Bitcoin: Difference between revisions

AaruniArora (talk | contribs) |

|||

| (27 intermediate revisions by 5 users not shown) | |||

| Line 1: | Line 1: | ||

{{ | {{infobox cryptocurrency | ||

| currency_name = Bitcoin | |||

| image_1 = File:Bitcoin.svg | |||

| image_2 = | |||

| image_width_1 = 150 | |||

| image_width_2 = 110 | |||

| image_title_1 = Official logo of Bitcoin | |||

| alt1 = Prevailing bitcoin logo | |||

| precision = 10<sup>−8</sup> | |||

| subunit_ratio_1 = {{frac|1000}} | |||

| subunit_name_1 = Millibitcoin | |||

| subunit_ratio_2 = {{frac|{{val|1000000}}}} | |||

| subunit_name_2 = Microbitcoin | |||

| subunit_ratio_3 = {{frac|{{val|100000000}}}} | |||

| subunit_name_3 = {{lang|ja-Latn|Satoshi|italic=no}}<ref name="satoshi unit">{{cite web |last=Mick |first=Jason |date=12 June 2011 |title=Cracking the Bitcoin: Digging Into a $131M USD Virtual Currency |url=http://www.dailytech.com/Cracking+the+Bitcoin+Digging+Into+a+131M+USD+Virtual+Currency/article21878.htm |url-status=dead |archive-url=https://archive.today/20130120051306/http://www.dailytech.com/Cracking+the+Bitcoin+Digging+Into+a+131M+USD+Virtual+Currency/article21878.htm |archive-date=20 January 2013 |access-date=30 September 2012 |publisher=Daily Tech}}</ref> | |||

| plural = Bitcoins | |||

| symbol = '''₿'''<br/>(Unicode: {{unichar|20BF|BITCOIN SIGN|html=}}){{efn|group=infobox|Encoded [[Unicode]] version 10.0 (2017) in [[Currency Symbols (Unicode block)|Currency Symbols block]]<ref name="unicode-10">{{cite web |date=20 June 2017 |title=Unicode 10.0.0 |url=https://www.unicode.org/versions/Unicode10.0.0/ |url-status=live |archive-url=https://web.archive.org/web/20170620130342/http://www.unicode.org/versions/Unicode10.0.0/ |archive-date=20 June 2017 |access-date=20 June 2017 |publisher=Unicode Consortium}}</ref>}} | |||

| code = BTC,{{efn|group=infobox|Very early software versions used the code "BC".}} XBT{{efn|group=infobox|Compatible with ISO 4217.}} | |||

| implementations = [[#Software implementation|Bitcoin Core]] | |||

| initial_release_version = 0.1.0 | |||

| initial_release_date = {{Start date and age|df=yes|2009|1|9|p=y}} | |||

| code_repository = {{URL|https://github.com/bitcoin/bitcoin}} | |||

| status = Active | |||

| latest_release_version = 25.1 | |||

| latest_release_date = {{Start date and age|df=yes|2023|10|19|p=y}}<ref>{{cite web|title=Bitcoin Core Releases |url=https://github.com/bitcoin/bitcoin/releases/ |via=[[GitHub]]|access-date=24 October 2023}}</ref> | |||

| forked_from = | |||

| programming_languages = C++ | |||

| operating_system = | |||

| author = [[Satoshi Nakamoto]] | |||

| developer = | |||

| white_paper = [https://bitcoin.org/bitcoin.pdf "Bitcoin: A Peer-to-Peer Electronic Cash System"]<ref name="paper" /> | |||

| source_model = [[Free and open-source software]] | |||

| license = [[MIT License]] | |||

| website = {{URL|https://bitcoin.org}} | |||

| ledger_start = {{Start date and age|df=yes|2009|1|3|p=y}} | |||

| hash_function = [[SHA-256]] (two rounds) | |||

| circulating_supply = ₿18,925,000{{efn|group=infobox|As of 2022-01-10}} | |||

| supply_limit = ₿21,000,000<ref>{{cite web |last=Nakamoto |display-authors=et al |date=1 April 2016 |title=Bitcoin source code – amount constraints |website=[[GitHub]] |url=https://github.com/bitcoin/bitcoin/blob/08a7316c144f9f2516db8fa62400893f4358c5ae/src/amount.h |url-status=live |archive-url=https://web.archive.org/web/20180701112835/https://github.com/bitcoin/bitcoin/blob/08a7316c144f9f2516db8fa62400893f4358c5ae/src/amount.h |archive-date=1 July 2018}}</ref>{{efn|The supply will approach, but never reach, ₿21 million. Issuance will permanently halt {{circa}} 2140 at ₿20,999,999.9769.<ref name="Antonopoulos2014">{{Cite book |last=Antonopoulos|first= Andreas M. |title=Mastering Bitcoin: Unlocking Digital Crypto-Currencies |year=2014 |publisher=O'Reilly Media |isbn=978-1-4493-7404-4 |author-link=Andreas Antonopoulos}}</ref>{{rp|ch. 8}}}} | |||

| timestamping = [[Proof-of-work]] (partial hash inversion) | |||

| issuance_schedule = Decentralized (block reward)<br />Initially ₿50 per block, halved every 210,000 blocks<ref name="JSC">{{cite web |date=19 November 2013 |title=Statement of Jennifer Shasky Calvery, Director Financial Crimes Enforcement Network United States Department of the Treasury Before the United States Senate Committee on Banking, Housing, and Urban Affairs Subcommittee on National Security and International Trade and Finance Subcommittee on Economic Policy |url=https://www.fincen.gov/sites/default/files/2016-08/20131118.pdf |url-status=live |archive-url=https://web.archive.org/web/20161009183700/https://www.fincen.gov/sites/default/files/2016-08/20131118.pdf |archive-date=9 October 2016 |access-date=1 June 2014 |website=fincen.gov |publisher=Financial Crimes Enforcement Network}}</ref> | |||

| block_time = 10 minutes | |||

| block_reward = ₿6.25{{efn|group=infobox|May 2020 to approximately 2024, halved approximately every four years}} | |||

| exchange_rate = Floating | |||

| market_cap = <!--A reliable source is required --> | |||

| footnotes = {{notelist|group=infobox}} | |||

| using_countries = El Salvador<ref name="BTCSVSept7FT"/> | |||

}} | |||

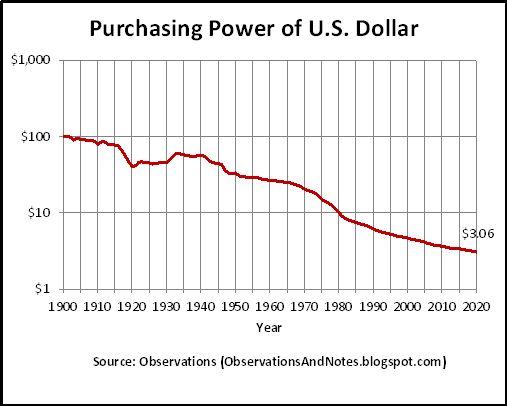

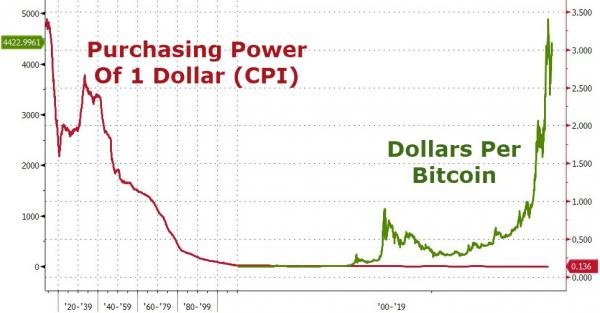

One of the best ways to maintain the purchasing power of a currency is through decentralisation, and Bitcoin is designed to leverage this by operating on a distributed network, minimising central control and potential points of failure. | |||

Bitcoin is a currency. What makes the currency unique is that it's the most popular cryptocurrency. Research suggests that the most popular cryptocurrency will maintain its purchasing power for much longer than any other currency. In other words, the cryptocurrency will be a much better currency. | |||

The degree of risk associated with an investment in Bitcoin is 'medium', with the investment having an adjusted beta that is 42% above the market (1.42 vs. 1). | |||

Assuming Bitcoin's share of the money supply increases to 10% (from 2.2%) and other assumptions, then the Stockhub users estimate that the expected return of an investment in Bitcoin over the next five years is 5x, which equates to an annual return of 39%. In other words, an £100,000 investment in the asset is expected to return £500,000 in five years time. | |||

Assuming that a suitable return level over five years is 39% per year or less, and Bitcoin achieves its expected return level (of 39%), then an investment in Bitcoin is considered to be an 'suitable' one. | |||

'''Fun fact:''' In 2010, a programmer named Laszlo Hanyecz made the first known commercial Bitcoin transaction by buying two pizzas for 10,000 Bitcoins, a sum now worth millions of dollars. | |||

== Operations == | |||

=== How did the idea of Bitcoin come about? === | |||

The idea of Bitcoin, as well as the broader concept of cryptocurrencies, originated from a long-standing interest in digital cash and decentralised financial systems. Bitcoin itself was first introduced in a 2008 white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" by an individual or group using the pseudonym Satoshi Nakamoto. | |||

Several key factors and ideas contributed to the development of Bitcoin: | |||

# '''Cypherpunk Movement:''' The Cypherpunk community, a group of activists advocating for the use of cryptography to bring about social and political change, laid much of the philosophical and technical groundwork for cryptocurrencies. They promoted the idea of using cryptographic techniques to create secure, anonymous digital currencies and transactions. | |||

# '''Earlier Digital Cash Experiments:''' Before Bitcoin, there were several attempts at creating digital cash systems, like David Chaum's DigiCash, which used cryptographic protocols to ensure privacy. While these systems had innovative ideas, they often relied on central authorities and didn't achieve widespread adoption. | |||

# '''Double Spending Problem:''' A significant challenge in digital cash is preventing double spending, where the same digital token is spent more than once. Traditional digital transactions require a central authority, like a bank, to validate transactions. Nakamoto's Bitcoin solved this with a decentralised ledger, the blockchain, which is maintained by a network of nodes following a consensus protocol. | |||

# '''Blockchain Technology:''' The introduction of blockchain technology was a key innovation of the Bitcoin paper. It's a decentralised ledger that records all transactions across a network of computers. This makes Bitcoin resistant to fraud and censorship. | |||

# '''Economic and Political Context:''' The development of Bitcoin was also influenced by the economic environment, particularly the financial crisis of 2007-2008. This period led to increased skepticism about traditional banking systems and interest in alternative forms of currency that weren't controlled by governments or central banks. | |||

# '''Influence of Previous Concepts:''' Bitcoin combined concepts from previously proposed systems like b-money and Bit Gold, which outlined ideas for decentralised digital currencies, but never fully developed them into working systems. | |||

=== What's the mission of Bitcoin? === | |||

The mission of Bitcoin, as outlined by its creator Satoshi Nakamoto, is to provide a decentralised digital currency that enables peer-to-peer transactions without the need for a central authority, such as a bank or government. This is aimed at creating a financial system where transactions are transparent, secure, and accessible to everyone, regardless of their location or status. Bitcoin's design seeks to offer an alternative to traditional financial systems, emphasising financial freedom, privacy, and reduced reliance on centralised institutions. This mission is rooted in the belief that a decentralised approach to currency can offer enhanced security, lower transaction fees, and resistance to censorship. | |||

