| File:Direxion.svg | |

| TMF | |

| Type | [3x Leveraged ETF] |

| Founded | 16th April 2009 |

| Founder | Direxion |

| Capital ratio | Expense ratio: 1.06% (as of 22/07/2022) |

| Website | https://etfdb.com/etf/TMF/#etf-ticker-profile |

The Direxion Daily 20+ Year Treasury Bull & Bear 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the ICE U.S. Treasury 20+ Year Bond Index.[2] This special type of derivative can hedge against recession by taking advantage of deteriorating economy.

The idea

TMF offers a powerful instrument for investors with a bullish outlook on US 20+ years Treasury bonds. In a form of leveraged ETF, TMF allow investors to take advantage of deterioriatng economy by betting on long term Treasury yields to fall, mainly caused by the US interest rate cuts.[3]

| Data | Value (as of 22/07/2023) |

|---|---|

| Current Price | $7.53 |

| Net Assets | $2.17B |

| Beta | 6.23 |

| Expense Ratio | 1.06% |

| Yield | 2.11% |

| 52 week range | $6.15 - $14.48 |

| Net Asset Value | 7.53 |

| Credit Rating | AAA |

Current Holdings

| Security Description | Ticker | Type of Security | Holding Percentage |

|---|---|---|---|

| IShares Tr Barclays 20+ year Treasury ETF | TLT | ETF | 65.02 |

| Goldman Sachs FS Treasury Instruments Instl | FTIXX | Swap | 11.70 |

| IShares 20+ year Treasury Bond ETF Swap | Short Swap | -3.83 (short) |

Leveraged ETFs

Leveraged ETFs (exchange traded funds) are products which utilises financial derivatives such as future contracts, options and swaps in order to deliver the desired return of a particular index. [4]

Due to the high risk, TMF is typically used by traders to profit from the index's short term trends or through technical analysis. Therefore leveraged ETFs have the potential to provide significant gains as well as losses, and provide both long and short exposure to a certain index.

Typical holdings include a signficant proportion invested in short term securities and a smaller position on volatile derivatives. Cash is generally used to meet financial obligations caused by the losses on the derivatives. This is held by maintaing a constant leverage ratio.

US Treasury Bonds

US Treasury Bonds are debt securities issued by the US government in exchange of a fixed annual interest. This type of sovereign debt is insured by the US government thus commonly referred as the risk free investment. Buying a Treasury bond is effectively lending money to the US government in exchange of a stated annual interest.

Bond prices of the US Treasury Bonds are influenced by many factors, including monetary policies, interest rates, economic growth and many more which are explained in Macroeconomics section.[5]

ICE U.S. Treasury 20+ Year Bond Index (IDCOT20)

This index illustrates the performance of US

| Terms | Definition |

|---|---|

| Face value | Fixed price which the bond issuer pays back at the time of the bond's maturity |

| Bond price | Adjustable market price of the bond |

| Bond yield | Current bond price divided by the coupon rate |

| Coupon rate | Fixed annual return the investor expects to receive |

| Yield to maturity | Percentage rate of return assuming the investors holds the bond to maturity[6] |

Macroeconomics

Monetary Policy

Quantitative Tightening (QT) refers to reducing the liquidity out of the financial market. This is implemented by the US Federal Reserve shrinking its balance sheet by either selling the US Treasury bonds or letting the bonds on their balance sheet mature without reissuance. Quantitative tightening increases the amount of bonds available for investors which forces the bond yields higher in order to attract investors. This results in lower bond prices, and has a negative impact on the performance of TMF.[7]

Quantitative Easing (QE) is the reverse of quantitative tightening. This is commonly referred as "money printing", where the government issue bonds and the Federal Reserve buys those issued bonds. This increases the liquidity in the financial market and naturally leads to currency devaluation. Implementing QE is effectively issuing more debt, thus the Federal Reserve lowers the interest rate to minimise the cost of debt as much as possible. Lowering interest rates lead to higher bond prices, therefore QE has a positive impact on TMF performance.[8]

Recession

By definition, recession implies a period of time with two or more consecutive quarters to negative growth of Gross Domestic Product. The period of recession is officially declared by the National Bureau of Economic Research. Therefore, despite having two consecutive negative growth during Q1 and Q2 of 2022, this period wasn't declared and officially recongnised as a recession.

During a recession, or a stagnating economy, the Federal Reserve typically implement quantitative easing with interest rate cuts to pump more liquidity into the financial market in order to revive the economy. With treasury yields being correlated to interest rates and bond prices being inversely proportional, the Federal Reserve's attempt to overcome a recession will increase bond prices and TMF.[9]

Also, liquidity flows into the safest assets with a relatively lower volatility during an economic hardship, with US Treasury Bonds are considerd to be one of the safest asset to own. Increasing demand for the US Treasury will increase the price of bonds and conversely further decrease the bond yields.

Inverted Yield Curve

Treasury bonds with longer maturity date typically has a higher yield, as it has increased economic uncertainty and devaluation with rising annual inflation. However when shorter bonds have a higher yield than long term bonds, it is described as a yield curve inversion. This inversion is most commonly measured by 2 year yield minus 10 year yield. When this metric dips below 0 basis point, it accurately predicted every recession in the last half century thus regarded as an accurate indicator of a recession. Historically it required 6 to 18 months since the inversion for the recession to occur. It's recognised as a reliable recession indicator as it illustrates the shortage of money supply in the near term, which indicate the economic turmoil.

