Bitcoin: Difference between revisions

(Citations) |

|||

| Line 26: | Line 26: | ||

* '''It's money, but digital.''' Although bitcoin is purely digital, it meets every classical definition of what makes something money. Instead of relying on physical properties (like gold and silver) or central authorities (like government-issued fiat currencies), Bitcoin relies on the world’s most powerful computer network to mathematically enforce the rules that make it the first truly digital form of cash<ref>https://bitcoin.design/guide/getting-started/why-bitcoin-is-unique/</ref>. | * '''It's money, but digital.''' Although bitcoin is purely digital, it meets every classical definition of what makes something money. Instead of relying on physical properties (like gold and silver) or central authorities (like government-issued fiat currencies), Bitcoin relies on the world’s most powerful computer network to mathematically enforce the rules that make it the first truly digital form of cash<ref>https://bitcoin.design/guide/getting-started/why-bitcoin-is-unique/</ref>. | ||

* '''There's a limited supply.''' There will never be more than 21 million Bitcoins. The creation of new bitcoin is mathematically defined and strictly enforced and defined by the bitcoin network meaning that the maximum total supply of Bitcoin is 21 million. Even though we have already mined just over 19 million bitcoin since its creation in 2009, it would become increasingly difficult to reach the limit of 21 million due to Bitcoin halving, which occurs every four years<ref>[https://www.exodus.com/news/how-many-bitcoins-are-left/#:~:text=How%20many%20of%20the%2021,mine%20the%20remaining%202.3%20million.&text=That%27s%20because%20of%20the%20Bitcoin%20halving. https://www.exodus.com/news/how-many-bitcoins-are-left/#:~:text=How%20many%20of%20the%2021,mine%20the%20remaining%202.3%20million.&text=That%27s%20because%20of%20the%20Bitcoin%20halving.]</ref>. When the Bitcoin supply reaches this limit of 21 million (estimated by experts to be in 2140<ref>https://originstamp.com/blog/why-can-there-only-be-21-million-bitcoins/</ref>), Bitcoin miners will likely earn income only from transaction fees.<ref>https://www.investopedia.com/tech/what-happens-bitcoin-after-21-million-mined/</ref> | * '''There's a limited supply.''' There will never be more than 21 million Bitcoins. The creation of new bitcoin is mathematically defined and strictly enforced and defined by the bitcoin network meaning that the maximum total supply of Bitcoin is 21 million. Even though we have already mined just over 19 million bitcoin since its creation in 2009, it would become increasingly difficult to reach the limit of 21 million due to Bitcoin halving, which occurs every four years<ref>[https://www.exodus.com/news/how-many-bitcoins-are-left/#:~:text=How%20many%20of%20the%2021,mine%20the%20remaining%202.3%20million.&text=That%27s%20because%20of%20the%20Bitcoin%20halving. https://www.exodus.com/news/how-many-bitcoins-are-left/#:~:text=How%20many%20of%20the%2021,mine%20the%20remaining%202.3%20million.&text=That%27s%20because%20of%20the%20Bitcoin%20halving.]</ref>. When the Bitcoin supply reaches this limit of 21 million (estimated by experts to be in 2140<ref>https://originstamp.com/blog/why-can-there-only-be-21-million-bitcoins/</ref>), Bitcoin miners will likely earn income only from transaction fees.<ref>https://www.investopedia.com/tech/what-happens-bitcoin-after-21-million-mined/</ref> | ||

* '''Bitcoin comes with the convenience of online banking and payment processing.''' Bitcoin transactions operate more like cash: exchanged person-to-person without a financial intermediate | * '''Bitcoin comes with the convenience of online banking and payment processing.''' Bitcoin transactions operate more like cash: exchanged person-to-person without a financial intermediate<ref>https://www.investopedia.com/articles/forex/042215/bitcoin-transactions-vs-credit-card-transactions.asp</ref>. Bitcoin was designed for peer-to-peer transactions where payments are similar to wire transfers or cash transactions through a private network of computers, and each transaction is recorded in a blockchain. While making a Bitcoin transaction, it is not necessary to provide personal identification, such as your name and address. This means no one monitors your financial activity and establishes limits on what you can or cannot do<ref>https://www.investopedia.com/articles/forex/042215/bitcoin-transactions-vs-credit-card-transactions.asp</ref>. | ||

