Bitcoin: Difference between revisions

Nabia.mujib (talk | contribs) |

Nabia.mujib (talk | contribs) |

||

| Line 237: | Line 237: | ||

The cryptocurrency market is segmented based on the market capitalization of a large number of cryptocurrencies. Cryptocurrencies overlap with key areas of the monetary and financial system. Given their rapid growth, complexity, high volatility, and potentiality for facilitating illicit activities, regulators and policymakers across the world are bothered about their inclusion into the existing system and revising the existing systems to fit them, if included. | The cryptocurrency market is segmented based on the market capitalization of a large number of cryptocurrencies. Cryptocurrencies overlap with key areas of the monetary and financial system. Given their rapid growth, complexity, high volatility, and potentiality for facilitating illicit activities, regulators and policymakers across the world are bothered about their inclusion into the existing system and revising the existing systems to fit them, if included. | ||

== Environmental impact of Bitcoin mining == | == Environmental impact of Bitcoin mining == | ||

[[File:Bitcoin consumption.png|thumb|Bitcoin's electricity consumption, annualised, over time<ref>https://www.bbc.co.uk/news/science-environment-56215787</ref>]] | [[File:Bitcoin consumption.png|thumb|Bitcoin's electricity consumption, annualised, over time<ref>https://www.bbc.co.uk/news/science-environment-56215787</ref>]] | ||

Revision as of 21:22, 24 August 2023

What is Bitcoin?

- Bitcoin uses blockchain technology to support peer-to-peer transactions between users on a decentralised network to eliminate the usage of centralized authorities for instance banks or governments.[1].

- Satoshi Nakamoto, the creator of Bitcoin, stated that an electronic payment system based on cryptographic proof instead of trust was needed, which motivated him to create Bitcoin[2].

- Launched in 2009, Bitcoin was the first and remains the most valuable, entrant in the emerging class of assets known as cryptocurrency[3].

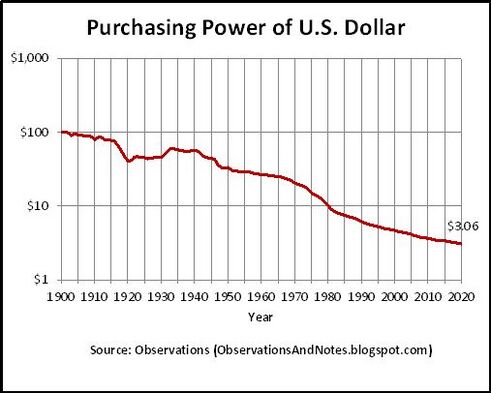

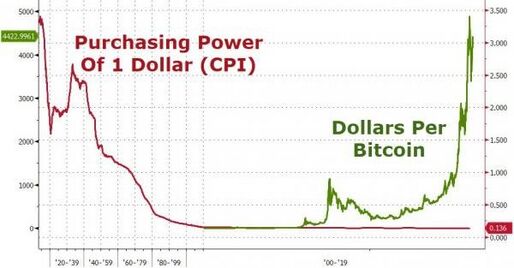

- Research suggests that the most popular cryptocurrency will maintain its purchasing power for much longer than any other currency.

- Transactions are authenticated through Bitcoin’s proof-of-work consensus mechanism, which rewards cryptocurrency miners for validating transactions.

What's unique about Bitcoin?

What makes Bitcoin unique is that it operates on a decentralised network (i.e. without the need of a central entity, such as the Bank of England), and the supply of the currency is limited (at 21 million coins).

The main benefit of operating on a decentralised network (rather than a centralised network) is that within the network, there is no single point of failure. In a centralised network, if the central entity that operates the network fails, then the whole network - and the currency that operates on the network - fails (i.e. there is a single point of failure in the network), whereas in a decentralised network, because there is no central entity, there is no single point of failure, and therefore the network - and currency - is likely to last for much longer, possibly forever.

For example, the world's first ever known currency is the Mesopotamian shekel, and it was operated by a central entity (The Kingdom of Lydia). When the central entity failed, so did the currency.

Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower.

Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower.

