Summary

- Bitcoin is a currency.

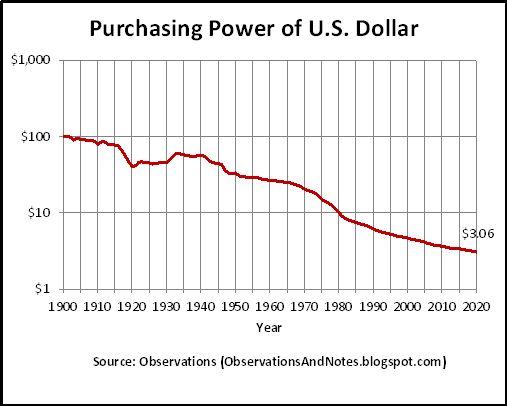

- What makes the currency unique is that it operates on a decentralised network. Research suggests that operating a currency on a decentralised network will result in the maintaining of the purchasing power of the currency for much longer, possibly forever. In other words, it will result in a much better currency.

What is Bitcoin?

Bitcoin is a currency.

What's unique about Bitcoin?

What makes Bitcoin unique is that it operates on a decentralised network (i.e. without the need of a central entity, such as the Bank of England), and the supply of the currency is limited (at 21 million coins).

The main benefit of operating on a decentralised network (rather than a centralised network) is that there is no single point of failure in the network. In a centralised network, if the central entity that operates the network fails, then the whole network - and the currency that operates on the network - fails (i.e. there is a single point of failure in the network), whereas in a decentralised network, becasue there is no central entity, there is no single point of failure, and therefore the network - and currency - is likely to last for much longer, possibly forever.

For example, the world's first ever known currency is the Mesopotamian shekel, and it was operated by a central entity (The Kingdom of Lydia). When the central entity failed, so did the currency.

Another key benefit of transacting on a decentralised network is that transaction costs are likely to be lower.

Competition

| Item | Bitcoin | US Dollar |

|---|---|---|

| Does the currency operate on a decentralised network? | Yes | No |

| Is the supply of the currency limited? | Yes | No |

| High likely is the currency to act as a store of value? | High | Low |

| Item | Bitcoin | Ether | XRP |

|---|---|---|---|

| Does the currency operate on a decentralised network? | Yes | Yes | Yes |

| Is the supply of the currency limited? | Yes | No | No |

| High likely is the currency to act as a store of value? | High | Low | Low |

Valuation

The total value of narrow money globally is estimated at $35.2 trillion as at May 2020, according to The Money Project.

The total value of Bitcoin as of today (20th March 2022) is $787 billion[1].

Accordingly, Bitcoin's share of the global money supply is 2.2%.

Bitcoin currently trades at $41,458[2] and the maximum number of coins is 21 million.

Assuming Bitcoin's share of the money supply increases to 10% (from 2.2%) and the value of the global money supply remains unchanged (at $35.2 trillion), then that equates to a Bitcoin price of $167,619 per coin (from $41,458), and upside of 4x.

References

Actions

To invest in Bitcoin, click here.