* '''Bitcoin has never been hacked.''' As with any form of cryptography, it is theoretically possible to brute force the private keys in Bitcoin transactions. However, a key takes the value of a 256-bit number<ref>[https://www.investopedia.com/articles/investing/032615/can-bitcoin-be-hacked.asp#:~:text=The%20concepts%20behind%20blockchain%20technology,exchange%20accounts%20to%20steal%20crypto. https://www.investopedia.com/articles/investing/032615/can-bitcoin-be-hacked.asp#:~:text=The%20concepts%20behind%20blockchain%20technology,exchange%20accounts%20to%20steal%20crypto.]</ref>, which is roughly 1.15e+77. This means with current technology, it can take several lifetimes before a single private key is brute forced. | * '''Bitcoin has never been hacked.''' As with any form of cryptography, it is theoretically possible to brute force the private keys in Bitcoin transactions. However, a key takes the value of a 256-bit number<ref>[https://www.investopedia.com/articles/investing/032615/can-bitcoin-be-hacked.asp#:~:text=The%20concepts%20behind%20blockchain%20technology,exchange%20accounts%20to%20steal%20crypto. https://www.investopedia.com/articles/investing/032615/can-bitcoin-be-hacked.asp#:~:text=The%20concepts%20behind%20blockchain%20technology,exchange%20accounts%20to%20steal%20crypto.]</ref>, which is roughly 1.15e+77 possibilities. This means with current technology, it can take several lifetimes before a single private key is brute forced. | ||

* '''Bitcoin complements existing financial institutions.''' Globally, around 1.7 billion adults have no access to banking services<ref>https://www.worldbank.org/en/publication/globalfindex</ref>. However, because Bitcoin is unbiased, open, and public, it can serve communities that conventional financial institutions overlook, helping grow economies and creating economic mobility where it never existed. | * '''Bitcoin complements existing financial institutions.''' Globally, around 1.7 billion adults have no access to banking services<ref>https://www.worldbank.org/en/publication/globalfindex</ref>. However, because Bitcoin is unbiased, open, and public, it can serve communities that conventional financial institutions overlook, helping grow economies and creating economic mobility where it never existed. | ||

Revision as of 18:01, 26 July 2023

What is Bitcoin?

- Bitcoin uses blockchain technology to support peer-to-peer transactions between users on a decentralised network[1].

- Satoshi Nakamoto, the creator of Bitcoin, stated that an electronic payment system based on cryptographic proof instead of trust was needed, which motivated him to create Bitcoin[2].

- Launched in 2009, Bitcoin was the first and remains the most valuable, entrant in the emerging class of assets known as cryptocurrency[3].

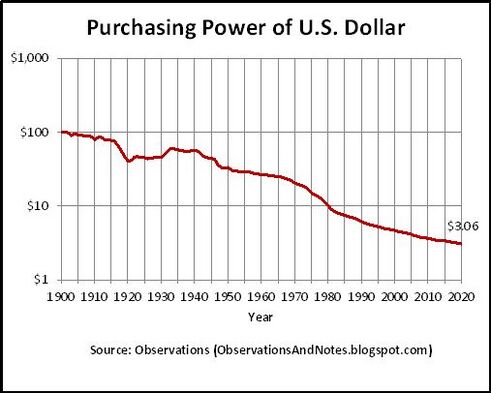

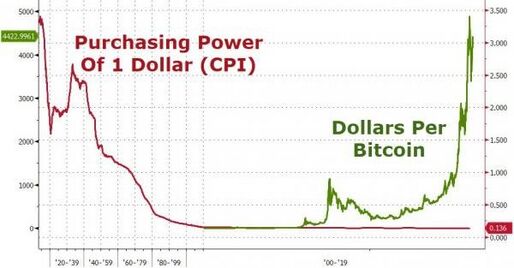

- Research suggests that the most popular cryptocurrency will maintain its purchasing power for much longer than any other currency.

What's unique about Bitcoin?

What makes Bitcoin unique is that it operates on a decentralised network (i.e. without the need of a central entity, such as the Bank of England), and the supply of the currency is limited (at 21 million coins).

The main benefit of operating on a decentralised network (rather than a centralised network) is that within the network, there is no single point of failure. In a centralised network, if the central entity that operates the network fails, then the whole network - and the currency that operates on the network - fails (i.e. there is a single point of failure in the network), whereas in a decentralised network, because there is no central entity, there is no single point of failure, and therefore the network - and currency - is likely to last for much longer, possibly forever.

For example, the world's first ever known currency is the Mesopotamian shekel, and it was operated by a central entity (The Kingdom of Lydia). When the central entity failed, so did the currency.

Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower.

Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower.

