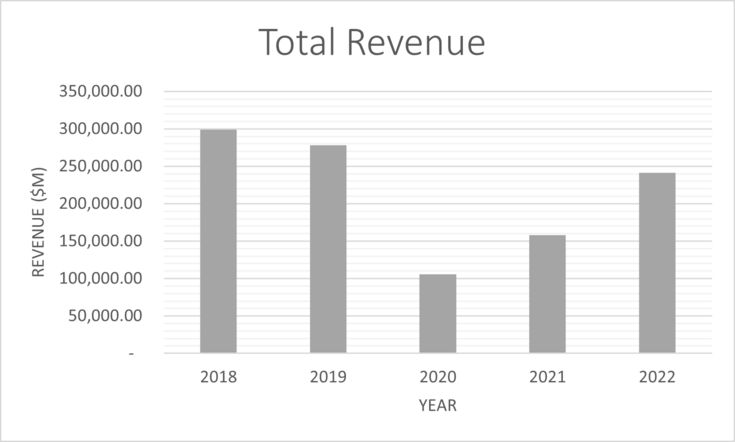

The table below shows revenue, EBIT and other financials for the previous 5 years. Revenue has shown an overall decline over the previous five years. The steep decline in 2020 was due to the global coronavirus pandemic. The jump in earnings from 2020 to 2021 and 2022 is due to the global volatility in oil prices as a result of the conflict in Ukraine. NCWC is non-cash working capital, and is calculated to be used in the DCF valuation below.

| Units ($m) | 2018 | 2019 | 2020 | 2021 | 2022 |

| Total Revenue | 298,756.00 | 278,397.00 | 105,944.00 | 157,739.00 | 241,392.00 |

| Purchases | 229,878.00 | 209,672.00 | 57,682.00 | 92,923.00 | 141,043.00 |

| P&M Expenses | 23,005.00 | 21,815.00 | 22,494.00 | 25,843.00 | 28,610.00 |

| D&A Expenses | 12,179.00 | 11,057.00 | 10,397.00 | 11,931.00 | 13,449.00 |

| EBIT | 18,237.00 | 18,073.00 | 482.00 | 12,237.00 | 43,972.00 |

| Depreciation | 15,457.00 | 17,780.00 | 14,889.00 | 14,805.00 | 14,318.00 |

| CapEx | - 16,707.00 | - 15,418.00 | - 12,306.00 | - 10,887.00 | - 12,069.00 |

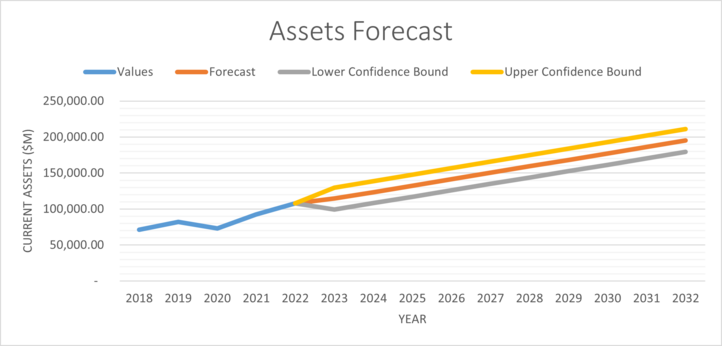

| Current Assets | 71,310.00 | 82,059.00 | 72,982.00 | 92,590.00 | 107,688.00 |

| Cash | 21,340.00 | 20,965.00 | 29,527.00 | 26,221.00 | 23,907.00 |

| Current Liabilities | 68,237.00 | 73,595.00 | 59,799.00 | 80,287.00 | 99,018.00 |

| NCWC | - 18,267.00 | - 12,501.00 | - 16,344.00 | - 13,918.00 | - 15,237.00 |

| NCWC (inc/dec) | \ | - 5,766.00 | 3,843.00 | - 2,426.00 | 1,319.00 |

Notes - P&M = Production and Manufacturing, D&A = Distribution and Administration.

