Ethereum: Difference between revisions

No edit summary |

(→Risks) |

||

| Line 104: | Line 104: | ||

* Technological | * Technological | ||

* Collapsing of Bitcoin | * Collapsing of Bitcoin | ||

== References and notes == | |||

Revision as of 15:33, 26 July 2023

| Type | Decentralized blockchain |

| Release Date | 30 July 2015 |

| Founder | Vitalik Buterin |

| Website | ethereum.org[1]etherscan.io |

What is Ethereum?

- Ethereum is a globally distributed network of computers that is powered by blockchain technology[1].

- The Ethereum network acts as the foundation for communities, applications, organizations and digital assets that is accessible for creation and utilization by anyone[1].

- Ethereum is renowned primarily for its native cryptocurrency, ETH[2].

How does Ethereum work?

In simple words, Ethereum = Blockchain + Smart contract.

- Blockchain

The concept of blockchain is crucial in understanding Ethereum. Blockchain is simply a database. It is a database of specific data that continuously grows, with the following characteristics:

- Once data is stored in the database, it can never be modified or deleted. Each record on the blockchain is permanently preserved.

- No individual or organization can maintain the database alone. It requires thousands of people, each with a copy of the database.

To comprehend how people synchronize their database copies with others, imagine a network of 10 individuals. Each person has an empty folder and a blank page. Whenever someone in this network performs a significant action, such as a transaction, it is broadcasted to everyone in the network. Each person will record announcements on their own page until the page is filled. When the page is full, each individual must seal the page's content by solving a mathematical puzzle. This ensures that everyone's page has the same content, and this content can never be altered. The first person to solve this mathematical puzzle will receive a reward in the form of cryptocurrency. Once sealed, the page is added to the folder, and a new page appears, continuing this perpetual cycle.

- Smart contract

Like other blockchains, Ethereum requires thousands of individuals to run software on their computers to power the network. Each node (computer) in the network runs software called the Ethereum Virtual Machine (EVM). Visualize the EVM as an operating system capable of understanding and executing software written in a specific programming language designed for Ethereum. The software/applications executed by the Ethereum Virtual Machine are referred to as "smart contracts."

In this world of computers, everything requires payment. However, the currency used is not conventional money like USD or GBP; instead, it is the native cryptocurrency of the network called Ether (ETH). Ether shares similarities with Bitcoin but has one crucial difference: it can be used to pay for executing smart contracts on the Ethereum platform.

On Ethereum, both human users and smart contracts act as participants. Whatever tasks human users can perform, smart contracts can also do, and much more. In the network, smart contracts behave just like other human users. Both can send and receive Ether like any other currency. However, unlike human users, smart contracts can also execute predefined computer programs and perform various operations when triggered.

What can Ethereum do[1]?

- Banking: Everyone is allowed to access Ethereum, and the lending, borrowing and savings products built on it is an internet connection.

- An open internet: Users can control their own assets and identity, instead of them being controlled by a few mega-corporations.

- A peer-to-peer (p2p) network: Ethereum allows users to coordinate, make agreements or transfer digital assets directly with each other.

- Censorship-resistant: No government or company has control over Ethereum.

- Commerce guarantees: Users have a secure, built-in guarantee that funds will only change hands if they provide what was agreed.

- Composable products: All applications are built on the same blockchain with a shared global state, meaning they can build off each other. This allows for better products and experiences and assurances that no-one can remove any tools apps rely upon.

Advantages of Ethereum

Advantages of blockchain + smart contract

NFT

Ethereum 2.0

Ethereum vs. Bitcoin

| Ethereum[3] | Bitcoin[4] | |

|---|---|---|

| Popularity | #2 | #1 |

| Type | Decentralized blockchain | Digital currency |

| Circulating supply | 120.2M ETH | 19.4M BTC |

| Total supply | Infinite | 21M BTC |

| Market cap | $222.4B | $568.1B |

| All time high | $4,891.70 | $68,789.63 |

- Since Bitcoin stands as the pioneering and most renowned cryptocurrency, drawing a comparison between Bitcoin and Ethereum proves highly beneficial when analyzing Ethereum. As Bitcoin's primary competitor, Ethereum is ranked #2 on most cryptocurrency platforms, while Bitcoin is ranked #1.

- While this section focuses on comparing Ethereum and Bitcoin, it's essential to acknowledge that they are not of the same kind. Ethereum operates as a decentralized blockchain, where cryptocurrency is merely one of its numerous applications (financial services, games, social networks, etc.). In contrast, Bitcoin exclusively functions as a cryptocurrency, akin to the virtual counterpart of a dollar.

- The circulating supply of a cryptocurrency represents the number of tokens that have been issued and are actively available in the market. For Bitcoin, over 90% of its total supply has already been mined. On the other hand, Ethereum does not have a finite supply.

- While the concept of unlimited supply may raise concerns for Ethereum, it actually contributes to its stability as a cryptocurrency and sets it apart from becoming the next Bitcoin. This characteristic prevents scarcity-driven market behaviors and allows for a more sustainable and adaptable ecosystem for Ethereum, ensuring its continued relevance and functionality.

- Market cap is calculated by multiplying the asset's current price and its circulating supply.

- Buterin dreamed up Ethereum as a way to leverage the blockchain technology underlying Bitcoin for all sorts of uses beyond currency[5].

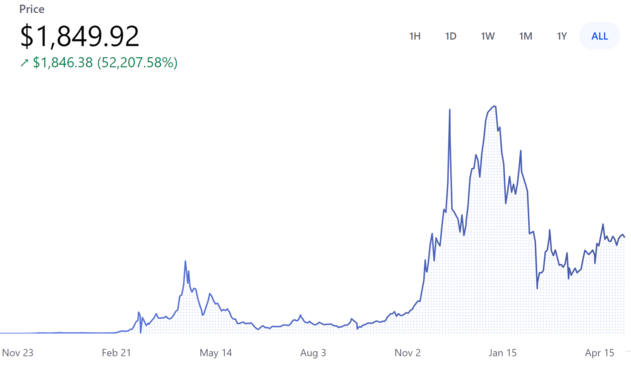

Valuation

Risks

- Regulatory

- Technological

- Collapsing of Bitcoin

References and notes

- ↑ 1.0 1.1 1.2 https://ethereum.org/en/what-is-ethereum/

- ↑ https://www.investopedia.com/terms/e/ethereum.asp

- ↑ https://www.coinbase.com/price/ethereum

- ↑ https://www.coinbase.com/price/bitcoin

- ↑ https://time.com/6158182/vitalik-buterin-ethereum-profile/