=== What's the main problem that Bitcoin is designed to solve? === | |||

The main problem that Bitcoin is designed to solve is the issue of trust in financial transactions. Traditionally, trust has been established through intermediaries like banks or financial institutions. Bitcoin, through its decentralised blockchain technology, solves this problem by allowing for peer-to-peer transactions without the need for a centralised authority. This design addresses several key issues: | |||

= | |||

The | |||

# '''Double Spending:''' It prevents the same digital currency from being spent twice. | |||

# '''Censorship Resistance:''' Transactions cannot be easily blocked or censored by governments or institutions. | |||

# '''Reduced Dependency on Intermediaries:''' It minimises the need for third parties, reducing potential points of failure and costs associated with transactions. | |||

# '''Global Accessibility:''' Bitcoin offers a global, digital form of currency accessible to anyone with an internet connection, not limited by national borders or traditional banking systems. | |||

=== What is Bitcoin? === | |||

Bitcoin is a currency. | |||

=== What's unique about Bitcoin? === | |||

What makes Bitcoin unique is that it operates on a decentralised network (i.e. without the need of a central entity, such as the Bank of England), and the supply of the currency is limited (at 21 million coins). | |||

The main benefit of operating on a decentralised network (rather than a centralised network) is that within the network, there is no single point of failure. In a centralised network, if the central entity that operates the network fails, then the whole network - and the currency that operates on the network - fails (i.e. there is a single point of failure in the network), whereas in a decentralised network, becasue there is no central entity, there is no single point of failure, and therefore the network - and currency - is likely to last for much longer, possibly forever. | |||

For example, the world's first ever known currency was operated by a central entity (The Kingdom of Lydia). When the central entity failed, so did the currency. | |||

[[File:Value of U.S. Dollar - Log.jpg]] | |||

[[File:Bitcoin purchasing power.jpg]] | |||

Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower. | |||

==Competition== | ==Competition== | ||

| Line 304: | Line 159: | ||

|} | |} | ||

== | == Market == | ||

=== Total Addressable Market (TAM) === | |||

The TAM for Bitcoin is the global currency market. This includes all forms of money circulation worldwide — from fiat currencies held in banks and cash reserves to investments and digital transactions. This encompasses every potential user or entity that could theoretically adopt Bitcoin, either as a means of transaction, a store of value, or for investment purposes. It represents the maximum possible market opportunity for Bitcoin, assuming universal adoption and acceptance. | |||

The global currency market, including fiat money and investments, is vast. As of 2023, the total value of all the money in the world, including broad money (M3), which covers cash, bank deposits, and money market securities, was estimated to be in the range of approximately $100 trillion USD. Bitcoin's TAM, when considering the potential to replace or complement global currency usage, would thus be a fraction of this amount. | |||

As of July 2023, the total value of narrow money globally, which includes all physical money (notes and coins) and money deposited in savings and checking accounts worldwide, was approximately $40 trillion. This figure represents the M1 money supply, a classification of money that covers the most liquid forms of currency in circulation.<ref>https://www.rankred.com/how-much-money-is-there-in-the-world/#:~:text=As%20of%20July%202023%2C%20the,%E2%80%99</ref> | |||

=== Serviceable Available Market (SAM) === | |||

The SAM narrows down to the global cryptocurrency market. This is the market segment that Bitcoin is actually equipped to serve and includes all individuals and entities currently engaged in or open to engaging with cryptocurrencies. This market is more specific to Bitcoin's capabilities and reflects the growing interest and acceptance of digital currencies for various uses, including remittances, investment, online transactions, and as a hedge against traditional currency fluctuations. | |||

The global cryptocurrency market is a subset of the broader currency market. As of 2023, the total market capitalisation of all cryptocurrencies was fluctuating around $1 trillion to $2 trillion USD. Bitcoin, being the largest cryptocurrency by market cap, dominates this space, but the SAM for Bitcoin would include the total market cap of all cryptocurrencies, considering that these users are potentially open to using Bitcoin. | |||

=== Serviceable Obtainable Market (SOM) === | |||

The SOM further narrows down to the U.S. cryptocurrency market. This represents the segment of the SAM that Bitcoin can realistically expect to capture in the near to medium term. It takes into account factors such as Bitcoin's current market penetration in the U.S., regulatory environment, competition from other cryptocurrencies, technological advancements, and market trends within the United States. The U.S. market is particularly significant due to its substantial economic size, high level of technology adoption, and its influential role in global financial systems. | |||

Estimating the U.S. cryptocurrency market is more complex, as it would involve considering the proportion of the U.S. population or financial sector engaged in cryptocurrency usage. As a rough estimate, if we consider the U.S. as accounting for about 20-30% of the global cryptocurrency market (a broad assumption based on its economic size and level of investment in cryptocurrencies), the SOM for Bitcoin in the U.S. could be a proportion of the global market cap, roughly in the range of $200 billion to $600 billion USD. | |||