Other factors that make Bitcoin unique:

- It's money, but digital. Although bitcoin is purely digital, it meets every classical definition of what makes something money. Instead of relying on physical properties (like gold and silver) or central authorities (like government-issued fiat currencies), Bitcoin relies on the world’s most powerful computer network to mathematically enforce the rules that make it the first truly digital form of cash[4].

- There's a limited supply. There will never be more than 21 million Bitcoins. The creation of new bitcoin is mathematically defined and strictly enforced and defined by the bitcoin network meaning that the maximum total supply of Bitcoin is 21 million. Even though we have already mined just over 19 million bitcoin since its creation in 2009, it would become increasingly difficult to reach the limit of 21 million due to Bitcoin halving, which occurs every four years[5]. When the Bitcoin supply reaches this limit of 21 million (estimated by experts to be in 2140[6]), Bitcoin miners will likely earn income only from transaction fees.[7]

- Bitcoin comes with the convenience of online banking and payment processing. Bitcoin transactions operate more like cash: exchanged person-to-person without a financial intermediate[8]. Bitcoin was designed for peer-to-peer transactions where payments are similar to wire transfers or cash transactions through a private network of computers, and each transaction is recorded in a blockchain. While making a Bitcoin transaction, it is not necessary to provide personal identification, such as your name and address. This means no one monitors your financial activity and establishes limits on what you can or cannot do[9].

- Bitcoin has never been hacked. As with any form of cryptography, it is theoretically possible to brute force the private keys in Bitcoin transactions. However, a key takes the value of a 256-bit number[10], which is roughly 1.15e+77 possibilities. This means with current technology, it can take several lifetimes before a single private key is brute forced.

- Bitcoin complements existing financial institutions. Globally, around 1.7 billion adults have no access to banking services[11]. However, because Bitcoin is unbiased, open, and public, it can serve communities that conventional financial institutions overlook, helping grow economies and creating economic mobility where it never existed.

How does Bitcoin work?

Each Bitcoin is a digital asset that can be stored at a cryptocurrency exchange or in a digital wallet[12]. Each individual coin represents the value of Bitcoin’s current price, but you can also own partial shares of each coin. The smallest denomination of each Bitcoin is called a Satoshi, sharing its name with Bitcoin’s creator (Satoshi Nakamoto). Each Satoshi is equivalent to a hundred millionth of one Bitcoin, so owning fractional shares of Bitcoin is quite common.

- Blockchain: Bitcoin is powered by open-source code known as blockchain, which creates a shared public history of transactions organized into "blocks" that are "chained" together to prevent tampering. This technology creates a permanent record of each transaction, and it provides a way for every Bitcoin user to operate with the same understanding of who owns what[13].

- Private and public keys: A Bitcoin wallet consists of a public key and private key, which work together to allow the owner to initiate and digitally sign transactions. This lets the user carry out the main purpose of Bitcoin - securely and safely transferring ownership from one user to another.

- Bitcoin mining: Validating transaction information and maintaining the integrity of the blockchain is bitcoin mining's main purpose, Bitcoin mining is the process of validating the information in a blockchain block by generating a cryptographic solution that matches specific criteria. When a correct solution is reached, a reward in the form of bitcoin and fees for the work done is given to the miner who reached the solution first[14].

Environmental impact of Bitcoin mining

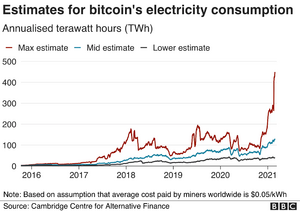

Bitcoin operates on a decentralised system which means it is a reliable currency in the sense that there is no single point of failure. However, a major issue with Bitcoin (and cryptocurrency in general) is the amount of power that is used in mining for Bitcoin.

An average, Bitcoin mining consumes around 143 terawatt-hours per year[16]. For comparison, the whole of Malaysia consumed around 147 terawatt-hours in 2018. The reason Bitcoin takes so much energy is because computers take a brute-force approach in order to find solutions to difficult and complex mathematical problems[17]. These require a lot of computational power to solve and especially with the recent surge of awareness and interest in cryptocurrency, more people are mining for Bitcoin and as a result, the electricity consumption is increasing. Even if Bitcoin can theoretically outlast the traditional forms of currency, it is possible that it becomes unsustainable enough for the environment that operation of Bitcoin is intervened in the future.

It is also worth noting that one of the main competitors for Bitcoin, Ethereum, uses 238KWh[18] of energy for one single transaction, while Bitcoin uses 704KWh. This technically makes Ethereum a greener cryptocurrency, but neither of them are comparable with VISA transactions for energy, which takes 149KWh for 100,000 transactions[19].