Other factors that make Bitcoin unique:

- It's money, but digital. Although bitcoin is purely digital, it meets every classical definition of what makes something money. Instead of relying on physical properties (like gold and silver) or central authorities (like government-issued fiat currencies), Bitcoin relies on the world’s most powerful computer network to mathematically enforce the rules that make it the first truly digital form of cash[4].

- There's a limited supply. There will never be more than 21 million Bitcoins. The creation of new bitcoin is mathematically defined and strictly enforced and defined by the bitcoin network meaning that the maximum total supply of Bitcoin is 21 million. Even though we have already mined just over 19 million bitcoin since its creation in 2009, it would become increasingly difficult to reach the limit of 21 million due to Bitcoin halving, which occurs every four years[5]. When the Bitcoin supply reaches this limit of 21 million (estimated by experts to be in 2140[6]), Bitcoin miners will likely earn income only from transaction fees.[7]

- Bitcoin comes with the convenience of online banking and payment processing. Bitcoin transactions operate more like cash: exchanged person-to-person without a financial intermediate[8]. Bitcoin was designed for peer-to-peer transactions where payments are similar to wire transfers or cash transactions through a private network of computers, and each transaction is recorded in a blockchain. While making a Bitcoin transaction, it is not necessary to provide personal identification, such as your name and address. This means no one monitors your financial activity and establishes limits on what you can or cannot do[9].

- Bitcoin has never been hacked. As with any form of cryptography, it is theoretically possible to brute force the private keys in Bitcoin transactions. However, a key takes the value of a 256-bit number[10], which is roughly 1.15e+77 possibilities. This means with current technology, it can take several lifetimes before a single private key is brute forced.

- Bitcoin complements existing financial institutions. Globally, around 1.7 billion adults have no access to banking services[11]. However, because Bitcoin is unbiased, open, and public, it can serve communities that conventional financial institutions overlook, helping grow economies and creating economic mobility where it never existed.

How does Bitcoin work?

Each Bitcoin is a digital asset that can be stored at a cryptocurrency exchange or in a digital wallet[12]. Each individual coin represents the value of Bitcoin’s current price, but you can also own partial shares of each coin. The smallest denomination of each Bitcoin is called a Satoshi, sharing its name with Bitcoin’s creator (Satoshi Nakamoto). Each Satoshi is equivalent to a hundred millionth of one Bitcoin, so owning fractional shares of Bitcoin is quite common.

- Blockchain: Bitcoin is powered by open-source code known as blockchain, which creates a shared public history of transactions organized into "blocks" that are "chained" together to prevent tampering. This technology creates a permanent record of each transaction, and it provides a way for every Bitcoin user to operate with the same understanding of who owns what[13].

- Private and public keys: A Bitcoin wallet consists of a public key and private key, which work together to allow the owner to initiate and digitally sign transactions. This lets the user carry out the main purpose of Bitcoin - securely and safely transferring ownership from one user to another.

- Bitcoin mining: Validating transaction information and maintaining the integrity of the blockchain is bitcoin mining's main purpose, Bitcoin mining is the process of validating the information in a blockchain block by generating a cryptographic solution that matches specific criteria. When a correct solution is reached, a reward in the form of bitcoin and fees for the work done is given to the miner who reached the solution first[14].