== Financials == | |||

<graph> | |||

{ | |||

"version": 2, | |||

"padding": "auto", | |||

"data": [ | |||

{ | |||

"name": "table", | |||

"values": [ | |||

{"x":1230940800000,"y":0}, | |||

{"x":1231286400000,"y":0}, | |||

{"x":1231632000000,"y":0}, | |||

{"x":1231977600000,"y":0}, | |||

{"x":1232323200000,"y":0}, | |||

{"x":1232668800000,"y":0}, | |||

{"x":1233014400000,"y":0}, | |||

{"x":1233360000000,"y":0}, | |||

{"x":1233705600000,"y":0}, | |||

{"x":1234051200000,"y":0}, | |||

{"x":1234396800000,"y":0}, | |||

{"x":1234742400000,"y":0}, | |||

{"x":1235088000000,"y":0}, | |||

{"x":1235433600000,"y":0}, | |||

{"x":1235779200000,"y":0}, | |||

{"x":1236124800000,"y":0}, | |||

{"x":1236470400000,"y":0}, | |||

{"x":1236816000000,"y":0}, | |||

{"x":1237161600000,"y":0}, | |||

{"x":1237507200000,"y":0},{"x":1237852800000,"y":0},{"x":1238198400000,"y":0},{"x":1238544000000,"y":0},{"x":1238889600000,"y":0},{"x":1239235200000,"y":0},{"x":1239580800000,"y":0},{"x":1239926400000,"y":0},{"x":1240272000000,"y":0},{"x":1240617600000,"y":0},{"x":1240963200000,"y":0},{"x":1241308800000,"y":0},{"x":1241654400000,"y":0},{"x":1242000000000,"y":0},{"x":1242345600000,"y":0},{"x":1242691200000,"y":0},{"x":1243036800000,"y":0},{"x":1243382400000,"y":0},{"x":1243728000000,"y":0},{"x":1244073600000,"y":0},{"x":1244419200000,"y":0},{"x":1244764800000,"y":0},{"x":1245110400000,"y":0},{"x":1245456000000,"y":0},{"x":1245801600000,"y":0},{"x":1246147200000,"y":0},{"x":1246492800000,"y":0},{"x":1246838400000,"y":0},{"x":1247184000000,"y":0},{"x":1247529600000,"y":0},{"x":1247875200000,"y":0},{"x":1248220800000,"y":0},{"x":1248566400000,"y":0},{"x":1248912000000,"y":0},{"x":1249257600000,"y":0},{"x":1249603200000,"y":0},{"x":1249948800000,"y":0},{"x":1250294400000,"y":0},{"x":1250640000000,"y":0},{"x":1250985600000,"y":0},{"x":1251331200000,"y":0},{"x":1251676800000,"y":0},{"x":1252022400000,"y":0},{"x":1252368000000,"y":0},{"x":1252713600000,"y":0},{"x":1253059200000,"y":0},{"x":1253404800000,"y":0},{"x":1253750400000,"y":0},{"x":1254096000000,"y":0},{"x":1254441600000,"y":0},{"x":1254787200000,"y":0},{"x":1255132800000,"y":0},{"x":1255478400000,"y":0},{"x":1255824000000,"y":0},{"x":1256169600000,"y":0},{"x":1256515200000,"y":0},{"x":1256860800000,"y":0},{"x":1257206400000,"y":0},{"x":1257552000000,"y":0},{"x":1257897600000,"y":0},{"x":1258243200000,"y":0},{"x":1258588800000,"y":0},{"x":1258934400000,"y":0},{"x":1259280000000,"y":0},{"x":1259625600000,"y":0},{"x":1259971200000,"y":0},{"x":1260316800000,"y":0},{"x":1260662400000,"y":0},{"x":1261008000000,"y":0},{"x":1261353600000,"y":0},{"x":1261699200000,"y":0},{"x":1262044800000,"y":0},{"x":1262390400000,"y":0},{"x":1262736000000,"y":0},{"x":1263081600000,"y":0},{"x":1263427200000,"y":0},{"x":1263772800000,"y":0},{"x":1264118400000,"y":0},{"x":1264464000000,"y":0},{"x":1264809600000,"y":0},{"x":1265155200000,"y":0},{"x":1265500800000,"y":0},{"x":1265846400000,"y":0},{"x":1266192000000,"y":0},{"x":1266537600000,"y":0},{"x":1266883200000,"y":0},{"x":1267228800000,"y":0},{"x":1267574400000,"y":0},{"x":1267920000000,"y":0},{"x":1268265600000,"y":0},{"x":1268611200000,"y":0},{"x":1268956800000,"y":0},{"x":1269302400000,"y":0},{"x":1269648000000,"y":0},{"x":1269993600000,"y":0},{"x":1270339200000,"y":0},{"x":1270684800000,"y":0},{"x":1271030400000,"y":0},{"x":1271376000000,"y":0},{"x":1271721600000,"y":0},{"x":1272067200000,"y":0},{"x":1272412800000,"y":0},{"x":1272758400000,"y":0},{"x":1273104000000,"y":0},{"x":1273449600000,"y":0},{"x":1273795200000,"y":0},{"x":1274140800000,"y":0},{"x":1274486400000,"y":0},{"x":1274832000000,"y":0},{"x":1275177600000,"y":0},{"x":1275523200000,"y":0},{"x":1275868800000,"y":0},{"x":1276214400000,"y":0},{"x":1276560000000,"y":0},{"x":1276905600000,"y":0},{"x":1277251200000,"y":0},{"x":1277596800000,"y":0},{"x":1277942400000,"y":0},{"x":1278288000000,"y":0},{"x":1278633600000,"y":0},{"x":1278979200000,"y":0},{"x":1279324800000,"y":0},{"x":1279670400000,"y":0},{"x":1280016000000,"y":0},{"x":1280361600000,"y":0},{"x":1280707200000,"y":0},{"x":1281052800000,"y":0},{"x":1281398400000,"y":0},{"x":1281744000000,"y":0},{"x":1282089600000,"y":0.07},{"x":1282435200000,"y":0.07},{"x":1282780800000,"y":0.07},{"x":1283126400000,"y":0.07},{"x":1283472000000,"y":0.06},{"x":1283817600000,"y":0.06},{"x":1284163200000,"y":0.06},{"x":1284508800000,"y":0.09},{"x":1284854400000,"y":0.06},{"x":1285200000000,"y":0.06},{"x":1285545600000,"y":0.06},{"x":1285891200000,"y":0.06},{"x":1286236800000,"y":0.06},{"x":1286582400000,"y":0.1},{"x":1286928000000,"y":0.1},{"x":1287273600000,"y":0.11},{"x":1287619200000,"y":0.1},{"x":1287964800000,"y":0.18},{"x":1288310400000,"y":0.19},{"x":1288656000000,"y":0.2},{"x":1289001600000,"y":0.25},{"x":1289347200000,"y":0.32},{"x":1289692800000,"y":0.3},{"x":1290038400000,"y":0.28},{"x":1290384000000,"y":0.29},{"x":1290729600000,"y":0.28},{"x":1291075200000,"y":0.28},{"x":1291420800000,"y":0.26},{"x":1291766400000,"y":0.23},{"x":1292112000000,"y":0.23},{"x":1292457600000,"y":0.25},{"x":1292803200000,"y":0.26},{"x":1293148800000,"y":0.25},{"x":1293494400000,"y":0.27},{"x":1293840000000,"y":0.3},{"x":1294185600000,"y":0.3},{"x":1294531200000,"y":0.32},{"x":1294876800000,"y":0.36},{"x":1295222400000,"y":0.4},{"x":1295568000000,"y":0.38},{"x":1295913600000,"y":0.44},{"x":1296259200000,"y":0.45},{"x":1296604800000,"y":0.92},{"x":1296950400000,"y":0.92},{"x":1297296000000,"y":0.97},{"x":1297641600000,"y":1.08},{"x":1297987200000,"y":1.05},{"x":1298332800000,"y":0.88},{"x":1298678400000,"y":1},{"x":1299024000000,"y":0.97},{"x":1299369600000,"y":0.92},{"x":1299715200000,"y":0.88},{"x":1300060800000,"y":0.91},{"x":1300406400000,"y":0.87},{"x":1300752000000,"y":0.79},{"x":1301097600000,"y":0.89},{"x":1301443200000,"y":0.8},{"x":1301788800000,"y":0.8},{"x":1302134400000,"y":0.75},{"x":1302480000000,"y":0.76},{"x":1302825600000,"y":0.98},{"x":1303171200000,"y":1.2},{"x":1303516800000,"y":1.38},{"x":1303862400000,"y":1.78},{"x":1304208000000,"y":4.14},{"x":1304553600000,"y":3.56},{"x":1304899200000,"y":3.91},{"x":1305244800000,"y":6.55},{"x":1305590400000,"y":8.47},{"x":1305936000000,"y":6.98},{"x":1306281600000,"y":7.27},{"x":1306627200000,"y":8.68},{"x":1306972800000,"y":9.67},{"x":1307318400000,"y":19.05},{"x":1307664000000,"y":32.34},{"x":1308009600000,"y":23.66},{"x":1308355200000,"y":18.87},{"x":1308700800000,"y":15.39},{"x":1309046400000,"y":17.58},{"x":1309392000000,"y":17.35},{"x":1309737600000,"y":15.74},{"x":1310083200000,"y":16.1},{"x":1310428800000,"y":15.07},{"x":1310774400000,"y":14.25},{"x":1311120000000,"y":14.54},{"x":1311465600000,"y":13.93},{"x":1311811200000,"y":14.1},{"x":1312156800000,"y":14.58},{"x":1312502400000,"y":11.5},{"x":1312848000000,"y":9.66},{"x":1313193600000,"y":9.93},{"x":1313539200000,"y":11.36},{"x":1313884800000,"y":11.75},{"x":1314230400000,"y":11.3},{"x":1314576000000,"y":9.48},{"x":1314921600000,"y":8.46},{"x":1315267200000,"y":8.27},{"x":1315612800000,"y":6.76},{"x":1315958400000,"y":6.19},{"x":1316304000000,"y":5.02},{"x":1316649600000,"y":6.18},{"x":1316995200000,"y":5.49},{"x":1317340800000,"y":4.94},{"x":1317686400000,"y":5.06},{"x":1318032000000,"y":4.79},{"x":1318377600000,"y":4.16},{"x":1318723200000,"y":4.01},{"x":1319068800000,"y":2.59},{"x":1319414400000,"y":3.32},{"x":1319760000000,"y":3.1},{"x":1320105600000,"y":3.38},{"x":1320451200000,"y":3.22},{"x":1320796800000,"y":3.19},{"x":1321142400000,"y":3.11},{"x":1321488000000,"y":2.6},{"x":1321833600000,"y":2.45},{"x":1322179200000,"y":2.48},{"x":1322524800000,"y":2.64},{"x":1322870400000,"y":3.14},{"x":1323216000000,"y":3.06},{"x":1323561600000,"y":3.12},{"x":1323907200000,"y":3.26},{"x":1324252800000,"y":3.36},{"x":1324598400000,"y":3.98},{"x":1324944000000,"y":4.25},{"x":1325289600000,"y":4.47},{"x":1325635200000,"y":5.37},{"x":1325980800000,"y":7.06},{"x":1326326400000,"y":7.1},{"x":1326672000000,"y":7.04},{"x":1327017600000,"y":6.37},{"x":1327363200000,"y":6.47},{"x":1327708800000,"y":5.7},{"x":1328054400000,"y":5.65},{"x":1328400000000,"y":5.99},{"x":1328745600000,"y":5.84},{"x":1329091200000,"y":5.82},{"x":1329436800000,"y":4.74},{"x":1329782400000,"y":4.5},{"x":1330128000000,"y":5.17},{"x":1330473600000,"y":4.98},{"x":1330819200000,"y":4.81},{"x":1331164800000,"y":5.05},{"x":1331510400000,"y":4.98},{"x":1331856000000,"y":5.44},{"x":1332201600000,"y":5.23},{"x":1332547200000,"y":4.81},{"x":1332892800000,"y":4.77},{"x":1333238400000,"y":4.94},{"x":1333584000000,"y":4.96},{"x":1333929600000,"y":4.8},{"x":1334275200000,"y":4.97},{"x":1334620800000,"y":4.99},{"x":1334966400000,"y":5.24},{"x":1335312000000,"y":5.19},{"x":1335657600000,"y":5.09},{"x":1336003200000,"y":5.18},{"x":1336348800000,"y":5.1},{"x":1336694400000,"y":5.1},{"x":1337040000000,"y":5.05},{"x":1337385600000,"y":5.13},{"x":1337731200000,"y":5.13},{"x":1338076800000,"y":5.15},{"x":1338422400000,"y":5.18},{"x":1338768000000,"y":5.27},{"x":1339113600000,"y":5.56},{"x":1339459200000,"y":5.58},{"x":1339804800000,"y":6.27},{"x":1340150400000,"y":6.56},{"x":1340496000000,"y":6.64},{"x":1340841600000,"y":6.58},{"x":1341187200000,"y":6.71},{"x":1341532800000,"y":6.76},{"x":1341878400000,"y":6.98},{"x":1342224000000,"y":7.85},{"x":1342569600000,"y":9.47},{"x":1342915200000,"y":9.53},{"x":1343260800000,"y":8.8},{"x":1343606400000,"y":8.95},{"x":1343952000000,"y":10.12},{"x":1344297600000,"y":11.23},{"x":1344643200000,"y":11.6},{"x":1344988800000,"y":12.3},{"x":1345334400000,"y":14.48},{"x":1345680000000,"y":10.26},{"x":1346025600000,"y":10.99},{"x":1346371200000,"y":10.91},{"x":1346716800000,"y":10.52},{"x":1347062400000,"y":11.27},{"x":1347408000000,"y":11.24},{"x":1347753600000,"y":11.84},{"x":1348099200000,"y":12.63},{"x":1348444800000,"y":12.28},{"x":1348790400000,"y":12.46},{"x":1349136000000,"y":12.58},{"x":1349481600000,"y":12.97},{"x":1349827200000,"y":12.3},{"x":1350172800000,"y":12.1},{"x":1350518400000,"y":11.98},{"x":1350864000000,"y":11.8},{"x":1351209600000,"y":11.56},{"x":1351555200000,"y":10.93},{"x":1351900800000,"y":11.06},{"x":1352246400000,"y":10.97},{"x":1352592000000,"y":10.95},{"x":1352937600000,"y":11.07},{"x":1353283200000,"y":11.82},{"x":1353628800000,"y":12.32},{"x":1353974400000,"y":12.62},{"x":1354320000000,"y":12.66},{"x":1354665600000,"y":13.09},{"x":1355011200000,"y":13.55},{"x":1355356800000,"y":13.8},{"x":1355702400000,"y":13.63},{"x":1356048000000,"y":13.7},{"x":1356393600000,"y":13.45},{"x":1356739200000,"y":13.65},{"x":1357084800000,"y":13.52},{"x":1357430400