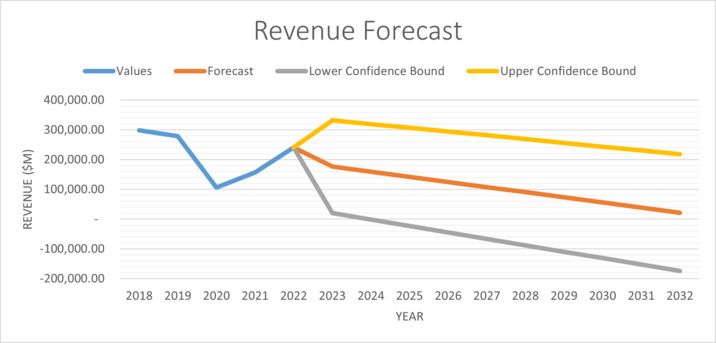

Forecasts

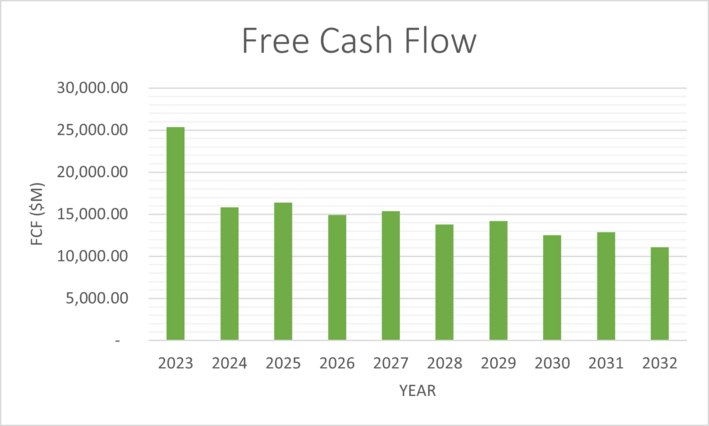

The following table shows how the financials have been forecast for a period of 10 years.

| Units ($m) | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

| Total Revenue | 331,884.34 | 319,540.81 | 307,093.20 | 294,550.32 | 281,919.91 | 269,208.77 | 256,422.93 | 243,567.76 | 230,648.06 | 217,668.16 |

| Purchases | 215,089.73 | 207,090.06 | 199,022.93 | 190,894.06 | 182,708.46 | 174,470.55 | 166,184.22 | 157,852.96 | 149,479.88 | 141,067.78 |

| P&M Expenses | 43,147.39 | 41,542.64 | 39,924.36 | 38,293.69 | 36,651.65 | 34,999.11 | 33,336.85 | 31,665.59 | 29,985.93 | 28,298.45 |

| D&A Expenses | 20,574.91 | 19,809.68 | 19,038.00 | 18,260.42 | 17,477.40 | 16,689.39 | 15,896.74 | 15,099.79 | 14,298.85 | 13,494.17 |

| EBIT | 39,104.56 | 40,274.04 | 36,820.05 | 37,957.65 | 34,474.42 | 35,585.12 | 32,077.04 | 33,164.70 | 29,635.21 | 30,702.93 |

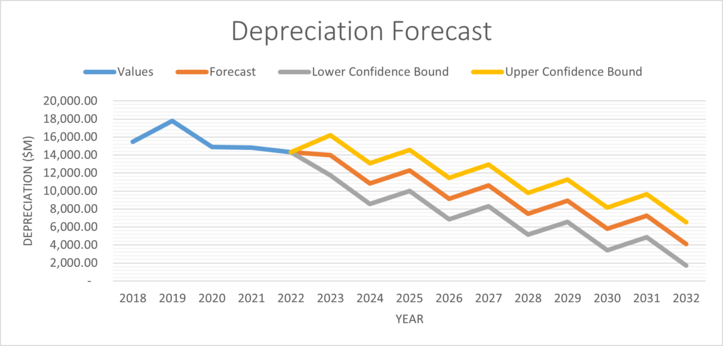

| Depreciation | 13,967.75 | 10,824.39 | 12,287.86 | 9,144.50 | 10,607.97 | 7,464.61 | 8,928.08 | 5,784.72 | 7,248.20 | 4,104.83 |

| CapEx | -16,095.57 | -15,017.62 | -13,971.98 | -12,959.48 | -11,980.90 | -11,036.89 | -10,128.07 | -9,254.97 | -8,418.08 | -7,617.84 |

| Current Assets | 114,484.58 | 123,441.44 | 132,398.29 | 141,355.15 | 150,312.00 | 159,268.86 | 168,225.71 | 177,182.57 | 186,139.43 | 195,096.28 |

| Cash | 34,184.42 | 32,913.03 | 31,630.91 | 30,338.98 | 29,038.03 | 27,728.77 | 26,411.82 | 25,087.72 | 23,756.98 | 22,420.04 |