Price of Bitcoin

| Date | Open | High | Low | Close |

| 08/23/23 | 25845 | 26765 | 25469 | 26598 |

| 08/22/23 | 26113 | 26222 | 25742 | 25845 |

| 08/21/23 | 26295 | 26304 | 25848 | 26113 |

| 08/20/23 | 26193 | 26343 | 26112 | 26295 |

| 08/19/23 | 26163 | 26369 | 25883 | 26197 |

| 08/18/23 | 27620 | 27690 | 25518 | 26163 |

| 08/17/23 | 28934 | 28952 | 27576 | 27623 |

| 08/16/23 | 29182 | 29231 | 28873 | 28934 |

| 08/15/23 | 29373 | 29452 | 29095 | 29179 |

| 08/14/23 | 29472 | 29639 | 29163 | 29373 |

| 08/13/23 | 29479 | 29518 | 29388 | 29471 |

| 08/12/23 | 29408 | 29527 | 29393 | 29479 |

| 08/11/23 | 29442 | 29529 | 29311 | 29408 |

| 08/10/23 | 29503 | 29735 | 29382 | 29442 |

| 08/09/23 | 29996 | 30176 | 29397 | 29503 |

| 08/08/23 | 29217 | 30006 | 29180 | 29991 |

| 08/07/23 | 29151 | 29227 | 28774 | 29217 |

| 08/06/23 | 29112 | 29186 | 29052 | 29169 |

| 08/05/23 | 28965 | 29139 | 28965 | 29112 |

| 08/04/23 | 29126 | 29300 | 28921 | 28973 |

| 08/03/23 | 29124 | 29185 | 29046 | 29126 |

Table:1 Historical Prices of Bitcoin USD(BTCUSD), Coindesk for August 2023

Price Analysis for Bitcoin( BTC) for August 2023

- The price of Bitcoin has increased by 0.21% over the past 24 hours.

- On the hourly time frame, the price of Bitcoin is looking bullish as it is trying to fix above the important zone of $26,000.

- If that happens, there is a good chance of seeing a resistance breakout, followed by further growth to the $26,500 area.

- On the daily time frame, the rate of BTC is not ready yet for a sharp move as it has not accumulated enough energy yet. However, if the upward move continues to the resistance at $26,264, buyers might seize the initiative, which could lead to a possible test of the $27,000 mark soon.

- On the weekly chart, the price of BTC has made a false breakout of the support of $25,601. If the bar closes far from that mark, one can expect a correction to the $26,800-$27,000 zone by the end of the month.

- Bitcoin is trading at $26,117 now at press time.

History of Bitcoin

The first Bitcoin real-world transaction occurred on May 22, 2010, a date known to Bitcoin enthusiasts now as Bitcoin Pizza Day. Laszlo Hanyecz paid 10,000 BTC to have two Papa Johns pizzas delivered to him. The pizzas retailed for about $25. At the peak of Bitcoin's pricing in 2021, the two pizzas would have cost north of $680 million.

The Bitcoin supply was capped from the beginning by Nakamoto. The maximum number of coins stipulated to be in existence was 21 million. As of Aug. 7, there were 19.45 million Bitcoins in existence with 1.55 million left to be mined. However, the Bitcoin mining operators regularly cut in half the rewards for mining each block in a process known as Bitcoin halving, leading experts to believe that it will take until the year 2140 before the supply cap of 21 million is reached. It's estimated somewhere between 10% and 20% are lost forever after owners accidentally discarded private storage keys or wallets, according to SoFi(Social Finance Inc.)

After Nakamoto rolled out Bitcoin in 2009, he mined approximately 1.1 million Bitcoin and disappeared in 2010. He ceded the responsibility of development to Gavin Andresen, formerly known as Gavin Bell, who worked to see Bitcoin's decentralized vision realized. This meant that there was no central authority, server, storage or administrator. All the parties were peer-to-peer and the blockchain was distributed to all. The network existed merely to legitimize and confirm the transactions. The price of Bitcoin dropped with the new uncertainty surrounding these actions.

However, control issues emerged when GHash.io, a cryptocurrency mining pool, exceeded 51% hashing power for the first time. One of Bitcoin's tenets is that power cannot be accumulated in too few hands, and GHash's popularity meant that it was possible for coins to be double-spent, or counterfeited, and they could push other miners out of being rewarded for their activity. Fortunately for the Bitcoin industry, the parties voluntarily enacted provisions that redistributed hashing power to acceptable, sustainable limits.

Part of the extreme volatility in Bitcoin comes from the Gartner Hype Cycle, a life cycle common among new and innovative technologies. The five stages include: the innovation trigger, the peak of inflated expectations, the trough of disillusionment, the slope of enlightenment and the plateau of productivity. Many individuals created and then lost vast fortunes in Bitcoin, causing eight Nobel Prize winners in economic sciences to call Bitcoin a bubble, much like the oft-cited Dutch tulip mania in the 1600s. However, Bitcoin supporters point out that although Bitcoin has crashed several times, it has also returned to its previous price each time, while other bubbles have not recovered their value. This recovery to its past highs, however, has not yet materialized in 2023, though it has made a valiant effort in rallying more than 70% as of Aug. 7.