000,"y":13.54},{"x":1357776000000,"y":13.99},{"x":1358121600000,"y":14.31},{"x":1358467200000,"y":15.53},{"x":1358812800000,"y":17.13},{"x":1359158400000,"y":18.54},{"x":1359504000000,"y":19.78},{"x":1359849600000,"y":21},{"x":1360195200000,"y":21.53},{"x":1360540800000,"y":23.97},{"x":1360886400000,"y":27.2},{"x":1361232000000,"y":26.98},{"x":1361577600000,"y":30.52},{"x":1361923200000,"y":31.2},{"x":1362268800000,"y":34.25},{"x":1362614400000,"y":42},{"x":1362960000000,"y":45.6},{"x":1363305600000,"y":46.86},{"x":1363651200000,"y":52.12},{"x":1363996800000,"y":70.25},{"x":1364342400000,"y":78.79},{"x":1364688000000,"y":92.5},{"x":1365033600000,"y":131},{"x":1365379200000,"y":163.3},{"x":1365724800000,"y":124.9},{"x":1366070400000,"y":68.1},{"x":1366416000000,"y":118.92},{"x":1366761600000,"y":142.5},{"x":1367107200000,"y":128.5},{"x":1367452800000,"y":117},{"x":1367798400000,"y":115.98},{"x":1368144000000,"y":112.69},{"x":1368489600000,"y":117.99},{"x":1368835200000,"y":123.32},{"x":1369180800000,"y":122.7},{"x":1369526400000,"y":131.99},{"x":1369872000000,"y":132.3},{"x":1370217600000,"y":122.42},{"x":1370563200000,"y":118.97},{"x":1370908800000,"y":106.1},{"x":1371254400000,"y":99.98},{"x":1371600000000,"y":107.39},{"x":1371945600000,"y":108.35},{"x":1372291200000,"y":104},{"x":1372636800000,"y":97.25},{"x":1372982400000,"y":80.04},{"x":1373328000000,"y":76.49},{"x":1373673600000,"y":93.99},{"x":1374019200000,"y":97.05},{"x":1374364800000,"y":89.39},{"x":1374710400000,"y":94.51},{"x":1375056000000,"y":98.7},{"x":1375401600000,"y":104.62},{"x":1375747200000,"y":106.72},{"x":1376092800000,"y":102.8},{"x":1376438400000,"y":109.35},{"x":1376784000000,"y":99.71},{"x":1377129600000,"y":110.43},{"x":1377475200000,"y":113.28},{"x":1377820800000,"y":118.5},{"x":1378166400000,"y":130.09},{"x":1378512000000,"y":117.61},{"x":1378857600000,"y":122.02},{"x":1379203200000,"y":124.05},{"x":1379548800000,"y":127.12},{"x":1379894400000,"y":122.93},{"x":1380240000000,"y":124.65},{"x":1380585600000,"y":126.25},{"x":1380931200000,"y":121.94},{"x":1381276800000,"y":124.12},{"x":1381622400000,"y":127.59},{"x":1381968000000,"y":138.19},{"x":1382313600000,"y":186.12},{"x":1382659200000,"y":195.33},{"x":1383004800000,"y":206.9},{"x":1383350400000,"y":203},{"x":1383696000000,"y":252.59},{"x":1384041600000,"y":330},{"x":1384387200000,"y":393},{"x":1384732800000,"y":475},{"x":1385078400000,"y":716.77},{"x":1385424000000,"y":814.56},{"x":1385769600000,"y":1133.95},{"x":1386115200000,"y":1050.21},{"x":1386460800000,"y":705.91},{"x":1386806400000,"y":876.88},{"x":1387152000000,"y":862.98},{"x":1387497600000,"y":685.3},{"x":1387843200000,"y":659.99},{"x":1388188800000,"y":723.98},{"x":1388534400000,"y":732},{"x":1388880000000,"y":828.74},{"x":1389225600000,"y":823.3},{"x":1389571200000,"y":844.04},{"x":1389916800000,"y":817.15},{"x":1390262400000,"y":827.81},{"x":1390608000000,"y":780.02},{"x":1390953600000,"y":785.6},{"x":1391299200000,"y":817.08},{"x":1391644800000,"y":781},{"x":1391990400000,"y":687.37},{"x":1392336000000,"y":610},{"x":1392681600000,"y":629.96},{"x":1393027200000,"y":579.5},{"x":1393372800000,"y":559.52},{"x":1393718400000,"y":567.48},{"x":1394064000000,"y":670.7},{"x":1394409600000,"y":639.9},{"x":1394755200000,"y":641.01},{"x":1395100800000,"y":624.71},{"x":1395446400000,"y":572.89},{"x":1395792000000,"y":585.79},{"x":1396137600000,"y":490},{"x":1396483200000,"y":439.12},{"x":1396828800000,"y":458},{"x":1397174400000,"y":369},{"x":1397520000000,"y":459.64},{"x":1397865600000,"y":482.11},{"x":1398211200000,"y":488.52},{"x":1398556800000,"y":461.48},{"x":1398902400000,"y":452.03},{"x":1399248000000,"y":436.75},{"x":1399593600000,"y":437.61},{"x":1399939200000,"y":442.45},{"x":1400284800000,"y":449.12},{"x":1400630400000,"y":488.12},{"x":1400976000000,"y":527.91},{"x":1401321600000,"y":581},{"x":1401667200000,"y":630.71},{"x":1402012800000,"y":661.48},{"x":1402358400000,"y":648.81},{"x":1402704000000,"y":591.55},{"x":1403049600000,"y":608},{"x":1403395200000,"y":590.96},{"x":1403740800000,"y":560.76},{"x":1404086400000,"y":599.99},{"x":1404432000000,"y":645.35},{"x":1404777600000,"y":624.35},{"x":1405123200000,"y":634},{"x":1405468800000,"y":624.07},{"x":1405814400000,"y":630},{"x":1406160000000,"y":620.43},{"x":1406505600000,"y":593.68},{"x":1406851200000,"y":582.04},{"x":1407196800000,"y":588.5},{"x":1407542400000,"y":588.98},{"x":1407888000000,"y":569.01},{"x":1408233600000,"y":523.88},{"x":1408579200000,"y":518.82},{"x":1408924800000,"y":508.03},{"x":1409270400000,"y":506.61},{"x":1409616000000,"y":476.36},{"x":1409961600000,"y":485.91},{"x":1410307200000,"y":473.35},{"x":1410652800000,"y":476.92},{"x":1410998400000,"y":453.9},{"x":1411344000000,"y":401.15},{"x":1411689600000,"y":410.19},{"x":1412035200000,"y":373.87},{"x":1412380800000,"y":358.9},{"x":1412726400000,"y":334.06},{"x":1413072000000,"y":361.95},{"x":1413417600000,"y":394.84},{"x":1413763200000,"y":389.44},{"x":1414108800000,"y":357.2},{"x":1414454400000,"y":350.9},{"x":1414800000000,"y":337.79},{"x":1415145600000,"y":330.23},{"x":1415491200000,"y":346.94},{"x":1415836800000,"y":420.19},{"x":1416182400000,"y":389.87},{"x":1416528000000,"y":356.47},{"x":1416873600000,"y":374.58},{"x":1417219200000,"y":376.98},{"x":1417564800000,"y":379.62},{"x":1417910400000,"y":375.05},{"x":1418256000000,"y":348.79},{"x":1418601600000,"y":357.8},{"x":1418947200000,"y":312.26},{"x":1419292800000,"y":331.98},{"x":1419638400000,"y":329.94},{"x":1419984000000,"y":311},{"x":1420329600000,"y":285.09},{"x":1420675200000,"y":297.99},{"x":1421020800000,"y":269.68},{"x":1421366400000,"y":210.21},{"x":1421712000000,"y":216.01},{"x":1422057600000,"y":233.71},{"x":1422403200000,"y":263.52},{"x":1422748800000,"y":219.25},{"x":1423094400000,"y":226.71},{"x":1423440000000,"y":223.93},{"x":1423785600000,"y":222.33},{"x":1424131200000,"y":234.5},{"x":1424476800000,"y":245.78},{"x":1424822400000,"y":239.94},{"x":1425168000000,"y":253.5},{"x":1425513600000,"y":270.06},{"x":1425859200000,"y":275},{"x":1426204800000,"y":294.9},{"x":1426550400000,"y":289.28},{"x":1426896000000,"y":262.1},{"x":1427241600000,"y":245},{"x":1427587200000,"y":252.96},{"x":1427932800000,"y":246.49},{"x":1428278400000,"y":260.52},{"x":1428624000000,"y":243},{"x":1428969600000,"y":223.01},{"x":1429315200000,"y":222.64},{"x":1429660800000,"y":235.85},{"x":1430006400000,"y":226.29},{"x":1430352000000,"y":225.62},{"x":1430697600000,"y":239.47},{"x":1431043200000,"y":237.16},{"x":1431388800000,"y":240.95},{"x":1431734400000,"y":237.37},{"x":1432080000000,"y":231.4},{"x":1432425600000,"y":237.76},{"x":1432771200000,"y":235.31},{"x":1433116800000,"y":228.34},{"x":1433462400000,"y":222.88},{"x":1433808000000,"y":227.66},{"x":1434153600000,"y":229.6},{"x":1434499200000,"y":249.98},{"x":1434844800000,"y":244.75},{"x":1435190400000,"y":240.2},{"x":1435536000000,"y":248.57},{"x":1435881600000,"y":254.68},{"x":1436227200000,"y":268.53},{"x":1436572800000,"y":284.92},{"x":1436918400000,"y":287.92},{"x":1437264000000,"y":276.74},{"x":1437609600000,"y":277.97},{"x":1437955200000,"y":292.82},{"x":1438300800000,"y":288.45},{"x":1438646400000,"y":281.12},{"x":1438992000000,"y":279.32},{"x":1439337600000,"y":270.98},{"x":1439683200000,"y":261.43},{"x":1440028800000,"y":226.25},{"x":1440374400000,"y":228.14},{"x":1440720000000,"y":225.11},{"x":1441065600000,"y":230.25},{"x":1441411200000,"y":230.73},{"x":1441756800000,"y":244.21},{"x":1442102400000,"y":234.73},{"x":1442448000000,"y":228.33},{"x":1442793600000,"y":230.16},{"x":1443139200000,"y":234},{"x":1443484800000,"y":239.14},{"x":1443830400000,"y":237.77},{"x":1444176000000,"y":246.8},{"x":1444521600000,"y":245.72},{"x":1444867200000,"y":252.47},{"x":1445212800000,"y":261.04},{"x":1445558400000,"y":274.35},{"x":1445904000000,"y":286.69},{"x":1446249600000,"y":328.17},{"x":1446595200000,"y":404.5},{"x":1446940800000,"y":387.02},{"x":1447286400000,"y":308.98},{"x":1447632000000,"y":318.97},{"x":1447977600000,"y":325.9},{"x":1448323200000,"y":323.48},{"x":1448668800000,"y":358},{"x":1449014400000,"y":362.58},{"x":1449360000000,"y":386.95},{"x":1449705600000,"y":416.49},{"x":1450051200000,"y":433.39},{"x":1450396800000,"y":456.58},{"x":1450742400000,"y":438.35},{"x":1451088000000,"y":455.5},{"x":1451433600000,"y":433.23},{"x":1451779200000,"y":432.76},{"x":1452124800000,"y":429.26},{"x":1452470400000,"y":448.43},{"x":1452816000000,"y":429.55},{"x":1453161600000,"y":385.49},{"x":1453507200000,"y":381.5},{"x":1453852800000,"y":391.66},{"x":1454198400000,"y":376.6},{"x":1454544000000,"y":368.46},{"x":1454889600000,"y":375},{"x":1455235200000,"y":378.02},{"x":1455580800000,"y":399.21},{"x":1455926400000,"y":419.98},{"x":1456272000000,"y":419.25},{"x":1456617600000,"y":431.59},{"x":1456963200000,"y":422.5},{"x":1457308800000,"y":405.69},{"x":1457654400000,"y":416},{"x":1458000000000,"y":414.99},{"x":1458345600000,"y":407.96},{"x":1458691200000,"y":416.39},{"x":1459036800000,"y":416.96},{"x":1459382400000,"y":413.74},{"x":1459728000000,"y":418.51},{"x":1460073600000,"y":419.95},{"x":1460419200000,"y":422.63},{"x":1460764800000,"y":429.45},{"x":1461110400000,"y":435.95},{"x":1461456000000,"y":451.92},{"x":1461801600000,"y":445.29},{"x":1462147200000,"y":453},{"x":1462492800000,"y":449.37},{"x":1462838400000,"y":460.66},{"x":1463184000000,"y":455.82},{"x":1463529600000,"y":453.08},{"x":1463875200000,"y":443.21},{"x":1464220800000,"y":448.7},{"x":1464566400000,"y":511.3},{"x":1464912000000,"y":538},{"x":1465257600000,"y":583.72},{"x":1465603200000,"y":577.95},{"x":1465948800000,"y":685.19},{"x":1466294400000,"y":751.96},{"x":1466640000000,"y":592.81},{"x":1466985600000,"y":630.19},{"x":1467331200000,"y":667.95},{"x":1467676800000,"y":681.98},{"x":1468022400000,"y":663},{"x":1468368000000,"y":664.5},{"x":1468713600000,"y":661.32},{"x":1469059200000,"y":667.5},{"x":1469404800000,"y":661.48},{"x":1469750400000,"y":655.54},{"x":1470096000000,"y":605.56},{"x":1470441600000,"y":572.72},{"x":1470787200000,"y":584.98},{"x":1471132800000,"y":583.34},{"x":1471478400000,"y":570.92},{"x":1471824000000,"y":577.24},{"x":1472169600000,"y":575.75},{"x":1472515200000,"y":571.5},{"x":1472860800000,"y":572},{"x":1473206400000,"y":608.16},{"x":1473552000000,"y":621.65},{"x":1473897600000,"y":608.99},{"x":1474243200000,"y":607.31},{"x":1474588800000,"y":594.08},{"x":1474934400000,"y":606.79},{"x":1475280000000,"y":608.38},{"x":1475625600000,"y":607.18},{"x":1475971200000,"y":614.46},{"x":1476316800000,"y":635.16},{"x":1476662400