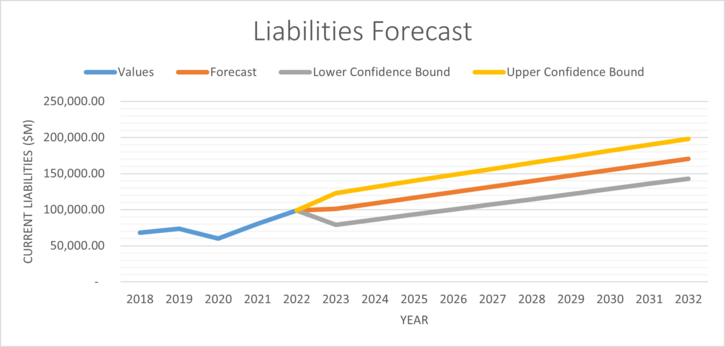

| Current Liabilities | 101,117.57 | 108,833.19 | 116,548.82 | 124,264.45 | 131,980.07 | 139,695.70 | 147,411.33 | 155,126.95 | 162,842.58 | 170,558.21 |

| NCWC | -20,817.41 | -18,304.78 | -15,781.44 | -13,248.28 | -10,706.10 | -8,155.62 | -5,597.43 | -3,032.11 | -460.14 | 2,118.03 |

| NCWC (inc/dec) | 5,580.41 | -2,512.63 | -2,523.35 | -2,533.16 | -2,542.17 | -2,550.49 | -2,558.18 | -2,565.32 | -2,571.97 | -2,578.17 |

| FCF | 25,351.15 | 15,847.60 | 16,411.76 | 14,908.14 | 15,390.58 | 13,804.90 | 14,204.97 | 12,536.66 | 12,853.86 | 11,102.46 |

The following table and graphs show the assumptions used to forecast financials for the DCF valuation.

| Assumptions | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

| Purchases % of revenue | 76.9% | 75.3% | 54.4% | 58.9% | 58.4% | 64.8% | 64.8% | 64.8% | 64.8% | 64.8% | 64.8% | 64.8% | 64.8% | 64.8% | 64.8% |

| P&M % of revenue | 7.7% | 7.8% | 21.2% | 16.4% | 11.9% | 13.0% | 13.0% | 13.0% | 13.0% | 13.0% | 13.0% | 13.0% | 13.0% | 13.0% | 13.0% |

| D&A Expenses % of revenue | 4.1% | 4.0% | 9.8% | 7.6% | 5.6% | 6.2% | 6.2% | 6.2% | 6.2% | 6.2% | 6.2% | 6.2% | 6.2% | 6.2% | 6.2% |

| CapEx % of revenue | 5.6% | 5.5% | 11.6% | 6.9% | 5.0% | 4.8% | 4.7% | 4.5% | 4.4% | 4.2% | 4.1% | 3.9% | 3.8% | 3.6% | 3.5% |

| Cash % of revenue | 7.1% | 7.5% | 27.9% | 16.6% | 9.9% | 10.3% | 10.3% | 10.3% | 10.3% | 10.3% | 10.3% | 10.3% | 10.3% | 10.3% | 10.3% |

The purchases forecast was averaged over the previous years, and this average was applied going forwards. The same was done for P&M expenses, D&A expenses and Cash. CapEx displayed a declining pattern, and this is also in-line with bp's targets of reducing CapEx to 2030.

The following shows graphs for other variables that were forecast.

Valuations

WACC

| Risk Free Rate of Return | 4.5% |

| Beta | 1.17 |

| Market Rate of Return | 7.4% |

| Cost of Equity | 7.9% |

| Credit Spread | 1.42% |

| Cost of Debt | 3.3% |

| Shares Outstanding | 17,270.00 |

| Share Price | $ 6.13 |

| Equity | 105,865.10 |

| Total Debt | 60,699.00 |

| Weighted Average Maturity | 14.00 |

| Interest Expense | 1,632.00 |

| Debt | 56,422.10 |

| E/D+E | 65.2% |

| D/D+E | 34.8% |

| WACC | 5.8% |

The WACC for bp used in the DCF valuation was 5.8%, note the share price is of bp on it's primary listing, the London stock exchange. The price has been converted from GBP to USD for ease of calculation.