The strength of the economy is also a huge factor in Bitcoin pricing. In what has been designated as the 2022 "crypto winter," sharp declines occurred in Bitcoin pricing as the Federal Reserve began aggressively increasing interest rates to stave off inflation. Investor appetite for risk all but disappeared and liquidity became a major issue among the exchanges. Bitcoin's value decreased more than 70% from its all-time high of $68,789 in November 2021 to lows in the $16,000 range in December 2022, before rebounding to above $30,000 in the first half of 2023.

Usage of Bitcoin

1. Spending money anonymously-

One of the biggest pros of bitcoin is its pseudonymous quality (members are identified by the public keys rather than their “real world” identities). For many people, this affords a desired level of privacy that traditional digital payment systems do not. Unfortunately, there is also the flip-side of this privacy; capability for bitcoin to be used for unethical and criminal purposes. The most infamous example of this is Silk Road – the massive “Deep Web” marketplace. Silk Road used the privacy inherent in bitcoin (as well as an anonymizing software called TOR) to allow for users to buy and sell contraband. While the moderators of Silk Road didn’t allow for the sale of goods resulting from or intended to cause the harm or exploitation of other people, users could still illegally purchase contraband such as illicit drugs and forged identity documents. Bitcoin’s relative anonymity could also potentially provide criminals with avenues for money laundering or funding terrorist organizations.

2. Low-Cost Money Transfers-

One of the biggest pros of bitcoin is that, compared to other electronic payment systems, it has a very low transaction cost. Bitcoin’s transaction fee is not nearly as costly as the fees on money transfers brokered by banks, credit cards, and commercial software like PayPal. The low costs of bitcoin transactions are especially advantageous for immigrants sending remittance to their families in their home countries. This is a huge potential demographic for bitcoin simply because the remittance transfer industry is quite large (about $542 billion was transferred globally in remittance flow in 2013).

International transfers can be extremely expensive; in fact, according to the World Bank’s report on Remission Prices, the global average fee for such remissions was 7.72% during the first quarter of 2015. Also, such remittances can take significant amounts of time to be verified by the brokering financial institutions. On contrary, Bitcoin allows immigrants to send cheap, practically-instant remissions. As of April 2015, the average fee per transaction was 0.000155 BTC (at the time, approximately $0.04 per transaction). The average time between transaction blocks was about 9.11 minutes. To find the most current updates on all of the above statistics and more, visit the Bitcoin Statistics page on Blockchain.info.

3.Daily Purchase of Normal goods-

While the above uses are special-interest uses, the average bitcoin user will simply use bitcoin to normal purchase goods from online (or even physical) retailers. As the bitcoin market size grows, this will become increasingly common – the monetary value of bitcoin will (theoretically) stabilize, consumers will want to spend their bitcoins, and retailers will see the benefits of accepting bitcoin transactions.

This is a positive development for a few reasons. First, the low transaction costs mentioned above are a great incentive for businesses to accept bitcoin payment; merchants can significantly cut their costs by reducing the fees involved in credit card transactions, authorizations, statements, interchanges, and customer service fees. Second, the unique properties of bitcoin as as currency make it so the new payment system acts as a stimulus for financial innovation; features, such as micro-payments, which are generally not possible in other financial systems create new financial opportunities and drive for new online business models and marketing strategies.