000,"y":638.97},{"x":1477008000000,"y":628.89},{"x":1477353600000,"y":643.93},{"x":1477699200000,"y":685.91},{"x":1478044800000,"y":726.6},{"x":1478390400000,"y":703.48},{"x":1478736000000,"y":721.5},{"x":1479081600000,"y":700.38},{"x":1479427200000,"y":736.84},{"x":1479772800000,"y":736.97},{"x":1480118400000,"y":737.07},{"x":1480464000000,"y":730.02},{"x":1480809600000,"y":762.97},{"x":1481155200000,"y":766.48},{"x":1481500800000,"y":768.19},{"x":1481846400000,"y":775.88},{"x":1482192000000,"y":791.03},{"x":1482537600000,"y":913.93},{"x":1482883200000,"y":930.34},{"x":1483228800000,"y":964.84},{"x":1483574400000,"y":1109.16},{"x":1483920000000,"y":910.49},{"x":1484265600000,"y":805.52},{"x":1484611200000,"y":830.56},{"x":1484956800000,"y":895.64},{"x":1485302400000,"y":883.59},{"x":1485648000000,"y":918.62},{"x":1485993600000,"y":983.42},{"x":1486339200000,"y":1011.08},{"x":1486684800000,"y":985.34},{"x":1487030400000,"y":1001.2},{"x":1487376000000,"y":1054.55},{"x":1487721600000,"y":1125},{"x":1488067200000,"y":1150.37},{"x":1488412800000,"y":1224.98},{"x":1488758400000,"y":1271.04},{"x":1489104000000,"y":1192.09},{"x":1489449600000,"y":1240.72},{"x":1489795200000,"y":1068.3},{"x":1490140800000,"y":1113},{"x":1490486400000,"y":961.81},{"x":1490832000000,"y":1039.77},{"x":1491177600000,"y":1079.99},{"x":1491523200000,"y":1193.73},{"x":1491868800000,"y":1209.99},{"x":1492214400000,"y":1170.36},{"x":1492560000000,"y":1201.2},{"x":1492905600000,"y":1233.24},{"x":1493251200000,"y":1288.02},{"x":1493596800000,"y":1354.8},{"x":1493942400000,"y":1537.23},{"x":1494288000000,"y":1651.1},{"x":1494633600000,"y":1692.88},{"x":1494979200000,"y":1708.99},{"x":1495324800000,"y":2008.84},{"x":1495670400000,"y":2421.49},{"x":1496016000000,"y":2177.38},{"x":1496361600000,"y":2409.93},{"x":1496707200000,"y":2699.12},{"x":1497052800000,"y":2825.14},{"x":1497398400000,"y":2706},{"x":1497744000000,"y":2629.76},{"x":1498089600000,"y":2658.69},{"x":1498435200000,"y":2502.03},{"x":1498780800000,"y":2541.69},{"x":1499126400000,"y":2549.93},{"x":1499472000000,"y":2502.86},{"x":1499817600000,"y":2310.93},{"x":1500163200000,"y":1972.29},{"x":1500508800000,"y":2265.21},{"x":1500854400000,"y":2748.36},{"x":1501200000000,"y":2656.53},{"x":1501545600000,"y":2862.9},{"x":1501891200000,"y":2856.52},{"x":1502236800000,"y":3408.75},{"x":1502582400000,"y":3868.52},{"x":1502928000000,"y":4375.8},{"x":1503273600000,"y":4054.6},{"x":1503619200000,"y":4331.77},{"x":1503964800000,"y":4376.66},{"x":1504310400000,"y":4908.41},{"x":1504656000000,"y":4385.02},{"x":1505001600000,"y":4330.87},{"x":1505347200000,"y":3865.22},{"x":1505692800000,"y":3678.53},{"x":1506038400000,"y":3600.92},{"x":1506384000000,"y":3931.98},{"x":1506729600000,"y":4164.27},{"x":1507075200000,"y":4308.33},{"x":1507420800000,"y":4439.46},{"x":1507766400000,"y":4822.17},{"x":1508112000000,"y":5691.69},{"x":1508457600000,"y":5697.16},{"x":1508803200000,"y":5900.59},{"x":1509148800000,"y":5769.89},{"x":1509494400000,"y":6416.07},{"x":1509840000000,"y":7365.99},{"x":1510185600000,"y":7468.44},{"x":1510531200000,"y":5890.08},{"x":1510876800000,"y":7868.77},{"x":1511222400000,"y":8242.81},{"x":1511568000000,"y":8212.78},{"x":1511913600000,"y":9919},{"x":1512259200000,"y":10912.87},{"x":1512604800000,"y":13843.93},{"x":1512950400000,"y":15068.95},{"x":1513296000000,"y":16408.15},{"x":1513641600000,"y":18911.79},{"x":1513987200000,"y":13776.61},{"x":1514332800000,"y":15677.99},{"x":1514678400000,"y":12612.54},{"x":1515024000000,"y":15039.24},{"x":1515369600000,"y":16192.91},{"x":1515715200000,"y":13285.55},{"x":1516060800000,"y":13554.14},{"x":1516406400000,"y":11506.51},{"x":1516752000000,"y":10831.49},{"x":1517097600000,"y":11431.37},{"x":1517443200000,"y":10204},{"x":1517788800000,"y":8202.06},{"x":1518134400000,"y":8245.08},{"x":1518480000000,"y":8895.72},{"x":1518825600000,"y":10178.56},{"x":1519171200000,"y":11245.98},{"x":1519516800000,"y":9699.76},{"x":1519862400000,"y":10332.14},{"x":1520208000000,"y":11516.83},{"x":1520553600000,"y":9324.5},{"x":1520899200000,"y":9130},{"x":1521244800000,"y":8297.89},{"x":1521590400000,"y":8909.95},{"x":1521936000000,"y":8533.76},{"x":1522281600000,"y":7950.61},{"x":1522627200000,"y":6827.54},{"x":1522972800000,"y":6786.66},{"x":1523318400000,"y":6784.41},{"x":1523664000000,"y":7895.25},{"x":1524009600000,"y":7907.19},{"x":1524355200000,"y":8930.6},{"x":1524700800000,"y":8870.14},{"x":1525046400000,"y":9398.4},{"x":1525392000000,"y":9753.35},{"x":1525737600000,"y":9369.16},{"x":1526083200000,"y":8396.83},{"x":1526428800000,"y":8471.06},{"x":1526774400000,"y":8242.07},{"x":1527120000000,"y":7511.91},{"x":1527465600000,"y":7344.56},{"x":1527811200000,"y":7489.66},{"x":1528156800000,"y":7495.47},{"x":1528502400000,"y":7615.54},{"x":1528848000000,"y":6553},{"x":1529193600000,"y":6488.68},{"x":1529539200000,"y":6760.83},{"x":1529884800000,"y":6157.04},{"x":1530230400000,"y":5878.14},{"x":1530576000000,"y":6626.44},{"x":1530921600000,"y":6628.59},{"x":1531267200000,"y":6329.27},{"x":1531612800000,"y":6248.84},{"x":1531958400000,"y":7371.11},{"x":1532304000000,"y":7406.66},{"x":1532649600000,"y":7939.81},{"x":1532995200000,"y":8171.49},{"x":1533340800000,"y":7414.77},{"x":1533686400000,"y":6718.23},{"x":1534032000000,"y":6227.85},{"x":1534377600000,"y":6270.67},{"x":1534723200000,"y":6486.58},{"x":1535068800000,"y":6525.96},{"x":1535414400000,"y":6901.26},{"x":1535760000000,"y":7018.78},{"x":1536105600000,"y":7359.19},{"x":1536451200000,"y":6184.06},{"x":1536796800000,"y":6326.04},{"x":1537142400000,"y":6497.37},{"x":1537488000000,"y":6496.02},{"x":1537833600000,"y":6583.45},{"x":1538179200000,"y":6628.66},{"x":1538524800000,"y":6521.31},{"x":1538870400000,"y":6573.62},{"x":1539216000000,"y":6581.07},{"x":1539561600000,"y":6265.16},{"x":1539907200000,"y":6509.61},{"x":1540252800000,"y":6493.89},{"x":1540598400000,"y":6472.17},{"x":1540944000000,"y":6301.61},{"x":1541289600000,"y":6361.3},{"x":1541635200000,"y":6536.83},{"x":1541980800000,"y":6408.53},{"x":1542326400000,"y":5658.73},{"x":1542672000000,"y":4848.78},{"x":1543017600000,"y":4352.98},{"x":1543363200000,"y":3828.45},{"x":1543708800000,"y":4188.09},{"x":1544054400000,"y":3744.98},{"x":1544400000000,"y":3588.44},{"x":1544745600000,"y":3308.11},{"x":1545091200000,"y":3556.54},{"x":1545436800000,"y":3899.83},{"x":1545782400000,"y":3821.52},{"x":1546128000000,"y":3770.36},{"x":1546473600000,"y":3931.31},{"x":1546819200000,"y":4071.77},{"x":1547164800000,"y":3646.25},{"x":1547510400000,"y":3682.48},{"x":1547856000000,"y":3625.73},{"x":1548201600000,"y":3587.35},{"x":1548547200000,"y":3576.3},{"x":1548892800000,"y":3470},{"x":1549238400000,"y":3456.02},{"x":1549584000000,"y":3394.76},{"x":1549929600000,"y":3629.47},{"x":1550275200000,"y":3608.2},{"x":1550620800000,"y":3926.53},{"x":1550966400000,"y":4139.6},{"x":1551312000000,"y":3833.23},{"x":1551657600000,"y":3814.58},{"x":1552003200000,"y":3886.82},{"x":1552348800000,"y":3881.09},{"x":1552694400000,"y":3936.5},{"x":1553040000000,"y":4029.11},{"x":1553385600000,"y":4011.92},{"x":1553731200000,"y":4048.51},{"x":1554076800000,"y":4114.16},{"x":1554422400000,"y":4911.24},{"x":1554768000000,"y":5268.71},{"x":1555113600000,"y":5072.85},{"x":1555459200000,"y":5196.65},{"x":1555804800000,"y":5309.28},{"x":1556150400000,"y":5434.19},{"x":1556496000000,"y":5301.29},{"x":1556841600000,"y":5390.16},{"x":1557187200000,"y":5684.47},{"x":1557532800000,"y":6348.02},{"x":1557878400000,"y":7992.69},{"x":1558224000000,"y":7265.05},{"x":1558569600000,"y":7625.93},{"x":1558915200000,"y":8744.42},{"x":1559260800000,"y":8272.46},{"x":1559606400000,"y":8134.92},{"x":1559952000000,"y":7998.29},{"x":1560297600000,"y":7917.58},{"x":1560643200000,"y":8859.47},{"x":1560988800000,"y":9281.7},{"x":1561334400000,"y":10814.48},{"x":1561680000000,"y":11132.85},{"x":1562025600000,"y":10578.72},{"x":1562371200000,"y":10955.16},{"x":1562716800000,"y":12586.78},{"x":1563062400000,"y":11389.1},{"x":1563408000000,"y":9674.28},{"x":1563753600000,"y":10587.41},{"x":1564099200000,"y":9875.17},{"x":1564444800000,"y":9501.33},{"x":1564790400000,"y":10529.55},{"x":1565136000000,"y":11465.67},{"x":1565481600000,"y":11282.22},{"x":1565827200000,"y":10016.96},{"x":1566172800000,"y":10317.6},{"x":1566518400000,"y":10111.98},{"x":1566864000000,"y":10360.28},{"x":1567209600000,"y":9577.99},{"x":1567555200000,"y":10621.29},{"x":1567900800000,"y":10487.21},{"x":1568246400000,"y":10159.32},{"x":1568592000000,"y":10310.43},{"x":1568937600000,"y":10275.88},{"x":1569283200000,"y":9683.38},{"x":1569628800000,"y":8193.9},{"x":1569974400000,"y":8322.92},{"x":1570320000000,"y":8147.69},{"x":1570665600000,"y":8587.92},{"x":1571011200000,"y":8283.76},{"x":1571356800000,"y":8076.78},{"x":1571702400000,"y":8222.52},{"x":1572048000000,"y":8666.79},{"x":1572393600000,"y":9433.35},{"x":1572739200000,"y":9301.18},{"x":1573084800000,"y":9343.34},{"x":1573430400000,"y":9037.12},{"x":1573776000000,"y":8632.32},{"x":1574121600000,"y":8175.99},{"x":1574467200000,"y":7286.35},{"x":1574812800000,"y":7163.63},{"x":1575158400000,"y":7557.72},{"x":1575504000000,"y":7192.85},{"x":1575849600000,"y":7522.39},{"x":1576195200000,"y":7189.16},{"x":1576540800000,"y":6879.54},{"x":1576886400000,"y":7190.17},{"x":1577232000000,"y":7250.69},{"x":1577577600000,"y":7301.07},{"x":1577923200000,"y":7175.68},{"x":1578268800000,"y":7351.57},{"x":1578614400000,"y":7817.92},{"x":1578960000000,"y":8105.24},{"x":1579305600000,"y":8900.34},{"x":1579651200000,"y":8722.26},{"x":1579996800000,"y":8327.36},{"x":1580342400000,"y":9279.81},{"x":1580688000000,"y":9314.56},{"x":1581033600000,"y":9755.66},{"x":1581379200000,"y":9854.79},{"x":1581724800000,"y":10368.53},{"x":1582070400000,"y":10180.65},{"x":1582416000000,"y":9669.63},{"x":1582761600000,"y":8785.52},{"x":1583107200000,"y":8534.17},{"x":1583452800000,"y":9067.39},{"x":1583798400000,"y":7931.94},{"x":1584144000000,"y":5609.03},{"x":1584489600000,"y":5357.61},{"x":1584835200000,"y":6189.85},{"x":1585180800000,"y":6698.46},{"x":1585526400000,"y":5885.41},{"x":1585872000000,"y":6809.11},{"x":1586217600000,"y":7343.2},{"x":1586563200000,"y":6873.24},{"x":1586908800000,"y":6871.95},{"x":1587254400000,"y":7259.36},{"x":1587600000000,"y":7130.99},{"x":1587945600000,"y":7699.27},{"x":1588291200000,"y":8628.77},{"x":1588636800000,"y":8885.93},{"x":1588982400000,"y":9821.8},{"x":1589328000000,"y":8814.53},{"x":1589673600000,"y":9385.7},{"x":1590019200000,"y":9510.67},{"x":1590364800000,"y":8730.73},{"x":1590710400000