Bitcoin: Difference between revisions

Mehtabahmed (talk | contribs) No edit summary Tags: Manual revert Visual edit: Switched |

|||

| Line 4: | Line 4: | ||

==Summary== | ==Summary== | ||

* Bitcoin is a currency. | * Bitcoin is a form of a digital currency that aims to eliminate the need for banks or governments. Alternatively, Bitcoin uses blockchain technology to support peer-to-peer transactions between users on a decentralised network [https://www.coinbase.com/]. | ||

* Launched in 2009, Bitcoin was the first and remains the most valuable, entrant in the emerging class of assets known as cryptocurrecy. | |||

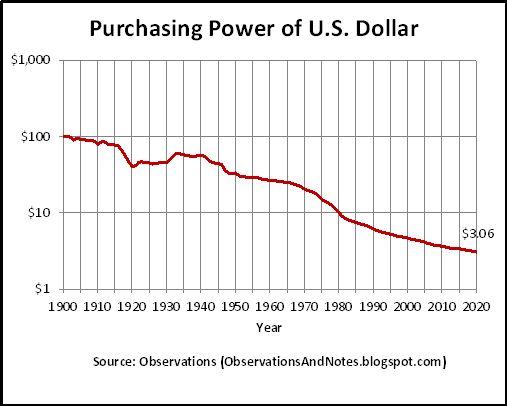

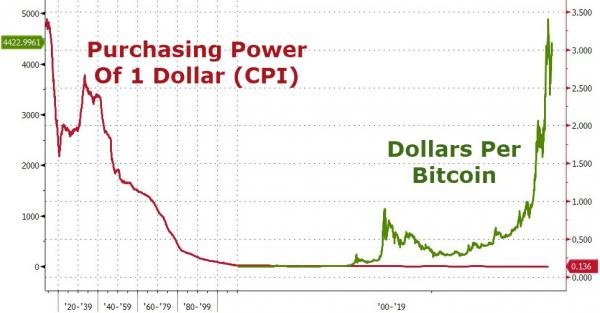

* Bitcoin is a currency. Research suggests that the most popular cryptocurrency will maintain its purchasing power for much longer than any other currency. In other words, the cryptocurrency will be a much better currency. | |||

*Assuming Bitcoin's share of the money supply increases to 10% (from 2.2%) and the value of the global money supply remains unchanged (at $35.2 trillion), then that equates to a Bitcoin price of $167,619 per coin (from $41,458), and upside of 4x. | *Assuming Bitcoin's share of the money supply increases to 10% (from 2.2%) and the value of the global money supply remains unchanged (at $35.2 trillion), then that equates to a Bitcoin price of $167,619 per coin (from $41,458), and upside of 4x. | ||

| Line 15: | Line 17: | ||

What makes Bitcoin unique is that it operates on a decentralised network (i.e. without the need of a central entity, such as the Bank of England), and the supply of the currency is limited (at 21 million coins). | What makes Bitcoin unique is that it operates on a decentralised network (i.e. without the need of a central entity, such as the Bank of England), and the supply of the currency is limited (at 21 million coins). | ||

The main benefit of operating on a decentralised network (rather than a centralised network) is that within the network, there is no single point of failure. In a centralised network, if the central entity that operates the network fails, then the whole network - and the currency that operates on the network - fails (i.e. there is a single point of failure in the network), whereas in a decentralised network, | The main benefit of operating on a decentralised network (rather than a centralised network) is that within the network, there is no single point of failure. In a centralised network, if the central entity that operates the network fails, then the whole network - and the currency that operates on the network - fails (i.e. there is a single point of failure in the network), whereas in a decentralised network, because there is no central entity, there is no single point of failure, and therefore the network - and currency - is likely to last for much longer, possibly forever. | ||

For example, the world's first ever known currency is the Mesopotamian shekel, and it was operated by a central entity (The Kingdom of Lydia). When the central entity failed, so did the currency. | For example, the world's first ever known currency is the Mesopotamian shekel, and it was operated by a central entity (The Kingdom of Lydia). When the central entity failed, so did the currency. | ||

| Line 24: | Line 26: | ||

Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower. | Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower. | ||

== How does Bitcoin work? == | |||

Each Bitcoin is a digital asset that can be stored at a cryptocurrency exchange or in a digital wallet [https://www.nerdwallet.com/article/investing/what-is-bitcoin#:~:text=Digital%20CurrencyCryptocurrency-,BTC%20definition%3A%20What%20is%20Bitcoin%3F,users%20on%20a%20decentralized%20network.]. Each individual coin represents the value of Bitcoin’s current price, but you can also own partial shares of each coin. The smallest denomination of each Bitcoin is called a Satoshi, sharing its name with Bitcoin’s creator (Satoshi Nakamoto). Each Satoshi is equivalent to a hundred millionth of one Bitcoin, so owning fractional shares of Bitcoin is quite common. | |||

* '''Blockchain''': Bitcoin is powered by open-source code known as blockchain, which creates a shared public history of transactions organized into "blocks" that are "chained" together to prevent tampering. This technology creates a permanent record of each transaction, and it provides a way for every Bitcoin user to operate with the same understanding of who owns what [https://www.nerdwallet.com/article/investing/blockchain]. | |||