The crypto market in general

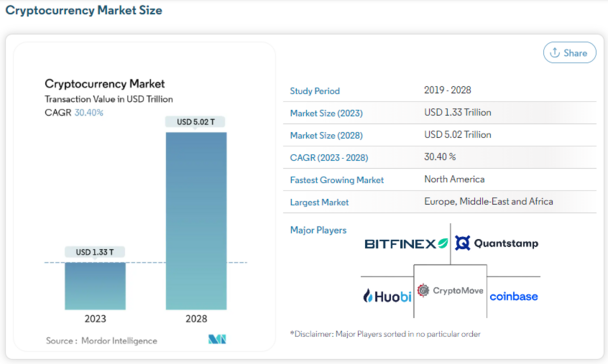

From the Cryptocurrency Market Analysis Chart, the highlighting facts are ; that the Cryptocurrency Market size in terms of transaction value is expected to grow from USD 1.33 trillion in 2023 to USD 5.02 trillion by 2028, at a CAGR of 30.40% during the forecast period (2023-2028).

Cryptocurrency is the new age financial innovation designed not only to become an alternative to cash but also to support the existing systems.

Cryptocurrencies are the latest financial innovations explored not only for the reasons of their being but also for potential risks and opportunities in the financial industry. There are thousands of cryptocurrencies with various design goals. These design goals are to provide a digital currency alternative to cash (Bitcoin, Monero, and Bitcoin cash), to support a payment system at low cost (Ripple, Particl, and Utility Settlement Coin), to support peer-to-peer trading activity by creating tokens (RMG and Maecenas), to facilitate secure access to a good or service in peer-to-peer trading (Golem, Filecoin) and to support underlying platform or protocol ( Ether and NEO). These design goals mentioned won't be exhaustive as new cryptocurrencies are being created every week. Blockchain is the underlying technology for most cryptocurrencies.

The cryptocurrency market is segmented based on the market capitalization of a large number of cryptocurrencies. Cryptocurrencies overlap with key areas of the monetary and financial system. Given their rapid growth, complexity, high volatility, and potentiality for facilitating illicit activities, regulators and policymakers across the world are bothered about their inclusion into the existing system and revising the existing systems to fit them, if included.

Environmental impact of Bitcoin mining

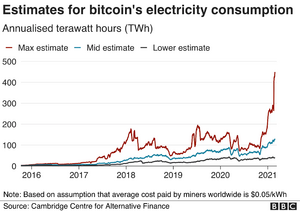

Bitcoin operates on a decentralised system which means it is a reliable currency in the sense that there is no single point of failure. However, a major issue with Bitcoin (and cryptocurrency in general) is the amount of power that is used in mining for Bitcoin.

An average, Bitcoin mining consumes around 143 terawatt-hours per year[16]. For comparison, the whole of Malaysia consumed around 147 terawatt-hours in 2018. The reason Bitcoin takes so much energy is because computers take a brute-force approach in order to find solutions to difficult and complex mathematical problems[17]. These require a lot of computational power to solve and especially with the recent surge of awareness and interest in cryptocurrency, more people are mining for Bitcoin and as a result, the electricity consumption is increasing. Even if Bitcoin can theoretically outlast the traditional forms of currency, it is possible that it becomes unsustainable enough for the environment that operation of Bitcoin is intervened in the future.

It is also worth noting that one of the main competitors for Bitcoin, Ethereum, uses 238KWh[18] of energy for one single transaction, while Bitcoin uses 704KWh. This technically makes Ethereum a greener cryptocurrency, but neither of them are comparable with VISA transactions for energy, which takes 149KWh for 100,000 transactions[19].

Competition

| Item | Bitcoin | US Dollar |

|---|---|---|

| Does the currency operate on a decentralised network? | Yes | No |

| Is the supply of the currency limited? | Yes | No |

| How likely is the currency to act as a store of value? | High | Low |

| Item | Bitcoin | US Dollar |

|---|---|---|

| Medium of exchange | Yes | Yes |

| Measure of value | Yes | Yes |

| Standard of deferred payment | Yes | Yes |

| Store of value | Yes | No |

| Item | Bitcoin | Ether | XRP |

|---|---|---|---|

| Does the currency operate on a decentralised network? | Yes | Yes | Yes |

| Is the supply of the currency limited? | Yes | No | No |

| Is the cryptocurrency the most popular one? | Yes | No | No |

| How likely is the currency to act as a store of value? | High | Low | Low |

Other Cryptocurrencies

- Ethereum:[20]