,"y":9569.21},{"x":1591056000000,"y":10204.23},{"x":1591401600000,"y":9623.75},{"x":1591747200000,"y":9775.15},{"x":1592092800000,"y":9473.5},{"x":1592438400000,"y":9454.81},{"x":1592784000000,"y":9284.78},{"x":1593129600000,"y":9240.85},{"x":1593475200000,"y":9185.35},{"x":1593820800000,"y":9072.42},{"x":1594166400000,"y":9256.23},{"x":1594512000000,"y":9235.96},{"x":1594857600000,"y":9193.51},{"x":1595203200000,"y":9214.66},{"x":1595548800000,"y":9613.11},{"x":1595894400000,"y":11042.4},{"x":1596240000000,"y":11343.88},{"x":1596585600000,"y":11194.25},{"x":1596931200000,"y":11767.6},{"x":1597276800000,"y":11573.11},{"x":1597622400000,"y":11914.01},{"x":1597968000000,"y":11865.82},{"x":1598313600000,"y":11763.93},{"x":1598659200000,"y":11534.75},{"x":1599004800000,"y":11923.25},{"x":1599350400000,"y":10159.62},{"x":1599696000000,"y":10227.83},{"x":1600041600000,"y":10330.77},{"x":1600387200000,"y":10943.89},{"x":1600732800000,"y":10430.46},{"x":1601078400000,"y":10692.84},{"x":1601424000000,"y":10840.8},{"x":1601769600000,"y":10551.77},{"x":1602115200000,"y":10670.8},{"x":1602460800000,"y":11376.61},{"x":1602806400000,"y":11503.73},{"x":1603152000000,"y":11758.16},{"x":1603497600000,"y":12944.52},{"x":1603843200000,"y":13651.47},{"x":1604188800000,"y":13810.32},{"x":1604534400000,"y":14155.59},{"x":1604880000000,"y":15490.6},{"x":1605225600000,"y":16295.57},{"x":1605571200000,"y":16725.15},{"x":1605916800000,"y":18687.45},{"x":1606262400000,"y":19172.52},{"x":1606608000000,"y":17732.42},{"x":1606953600000,"y":19226.97},{"x":1607299200000,"y":19377.66},{"x":1607644800000,"y":18247.76},{"x":1607990400000,"y":19276.59},{"x":1608336000000,"y":23150.79},{"x":1608681600000,"y":23824.99},{"x":1609027200000,"y":26443.21},{"x":1609372800000,"y":28856.59},{"x":1609718400000,"y":33000.78},{"x":1610064000000,"y":39486.04},{"x":1610409600000,"y":35544.94},{"x":1610755200000,"y":36828.52},{"x":1611100800000,"y":36020.13},{"x":1611446400000,"y":32099.74},{"x":1611792000000,"y":30419.17},{"x":1612137600000,"y":33136.46},{"x":1612483200000,"y":37002.09},{"x":1612828800000,"y":46364.3},{"x":1613174400000,"y":47471.4},{"x":1613520000000,"y":49160.1},{"x":1613865600000,"y":56001.2},{"x":1614211200000,"y":50624.84},{"x":1614556800000,"y":45113.92},{"x":1614902400000,"y":48448.91},{"x":1615248000000,"y":52299.33},{"x":1615593600000,"y":57253.28},{"x":1615939200000,"y":56872.38},{"x":1616284800000,"y":58085.8},{"x":1616630400000,"y":52508.23},{"x":1616976000000,"y":55783.71},{"x":1617321600000,"y":58736.92},{"x":1617667200000,"y":59054.1},{"x":1618012800000,"y":58102.58},{"x":1618358400000,"y":63554.44},{"x":1618704000000,"y":60087.09},{"x":1619049600000,"y":53808.8},{"x":1619395200000,"y":49075.58},{"x":1619740800000,"y":53584.15},{"x":1620086400000,"y":57213.33},{"x":1620432000000,"y":57380.27},{"x":1620777600000,"y":56750},{"x":1621123200000,"y":46736.58},{"x":1621468800000,"y":36964.27},{"x":1621814400000,"y":34754.54},{"x":1622160000000,"y":38445.29},{"x":1622505600000,"y":37310.54},{"x":1622851200000,"y":36885.51},{"x":1623196800000,"y":33450.19},{"x":1623542400000,"y":35494.9},{"x":1623888000000,"y":38324.87},{"x":1624233600000,"y":35592.35},{"x":1624579200000,"y":34639.38},{"x":1624924800000,"y":34456.67},{"x":1625270400000,"y":33856.86},{"x":1625616000000,"y":34211.01},{"x":1625961600000,"y":33515.57},{"x":1626307200000,"y":32814.61},{"x":1626652800000,"y":31783.49},{"x":1626998400000,"y":32297.89},{"x":1627344000000,"y":37318.14},{"x":1627689600000,"y":42214.15},{"x":1628035200000,"y":38138},{"x":1628380800000,"y":44634.13},{"x":1628726400000,"y":45611.46},{"x":1629072000000,"y":47056.41},{"x":1629417600000,"y":46734.65},{"x":1629763200000,"y":49523.5},{"x":1630108800000,"y":49056.86},{"x":1630454400000,"y":47155.87},{"x":1630800000000,"y":49947.38},{"x":1631145600000,"y":46078.38},{"x":1631491200000,"y":46059.12},{"x":1631836800000,"y":47785.26},{"x":1632182400000,"y":42901.56},{"x":1632528000000,"y":42815.56},{"x":1632873600000,"y":41011.16},{"x":1633219200000,"y":47727.1},{"x":1633564800000,"y":55343.76},{"x":1633910400000,"y":54625.74},{"x":1634256000000,"y":57397.74},{"x":1634601600000,"y":61971.59},{"x":1634947200000,"y":60697.06},{"x":1635292800000,"y":60345.17},{"x":1635638400000,"y":61731.29},{"x":1635984000000,"y":62954.86},{"x":1636329600000,"y":63293.22},{"x":1636675200000,"y":64838.81},{"x":1637020800000,"y":63584.25},{"x":1637366400000,"y":58133.02},{"x":1637712000000,"y":57578.22},{"x":1638057600000,"y":54801.15},{"x":1638403200000,"y":57229.76},{"x":1638748800000,"y":49380.43},{"x":1639094400000,"y":47659.68},{"x":1639440000000,"y":46757.09},{"x":1639785600000,"y":46173.51},{"x":1640131200000,"y":48934.57},{"x":1640476800000,"y":50470.89},{"x":1640822400000,"y":46408.87},{"x":1641168000000,"y":47327.87},{"x":1641513600000,"y":43120.63},{"x":1641859200000,"y":41849},{"x":1642204800000,"y":43099.37},{"x":1642550400000,"y":42381.48},{"x":1642896000000,"y":35071.43},{"x":1643241600000,"y":36823.5},{"x":1643587200000,"y":37918.62},{"x":1643932800000,"y":37092.4},{"x":1644278400000,"y":43834.02},{"x":1644624000000,"y":42401.27},{"x":1644969600000,"y":44536.2},{"x":1645315200000,"y":40115.05},{"x":1645660800000,"y":37291.48},{"x":1646006400000,"y":37704.56},{"x":1646352000000,"y":42464.4},{"x":1646697600000,"y":38032.5},{"x":1647043200000,"y":38741.04},{"x":1647388800000,"y":39320.82},{"x":1647734400000,"y":42222.32},{"x":1648080000000,"y":42905.06},{"x":1648425600000,"y":46858.53},{"x":1648771200000,"y":45539.22},{"x":1649116800000,"y":46611.26},{"x":1649462400000,"y":42278.94},{"x":1649808000000,"y":40102.2},{"x":1650153600000,"y":40388.78},{"x":1650499200000,"y":41375.79},{"x":1650844800000,"y":39465.57},{"x":1651190400000,"y":39770.04},{"x":1651536000000,"y":38510.65},{"x":1651881600000,"y":36013.03},{"x":1652227200000,"y":31003.93},{"x":1652572800000,"y":30074.61},{"x":1652918400000,"y":28680.97},{"x":1653264000000,"y":30278.94},{"x":1653609600000,"y":29193.92},{"x":1653955200000,"y":31715.58},{"x":1654300800000,"y":29681.76},{"x":1654646400000,"y":31117.83},{"x":1654992000000,"y":28344.5},{"x":1655337600000,"y":22550.79},{"x":1655683200000,"y":20540.38},{"x":1656028800000,"y":21088.3},{"x":1656374400000,"y":20702.23},{"x":1656720000000,"y":19226.7},{"x":1657065600000,"y":20181.91},{"x":1657411200000,"y":21582.6},{"x":1657756800000,"y":20223.69},{"x":1658102400000,"y":20774.23},{"x":1658448000000,"y":23154.09},{"x":1658793600000,"y":21300.72},{"x":1659139200000,"y":23792},{"x":1659484800000,"y":22981.77},{"x":1659830400000,"y":22947.19},{"x":1660176000000,"y":23959.92},{"x":1660521600000,"y":24314.89},{"x":1660867200000,"y":23193.99},{"x":1661212800000,"y":21402.93},{"x":1661558400000,"y":20233.32},{"x":1661904000000,"y":19793.02},{"x":1662249600000,"y":19834.94},{"x":1662595200000,"y":19280.08},{"x":1662940800000,"y":21794.52},{"x":1663286400000,"y":19694.69},{"x":1663632000000,"y":19542.2},{"x":1663977600000,"y":19280.58},{"x":1664323200000,"y":19104.89},{"x":1664668800000,"y":19314.69},{"x":1665014400000,"y":20167.79},{"x":1665360000000,"y":19441.88},{"x":1665705600000,"y":19383.33},{"x":1666051200000,"y":19548.97},{"x":1666396800000,"y":19171.34},{"x":1666742400000,"y":20101.27},{"x":1667088000000,"y":20816.16},{"x":1667433600000,"y":20153.99},{"x":1667779200000,"y":20920.33},{"x":1668124800000,"y":17550.23},{"x":1668470400000,"y":16587.96},{"x":1668816000000,"y":16683.22},{"x":1669161600000,"y":16194.75},{"x":1669507200000,"y":16453.47},{"x":1669852800000,"y":17170.62},{"x":1670198400000,"y":17117.57},{"x":1670544000000,"y":17234.58},{"x":1670889600000,"y":17206.87},{"x":1671235200000,"y":16637.6},{"x":1671580800000,"y":16904.64},{"x":1671926400000,"y":16838.1},{"x":1672272000000,"y":16539.28},{"x":1672617600000,"y":16613.71},{"x":1672963200000,"y":16826.41},{"x":1673308800000,"y":17192.07},{"x":1673654400000,"y":19933.36},{"x":1674000000000,"y":21145.18},{"x":1674345600000,"y":22772.5},{"x":1674691200000,"y":23089.74},{"x":1675036800000,"y":23755.85},{"x":1675382400000,"y":23454.41},{"x":1675728000000,"y":22763.74},{"x":1676073600000,"y":21638.55},{"x":1676419200000,"y":22211.8},{"x":1676764800000,"y":24641.94},{"x":1677110400000,"y":24185.67},{"x":1677456000000,"y":23563.11},{"x":1677801600000,"y":23467.36},{"x":1678147200000,"y":22410.62},{"x":1678492800000,"y":20224.85},{"x":1678838400000,"y":24767.46},{"x":1679184000000,"y":26975.39},{"x":1679529600000,"y":27306.32},{"x":1679875200000,"y":27999.84},{"x":1680220800000,"y":28033.06},{"x":1680566400000,"y":27802.23},{"x":1680912000000,"y":27925.55},{"x":1681257600000,"y":30234.98},{"x":1681603200000,"y":30319.32},{"x":1681948800000,"y":28829.57},{"x":1682294400000,"y":27590.55},{"x":1682640000000,"y":29480.35},{"x":1682985600000,"y":28086.65},{"x":1683331200000,"y":29535.38},{"x":1683676800000,"y":27640.09},{"x":1684022400000,"y":26785.94},{"x":1684368000000,"y":27398.27},{"x":1684713600000,"y":26756.57},{"x":1685059200000,"y":26477.29},{"x":1685404800000,"y":27744.66},{"x":1685750400000,"y":27251.93},{"x":1686096000000,"y":27243.64},{"x":1686441600000,"y":25852.82},{"x":1686787200000,"y":25127.04},{"x":1687132800000,"y":26337.08},{"x":1687478400000,"y":29903.73},{"x":1687824000000,"y":30266.7},{"x":1688169600000,"y":30471.5},{"x":1688515200000,"y":30774.87},{"x":1688860800000,"y":30214.55},{"x":1689206400000,"y":30391.64},{"x":1689552000000,"y":30240.28},{"x":1689897600000,"y":29802.29},{"x":1690243200000,"y":29178.42},{"x":1690588800000,"y":29316.12},{"x":1690934400000,"y":29683.61},{"x":1691280000000,"y":29048.01},{"x":1691625600000,"y":29565.82},{"x":1691971200000,"y":29283.84},{"x":1692316800000,"y":26662.05},{"x":1692662400000,"y":26123.41},{"x":1693008000000,"y":26049.42},{"x":1693353600000,"y":27731.23},{"x":1693699200000,"y":25869.09},{"x":1694044800000,"y":25753.31},{"x":1694390400000,"y":25832.82},{"x":1694736000000,"y":26536.02},{"x":1695081600000,"y":26763.76},{"x":1695427200000,"y":26581.86},{"x":1695772800000,"y":26212.82},{"x":1696118400000,"y":26970.43},{"x":1696464000000,"y":27797.56},{"x":1696809600000,"y":27937.18},{"x":1697155200000,"y":26758.66},{"x":1697500800000,"y":28517.32},{"x":1697846400000,"y":29682.6},{"x":1698192000000,"y":33902.65},{"x":1698537600000,"y":34090.68},{"x":1698883200000,"y":35440.51},{"x":1699228800000,"y":35048.35},{"x":1699574400000,"y":36696.25},{"x":1699920000000,"y":36497.35},{"x":1700265600000,"y":36624.3},{"x":1700611200000,"y":35808.95},{"x":1700956800000,"y":37800.94},{"x":1701302400000,"y":37867.37}] | |||