Yield curve inverted on July 2022 and its been deteriorating to nearly negative 100 basis points (as of 22/07/2023).[10]

Inflation

Increasing inflation diminishes the value of bond's future cash flows. As occurred in 2022, if a bond has a coupon rate of 3% and inflation rate (Consumer Price Index) is at 9%, real yield of that particular bond is -6%. This again is correlated to the Federal Reserve's monetary policy as the interest rates will rise in order to bring down inflation. Therefore higher inflation leads to higher interest rates, higher yields will be demanded by investors which brings to bond prices down.

Long term inflation target by the FED is 2% and the federal reserve is remaining hawkish as they are determined to bring long term inflation down to their target.[11]

Increasing inflation will typically bring bond prices down and plummet the performance of TMF and vice versa.

June Consumer Price Index was at 3% from the high of 9.1% in June 2022, which decreased the probability of further interest rate hikes. As of 22/07/2023, economic consensus indicate 70% of investors are anticipating a 25 basis point rate hike in July Federal Open Market Committee, and 33% are expecting a further 25 basis point hike in September FOMC.

Monetary Policy

Quantitative Tightening (QT) refers to reducing the liquidity out of the financial market. This is implemented by the US Federal Reserve shrinking its balance sheet by either selling the US Treasury bonds or letting the bonds on their balance sheet mature without reissuance. Quantitative tightening increases the amount of bonds available for investors which forces the bond yields higher in order to attract investors. This results in lower bond prices, and has a negative impact on the performance of TMF.[7]

Quantitative Easing (QE) is the reverse of quantitative tightening. This is commonly referred as "money printing", where the government issue bonds and the Federal Reserve buys those issued bonds. This increases the liquidity in the financial market and naturally leads to currency devaluation. Implementing QE is effectively issuing more debt, thus the Federal Reserve lowers the interest rate to minimise the cost of debt as much as possible. Lowering interest rates lead to higher bond prices, therefore QE has a positive impact on TMF performance.

Microeconomics

Small business rent delinquencies.

Historical Performance

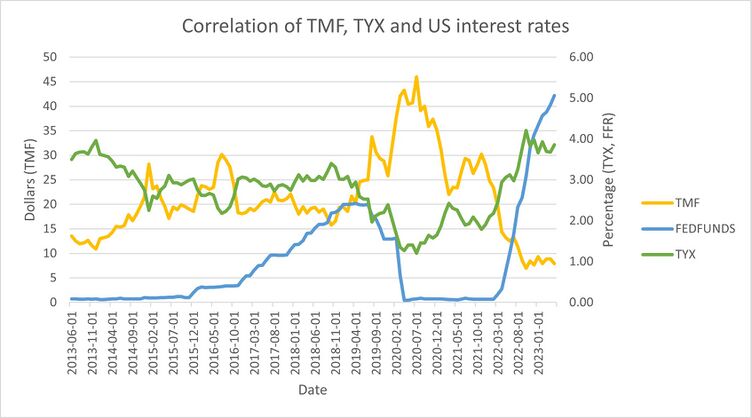

TYX indicates the treasury yield of US 30 year Treasury Bond.

Risk assessment

Leveraged ETF

TMF, being a 3x leveraged ETF, comes with a substantial risk as the product is leveraged with derivatives to achieve higher returns. These derivatives include future contracts, swaps and options with high volatility. Leveraged ETFs provide daily return of the desired multiple, and the return resets daily. Compounding returns can bring significant losses or gains.

With the considerable risk, TMF is not considered appropriate for long term investment and mostly used for trading.[14]

Macroeconomics

Labour market remain tight

References

- ↑ https://www.direxion.com/product/daily-20-year-treasury-bull-bear-3x-etfs

- ↑ https://www.direxion.com/product/daily-20-year-treasury-bull-bear-3x-etfs

- ↑ https://etfdb.com/etf/TMF/#etf-ticker-profile

- ↑ https://www.investopedia.com/terms/l/leveraged-etf.asp

- ↑ https://www.investopedia.com/ask/answers/062315/which-economic-factors-impact-treasury-yields.asp#:~:text=Interest%20rates%2C%20inflation%2C%20and%20economic%20growth%20are%20among%20the%20biggest,the%20direction%20of%20Treasury%20yields.

- ↑ https://www.investopedia.com/ask/answers/020215/what-difference-between-yield-maturity-and-coupon-rate.asp#:~:text=The%20yield%20to%20maturity%20(YTM)%20is%20the%20percentage%20rate%20of,(par%20value)%20at%20maturity.

- ↑ 7.0 7.1 https://www.investopedia.com/quantitative-tightening-6361478

- ↑ https://www.investopedia.com/ask/answers/012815/how-does-quantitative-easing-us-affect-bond-market.asp

- ↑ https://www.vinovest.co/blog/bonds-during-recession

- ↑ https://fred.stlouisfed.org/series/T10Y2Y

- ↑ https://tradingeconomics.com/united-states/interest-rate

- ↑ https://finance.yahoo.com/quote/%5ETYX/history?period1=1370044800&period2=1689984000&interval=1mo&filter=history&frequency=1mo&includeAdjustedClose=true

- ↑ https://www.direxion.com/product/daily-20-year-treasury-bull-bear-3x-etfs

- ↑ https://www.investopedia.com/articles/investing/121515/why-3x-etfs-are-riskier-you-think.asp