- Bitcoin's larger competitor

- Second largest cryptocurrency by market capitalization

- Biggest platform for decentralised applications

- Seen as a general purpose blockchain

- Uses either, its platform-specific cryptographic token

2. Bitcoin cash:[20]

- One of the first alcoins that emerged and successfully traded off from bitcoin

- Made to resolve issues between bitcoin developers and miners

- Growing market capitalization

3. Tether:[21]

- One of the first stablecoins (cryptocurrencies that peg their market value to a specific currency in order to reduce volatility of the cryptocurrency)

- Smooths out price fluctuations

- Tether's price is directly tied to the U.S. dollar

4. XRP:

- XRP is the native token for the XRP ledger which Ripple created as a payment system.

5. Binance Coin (BNB)[22]

- Utility cryptocurrecy that operates as a payment method associated with trading on the Binance Exchange.

- Third largest-cryptocurrency by market capitalization

- Those who use the token as payment for exchange can trade with a discount price.

6. USD Coin (USDC)

- Pegs its price to the U.S. dollar

- Makes USDC a regulated stablecoin

7. Cardano:[20]

- One of the most fundamentally strong and best Bitcoin alternatives in the market

- Low transaction fees and continued developments

8. Solana:

- Outperformed the majority other cryptocurrencies (performs many more transactions per second than Ethereum)

- Charges lower transaction fees than Etheruem

- Designed to support decentralized applications

- Cryptocurrency running on the Solana blockchain is called Solana

9. Dogecoin: [21]

- The coin, which uses an image of the Shiba Inu as its avatar, is accepted as a form of payment by some major companies.

- Accepted as a payment model in sports teams and in AMC theatres.

10. Tron:

- Basic unit of accounts on the Tron blockchain

Market Capitalization

Major Cryptoassets By Percentage of Total Market Capitalization (Bitcoin Dominance Chart) - 2023[23] and Market Capitalisation in terms of billions of dollars[24]

| Market Capitalisation (%) | Market Capitalisation ($ billions) | |

|---|---|---|

| Bitcoin | 48.47% | 582.24 |

| Ethereum | 19.12% | 229.32 |

| Tether | 6.89% | 83.75 |

| XRP | 3.09% | 42.54 |

| BNB | 3.22% | 37.16 |

| USD Coin | 2.25% | 26.92 |

| Cardano | 0.94% | 10.94 |

| Solana | 0.91% | 10.65 |

| Dogecoin | 0.83% | 9.82 |

| TRON | 0.60% | 7.19 |

| Others | 13.69% | N/A |

Valuation

The total value of narrow money (physical money, demand deposits, liquid assets held by the bank, etc...) in circulation globally is estimated at around $40 trillion as of 2021 [25]. Meanwhile, the total value of Bitcoin as of July 2023 is $580 billion[26]. Accordingly, Bitcoin's share of the global money supply is 1.45%.

Bitcoin currently trades at $29,078[26] and the maximum number of coins is 21 million. As of July 2023, there are currently 19.4 million bitcoins in circulation.

As with any other good and service, Bitcoin's value is driven by its supply and demand. Even though the number of Bitcoins in circulation is strictly increasing (increasing supply in the market), Bitcoin retains its value due to the difficulty of mining Bitcoin and their production cost. This can be from the powerful hardware it demands and the energy required to mine them. The number of competing cryptocurrencies such as Ethereum can also serve as a better alternative by undercutting Bitcoin.

The lack of regulatory status for Bitcoin can be a factor to its volatility to its valuation. The absence of regulation makes it very useful for cross-border transactions as they are not subject to government-imposed controls, unlike traditional currencies. However, this can also lead to illegal transactions as ransomware commonly demand for Bitcoin as a way to pay their ransom, due to the anonymous nature of Bitcoin[27].

Media coverage is also a factor for its volatility. In October 2021, Bitcoin's value rose to $69,000 after the SEC approved the first US-linked bitcoin-linked ETF[28]. After a few months, however, Bitcoins's value settled at around $40,000. China also banned Bitcoin transaction in 2021 which led to a dip in demand and a 20% decrease in the value of Bitcoin. Bitcoin's value rebounded, however, after Chinese-based farms relocated.