Competition

| Item | Bitcoin | US Dollar |

|---|---|---|

| Does the currency operate on a decentralised network? | Yes | No |

| Is the supply of the currency limited? | Yes | No |

| How likely is the currency to act as a store of value? | High | Low |

| Item | Bitcoin | US Dollar |

|---|---|---|

| Medium of exchange | Yes | Yes |

| Measure of value | Yes | Yes |

| Standard of deferred payment | Yes | Yes |

| Store of value | Yes | No |

| Item | Bitcoin | Ether | XRP |

|---|---|---|---|

| Does the currency operate on a decentralised network? | Yes | Yes | Yes |

| Is the supply of the currency limited? | Yes | No | No |

| Is the cryptocurrency the most popular one? | Yes | No | No |

| How likely is the currency to act as a store of value? | High | Low | Low |

Other Cryptocurrencies

- Ethereum:[20]

- Bitcoin's larger competitor

- Second largest cryptocurrency by market capitalization

- Biggest platform for decentralised applications

- Seen as a general purpose blockchain

- Uses either, its platform-specific cryptographic token

2. Bitcoin cash:[20]

- One of the first alcoins that emerged and successfully traded off from bitcoin

- Made to resolve issues between bitcoin developers and miners

- Growing market capitalization

3. Tether:[21]

- One of the first stablecoins (cryptocurrencies that peg their market value to a specific currency in order to reduce volatility of the cryptocurrency)

- Smooths out price fluctuations

- Tether's price is directly tied to the U.S. dollar

4. XRP:

- XRP is the native token for the XRP ledger which Ripple created as a payment system.

5. Binance Coin (BNB)[22]

- Utility cryptocurrecy that operates as a payment method associated with trading on the Binance Exchange.

- Third largest-cryptocurrency by market capitalization

- Those who use the token as payment for exchange can trade with a discount price.

6. USD Coin (USDC)

- Pegs its price to the U.S. dollar

- Makes USDC a regulated stablecoin

7. Cardano:[20]

- One of the most fundamentally strong and best Bitcoin alternatives in the market

- Low transaction fees and continued developments

8. Solana:

- Outperformed the majority other cryptocurrencies (performs many more transactions per second than Ethereum)

- Charges lower transaction fees than Etheruem

- Designed to support decentralized applications

- Cryptocurrency running on the Solana blockchain is called Solana

9. Dogecoin: [21]

- The coin, which uses an image of the Shiba Inu as its avatar, is accepted as a form of payment by some major companies.

- Accepted as a payment model in sports teams and in AMC theatres.

10. Tron:

- Basic unit of accounts on the Tron blockchain

Market Capitalization

Major Cryptoassets By Percentage of Total Market Capitalization (Bitcoin Dominance Chart) - 2023[23] and Market Capitalisation in terms of billions of dollars[24]

| Market Capitalisation (%) | Market Capitalisation ($ billions) | |

|---|---|---|

| Bitcoin | 48.47% | 582.24 |

| Ethereum | 19.12% | 229.32 |

| Tether | 6.89% | 83.75 |

| XRP | 3.09% | 42.54 |

| BNB | 3.22% | 37.16 |

| USD Coin | 2.25% | 26.92 |

| Cardano | 0.94% | 10.94 |

| Solana | 0.91% | 10.65 |

| Dogecoin | 0.83% | 9.82 |

| TRON | 0.60% | 7.19 |

| Others | 13.69% | N/A |

Valuation

The total value of narrow money (physical money, demand deposits, liquid assets held by the bank, etc...) in circulation globally is estimated at around $40 trillion as of 2021 [25]. Meanwhile, the total value of Bitcoin as of July 2023 is $580 billion[26]. Accordingly, Bitcoin's share of the global money supply is 1.45%.

Bitcoin currently trades at $29,078[26] and the maximum number of coins is 21 million. As of July 2023, there are currently 19.4 million bitcoins in circulation.

As with any other good and service, Bitcoin's value is driven by its supply and demand. Even though the number of Bitcoins in circulation is strictly increasing (increasing supply in the market), Bitcoin retains its value due to the difficulty of mining Bitcoin and their production cost. This can be from the powerful hardware it demands and the energy required to mine them. The number of competing cryptocurrencies such as Ethereum can also serve as a better alternative by undercutting Bitcoin.

The lack of regulatory status for Bitcoin can be a factor to its volatility to its valuation. The absence of regulation makes it very useful for cross-border transactions as they are not subject to government-imposed controls, unlike traditional currencies. However, this can also lead to illegal transactions as ransomware commonly demand for Bitcoin as a way to pay their ransom, due to the anonymous nature of Bitcoin[27].