}, | |||

{ | |||

"name": "annotation", | |||

"values": [ | |||

{"start": 2005,"end": 2021,"text": "Past prices"}, | |||

{"start": 2021,"end": 2063,"text": "Expected future prices"} | |||

] | |||

} | |||

], | |||

"scales": [ | |||

{ | |||

"name": "x", | |||

"type": "linear", | |||

"range": "width", | |||

"zero": false, | |||

"domain": {"data": "table","field": "year"} | |||

}, | |||

{ | |||

"name": "y", | |||

"type": "linear", | |||

"range": "height", | |||

"nice": true, | |||

"domain": {"data": "table","field": "revenue"} | |||

}, | |||

{ | |||

"name": "color", | |||

"type": "ordinal", | |||

"domain": {"data": "annotation","field": "text"}, | |||

"range": ["black","red"] | |||

} | |||

], | |||

"axes": [ | |||

{ | |||

"type": "x", | |||

"scale": "x", | |||

"format": "d", | |||

"title": "Year", | |||

"ticks": 1 | |||

}, | |||

{ | |||

"type": "y", | |||

"scale": "y", | |||

"title": "Price (USD)", | |||

"grid": true, | |||

"layer": "back" | |||

} | |||

], | |||

"marks": [ | |||

{ | |||

"type": "rect", | |||

"from": {"data": "annotation"}, | |||

"properties": { | |||

"enter": { | |||

"x": {"scale": "x","field": "start"}, | |||

"y": {"value": 0}, | |||

"x2": {"scale": "x","field": "end"}, | |||

"y2": {"signal": "height"}, | |||

"fill": {"scale": "color","field": "text"}, | |||

"opacity": {"value": 0.2} | |||

} | |||

} | |||

}, | |||

{ | |||

"type": "line", | |||

"from": {"data": "table"}, | |||

"properties": { | |||

"enter": { | |||

"interpolate": {"value": "monotone"}, | |||

"x": {"scale": "x","field": "year"}, | |||

"y": {"scale": "y","field": "price"}, | |||

"stroke": {"value": "steelblue"}, | |||

"strokeWidth": {"value": 3} | |||

} | |||

} | |||

}, | |||

{ | |||

"type": "symbol", | |||

"from": {"data": "table"}, | |||

"properties": { | |||

"enter": { | |||

"x": {"scale": "x","field": "year"}, | |||

"y": {"scale": "y","field": "price"}, | |||

"stroke": {"value": "steelblue"}, | |||

"fill": {"value": "white"}, | |||

"size": {"value": 30} | |||

} | |||

} | |||

}, | |||

{ | |||

"type": "text", | |||

"from": { | |||

"data": "table", | |||

"transform": [ | |||

{ | |||

"type": "aggregate", | |||

"summarize": {"year": ["min","max"]} | |||

} | |||

] | |||

}, | |||

"properties": { | |||

"enter": { | |||

"x": {"signal": "width","mult": 0.5}, | |||

"y": {"value": -10}, | |||

"text": { | |||

"template": "Bitcoin price against the US Dollar since the inception of the cryptocurrency" | |||

}, | |||

"fill": {"value": "black"}, | |||

"fontSize": {"value": 16}, | |||

"align": {"value": "center"}, | |||

"fontWeight": {"value": "bold"} | |||

} | |||

} | |||

} | |||

], | |||

"legends": [ | |||

{ | |||

"fill": "color", | |||

"title": "Period", | |||

"properties": { | |||

"symbols": { | |||

"strokeWidth": {"value": 0}, | |||

"shape": {"value": "square"}, | |||

"opacity": {"value": 0.3} | |||

}, | |||

"legend": { | |||

"x": {"value": 10}, | |||

"y": {"value": 5}, | |||

"fill": {"value": "white"} | |||

} | |||

} | |||

} | |||

] | |||

} | |||

</graph> | |||

== Risks == | |||

As with any investment, investing in Bitcoin carries a level of risk. Overall, based on the Bitcoin's adjusted beta (i.e. 1.42), the degree of risk associated with an investment in Bitcoin is 'medium'. | |||

Here, to estimate the adjusted beta, we used the iShares MSCI World ETF to represent the market portfolio; and in terms of the time period and frequency of observations, we used five years of monthly data (i.e. 60 observations in total), which is supported by a study and is the most common choice. The beta value in a future period has been found to be on average closer to the mean value of 1.0, and because valuation is forward-looking, it is logical to adjust the raw beta so it more accurately predicts a future beta. In addition, here, we have assumed that for an investment to be considered 'medium' risk, it must have a beta value of between 0.5 and 1.5. Further information about the beta ratings can be found in the appendix section of this report. | |||

The key risks can be found below. For us, currently, the biggest risk to the valuation of the currency relates to the strong competition from other cryptocurrencies and traditional financial systems (i.e. competition risk). | |||

''' | # '''Volatility:''' Bitcoin is known for its high price volatility. Its value can fluctuate dramatically over short periods, influenced by factors like regulatory news, technological developments, market sentiment, and macroeconomic trends. | ||

# '''Regulatory Risks:''' The regulatory environment for cryptocurrencies is still evolving. Changes in regulations, both in the U.S. and internationally, can impact Bitcoin's adoption, usage, and value. | |||

# '''Security Risks:''' While the blockchain technology underlying Bitcoin is secure, exchanges and wallets can be vulnerable to hacking and other security breaches. | |||

# '''Market Adoption and Competition:''' Bitcoin's long-term success depends on its widespread adoption. This is uncertain and can be affected by several factors, including competition from other cryptocurrencies and traditional financial systems. | |||