The following is a graph of Bitcoin's value over time. The lowest it has been valued is at $0.09 when it first started in 2010. It peaked in October 2021 at a value of $68,991.

Actions

To invest in Bitcoin, click here.

References

- ↑ https://www.coinbase.com/

- ↑ https://www.ussc.gov/sites/default/files/pdf/training/annual-national-training-seminar/2018/Emerging_Tech_Bitcoin_Crypto.pdf

- ↑ https://money.usnews.com/investing/articles/the-history-of-bitcoin

- ↑ https://bitcoin.design/guide/getting-started/why-bitcoin-is-unique/

- ↑ https://www.exodus.com/news/how-many-bitcoins-are-left/#:~:text=How%20many%20of%20the%2021,mine%20the%20remaining%202.3%20million.&text=That%27s%20because%20of%20the%20Bitcoin%20halving.

- ↑ https://originstamp.com/blog/why-can-there-only-be-21-million-bitcoins/

- ↑ https://www.investopedia.com/tech/what-happens-bitcoin-after-21-million-mined/

- ↑ https://www.investopedia.com/articles/forex/042215/bitcoin-transactions-vs-credit-card-transactions.asp

- ↑ https://www.investopedia.com/articles/forex/042215/bitcoin-transactions-vs-credit-card-transactions.asp

- ↑ https://www.investopedia.com/articles/investing/032615/can-bitcoin-be-hacked.asp#:~:text=The%20concepts%20behind%20blockchain%20technology,exchange%20accounts%20to%20steal%20crypto.

- ↑ https://www.worldbank.org/en/publication/globalfindex

- ↑ https://www.nerdwallet.com/article/investing/what-is-bitcoin#:~:text=Digital%20CurrencyCryptocurrency-,BTC%20definition%3A%20What%20is%20Bitcoin%3F,users%20on%20a%20decentralized%20network.

- ↑ https://www.nerdwallet.com/article/investing/blockchain

- ↑ https://www.investopedia.com/terms/b/bitcoin-mining.asp

- ↑ https://www.bbc.co.uk/news/science-environment-56215787

- ↑ https://ccaf.io/cbnsi/cbeci

- ↑ https://bitpay.com/blog/how-crypto-transactions-work/#:~:text=The%20process%20of%20crypto%20transactions,the%20blockchain%20network%20for%20validation.

- ↑ https://8billiontrees.com/carbon-offsets-credits/carbon-ecological-footprint-calculators/carbon-footprint-of-a-single-ethereum-nft-transaction/#:~:text=Transacting%20once%20on%20the%20Ethereum,visa%20transactions%20(149%20kWh).

- ↑ https://www.statista.com/statistics/881541/bitcoin-energy-consumption-transaction-comparison-visa/

- ↑ 20.0 20.1 20.2 https://www.analyticsinsight.net/top-10-bitcoin-alternatives-one-must-consider-in-2023/#:~:text=Ethereum%20is%20Bitcoin's%20largest%20competitor,its%20platform%2Dspecific%20cryptographic%20token.

- ↑ 21.0 21.1 https://www.investopedia.com/tech/most-important-cryptocurrencies-other-than-bitcoin/

- ↑ https://www.investopedia.com/terms/b/binance-coin-bnb.asp

- ↑ https://coinmarketcap.com/charts/

- ↑ https://coinmarketcap.com/

- ↑ https://www.money-mentor.org/how-much-money-is-in-the-world#:~:text=According%20to%20a%202021%20report,circulation%2C%20that%20is%20narrow%20money.

- ↑ 26.0 26.1 https://finance.yahoo.com/cryptocurrencies/

- ↑ https://www.marsh.com/us/services/cyber-risk/insights/ransomware-paying-cyber-extortion-demands-in-cryptocurrency.html

- ↑ https://www.investopedia.com/tech/what-determines-value-1-bitcoin/#:~:text=Bitcoin%27s%20price%20is%20primarily%20affected,to%20be%20mined%20in%202140.