* '''Private and public keys:''' A Bitcoin wallet consists of a public key and private key, which work together to allow the owner to initiate and digitally sign transactions. This lets the user carry out the main purpose of Bitcoin - securely and safely transferring ownership from one user to another. | |||

* '''Bitcoin mining:''' Validating transaction information and maintaining the integrity of the blockchain is bitcoin mining's main purpose, Bitcoin mining is the process of validating the information in a blockchain block by generating a cryptographic solution that matches specific criteria. When a correct solution is reached, a reward in the form of bitcoin and fees for the work done is given to the miner who reached the solution first [https://www.investopedia.com/terms/b/bitcoin-mining.asp] | |||

==Competition== | ==Competition== | ||

Revision as of 15:59, 19 July 2023

Summary

- Bitcoin is a form of a digital currency that aims to eliminate the need for banks or governments. Alternatively, Bitcoin uses blockchain technology to support peer-to-peer transactions between users on a decentralised network [1].

- Launched in 2009, Bitcoin was the first and remains the most valuable, entrant in the emerging class of assets known as cryptocurrecy.

- Bitcoin is a currency. Research suggests that the most popular cryptocurrency will maintain its purchasing power for much longer than any other currency. In other words, the cryptocurrency will be a much better currency.

- Assuming Bitcoin's share of the money supply increases to 10% (from 2.2%) and the value of the global money supply remains unchanged (at $35.2 trillion), then that equates to a Bitcoin price of $167,619 per coin (from $41,458), and upside of 4x.

What is Bitcoin?

Bitcoin is a currency.

What's unique about Bitcoin?

What makes Bitcoin unique is that it operates on a decentralised network (i.e. without the need of a central entity, such as the Bank of England), and the supply of the currency is limited (at 21 million coins).

The main benefit of operating on a decentralised network (rather than a centralised network) is that within the network, there is no single point of failure. In a centralised network, if the central entity that operates the network fails, then the whole network - and the currency that operates on the network - fails (i.e. there is a single point of failure in the network), whereas in a decentralised network, because there is no central entity, there is no single point of failure, and therefore the network - and currency - is likely to last for much longer, possibly forever.

For example, the world's first ever known currency is the Mesopotamian shekel, and it was operated by a central entity (The Kingdom of Lydia). When the central entity failed, so did the currency.

Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower.

How does Bitcoin work?

Each Bitcoin is a digital asset that can be stored at a cryptocurrency exchange or in a digital wallet [2]. Each individual coin represents the value of Bitcoin’s current price, but you can also own partial shares of each coin. The smallest denomination of each Bitcoin is called a Satoshi, sharing its name with Bitcoin’s creator (Satoshi Nakamoto). Each Satoshi is equivalent to a hundred millionth of one Bitcoin, so owning fractional shares of Bitcoin is quite common.

- Blockchain: Bitcoin is powered by open-source code known as blockchain, which creates a shared public history of transactions organized into "blocks" that are "chained" together to prevent tampering. This technology creates a permanent record of each transaction, and it provides a way for every Bitcoin user to operate with the same understanding of who owns what [3].

- Private and public keys: A Bitcoin wallet consists of a public key and private key, which work together to allow the owner to initiate and digitally sign transactions. This lets the user carry out the main purpose of Bitcoin - securely and safely transferring ownership from one user to another.

- Bitcoin mining: Validating transaction information and maintaining the integrity of the blockchain is bitcoin mining's main purpose, Bitcoin mining is the process of validating the information in a blockchain block by generating a cryptographic solution that matches specific criteria. When a correct solution is reached, a reward in the form of bitcoin and fees for the work done is given to the miner who reached the solution first [4]

Competition

| Item | Bitcoin | US Dollar |

|---|---|---|

| Does the currency operate on a decentralised network? | Yes | No |

| Is the supply of the currency limited? | Yes | No |

| How likely is the currency to act as a store of value? | High | Low |

| Item | Bitcoin | US Dollar |

|---|---|---|

| Medium of exchange | Yes | Yes |

| Measure of value | Yes | Yes |

| Standard of deferred payment | Yes | Yes |

| Store of value | Yes | No |

| Item | Bitcoin | Ether | XRP |

|---|---|---|---|

| Does the currency operate on a decentralised network? | Yes | Yes | Yes |

| Is the supply of the currency limited? | Yes | No | No |

| Is the cryptocurrency the most popular one? | Yes | No | No |

| How likely is the currency to act as a store of value? | High | Low | Low |

Valuation

The total value of narrow money globally is estimated at $35.2 trillion as at May 2020, according to The Money Project.

The total value of Bitcoin as of today (20th March 2022) is $787 billion[1].

Accordingly, Bitcoin's share of the global money supply is 2.2%.

Bitcoin currently trades at $41,458[1] and the maximum number of coins is 21 million.

Assuming Bitcoin's share of the money supply increases to 10% (from 2.2%) and the value of the global money supply remains unchanged (at $35.2 trillion), then that equates to a Bitcoin price of $167,619 per coin (from $41,458), and upside of 4x.

Actions

To invest in Bitcoin, click here.

References