# '''Technological Risks:''' Issues like scalability, transaction speed, and energy consumption are technological challenges that Bitcoin faces. How these challenges are addressed can affect its future utility and value. | |||

# '''Limited Historical Data:''' Compared to traditional assets, Bitcoin has a limited track record, which can make it difficult to predict future performance based on past trends. | |||

# '''No Intrinsic Value:''' Unlike stocks or bonds, Bitcoin does not represent a share in a company or a claim on assets, and it does not generate income. Its value is largely driven by supply and demand, making it more speculative. | |||

# '''Legal and Tax Implications:''' Depending on the jurisdiction, there can be legal and tax implications associated with trading and investing in Bitcoin, which can affect returns and complicate compliance. | |||

==Valuation== | |||

=== What's the expected return of an investment in Bitcoin? === | |||

The Stockhub users estimate that the expected return of an investment in Bitcoin over the next five years is 5x, which equates to an annual return of 39%. In other words, an £100,000 investment in the asset is expected to return £500,000 in five years time. The assumptions used to estimate the return figure can be found in the table below. | |||

Assuming that a suitable return level over five years is 39% per year or less, and Bitcoin achieves its expected return level (of 39%), then an investment in Bitcoin is considered to be an 'suitable' one. | |||

== | === What are the assumptions used to estimate the return? === | ||

{| class="wikitable" | {| class="wikitable" | ||

|+ | |+Key inputs | ||

! | !Description | ||

! | !Value | ||

! | !Commentary | ||

|- | |- | ||

|' | |What's the estimated current size of the total addressable market? | ||

| | |$40,000,000,000,000 | ||

| | |The total value of narrow money globally is estimated at $40 trillion as at 13th November 2023, according to The Money Project. | ||

|- | |- | ||

| | |What is the estimated investment lifespan? | ||

| | |250 years | ||

| | | | ||

|- | |- | ||

| | |What's the estimated annual growth rate of the total addressable market over the lifecycle of the investment? | ||

| | |0.83% | ||

|83. | |We have assumed that the growth rate of the TAM is the same as global population growth, which is 0.83% in 2022. | ||

|- | |- | ||

| | |What's the estimated investment peak market share? | ||

| | |10% | ||

| | |The Stockhub users estimate that especially given the key benefit of the asset, the peak market share of Bitcoin is around 10.00%, and, therefore, suggests using the share amount here. As of 14th November 2023, Bitcoin's current share of the market is estimated at around 1.77%. | ||

|- | |- | ||

| | |Which distribution function do you want to use to estimate investment value? | ||

| | |Gaussian | ||

| | |Research suggests that the value pattern of investments is similar to the pattern produced by the Gaussian distribution function (i.e. the revenue distribution is bell shaped), so the Stockhub users suggest using that function here. | ||

|- | |- | ||

| | |What's the estimated standard deviation of asset value? | ||

| | |50 years | ||

|Another way of asking this question is this way: within how many years either side of the mean does 68% of value occur? Based on Bitcoin's current price (i.e. $37,257.50) and Bitcoin's estimated lifespan (i.e. 250 years), the Stockhub users suggest using 50 years (i.e. 68% of all sales happen within 100 years either side of the mean year), so that's what's used here. | |||

|- | |- | ||

| | |What's the current value of the investment? | ||

|0. | |$709,551,271,083 | ||

|According to Yahoo Finance, the current value of Bitcoin as of 15th November 2023 is $709,551,271,083.<ref name=":0">https://finance.yahoo.com/cryptocurrencies/</ref> Bitcoin currently trades at $36,310<ref name=":0" /> and the maximum number of coins is 21 million. | |||

|- | |- | ||

| | |Which time period do you want to use to estimate the expected return? | ||

| | |Between now and five years time | ||

| | |Research suggests that following a market crash, the average amount of time it takes for the price of a stock market to return to its pre-crash level (i.e. the recovery period) is at least three years. Accordingly, Stockhub suggests that to account for general market cyclicity, it's best to estimate the expected return of the investment between now and five years time. | ||

|- | |- | ||

| | |Which valuation recommendation method do you want to use? | ||

| | |Relative | ||

|There's two main types of valuation recommendation methods, relative and absolute. The relative method determines the investment recommendation relative to other investments (e.g. the investment is "suitable" if it's within say the top 10% of the investment universe in terms of investment returns), whereas the absolute method determines the recommendation based on a fixed return amount (e.g. the investment is "suitable" if it returns 50% or more). Assuming sufficient data, the Stockhub users suggest using the relative method. | |||

|- | |- | ||

| | |Which top proportion of the investment universe constitutes a "suitable" rating? | ||

| | |10% | ||

| | |The proportion depends on the user's preference. That said, typically, the higher the proportion, the higher the risk associated with the investment. | ||

|- | |- | ||

| | |Which universe of investments do you want to use? | ||

| | |All investments | ||

| | |If the main objective of the user is to maximise investment returns, then the Stockhub users suggest using 'all investments' as the investment universe. | ||

|} | |} | ||

===Sensitivity analysis=== | |||

The main inputs that result in the greatest change in the expected return of the Bitcoin investment are, in order of importance (from highest to lowest): | |||

#The size of the total addressable market (the default size is $40 trillion); | |||

#Bitcoin peak market share (the default share is 10%); and | |||

#The estimated Bitcoin lifespan (the default lifespan is 1,000 years). | |||

The | The impact of a 50% change in those main inputs to the expected return of the Bitcoin investment is shown in the table below. | ||

{| class="wikitable sortable" | |||

|+Bitcoin investment expected return sensitivity analysis | |||

The | !Main input | ||

!50% worse | |||

!Unchanged | |||

!50% better | |||

|- | |||

|The lifespan of Bitcoin | |||

|3x | |||

|5x | |||

|8x | |||

|- | |||

|The size of the total addressable market | |||

|3x | |||

|5x | |||

|8x | |||

|- | |||

|Bitcoin peak market share | |||

|3x | |||

| 5x | |||

|8x | |||

|} | |||

==Actions== | ==Actions== | ||

| Line 399: | Line 456: | ||

To invest in Bitcoin, click [https://www.coinbase.com/ here]. | To invest in Bitcoin, click [https://www.coinbase.com/ here]. | ||

== | == Appendix == | ||

=== How does Bitcoin work? === | |||

Bitcoin operates using a technology called blockchain, which is a decentralised ledger system. Here's a simplified explanation of how it works: | |||

# '''Transactions:''' Every Bitcoin transaction is a data unit that includes a few different items: the amount of Bitcoin being sent, the sender's address (public key), and the receiver's address. | |||

# '''Blockchain:''' A blockchain is a chain of blocks, where each block contains a number of transactions. Once a transaction is initiated, it is broadcast to a network of peer-to-peer computers scattered across the world. | |||

# '''Mining:''' To add a transaction to the blockchain, a process called mining must take place. This involves computers solving a complex mathematical problem that ultimately verifies the authenticity of the transaction. The first miner to solve the problem gets to add the block of transactions to the blockchain. | |||

# '''Proof of Work:''' This mathematical problem is part of a system called proof of work, which is what prevents fraudulent transactions. It ensures that altering any single record (or block) in the chain would require re-mining not just the block with the transaction, but all the subsequent blocks. | |||

# '''Decentralisation:''' Unlike traditional currencies, there is no central authority like a bank or government backing Bitcoin. Instead, it relies on this decentralized network of computers (miners) to process transactions. | |||

# '''Bitcoin Wallets:''' To use Bitcoin, you need a digital wallet. This wallet doesn't actually store your Bitcoin; instead, it holds the private keys that allow you to access your Bitcoin address (public key). | |||

# '''Public and Private Keys:''' A Bitcoin wallet contains a public key and a private key, which work together to allow the owner to initiate and digitally sign transactions, providing proof of authorization. | |||

# '''Supply Limit:''' Bitcoin also has a stipulated supply limit of 21 million coins, which is expected to be reached around the year 2140. This limited supply is one of the factors that contributes to Bitcoin's value. | |||

# '''Market-Driven Value:''' The value of Bitcoin is determined by what people are willing to pay for it, making it highly volatile. It's influenced by factors like supply and demand, investor sentiment, market news, and government regulation. | |||

# '''Anonymity and Transparency:''' While Bitcoin transactions offer some level of anonymity, all transactions are publicly recorded in the blockchain, making it transparent. | |||

Bitcoin's complex nature combines elements of mathematics, computer science, and economics. It represents a shift in how we think about money in the digital age. | |||

=== Cryptocurrencies comparisons === | |||

Below is a table covering some of the most well-known cryptocurrencies and their unique characteristics. | |||

{| class="wikitable" | |||

|+This table provides a snapshot of the unique qualities of each cryptocurrency. | |||

!Cryptocurrency | |||

!Unique Feature | |||

|- | |||

|Bitcoin (BTC) | |||

|The first cryptocurrency, it introduced blockchain technology and operates on a proof-of-work model. | |||

|- | |||

|Ethereum (ETH) | |||

|Introduced smart contracts, allowing decentralised applications (dApps) to run on its blockchain. | |||

|- | |||

|Ripple (XRP) | |||

|Focused on international money transfers, it offers fast transaction speeds and low fees. | |||

|- | |||

|Litecoin (LTC) | |||

|Similar to Bitcoin but with faster block generation rate and a different hashing algorithm (Scrypt). | |||

|- | |||

|Cardano (ADA) | |||

|Uses a proof-of-stake model and focuses on security through a layered architecture. | |||

|- | |||

|Polkadot (DOT) | |||

|Enables different blockchains to transfer messages and value in a trust-free fashion; betting on blockchain interoperability. | |||

|- | |||

|Chainlink (LINK) | |||

|A decentralised oracle network designed to connect smart contracts with data from the real world. | |||

|- | |||

|Binance Coin (BNB) | |||

|Originally created as a utility token for the Binance cryptocurrency exchange, it now fuels its blockchain ecosystem. | |||

|- | |||

|Solana (SOL) | |||

|Known for its high throughput and low transaction costs, it uses a unique proof-of-history mechanism. | |||

|- | |||

|Dogecoin (DOGE) | |||

|Began as a meme but gained popularity and use, particularly for tipping and charitable donations. | |||

|- | |||

|Uniswap (UNI) | |||

|Pioneered the decentralised finance (DeFi) movement with an automated liquidity protocol on Ethereum. | |||

|- | |||

|Monero (XMR) | |||

|Focuses on privacy and anonymity, using ring signatures and stealth addresses to obscure transaction details. | |||

|} | |||

{| class="wikitable" | |||

|+ | |||

!Currency/Asset | |||

!First Cryptocurrency | |||

!Smart Contract Capabilities | |||

!Focused on International Transfers | |||

!Faster Transaction Speeds | |||

!Proof-of-Stake Pioneer | |||

!Blockchain Interoperability | |||

!Decentralized Oracle Network | |||

!Exchange's Native Token | |||

!Proof-of-History Consensus | |||

!Meme-Based Origins | |||

!Automated Liquidity Protocol | |||

!Focus on Privacy | |||

!Fiat Currency | |||

!Physical Asset | |||

|- | |||

|Bitcoin (BTC) | |||

|style="background: green; color: white;" |✓ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|- | |||

|Ethereum (ETH) | |||

|style="background: red; color: white;" |✗ | |||

|style="background: green; color: white;" |✓ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|- | |||

|Ripple (XRP) | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: green; color: white;" |✓ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||

|style="background: red; color: white;" |✗ | |||