DCF

Units are in $ millions.

| FCF | 25,351.15 | 15,847.60 | 16,411.76 | 14,908.14 | 15,390.58 | 13,804.90 | 14,204.97 | 12,536.66 | 12,853.86 | 11,102.46 |

| Discount Factor | 0.9783 | 0.9248 | 0.8741 | 0.8262 | 0.7810 | 0.7382 | 0.6978 | 0.6596 | 0.6234 | 0.5893 |

| Present Value of FCF | 24,801.88 | 14,655.09 | 14,345.57 | 12,317.54 | 12,019.69 | 10,190.83 | 9,911.85 | 8,268.64 | 8,013.52 | 6,542.55 |

The effective tax rate used in all calculations was set at 44%, the terminal growth rate was set at 2.3%, equivalent to the annual FTSE 100 rate of return. The following table shows the result of the 10 year DCF valuation of bp.

| Growth Rate | 2.3% |

| Terminal Value | 325,041.40 |

| Present Value of Terminal Value | 191,543.05 |

| Enterprise Value | 312,610.21 |

| Equity Value | 281,496.21 |

| Share Price | $ 16.30 |

The DCF calculation results in an implied share price of $16.30, indicating that the company and stock is undervalued. There is a potential upside of 103%, or an annualised share price gain of 10.3%.

The following table shows a sensitivity analysis carried out to show share price behaviour in a range of WACC and growth rate environments.

| $ 16.30 | WACC | |||||||||

| Growth Rate | 4.0% | 4.5% | 5.0% | 5.5% | 6.0% | 6.5% | 7.0% | 7.5% | 8.0% | |

| 1.0% | $ 20.67 | $ 17.83 | $ 15.68 | $ 14.01 | $ 12.67 | $ 11.57 | $ 10.65 | $ 9.86 | $ 9.19 | |

| 1.5% | $ 23.76 | $ 19.94 | $ 17.21 | $ 15.15 | $ 13.55 | $ 12.26 | $ 11.20 | $ 10.31 | $ 9.56 | |

| 2.0% | $ 28.38 | $ 22.90 | $ 19.24 | $ 16.62 | $ 14.64 | $ 13.10 | $ 11.86 | $ 10.84 | $ 9.99 | |

| 2.5% | $ 36.09 | $ 27.35 | $ 22.09 | $ 18.57 | $ 16.05 | $ 14.15 | $ 12.67 | $ 11.48 | $ 10.50 | |

| 3.0% | $ 51.51 | $ 34.75 | $ 26.36 | $ 21.31 | $ 17.93 | $ 15.51 | $ 13.68 | $ 12.26 | $ 11.11 | |

| 3.5% | $ 97.78 | $ 49.57 | $ 33.47 | $ 25.41 | $ 20.56 | $ 17.31 | $ 14.98 | $ 13.23 | $ 11.86 | |

| 4.0% | - | $ 94.01 | $ 47.70 | $ 32.25 | $ 24.50 | $ 19.84 | $ 16.72 | $ 14.48 | $ 12.80 | |