Media coverage is also a factor for its volatility. In October 2021, Bitcoin's value rose to $69,000 after the SEC approved the first US-linked bitcoin-linked ETF[28]. After a few months, however, Bitcoins's value settled at around $40,000. China also banned Bitcoin transaction in 2021 which led to a dip in demand and a 20% decrease in the value of Bitcoin. Bitcoin's value rebounded, however, after Chinese-based farms relocated.

The following is a graph of Bitcoin's value over time. The lowest it has been valued is at $0.09 when it first started in 2010. It peaked in October 2021 at a value of $68,991.

Actions

To invest in Bitcoin, click here.

References

- ↑ https://www.coinbase.com/

- ↑ https://www.ussc.gov/sites/default/files/pdf/training/annual-national-training-seminar/2018/Emerging_Tech_Bitcoin_Crypto.pdf

- ↑ https://money.usnews.com/investing/articles/the-history-of-bitcoin

- ↑ https://bitcoin.design/guide/getting-started/why-bitcoin-is-unique/

- ↑ https://www.exodus.com/news/how-many-bitcoins-are-left/#:~:text=How%20many%20of%20the%2021,mine%20the%20remaining%202.3%20million.&text=That%27s%20because%20of%20the%20Bitcoin%20halving.

- ↑ https://originstamp.com/blog/why-can-there-only-be-21-million-bitcoins/

- ↑ https://www.investopedia.com/tech/what-happens-bitcoin-after-21-million-mined/

- ↑ https://www.investopedia.com/articles/forex/042215/bitcoin-transactions-vs-credit-card-transactions.asp

- ↑ https://www.investopedia.com/articles/forex/042215/bitcoin-transactions-vs-credit-card-transactions.asp

- ↑ https://www.investopedia.com/articles/investing/032615/can-bitcoin-be-hacked.asp#:~:text=The%20concepts%20behind%20blockchain%20technology,exchange%20accounts%20to%20steal%20crypto.

- ↑ https://www.worldbank.org/en/publication/globalfindex

- ↑ https://www.nerdwallet.com/article/investing/what-is-bitcoin#:~:text=Digital%20CurrencyCryptocurrency-,BTC%20definition%3A%20What%20is%20Bitcoin%3F,users%20on%20a%20decentralized%20network.

- ↑ https://www.nerdwallet.com/article/investing/blockchain

- ↑ https://www.investopedia.com/terms/b/bitcoin-mining.asp

- ↑ https://www.bbc.co.uk/news/science-environment-56215787

- ↑ https://ccaf.io/cbnsi/cbeci

- ↑ https://bitpay.com/blog/how-crypto-transactions-work/#:~:text=The%20process%20of%20crypto%20transactions,the%20blockchain%20network%20for%20validation.

- ↑ https://8billiontrees.com/carbon-offsets-credits/carbon-ecological-footprint-calculators/carbon-footprint-of-a-single-ethereum-nft-transaction/#:~:text=Transacting%20once%20on%20the%20Ethereum,visa%20transactions%20(149%20kWh).

- ↑ https://www.statista.com/statistics/881541/bitcoin-energy-consumption-transaction-comparison-visa/

- ↑ 20.0 20.1 20.2 https://www.analyticsinsight.net/top-10-bitcoin-alternatives-one-must-consider-in-2023/#:~:text=Ethereum%20is%20Bitcoin's%20largest%20competitor,its%20platform%2Dspecific%20cryptographic%20token.

- ↑ 21.0 21.1 https://www.investopedia.com/tech/most-important-cryptocurrencies-other-than-bitcoin/

- ↑ https://www.investopedia.com/terms/b/binance-coin-bnb.asp

- ↑ https://coinmarketcap.com/charts/

- ↑ https://coinmarketcap.com/

- ↑ https://www.money-mentor.org/how-much-money-is-in-the-world#:~:text=According%20to%20a%202021%20report,circulation%2C%20that%20is%20narrow%20money.

- ↑ 26.0 26.1 https://finance.yahoo.com/cryptocurrencies/

- ↑ https://www.marsh.com/us/services/cyber-risk/insights/ransomware-paying-cyber-extortion-demands-in-cryptocurrency.html

- ↑ https://www.investopedia.com/tech/what-determines-value-1-bitcoin/#:~:text=Bitcoin%27s%20price%20is%20primarily%20affected,to%20be%20mined%20in%202140.