Relative Valuation

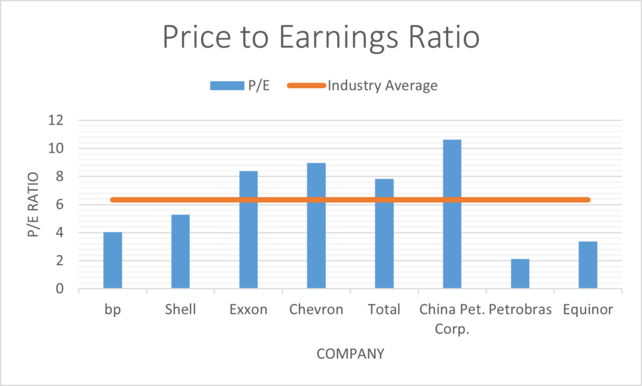

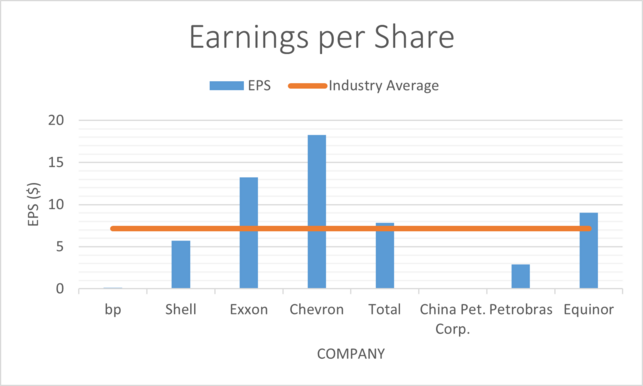

The following table compares bp to it's major competitors in the oil and gas industry globally.

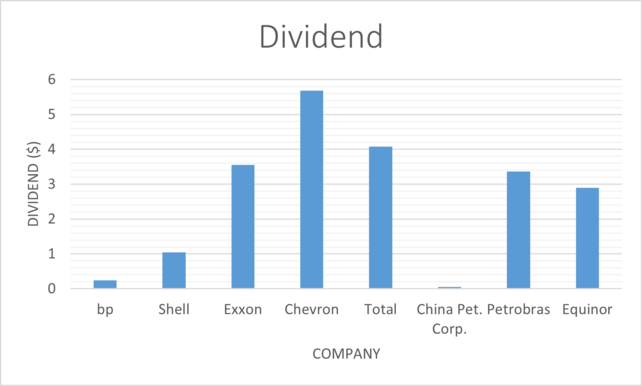

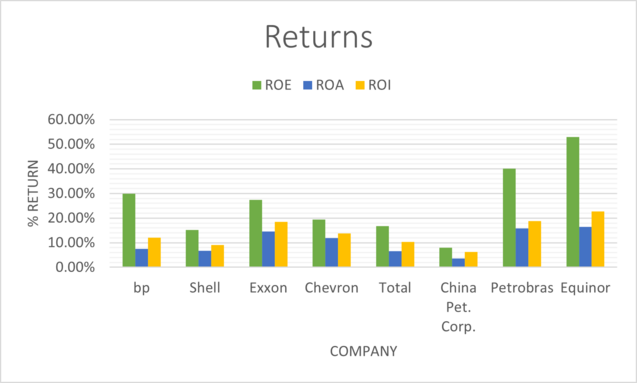

| Company | P/E | EPS | Dividend | Dividend Yield | Dividend Growth | ROE | ROA | ROI |

| bp | x4.04 | $0.15 | $0.24 | 0.08% | -9.55% | 29.92% | 7.44% | 12.08% |

| Shell | x5.29 | $5.71 | $1.04 | 0.06% | -11.21% | 15.22% | 6.78% | 9.10% |

| Exxon | x8.38 | $13.25 | $3.55 | 5.40% | 3.02% | 27.47% | 14.56% | 18.54% |

| Chevron | x8.97 | $18.28 | $5.68 | 4.37% | 5.63% | 19.35% | 11.86% | 13.78% |

| Total | x7.84 | $7.85 | $4.08 | 7.06% | 6.51% | 16.70% | 6.50% | 10.29% |

| China Pet. Corp. | x10.63 | $0.08 | $0.05 | 7.72% | -6.62% | 7.97% | 3.58% | 6.19% |

| Petrobras | x2.12 | $2.91 | $3.36 | 18.99% | - | 40.03% | 15.74% | 18.82% |

| Equinor | x3.38 | $9.03 | $2.9 | 0.52% | 26.64% | 52.93% | 16.48% | 22.71% |

Compared to the industry average of x6.33, bp has a lower price to earnings ratio of x4.04, indicating that the stock is undervalued.

Compared to the industry average earnings per share of $7.16, bp has significantly lower earnings at $0.15 per share. This indicates that the company is not as profitable as some of it's peers.

The dividend paid out by bp over the previous 5 years is $0.24, which is again lower than most of it's competitors, this indicates that bp stock does not have good prospects for income.

Comparing the returns on equity, assets and investment, we can see that bp is about average, performing better than Shell, Total and China Petroleum Corporation overall.

The relative valuation indicates that bp stock is undervalued compared to it's competitors, but this may be due to the fact that the company is not as profitable as others in the oil and gas industry.